Key Insights

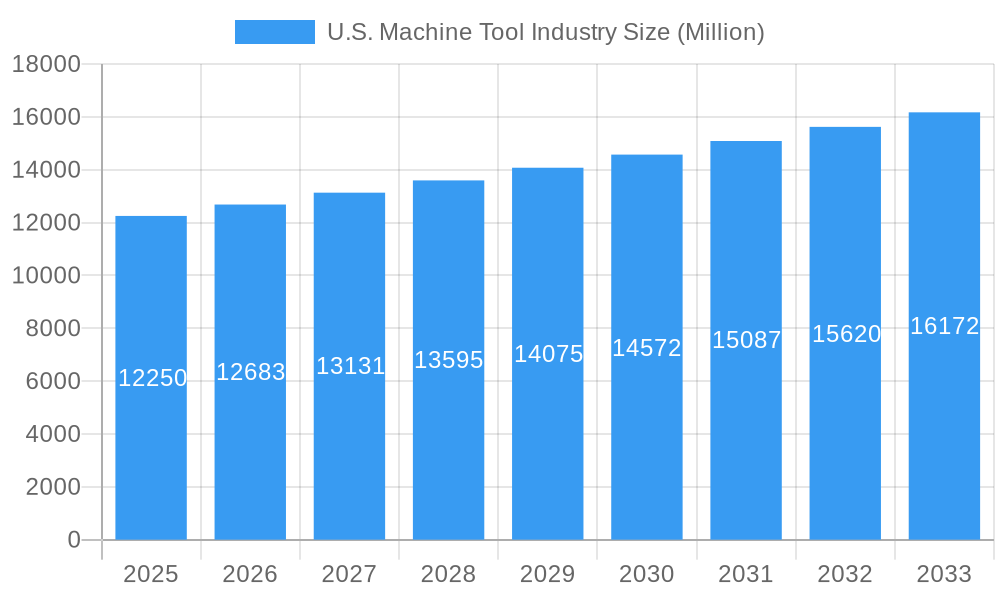

The U.S. machine tool industry, valued at $12.25 billion in 2025, is projected to experience steady growth, driven by increasing automation in manufacturing, reshoring initiatives, and the expansion of key sectors like automotive, aerospace, and energy. A Compound Annual Growth Rate (CAGR) of 3.38% from 2025 to 2033 suggests a continued, albeit moderate, expansion of the market. Key drivers include advancements in technology, such as the adoption of Industry 4.0 technologies (including AI and IoT integration in machine tools), leading to improved productivity and efficiency. Furthermore, government initiatives promoting domestic manufacturing and investment in advanced manufacturing technologies are fueling demand. However, factors like economic fluctuations, supply chain disruptions, and skilled labor shortages could potentially restrain growth. The industry is segmented by machine type (e.g., CNC machines, milling machines, lathes), application (e.g., metal cutting, metal forming), and end-user industry. Leading players, including TRUMPF Inc, Haas Automation Inc, and Amada Co Ltd, are actively investing in research and development to maintain their competitive edge through innovation and technological advancements. The competitive landscape is characterized by both established players and specialized niche manufacturers.

U.S. Machine Tool Industry Market Size (In Billion)

Looking ahead to 2033, the continued adoption of advanced manufacturing techniques, including additive manufacturing and digital twins, will likely reshape the market landscape. The focus will shift towards more flexible and adaptable machine tools capable of handling smaller batch sizes and customized production runs. The industry’s success will depend on effectively navigating the challenges of talent acquisition and retention, while simultaneously capitalizing on technological breakthroughs and the growing demand for precision and efficiency in manufacturing. This necessitates strategic investments in workforce training and collaboration between industry stakeholders to ensure the continued competitiveness of the U.S. machine tool sector. Specific regional variations in growth may exist, reflecting the concentration of manufacturing activities and industrial hubs across the country.

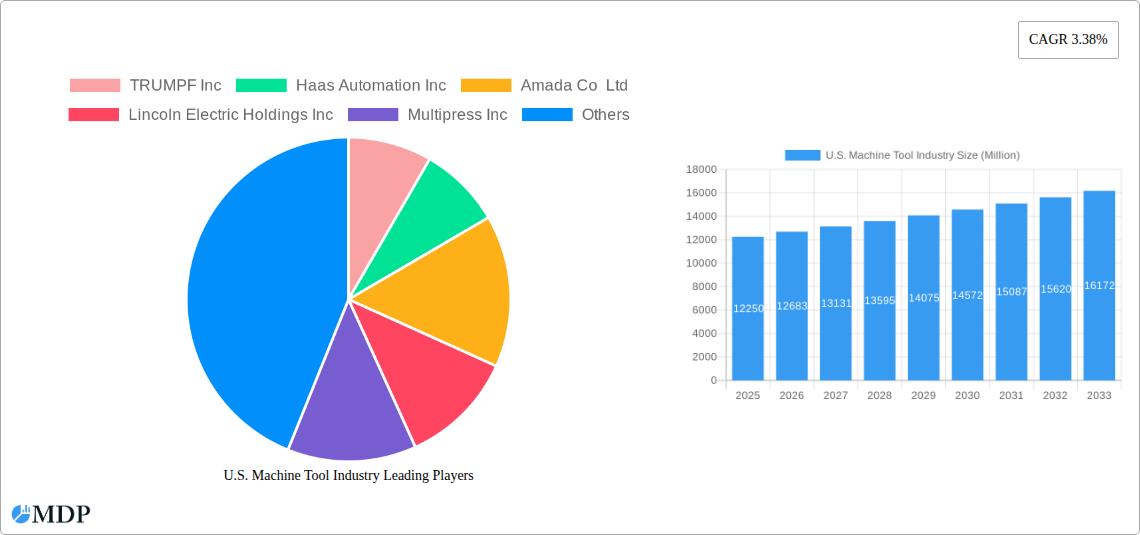

U.S. Machine Tool Industry Company Market Share

U.S. Machine Tool Industry Market Report: 2019-2033

Dive deep into the comprehensive analysis of the U.S. Machine Tool Industry, covering market dynamics, trends, leading players, and future projections (2019-2033). This report provides actionable insights for stakeholders, investors, and industry professionals.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

U.S. Machine Tool Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the U.S. machine tool industry, exploring market concentration, innovation drivers, regulatory frameworks, and market dynamics. The industry is characterized by a mix of large multinational corporations and specialized smaller businesses. Market share is highly fragmented, with no single company commanding a dominant position. However, several key players exert significant influence. The estimated market size in 2025 is $xx Million.

- Market Concentration: Moderately fragmented, with top 5 players holding an estimated xx% market share in 2025.

- Innovation Drivers: Automation, AI integration, advanced materials, and Industry 4.0 technologies are driving significant innovation.

- Regulatory Frameworks: Compliance with safety and environmental regulations influences manufacturing processes and product development.

- Product Substitutes: 3D printing and additive manufacturing present emerging challenges to traditional machining technologies.

- End-User Trends: Growing demand from the automotive, aerospace, and energy sectors fuels market growth.

- M&A Activities: The industry has witnessed xx M&A deals between 2019 and 2024, indicating consolidation and strategic expansion. For example, the acquisition of Peterson Tool Company by Sandvik in July 2022 represents a significant consolidation move.

U.S. Machine Tool Industry Industry Trends & Analysis

The U.S. machine tool industry exhibits a dynamic growth trajectory, driven by several key factors. Technological advancements, evolving consumer preferences, and intense competition shape the industry landscape. The industry is expected to experience a CAGR of xx% during the forecast period (2025-2033). Market penetration of advanced technologies like CNC machines and robotic automation continues to increase, reaching an estimated xx% in 2025.

- Market Growth Drivers: Increased automation, reshoring of manufacturing activities, and rising demand across diverse end-use sectors are driving the market's expansion.

- Technological Disruptions: The adoption of AI, IoT, and digital twins is revolutionizing manufacturing processes and improving efficiency.

- Consumer Preferences: Demand for high-precision, high-speed, and energy-efficient machines is shaping product development.

- Competitive Dynamics: Intense competition drives innovation and fosters the development of cutting-edge technologies.

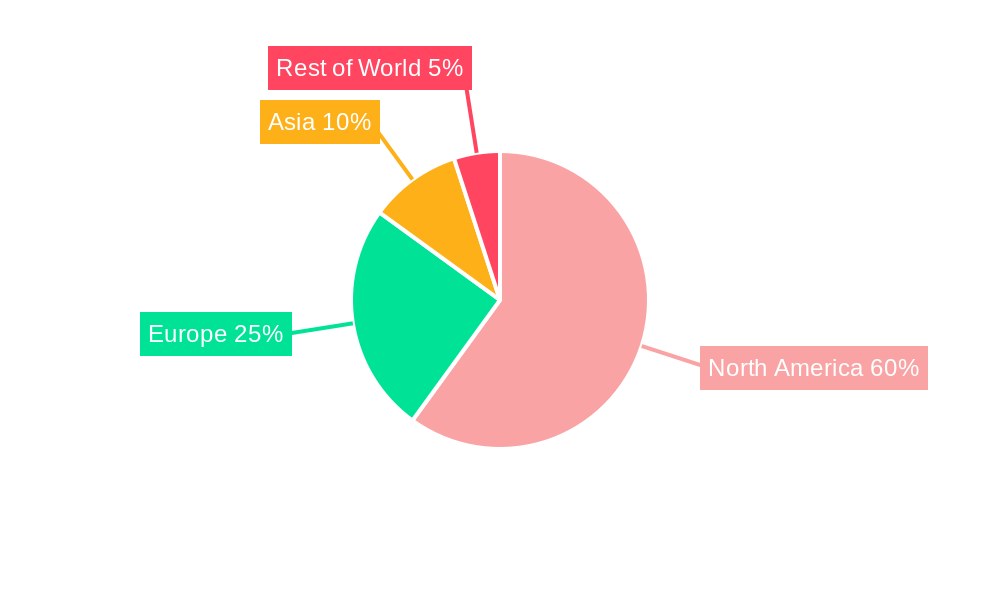

Leading Markets & Segments in U.S. Machine Tool Industry

The U.S. machine tool industry is geographically diverse, with significant regional variations in market size and growth rate. However, the Midwest region currently holds a leading position due to its strong manufacturing base. This region benefits from established infrastructure, skilled labor, and supportive government policies.

- Key Drivers of Midwest Dominance:

- Established industrial infrastructure.

- Concentration of automotive and aerospace manufacturing.

- Presence of skilled workforce.

- Supportive state and local government policies.

The automotive segment is the largest end-use market, followed by aerospace, and energy sectors. Growth in these sectors directly influences the demand for machine tools.

U.S. Machine Tool Industry Product Developments

Recent years have witnessed significant advancements in machine tool technology. Innovations include the integration of AI-powered predictive maintenance, improved automation features, and the development of more sustainable and energy-efficient machines. These advancements enhance precision, speed, and overall manufacturing efficiency. The development of hybrid and multi-functional machines is another important trend, enhancing flexibility and reducing the overall footprint of manufacturing operations.

Key Drivers of U.S. Machine Tool Industry Growth

Several factors fuel the growth of the U.S. machine tool industry. Government incentives for manufacturing automation, increased investments in infrastructure, and technological advancements contribute significantly. The growing adoption of Industry 4.0 principles enhances productivity and efficiency.

- Technological Advancements: Automation, AI, and digitalization improve efficiency and productivity.

- Economic Factors: Government investment in infrastructure and reshoring initiatives stimulate demand.

- Regulatory Factors: Incentives and tax benefits encourage investment in advanced technologies.

Challenges in the U.S. Machine Tool Industry Market

The industry faces several challenges, including supply chain disruptions, skilled labor shortages, and intense global competition. These factors impact production costs and profitability. For instance, supply chain disruptions related to the pandemic caused significant delays and cost increases in 2020-2022, impacting the industry by approximately $xx Million.

- Supply Chain Issues: Global supply chain vulnerabilities impact the availability of components.

- Skilled Labor Shortages: A lack of skilled workers hinders the industry's growth.

- Competitive Pressures: Global competition from low-cost manufacturers puts pressure on pricing.

Emerging Opportunities in U.S. Machine Tool Industry

Despite challenges, several opportunities exist for growth. The integration of additive manufacturing technologies into existing machine tool operations, expansion into new markets like renewable energy, and strategic partnerships for technological advancement present significant potential. The development of customized machine tools tailored to specific industry requirements represents another lucrative avenue.

Leading Players in the U.S. Machine Tool Industry Sector

- TRUMPF Inc

- Haas Automation Inc

- Amada Co Ltd

- Lincoln Electric Holdings Inc

- Multipress Inc

- MITUSA Inc

- MC Machinery Systems Inc

- Mate Precision Tooling Inc

- Bystronic Inc

- Laser Mechanisms Inc

- Koike Aronson Inc /Ransome

- FENN Metal Forming Machinery Solutions

- Cincinnati Inc (List Not Exhaustive)

Key Milestones in U.S. Machine Tool Industry Industry

- July 2022: Sandvik acquires Peterson Tool Company, expanding its tooling portfolio and strengthening its position in the market.

- June 2022: Doosan Machine Tools rebrands as DN Solutions, signifying a strategic shift towards comprehensive manufacturing solutions.

Strategic Outlook for U.S. Machine Tool Industry Market

The U.S. machine tool industry is poised for continued growth, driven by technological innovation and increasing demand across key sectors. Strategic partnerships, investment in automation, and focus on sustainability will be crucial for success in the coming years. The industry's future hinges on adapting to technological disruptions, addressing workforce challenges, and navigating global supply chain dynamics. The projected market size in 2033 is estimated to be $xx Million.

U.S. Machine Tool Industry Segmentation

-

1. Type

- 1.1. Metalworking Machines

- 1.2. Parts and Accessories

- 1.3. Installation

- 1.4. Repair

- 1.5. Maintenance

-

2. End User

- 2.1. Automotive

- 2.2. Fabrication and Industrial Machinery Manufacturing

- 2.3. Marine, Aerospace & Defense

- 2.4. Precision Engineering

- 2.5. Other End Users

U.S. Machine Tool Industry Segmentation By Geography

- 1. U.S.

U.S. Machine Tool Industry Regional Market Share

Geographic Coverage of U.S. Machine Tool Industry

U.S. Machine Tool Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing demand for domestic machine tools driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Machine Tool Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Metalworking Machines

- 5.1.2. Parts and Accessories

- 5.1.3. Installation

- 5.1.4. Repair

- 5.1.5. Maintenance

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Fabrication and Industrial Machinery Manufacturing

- 5.2.3. Marine, Aerospace & Defense

- 5.2.4. Precision Engineering

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TRUMPF Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haas Automation Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amada Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lincoln Electric Holdings Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Multipress Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MITUSA Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MC Machinery Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mate Precision Tooling Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bystronic Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Laser Mechanisms Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Koike Aronson Inc /Ransome

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 FENN Metal Forming Machinery Solutions

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cincinnati Inc **List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 TRUMPF Inc

List of Figures

- Figure 1: U.S. Machine Tool Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: U.S. Machine Tool Industry Share (%) by Company 2025

List of Tables

- Table 1: U.S. Machine Tool Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: U.S. Machine Tool Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 3: U.S. Machine Tool Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: U.S. Machine Tool Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 5: U.S. Machine Tool Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: U.S. Machine Tool Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: U.S. Machine Tool Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: U.S. Machine Tool Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 9: U.S. Machine Tool Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: U.S. Machine Tool Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 11: U.S. Machine Tool Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: U.S. Machine Tool Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Machine Tool Industry?

The projected CAGR is approximately 3.38%.

2. Which companies are prominent players in the U.S. Machine Tool Industry?

Key companies in the market include TRUMPF Inc, Haas Automation Inc, Amada Co Ltd, Lincoln Electric Holdings Inc, Multipress Inc, MITUSA Inc, MC Machinery Systems Inc, Mate Precision Tooling Inc, Bystronic Inc, Laser Mechanisms Inc, Koike Aronson Inc /Ransome, FENN Metal Forming Machinery Solutions, Cincinnati Inc **List Not Exhaustive.

3. What are the main segments of the U.S. Machine Tool Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.25 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing demand for domestic machine tools driving the market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: Peterson Tool Company, Inc. ("PTC"), a leading provider of machine-specific custom insert tooling solutions, had the previously announced finalized acquisition of its assets by Sandvik. Custom carbide form inserts are part of the product line and are used mainly in the general engineering and automotive industries for high-production turning and grooving applications. The operation will be referred to as Walter's GWS Tool division, which is a part of the Sandvik Manufacturing and Machining Solutions business area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Machine Tool Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Machine Tool Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Machine Tool Industry?

To stay informed about further developments, trends, and reports in the U.S. Machine Tool Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence