Key Insights

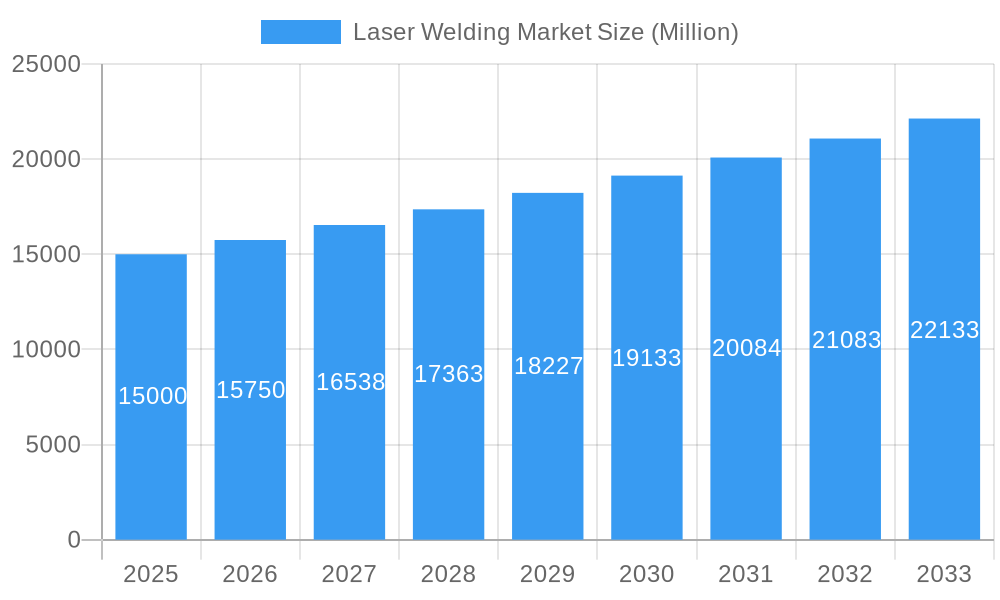

The global laser welding market is poised for significant expansion, propelled by escalating industrial automation and the superior performance of laser welding compared to conventional methods. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.7%. Key growth drivers include the automotive sector's demand for precise welding in lightweight vehicle construction, and advancements in laser technology that enhance efficiency, accuracy, and cost-effectiveness. The electronics industry's need for miniaturization and high-volume production, alongside emerging applications in medical devices and aerospace, further fuels market penetration. While initial equipment costs and skilled labor requirements present challenges, ongoing technological progress and the long-term economic benefits of laser welding are effectively addressing these concerns. The market is segmented by laser type, application, and region. Key market participants are actively driving innovation and fostering competition. The forecast period indicates sustained growth, promising a favorable outlook for stakeholders.

Laser Welding Market Market Size (In Billion)

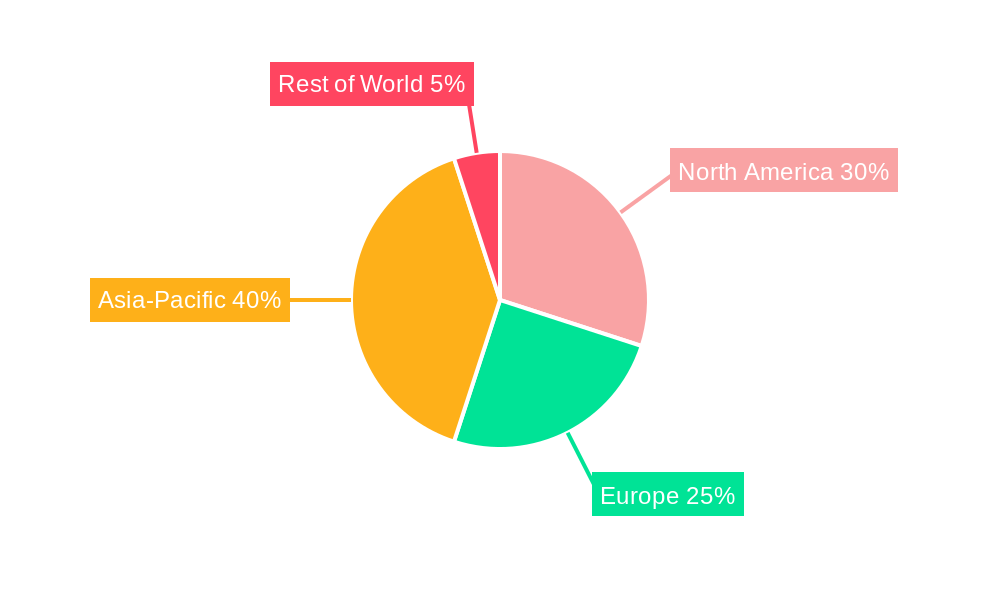

The estimated market size for 2025 is $2.9 billion, with consistent growth anticipated throughout the forecast period. Regional market dominance is expected in areas with robust manufacturing activities, notably Asia-Pacific, due to a high concentration of manufacturers. North America and Europe are also projected to retain substantial market shares, driven by established industries and technological advancements. Competitive analysis reveals ongoing innovation and strategic consolidation as companies pursue market leadership and technological differentiation. Continued investment in research and development for high-power lasers and sophisticated control systems will enhance laser welding capabilities and applications, thereby driving future market expansion.

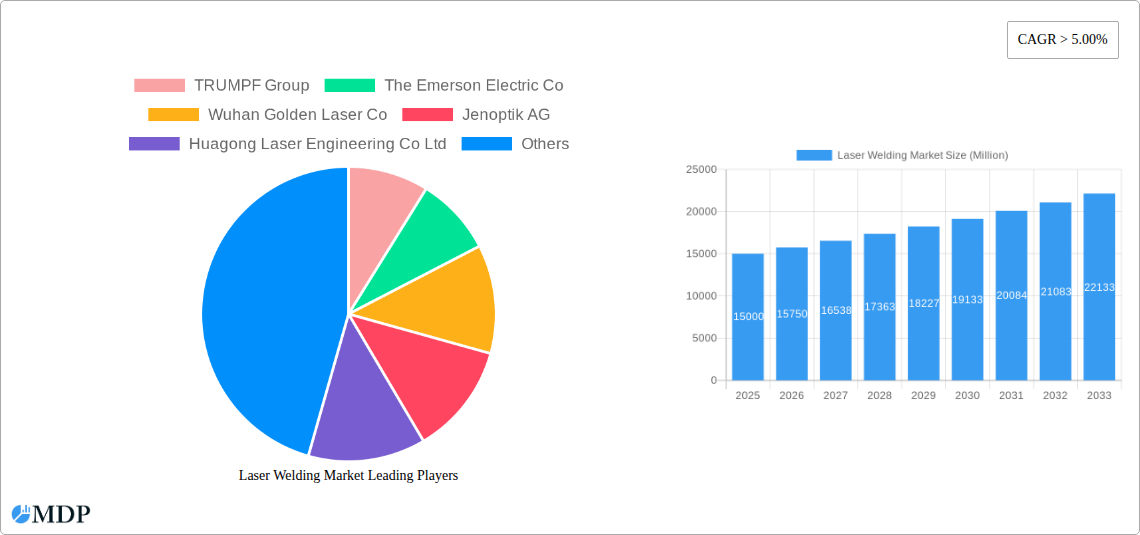

Laser Welding Market Company Market Share

Laser Welding Market: Comprehensive Report 2019-2033

This in-depth report provides a comprehensive analysis of the Laser Welding Market, covering market dynamics, industry trends, leading players, and future growth prospects from 2019 to 2033. With a focus on actionable insights and data-driven predictions, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report utilizes a robust methodology, incorporating extensive primary and secondary research to deliver precise market sizing, forecasting, and competitive landscaping. This report covers the period 2019-2024 (Historical Period), 2025 (Base Year & Estimated Year), and 2025-2033 (Forecast Period).

Laser Welding Market Market Dynamics & Concentration

The Laser Welding Market exhibits a [xx]% market concentration in 2025, indicating a [Highly Concentrated/ Moderately Concentrated/Fragmented] competitive landscape. Key drivers of innovation include advancements in laser technology (e.g., fiber lasers, ultra-short pulse lasers), increasing demand for high-precision welding in diverse industries, and stringent regulatory compliance requirements for safety and quality. Product substitutes, such as traditional welding techniques (e.g., arc welding, resistance welding), pose a competitive challenge, although laser welding continues to gain market share due to its superior precision and efficiency. End-user trends reveal a growing preference for automation and integration of laser welding systems into smart manufacturing environments.

Market Dynamics:

- High market growth driven by increasing automation in manufacturing.

- Technological advancements leading to improved precision and efficiency.

- Stringent regulatory frameworks driving adoption of safer welding technologies.

- Rising demand from automotive, electronics, and medical sectors.

- [xx] M&A deals observed in the past 5 years, indicating consolidation in the market.

- Average market share of top 5 players: [xx]%

Laser Welding Market Industry Trends & Analysis

The Laser Welding Market is projected to experience a CAGR of [xx]% during the forecast period (2025-2033). This robust growth is fueled by several key factors, including the increasing adoption of automation in various industries, the growing demand for high-precision welding in sectors such as automotive and electronics, and technological advancements that enhance the efficiency and capabilities of laser welding systems. Consumer preferences are shifting toward higher-quality, more durable products, driving demand for advanced welding techniques. Competitive dynamics are characterized by intense rivalry among established players and the emergence of innovative startups. Market penetration of laser welding technology is expected to reach [xx]% by 2033, driven by continuous improvements in technology and decreasing costs.

Leading Markets & Segments in Laser Welding Market

[Dominant Region/Country] holds the largest market share in the Laser Welding Market in 2025, accounting for approximately [xx]% of the global market. This dominance is attributed to several factors:

- Key Drivers:

- Strong economic growth and industrial development.

- Favorable government policies promoting advanced manufacturing.

- Robust automotive and electronics industries.

- Well-developed infrastructure supporting industrial operations.

Dominance Analysis: The region's established manufacturing base, coupled with its focus on technological innovation and automation, positions it as a key growth hub for the Laser Welding Market. Furthermore, supportive government initiatives promoting industrial automation have accelerated the adoption of laser welding technology.

Laser Welding Market Product Developments

Recent product innovations include the development of high-power fiber lasers capable of welding thicker materials, more compact and portable laser welding systems suitable for diverse applications, and advanced process control systems that enhance precision and repeatability. These developments are driven by the demand for increased efficiency, cost-effectiveness, and flexibility in manufacturing processes. New applications are emerging in areas such as medical device manufacturing, aerospace components, and battery production, driven by the need for precise and reliable welds.

Key Drivers of Laser Welding Market Growth

The Laser Welding Market is experiencing significant growth driven by several factors:

- Advancements in laser technology, leading to improved precision and speed.

- Increasing demand for automation in manufacturing across various industries.

- Growing need for high-quality welds in demanding applications like automotive and aerospace.

- Government regulations promoting energy efficiency and reduced emissions.

Challenges in the Laser Welding Market Market

Despite its strong growth potential, the Laser Welding Market faces several challenges:

- High initial investment costs associated with laser welding equipment.

- Potential supply chain disruptions impacting the availability of components.

- Intense competition among established players and emerging startups.

- Regulatory hurdles related to laser safety and environmental compliance.

Emerging Opportunities in Laser Welding Market

Emerging opportunities for the Laser Welding Market include:

The adoption of laser welding in new and emerging applications is expected to open up significant market opportunities, including the growing interest in 3D-printed metal components, where laser welding plays a crucial role in post-processing. Strategic partnerships and collaborations between laser manufacturers and industrial end-users are driving market expansion and fostering innovation. Additionally, the development of more sustainable and energy-efficient laser welding systems is attracting significant attention, especially within the context of environmental concerns.

Leading Players in the Laser Welding Market Sector

- TRUMPF Group

- The Emerson Electric Co

- Wuhan Golden Laser Co

- Jenoptik AG

- Huagong Laser Engineering Co Ltd

- LaserStar Technologies Corporation

- Shenzhen HeroLaser Equipment Co Ltd

- IPG Photonics Corporation

- Amada Miyachi

- EMAG GmbH & Co KG

- FANUC Robotics

- LASAG

- List Not Exhaustive

Key Milestones in Laser Welding Market Industry

- May 2022: HELD Industries GmbH's acquisition by INDUS Holding AG signals increased investment in precision laser welding, particularly for hydrogen electrolysis applications.

- February 2022: NLight's purchase of Plasmo Industrietechnik expands its offerings with advanced quality assurance solutions for welding and additive manufacturing.

Strategic Outlook for Laser Welding Market Market

The Laser Welding Market is poised for significant growth in the coming years, driven by continued technological advancements, expanding applications across diverse industries, and supportive government policies. Strategic opportunities lie in developing innovative laser welding solutions tailored to specific industry needs, expanding into new markets, and fostering strategic partnerships to enhance market reach and technological capabilities. The focus on sustainability and energy efficiency will also shape the future of the laser welding market.

Laser Welding Market Segmentation

-

1. Technology

- 1.1. Fiber

- 1.2. Co2

- 1.3. Solid-State

- 1.4. Others

Laser Welding Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Laser Welding Market Regional Market Share

Geographic Coverage of Laser Welding Market

Laser Welding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Fiber

- 5.1.2. Co2

- 5.1.3. Solid-State

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Fiber

- 6.1.2. Co2

- 6.1.3. Solid-State

- 6.1.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Fiber

- 7.1.2. Co2

- 7.1.3. Solid-State

- 7.1.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Fiber

- 8.1.2. Co2

- 8.1.3. Solid-State

- 8.1.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Fiber

- 9.1.2. Co2

- 9.1.3. Solid-State

- 9.1.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Fiber

- 10.1.2. Co2

- 10.1.3. Solid-State

- 10.1.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TRUMPF Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Emerson Electric Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wuhan Golden Laser Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jenoptik AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Huagong Laser Engineering Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LaserStar Technologies Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shenzhen HeroLaser Equipment Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IPG Photonics Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amada Miyachi

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 EMAG GmbH & Co KG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FANUC Robotics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LASAG*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 TRUMPF Group

List of Figures

- Figure 1: Laser Welding Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Laser Welding Market Share (%) by Company 2025

List of Tables

- Table 1: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Laser Welding Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Laser Welding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: Laser Welding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Laser Welding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Laser Welding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Laser Welding Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laser Welding Market?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Laser Welding Market?

Key companies in the market include TRUMPF Group, The Emerson Electric Co, Wuhan Golden Laser Co, Jenoptik AG, Huagong Laser Engineering Co Ltd, LaserStar Technologies Corporation, Shenzhen HeroLaser Equipment Co Ltd, IPG Photonics Corporation, Amada Miyachi, EMAG GmbH & Co KG, FANUC Robotics, LASAG*List Not Exhaustive.

3. What are the main segments of the Laser Welding Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Demand from the Automotive Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2022: The stock exchange HELD Industries GmbH, with its headquarters in Heusenstamm close to Offenbach, has sold 70% of its shares to INDUS Holding AG. The profitable medium-sized supplier of specialized equipment and systems for precision laser cutting and welding, which employed 22 people, achieved yearly revenues of about 12 million euros in the fiscal year 2021. Now that they have a reliable partner by their side, they wish to open up new business sectors and extend their international sales and service operations. In the future industry of hydrogen electrolysis, their ground-breaking laser welding technologies for H2 electrodes have particularly intriguing growth prospects.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laser Welding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laser Welding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laser Welding Market?

To stay informed about further developments, trends, and reports in the Laser Welding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence