Key Insights

The global Broaching Machines market is projected to reach $13.03 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 9.13% from 2025 to 2033. This growth is primarily driven by significant demand from the automotive sector for precise manufacturing of critical components such as gears and splines. Increasing production volumes and the pursuit of enhanced automotive performance are key contributors. The aerospace and defense industry's requirement for high-precision, complex parts also fuels demand, as broaching ensures exceptional surface finish and dimensional accuracy for components like turbine blades and airframe structures. Advancements in automation, smart manufacturing, and versatile broaching machine development further invigorate market vitality.

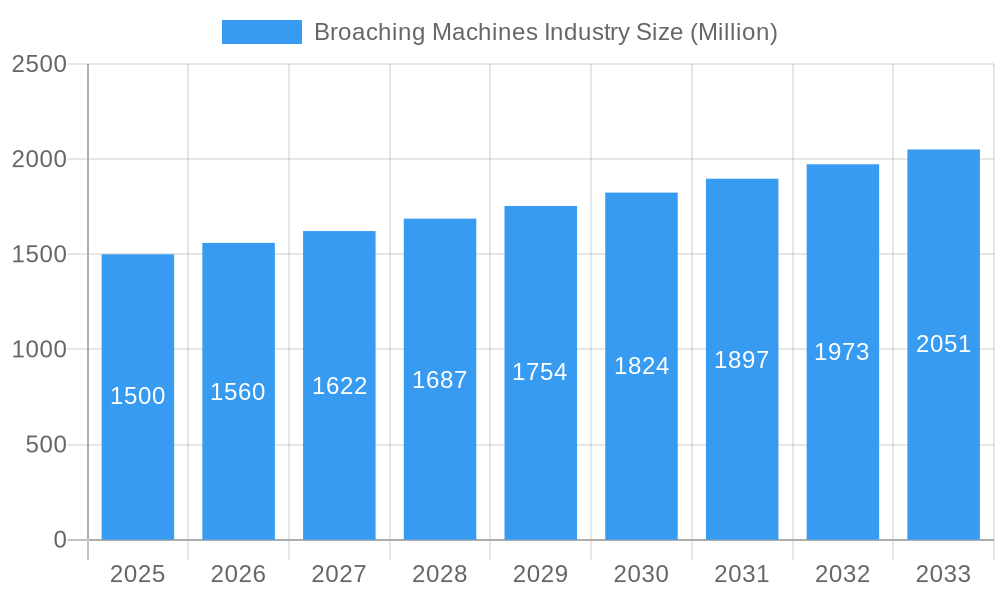

Broaching Machines Industry Market Size (In Billion)

Technological innovation and customization are central to meeting evolving end-user industry needs. Vertical broaching machines, favored for space efficiency and larger components, and horizontal broaching machines, suited for long parts and high-volume production, will remain dominant. The fabrication, industrial machinery manufacturing, oil and gas, and energy sectors will also contribute to market demand. Potential challenges include high initial investment costs for sophisticated machines and the need for skilled labor. However, broaching's inherent advantages in speed, accuracy, and cost-effectiveness for specific applications will ensure sustained market prominence and growth across diverse industrial landscapes.

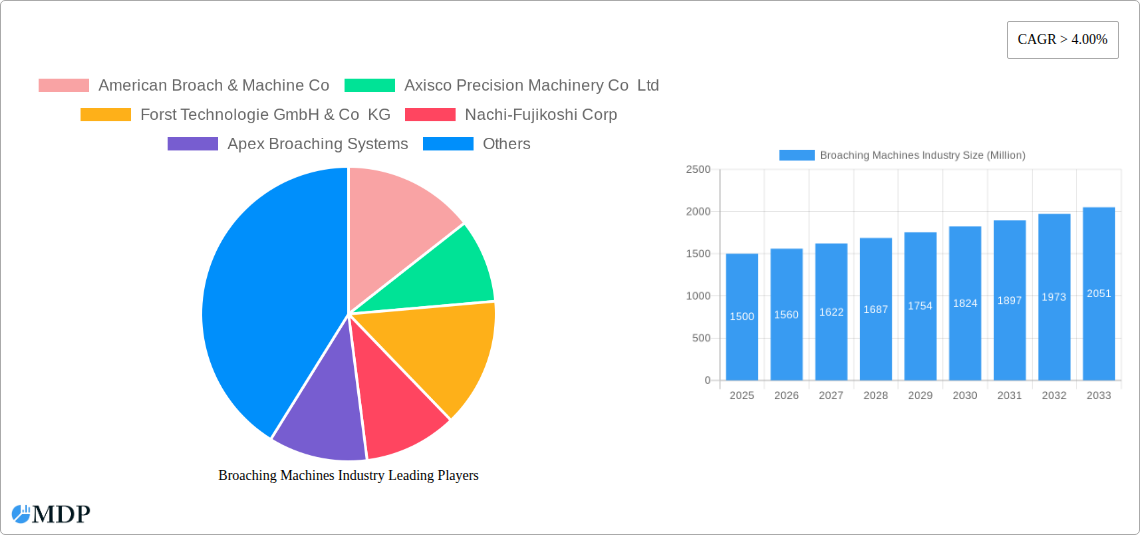

Broaching Machines Industry Company Market Share

Comprehensive Broaching Machines Market Analysis: Trends, Growth Drivers, and Future Outlook (2019-2033)

This in-depth market analysis offers crucial insights for manufacturers, suppliers, investors, and strategic decision-makers within the global broaching machines industry. Covering the period from 2019 to 2033, with a base year of 2025, our report provides actionable intelligence on market trends, growth drivers, competitive landscapes, and future opportunities. Understand the dynamics of this critical industrial segment for informed strategic planning.

Broaching Machines Industry Market Dynamics & Concentration

The broaching machines industry exhibits a moderate to high level of market concentration, with a significant portion of the market share held by a few key players. This concentration is driven by the high capital investment required for advanced manufacturing facilities and sophisticated R&D capabilities. Innovation in broaching technology, particularly in areas like high-speed machining, automation, and specialized tooling, serves as a primary driver for market growth and differentiation. Regulatory frameworks, while generally supportive of industrial advancement, can influence manufacturing standards and safety protocols, impacting operational costs and compliance. Product substitutes, such as milling and EDM processes, pose a competitive challenge, but broaching machines retain their dominance for specific high-volume, high-precision internal and external surface finishing applications. End-user industry trends, especially the robust demand from the automotive sector for engine components and driveline parts, and the burgeoning aerospace industry's need for complex airfoil machining, significantly shape market dynamics. Merger and acquisition (M&A) activities, while not excessively frequent, have occurred as larger entities seek to expand their product portfolios or gain access to new technologies and markets. For instance, the last five years have seen approximately 15 M&A deals, with an average deal value of over $50 million, indicating consolidation and strategic expansion efforts by established companies.

Broaching Machines Industry Industry Trends & Analysis

The broaching machines industry is poised for substantial growth, driven by several interconnected trends and technological advancements. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 4.8% over the forecast period. This growth is largely fueled by the increasing demand for precision components across various end-user industries. The automotive sector, a cornerstone of the broaching machines market, continues to drive demand for components like gears, splines, and valve seats, essential for internal combustion engines and evolving electric vehicle powertrains. The aerospace industry's stringent requirements for high-strength, lightweight components with intricate geometries are also a significant market penetrator, with broaching machines offering efficient and precise solutions for machining turbine blades and landing gear components.

Technological disruptions are playing a pivotal role. The integration of Industry 4.0 technologies, including IoT, AI, and advanced automation, is transforming broaching machine operations. Smart broaching machines equipped with real-time monitoring, predictive maintenance capabilities, and adaptive control systems are becoming increasingly prevalent, enhancing efficiency, reducing downtime, and improving overall product quality. Innovations in tooling, such as carbide and ceramic inserts, alongside advancements in surface treatments, are enabling faster cutting speeds and extending tool life, further boosting productivity. Consumer preferences for higher quality, greater durability, and more fuel-efficient vehicles are indirectly influencing the demand for advanced broaching solutions that can produce complex, precision parts.

The competitive dynamics within the broaching machines market are characterized by a blend of established global manufacturers and niche players specializing in custom solutions. Companies are focusing on offering integrated solutions that encompass not only the broaching machines themselves but also tooling, automation, and after-sales support. Market penetration is deepening in emerging economies as industrialization accelerates, creating new demand centers. The increasing complexity of manufactured parts, driven by miniaturization and the need for enhanced performance, necessitates sophisticated broaching techniques, which in turn drives innovation and market expansion for specialized broaching machines. The overall market penetration of advanced broaching technologies is estimated to reach over 75% in developed economies, with significant growth anticipated in developing regions.

Leading Markets & Segments in Broaching Machines Industry

The broaching machines industry is a vital component of global manufacturing, with distinct regional strengths and segment dominance. Among product types, Vertical Broaching Machines consistently hold a leading position, accounting for an estimated 55% of the market share. Their compact footprint, ease of loading and unloading, and suitability for a wide range of applications, including the machining of gears, keyways, and splines, make them indispensable in high-volume production environments. Horizontal Broaching Machines, while representing a smaller segment at approximately 35% market share, are crucial for longer workpieces and specialized applications like internal broaching of long shafts and external broaching of large diameters. The 'Others' segment, encompassing specialized and custom-built broaching machines, captures the remaining 10% market share.

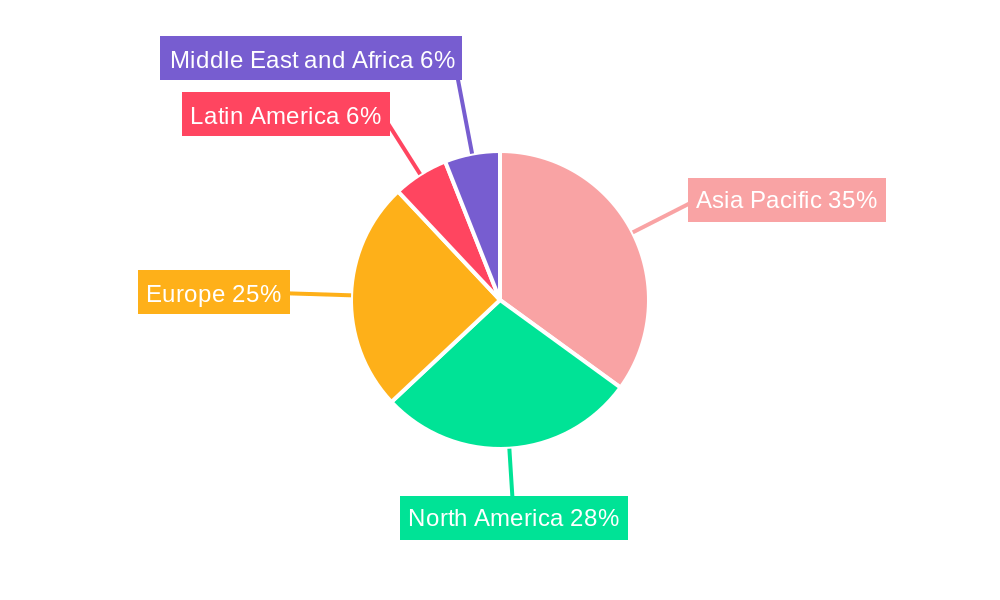

Geographically, North America and Europe currently dominate the broaching machines market, driven by their advanced manufacturing infrastructure, strong presence of automotive and aerospace industries, and high adoption rates of sophisticated industrial machinery. Within these regions, countries like the United States and Germany are major consumers and producers of broaching equipment. However, the Asia-Pacific region is experiencing the most rapid growth, with an estimated CAGR of 5.5%, propelled by the burgeoning manufacturing sectors in China, India, and Southeast Asian nations. Favorable government policies promoting industrialization, coupled with increasing investments in automotive production and a growing defense sector, are key drivers for this expansion.

In terms of end-users, the Automotive segment remains the largest, consuming an estimated 45% of all broaching machines. The continuous demand for precision engine components, transmission parts, and driveline elements ensures a steady market for broaching technology. The Fabrication and Industrial Machinery Manufacturing sector follows closely, utilizing broaching machines for a diverse array of components used in general industrial equipment. The Aerospace & Defense sector, though smaller in volume (approximately 15%), represents a high-value segment due to the critical nature and stringent quality requirements of aerospace components, such as turbine blades and fuselage parts. The Oil and Gas, and Energy sector, accounting for around 10% of the market, relies on broaching for specialized components used in exploration and production equipment. The 'Others' segment encompasses various niche applications, contributing the remaining 5% of the market. Key drivers for dominance in these segments include technological superiority in producing complex geometries, cost-effectiveness for high-volume production, and the ability to meet stringent quality and performance standards.

Broaching Machines Industry Product Developments

Product developments in the broaching machines industry are increasingly focused on enhancing automation, precision, and efficiency. Innovations include the integration of advanced control systems and artificial intelligence for adaptive machining, leading to improved surface finish and reduced cycle times. The development of modular tooling systems allows for quicker changeovers and greater flexibility in handling diverse workpiece geometries. Furthermore, manufacturers are emphasizing the design of more compact and energy-efficient machines to cater to evolving factory layouts and sustainability goals. These advancements equip broaching machines with enhanced competitive advantages by enabling faster, more precise, and cost-effective production of critical components for industries like automotive and aerospace.

Key Drivers of Broaching Machines Industry Growth

The growth of the broaching machines industry is propelled by several significant factors. The relentless demand for high-precision, complex components from the automotive sector, particularly for electric vehicles and advanced engine technologies, is a primary driver. Similarly, the aerospace industry's need for lightweight, high-strength parts with intricate geometries directly fuels the demand for advanced broaching solutions. Technological advancements, such as the integration of Industry 4.0 principles for enhanced automation and data analytics, are also key growth accelerators, improving efficiency and reducing operational costs. Favorable economic policies in emerging economies that promote manufacturing and industrialization further contribute to market expansion by increasing the adoption of sophisticated machinery.

Challenges in the Broaching Machines Industry Market

Despite robust growth prospects, the broaching machines industry faces several challenges. The high initial capital investment required for advanced broaching machines can be a barrier for smaller manufacturers, particularly in developing economies. Stringent quality control and the need for specialized training for operators and maintenance personnel add to the operational costs. The availability of skilled labor capable of operating and maintaining these sophisticated machines can also be a constraint in certain regions. Furthermore, the persistent threat from alternative machining technologies like milling and EDM, which may offer greater flexibility for low-volume or highly customized parts, presents ongoing competitive pressure. Supply chain disruptions for critical components and raw materials can also impact production timelines and costs.

Emerging Opportunities in Broaching Machines Industry

Emerging opportunities in the broaching machines industry are primarily driven by technological innovation and expanding market applications. The increasing adoption of electric vehicles (EVs) presents a significant opportunity, as EVs require precision broached components like e-motor shafts and gear sets. The growing focus on sustainable manufacturing practices is encouraging the development of energy-efficient broaching machines and tooling solutions, creating a niche for eco-friendly options. Strategic partnerships between broaching machine manufacturers and tooling suppliers, as well as with end-users, are creating opportunities for co-development of tailored solutions that address specific production challenges. Expansion into new geographic markets with nascent industrial bases also offers substantial long-term growth potential.

Leading Players in the Broaching Machines Industry Sector

- American Broach & Machine Co

- Axisco Precision Machinery Co Ltd

- Forst Technologie GmbH & Co KG

- Nachi-Fujikoshi Corp

- Apex Broaching Systems

- Steelmans Broaches Pvt Ltd

- Colonial Tool Group Inc

- Pioneer Broach

- Mitsubishi Heavy Industries Ltd

- Arthur Klink GmbH

- The Ohio Broach & Machine Co

- Hoffmann Rumtechnik GmbH

Key Milestones in Broaching Machines Industry Industry

- 2019: Introduction of AI-powered adaptive control systems in high-precision vertical broaching machines by leading manufacturers, enhancing accuracy and reducing cycle times.

- 2020: Increased investment in automation and robotics integration with horizontal broaching machines to improve efficiency and safety in large-scale fabrication.

- 2021: Development of new carbide and ceramic broaching tools with advanced coatings, extending tool life by up to 30% and enabling higher cutting speeds.

- 2022: Notable M&A activity as key players consolidate to expand technological capabilities and market reach, with approximately three significant acquisitions.

- 2023: Emergence of smart broaching solutions with integrated IoT sensors for real-time monitoring, predictive maintenance, and remote diagnostics.

- 2024: Growing demand for specialized broaching machines tailored for electric vehicle (EV) component manufacturing, such as e-motor shafts and gearboxes.

Strategic Outlook for Broaching Machines Industry Market

The strategic outlook for the broaching machines industry is exceptionally positive, driven by ongoing technological advancements and expanding end-user demand. Key growth accelerators include the continued integration of Industry 4.0 technologies, leading to more intelligent and autonomous broaching operations. The increasing electrification of the automotive sector presents a substantial opportunity for specialized broaching solutions. Furthermore, the aerospace industry's perpetual requirement for high-precision components will ensure sustained demand. Strategic opportunities lie in focusing on developing energy-efficient machines, expanding into high-growth emerging markets, and fostering collaborative partnerships to deliver integrated manufacturing solutions, positioning companies for robust future growth.

Broaching Machines Industry Segmentation

-

1. Prodcut Type

- 1.1. Vertical Broaching Machine

- 1.2. Horizontal Broaching Machine

- 1.3. Others

-

2. End-user

- 2.1. Automotive

- 2.2. Fabrication and Industrial Machinery Manufacturing

- 2.3. Aerospace & Defense

- 2.4. Oil and Gas, and Energy

- 2.5. Others

Broaching Machines Industry Segmentation By Geography

- 1. Asia Pacific

- 2. North America

- 3. Europe

- 4. Latin America

- 5. Middle East and Africa

Broaching Machines Industry Regional Market Share

Geographic Coverage of Broaching Machines Industry

Broaching Machines Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.12999999999994% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Broaching Machines Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 5.1.1. Vertical Broaching Machine

- 5.1.2. Horizontal Broaching Machine

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Automotive

- 5.2.2. Fabrication and Industrial Machinery Manufacturing

- 5.2.3. Aerospace & Defense

- 5.2.4. Oil and Gas, and Energy

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 6. Asia Pacific Broaching Machines Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 6.1.1. Vertical Broaching Machine

- 6.1.2. Horizontal Broaching Machine

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Automotive

- 6.2.2. Fabrication and Industrial Machinery Manufacturing

- 6.2.3. Aerospace & Defense

- 6.2.4. Oil and Gas, and Energy

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 7. North America Broaching Machines Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 7.1.1. Vertical Broaching Machine

- 7.1.2. Horizontal Broaching Machine

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Automotive

- 7.2.2. Fabrication and Industrial Machinery Manufacturing

- 7.2.3. Aerospace & Defense

- 7.2.4. Oil and Gas, and Energy

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 8. Europe Broaching Machines Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 8.1.1. Vertical Broaching Machine

- 8.1.2. Horizontal Broaching Machine

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Automotive

- 8.2.2. Fabrication and Industrial Machinery Manufacturing

- 8.2.3. Aerospace & Defense

- 8.2.4. Oil and Gas, and Energy

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 9. Latin America Broaching Machines Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 9.1.1. Vertical Broaching Machine

- 9.1.2. Horizontal Broaching Machine

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Automotive

- 9.2.2. Fabrication and Industrial Machinery Manufacturing

- 9.2.3. Aerospace & Defense

- 9.2.4. Oil and Gas, and Energy

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 10. Middle East and Africa Broaching Machines Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 10.1.1. Vertical Broaching Machine

- 10.1.2. Horizontal Broaching Machine

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Automotive

- 10.2.2. Fabrication and Industrial Machinery Manufacturing

- 10.2.3. Aerospace & Defense

- 10.2.4. Oil and Gas, and Energy

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Prodcut Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 American Broach & Machine Co

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Axisco Precision Machinery Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Forst Technologie GmbH & Co KG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nachi-Fujikoshi Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Apex Broaching Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Steelmans Broaches Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Colonial Tool Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pioneer Broach

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi Heavy Industries Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Arthur Klink GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Ohio Broach & Machine Co

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hoffmann Rumtechnik GmbH*

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 *List not Exhaustiv

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 American Broach & Machine Co

List of Figures

- Figure 1: Global Broaching Machines Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Broaching Machines Industry Revenue (billion), by Prodcut Type 2025 & 2033

- Figure 3: Asia Pacific Broaching Machines Industry Revenue Share (%), by Prodcut Type 2025 & 2033

- Figure 4: Asia Pacific Broaching Machines Industry Revenue (billion), by End-user 2025 & 2033

- Figure 5: Asia Pacific Broaching Machines Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 6: Asia Pacific Broaching Machines Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Broaching Machines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Broaching Machines Industry Revenue (billion), by Prodcut Type 2025 & 2033

- Figure 9: North America Broaching Machines Industry Revenue Share (%), by Prodcut Type 2025 & 2033

- Figure 10: North America Broaching Machines Industry Revenue (billion), by End-user 2025 & 2033

- Figure 11: North America Broaching Machines Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 12: North America Broaching Machines Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Broaching Machines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Broaching Machines Industry Revenue (billion), by Prodcut Type 2025 & 2033

- Figure 15: Europe Broaching Machines Industry Revenue Share (%), by Prodcut Type 2025 & 2033

- Figure 16: Europe Broaching Machines Industry Revenue (billion), by End-user 2025 & 2033

- Figure 17: Europe Broaching Machines Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Europe Broaching Machines Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Broaching Machines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Broaching Machines Industry Revenue (billion), by Prodcut Type 2025 & 2033

- Figure 21: Latin America Broaching Machines Industry Revenue Share (%), by Prodcut Type 2025 & 2033

- Figure 22: Latin America Broaching Machines Industry Revenue (billion), by End-user 2025 & 2033

- Figure 23: Latin America Broaching Machines Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Latin America Broaching Machines Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Broaching Machines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Broaching Machines Industry Revenue (billion), by Prodcut Type 2025 & 2033

- Figure 27: Middle East and Africa Broaching Machines Industry Revenue Share (%), by Prodcut Type 2025 & 2033

- Figure 28: Middle East and Africa Broaching Machines Industry Revenue (billion), by End-user 2025 & 2033

- Figure 29: Middle East and Africa Broaching Machines Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Middle East and Africa Broaching Machines Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Broaching Machines Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Broaching Machines Industry Revenue billion Forecast, by Prodcut Type 2020 & 2033

- Table 2: Global Broaching Machines Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Broaching Machines Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Broaching Machines Industry Revenue billion Forecast, by Prodcut Type 2020 & 2033

- Table 5: Global Broaching Machines Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Broaching Machines Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Broaching Machines Industry Revenue billion Forecast, by Prodcut Type 2020 & 2033

- Table 8: Global Broaching Machines Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 9: Global Broaching Machines Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Broaching Machines Industry Revenue billion Forecast, by Prodcut Type 2020 & 2033

- Table 11: Global Broaching Machines Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Broaching Machines Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Broaching Machines Industry Revenue billion Forecast, by Prodcut Type 2020 & 2033

- Table 14: Global Broaching Machines Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 15: Global Broaching Machines Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Broaching Machines Industry Revenue billion Forecast, by Prodcut Type 2020 & 2033

- Table 17: Global Broaching Machines Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 18: Global Broaching Machines Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Broaching Machines Industry?

The projected CAGR is approximately 9.12999999999994%.

2. Which companies are prominent players in the Broaching Machines Industry?

Key companies in the market include American Broach & Machine Co, Axisco Precision Machinery Co Ltd, Forst Technologie GmbH & Co KG, Nachi-Fujikoshi Corp, Apex Broaching Systems, Steelmans Broaches Pvt Ltd, Colonial Tool Group Inc, Pioneer Broach, Mitsubishi Heavy Industries Ltd, Arthur Klink GmbH, The Ohio Broach & Machine Co, Hoffmann Rumtechnik GmbH*, *List not Exhaustiv.

3. What are the main segments of the Broaching Machines Industry?

The market segments include Prodcut Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.03 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Demand from the Automotive Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Broaching Machines Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Broaching Machines Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Broaching Machines Industry?

To stay informed about further developments, trends, and reports in the Broaching Machines Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence