Key Insights

The global assembly line industry is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 7.85%. This robust growth, estimated from a market size of 307.15 billion in the base year 2025, is propelled by escalating automation adoption across diverse manufacturing sectors. Key growth drivers include the imperative for enhanced efficiency, increased productivity, and reduced operational costs. The integration of advanced technologies like robotics, AI, and Industry 4.0 principles further accelerates market development. The burgeoning e-commerce landscape demands faster, more agile assembly processes, contributing to this upward trend. Additionally, the increasing preference for personalized products and shorter product lifecycles necessitates highly adaptable and efficient assembly solutions, bolstering market demand.

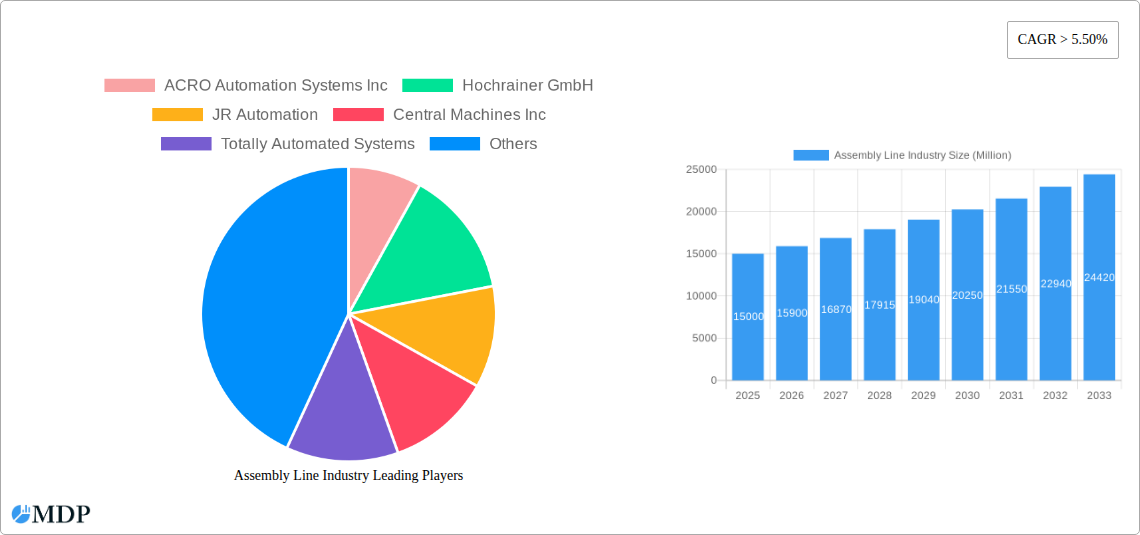

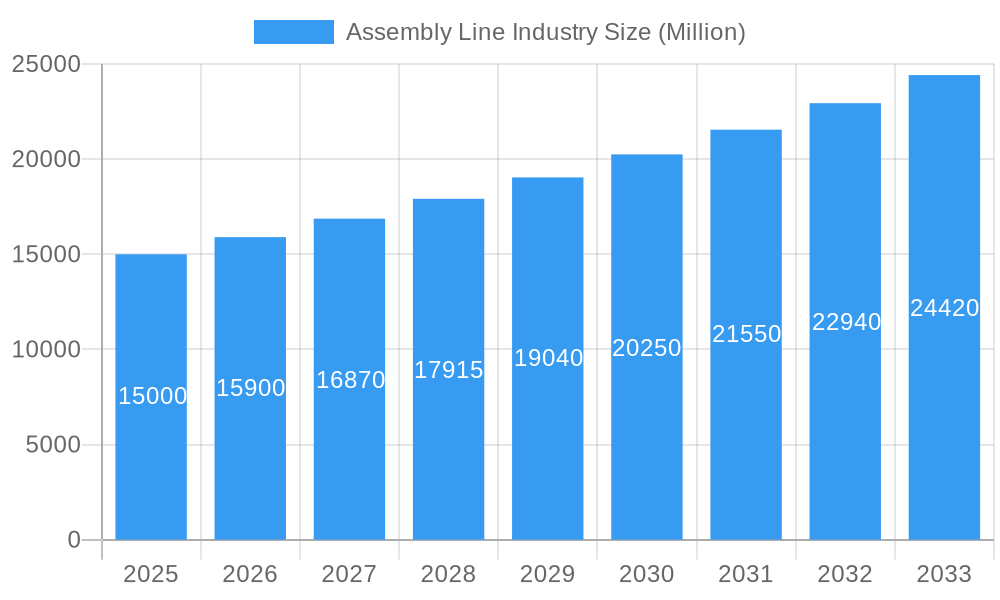

Assembly Line Industry Market Size (In Billion)

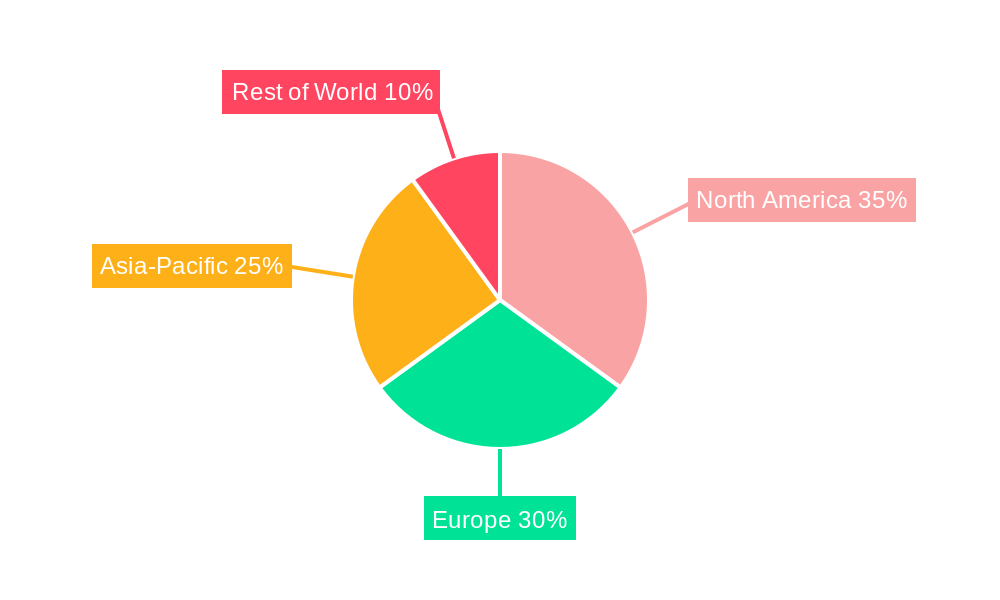

The assembly line market is segmented by automation type (e.g., robotic, automated guided vehicles - AGVs), industry served (e.g., automotive, electronics, food & beverage), and component. Leading industry participants, including ACRO Automation Systems Inc, Hochrainer GmbH, and JR Automation, are strategically investing in research and development to pioneer innovative solutions and fortify their market positions. While North America and Europe currently dominate market share due to established manufacturing ecosystems and technological leadership, the Asia-Pacific region is anticipated to experience the most rapid growth. This surge is attributed to rapid industrialization and expanding manufacturing capabilities in economies such as China and India. The forecast period, from 2025 to 2033, anticipates sustained market growth, influenced by continuous technological advancements, evolving industrial requirements, and prevailing global economic conditions.

Assembly Line Industry Company Market Share

Assembly Line Industry Market Report: 2019-2033

Unlocking Growth in the Multi-Billion Dollar Assembly Line Industry: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the global Assembly Line Industry, projecting a market value exceeding $XX Million by 2033. It delves into market dynamics, industry trends, leading players, and emerging opportunities, offering crucial insights for stakeholders across the value chain. The report leverages data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033) to deliver actionable intelligence.

Assembly Line Industry Market Dynamics & Concentration

The global assembly line industry, valued at $XX Million in 2025, is experiencing a dynamic shift driven by technological advancements, evolving regulatory landscapes, and fluctuating end-user demands. Market concentration is moderate, with several key players vying for dominance. While precise market share figures for each company are unavailable, the industry is characterized by both large multinational corporations and specialized niche players. The estimated annual M&A deal count within the sector sits at approximately xx deals annually, indicating substantial consolidation efforts.

- Innovation Drivers: Automation, AI, robotics, and IoT are revolutionizing assembly line processes, leading to increased efficiency and reduced costs.

- Regulatory Frameworks: Stringent safety and environmental regulations influence design, production, and operation of assembly lines, driving innovation in compliance solutions.

- Product Substitutes: While few direct substitutes exist for fully automated assembly lines, alternative production methods pose some competitive pressure.

- End-User Trends: Growing demand across diverse sectors like automotive, electronics, pharmaceuticals, and food processing fuels market growth.

- M&A Activities: Strategic acquisitions and mergers are reshaping the competitive landscape, driving technological integration and expansion into new markets.

Assembly Line Industry Industry Trends & Analysis

The Assembly Line Industry exhibits a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily propelled by escalating automation adoption, surging demand for customized products, and increasing investments in advanced technologies. Technological disruptions, particularly in areas such as AI-powered quality control and predictive maintenance, are significantly altering manufacturing processes. Market penetration of these advanced technologies remains relatively low (xx%), but it is anticipated to witness substantial growth in the coming years, exceeding xx% by 2033. Consumer preferences for personalized and high-quality products are driving demand for flexible and adaptable assembly lines. The competitive landscape is marked by intense competition, particularly among larger players who are strategically investing in R&D and expanding geographically.

Leading Markets & Segments in Assembly Line Industry

The dominant region for assembly line solutions is currently North America, followed closely by Europe and Asia. Within these regions, specific countries like the USA, Germany, and China hold significant market shares due to robust manufacturing sectors and higher technological adoption rates.

- Key Drivers in North America: Strong automotive and electronics industries, supportive government policies, and well-developed infrastructure.

- Key Drivers in Europe: High level of automation in manufacturing, focus on sustainability, and presence of several leading assembly line solution providers.

- Key Drivers in Asia: Rapid industrialization, burgeoning consumer markets, and lower labor costs.

The automotive segment currently dominates the Assembly Line Industry, accounting for approximately xx% of the overall market. However, substantial growth is projected in the electronics and pharmaceutical segments driven by increasing production volumes and stringent quality control requirements.

Assembly Line Industry Product Developments

Recent product innovations include flexible and reconfigurable assembly lines, AI-powered quality inspection systems, and collaborative robots (cobots) designed to enhance human-robot interaction. These innovations significantly improve efficiency, reduce waste, and improve product quality. The market fit is excellent, with numerous companies across diverse industries actively seeking automation solutions to enhance their operations. The trend is towards modular and scalable solutions that can adapt to changing production needs.

Key Drivers of Assembly Line Industry Growth

Several key factors propel the growth of the Assembly Line Industry:

- Technological advancements: AI, robotics, and IoT are driving efficiency, productivity, and quality improvements.

- Economic factors: Rising disposable incomes, increasing consumer demand, and global industrial expansion.

- Regulatory pressures: Stringent environmental and safety regulations drive demand for advanced and compliant assembly lines.

Challenges in the Assembly Line Industry Market

The Assembly Line Industry faces significant challenges:

- High initial investment costs: Implementing advanced automation solutions requires substantial upfront capital expenditure.

- Supply chain disruptions: Global supply chain vulnerabilities can impact the availability of components and materials.

- Intense competition: The industry is characterized by fierce competition, requiring companies to constantly innovate and differentiate.

Emerging Opportunities in Assembly Line Industry

Significant long-term growth opportunities exist due to:

- Advancements in AI and machine learning: These technologies promise to further optimize production processes and improve quality control.

- Strategic partnerships and collaborations: Joint ventures and alliances enable companies to leverage complementary resources and technologies.

- Expansion into new markets: Emerging economies present untapped potential for growth.

Leading Players in the Assembly Line Industry Sector

- ACRO Automation Systems Inc

- Hochrainer GmbH

- JR Automation

- Central Machines Inc

- Totally Automated Systems

- Fusion Systems Group

- Adescor Inc

- Gemtec GmbH

- Markone Control Systems

- Eriez Manufacturing Co

- NEVMAT Australia PTY LTD

- RNA Automation

- UMD Automated Systems

- Mondragon Assembly

- Hitachi Power Solutions Co Ltd

- MechTech Automation Group

- RG-Luma Automation

- BBS Automation

- SITEC Industrietechnologie GmbH

List Not Exhaustive

Key Milestones in Assembly Line Industry Industry

- May 2021: Mondragon Assembly expands into the USA market, opening a new subsidiary in Chicago. This significantly increases their market reach and strengthens their service capabilities in North America.

- August 2021: JR Automation unites its five divisional brands under a single corporate identity, streamlining operations and enhancing brand recognition. This move likely improved internal coordination and market presence.

Strategic Outlook for Assembly Line Industry Market

The Assembly Line Industry is poised for continued growth, driven by technological advancements and increasing demand from diverse sectors. Strategic opportunities lie in developing innovative solutions, fostering strategic partnerships, and capitalizing on expansion into high-growth markets. Companies that embrace cutting-edge technologies, adapt to evolving customer needs, and proactively manage supply chain risks will be best positioned to thrive in this dynamic market.

Assembly Line Industry Segmentation

-

1. Type

- 1.1. Manual Assembly Lines

- 1.2. Semi-automated Assembly Lines

- 1.3. Fully Automated Assembly Lines

-

2. End-user

- 2.1. Automotive

- 2.2. Industrial Manufacturing

- 2.3. Electronics and Semiconductors

- 2.4. Medical & Pharmaceutical

- 2.5. Others

Assembly Line Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Latin America

- 5. Rest of the World

Assembly Line Industry Regional Market Share

Geographic Coverage of Assembly Line Industry

Assembly Line Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand from Electric Vehicle Companies Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Manual Assembly Lines

- 5.1.2. Semi-automated Assembly Lines

- 5.1.3. Fully Automated Assembly Lines

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Automotive

- 5.2.2. Industrial Manufacturing

- 5.2.3. Electronics and Semiconductors

- 5.2.4. Medical & Pharmaceutical

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. Latin America

- 5.3.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Manual Assembly Lines

- 6.1.2. Semi-automated Assembly Lines

- 6.1.3. Fully Automated Assembly Lines

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Automotive

- 6.2.2. Industrial Manufacturing

- 6.2.3. Electronics and Semiconductors

- 6.2.4. Medical & Pharmaceutical

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Manual Assembly Lines

- 7.1.2. Semi-automated Assembly Lines

- 7.1.3. Fully Automated Assembly Lines

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Automotive

- 7.2.2. Industrial Manufacturing

- 7.2.3. Electronics and Semiconductors

- 7.2.4. Medical & Pharmaceutical

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Manual Assembly Lines

- 8.1.2. Semi-automated Assembly Lines

- 8.1.3. Fully Automated Assembly Lines

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Automotive

- 8.2.2. Industrial Manufacturing

- 8.2.3. Electronics and Semiconductors

- 8.2.4. Medical & Pharmaceutical

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Manual Assembly Lines

- 9.1.2. Semi-automated Assembly Lines

- 9.1.3. Fully Automated Assembly Lines

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Automotive

- 9.2.2. Industrial Manufacturing

- 9.2.3. Electronics and Semiconductors

- 9.2.4. Medical & Pharmaceutical

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of the World Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Manual Assembly Lines

- 10.1.2. Semi-automated Assembly Lines

- 10.1.3. Fully Automated Assembly Lines

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Automotive

- 10.2.2. Industrial Manufacturing

- 10.2.3. Electronics and Semiconductors

- 10.2.4. Medical & Pharmaceutical

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ACRO Automation Systems Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hochrainer GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JR Automation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Central Machines Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Totally Automated Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fusion Systems Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Adescor Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gemtec GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Markone Control Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eriez Manufacturing Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NEVMAT Australia PTY LTD

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 RNA Automation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 UMD Automated Systems

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mondragon Assembly

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hitachi Power Solutions Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 MechTech Automation Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 RG-Luma Automation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 BBS Automation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 SITEC Industrietechnologie GmbH**List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 ACRO Automation Systems Inc

List of Figures

- Figure 1: Global Assembly Line Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Asia Pacific Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Asia Pacific Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 11: Asia Pacific Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Asia Pacific Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 17: Europe Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Europe Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 23: Latin America Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Latin America Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Rest of the World Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 29: Rest of the World Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Rest of the World Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Rest of the World Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Assembly Line Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 9: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 15: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 18: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Assembly Line Industry?

The projected CAGR is approximately 7.85%.

2. Which companies are prominent players in the Assembly Line Industry?

Key companies in the market include ACRO Automation Systems Inc, Hochrainer GmbH, JR Automation, Central Machines Inc, Totally Automated Systems, Fusion Systems Group, Adescor Inc, Gemtec GmbH, Markone Control Systems, Eriez Manufacturing Co, NEVMAT Australia PTY LTD, RNA Automation, UMD Automated Systems, Mondragon Assembly, Hitachi Power Solutions Co Ltd, MechTech Automation Group, RG-Luma Automation, BBS Automation, SITEC Industrietechnologie GmbH**List Not Exhaustive.

3. What are the main segments of the Assembly Line Industry?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 307.15 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand from Electric Vehicle Companies Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2021: Mondragon Assembly is expanding into the USA market. The opening of a new subsidiary in Chicago will enable Mondragon Assembly to provide a closer and personalized service to the customers in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Assembly Line Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Assembly Line Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Assembly Line Industry?

To stay informed about further developments, trends, and reports in the Assembly Line Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence