Key Insights

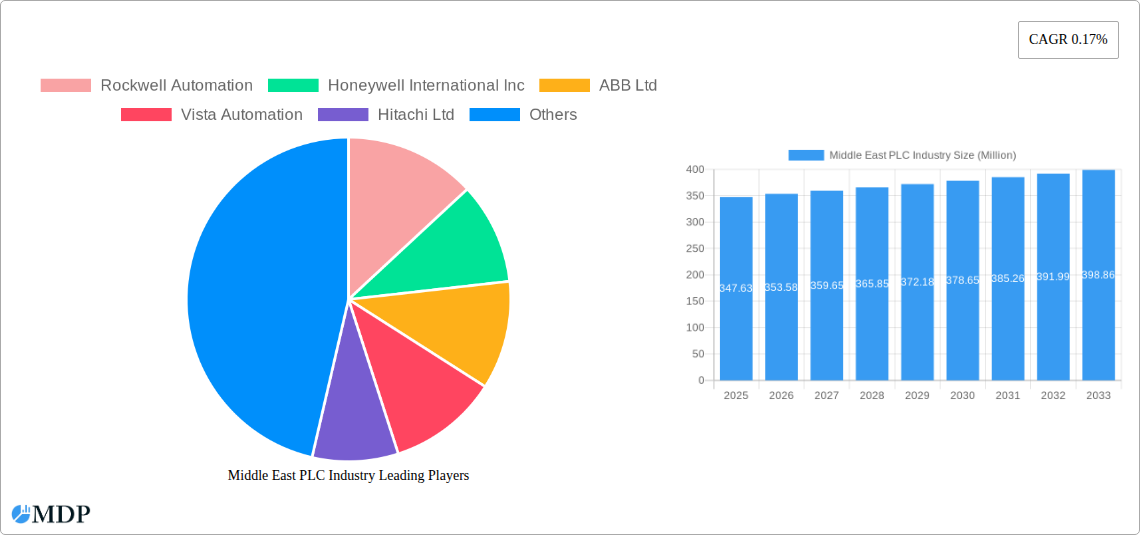

The Middle East Programmable Logic Controller (PLC) market is poised for significant expansion, projected to reach approximately USD 347.63 million by 2025, driven by robust industrial automation initiatives across key sectors. The region is witnessing a considerable CAGR of 0.17, indicating a steady and sustainable growth trajectory over the forecast period of 2025-2033. This growth is primarily fueled by the increasing adoption of advanced automation solutions in the Food, Tobacco, and Beverage, Automotive, and Oil and Gas industries, all of which are undergoing substantial modernization and expansion to meet growing domestic and international demands. Furthermore, the pharmaceutical and energy sectors are heavily investing in sophisticated control systems to enhance efficiency, safety, and product quality. The demand for integrated hardware, software, and services for PLC systems underscores a trend towards comprehensive automation solutions that offer enhanced functionality and seamless integration into existing industrial infrastructures. This focus on upgrading operational capabilities and implementing smart manufacturing practices is a critical catalyst for the market's upward movement.

Middle East PLC Industry Market Size (In Million)

The Middle East's strategic vision for economic diversification and the development of advanced industrial ecosystems are creating a fertile ground for PLC adoption. Countries like Saudi Arabia and the United Arab Emirates are at the forefront, leading investments in smart manufacturing, industrial IoT (IIoT), and Industry 4.0 technologies, all of which rely heavily on sophisticated PLC systems for real-time control and data management. The ongoing digital transformation initiatives are necessitating the replacement of legacy systems with more intelligent and connected PLC solutions that can support predictive maintenance, optimize energy consumption, and improve overall equipment effectiveness. While the market benefits from these strong growth drivers, potential restraints such as the initial high cost of sophisticated automation systems and the need for skilled labor for implementation and maintenance require strategic consideration. However, the long-term benefits of increased productivity, reduced operational costs, and enhanced competitiveness are compelling organizations across the region to overcome these challenges, ensuring sustained demand for PLC technology.

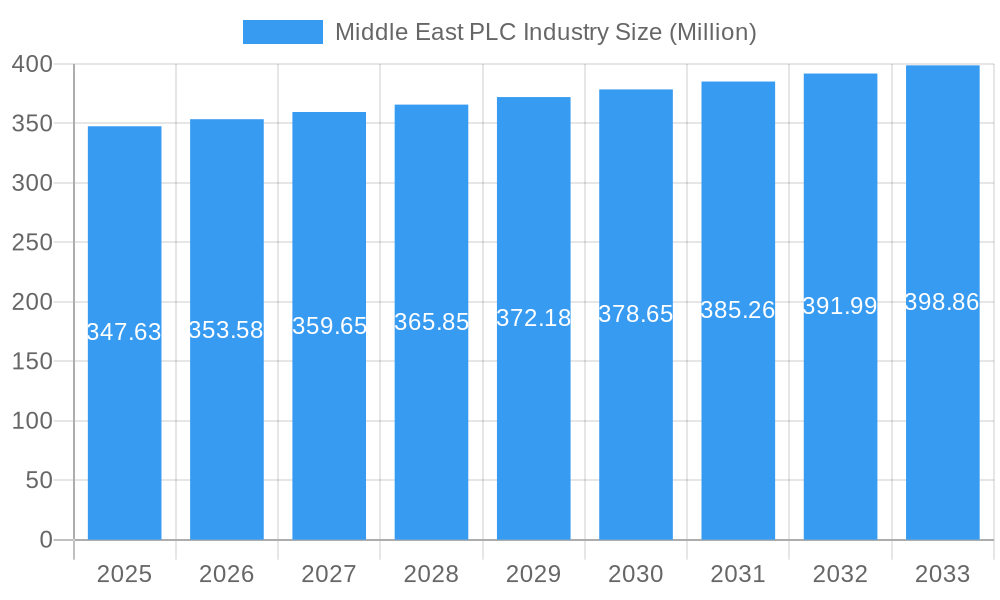

Middle East PLC Industry Company Market Share

Here's the SEO-optimized and engaging report description for the Middle East PLC Industry, structured as requested and incorporating high-traffic keywords:

Unlocking the Future of Industrial Automation: Middle East PLC Industry Market Dynamics, Trends, and Opportunities (2019–2033)

This comprehensive report provides an in-depth analysis of the rapidly evolving Middle East PLC market. Delve into the critical factors shaping the industrial automation landscape across the region, from programmable logic controllers (PLCs) to advanced industrial software and PLC services. Understand the key drivers, emerging trends, and competitive dynamics that will define the PLC market size and trajectory in the coming years. Essential for automation companies, industrial stakeholders, and technology providers, this report offers actionable insights into market concentration, innovation, and future growth potential.

Middle East PLC Industry Market Dynamics & Concentration

The Middle East PLC industry is characterized by a moderate to high level of market concentration, with a few dominant players holding significant market share. Key innovation drivers include the increasing adoption of Industry 4.0 technologies, the demand for smart manufacturing solutions, and the push for greater operational efficiency across diverse end-user sectors. Regulatory frameworks are evolving to support industrial development and digitalization, fostering a conducive environment for PLC adoption. Product substitutes, such as DCS (Distributed Control Systems) and PACs (Programmable Automation Controllers), offer alternative solutions, but PLCs maintain a strong position due to their cost-effectiveness and suitability for discrete control applications. End-user trends are leaning towards advanced automation, predictive maintenance, and energy management, directly influencing PLC feature demands. Mergers and acquisitions (M&A) activities have been strategic, aimed at expanding product portfolios and geographical reach. For instance, the historical period (2019-2024) saw an estimated XX M&A deal count, with key transactions focusing on integrating software capabilities and expanding service offerings. Market share in the base year 2025 is estimated to be dominated by a few key players, with Rockwell Automation, Siemens AG, and Honeywell International Inc. holding substantial portions.

Middle East PLC Industry Industry Trends & Analysis

The Middle East PLC industry is experiencing robust growth, driven by a confluence of factors that are transforming industrial operations across the region. The increasing demand for automation solutions in sectors like Oil and Gas, Energy and Utilities, and Chemical and Petrochemical is a primary growth driver. Governments in the Middle East are actively promoting industrial diversification and economic growth through initiatives like Saudi Vision 2030 and UAE Vision 2021, which necessitate advanced automation for enhanced productivity and competitiveness. This has led to a projected Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period of 2025–2033. Technological disruptions, including the integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) with PLCs, are revolutionizing functionality, enabling predictive maintenance, real-time data analytics, and remote monitoring. Consumer preferences are shifting towards more sophisticated, integrated, and energy-efficient automation systems that can optimize production processes and reduce operational costs. Competitive dynamics are intensifying, with leading global players like Siemens AG, ABB Ltd, and Emerson Electric Co (GE) vying for market share through continuous product innovation and strategic partnerships. The market penetration of advanced PLC functionalities is expected to rise significantly as businesses recognize the return on investment. Furthermore, the Food, Tobacco, and Beverage, and Automotive sectors are also witnessing increased adoption of PLCs for process control and automation, further fueling market expansion. The pharmaceutical sector's growing emphasis on stringent quality control and regulatory compliance also contributes to the demand for reliable PLC systems. The overall market penetration of PLCs in the Middle East, currently at an estimated xx% in the base year 2025, is projected to climb steadily.

Leading Markets & Segments in Middle East PLC Industry

The Energy and Utilities sector stands out as the dominant end-user industry in the Middle East PLC market. This dominance is fueled by substantial investments in power generation, water desalination, and oil and gas extraction and processing infrastructure. Economic policies promoting energy security and diversification, alongside the ongoing development of smart grids and renewable energy projects, are key drivers. The Oil and Gas segment, in particular, relies heavily on robust and reliable PLC systems for critical control applications in exploration, production, refining, and transportation.

Within the Type segmentation, Hardware components of PLCs continue to represent the largest share, given their foundational role in industrial control systems. However, the Software segment is experiencing the most rapid growth, driven by the increasing demand for sophisticated SCADA systems, HMI software, and specialized industrial automation applications. Services, including installation, maintenance, and system integration, are also crucial, with a growing emphasis on lifecycle support and remote diagnostics.

Geographically, Saudi Arabia and the United Arab Emirates (UAE) are leading markets due to their significant industrial footprints and proactive government initiatives to foster technological advancement and economic diversification. Infrastructure development plays a pivotal role, with ongoing projects in manufacturing, logistics, and smart cities requiring widespread PLC deployment. The Chemical and Petrochemical industry also represents a significant market, driven by the region's abundant natural resources and expansion plans in downstream processing. The Automotive sector, while still developing in some parts of the region, shows strong potential for growth as localized manufacturing expands. The Food, Tobacco, and Beverage sector is increasingly adopting PLCs for automation to enhance production efficiency, ensure product quality, and meet evolving consumer demands.

Middle East PLC Industry Product Developments

Product developments in the Middle East PLC industry are heavily influenced by the drive towards digitalization and Industry 4.0. Innovations focus on enhancing connectivity through IoT integration, enabling seamless data exchange for real-time monitoring and analytics. Advancements in edge computing are empowering PLCs to perform complex processing locally, reducing latency and improving decision-making speed. Cybersecurity features are also a critical focus, with manufacturers developing robust solutions to protect against evolving threats in connected industrial environments. Competitive advantages are being gained through offerings that simplify integration, improve energy efficiency, and provide enhanced diagnostics for predictive maintenance. The market is seeing a trend towards more modular and scalable PLC architectures, allowing businesses to adapt their automation systems as their needs evolve.

Key Drivers of Middle East PLC Industry Growth

The growth of the Middle East PLC industry is primarily propelled by significant investments in industrial infrastructure and the widespread adoption of Industry 4.0 principles. Government initiatives aimed at economic diversification and enhancing manufacturing capabilities across sectors like oil and gas, petrochemicals, and renewables are creating substantial demand. The increasing imperative for operational efficiency, cost reduction, and enhanced productivity is driving businesses to upgrade their automation systems. Furthermore, the growing emphasis on smart manufacturing, predictive maintenance, and energy management solutions necessitates advanced PLC capabilities. The integration of AI and IoT with PLCs is unlocking new functionalities, further stimulating market expansion.

Challenges in the Middle East PLC Industry Market

Despite the positive growth trajectory, the Middle East PLC market faces several challenges. A key restraint is the shortage of skilled labor capable of designing, implementing, and maintaining advanced automation systems. Cybersecurity concerns are also paramount, as the increasing connectivity of industrial control systems makes them vulnerable to sophisticated cyber threats. High initial investment costs for sophisticated PLC hardware and software can be a barrier for small and medium-sized enterprises (SMEs). Interoperability issues between different vendors' systems can also create integration complexities. Additionally, evolving regulatory landscapes in some countries might introduce compliance hurdles. The supply chain for specialized components can also experience disruptions, impacting project timelines.

Emerging Opportunities in Middle East PLC Industry

Emerging opportunities in the Middle East PLC industry are centered around the burgeoning demand for smart factory solutions and the digital transformation of traditional industries. The region's commitment to developing sustainable energy sources, such as solar and wind power, presents a significant opportunity for PLCs in grid management and renewable energy plant automation. The expansion of the automotive manufacturing sector and the growth of the food processing industry are creating new avenues for PLC adoption. Strategic partnerships between global PLC manufacturers and local system integrators are crucial for localized support and customized solutions. Furthermore, the increasing adoption of cloud-based PLC management and remote monitoring services offers substantial growth potential. The development of intelligent automation solutions powered by AI and machine learning will also be a key catalyst for long-term growth.

Leading Players in the Middle East PLC Industry Sector

- Rockwell Automation

- Honeywell International Inc

- ABB Ltd

- Vista Automation

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Emerson Electric Co (GE)

- Omron Corporation

- Robert Bosch GmbH

- Panasonic Corporation

- Control Tech

Key Milestones in Middle East PLC Industry Industry

- 2019: Increased focus on Industry 4.0 initiatives across GCC countries, driving demand for advanced automation.

- 2020: Growing adoption of remote monitoring and control solutions due to global pandemic disruptions.

- 2021: Significant investments in renewable energy projects, boosting PLC demand in the Energy sector.

- 2022: Introduction of enhanced cybersecurity features in new PLC models from leading manufacturers.

- 2023: Expansion of the automotive manufacturing sector in key Middle Eastern countries, increasing PLC requirements.

- 2024: Growing trend towards integrated software and hardware solutions for comprehensive industrial automation.

Strategic Outlook for Middle East PLC Industry Market

The strategic outlook for the Middle East PLC industry is exceptionally promising, driven by continued governmental support for industrialization and technological advancement. The ongoing digital transformation across critical sectors like energy, petrochemicals, and manufacturing will fuel sustained demand for advanced PLC solutions. Growth accelerators include the increasing adoption of AI and IoT for smart manufacturing, the expansion of renewable energy infrastructure, and the drive for greater operational efficiency and sustainability. Strategic opportunities lie in developing tailored solutions for emerging industries, strengthening cybersecurity offerings, and fostering local talent development. The market is poised for significant expansion as businesses embrace automation to enhance competitiveness and achieve their long-term economic objectives.

Middle East PLC Industry Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. End-User Industry

- 2.1. Food, Tobacco, and Beverage

- 2.2. Automotive

- 2.3. Chemical and Petrochemical

- 2.4. Energy and Utilities

- 2.5. Pharmaceutical

- 2.6. Oil and Gas

- 2.7. Other End-user Industries

Middle East PLC Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East PLC Industry Regional Market Share

Geographic Coverage of Middle East PLC Industry

Middle East PLC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Oil and Gas Sector in the Region Driving the PLC Market; Increasing Usage of Automation System in Different End-user Verticals

- 3.3. Market Restrains

- 3.3.1. High Cost of Adoption

- 3.4. Market Trends

- 3.4.1. Oil Segment Accounts for Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East PLC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food, Tobacco, and Beverage

- 5.2.2. Automotive

- 5.2.3. Chemical and Petrochemical

- 5.2.4. Energy and Utilities

- 5.2.5. Pharmaceutical

- 5.2.6. Oil and Gas

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rockwell Automation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vista Automation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Emerson Electric Co (GE)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Omron Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Robert Bosch GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Control Tech

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Rockwell Automation

List of Figures

- Figure 1: Middle East PLC Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East PLC Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East PLC Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East PLC Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Middle East PLC Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle East PLC Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Middle East PLC Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Middle East PLC Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East PLC Industry?

The projected CAGR is approximately 0.17%.

2. Which companies are prominent players in the Middle East PLC Industry?

Key companies in the market include Rockwell Automation, Honeywell International Inc, ABB Ltd, Vista Automation, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Emerson Electric Co (GE), Omron Corporation, Robert Bosch GmbH, Panasonic Corporation, Control Tech.

3. What are the main segments of the Middle East PLC Industry?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 347.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Oil and Gas Sector in the Region Driving the PLC Market; Increasing Usage of Automation System in Different End-user Verticals.

6. What are the notable trends driving market growth?

Oil Segment Accounts for Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost of Adoption.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East PLC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East PLC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East PLC Industry?

To stay informed about further developments, trends, and reports in the Middle East PLC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence