Key Insights

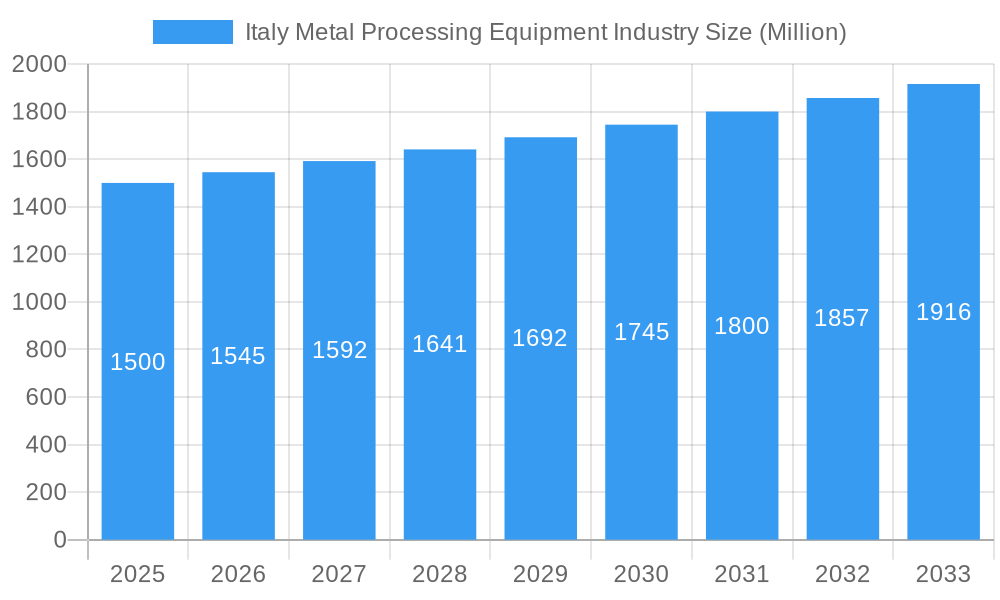

The Italy Metal Processing Equipment market is projected for sustained growth, with an estimated market size of $1.8 billion in the base year 2024. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of approximately 1.941% through 2033. This expansion is driven by increased adoption of automation in key Italian manufacturing sectors such as automotive, aerospace, and construction, necessitating advanced metal processing technologies. The ongoing trend towards lightweighting materials also fuels demand for precise and efficient equipment. Government initiatives supporting industrial modernization and sustainable manufacturing practices further bolster market expansion.

Italy Metal Processing Equipment Industry Market Size (In Billion)

Key challenges for the Italy Metal Processing Equipment industry include fluctuations in raw material prices, intense competition from global players, and rising labor costs. The market is segmented by equipment type (e.g., laser cutting machines, press brakes, CNC machining centers), application (automotive, aerospace, construction), and regional distribution within Italy. Leading companies like TRUMPF, DMG Mori, and Bystronic Laser AG are actively shaping the market through technological innovation and strategic alliances.

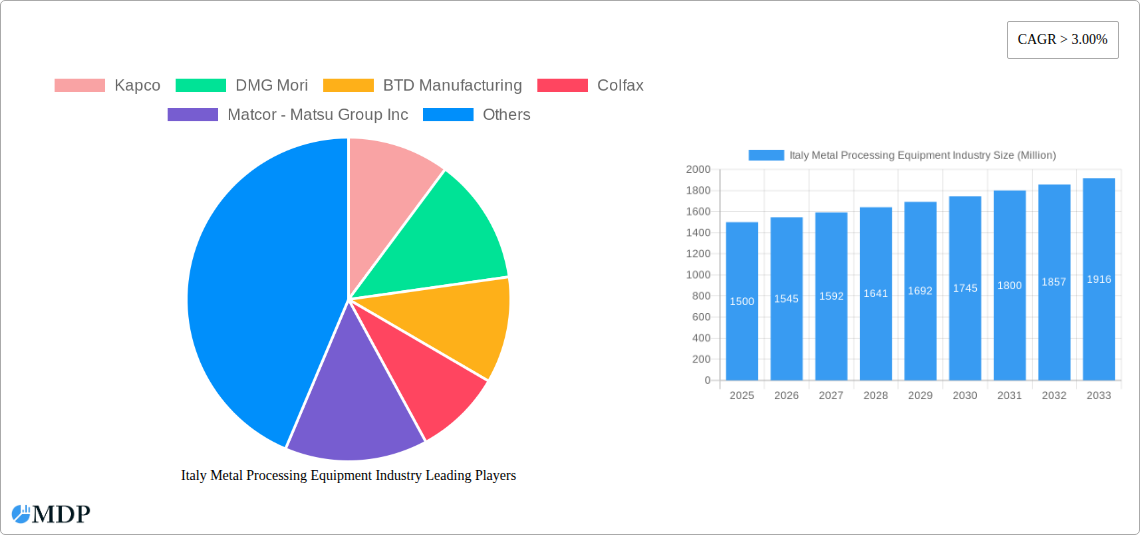

Italy Metal Processing Equipment Industry Company Market Share

The forecast period (2025-2033) anticipates continued growth, influenced by macroeconomic conditions and technological advancements. Regional market performance will vary based on industrial concentration and supportive government policies. The adoption of Industry 4.0 principles, including smart manufacturing and connected technologies, is accelerating, creating opportunities for integrated solutions that enhance efficiency and product quality. Growing demand for customized, high-precision metal components is driving equipment innovation. Increased competition will necessitate a focus on innovation, customization, and robust after-sales service. Market consolidation through mergers and acquisitions is also anticipated. Environmental sustainability regulations are encouraging the development of more energy-efficient and eco-friendly equipment. Strategic analysis of these dynamic factors is crucial for market success.

Italy Metal Processing Equipment Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Italy Metal Processing Equipment industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unravels market dynamics, trends, and future growth potential.

Keywords: Italy Metal Processing Equipment, Metal Processing Equipment Market, Italian Manufacturing, Metal Fabrication, Sheet Metal Processing, Precision Machining, Automation, M&A, Industry 4.0, Market Analysis, Market Forecast, CAGR, Kapco, DMG Mori, BTD Manufacturing, Colfax, Matcor, TRUMPF, Bystronic Laser AG, Sovema Group, Schuler, ANDRITZ.

Italy Metal Processing Equipment Industry Market Dynamics & Concentration

The Italian metal processing equipment market, valued at xx Million in 2024, is characterized by moderate concentration, with several major players and numerous smaller specialized firms. Market share is currently dominated by a few multinational corporations (estimated at 40%), while the remaining 60% is fragmented amongst domestic and smaller international companies. Innovation is a key driver, spurred by Industry 4.0 initiatives focusing on automation and digitalization. Stringent environmental regulations are influencing the adoption of sustainable technologies and pushing for energy-efficient equipment. The market sees competition from substitutes such as 3D printing for certain applications, although these are not yet fully replacing traditional metal processing methods. End-user trends favour higher precision, faster processing speeds and flexible manufacturing systems. Mergers and acquisitions (M&A) activity is significant, with xx M&A deals recorded between 2019-2024, driving consolidation and enhancing technological capabilities. This includes the acquisition of Sovema.

- Market Concentration: Moderately concentrated, with top players holding ~40% market share.

- Innovation Drivers: Industry 4.0, automation, digitalization, sustainable technologies.

- Regulatory Framework: Stringent environmental regulations promoting energy efficiency.

- Product Substitutes: 3D printing (limited impact currently).

- End-User Trends: Demand for higher precision, speed, and flexible manufacturing systems.

- M&A Activity: xx deals recorded between 2019-2024, driving consolidation.

Italy Metal Processing Equipment Industry Industry Trends & Analysis

The Italian metal processing equipment market exhibits a projected CAGR of xx% during the forecast period (2025-2033). Several factors contribute to this growth. Increased automation across various sectors, driven by Industry 4.0 adoption, is a significant driver, leading to higher productivity and efficiency demands. Technological disruptions, such as advancements in laser cutting, robotic welding, and additive manufacturing, are reshaping the industry landscape. Consumer preferences are increasingly favoring customized solutions and faster turnaround times, compelling manufacturers to invest in advanced technologies. Competitive dynamics are characterized by intense competition among established players and the emergence of niche players specializing in specific segments. Market penetration of advanced technologies like AI-powered process optimization and predictive maintenance is gradually increasing.

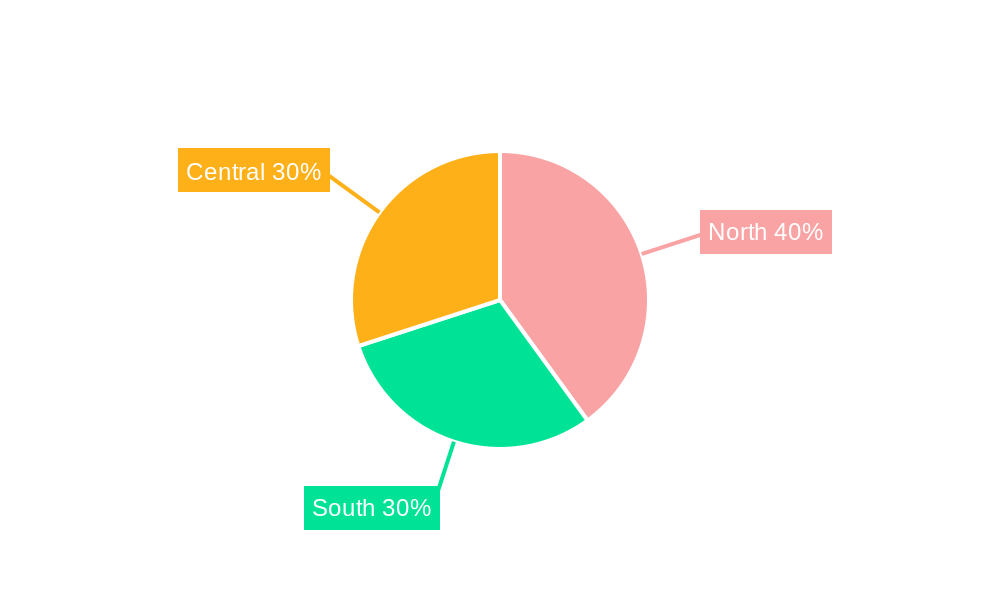

Leading Markets & Segments in Italy Metal Processing Equipment Industry

The Northern region of Italy demonstrates dominance within the Italian metal processing equipment market due to its higher concentration of manufacturing industries, particularly automotive and aerospace. This region benefits from well-developed infrastructure, skilled labor, and supportive economic policies encouraging industrial growth.

- Key Drivers of Northern Italy's Dominance:

- Concentrated Manufacturing Hubs (Automotive, Aerospace)

- Robust Infrastructure (Logistics and Supply Chain)

- Skilled Workforce and Technological Expertise

- Government Support for Industrial Development

Italy Metal Processing Equipment Industry Product Developments

Recent product innovations include more energy-efficient machines, integrated automation systems, and advanced software for process optimization. These improvements are designed to meet the growing demands for precision, speed, and sustainability. The market is witnessing an increase in the adoption of modular and flexible systems, allowing for customization and easier integration into existing production lines. This flexibility is a key competitive advantage in today's dynamic manufacturing landscape.

Key Drivers of Italy Metal Processing Equipment Industry Growth

Several factors contribute to the growth of the Italian metal processing equipment market. These include increasing automation needs across diverse industries, the rising adoption of Industry 4.0 technologies, governmental incentives promoting industrial modernization, and the ongoing expansion of the automotive and aerospace sectors. The demand for higher precision and efficiency in manufacturing processes further fuels market growth.

Challenges in the Italy Metal Processing Equipment Industry Market

The industry faces challenges such as high capital investment costs for advanced equipment, potential supply chain disruptions impacting raw materials and components, and intense competition from international players. Regulatory compliance also adds complexity, potentially influencing operational costs.

Emerging Opportunities in Italy Metal Processing Equipment Industry

Strategic partnerships between equipment manufacturers and end-users are creating opportunities for co-development of customized solutions. The market also sees potential in the growing adoption of additive manufacturing and the integration of advanced sensor technologies and AI for predictive maintenance and process optimization. Expansion into new niche markets, such as renewable energy, can drive long-term growth.

Leading Players in the Italy Metal Processing Equipment Industry Sector

- Kapco

- DMG Mori

- BTD Manufacturing

- Colfax

- Matcor - Matsu Group Inc

- Standard Iron and Wire Works

- TRUMPF

- Bystronic Laser AG

- List Not Exhaustive

Key Milestones in Italy Metal Processing Equipment Industry Industry

- August 2022: Acquisition of the Italian Sovema Group by Schuler (ANDRITZ), creating a leading battery cell production solutions supplier.

- June 2022: Acquisition of Chicago Elite Manufacturing Technologies by CGI Automated Manufacturing, expanding CGI's precision manufacturing capabilities.

Strategic Outlook for Italy Metal Processing Equipment Industry Market

The Italian metal processing equipment market holds significant growth potential, driven by technological advancements, increasing automation needs, and government initiatives promoting industrial innovation. Strategic investments in R&D, partnerships, and expansion into new markets will be crucial for continued success in this dynamic industry. The focus on sustainability and energy efficiency will also shape the future of the market.

Italy Metal Processing Equipment Industry Segmentation

-

1. Product Type

- 1.1. Automatic

- 1.2. Semi-automatic

- 1.3. Manual

-

2. Equipment Type

- 2.1. Cutting

- 2.2. Machining

- 2.3. Forming

- 2.4. Welding

- 2.5. Other Equipment Types

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Manufacturing

- 3.3. Power and Utilities

- 3.4. Construction

- 3.5. Other End-user Industries

Italy Metal Processing Equipment Industry Segmentation By Geography

- 1. Italy

Italy Metal Processing Equipment Industry Regional Market Share

Geographic Coverage of Italy Metal Processing Equipment Industry

Italy Metal Processing Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.941% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Manufacturing Production is the Key Trend Driving Demand Generation in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Metal Processing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Automatic

- 5.1.2. Semi-automatic

- 5.1.3. Manual

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Cutting

- 5.2.2. Machining

- 5.2.3. Forming

- 5.2.4. Welding

- 5.2.5. Other Equipment Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Manufacturing

- 5.3.3. Power and Utilities

- 5.3.4. Construction

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kapco

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DMG Mori

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BTD Manufacturing

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Colfax

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Matcor - Matsu Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Standard Iron and Wire Works

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TRUMPF

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bystronic Laser AG**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Kapco

List of Figures

- Figure 1: Italy Metal Processing Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Metal Processing Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 3: Italy Metal Processing Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 7: Italy Metal Processing Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Metal Processing Equipment Industry?

The projected CAGR is approximately 1.941%.

2. Which companies are prominent players in the Italy Metal Processing Equipment Industry?

Key companies in the market include Kapco, DMG Mori, BTD Manufacturing, Colfax, Matcor - Matsu Group Inc, Standard Iron and Wire Works, TRUMPF, Bystronic Laser AG**List Not Exhaustive.

3. What are the main segments of the Italy Metal Processing Equipment Industry?

The market segments include Product Type, Equipment Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Manufacturing Production is the Key Trend Driving Demand Generation in the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022: The Italian Sovema Group was acquired by Schuler, a part of the global technology group ANDRITZ, enabling it to become a leading systems supplier of battery cell production solutions for the automobile industry and other markets. In collaboration with Sovema, Schuler will create the tools required to outfit gigafactories for the mass manufacture of lithium-ion batteries, whose widespread availability is crucial for the commercial viability of eco-friendly e-mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Metal Processing Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Metal Processing Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Metal Processing Equipment Industry?

To stay informed about further developments, trends, and reports in the Italy Metal Processing Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence