Key Insights

The European Metal Fabrication Equipment market is poised for significant expansion, driven by increasing automation across key manufacturing sectors including automotive, aerospace, and construction. This dynamic market, projected to grow at a Compound Annual Growth Rate (CAGR) of 3.7%, is estimated to reach a market size of $850.5 billion by 2025. Key growth drivers include the adoption of advanced technologies such as laser cutting, 3D printing, and robotics, which enhance precision, efficiency, and productivity. The growing demand for lightweight, high-strength materials further necessitates sophisticated fabrication techniques, fueling market expansion. Leading players are actively investing in research and development, strategic partnerships, and geographical expansion to capitalize on market opportunities. The market is segmented by equipment type, application, and region, with notable contributions from Germany, the UK, France, and Italy. The ongoing investment in industrial modernization and the integration of Industry 4.0 technologies are fundamental to the market's positive trajectory.

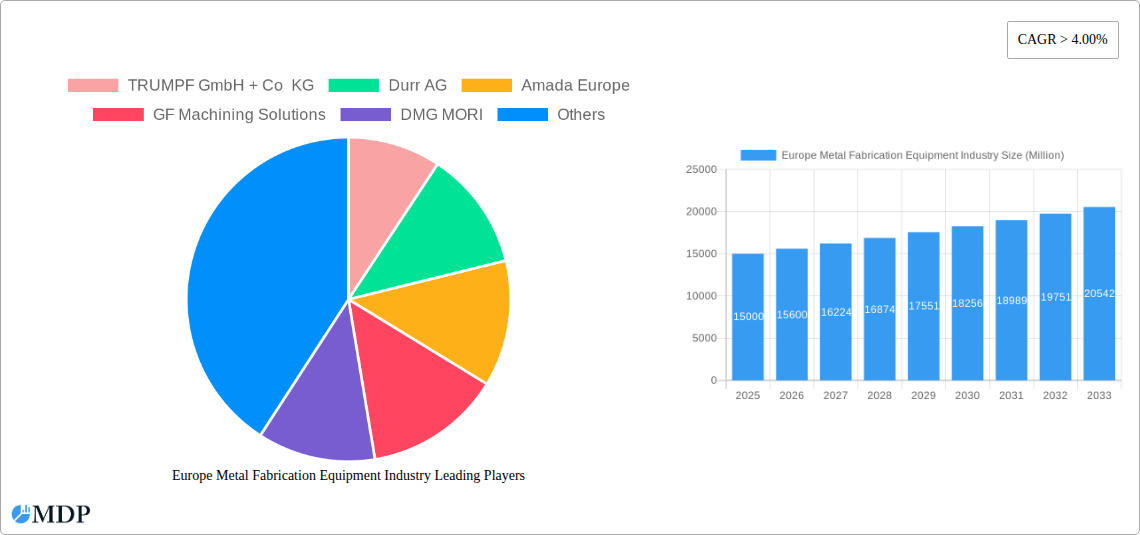

Europe Metal Fabrication Equipment Industry Market Size (In Billion)

The competitive environment is characterized by intense innovation, with both established corporations and specialized niche players striving to offer cutting-edge solutions. The integration of collaborative robots (cobots) and smart manufacturing solutions is enhancing human-machine interaction and optimizing production processes. Continuous research and development investments are vital for maintaining a competitive edge. Government initiatives promoting industrial automation and technological advancements further support the market's growth. Market participants must, however, effectively navigate regulatory landscapes and manage potential supply chain disruptions.

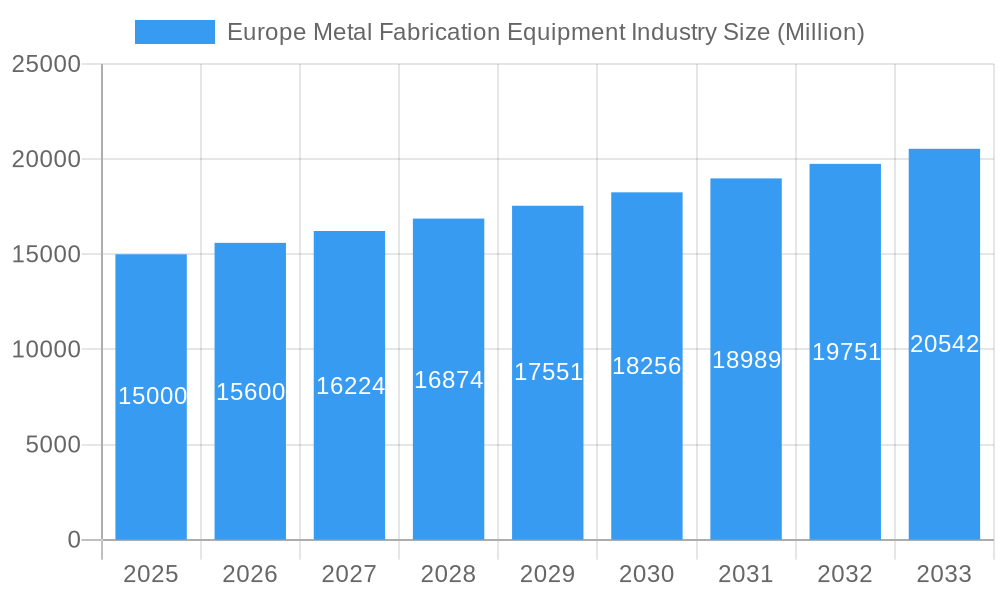

Europe Metal Fabrication Equipment Industry Company Market Share

Europe Metal Fabrication Equipment Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Metal Fabrication Equipment industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, trends, leading players, and future growth potential. The European market is projected to reach XX Million by 2033, demonstrating significant growth opportunities.

Europe Metal Fabrication Equipment Industry Market Dynamics & Concentration

The Europe metal fabrication equipment market is characterized by a moderately concentrated landscape, with several key players holding significant market share. Market concentration is influenced by factors such as technological advancements, stringent regulatory frameworks (e.g., environmental regulations impacting manufacturing processes), and the presence of substitute materials (e.g., composites). End-user trends, particularly in automotive and aerospace, significantly impact demand. Furthermore, M&A activities play a role in shaping the competitive dynamics.

- Market Share: The top 10 players (including TRUMPF GmbH + Co KG, Dürr AG, Amada Europe, GF Machining Solutions, DMG MORI, Schuler AG, GROB-WERKE GmbH, Bystronic Maschinen AG, Feintool International Holding AG, and Mazak U K Limited, plus 6 other significant companies: Reishauer AG, Okuma Europe, Gebr. Heller Maschinenfabrik GmbH, Starrag Group Holding AG, Meusburger Georg GmbH, and Baileigh Industrial) collectively hold approximately 60% of the market share in 2025. Individual company market shares vary significantly, with TRUMPF and Dürr estimated to be among the top leaders.

- M&A Activity: The historical period (2019-2024) witnessed approximately xx M&A deals, primarily focused on consolidating market presence and enhancing technological capabilities. A rise in strategic partnerships is also observed, aiming for synergistic benefits.

- Innovation Drivers: Continuous innovation in automation, digitalization (Industry 4.0), and advanced materials is driving market growth and influencing the competitive landscape.

- Regulatory Impact: EU regulations concerning environmental sustainability and worker safety significantly influence the design, manufacturing, and operation of metal fabrication equipment.

Europe Metal Fabrication Equipment Industry Industry Trends & Analysis

The Europe metal fabrication equipment market is experiencing robust growth, driven by several key factors. Technological advancements, including the rise of Industry 4.0 and AI-powered automation, are transforming manufacturing processes, boosting productivity, and driving demand for sophisticated equipment. Consumer preferences for customized products and shorter lead times are also pushing companies to adopt flexible and adaptable metal fabrication technologies. The market displays a strong competitive landscape with companies engaging in product differentiation, technological innovation, and strategic partnerships.

The CAGR for the forecast period (2025-2033) is estimated at xx%, indicating substantial market expansion. Market penetration of advanced technologies, such as laser cutting and 3D printing, is gradually increasing, further influencing the market trajectory. The competitive dynamics are characterized by intense rivalry, with established players and emerging companies vying for market share.

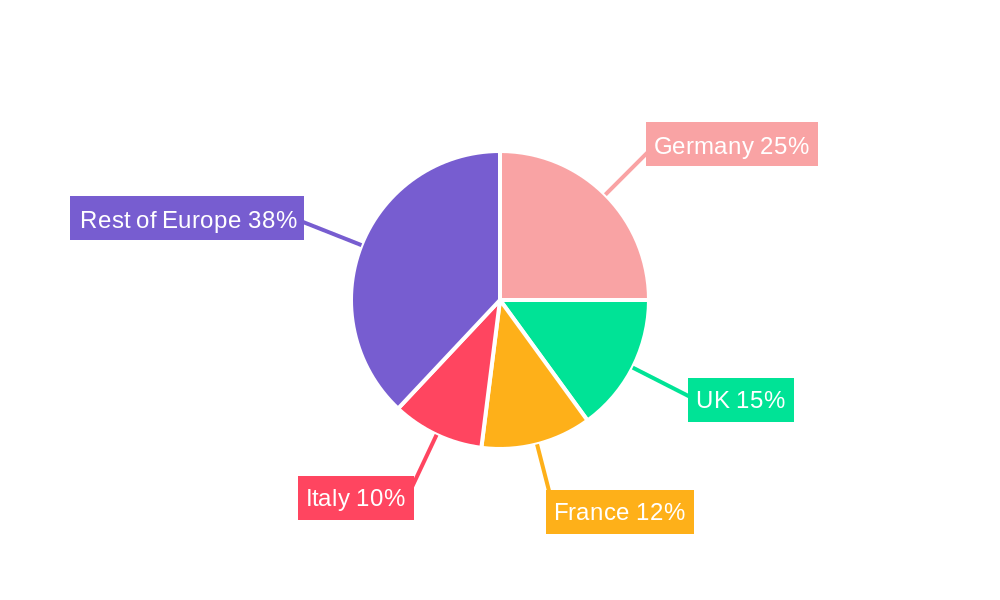

Leading Markets & Segments in Europe Metal Fabrication Equipment Industry

Germany remains the leading market for metal fabrication equipment in Europe, followed by Italy, France, and the UK. This dominance is primarily attributed to:

- Strong Automotive and Aerospace Industries: Germany's robust automotive and aerospace sectors are major drivers of demand.

- Established Manufacturing Base: A long-standing industrial presence and skilled workforce contribute to a thriving metal fabrication ecosystem.

- Government Support for Advanced Manufacturing: Supportive government policies and initiatives promote technological innovation and adoption.

- High-value added manufacturing: Focus on high-precision and high-complexity fabrication is driving demand for advanced equipment.

Other significant segments include the construction, energy, and consumer goods sectors. These sectors also drive demand but at a relatively lower scale compared to automotive and aerospace.

Europe Metal Fabrication Equipment Industry Product Developments

Recent product innovations focus on enhanced automation, precision, and efficiency. Laser cutting systems with higher power outputs, advanced robotics for material handling, and integrated software solutions for process optimization are prominent examples. These advancements are aimed at improving productivity, reducing operational costs, and meeting the demands for customized production and shorter lead times. The market emphasizes the development of flexible manufacturing systems and adaptable equipment to handle various materials and product designs.

Key Drivers of Europe Metal Fabrication Equipment Growth

Several factors fuel the growth of the European metal fabrication equipment market:

- Technological Advancements: Automation, digitalization, and the adoption of Industry 4.0 technologies are driving increased efficiency and productivity.

- Economic Growth: A recovering European economy, especially in key manufacturing sectors, supports the growth of capital expenditure for new equipment.

- Government Initiatives: Government support for manufacturing and industrial competitiveness drives investment in advanced equipment and infrastructure.

Challenges in the Europe Metal Fabrication Equipment Industry Market

The market faces several challenges:

- Supply Chain Disruptions: Global supply chain issues impacting the availability of components and raw materials can cause production delays and price increases.

- Intense Competition: The market is highly competitive, with pressure on pricing and margins.

- High Investment Costs: The purchase and implementation of advanced equipment require significant investments, posing a barrier for some companies.

Emerging Opportunities in Europe Metal Fabrication Equipment Industry

Long-term growth is driven by several opportunities:

- Sustainable Manufacturing: Increasing demand for eco-friendly manufacturing processes fuels the development of energy-efficient and environmentally responsible equipment.

- Additive Manufacturing: The adoption of 3D printing and additive manufacturing technologies opens up new possibilities for customized production and complex designs.

- Digitalization and Connectivity: The integration of smart manufacturing technologies and data analytics enhances production efficiency and provides valuable insights for optimizing operations.

Leading Players in the Europe Metal Fabrication Equipment Industry Sector

- TRUMPF GmbH + Co KG

- Durr AG

- Amada Europe

- GF Machining Solutions

- DMG MORI

- Schuler AG

- GROB-WERKE GmbH

- Bystronic Maschinen AG

- Feintool International Holding AG

- Mazak U K Limited

- Reishauer AG

- Okuma Europe

- Gebr. Heller Maschinenfabrik GmbH

- Starrag Group Holding AG

- Meusburger Georg GmbH

- Baileigh Industrial

Key Milestones in Europe Metal Fabrication Equipment Industry Industry

- December 2022: TRUMPF and STOPA announce a strategic partnership to integrate automated storage systems into TRUMPF's smart factory solutions, boosting production efficiency.

- December 2022: Dürr launches a new generation of EcoPump2 VP pneumatic vertical piston pumps, enhancing process reliability and reducing maintenance needs across various industries, including metalworking.

Strategic Outlook for Europe Metal Fabrication Equipment Industry Market

The Europe metal fabrication equipment market exhibits strong potential for growth driven by technological innovations, increasing automation, and the rising demand for high-precision, customized products across various industrial sectors. Strategic opportunities lie in focusing on sustainable manufacturing practices, exploring partnerships, and adopting advanced technologies such as AI and IoT to improve operational efficiency and offer integrated solutions to customers. Expansion into emerging markets within Europe and strategic acquisitions will also contribute significantly to long-term success in this dynamic market.

Europe Metal Fabrication Equipment Industry Segmentation

-

1. Service type

- 1.1. Machining

- 1.2. Cutting

- 1.3. Welding

- 1.4. Forming

- 1.5. Other Service Types

-

2. End-user Industries

- 2.1. Automotive

- 2.2. Construction

- 2.3. Aerospace

- 2.4. Electrical and Electronics

- 2.5. Other End-user Industries

Europe Metal Fabrication Equipment Industry Segmentation By Geography

- 1. Germany

- 2. UK

- 3. France

- 4. Rest of the Europe

Europe Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of Europe Metal Fabrication Equipment Industry

Europe Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Technological Innovations in Metal Fabrication Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service type

- 5.1.1. Machining

- 5.1.2. Cutting

- 5.1.3. Welding

- 5.1.4. Forming

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Automotive

- 5.2.2. Construction

- 5.2.3. Aerospace

- 5.2.4. Electrical and Electronics

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. UK

- 5.3.3. France

- 5.3.4. Rest of the Europe

- 5.1. Market Analysis, Insights and Forecast - by Service type

- 6. Germany Europe Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service type

- 6.1.1. Machining

- 6.1.2. Cutting

- 6.1.3. Welding

- 6.1.4. Forming

- 6.1.5. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industries

- 6.2.1. Automotive

- 6.2.2. Construction

- 6.2.3. Aerospace

- 6.2.4. Electrical and Electronics

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Service type

- 7. UK Europe Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service type

- 7.1.1. Machining

- 7.1.2. Cutting

- 7.1.3. Welding

- 7.1.4. Forming

- 7.1.5. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industries

- 7.2.1. Automotive

- 7.2.2. Construction

- 7.2.3. Aerospace

- 7.2.4. Electrical and Electronics

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Service type

- 8. France Europe Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service type

- 8.1.1. Machining

- 8.1.2. Cutting

- 8.1.3. Welding

- 8.1.4. Forming

- 8.1.5. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industries

- 8.2.1. Automotive

- 8.2.2. Construction

- 8.2.3. Aerospace

- 8.2.4. Electrical and Electronics

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Service type

- 9. Rest of the Europe Europe Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service type

- 9.1.1. Machining

- 9.1.2. Cutting

- 9.1.3. Welding

- 9.1.4. Forming

- 9.1.5. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industries

- 9.2.1. Automotive

- 9.2.2. Construction

- 9.2.3. Aerospace

- 9.2.4. Electrical and Electronics

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Service type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 TRUMPF GmbH + Co KG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Durr AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amada Europe

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GF Machining Solutions

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DMG MORI

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Schuler AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 GROB-WERKE GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Bystronic Maschinen AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Feintool International Holding AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mazak U K Limited**List Not Exhaustive 6 3 Other Companies (Reishauer AG Okuma Europe Gebr Heller Maschinenfabrik GmbH Starrag Group Holding AG Meusburger Georg Gmbh Baileigh Industrial

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 TRUMPF GmbH + Co KG

List of Figures

- Figure 1: Global Europe Metal Fabrication Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Metal Fabrication Equipment Industry Revenue (billion), by Service type 2025 & 2033

- Figure 3: Germany Europe Metal Fabrication Equipment Industry Revenue Share (%), by Service type 2025 & 2033

- Figure 4: Germany Europe Metal Fabrication Equipment Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 5: Germany Europe Metal Fabrication Equipment Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 6: Germany Europe Metal Fabrication Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Germany Europe Metal Fabrication Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: UK Europe Metal Fabrication Equipment Industry Revenue (billion), by Service type 2025 & 2033

- Figure 9: UK Europe Metal Fabrication Equipment Industry Revenue Share (%), by Service type 2025 & 2033

- Figure 10: UK Europe Metal Fabrication Equipment Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 11: UK Europe Metal Fabrication Equipment Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 12: UK Europe Metal Fabrication Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: UK Europe Metal Fabrication Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: France Europe Metal Fabrication Equipment Industry Revenue (billion), by Service type 2025 & 2033

- Figure 15: France Europe Metal Fabrication Equipment Industry Revenue Share (%), by Service type 2025 & 2033

- Figure 16: France Europe Metal Fabrication Equipment Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 17: France Europe Metal Fabrication Equipment Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 18: France Europe Metal Fabrication Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: France Europe Metal Fabrication Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue (billion), by Service type 2025 & 2033

- Figure 21: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue Share (%), by Service type 2025 & 2033

- Figure 22: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 23: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 24: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Service type 2020 & 2033

- Table 2: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 3: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Service type 2020 & 2033

- Table 5: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 6: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Service type 2020 & 2033

- Table 8: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 9: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Service type 2020 & 2033

- Table 11: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 12: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Service type 2020 & 2033

- Table 14: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 15: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Metal Fabrication Equipment Industry?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Europe Metal Fabrication Equipment Industry?

Key companies in the market include TRUMPF GmbH + Co KG, Durr AG, Amada Europe, GF Machining Solutions, DMG MORI, Schuler AG, GROB-WERKE GmbH, Bystronic Maschinen AG, Feintool International Holding AG, Mazak U K Limited**List Not Exhaustive 6 3 Other Companies (Reishauer AG Okuma Europe Gebr Heller Maschinenfabrik GmbH Starrag Group Holding AG Meusburger Georg Gmbh Baileigh Industrial.

3. What are the main segments of the Europe Metal Fabrication Equipment Industry?

The market segments include Service type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 850.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Technological Innovations in Metal Fabrication Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: One of the top producers of automated storage systems, STOPA, and the high-tech business TRUMPF have announced a deal to cooperate more in the future. Numerous applications, including TRUMPF's smart-factory solutions, leverage STOPA's automated storage options. Customers may automatically load and unload their machines with STOPA systems, and they can connect units to create logistics networks. This greatly reduces non-productive time, which increases shop floor production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the Europe Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence