Key Insights

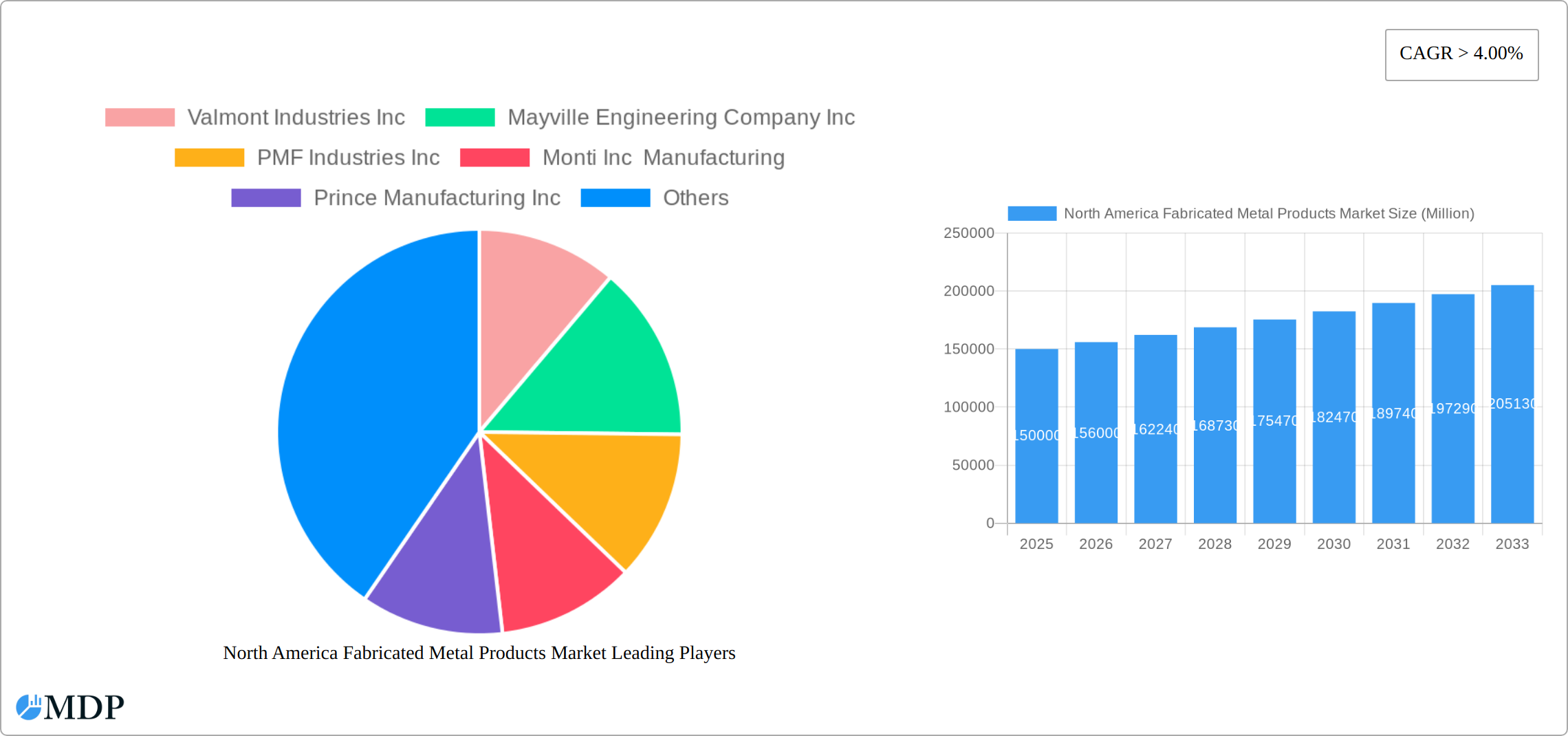

The North America fabricated metal products market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 9.7%. Valued at approximately 65.5 billion in the 2025 base year, the market is expected to witness substantial growth through 2033. Key drivers include robust demand from the construction sector, particularly for infrastructure and commercial projects, alongside strong uptake in the automotive and aerospace industries for precision-engineered components. Technological advancements in automation and materials science are enhancing manufacturing efficiency and product quality, further fueling market growth. Additionally, the increasing adoption of sustainable and lightweight metal solutions across these sectors is a significant contributor.

North America Fabricated Metal Products Market Market Size (In Billion)

While the market demonstrates strong growth potential, it faces challenges including raw material price volatility (steel, aluminum), supply chain disruptions, and labor shortages. However, sustained investment in infrastructure, continuous innovation in materials and manufacturing processes, and a growing emphasis on sustainability are expected to offset these restraints. The competitive landscape remains dynamic, characterized by the presence of both established industry leaders and specialized niche players, underscoring the market's inherent resilience and ongoing development.

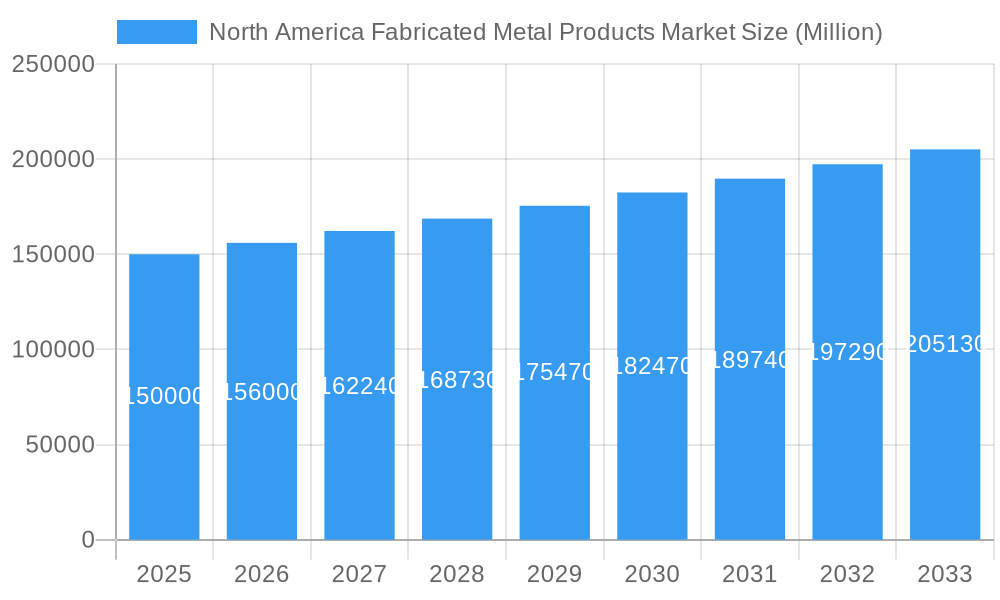

North America Fabricated Metal Products Market Company Market Share

North America Fabricated Metal Products Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Fabricated Metal Products Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033, and utilizes 2025 as the base year. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report meticulously analyzes market dynamics, leading players, emerging trends, and future growth opportunities, providing actionable intelligence to navigate the competitive landscape.

North America Fabricated Metal Products Market Market Dynamics & Concentration

The North American fabricated metal products market is characterized by a moderately concentrated landscape with a few major players commanding significant market share. The market share of the top 5 players is estimated at xx%, indicating room for both consolidation and expansion by smaller players. Innovation plays a crucial role, driven by advancements in materials science, manufacturing processes (e.g., additive manufacturing), and automation. Stringent regulatory frameworks concerning safety, emissions, and material sourcing significantly influence operational costs and product design. The market also faces competition from substitute materials like plastics and composites, although the durability and strength of metal products continue to ensure their dominance in many applications. End-user trends are shifting towards lighter, more efficient, and customizable products, impacting design and manufacturing processes. M&A activity has been notable, with xx deals recorded in the past five years. These transactions primarily focus on expanding product portfolios, geographical reach, and enhancing technological capabilities.

- Market Concentration: Top 5 players hold approximately xx% market share.

- Innovation Drivers: Advancements in materials science, additive manufacturing, automation.

- Regulatory Framework: Stringent safety, emission, and material sourcing regulations.

- Product Substitutes: Plastics and composites pose a limited threat in specific applications.

- End-User Trends: Demand for lighter, efficient, and customizable products is growing.

- M&A Activity: xx mergers and acquisitions recorded from 2019 to 2024.

North America Fabricated Metal Products Market Industry Trends & Analysis

The North American fabricated metal products market is experiencing robust growth, propelled by factors such as rising infrastructure spending, increasing demand from the automotive and construction sectors, and ongoing industrialization. Technological disruptions, particularly the increasing adoption of additive manufacturing (3D printing) and automation, are transforming manufacturing processes, leading to improved efficiency, reduced costs, and enhanced product customization. Consumer preferences are shifting towards sustainable and ethically sourced materials, prompting manufacturers to adopt environmentally friendly practices. Competitive dynamics are characterized by both consolidation through M&A activity and the emergence of specialized niche players focusing on specific applications or materials. Market penetration of advanced manufacturing techniques like laser cutting and robotic welding is steadily increasing, contributing to higher productivity and improved product quality.

Leading Markets & Segments in North America Fabricated Metal Products Market

The United States stands as the undisputed leader in the North America fabricated metal products market. This dominance is underpinned by its vast and highly diversified industrial landscape, extensive and continually evolving infrastructure, and substantial ongoing investments in cutting-edge manufacturing capabilities. While Canada and Mexico are significant contributors to the regional market, their economic scale and industrial output are considerably smaller than that of the US. Within the market's demand drivers, the construction segment is paramount, fueled by ambitious nationwide infrastructure renewal initiatives and a sustained surge in both residential and commercial building projects. Equally vital is the automotive industry, a cornerstone segment that necessitates high-precision, lightweight, and exceptionally durable fabricated metal components for vehicle production.

-

Pillars of US Market Dominance:

- A vast and highly diversified industrial ecosystem.

- Continuous and robust infrastructure development programs.

- Significant capital investments bolstering advanced manufacturing capacities.

- Powerful and sustained demand from the automotive and construction sectors.

-

Key Contributing Regions: Canada and Mexico, each with distinct industrial strengths and market dynamics.

North America Fabricated Metal Products Market Product Developments

The trajectory of product innovation within the North America fabricated metal products market is sharply focused on developing solutions that prioritize lightweighting, leverage high-strength materials, and integrate advanced surface treatments designed to maximize corrosion resistance and extend product lifespan. A notable emerging trend is the incorporation of smart sensors and sophisticated data analytics. This integration is paving the way for predictive maintenance strategies and significantly enhancing operational efficiency across various applications. These advancements are not merely incremental; they are critical in meeting the escalating global demand for fabricated metal products that are not only sustainable and energy-efficient but also deliver superior performance across a wide spectrum of industrial sectors.

Key Drivers of North America Fabricated Metal Products Market Growth

The expansion of the North America fabricated metal products market is propelled by a confluence of potent drivers. Foremost among these are ambitious infrastructure development projects across the continent, coupled with substantial and sustained investments in the automotive and construction sectors. Furthermore, there is a growing appetite for durable, customized, and precisely engineered metal components tailored to specific industry needs. Technological breakthroughs in manufacturing processes, such as the widespread adoption of automation and the burgeoning field of additive manufacturing (3D printing), are revolutionizing efficiency and elevating product quality to new heights. Complementing these technological advancements are supportive government policies and incentives that actively champion and bolster domestic manufacturing initiatives, thereby creating a more conducive environment for market growth.

Challenges in the North America Fabricated Metal Products Market Market

Despite its robust growth, the North America fabricated metal products market navigates a landscape fraught with challenges. Significant hurdles include the inherent volatility of raw material prices, persistent supply chain disruptions that can impede production flows, and intense competition emanating from both domestic and formidable international competitors. The evolving landscape of environmental regulations and a growing emphasis on sustainability present complex challenges, necessitating a proactive adoption of eco-conscious manufacturing practices. Moreover, the persistent issues of labor costs and shortages of skilled workforce continue to exert pressure on production efficiency and overall operational expenses. These intertwined factors collectively influence the market's overall profitability and its future growth trajectory, compelling manufacturers to strategically implement adaptive measures to effectively mitigate these inherent risks.

Emerging Opportunities in North America Fabricated Metal Products Market

Significant opportunities exist within the market due to increasing adoption of additive manufacturing, the development of high-strength, lightweight alloys, and the expansion into emerging applications such as renewable energy and advanced robotics. Strategic partnerships focused on research and development and the integration of smart technologies also create substantial growth potential. Focus on sustainable manufacturing practices and the utilization of recycled materials can open up new market segments.

Leading Players in the North America Fabricated Metal Products Market Sector

- Valmont Industries Inc

- Mayville Engineering Company Inc

- PMF Industries Inc

- Monti Inc Manufacturing

- Prince Manufacturing Inc

- O'Neal Manufacturing Services

- BTD Manufacturing Inc

- United Steel Inc

- Colfax Corporation

- Komaspec

- Matcor Matsu Group Inc

- Sandvik Mining and Construction Canada Inc

Key Milestones in North America Fabricated Metal Products Market Industry

- October 2022: Siemens and Desktop Metal partnered to accelerate additive manufacturing adoption. This collaboration boosts the potential for advanced manufacturing techniques within the industry.

- September 2022: Victaulic acquired Tennessee Metal Fabricating Corporation, expanding its infrastructure market presence and large-diameter pipe solutions. This acquisition signifies consolidation and growth within the sector.

Strategic Outlook for North America Fabricated Metal Products Market Market

The North America fabricated metal products market is poised for continued growth, driven by ongoing technological advancements, infrastructure development, and the increasing adoption of sustainable manufacturing practices. Strategic partnerships, investment in R&D, and a focus on innovative product development will be crucial for companies to maintain a competitive edge and capitalize on the market’s long-term potential. The market is expected to see further consolidation through mergers and acquisitions, with an emphasis on companies that possess cutting-edge technologies and a strong commitment to sustainability.

North America Fabricated Metal Products Market Segmentation

-

1. Material Type

- 1.1. Steel

- 1.2. Aluminum

- 1.3. Other Material Types

-

2. End-User Industry

- 2.1. Manufacturing

- 2.2. Power and Utilities

- 2.3. Construction

- 2.4. Oil & Gas

- 2.5. Other End-user Industries

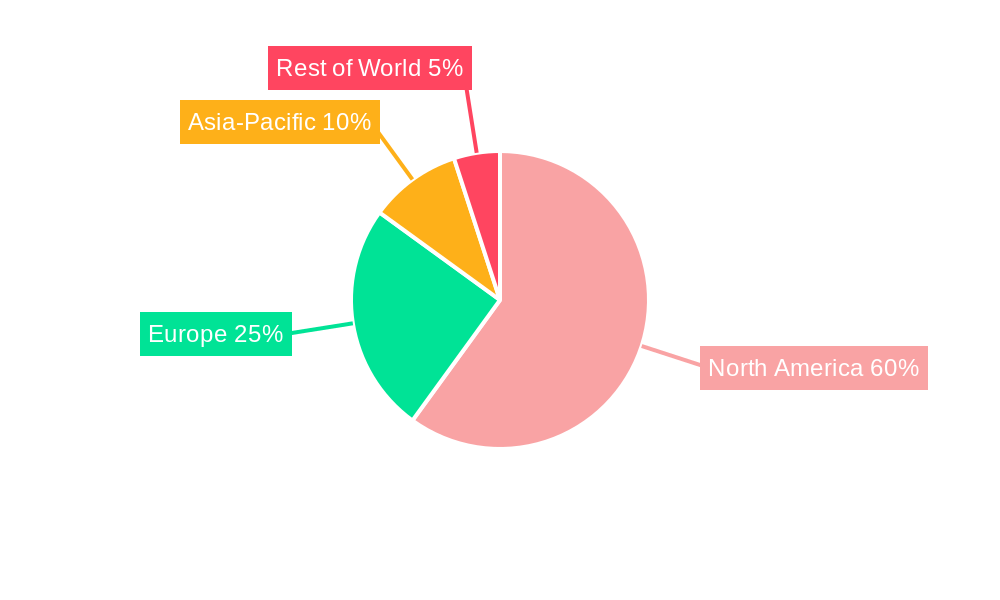

North America Fabricated Metal Products Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fabricated Metal Products Market Regional Market Share

Geographic Coverage of North America Fabricated Metal Products Market

North America Fabricated Metal Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Demand for Advanced Automotive and Industrial Parts

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fabricated Metal Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Steel

- 5.1.2. Aluminum

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Manufacturing

- 5.2.2. Power and Utilities

- 5.2.3. Construction

- 5.2.4. Oil & Gas

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Valmont Industries Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mayville Engineering Company Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PMF Industries Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Monti Inc Manufacturing

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prince Manufacturing Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 O' Neal Manufacturing Services

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BTD Manufacturing Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Steel Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Colfax

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Komaspec

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Matcor Matsu Group Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sandvik Mining and Construction Canada Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Valmont Industries Inc

List of Figures

- Figure 1: North America Fabricated Metal Products Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Fabricated Metal Products Market Share (%) by Company 2025

List of Tables

- Table 1: North America Fabricated Metal Products Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: North America Fabricated Metal Products Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 3: North America Fabricated Metal Products Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Fabricated Metal Products Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 5: North America Fabricated Metal Products Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: North America Fabricated Metal Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Fabricated Metal Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Fabricated Metal Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Fabricated Metal Products Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fabricated Metal Products Market?

The projected CAGR is approximately 9.7%.

2. Which companies are prominent players in the North America Fabricated Metal Products Market?

Key companies in the market include Valmont Industries Inc, Mayville Engineering Company Inc, PMF Industries Inc, Monti Inc Manufacturing, Prince Manufacturing Inc, O' Neal Manufacturing Services, BTD Manufacturing Inc, United Steel Inc, Colfax, Komaspec, Matcor Matsu Group Inc, Sandvik Mining and Construction Canada Inc **List Not Exhaustive.

3. What are the main segments of the North America Fabricated Metal Products Market?

The market segments include Material Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 65.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Demand for Advanced Automotive and Industrial Parts.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Siemens and Desktop Metal have announced a multifaceted partnership aimed at accelerating the adoption of additive manufacturing for production applications, with a particular emphasis on the world's largest manufacturers. The collaboration will cover a wide range of aspects of the desktop metal business. This includes increased integration of Siemens technology, such as operational technology, information technology, and automation, into Desktop Metal's AM 2.0 systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fabricated Metal Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fabricated Metal Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fabricated Metal Products Market?

To stay informed about further developments, trends, and reports in the North America Fabricated Metal Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence