Key Insights

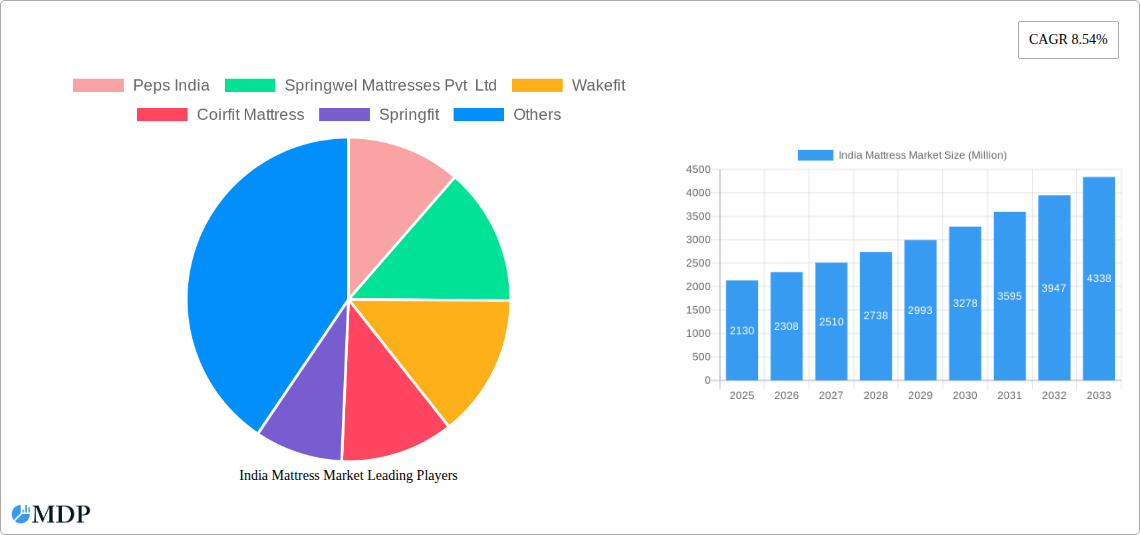

The India mattress market, valued at ₹2130 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.54% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes and a growing middle class are leading to increased spending on home improvement and better quality sleep products. Furthermore, a shift towards online purchasing and greater awareness of the importance of sleep hygiene are boosting demand. The market is segmented by mattress type (innerspring, memory foam, latex, and hybrid varieties), application (residential and commercial), and distribution channels (specialty stores, multi-brand stores, and online retailers). The increasing popularity of online channels reflects changing consumer preferences for convenience and broader product choices. While precise figures for each segment are unavailable, it's reasonable to infer that the memory foam and hybrid mattress segments are experiencing above-average growth due to their perceived comfort and advanced features. Competition is intense, with established players like Sheela Foam and Duroflex alongside newer brands like Wakefit vying for market share. Regional variations exist, with metropolitan areas likely exhibiting higher per capita spending compared to rural regions. However, increasing urbanization and improved logistics are contributing to market penetration across all regions.

India Mattress Market Market Size (In Billion)

The projected growth trajectory suggests a substantial market size by 2033. While precise forecasting requires granular data for individual segments and regions, conservative estimates suggest that the market will likely exceed ₹4000 million by 2030 and potentially approach ₹6000 million by 2033, driven by sustained economic growth and evolving consumer preferences. The market will continue to witness innovation in materials and designs, further stimulating growth. Challenges remain, such as managing supply chain complexities and adapting to evolving customer expectations. However, the overall outlook for the India mattress market remains optimistic, offering significant opportunities for both established and emerging players.

India Mattress Market Company Market Share

India Mattress Market Report: 2019-2033

Dive into the comprehensive analysis of the burgeoning India Mattress Market, a detailed report covering market dynamics, industry trends, leading segments, key players, and future outlook. This report provides actionable insights for industry stakeholders, investors, and businesses seeking to capitalize on the growth opportunities within this dynamic sector. The study period spans 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period covered is 2019-2024. The market size is expected to reach xx Million by 2033.

India Mattress Market Market Dynamics & Concentration

The Indian mattress market is experiencing significant growth fueled by rising disposable incomes, urbanization, and a growing awareness of sleep hygiene. Market concentration is moderate, with a few major players holding substantial market share, while numerous smaller players cater to niche segments. The market is characterized by intense competition, driving innovation in mattress technology and distribution strategies. Key innovation drivers include the introduction of advanced materials like memory foam and latex, as well as the integration of smart technology. Regulatory frameworks concerning product safety and standards are evolving, influencing the manufacturing and distribution aspects of the market. Product substitutes, such as traditional bedding alternatives, pose a marginal challenge. However, the increasing preference for comfort and ergonomic support drives consumer demand for modern mattresses. Mergers and acquisitions (M&A) activity is relatively frequent, with larger players consolidating their position and expanding their market reach.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Deal Counts: xx deals were recorded between 2019 and 2024.

- Key Market Trends: Increased focus on online sales channels, growing demand for premium mattresses, and expansion into tier 2 and 3 cities.

India Mattress Market Industry Trends & Analysis

The India mattress market exhibits robust growth, driven by several key factors. The compound annual growth rate (CAGR) is estimated at xx% during the forecast period (2025-2033). This growth is fueled by increased awareness about sleep quality, a rising middle class with higher disposable incomes, and changing lifestyles promoting better sleep hygiene. Technological advancements such as the introduction of memory foam, latex, and hybrid mattresses have disrupted the market, offering enhanced comfort and support. Consumer preferences are shifting towards premium products with advanced features, leading to a higher average selling price (ASP). Competitive dynamics are intense, with both established and emerging players vying for market share through product innovation, aggressive marketing campaigns, and strategic partnerships. Market penetration of premium mattresses is steadily increasing, fueled by growing consumer awareness and improved affordability.

Leading Markets & Segments in India Mattress Market

The residential segment dominates the Indian mattress market, accounting for approximately xx% of the total market value. Within mattress types, Innerspring mattresses hold the largest market share, followed by memory foam and latex mattresses. However, the "Other Types" segment, including hybrid, gel, air beds, and Celliant-infused mattresses, is witnessing the fastest growth rate. Online distribution channels are experiencing significant growth, driven by increasing internet penetration and the convenience they offer.

- Type:

- Innerspring Mattress: Dominant due to affordability and wide availability.

- Memory Foam Mattress: Growing rapidly due to superior comfort and support.

- Latex Mattress: Niche segment with strong growth potential among environmentally conscious consumers.

- Other Types: Fastest-growing segment driven by innovation and premium features.

- Application: Residential segment dominates. Commercial segment is relatively smaller but demonstrates steady growth in hotels and healthcare facilities.

- Distribution Channel: Online sales are growing rapidly, while specialty stores and multi-brand stores maintain significant market share.

Key Drivers:

- Growing urbanization and rising disposable incomes.

- Increasing awareness about sleep quality and its impact on health.

- Technological advancements in mattress materials and designs.

- Expansion of e-commerce platforms and online retail channels.

India Mattress Market Product Developments

The Indian mattress market is witnessing rapid product innovation, driven by the demand for enhanced comfort, support, and technological integration. New materials like memory foam, latex, and hybrid combinations are being introduced, offering superior comfort and health benefits. Smart mattresses with integrated features are also gaining traction, albeit slowly, offering personalized sleep experiences. These product advancements cater to the evolving needs of consumers seeking enhanced sleep quality and personalized comfort. Competitive advantages are increasingly determined by factors such as innovative designs, superior materials, and strong brand reputation.

Key Drivers of India Mattress Market Growth

The growth of the India mattress market is propelled by several key factors:

- Rising disposable incomes: A growing middle class with increased spending power fuels demand for premium mattresses.

- Urbanization: Increased migration to urban areas creates higher demand for modern housing and furnishings.

- Technological advancements: Innovations in mattress materials and designs cater to diverse consumer preferences.

- Government initiatives: Policies promoting the growth of the manufacturing sector positively impact market growth.

Challenges in the India Mattress Market Market

Despite the significant growth, challenges persist:

- Intense competition: The presence of numerous players creates a competitive landscape, affecting profitability.

- Supply chain disruptions: Fluctuations in raw material prices and logistical challenges can impact production.

- Consumer awareness: Educating consumers about the benefits of different mattress types is crucial.

Emerging Opportunities in India Mattress Market

The India mattress market presents numerous opportunities for long-term growth:

- Expansion into Tier 2 and 3 cities: Untapped market potential exists in smaller cities and towns.

- Strategic partnerships: Collaboration among manufacturers, retailers, and technology providers can drive innovation.

- Focus on sustainable and eco-friendly products: Growing consumer preference for sustainable products presents new opportunities.

Leading Players in the India Mattress Market Sector

- Peps India

- Springwel Mattresses Pvt Ltd

- Wakefit

- Coirfit Mattress

- Springfit

- Sheela Foam

- Duroflex

- Wink and Nod

- Coirfoam (India) Pvt Ltd

Key Milestones in India Mattress Market Industry

- August 2023: Springfit Mattress announced plans to open 150-200 new showrooms. This signifies an expansion strategy focusing on enhanced retail presence and customer reach.

- July 2023: Sheela Foam acquired a 94.6% stake in Kurlon Enterprise Limited, strengthening its market leadership. This acquisition consolidates market share and expands product portfolio.

- March 2023: VFI Group partnered with Setra Simmons to produce luxury bedding in India. This collaboration introduces advanced manufacturing capabilities and premium product offerings.

Strategic Outlook for India Mattress Market Market

The India mattress market presents substantial growth potential. Continued investment in product innovation, strategic partnerships, and expansion into untapped markets will be crucial for success. Focus on digital marketing and e-commerce channels will further enhance market reach and customer engagement. Adopting sustainable manufacturing practices will resonate with environmentally conscious consumers and enhance brand reputation. The market is poised for continued expansion, driven by rising consumer demand and industry innovation.

India Mattress Market Segmentation

-

1. Type

- 1.1. Innerspring Mattress

- 1.2. Memory Foam Mattress

- 1.3. Latex Mattress

- 1.4. Other Ty

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Specialty Stores

- 3.2. Multi-Brand Stores

- 3.3. Online

- 3.4. Other Di

India Mattress Market Segmentation By Geography

- 1. India

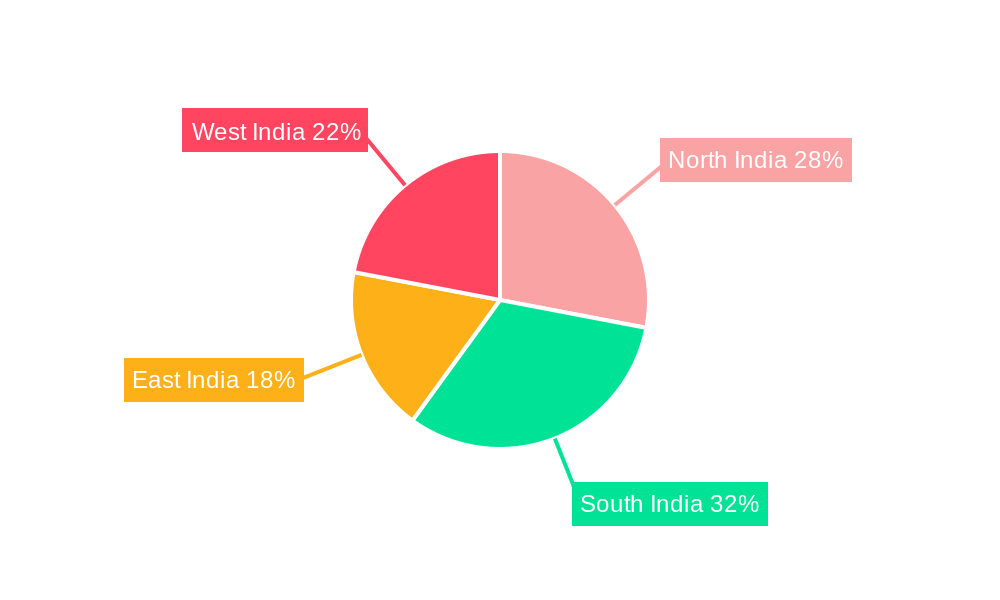

India Mattress Market Regional Market Share

Geographic Coverage of India Mattress Market

India Mattress Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Residential And Commercial Space Driving The Market; Growing Awareness of Health and Wellness Trends

- 3.3. Market Restrains

- 3.3.1 Higher Prices of Luxury and Smart Mattresses; Lack of Stores and Supply chains in Tier 2

- 3.3.2 3 cities

- 3.4. Market Trends

- 3.4.1. Rising Residential Space In India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Mattress Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Innerspring Mattress

- 5.1.2. Memory Foam Mattress

- 5.1.3. Latex Mattress

- 5.1.4. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialty Stores

- 5.3.2. Multi-Brand Stores

- 5.3.3. Online

- 5.3.4. Other Di

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Peps India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Springwel Mattresses Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wakefit

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Coirfit Mattress

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Springfit

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sheela Foam

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Duroflex

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wink and Nod

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Coirfoam (India) Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Peps India

List of Figures

- Figure 1: India Mattress Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Mattress Market Share (%) by Company 2025

List of Tables

- Table 1: India Mattress Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Mattress Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: India Mattress Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: India Mattress Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: India Mattress Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Mattress Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: India Mattress Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Mattress Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: India Mattress Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: India Mattress Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: India Mattress Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: India Mattress Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: India Mattress Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: India Mattress Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: India Mattress Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Mattress Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Mattress Market?

The projected CAGR is approximately 8.54%.

2. Which companies are prominent players in the India Mattress Market?

Key companies in the market include Peps India, Springwel Mattresses Pvt Ltd, Wakefit, Coirfit Mattress, Springfit, Sheela Foam, Duroflex, Wink and Nod, Coirfoam (India) Pvt Ltd.

3. What are the main segments of the India Mattress Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Residential And Commercial Space Driving The Market; Growing Awareness of Health and Wellness Trends.

6. What are the notable trends driving market growth?

Rising Residential Space In India is Driving the Market.

7. Are there any restraints impacting market growth?

Higher Prices of Luxury and Smart Mattresses; Lack of Stores and Supply chains in Tier 2. 3 cities.

8. Can you provide examples of recent developments in the market?

In August 2023, Springfit Mattress announced it is planning to open 150–200 Springfit Lounge showrooms in the next year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Mattress Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Mattress Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Mattress Market?

To stay informed about further developments, trends, and reports in the India Mattress Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence