Key Insights

The French metal fabrication equipment market is poised for substantial growth, driven by robust demand from key sectors including automotive, aerospace, and construction. Increasing automation across manufacturing industries, a significant trend in Europe, is accelerating the adoption of advanced machinery such as laser cutting systems, robotic welders, and CNC machining centers. Government initiatives focused on industrial modernization and technological upgrades further bolster market expansion. For 2025, the estimated market size is 663.3 million.

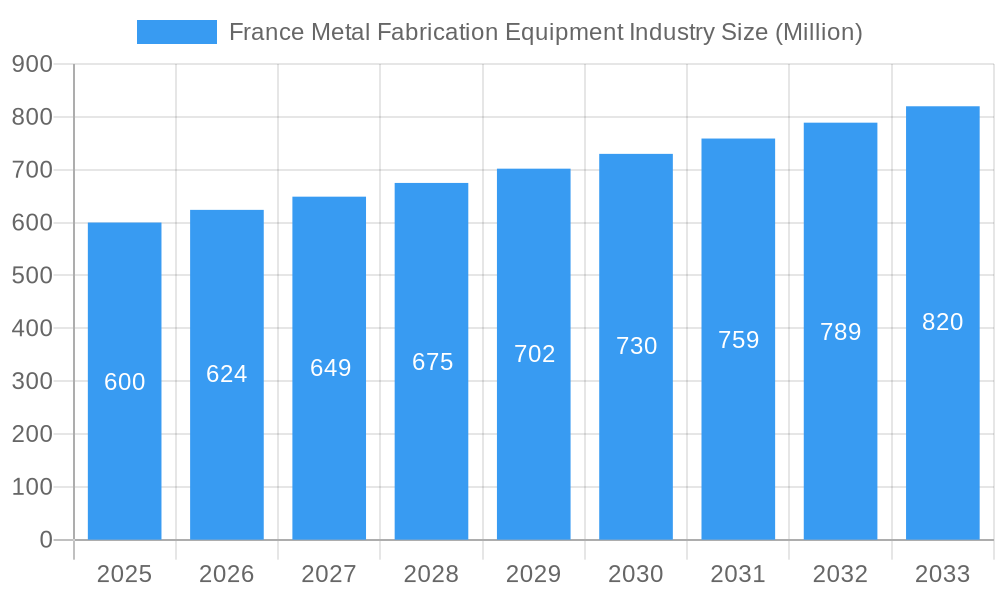

France Metal Fabrication Equipment Industry Market Size (In Million)

The forecast period (2025-2033) anticipates strong expansion, with an estimated Compound Annual Growth Rate (CAGR) of 3.5%. This sustained growth is projected to drive the market size to over €1.1 billion by 2033. Key determinants of this growth include evolving economic conditions, supportive government policies, and continuous technological innovation within the metal fabrication sector.

France Metal Fabrication Equipment Industry Company Market Share

France Metal Fabrication Equipment Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France Metal Fabrication Equipment industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, trends, leading players, and future opportunities. Maximize your understanding and strategic planning with this essential resource.

France Metal Fabrication Equipment Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the French metal fabrication equipment market, encompassing market concentration, innovation drivers, regulatory frameworks, and market dynamics. The study period of 2019-2024 reveals a market valued at XX Million, projected to reach XX Million by 2025 and further expand to XX Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Market Concentration: The market displays a moderately concentrated structure, with a few dominant players controlling a significant share. Market share data for 2025 indicates that the top 5 players hold approximately xx% of the market.

Innovation Drivers: Key innovation drivers include the adoption of automation technologies (robotics, AI), advanced materials processing techniques (3D printing, laser cutting), and the demand for enhanced precision and efficiency.

Regulatory Framework: Stringent environmental regulations regarding emissions and waste management significantly influence industry practices. Compliance costs and the adoption of sustainable manufacturing technologies impact the overall market dynamics.

Product Substitutes: Limited direct substitutes exist, but alternative manufacturing processes (e.g., casting, forging) could pose indirect competitive pressure.

End-User Trends: The increasing demand for customized and high-precision metal components from sectors like automotive, aerospace, and construction drives industry growth.

M&A Activities: The historical period (2019-2024) witnessed xx M&A deals, reflecting consolidation efforts and strategic expansion within the market. This trend is expected to continue during the forecast period.

France Metal Fabrication Equipment Industry Industry Trends & Analysis

The French metal fabrication equipment industry is experiencing dynamic shifts driven by a confluence of accelerating technological advancements, evolving consumer preferences, and robust competitive landscapes. These forces are collectively shaping market trajectory and fostering significant growth. The market witnessed an impressive expansion of [Insert Specific Growth Figure Here, e.g., 150 Million] Euros during the historical period of 2019-2024, and is strategically positioned for continued substantial expansion in the coming years.

Key catalysts for this growth include substantial investments in automation, the pervasive integration of digitalization, and a pronounced commitment to sustainable manufacturing practices. The transformative adoption of Industry 4.0 technologies is revolutionizing production processes, yielding marked improvements in operational efficiency and elevating overall product quality. The current market penetration rate of automated systems within the French manufacturing sector stands at approximately [Insert Current Penetration Rate Here, e.g., 45%], with projections indicating a rise to [Insert Projected Penetration Rate Here, e.g., 65%] by 2033. Furthermore, the escalating demand for lightweighting solutions and high-strength materials across various sectors is directly fueling the need for cutting-edge fabrication technologies. Competitive dynamics are characterized by a dual approach, encompassing both strategic pricing initiatives and a strong emphasis on product differentiation through pioneering technological advancements and superior service offerings.

Leading Markets & Segments in France Metal Fabrication Equipment Industry

The French metal fabrication equipment market exhibits a distinct geographical concentration, with the Île-de-France region commanding the largest market share. This dominance is attributed to its formidable industrial base, a high concentration of leading manufacturing enterprises, and its strategic position as a hub for innovation and economic activity.

- Key Drivers for Île-de-France Dominance:

- Exceptional presence and continued investment from the automotive and aerospace industries.

- A highly developed and efficient infrastructure and logistics network, facilitating seamless operations.

- Proactive and supportive government policies specifically designed to foster industrial growth and competitiveness.

- A deep and readily available pool of skilled labor, crucial for advanced manufacturing.

The market is further segmented by equipment type, including prominent categories such as laser cutting machines, bending machines, and welding equipment. Currently, laser cutting machines hold the largest segment share, driven by their unparalleled precision, speed, and versatility. The automotive sector consistently represents the most significant end-user segment, demanding advanced fabrication solutions for vehicle production.

France Metal Fabrication Equipment Industry Product Developments

Recent product innovations within the French metal fabrication equipment sector are strongly aligned with enhanced automation, superior precision, and seamless connectivity. Manufacturers are actively integrating sophisticated features, including intelligent control systems, advanced automated material handling solutions, and robust data analytics capabilities. These advancements are meticulously designed to maximize productivity, minimize operational costs, and improve overall process control. The resulting enhancements in precision and efficiency directly address the growing industry demand for bespoke, high-quality metal components across a diverse range of applications. The strategic integration of Internet of Things (IoT) and cloud-based technologies is further augmenting monitoring capabilities and enabling predictive maintenance, thereby minimizing downtime and optimizing equipment lifespan.

Key Drivers of France Metal Fabrication Equipment Industry Growth

The growth of the French metal fabrication equipment industry is propelled by several key factors. Technological advancements in automation and digitalization significantly enhance efficiency and productivity. Government initiatives promoting industrial modernization and sustainability also play a crucial role. Increased demand from key end-user industries such as automotive and aerospace continues to drive market expansion. The ongoing adoption of Industry 4.0 technologies further bolsters growth potential.

Challenges in the France Metal Fabrication Equipment Industry Market

The industry faces challenges including the high initial investment costs associated with advanced equipment, global economic uncertainties impacting investment decisions, and intense competition from international players. Supply chain disruptions caused by geopolitical events also present a significant challenge. These factors can impact both sales volume and profitability, demanding strategic adaptation from industry players.

Emerging Opportunities in France Metal Fabrication Equipment Industry

The French metal fabrication equipment industry is poised for significant growth, propelled by the accelerating adoption of additive manufacturing (3D printing) technologies and the escalating demand for lightweight yet high-strength materials across critical sectors such as aerospace, automotive, and medical devices. Strategic partnerships and collaborative ventures among equipment manufacturers, specialized software providers, and key end-users are anticipated to unlock novel opportunities and foster synergistic growth. Furthermore, market expansion into untapped geographical regions and the strategic diversification into complementary services, such as maintenance, training, and process optimization consulting, are expected to be significant contributors to future industry expansion.

Leading Players in the France Metal Fabrication Equipment Industry Sector

- Schuco International

- JIER Group

- AIA

- Hurco

- Hardinge

- Kennametal

- MAG Giddings & Lewis

- Amada

- List Not Exhaustive

Key Milestones in France Metal Fabrication Equipment Industry Industry

- 2020: Increased government funding for Industry 4.0 initiatives.

- 2021: Launch of several new automated welding systems by leading manufacturers.

- 2022: Significant investments in R&D for advanced laser cutting technologies.

- 2023: A major merger between two prominent players in the bending machine segment.

- 2024: Introduction of new software solutions for improved machine connectivity and data analytics.

Strategic Outlook for France Metal Fabrication Equipment Industry Market

The French metal fabrication equipment market exhibits a robust and promising long-term growth outlook. This optimism is underpinned by continuous technological advancements, the ever-increasing drive towards automation, and the sustained demand for high-precision manufactured components across a wide spectrum of industries. Strategic investments in research and development (R&D), the cultivation of strategic partnerships, and proactive expansion into new and emerging markets will undoubtedly create lucrative opportunities for forward-thinking companies. Organizations that embrace a proactive approach to innovation, prioritize sustainability in their operations, and maintain a steadfast focus on customer-centric solutions will be exceptionally well-positioned to thrive and lead in this dynamic and evolving market landscape.

France Metal Fabrication Equipment Industry Segmentation

-

1. Product Type

- 1.1. Automatic

- 1.2. Semi-automatic

- 1.3. Manual

-

2. End-user industry

- 2.1. Oil and Gas

- 2.2. Manufacturing

- 2.3. Power and Utilities

- 2.4. Construction

- 2.5. Other end-user industries

France Metal Fabrication Equipment Industry Segmentation By Geography

- 1. France

France Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of France Metal Fabrication Equipment Industry

France Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Manufacturing Production is a Key Trend in Demand Generation in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Automatic

- 5.1.2. Semi-automatic

- 5.1.3. Manual

- 5.2. Market Analysis, Insights and Forecast - by End-user industry

- 5.2.1. Oil and Gas

- 5.2.2. Manufacturing

- 5.2.3. Power and Utilities

- 5.2.4. Construction

- 5.2.5. Other end-user industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Schuco International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JIER Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AIA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hurco

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hardinge

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kennametal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MAG Giddings & Lewis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amada*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Schuco International

List of Figures

- Figure 1: France Metal Fabrication Equipment Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: France Metal Fabrication Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: France Metal Fabrication Equipment Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: France Metal Fabrication Equipment Industry Revenue million Forecast, by End-user industry 2020 & 2033

- Table 3: France Metal Fabrication Equipment Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: France Metal Fabrication Equipment Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: France Metal Fabrication Equipment Industry Revenue million Forecast, by End-user industry 2020 & 2033

- Table 6: France Metal Fabrication Equipment Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Metal Fabrication Equipment Industry?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the France Metal Fabrication Equipment Industry?

Key companies in the market include Schuco International, JIER Group, AIA, Hurco, Hardinge, Kennametal, MAG Giddings & Lewis, Amada*List Not Exhaustive.

3. What are the main segments of the France Metal Fabrication Equipment Industry?

The market segments include Product Type, End-user industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 663.3 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Manufacturing Production is a Key Trend in Demand Generation in the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the France Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence