Key Insights

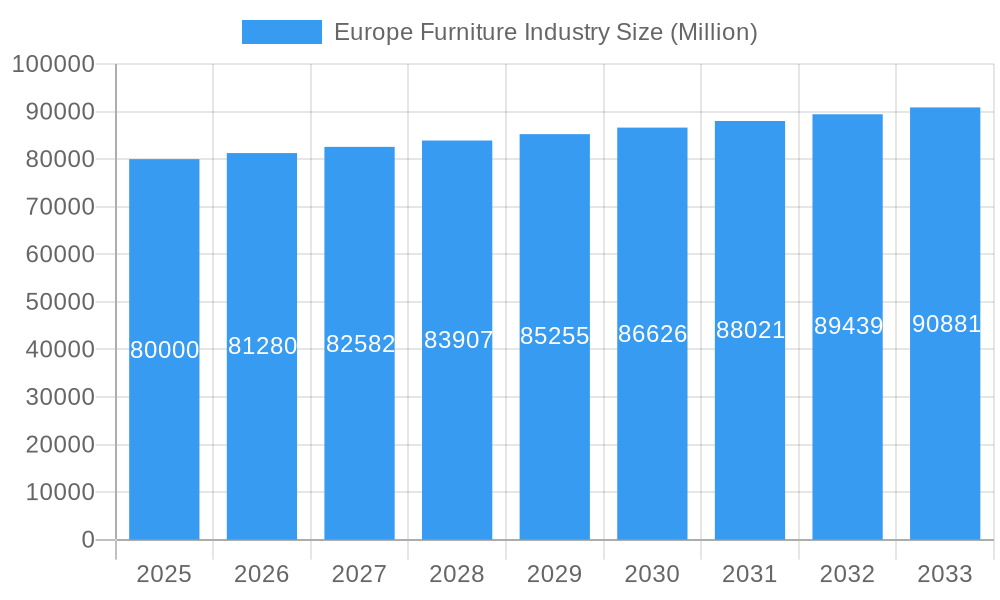

The European furniture market is projected to reach $175.8 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 2.7% through 2033. This expansion is driven by increasing consumer spending, a growing demand for sustainable and personalized furniture, and the persistent trend of remote work boosting home office furniture sales. Key growth segments include home furnishings and online retail, with significant contributions from Germany, France, Italy, and the UK. Emerging markets in Sweden and the Netherlands also show strong potential. While supply chain challenges and material cost fluctuations exist, robust consumer demand and innovation underpin a positive market outlook.

Europe Furniture Industry Market Size (In Billion)

The European furniture market presents significant opportunities, tempered by competitive pressures and evolving consumer demands. Intense competition from established and niche brands, alongside price volatility of raw materials like timber and metal, necessitates agile strategies. Continuous adaptation to changing consumer tastes and a strong commitment to sustainability and supply chain transparency are paramount. The market is segmented by material (wood, metal, plastic), distribution channel (retail, online), and application (residential, commercial). A focus on wood-based products, online sales, and residential furniture is recommended for strategic growth.

Europe Furniture Industry Company Market Share

Europe Furniture Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the European furniture industry, covering market dynamics, leading players, key trends, and future growth prospects from 2019 to 2033. The study period spans 2019-2024 (Historical Period), with 2025 serving as both the Base Year and Estimated Year. The forecast period extends from 2025-2033. This report is an essential resource for industry stakeholders, investors, and businesses seeking to navigate the complexities and opportunities within this dynamic market. Expected market size values are presented in Millions.

Europe Furniture Industry Market Dynamics & Concentration

The European furniture market, valued at €xx Million in 2024, is characterized by a mix of established giants and emerging players. Market concentration is moderate, with several large companies holding significant shares, but numerous smaller businesses also contributing significantly. Innovation, particularly in sustainable materials and smart furniture, is a key driver. Stringent regulatory frameworks concerning materials and manufacturing processes influence market behavior. Product substitutes, like modular and customizable furniture, are gaining traction. End-user trends increasingly favor eco-conscious and multifunctional pieces.

Key Metrics & Observations:

- Market share of top 5 players: xx% (2024)

- Estimated M&A deal count (2019-2024): xx

- Average deal value (2019-2024): €xx Million

Europe Furniture Industry Industry Trends & Analysis

The European furniture market exhibits a steady growth trajectory, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for aesthetically pleasing and functional home environments. Technological advancements, such as 3D printing and smart home integration, are revolutionizing furniture design and manufacturing. Consumer preferences are shifting towards sustainable and ethically sourced materials, alongside personalization options. Competitive dynamics are intense, with established brands facing pressure from both emerging players and online retailers.

- Estimated CAGR (2025-2033): xx%

- Market penetration of online sales (2024): xx%

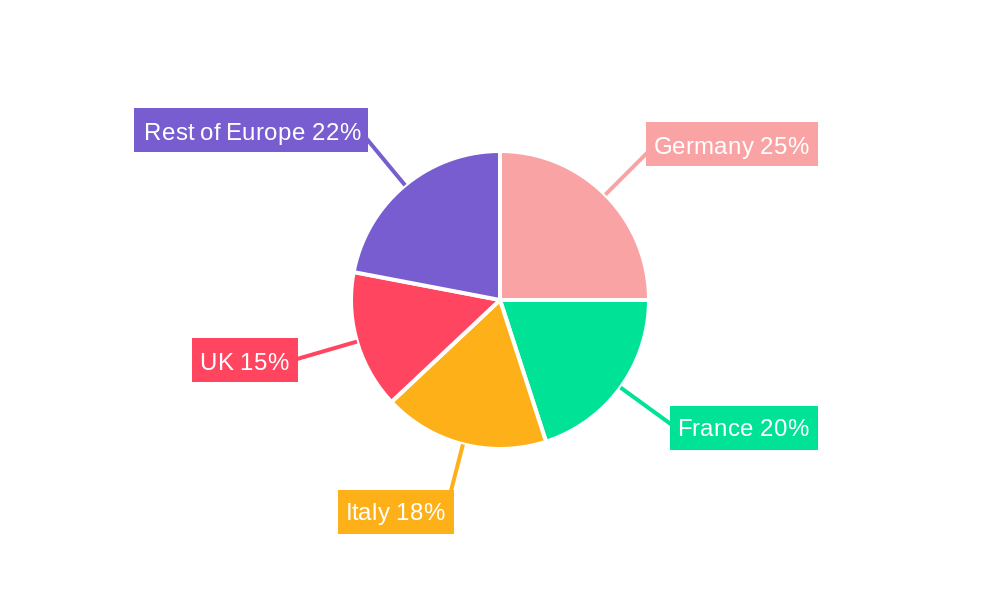

Leading Markets & Segments in Europe Furniture Industry

Germany, France, and the UK remain the dominant markets within Europe, driven by robust economies, strong consumer spending, and established furniture manufacturing sectors. Within segments, the wood furniture segment holds the largest share by material, followed by metal. Specialty stores are the leading distribution channel, although online sales are experiencing significant growth. Home furniture constitutes the most significant application segment, with office furniture and hospitality segments also exhibiting substantial demand.

Key Drivers by Segment:

By Material:

- Wood: Traditional craftsmanship, sustainability initiatives, diverse styles.

- Metal: Modern aesthetics, durability, versatility in industrial and minimalist designs.

- Plastic: Affordability, ease of manufacturing, suitability for outdoor furniture.

- Other Materials: Innovation in recycled and upcycled materials; increased use of sustainable alternatives.

By Distribution Channel:

- Specialty Stores: Expert advice, curated selections, enhanced customer experience.

- Supermarkets: Convenience, affordability, targeted towards price-sensitive consumers.

- Online: Expanding reach, customer convenience, broader product range.

- Other Distribution Channels: Direct-to-consumer models, pop-up shops, interior design showrooms.

By Application:

- Home Furniture: Largest segment, driven by household formation and renovation projects.

- Office Furniture: Demand influenced by corporate investments and changing workspace dynamics.

- Hospitality: Growth driven by the tourism sector and hotel refurbishment.

- Other Furniture: Includes educational and healthcare furniture, reflecting specific sector needs.

Europe Furniture Industry Product Developments

Recent product innovations focus on modularity, customization, and smart features. Furniture incorporating technology such as integrated lighting, charging ports, and voice-activated controls is gaining traction. Sustainable materials like bamboo and recycled plastic are increasingly used, enhancing the eco-friendly appeal of furniture pieces. These advancements cater to the evolving consumer demands for functionality, style, and environmental responsibility.

Key Drivers of Europe Furniture Industry Growth

The European furniture industry's growth is fueled by several factors. Economic growth and increased disposable incomes contribute to higher consumer spending on home furnishings. Technological advancements streamline production and create opportunities for innovative products. Favorable government policies promoting sustainable practices and domestic manufacturing further boost the market.

Challenges in the Europe Furniture Industry Market

Significant challenges include fluctuating raw material prices, supply chain disruptions, and intense competition. Stricter environmental regulations and labor costs exert pressure on profitability. The rising popularity of online retailers necessitates adaptability and efficient e-commerce strategies. The impact of these challenges varies based on company size and product specialization, with smaller businesses potentially more vulnerable.

Emerging Opportunities in Europe Furniture Industry

The European furniture industry anticipates significant growth driven by increased demand for smart furniture, sustainable materials, and personalized designs. Collaborations between manufacturers and technology companies present opportunities for innovative products. Strategic market expansions into new regions and the development of eco-friendly practices will define the industry's future.

Leading Players in the Europe Furniture Industry Sector

- Poltrona Frau

- Molteni

- Natuzzi

- Fritz Hansen

- Roche Bobois

- IKEA

- Colombini

- Calligaris

- BoConcept

- B&B Italia

Key Milestones in Europe Furniture Industry Industry

- 2021 (Q[Month not specified]): Chairish acquires Pamono, creating a major European e-commerce player.

- 2021 (Q[Month not specified]): P3G Group and Alsapan merge to form Alpagroup, signifying consolidation within the French (and subsequently European) furniture manufacturing sector.

Strategic Outlook for Europe Furniture Industry Market

The future of the European furniture industry appears promising, driven by technological advancements, sustainability initiatives, and evolving consumer preferences. Companies focusing on innovation, customization, and eco-friendly practices will be best positioned for long-term growth and success. Strategic partnerships and investments in digital technologies will be crucial in maintaining a competitive edge within this dynamic market.

Europe Furniture Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Furniture Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Furniture Industry Regional Market Share

Geographic Coverage of Europe Furniture Industry

Europe Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Water Conservation and Sustainability Drives The Market; Smart Integration with Home Systems Drives The Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation; Technical Difficulties Impedes Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Office Furniture Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Poltrona Frau

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Molteni

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Natuzzi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fritz Hansen

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Roche Bobois

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IKEA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Colombini**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Calligaris

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BoConcept

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 B&B Italia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Poltrona Frau

List of Figures

- Figure 1: Europe Furniture Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Furniture Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Furniture Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Furniture Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Furniture Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Furniture Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Furniture Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Furniture Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Furniture Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Furniture Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Furniture Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Furniture Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Furniture Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Furniture Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Furniture Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Furniture Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Furniture Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Furniture Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Furniture Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Furniture Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Furniture Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Furniture Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Furniture Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Furniture Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Furniture Industry?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Europe Furniture Industry?

Key companies in the market include Poltrona Frau, Molteni, Natuzzi, Fritz Hansen, Roche Bobois, IKEA, Colombini**List Not Exhaustive, Calligaris, BoConcept, B&B Italia.

3. What are the main segments of the Europe Furniture Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 175.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Water Conservation and Sustainability Drives The Market; Smart Integration with Home Systems Drives The Market.

6. What are the notable trends driving market growth?

Increasing Demand for Office Furniture Driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Installation; Technical Difficulties Impedes Market Growth.

8. Can you provide examples of recent developments in the market?

In 2021, online home furnishings marketplace Chairish announced the acquisition of Pamono, the leading digital home goods resource in Europe, with plans to unite the brands into one global e-commerce destination.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Furniture Industry?

To stay informed about further developments, trends, and reports in the Europe Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence