Key Insights

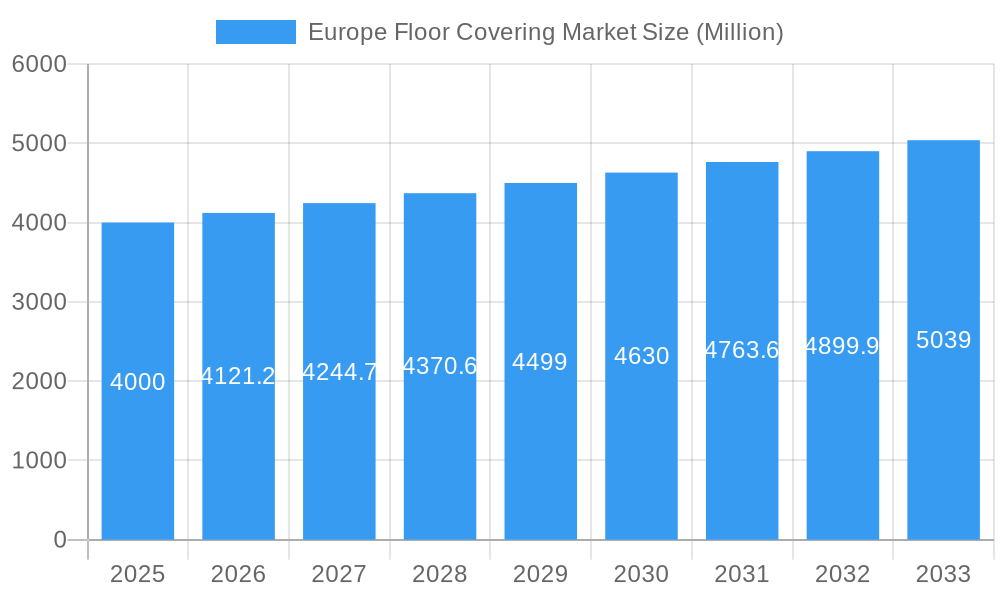

The European floor covering market, valued at €4 billion in 2025, is projected to experience steady growth, driven by factors such as rising construction activities, particularly in residential sectors across major economies like Germany, the UK, and France. Renovation and replacement projects also contribute significantly to market demand, fueled by increasing disposable incomes and a preference for aesthetically pleasing and durable flooring solutions. Growth within the market is further boosted by the expanding e-commerce sector, offering consumers wider choices and convenient purchasing options. While resilient flooring and ceramic tiles maintain a strong market share due to their durability and versatility, the carpet flooring segment continues to show resilience, adapting with innovative designs and eco-friendly materials to attract environmentally conscious buyers. However, market growth faces potential restraints including fluctuations in raw material prices, supply chain disruptions, and economic downturns impacting consumer spending. Competition among established players like Tarkett, Mohawk Industries, and Forbo Flooring, alongside the emergence of smaller, specialized companies, keeps the market dynamic and innovative. The preference for sustainable and eco-friendly flooring options is a notable trend, driving manufacturers to develop products with reduced environmental impact.

Europe Floor Covering Market Market Size (In Billion)

Looking ahead to 2033, the market is forecast to exhibit a Compound Annual Growth Rate (CAGR) of 3.03%, resulting in a projected market size exceeding €X billion. This growth will be influenced by various factors including governmental regulations promoting sustainable building practices and ongoing technological advancements in flooring materials. The increasing adoption of smart homes and building automation will also play a crucial role, influencing the demand for specialized flooring solutions compatible with these technologies. Regional variations in growth rates will likely be observed, depending on the economic performance and construction activity within individual European countries. Germany, the UK, and France will remain dominant markets, while other countries in the region will see variable growth based on their unique market dynamics and infrastructure development. Segmentation by distribution channel will show a continued shift towards online sales, although traditional channels such as home centers and specialty stores will retain their relevance.

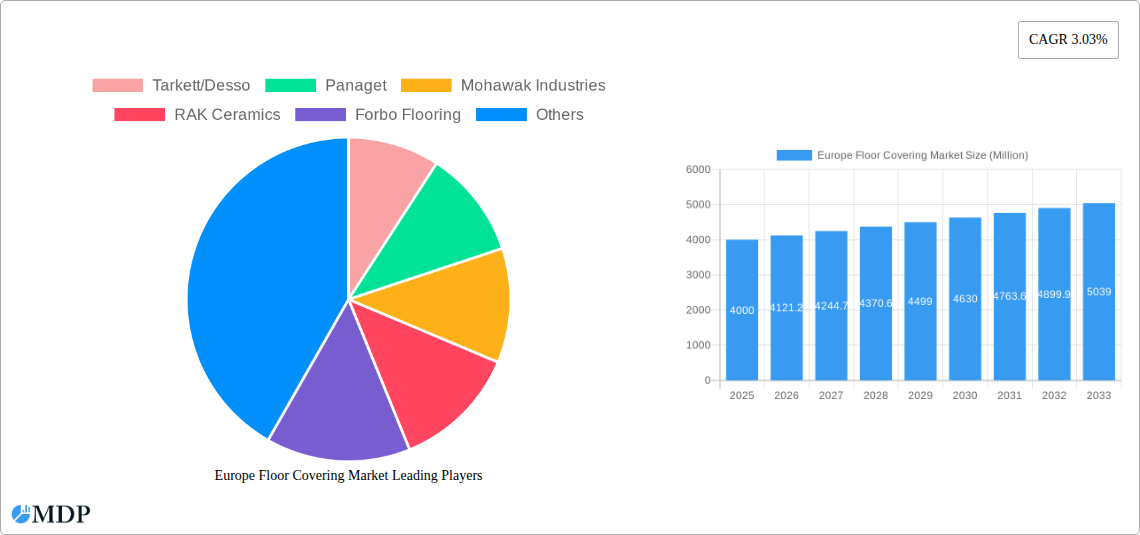

Europe Floor Covering Market Company Market Share

Europe Floor Covering Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe floor covering market, encompassing market dynamics, industry trends, leading segments, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This in-depth analysis is crucial for businesses looking to capitalize on the growth opportunities within this dynamic sector. Download now to gain a competitive edge!

Europe Floor Covering Market Market Dynamics & Concentration

The European floor covering market exhibits a moderately consolidated structure, with several key players holding significant market share. Market concentration is influenced by factors such as M&A activity, innovation, regulatory changes, and the availability of substitute products. While precise market share figures for each company require proprietary data within the full report, analysis suggests a relatively even distribution amongst the leading players.

- Market Concentration: The market is characterized by a mix of large multinational corporations and smaller, specialized firms. The Herfindahl-Hirschman Index (HHI) is estimated to be at xx, indicating a moderately concentrated market (the specific value is available within the full report).

- Innovation Drivers: Continuous innovation in materials, designs, and manufacturing processes fuels market growth. The demand for sustainable and eco-friendly flooring options is a significant driver.

- Regulatory Frameworks: EU regulations concerning building materials, including VOC emissions and sustainability, directly influence product development and market competitiveness. Compliance costs and eco-labeling requirements play a significant role in shaping the market landscape.

- Product Substitutes: The market faces competition from alternative flooring solutions such as wood, stone, and other natural materials, though resilient flooring and carpet continue to be dominant.

- End-User Trends: The increasing demand for aesthetically pleasing and functional floor coverings in both residential and commercial settings is a key driver. This includes a shift towards versatile designs, improved durability, and easier maintenance options.

- M&A Activities: The number of M&A deals in the sector has fluctuated between xx and xx annually over the past five years, driven by the quest for market consolidation and technological expertise.

Europe Floor Covering Market Industry Trends & Analysis

The European floor covering market is witnessing robust growth, primarily driven by the construction sector's expansion and increasing disposable income across several European countries. The market is experiencing technological advancements such as the introduction of eco-friendly materials and smart flooring solutions. Consumer preferences are increasingly shaped by design trends, sustainability considerations, and the desire for improved durability.

The market experienced a CAGR of xx% during the historical period (2019-2024), and is projected to exhibit a CAGR of xx% during the forecast period (2025-2033). Market penetration of specific product segments, such as resilient flooring and LVT, continues to increase, fueled by their versatility and performance capabilities. Competitive dynamics are intensifying as existing companies innovate and new players enter the market, creating a diverse range of offerings.

Leading Markets & Segments in Europe Floor Covering Market

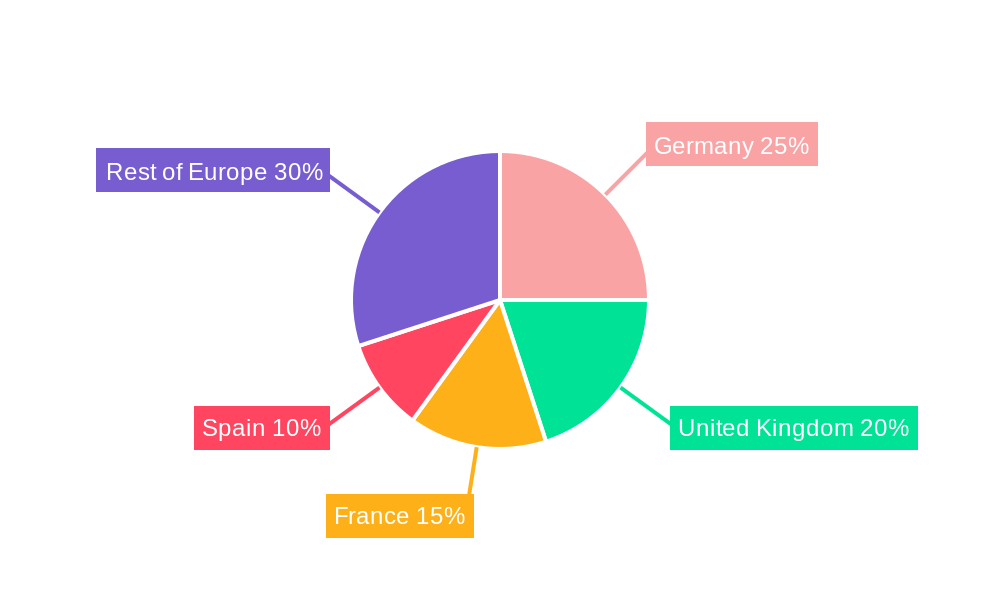

The European floor covering market is segmented by construction type (new construction and renovation/replacement), distribution channel (home centers, specialty stores, online, other), country (Germany, UK, France, Spain, Rest of Europe), material (carpet, resilient, non-resilient, ceramic), and end-user (residential, commercial).

- Dominant Regions: Germany and the UK consistently hold the largest market shares due to their robust construction sectors and higher disposable incomes. France and Spain also contribute significantly to the overall market size.

- Construction Type: Renovation/replacement activities currently represent a larger segment than new construction, driven by the substantial existing building stock across Europe. However, new construction projects contribute significantly to overall market growth.

- Distribution Channel: Home centers dominate distribution channels, followed by specialty stores. Online sales are experiencing substantial growth, though still a smaller segment compared to traditional retail.

- Material: Resilient flooring and carpet hold significant market shares, though the demand for eco-friendly alternatives like LVT is rapidly growing. Ceramic tiles represent a sizeable segment particularly in certain regions and applications.

- End-User: The commercial sector drives significant demand, followed by the residential segment. The increasing number of commercial construction projects in major European cities fuels growth in this segment.

Key Drivers: Government initiatives promoting sustainable building materials, increasing investments in infrastructure projects, and improving economic conditions in several European countries are driving market growth.

Europe Floor Covering Market Product Developments

Recent product developments highlight a strong focus on sustainability, design innovation, and improved performance. Companies are increasingly incorporating recycled materials and introducing products with low VOC emissions. New collections are incorporating advanced surface technologies enhancing durability and ease of maintenance. There’s a significant trend toward modular and easily installable flooring systems to cater to DIY projects. The introduction of LVT flooring with diverse patterns and textures responds to evolving consumer preferences.

Key Drivers of Europe Floor Covering Market Growth

The growth of the Europe floor covering market is primarily fueled by several key factors:

- Technological Advancements: Continuous innovation in materials, designs, and manufacturing processes results in improved product quality, durability, and aesthetic appeal.

- Economic Growth: Positive economic conditions and increased disposable income contribute to higher consumer spending on home improvement and commercial construction projects.

- Regulatory Changes: Government initiatives promoting sustainable construction practices and the demand for eco-friendly materials directly influence market growth. Regulations reducing harmful emissions contribute to a focus on eco-friendly products.

Challenges in the Europe Floor Covering Market Market

Several challenges impede the market's growth:

- Regulatory Hurdles: Stringent environmental regulations and compliance costs can affect the profitability of certain product segments.

- Supply Chain Issues: Disruptions in global supply chains, impacting the availability and cost of raw materials, can create challenges for manufacturers.

- Competitive Pressures: The market is intensely competitive, requiring companies to constantly innovate and differentiate their offerings to maintain market share.

Emerging Opportunities in Europe Floor Covering Market

Significant long-term growth opportunities exist in:

- Technological Breakthroughs: Innovations in materials science and manufacturing technologies leading to the development of high-performance, sustainable, and cost-effective flooring solutions.

- Strategic Partnerships: Collaborations between flooring manufacturers and technology companies allow for the integration of smart features into flooring products, creating new market segments.

- Market Expansion: Focusing on underserved markets within Europe and expanding into new regions will drive growth.

Leading Players in the Europe Floor Covering Market Sector

- Tarkett/Desso

- Panaget

- Mohawk Industries

- RAK Ceramics

- Forbo Flooring

- Berry Alloc

- PolyFlor

- Parador

- City Flooring Europe Limited

- Milliken Flooring

- Balta Group

- Balsan

- Gerflor

- Interface

Key Milestones in Europe Floor Covering Market Industry

- October 2023: Tarkett launched its Collaborative portfolio, a collection of eleven designs in soft surface and LVT flooring. This launch signifies a focus on contemporary workplace design and caters to evolving office needs.

- August 2023: Milliken introduced Merge Forward, a PVC-free resilient tile collection emphasizing sustainability and design variety. This launch indicates a growing market demand for eco-friendly options.

Strategic Outlook for Europe Floor Covering Market Market

The future of the Europe floor covering market is bright, driven by continuous technological advancements, sustainability concerns, and the ongoing growth in the construction sector. Companies that successfully adapt to evolving consumer preferences, invest in innovation, and effectively manage supply chain challenges will be best positioned to capture significant market share and drive long-term growth. Strategic partnerships and market expansion initiatives will be critical to achieving sustained success.

Europe Floor Covering Market Segmentation

-

1. Material

- 1.1. Carpet Flooring

-

1.2. Non-resilient Flooring

- 1.2.1. Wood Flooring

- 1.2.2. Laminate Flooring

- 1.2.3. Stone Flooring

- 1.2.4. Ceramic Floor and Wall Tile

-

1.3. Resilient Flooring

- 1.3.1. Vinyl Sheets and Luxury Vinyl Tiles

- 1.3.2. Other Resilient Products

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Construction

- 3.1. New Construction

- 3.2. Renovation/Replacement

-

4. Distribution Channel

- 4.1. Home Centers

- 4.2. Specialty Stores

- 4.3. Online

- 4.4. Other Distribution Channels

Europe Floor Covering Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Floor Covering Market Regional Market Share

Geographic Coverage of Europe Floor Covering Market

Europe Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Urbanization and the Expansion of Ultramodern Workspaces; Rising Consumer Awareness About Eco-Friendly and Sustainable Flooring Options

- 3.3. Market Restrains

- 3.3.1. Volatility in Raw Material Prices to Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Expansion in the Construction Industry is Expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Carpet Flooring

- 5.1.2. Non-resilient Flooring

- 5.1.2.1. Wood Flooring

- 5.1.2.2. Laminate Flooring

- 5.1.2.3. Stone Flooring

- 5.1.2.4. Ceramic Floor and Wall Tile

- 5.1.3. Resilient Flooring

- 5.1.3.1. Vinyl Sheets and Luxury Vinyl Tiles

- 5.1.3.2. Other Resilient Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Construction

- 5.3.1. New Construction

- 5.3.2. Renovation/Replacement

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Home Centers

- 5.4.2. Specialty Stores

- 5.4.3. Online

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tarkett/Desso

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Panaget

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mohawak Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RAK Ceramics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Forbo Flooring

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Berry Alloc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PolyFlor

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Parador

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 City Flooring Europe Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Milliken Flooring

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Balta Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Balsan**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Gerflor

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Interface

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Tarkett/Desso

List of Figures

- Figure 1: Europe Floor Covering Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Floor Covering Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Floor Covering Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Europe Floor Covering Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Europe Floor Covering Market Revenue Million Forecast, by Construction 2020 & 2033

- Table 4: Europe Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Floor Covering Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Floor Covering Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: Europe Floor Covering Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Europe Floor Covering Market Revenue Million Forecast, by Construction 2020 & 2033

- Table 9: Europe Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Floor Covering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Floor Covering Market?

The projected CAGR is approximately 3.03%.

2. Which companies are prominent players in the Europe Floor Covering Market?

Key companies in the market include Tarkett/Desso, Panaget, Mohawak Industries, RAK Ceramics, Forbo Flooring, Berry Alloc, PolyFlor, Parador, City Flooring Europe Limited, Milliken Flooring, Balta Group, Balsan**List Not Exhaustive, Gerflor, Interface.

3. What are the main segments of the Europe Floor Covering Market?

The market segments include Material, End User, Construction, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Urbanization and the Expansion of Ultramodern Workspaces; Rising Consumer Awareness About Eco-Friendly and Sustainable Flooring Options.

6. What are the notable trends driving market growth?

Expansion in the Construction Industry is Expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Volatility in Raw Material Prices to Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

October 2023: Tarkett introduced its complete Collaborative portfolio, featuring a total of eleven designs in both soft surface and LVT flooring. First showcased at Design Days earlier this summer, the Collaborative emerged as one of Tarkett's most anticipated collections of the year. Tailored for a contemporary workplace, this collection offers a variety of patterns that allow spaces to adapt to evolving needs and cater to diverse work styles, bustling collaborative spaces, and tranquil, focused areas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Floor Covering Market?

To stay informed about further developments, trends, and reports in the Europe Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence