Key Insights

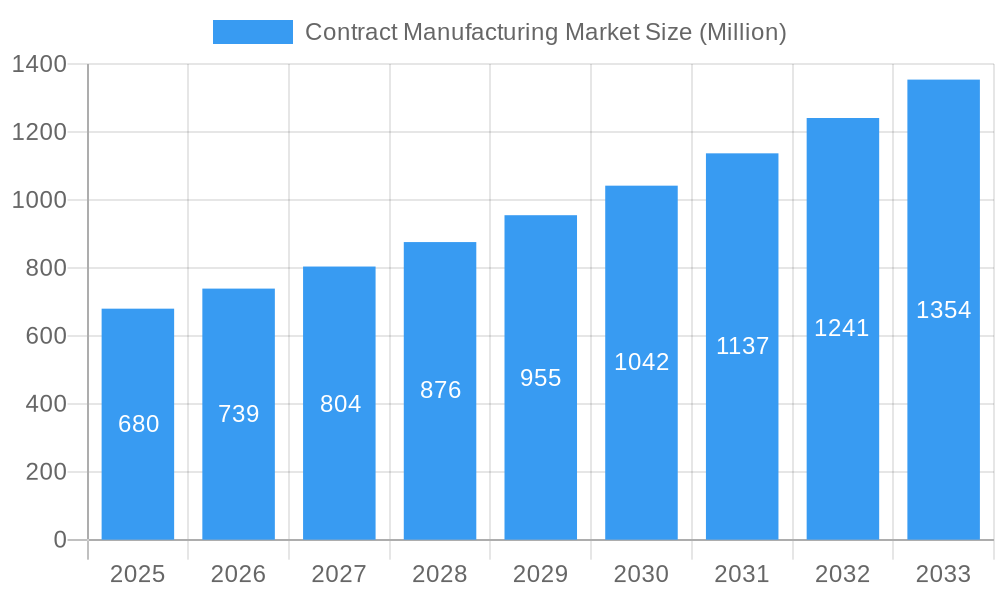

The global contract manufacturing market, valued at $0.68 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing complexity of electronics and the rising demand for specialized manufacturing capabilities are compelling businesses to outsource production to contract manufacturers (CMs). This allows companies to focus on core competencies like research and development, marketing, and sales, while leveraging the expertise and economies of scale offered by CMs. Furthermore, the trend towards shorter product lifecycles and the need for rapid prototyping necessitates flexible and agile manufacturing solutions, a strength of the contract manufacturing sector. Geographic expansion, particularly into regions with lower labor costs and favorable government policies, is another significant driver. However, challenges remain, including supply chain disruptions, geopolitical instability, and the increasing need for sophisticated technological capabilities within the CM industry itself. The market's growth will likely be influenced by fluctuations in global demand, particularly within the electronics and automotive sectors, which are major consumers of contract manufacturing services.

Contract Manufacturing Market Market Size (In Million)

The market is highly competitive, with major players like Hon Hai Precision Industry, Flextronics International, Jabil, and Celestica vying for market share. These established players possess extensive manufacturing capabilities, global reach, and strong client relationships. However, the emergence of smaller, specialized contract manufacturers, particularly in developing economies, is also noteworthy. These companies often offer niche services or focus on specific industries, posing both competition and potential collaborative opportunities for larger players. Looking ahead, the market is poised for continued expansion, fueled by technological advancements in automation and artificial intelligence, which promise to enhance efficiency and reduce production costs. The continued growth of e-commerce and the proliferation of smart devices will further contribute to market expansion over the forecast period of 2025-2033. This growth, however, will likely not be linear, and will be subject to macroeconomic conditions and technological shifts.

Contract Manufacturing Market Company Market Share

Contract Manufacturing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Contract Manufacturing Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unveils market dynamics, trends, leading players, and future opportunities within this rapidly evolving sector. Expect detailed breakdowns of market segments, regional dominance, and key growth drivers, providing a clear roadmap for navigating the complexities of this dynamic landscape. The total market size is projected to reach xx Million by 2033.

Contract Manufacturing Market Market Dynamics & Concentration

The Contract Manufacturing Market exhibits a moderately concentrated landscape, with several large players commanding significant market share. The market share of the top 5 players is estimated to be around xx%, while the remaining market is shared by numerous smaller and specialized contract manufacturers. Innovation in manufacturing technologies, automation, and digitalization are key drivers for growth, alongside increasing demand for customized solutions and specialized manufacturing capabilities. Regulatory frameworks, particularly concerning quality control, compliance, and environmental regulations, significantly impact market operations. Product substitutes, such as in-house manufacturing or alternative outsourcing models, pose a competitive challenge. End-user trends, driven by factors such as supply chain optimization and reduced capital expenditure, fuel market demand. M&A activities are frequent, with xx major deals recorded in the past five years, reflecting industry consolidation and expansion strategies.

- Market Concentration: Top 5 players hold approximately xx% market share.

- Innovation Drivers: Automation, digitalization, and specialized manufacturing capabilities.

- Regulatory Frameworks: Stringent quality control, compliance, and environmental regulations.

- Product Substitutes: In-house manufacturing, alternative outsourcing models.

- End-User Trends: Supply chain optimization, reduced capital expenditure.

- M&A Activities: xx major deals in the past five years, indicative of industry consolidation.

Contract Manufacturing Market Industry Trends & Analysis

The Contract Manufacturing Market is experiencing robust growth, driven by a multitude of factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, including the rise of Industry 4.0 technologies such as AI, robotics, and IoT, are revolutionizing manufacturing processes, leading to increased efficiency and productivity. Consumer preferences for customized products and faster delivery times are placing increasing pressure on manufacturers to adopt flexible and agile production models. Competitive dynamics are characterized by intense rivalry amongst established players and the emergence of new entrants, particularly in niche segments. Market penetration of contract manufacturing services is steadily increasing across various industries, driven by the advantages of reduced operational costs and access to specialized expertise.

Leading Markets & Segments in Contract Manufacturing Market

The Asia-Pacific region currently dominates the Contract Manufacturing Market, accounting for approximately xx% of the global market share. This dominance is attributed to several key factors:

- Cost-Effective Labor: Lower labor costs compared to other regions.

- Robust Infrastructure: Well-established manufacturing infrastructure and supply chains.

- Government Support: Favorable government policies and incentives for manufacturing industries.

- Proximity to Key Markets: Strategic location facilitates access to major consumer markets in Asia and beyond.

China and other Southeast Asian countries are key contributors to this regional dominance. The electronics and healthcare segments are currently the largest contributors to overall market revenue, exhibiting high growth potential owing to increasing demand for electronic devices and medical equipment. Europe and North America are also significant markets, driven by strong demand for high-quality, specialized manufacturing services.

Contract Manufacturing Market Product Developments

Recent product innovations have centered on advanced manufacturing technologies, such as additive manufacturing (3D printing), and sustainable manufacturing practices to cater to growing environmental concerns. These developments are enhancing product quality, reducing production costs, and improving supply chain responsiveness. New applications are emerging in various sectors, including pharmaceuticals, medical devices, and renewable energy, broadening the scope of the contract manufacturing industry. These innovations offer manufacturers a competitive advantage, allowing them to offer customized, high-quality solutions and enhanced value propositions to clients.

Key Drivers of Contract Manufacturing Market Growth

Several factors are propelling the growth of the Contract Manufacturing Market:

- Technological advancements in automation and digitalization are boosting efficiency and productivity.

- Growing demand for customized products necessitates flexible and agile manufacturing solutions.

- Stringent regulatory compliance requires specialized expertise and streamlined processes. This often necessitates outsourcing manufacturing to firms with the necessary certifications and infrastructure.

- Rising globalization fosters increased outsourcing of manufacturing operations to leverage cost advantages and regional expertise.

Challenges in the Contract Manufacturing Market Market

The Contract Manufacturing Market faces several challenges:

- Supply chain disruptions can significantly impact production schedules and costs. The estimated impact of supply chain issues on annual revenue is projected to be xx Million.

- Intense competition among contract manufacturers requires constant innovation and cost optimization.

- Fluctuating raw material prices affect profitability and pricing strategies.

- Geopolitical instability and trade wars can disrupt global supply chains and affect market growth.

Emerging Opportunities in Contract Manufacturing Market

The Contract Manufacturing Market presents significant long-term growth opportunities fueled by:

- The rise of Industry 4.0 technologies, including AI and robotics, leading to increased automation and efficiency.

- The expansion of emerging markets in Asia and Africa, providing lucrative opportunities for contract manufacturers.

- Strategic partnerships between contract manufacturers and technology providers are accelerating innovation.

- The growing focus on sustainability is driving demand for eco-friendly manufacturing practices.

Leading Players in the Contract Manufacturing Market Sector

- Hon Hai Precision Industry Co Ltd (Foxconn)

- Flextronics International Ltd (Flex)

- Jabil Inc (Jabil)

- Celestica Inc (Celestica)

- Kinpo Group

- Shenzhen Kaifa Technology Co Ltd

- Benchmark Electronics Inc (Benchmark)

- Universal Scientific Industrial Co Ltd

- Venture Corporation Limited (Venture Corporation)

- Wistron Coporation

*List Not Exhaustive

Key Milestones in Contract Manufacturing Market Industry

- August 2024: Eckert & Ziegler secures a multi-year contract with Telix Pharmaceuticals for the European contract manufacturing of Lu-177 for Telix's ProstACT GLOBAL Phase III study, highlighting the growing demand for specialized CMO services in the pharmaceutical sector.

- August 2024: Salt Medical, a CDMO specializing in medical devices, opens a new facility in Ireland, expanding its global manufacturing network and demonstrating investment in the medical device contract manufacturing segment.

Strategic Outlook for Contract Manufacturing Market Market

The Contract Manufacturing Market is poised for sustained growth, driven by technological advancements, expanding global demand, and a growing emphasis on sustainability. Strategic partnerships, investments in automation, and the adoption of innovative manufacturing techniques will be crucial for success. Companies that can effectively navigate supply chain complexities, adapt to evolving consumer preferences, and adhere to stringent regulatory requirements will be best positioned to capitalize on the significant opportunities in this dynamic market.

Contract Manufacturing Market Segmentation

-

1. Service Type

- 1.1. Manufacturing Services

- 1.2. Design Services

- 1.3. Post Manufacturing Services

-

2. End-user Vertical

- 2.1. Electronics

- 2.2. Pharmaceuticals and Healthcare

- 2.3. Automotive

- 2.4. Consumer Goods

- 2.5. Other End-user Verticals

-

3. Contract Type

- 3.1. Long-term Contract

- 3.2. Short-term Contract

Contract Manufacturing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Contract Manufacturing Market Regional Market Share

Geographic Coverage of Contract Manufacturing Market

Contract Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Efficiency; Globalization and Market Expansion

- 3.3. Market Restrains

- 3.3.1. Cost Efficiency; Globalization and Market Expansion

- 3.4. Market Trends

- 3.4.1. Electronics Sector is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Manufacturing Services

- 5.1.2. Design Services

- 5.1.3. Post Manufacturing Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Electronics

- 5.2.2. Pharmaceuticals and Healthcare

- 5.2.3. Automotive

- 5.2.4. Consumer Goods

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Contract Type

- 5.3.1. Long-term Contract

- 5.3.2. Short-term Contract

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Manufacturing Services

- 6.1.2. Design Services

- 6.1.3. Post Manufacturing Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Electronics

- 6.2.2. Pharmaceuticals and Healthcare

- 6.2.3. Automotive

- 6.2.4. Consumer Goods

- 6.2.5. Other End-user Verticals

- 6.3. Market Analysis, Insights and Forecast - by Contract Type

- 6.3.1. Long-term Contract

- 6.3.2. Short-term Contract

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Manufacturing Services

- 7.1.2. Design Services

- 7.1.3. Post Manufacturing Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Electronics

- 7.2.2. Pharmaceuticals and Healthcare

- 7.2.3. Automotive

- 7.2.4. Consumer Goods

- 7.2.5. Other End-user Verticals

- 7.3. Market Analysis, Insights and Forecast - by Contract Type

- 7.3.1. Long-term Contract

- 7.3.2. Short-term Contract

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Manufacturing Services

- 8.1.2. Design Services

- 8.1.3. Post Manufacturing Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Electronics

- 8.2.2. Pharmaceuticals and Healthcare

- 8.2.3. Automotive

- 8.2.4. Consumer Goods

- 8.2.5. Other End-user Verticals

- 8.3. Market Analysis, Insights and Forecast - by Contract Type

- 8.3.1. Long-term Contract

- 8.3.2. Short-term Contract

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Australia and New Zealand Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Manufacturing Services

- 9.1.2. Design Services

- 9.1.3. Post Manufacturing Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Electronics

- 9.2.2. Pharmaceuticals and Healthcare

- 9.2.3. Automotive

- 9.2.4. Consumer Goods

- 9.2.5. Other End-user Verticals

- 9.3. Market Analysis, Insights and Forecast - by Contract Type

- 9.3.1. Long-term Contract

- 9.3.2. Short-term Contract

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Latin America Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Manufacturing Services

- 10.1.2. Design Services

- 10.1.3. Post Manufacturing Services

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Electronics

- 10.2.2. Pharmaceuticals and Healthcare

- 10.2.3. Automotive

- 10.2.4. Consumer Goods

- 10.2.5. Other End-user Verticals

- 10.3. Market Analysis, Insights and Forecast - by Contract Type

- 10.3.1. Long-term Contract

- 10.3.2. Short-term Contract

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Middle East and Africa Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 11.1.1. Manufacturing Services

- 11.1.2. Design Services

- 11.1.3. Post Manufacturing Services

- 11.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.2.1. Electronics

- 11.2.2. Pharmaceuticals and Healthcare

- 11.2.3. Automotive

- 11.2.4. Consumer Goods

- 11.2.5. Other End-user Verticals

- 11.3. Market Analysis, Insights and Forecast - by Contract Type

- 11.3.1. Long-term Contract

- 11.3.2. Short-term Contract

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Hon Hai Precision Industry Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Flextronics International Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Jabil Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Celestica Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kinpo Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Shenzhen Kaifa Technology Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Benchmark Electronics Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Universal Scientific Industrial Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Venture Corporation Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Wistron Coporation*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Hon Hai Precision Industry Co Ltd

List of Figures

- Figure 1: Global Contract Manufacturing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Contract Manufacturing Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 4: North America Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 5: North America Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 7: North America Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 8: North America Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 9: North America Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 10: North America Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 11: North America Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 12: North America Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 13: North America Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 14: North America Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 15: North America Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 17: North America Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 20: Europe Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 21: Europe Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Europe Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 23: Europe Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 24: Europe Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 25: Europe Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 26: Europe Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 27: Europe Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 28: Europe Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 29: Europe Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 30: Europe Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 31: Europe Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 33: Europe Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 36: Asia Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 37: Asia Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 38: Asia Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 39: Asia Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 40: Asia Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 41: Asia Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 42: Asia Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 43: Asia Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 44: Asia Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 45: Asia Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 46: Asia Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 47: Asia Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Asia Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 52: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 53: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 54: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 55: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 56: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 57: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 58: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 59: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 60: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 61: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 62: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 63: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 65: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Latin America Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 68: Latin America Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 69: Latin America Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 70: Latin America Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 71: Latin America Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 72: Latin America Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 73: Latin America Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 74: Latin America Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 75: Latin America Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 76: Latin America Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 77: Latin America Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 78: Latin America Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 79: Latin America Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Latin America Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 81: Latin America Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Latin America Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East and Africa Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 84: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 85: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 86: Middle East and Africa Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 87: Middle East and Africa Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 88: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 89: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 90: Middle East and Africa Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 91: Middle East and Africa Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 92: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 93: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 94: Middle East and Africa Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 95: Middle East and Africa Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 97: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East and Africa Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 3: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 5: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 6: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 7: Global Contract Manufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Contract Manufacturing Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 9: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 11: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 13: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 14: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 15: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 17: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 18: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 19: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 21: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 22: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 23: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 26: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 27: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 30: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 31: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 33: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 34: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 35: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 36: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 37: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 38: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 39: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 41: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 42: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 43: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 44: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 45: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 46: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 47: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 49: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 50: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 51: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 52: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 53: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 54: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 55: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Manufacturing Market?

The projected CAGR is approximately 8.70%.

2. Which companies are prominent players in the Contract Manufacturing Market?

Key companies in the market include Hon Hai Precision Industry Co Ltd, Flextronics International Ltd, Jabil Inc, Celestica Inc, Kinpo Group, Shenzhen Kaifa Technology Co Ltd, Benchmark Electronics Inc, Universal Scientific Industrial Co Ltd, Venture Corporation Limited, Wistron Coporation*List Not Exhaustive.

3. What are the main segments of the Contract Manufacturing Market?

The market segments include Service Type, End-user Vertical, Contract Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Efficiency; Globalization and Market Expansion.

6. What are the notable trends driving market growth?

Electronics Sector is Driving the Market.

7. Are there any restraints impacting market growth?

Cost Efficiency; Globalization and Market Expansion.

8. Can you provide examples of recent developments in the market?

August 2024: Eckert & Ziegler and Telix Pharmaceuticals Limited (Telix) announced a significant multi-year agreement. Under this contract, Eckert & Ziegler will act as the European contract manufacturing organization (CMO) for Telix's ProstACT GLOBAL Phase III study. The contract ensures the supply for the entire European patient base from Eckert & Ziegler's state-of-the-art facility in Berlin. Eckert & Ziegler will supply the essential starting material: their high-purity, non-carrier-added GMP-grade Lutetium-177 (Lu-177).August 2024: Salt Medical, a Contract Development and Manufacturing Organization (CDMO) focusing on medical device manufacturing, is set to debut at Claregalway Corporate Park in Co. Galway. Salt Medical boasts a distinguished international platform in the medical device arena, bolstered by a robust global research and development (R&D) and manufacturing network. While the company has established R&D and manufacturing hubs in Ireland, it also sources raw materials and precision components, complemented by large-scale manufacturing operations in both the United States and the Asia-Pacific region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Manufacturing Market?

To stay informed about further developments, trends, and reports in the Contract Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence