Key Insights

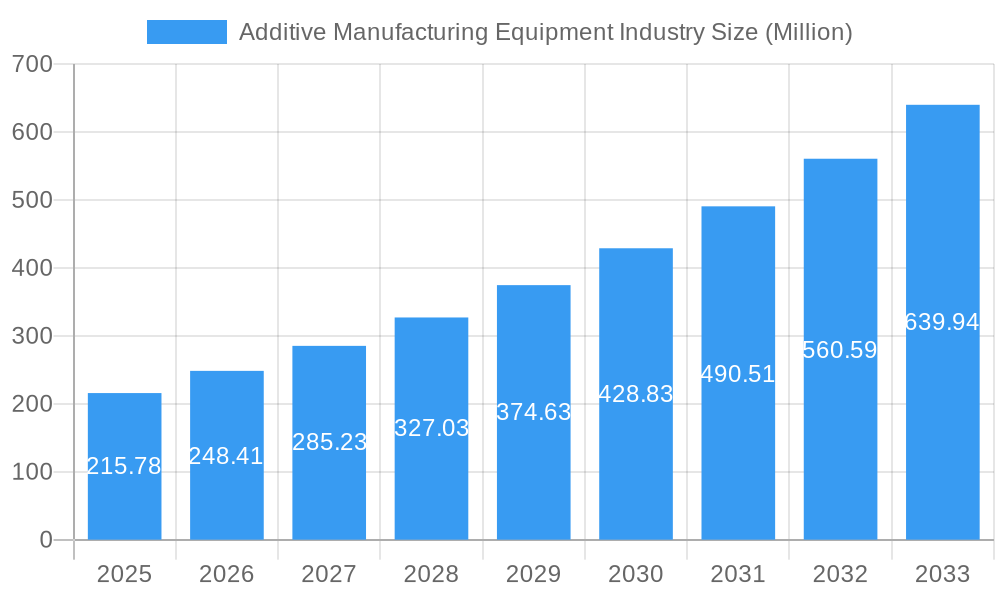

The Additive Manufacturing Equipment market is experiencing robust growth, projected to reach \$215.78 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 15.17% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing adoption across diverse industries, such as aerospace, automotive, and healthcare, is a significant factor. The demand for customized and lightweight components, coupled with the ability of additive manufacturing to produce complex geometries unattainable through traditional methods, is driving market expansion. Furthermore, advancements in materials science, leading to the development of high-performance materials suitable for additive manufacturing processes, are enhancing the capabilities and applications of this technology. Growing investments in research and development within the additive manufacturing sector further contribute to its growth trajectory. Competitive pressures among manufacturers are also driving innovation and the release of more efficient and cost-effective equipment.

Additive Manufacturing Equipment Industry Market Size (In Million)

However, the market also faces certain restraints. High initial investment costs associated with acquiring additive manufacturing equipment can be a barrier to entry for smaller companies. Furthermore, the need for skilled operators and technicians can limit widespread adoption, particularly in regions with limited access to specialized training programs. Despite these challenges, the long-term outlook for the additive manufacturing equipment market remains positive, driven by continuous technological advancements, expanding applications, and increasing industry awareness of the benefits offered by this transformative technology. Key players like Optomec Inc, Mazak Corporation, and DMG MORI are actively shaping the market landscape through innovation and strategic partnerships. The market is expected to witness significant regional variations, with North America and Europe currently holding substantial market share.

Additive Manufacturing Equipment Industry Company Market Share

Additive Manufacturing Equipment Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Additive Manufacturing Equipment industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market dynamics, leading players, and emerging opportunities. The global market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Additive Manufacturing Equipment Industry Market Dynamics & Concentration

The Additive Manufacturing Equipment market is characterized by a moderately concentrated landscape, with a handful of major players holding significant market share. However, the market is witnessing increasing competition from new entrants and disruptive technologies. Market concentration is estimated at xx%, with the top 5 players accounting for approximately xx Million in revenue in 2024. Innovation is a key driver, fueled by advancements in materials science, software, and printing technologies. Stringent regulatory frameworks, particularly concerning safety and environmental impact, are shaping industry practices. The industry also faces challenges from traditional manufacturing methods that remain cost-competitive for certain applications. M&A activity has been relatively robust in recent years, with xx major deals recorded in the historical period (2019-2024), signifying consolidation and strategic expansion among key players. End-user trends show a growing preference for customized, high-precision parts, driving demand for advanced AM equipment.

- Market Share: Top 5 players hold approximately xx%.

- M&A Activity: xx major deals from 2019-2024.

- Key Innovation Drivers: Advancements in materials, software, and printing technologies.

- Regulatory Landscape: Stringent safety and environmental regulations.

Additive Manufacturing Equipment Industry Industry Trends & Analysis

The Additive Manufacturing Equipment market is experiencing robust growth, driven by several key factors. The increasing adoption of additive manufacturing across diverse industries, including aerospace, automotive, healthcare, and consumer goods, is a major catalyst. Technological disruptions, such as the development of faster, more precise, and cost-effective printing technologies, are further accelerating market expansion. Consumer preferences are shifting towards customized and on-demand production, aligning perfectly with the capabilities of additive manufacturing. The competitive dynamics are marked by intense innovation, strategic partnerships, and a focus on expanding market reach. The market is witnessing a notable shift towards Industry 4.0 technologies and digitalization, with companies integrating AM processes into broader smart manufacturing initiatives. This trend is reflected in the significant growth in software solutions supporting additive manufacturing operations. This is expected to increase the market value with a CAGR of xx% by 2033. Market penetration is currently estimated at approximately xx% across key industries, with significant potential for further expansion.

Leading Markets & Segments in Additive Manufacturing Equipment Industry

The North American market continues its leadership in the global Additive Manufacturing Equipment landscape, propelled by persistent technological advancements, substantial research and development investments, and a high concentration of pioneering companies. The Asia-Pacific region is experiencing a period of accelerated growth, driven by escalating industrialization efforts and robust government initiatives championing the adoption of advanced manufacturing technologies. Key nations such as the United States, Germany, China, and Japan are at the forefront, making significant contributions to the overall market revenue.

Key Pillars Supporting North American Dominance:

- Robust R&D Ecosystem: Significant and ongoing funding dedicated to cutting-edge AM research and development, fostering continuous innovation.

- Concentration of Industry Leaders: A high density of major AM equipment manufacturers, material innovators, and comprehensive technology solution providers.

- Pioneering Cross-Industry Adoption: Rapid and widespread integration of AM technologies across a diverse array of industrial sectors, demonstrating early-stage maturity and value realization.

Key Catalysts for Asia-Pacific Growth:

- Dynamic Industrial Expansion: A surge in manufacturing activity and a growing demand for sophisticated, next-generation manufacturing solutions.

- Proactive Government Initiatives: Supportive policies, incentives, and strategic funding aimed at accelerating AM adoption and fostering technological development.

- Expanding Multinational Presence: The strategic establishment and growth of manufacturing operations by leading global corporations within the region.

The metal additive manufacturing segment commands the largest market share, underpinned by its critical and widespread applications in high-stakes industries. Concurrently, the polymer additive manufacturing segment is exhibiting rapid growth, attributed to its inherent cost-effectiveness and remarkable versatility across a broad spectrum of applications.

Additive Manufacturing Equipment Industry Product Developments

Recent product advancements are sharply focused on elevating precision, augmenting operational speed, and broadening material compatibility. Notable innovations include the deployment of sophisticated laser technologies, the development of enhanced software algorithms for sophisticated process optimization, and the creation of novel materials possessing unique and superior properties. These advancements are instrumental in unlocking new application frontiers for additive manufacturing, substantially improving process efficiency and cost-effectiveness, and paving the way for an expansive range of end-use products. These include highly customized medical implants tailored to individual patient anatomy, ultra-lightweight aerospace components designed for optimal performance, and intricate tooling solutions enabling complex manufacturing tasks. A prevailing trend is the emergence of modular and inherently scalable system architectures, empowering manufacturers to precisely calibrate their production capabilities to align with their distinct operational requirements and future growth trajectories.

Key Drivers of Additive Manufacturing Equipment Industry Growth

Several factors contribute to the robust growth of the Additive Manufacturing Equipment market. Technological advancements, including faster printing speeds, improved material properties, and greater precision, are making AM more attractive to businesses. Favorable economic conditions and growing industrial automation are driving adoption across sectors. Supportive government policies and initiatives are incentivizing AM adoption by offering subsidies, grants, and tax breaks. Examples include the ongoing initiatives by several national governments focused on promoting Industry 4.0 and digital manufacturing technologies.

Challenges in the Additive Manufacturing Equipment Industry Market

The Additive Manufacturing Equipment industry faces several challenges, including high initial investment costs and ongoing maintenance expenses that limit adoption by smaller businesses. Supply chain disruptions can impact production timelines and costs. Intense competition from established players and new entrants creates price pressures. Regulatory uncertainty and compliance requirements in certain markets can also create hurdles for market expansion.

Emerging Opportunities in Additive Manufacturing Equipment Industry

The long-term trajectory of growth for the Additive Manufacturing Equipment industry is being significantly shaped by a confluence of potent factors. Breakthroughs in technological innovation are continuously expanding the capabilities and concurrently reducing the economic barriers to entry for AM technologies. Strategic alliances and collaborative ventures forged between leading equipment manufacturers, advanced material suppliers, and innovative software developers are instrumental in crafting holistic and integrated solutions that address the multifaceted needs of diverse industries. The burgeoning expansion into novel application domains and previously untapped markets, such as the realization of personalized medicine and the advancement of sustainable manufacturing practices, are poised to be significant drivers of demand in the forthcoming years.

Leading Players in the Additive Manufacturing Equipment Industry Sector

- Optomec Inc

- Mazak Corporation

- DMG MORI

- Matsuura Machinery Ltd

- Hybrid Manufacturing Technologies

- ELB-SCHLIFF Werkzeugmaschinen GmbH

- Mitsui Seiki Inc

- Okuma America Corporation

- Diversified Machine Systems

- Fabrisonic

Key Milestones in Additive Manufacturing Equipment Industry Industry

- July 2023: Mazak India opens a new production facility in Pune, demonstrating commitment to expansion in the Indian market.

- October 2023: Siemens partners with DMG MORI, offering a digital twin for machine tool processing on its Xcelerator marketplace, showcasing Industry 4.0 integration.

- October 2023: Alphacam GmbH and Evolve Additive Solutions form a strategic alliance, expanding STEP technology availability in Europe.

Strategic Outlook for Additive Manufacturing Equipment Industry Market

The future outlook for the Additive Manufacturing Equipment market is exceptionally robust, signaling significant potential for sustained and dynamic growth. Continuous technological evolution, the cultivation of strategic partnerships, and the accelerating adoption across a widening array of industries are the primary engines set to propel market expansion. Enterprises that prioritize relentless innovation, focus on optimizing cost structures, and actively engage in strategic collaborations are optimally positioned to seize emerging opportunities and secure a competitive advantage. The market is anticipated to undergo a phase of consolidation, characterized by strategic acquisitions where larger, established players absorb smaller, innovative companies to broaden their product portfolios and extend their market reach and influence.

Additive Manufacturing Equipment Industry Segmentation

-

1. End-user Industry

- 1.1. Aerospace & Defense

- 1.2. Energy & Power

- 1.3. Electronics

- 1.4. Medical

- 1.5. Automotive

- 1.6. Other End-user Industries

Additive Manufacturing Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Additive Manufacturing Equipment Industry Regional Market Share

Geographic Coverage of Additive Manufacturing Equipment Industry

Additive Manufacturing Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Industry 4.0 Integration; In industries like healthcare and automotive

- 3.2.2 there is a growing demand for customized and patient-specific parts.

- 3.3. Market Restrains

- 3.3.1 Industry 4.0 Integration; In industries like healthcare and automotive

- 3.3.2 there is a growing demand for customized and patient-specific parts.

- 3.4. Market Trends

- 3.4.1. Medical Sector Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Additive Manufacturing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Aerospace & Defense

- 5.1.2. Energy & Power

- 5.1.3. Electronics

- 5.1.4. Medical

- 5.1.5. Automotive

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Additive Manufacturing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Aerospace & Defense

- 6.1.2. Energy & Power

- 6.1.3. Electronics

- 6.1.4. Medical

- 6.1.5. Automotive

- 6.1.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Additive Manufacturing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Aerospace & Defense

- 7.1.2. Energy & Power

- 7.1.3. Electronics

- 7.1.4. Medical

- 7.1.5. Automotive

- 7.1.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Additive Manufacturing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Aerospace & Defense

- 8.1.2. Energy & Power

- 8.1.3. Electronics

- 8.1.4. Medical

- 8.1.5. Automotive

- 8.1.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Rest of the World Additive Manufacturing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Aerospace & Defense

- 9.1.2. Energy & Power

- 9.1.3. Electronics

- 9.1.4. Medical

- 9.1.5. Automotive

- 9.1.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Optomec Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mazak Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DMG MORI

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Matsuura Machinery Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hybrid Manufacturing technologies

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ELB-SCHLIFF Werkzeugmaschinen GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mitsui Seiki Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Okuma America Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Diversified Machine Systems

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Fabrisonic**List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Optomec Inc

List of Figures

- Figure 1: Global Additive Manufacturing Equipment Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Additive Manufacturing Equipment Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Additive Manufacturing Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 4: North America Additive Manufacturing Equipment Industry Volume (Billion), by End-user Industry 2025 & 2033

- Figure 5: North America Additive Manufacturing Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Additive Manufacturing Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 7: North America Additive Manufacturing Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Additive Manufacturing Equipment Industry Volume (Billion), by Country 2025 & 2033

- Figure 9: North America Additive Manufacturing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Additive Manufacturing Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Additive Manufacturing Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: Europe Additive Manufacturing Equipment Industry Volume (Billion), by End-user Industry 2025 & 2033

- Figure 13: Europe Additive Manufacturing Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Europe Additive Manufacturing Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Europe Additive Manufacturing Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Additive Manufacturing Equipment Industry Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Additive Manufacturing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Additive Manufacturing Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Additive Manufacturing Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: Asia Pacific Additive Manufacturing Equipment Industry Volume (Billion), by End-user Industry 2025 & 2033

- Figure 21: Asia Pacific Additive Manufacturing Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Asia Pacific Additive Manufacturing Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Additive Manufacturing Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Additive Manufacturing Equipment Industry Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Additive Manufacturing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Additive Manufacturing Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the World Additive Manufacturing Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 28: Rest of the World Additive Manufacturing Equipment Industry Volume (Billion), by End-user Industry 2025 & 2033

- Figure 29: Rest of the World Additive Manufacturing Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Rest of the World Additive Manufacturing Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World Additive Manufacturing Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Rest of the World Additive Manufacturing Equipment Industry Volume (Billion), by Country 2025 & 2033

- Figure 33: Rest of the World Additive Manufacturing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Additive Manufacturing Equipment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Additive Manufacturing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Additive Manufacturing Equipment Industry Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Additive Manufacturing Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Additive Manufacturing Equipment Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Additive Manufacturing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Additive Manufacturing Equipment Industry Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Additive Manufacturing Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Additive Manufacturing Equipment Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 9: Global Additive Manufacturing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Additive Manufacturing Equipment Industry Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Additive Manufacturing Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Additive Manufacturing Equipment Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Additive Manufacturing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Additive Manufacturing Equipment Industry Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Additive Manufacturing Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Additive Manufacturing Equipment Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Additive Manufacturing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Additive Manufacturing Equipment Industry Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Additive Manufacturing Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Additive Manufacturing Equipment Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Additive Manufacturing Equipment Industry?

The projected CAGR is approximately 15.17%.

2. Which companies are prominent players in the Additive Manufacturing Equipment Industry?

Key companies in the market include Optomec Inc, Mazak Corporation, DMG MORI, Matsuura Machinery Ltd, Hybrid Manufacturing technologies, ELB-SCHLIFF Werkzeugmaschinen GmbH, Mitsui Seiki Inc, Okuma America Corporation, Diversified Machine Systems, Fabrisonic**List Not Exhaustive.

3. What are the main segments of the Additive Manufacturing Equipment Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 215.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Industry 4.0 Integration; In industries like healthcare and automotive. there is a growing demand for customized and patient-specific parts..

6. What are the notable trends driving market growth?

Medical Sector Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Industry 4.0 Integration; In industries like healthcare and automotive. there is a growing demand for customized and patient-specific parts..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Additive Manufacturing Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Additive Manufacturing Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Additive Manufacturing Equipment Industry?

To stay informed about further developments, trends, and reports in the Additive Manufacturing Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence