Key Insights

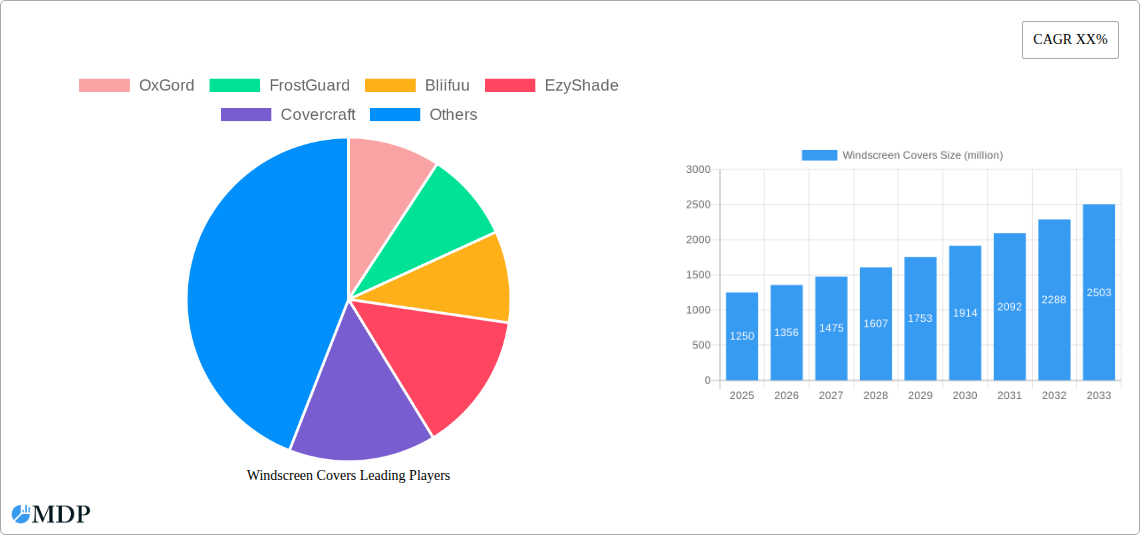

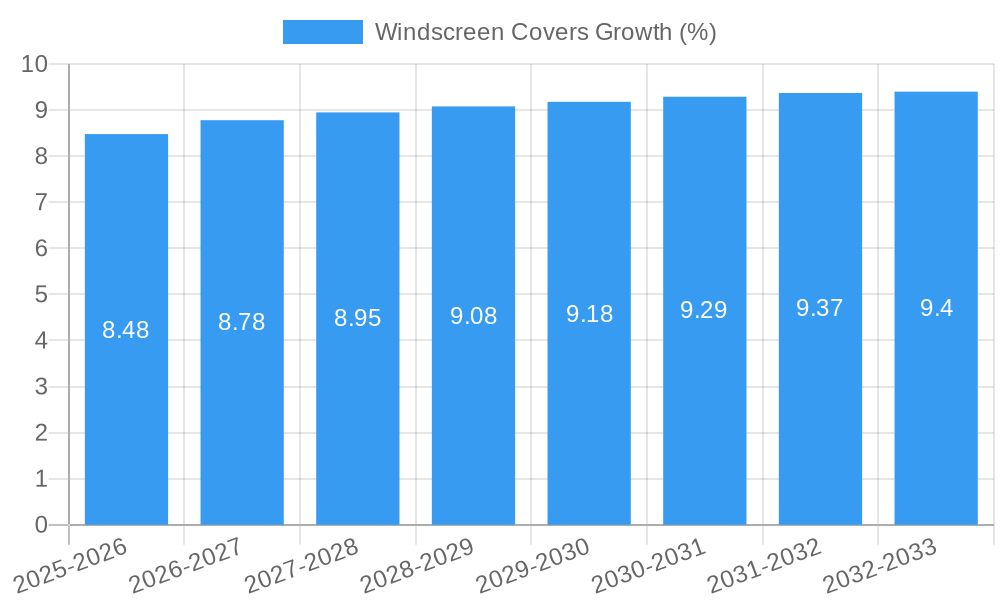

The global windscreen covers market is poised for significant expansion, projected to reach an estimated USD 1,250 million by 2025, driven by increasing vehicle ownership worldwide and a growing awareness of the need for UV protection and anti-theft features. The market is expected to witness a healthy Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025-2033. This robust growth is primarily fueled by the rising demand for convenience and vehicle protection, especially in regions with extreme weather conditions, such as intense sun exposure and frequent snowfall. Consumers are increasingly seeking practical solutions to maintain their vehicles' aesthetics and functionality, thereby boosting the adoption of windscreen covers. The surge in commercial vehicle fleets, coupled with a steady increase in passenger car sales, further underpins this upward trajectory. Key drivers include the growing emphasis on preserving vehicle interiors from sun damage, preventing frost buildup in colder climates, and deterring potential theft by obscuring the vehicle's interior. The market is also benefiting from technological advancements in material science, leading to the development of more durable, lightweight, and easy-to-use windscreen cover solutions.

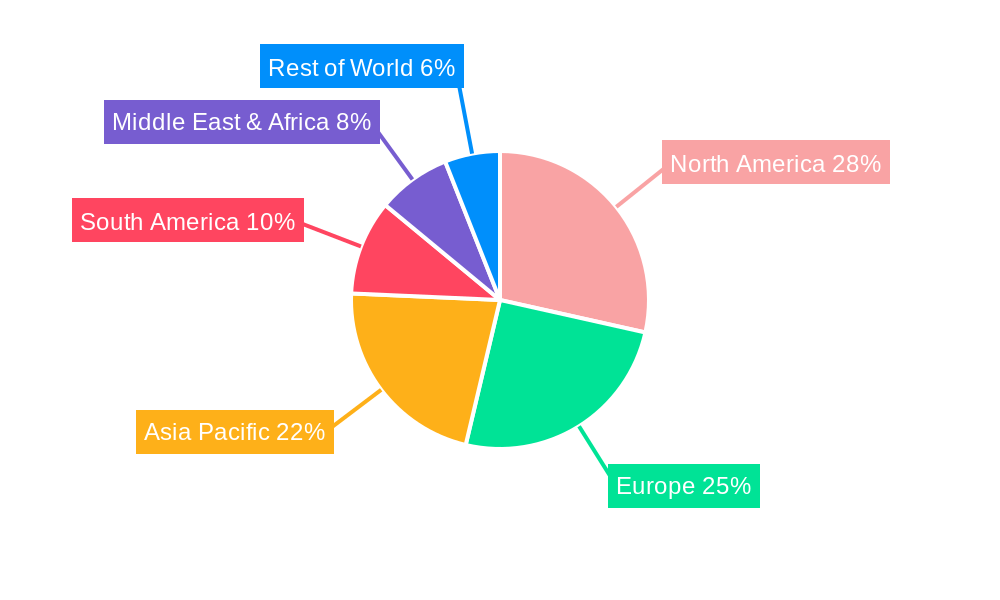

The market segmentation reveals a dynamic landscape with substantial opportunities across various applications and material types. The Polypropylene segment is anticipated to dominate owing to its excellent durability, affordability, and resistance to UV radiation. In terms of application, Passenger Vehicles will likely represent the largest share, given the sheer volume of these vehicles on the road. However, the Commercial Vehicles segment is expected to exhibit a higher growth rate due to the increasing need for fleet management solutions that include protecting vehicles from elements, thereby reducing maintenance costs and downtime. Geographically, Asia Pacific, led by China and India, is projected to be the fastest-growing region due to rapid industrialization, escalating vehicle production, and a burgeoning middle class with increasing disposable incomes. North America and Europe, with their established automotive markets and strong consumer focus on vehicle maintenance and protection, will continue to hold significant market shares. Emerging restraints, such as the availability of cheaper, less durable alternatives and consumer inertia, are being mitigated by the increasing availability of premium, feature-rich windscreen covers and growing online retail penetration.

Windscreen Covers Market Analysis: Comprehensive Growth Strategies and Industry Insights (2019-2033)

This comprehensive report delves into the dynamic windscreen covers market, offering an in-depth analysis of its trajectory from 2019 to 2033. With the base year at 2025 and a forecast period spanning 2025–2033, this study provides actionable intelligence for stakeholders seeking to navigate and capitalize on market opportunities. Examining key segments like Commercial Vehicles and Passenger Vehicles, and types including Polyvinyl Chloride, Polypropylene, and Polyester Fiber, this report equips industry leaders, investors, and manufacturers with critical data and strategic recommendations.

Windscreen Covers Market Dynamics & Concentration

The windscreen covers market exhibits a moderate level of concentration, with a blend of established global players and regional specialists. Innovation drivers are primarily centered around material advancements for enhanced durability, UV protection, and ease of use. The growing adoption of eco-friendly and recyclable materials, such as advanced Polyvinyl Chloride and sustainable Polyester Fiber alternatives, is a significant trend. Regulatory frameworks are evolving, particularly concerning material safety and environmental impact, prompting manufacturers to invest in compliant product development. Product substitutes, including specialized window films and spray-on coatings, represent a constant competitive pressure. End-user trends show a rising demand for convenience and all-weather protection solutions, especially among Passenger Vehicle owners. The Commercial Vehicle segment, while smaller, demonstrates consistent demand for robust, heavy-duty covers. Mergers and acquisitions (M&A) activity in the historical period (2019-2024) was relatively low, with an estimated xx deal counts. However, the increasing market potential suggests an upward trend in strategic partnerships and potential consolidations as companies seek to expand their product portfolios and geographic reach. Market share is currently distributed, with the top five companies holding an estimated xx% of the global market.

Windscreen Covers Industry Trends & Analysis

The windscreen covers industry is poised for significant expansion, driven by a confluence of factors that underscore its robust growth trajectory. The estimated Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be xx%, indicating a healthy and sustained upward trend. This growth is propelled by increasing consumer awareness regarding vehicle protection and the extending lifespan of automotive components. Technological disruptions are playing a pivotal role, with advancements in material science leading to the development of lighter, more durable, and weather-resistant windscreen covers. Innovations such as integrated sensor pockets, enhanced magnetic sealing, and improved anti-theft features are enhancing product functionality and appeal.

Consumer preferences are increasingly leaning towards customizable and aesthetically pleasing solutions, alongside practical benefits. The growing demand for ease of installation and storage solutions further influences product design and features. The proliferation of online retail channels has also democratized access to a wider array of windscreen cover options, fostering competition and driving down prices while simultaneously pushing for higher quality standards. The market penetration of windscreen covers, particularly in developed economies, is still considerable, with ample room for growth in emerging markets where vehicle ownership is on the rise.

The competitive landscape is characterized by a dynamic interplay between established brands and agile new entrants. Companies are focusing on differentiation through innovative features, superior materials, and targeted marketing strategies. The Passenger Vehicle segment, accounting for the largest share, continues to be a primary focus, driven by a vast consumer base. However, the Commercial Vehicle segment, though smaller in volume, presents a niche opportunity for specialized, heavy-duty solutions. The industry is also witnessing a growing emphasis on sustainable and eco-friendly materials, reflecting a broader societal shift towards environmental consciousness. This trend is creating opportunities for manufacturers who can offer products made from recycled or biodegradable materials.

Leading Markets & Segments in Windscreen Covers

The global windscreen covers market is characterized by distinct regional strengths and segment dominance, offering unique growth avenues.

Dominant Regions and Countries:

- North America currently leads the market, driven by a high concentration of vehicle ownership, a strong culture of vehicle maintenance and protection, and a significant demand for all-weather solutions due to diverse climatic conditions. The United States, in particular, is a key market, supported by robust aftermarket accessory sales and a large Passenger Vehicle fleet. Economic policies that encourage vehicle ownership and a well-developed retail infrastructure further bolster its position.

- Europe follows closely, with countries like Germany, the UK, and France showing substantial demand. The increasing adoption of environmentally friendly products and stringent regulations regarding vehicle care are shaping market trends. Investment in automotive infrastructure and a growing awareness of UV damage prevention contribute to market growth.

- Asia-Pacific represents the fastest-growing region. Rapid urbanization, a burgeoning middle class, and a significant increase in vehicle sales, especially in countries like China and India, are key drivers. Government initiatives promoting the automotive sector and rising disposable incomes are contributing to market expansion.

Leading Segments:

Application: Passenger Vehicles dominates the market, comprising an estimated xx% of global sales. This segment is driven by the sheer volume of passenger cars and the increasing consumer desire for convenience, protection from the elements (sun, snow, frost), and preservation of vehicle aesthetics. The widespread availability of diverse product offerings tailored to specific car models further fuels this segment's dominance.

Application: Commercial Vehicles represents a smaller yet crucial segment, accounting for approximately xx% of the market. This segment is characterized by the demand for heavy-duty, durable covers designed for larger vehicles such as trucks, vans, and buses. Factors such as operational efficiency, vehicle downtime reduction, and protection against harsh weather conditions during long hauls are paramount. The need for specialized covers that accommodate specific vehicle features and configurations drives innovation in this area.

Type: Polyester Fiber is a leading material choice, estimated to hold xx% of the market share. Its popularity stems from its excellent durability, UV resistance, water repellency, and affordability. It offers a good balance of performance and cost-effectiveness, making it a preferred option for a wide range of windscreen covers.

Type: Polypropylene is another significant material, accounting for an estimated xx% of the market. Known for its lightweight nature, resistance to mildew and moisture, and cost-effectiveness, it is often used in basic and disposable windscreen covers. Its recyclability also appeals to environmentally conscious consumers.

Type: Polyvinyl Chloride (PVC) holds an estimated xx% market share. PVC offers good flexibility, durability, and water resistance, making it suitable for certain types of covers, especially those requiring a more rigid structure or enhanced weatherproofing. However, environmental concerns associated with PVC are leading some manufacturers to explore alternatives.

Other material types, including blends and advanced composites, represent the remaining xx% of the market. This category includes innovative materials developed for specific performance characteristics, such as extreme temperature resistance or enhanced breathability.

Windscreen Covers Product Developments

Application: Passenger Vehicles dominates the market, comprising an estimated xx% of global sales. This segment is driven by the sheer volume of passenger cars and the increasing consumer desire for convenience, protection from the elements (sun, snow, frost), and preservation of vehicle aesthetics. The widespread availability of diverse product offerings tailored to specific car models further fuels this segment's dominance.

Application: Commercial Vehicles represents a smaller yet crucial segment, accounting for approximately xx% of the market. This segment is characterized by the demand for heavy-duty, durable covers designed for larger vehicles such as trucks, vans, and buses. Factors such as operational efficiency, vehicle downtime reduction, and protection against harsh weather conditions during long hauls are paramount. The need for specialized covers that accommodate specific vehicle features and configurations drives innovation in this area.

Type: Polyester Fiber is a leading material choice, estimated to hold xx% of the market share. Its popularity stems from its excellent durability, UV resistance, water repellency, and affordability. It offers a good balance of performance and cost-effectiveness, making it a preferred option for a wide range of windscreen covers.

Type: Polypropylene is another significant material, accounting for an estimated xx% of the market. Known for its lightweight nature, resistance to mildew and moisture, and cost-effectiveness, it is often used in basic and disposable windscreen covers. Its recyclability also appeals to environmentally conscious consumers.

Type: Polyvinyl Chloride (PVC) holds an estimated xx% market share. PVC offers good flexibility, durability, and water resistance, making it suitable for certain types of covers, especially those requiring a more rigid structure or enhanced weatherproofing. However, environmental concerns associated with PVC are leading some manufacturers to explore alternatives.

Other material types, including blends and advanced composites, represent the remaining xx% of the market. This category includes innovative materials developed for specific performance characteristics, such as extreme temperature resistance or enhanced breathability.

Windscreen Covers Product Developments

Product innovation in the windscreen covers market is primarily focused on enhanced material science and user-centric design. Manufacturers are introducing covers made from advanced, lightweight, and highly durable Polyester Fiber and reinforced Polypropylene blends, offering superior UV protection and weather resistance. Developments include integrated magnetic strips for secure fitting, anti-scratch lining to protect vehicle paintwork, and compact designs for easy storage. Innovations such as multi-layer construction for improved insulation against extreme temperatures and reflective outer surfaces to minimize heat buildup are gaining traction. These advancements aim to provide comprehensive protection against sun, snow, frost, dust, and bird droppings, enhancing the longevity and aesthetic appeal of vehicles, thereby providing a significant competitive advantage.

Key Drivers of Windscreen Covers Growth

The windscreen covers market is experiencing robust growth propelled by several key factors. Firstly, the increasing global vehicle parc, particularly the surge in Passenger Vehicle ownership in emerging economies, creates a larger addressable market. Secondly, growing consumer awareness regarding the detrimental effects of prolonged exposure to sunlight, frost, and environmental pollutants on vehicle exteriors is driving demand for protective solutions. Advancements in material technology, leading to more durable, lightweight, and user-friendly covers made from materials like Polyester Fiber and advanced Polyvinyl Chloride alternatives, are enhancing product appeal and performance. Furthermore, the rising popularity of automotive customization and protection accessories, coupled with the convenience offered by these products, fuels market expansion. Regulatory emphasis on vehicle maintenance and longevity in certain regions also indirectly supports the windscreen cover market.

Challenges in the Windscreen Covers Market

Despite its growth, the windscreen covers market faces several hurdles. Intense competitive pressure from numerous established and emerging players, including brands like OxGord and FrostGuard, leads to price sensitivity and necessitates continuous innovation to maintain market share. The supply chain disruptions witnessed in recent years can impact raw material availability and manufacturing costs. Furthermore, the availability of product substitutes, such as car covers or specialized cleaning and protection sprays, poses a challenge. While environmental concerns are driving demand for sustainable materials, the cost associated with developing and producing eco-friendly windscreen covers can be higher, potentially limiting widespread adoption for budget-conscious consumers. The evolving regulatory landscape concerning material safety and recyclability also requires manufacturers to invest in compliance and product redesign.

Emerging Opportunities in Windscreen Covers

The windscreen covers market presents significant emerging opportunities for growth. The increasing demand for smart and connected vehicle accessories opens avenues for integrated sensor compatibility or solar charging capabilities within windscreen covers. The growing emphasis on sustainability is driving demand for covers made from recycled materials and biodegradable options, creating a niche for eco-conscious manufacturers. The expansion of the automotive aftermarket in emerging economies offers substantial untapped potential for market penetration. Furthermore, strategic partnerships with automotive dealerships, online car accessory retailers, and fleet management companies can unlock new distribution channels. Innovations in customization and personalization, allowing consumers to tailor covers to specific vehicle models or aesthetic preferences, also represent a growing opportunity.

Leading Players in the Windscreen Covers Sector

- OxGord

- FrostGuard

- Bliifuu

- EzyShade

- Covercraft

- MATCC

- RVMasking

- Topfit

- Delk

- Kktick

- ProElite

- Autostyle

- Kzematli

- FrostGuard Plus

- Shade-It

- SnowOFF

- Sunferno

- Subzero

- Zacar

Key Milestones in Windscreen Covers Industry

- 2019: Increased adoption of UV-resistant coatings and materials in windscreen covers to combat rising global temperatures.

- 2020: Surge in demand for frost and snow protection covers due to severe winter seasons in key markets.

- 2021: Growing consumer preference for lightweight and easily foldable designs for enhanced portability and storage. Introduction of early biodegradable material prototypes by niche manufacturers.

- 2022: Significant advancements in magnetic sealing technology for improved fit and security. Increased market presence of e-commerce platforms for direct-to-consumer sales.

- 2023: Focus on multi-functional covers incorporating features like bird-dropping protection and enhanced dust repellency. Early exploration of smart materials for temperature regulation.

- 2024: Greater emphasis on eco-friendly materials and sustainable manufacturing processes driven by consumer and regulatory pressures.

Strategic Outlook for Windscreen Covers Market

The windscreen covers market is on an upward trajectory, driven by a growing appreciation for vehicle protection and convenience. The strategic outlook points towards continued growth fueled by innovation in materials, particularly sustainable options like advanced Polyester Fiber and recycled Polypropylene. The increasing global vehicle parc and rising disposable incomes in emerging markets present substantial expansion opportunities. Companies that can effectively leverage online distribution channels, forge strategic partnerships, and focus on product differentiation through enhanced features and eco-friendly attributes will be best positioned for success. The market's future will likely see a blend of functional utility and aesthetic appeal, with a growing demand for customized solutions across both Passenger Vehicles and Commercial Vehicles.

Windscreen Covers Segmentation

-

1. Application

- 1.1. Commercial Vehicles

- 1.2. Passenger Vehicles

-

2. Types

- 2.1. Polyvinyl Chloride

- 2.2. Polypropylene

- 2.3. Polyester Fiber

- 2.4. Other

Windscreen Covers Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Windscreen Covers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Windscreen Covers Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Vehicles

- 5.1.2. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Polyvinyl Chloride

- 5.2.2. Polypropylene

- 5.2.3. Polyester Fiber

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Windscreen Covers Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Vehicles

- 6.1.2. Passenger Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Polyvinyl Chloride

- 6.2.2. Polypropylene

- 6.2.3. Polyester Fiber

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Windscreen Covers Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Vehicles

- 7.1.2. Passenger Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Polyvinyl Chloride

- 7.2.2. Polypropylene

- 7.2.3. Polyester Fiber

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Windscreen Covers Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Vehicles

- 8.1.2. Passenger Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Polyvinyl Chloride

- 8.2.2. Polypropylene

- 8.2.3. Polyester Fiber

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Windscreen Covers Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Vehicles

- 9.1.2. Passenger Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Polyvinyl Chloride

- 9.2.2. Polypropylene

- 9.2.3. Polyester Fiber

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Windscreen Covers Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Vehicles

- 10.1.2. Passenger Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Polyvinyl Chloride

- 10.2.2. Polypropylene

- 10.2.3. Polyester Fiber

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 OxGord

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FrostGuard

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bliifuu

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EzyShade

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Covercraft

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MATCC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RVMasking

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Topfit

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Delk

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kktick

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ProElite

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Autostyle

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Kzematli

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 FrostBlocker

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sunferno

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Subzero

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Zacar

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 FrostGuard Plus

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Shade-It

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 SnowOFF

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 OxGord

List of Figures

- Figure 1: Global Windscreen Covers Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Windscreen Covers Revenue (million), by Application 2024 & 2032

- Figure 3: North America Windscreen Covers Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Windscreen Covers Revenue (million), by Types 2024 & 2032

- Figure 5: North America Windscreen Covers Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Windscreen Covers Revenue (million), by Country 2024 & 2032

- Figure 7: North America Windscreen Covers Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Windscreen Covers Revenue (million), by Application 2024 & 2032

- Figure 9: South America Windscreen Covers Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Windscreen Covers Revenue (million), by Types 2024 & 2032

- Figure 11: South America Windscreen Covers Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Windscreen Covers Revenue (million), by Country 2024 & 2032

- Figure 13: South America Windscreen Covers Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Windscreen Covers Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Windscreen Covers Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Windscreen Covers Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Windscreen Covers Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Windscreen Covers Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Windscreen Covers Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Windscreen Covers Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Windscreen Covers Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Windscreen Covers Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Windscreen Covers Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Windscreen Covers Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Windscreen Covers Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Windscreen Covers Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Windscreen Covers Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Windscreen Covers Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Windscreen Covers Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Windscreen Covers Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Windscreen Covers Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Windscreen Covers Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Windscreen Covers Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Windscreen Covers Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Windscreen Covers Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Windscreen Covers Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Windscreen Covers Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Windscreen Covers Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Windscreen Covers Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Windscreen Covers Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Windscreen Covers Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Windscreen Covers Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Windscreen Covers Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Windscreen Covers Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Windscreen Covers Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Windscreen Covers Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Windscreen Covers Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Windscreen Covers Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Windscreen Covers Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Windscreen Covers Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Windscreen Covers Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Windscreen Covers?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Windscreen Covers?

Key companies in the market include OxGord, FrostGuard, Bliifuu, EzyShade, Covercraft, MATCC, RVMasking, Topfit, Delk, Kktick, ProElite, Autostyle, Kzematli, FrostBlocker, Sunferno, Subzero, Zacar, FrostGuard Plus, Shade-It, SnowOFF.

3. What are the main segments of the Windscreen Covers?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Windscreen Covers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Windscreen Covers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Windscreen Covers?

To stay informed about further developments, trends, and reports in the Windscreen Covers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence