Key Insights

The United States pharmaceutical 3PL market is experiencing robust growth, driven by the increasing complexity of pharmaceutical supply chains and the rising demand for temperature-sensitive drug delivery. The market's expansion is fueled by several key factors. Firstly, pharmaceutical companies are increasingly outsourcing logistics functions to 3PL providers to focus on core competencies like research and development. Secondly, the stringent regulatory requirements and the need for specialized handling and storage of pharmaceuticals necessitate the expertise offered by experienced 3PLs. Thirdly, the growth of e-commerce in the pharmaceutical sector is driving the need for efficient and reliable last-mile delivery solutions, further boosting demand for 3PL services. The market is segmented by function (domestic and international transportation management, value-added warehousing and distribution) and by supply chain type (cold chain and non-cold chain). Cold chain logistics, due to the temperature-sensitive nature of many pharmaceuticals, represents a significant and rapidly growing segment within the overall market. Major players like FedEx, UPS, DHL, and specialized pharmaceutical logistics providers are intensely competitive, constantly innovating to improve efficiency, track-and-trace capabilities, and overall supply chain visibility. The market is projected to maintain a healthy CAGR, reflecting the continued reliance on outsourced logistics expertise within the pharmaceutical industry. Specific regional variations within the US market likely exist, with higher concentrations of activity in areas with major pharmaceutical manufacturing and distribution hubs.

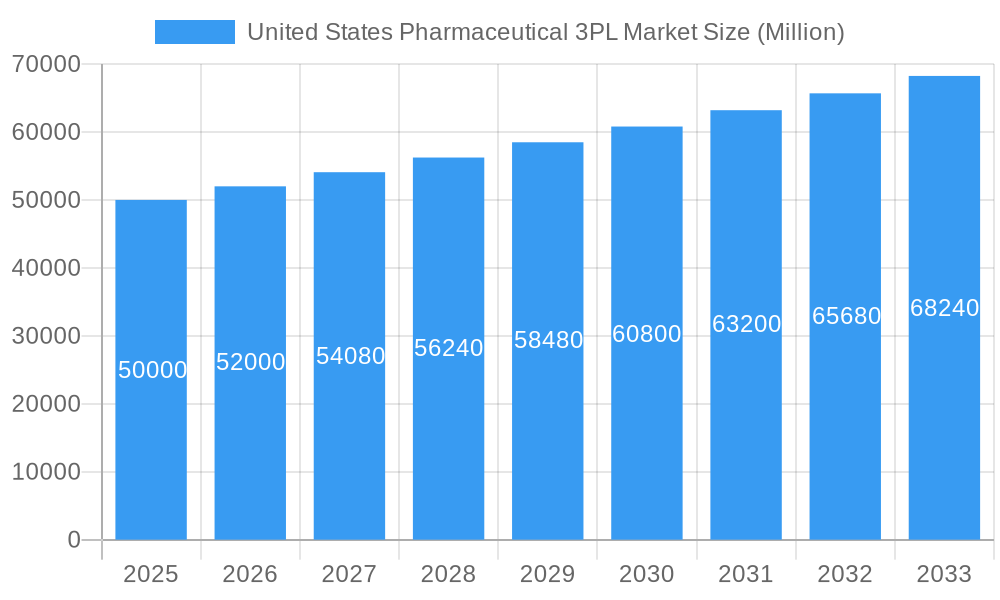

United States Pharmaceutical 3PL Market Market Size (In Billion)

Considering the provided European data and the global nature of pharmaceutical logistics, we can reasonably infer that the US market size is substantial, likely exceeding $XX billion in 2025. A CAGR above 4% suggests a continuously expanding market, potentially reaching $YY billion (estimate based on the provided CAGR and a logical projection) by 2033. Key challenges include maintaining stringent quality control standards, managing fluctuating demand, and ensuring compliance with evolving regulations. The market's future growth trajectory will depend on factors such as the pace of technological advancements, regulatory changes, and the continued outsourcing trend within the pharmaceutical sector. The consolidation among 3PL providers is also expected to shape the competitive landscape in the coming years.

United States Pharmaceutical 3PL Market Company Market Share

United States Pharmaceutical 3PL Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Pharmaceutical 3PL market, offering invaluable insights for stakeholders across the pharmaceutical supply chain. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. Benefit from detailed segment analysis, competitive landscaping, and key milestone tracking, enabling informed strategic decision-making. Download now to gain a competitive edge.

United States Pharmaceutical 3PL Market Market Dynamics & Concentration

The United States Pharmaceutical 3PL market is a highly dynamic and moderately consolidated landscape, shaped by intense competition among established global leaders and specialized domestic providers. Key players like DB Schenker, DHL Supply Chain, UPS Healthcare, FedEx Logistics, Expeditors International of Washington Inc., CEVA Logistics, Kuehne + Nagel, Agility, Kerry Logistics, and C.H. Robinson are at the forefront, vying for market share. While precise market share figures fluctuate annually, the top five entities consistently command a significant majority of the market. The market concentration ratio (CR5) is projected to be around xx% in 2025, indicating a substantial portion of the market is held by a few dominant players. This consolidation is further influenced by ongoing advancements in critical areas such as cold chain logistics, encompassing sophisticated temperature-controlled storage and transportation solutions. Automation, from robotic warehousing to AI-driven route optimization, is also a significant driver of operational efficiency and market evolution. Furthermore, the stringent and ever-evolving regulatory framework, particularly FDA guidelines on drug handling, storage, and transportation, plays a pivotal role in shaping market strategies and demanding high operational standards. The inherent nature of specialized pharmaceutical logistics, with limited readily available substitutes for core 3PL services, contributes to market stability. Evolving end-user demands for enhanced supply chain visibility, traceability, and resilience are actively fueling the adoption of more advanced and integrated 3PL solutions. Moderate Merger and Acquisition (M&A) activity, with an estimated xx deals recorded between 2019 and 2024, reflects a strategic consolidation trend. These transactions are often driven by 3PL providers seeking to broaden their service portfolios, extend their geographic reach, and enhance their specialized capabilities within the pharmaceutical sector.

- Market Concentration (CR5, 2025): xx%

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Advanced cold chain technology, automation in warehousing and transportation, AI-powered data analytics for supply chain optimization and predictive insights.

United States Pharmaceutical 3PL Market Industry Trends & Analysis

The US Pharmaceutical 3PL market is experiencing robust growth, driven by several key factors. The rising demand for pharmaceutical products, coupled with the increasing complexity of global supply chains, fuels the need for specialized 3PL services. Technological advancements, such as the adoption of IoT sensors and AI-powered route optimization, are enhancing efficiency and reducing costs. Consumer preferences for faster delivery and enhanced traceability are further driving market expansion. The market is witnessing increased competition, with both established players and new entrants vying for market share. The compound annual growth rate (CAGR) for the market is projected to be xx% during the forecast period (2025-2033). Market penetration of advanced 3PL solutions, such as temperature-controlled transportation and warehousing, is steadily increasing, reflecting a growing focus on product integrity. Competitive dynamics are shaped by pricing strategies, service offerings, and technological capabilities. The market is expected to reach USD xx Million by 2033.

Leading Markets & Segments in United States Pharmaceutical 3PL Market

The US Pharmaceutical 3PL market exhibits significant regional variations in growth and segment dominance. While data on precise regional breakdowns is limited, the Northeast and West Coast regions are generally considered to be the most significant markets. This is due to the concentration of pharmaceutical companies and research institutions in these areas. However, growth in other regions is expected to increase as manufacturing and distribution networks expand nationally.

Function:

- Domestic Transportation Management: Strong growth driven by the need for efficient and reliable domestic delivery networks.

- International Transportation Management: This segment is experiencing robust growth due to increasing global trade and the need for specialized cross-border logistics.

- Value-added Warehousing and Distribution: This segment is crucial, with high demand driven by the need for specialized storage and handling of temperature-sensitive pharmaceuticals.

Supply Chain:

- Cold Chain: This segment holds significant market share and is experiencing the fastest growth due to the stringent temperature requirements for many pharmaceutical products. Advancements in cold chain technology, including the use of GPS tracking and specialized containers, are driving growth.

- Non-cold Chain: This segment comprises the transportation and warehousing of pharmaceuticals that do not require stringent temperature control. This segment has stable growth, but it is smaller than the cold chain segment.

Key drivers for these segments include the robust pharmaceutical manufacturing sector, well-established transportation infrastructure, and governmental regulatory support for efficient logistics.

United States Pharmaceutical 3PL Market Product Developments

Recent product innovations within the US Pharmaceutical 3PL market center around enhancing visibility and efficiency within the cold chain. Real-time temperature monitoring, GPS tracking, and predictive analytics are becoming increasingly integrated into 3PL services. These technologies are improving the security and integrity of pharmaceutical shipments while reducing the risk of product spoilage and loss. Such improvements are creating a competitive advantage for 3PL providers who can offer these sophisticated solutions, enabling them to command premium pricing and attract high-value clients.

Key Drivers of United States Pharmaceutical 3PL Market Growth

The robust growth trajectory of the United States Pharmaceutical 3PL market is underpinned by a confluence of powerful drivers. Technological advancements are at the forefront, with widespread adoption of real-time tracking and monitoring systems, sophisticated temperature-controlled solutions for cold chain integrity, and the integration of Artificial Intelligence (AI) for predictive analytics and optimized route planning, all contributing to heightened efficiency and risk mitigation. The unwavering demand for stringent regulatory compliance, mandated by bodies like the FDA, necessitates and fuels the development of specialized 3PL infrastructure and expertise for the secure and compliant handling, storage, and distribution of pharmaceuticals. The increasing complexity of global pharmaceutical supply chains, characterized by diverse product requirements and international reach, further amplifies the need for specialized 3PL providers with comprehensive capabilities. Moreover, the consistently growing global demand for pharmaceutical products, a trend significantly amplified by recent global health crises and an aging population, directly translates into increased demand for efficient and reliable logistics services.

Challenges in the United States Pharmaceutical 3PL Market Market

The US Pharmaceutical 3PL market faces several challenges. Stringent regulatory compliance requirements increase operational costs and complexity. Maintaining an unbroken cold chain presents significant logistical hurdles, especially for temperature-sensitive pharmaceuticals. Competition is fierce, with pressure on pricing and service differentiation. Supply chain disruptions, as seen during recent global events, can significantly impact market stability. The estimated impact of these challenges on overall market growth is approximately xx% reduction in annual revenue, compared to a scenario without these hindrances.

Emerging Opportunities in United States Pharmaceutical 3PL Market

The US Pharmaceutical 3PL market presents several promising opportunities. Technological breakthroughs, such as blockchain technology for enhanced traceability, and the expansion of 3PL services into emerging markets are driving long-term growth. Strategic partnerships between 3PL providers and pharmaceutical companies are creating synergies, enhancing market efficiency. Expansion into specialized niche markets, such as personalized medicine logistics, offers significant potential for market expansion and diversification.

Leading Players in the United States Pharmaceutical 3PL Market Sector

- DB Schenker

- DHL Supply Chain

- UPS Healthcare

- Expeditors International of Washington Inc.

- FedEx Logistics

- CEVA Logistics

- Kuehne + Nagel

- Agility

- Kerry Logistics

- C.H. Robinson

Key Milestones in United States Pharmaceutical 3PL Market Industry

- May 2021: UPS expanded its specialty pharmaceutical offerings by establishing UPS Cold Chain Solutions, significantly enhancing its cold chain capabilities and market competitiveness.

- December 2021: FedEx Corp. opened a substantially larger air cargo hub at Miami International Airport, featuring a significantly expanded cold storage section. This expansion doubles the hub's capacity and enhances its cold chain logistics capabilities, allowing it to better serve the growing demand in the pharmaceutical sector.

Strategic Outlook for United States Pharmaceutical 3PL Market Market

The US Pharmaceutical 3PL market shows strong potential for continued growth, driven by technological innovation, increasing regulatory scrutiny, and rising demand for efficient and reliable pharmaceutical logistics. Strategic opportunities lie in leveraging advanced technologies like AI and blockchain, focusing on cold chain specialization, and building strategic partnerships within the pharmaceutical industry. Companies that can effectively navigate regulatory hurdles and offer innovative, customized solutions are poised for significant market success.

United States Pharmaceutical 3PL Market Segmentation

-

1. Function

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. Supply Chain

- 2.1. Cold Chain

- 2.2. Non-cold Chain

United States Pharmaceutical 3PL Market Segmentation By Geography

- 1. United States

United States Pharmaceutical 3PL Market Regional Market Share

Geographic Coverage of United States Pharmaceutical 3PL Market

United States Pharmaceutical 3PL Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Transportation Ordered

- 3.4. Market Trends

- 3.4.1. The United States is Leading in the Pharmaceutical Market Across the World

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Pharmaceutical 3PL Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by Supply Chain

- 5.2.1. Cold Chain

- 5.2.2. Non-cold Chain

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UPS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expeditors International of Washington Inc *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kerry Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 C H Robinson

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: United States Pharmaceutical 3PL Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Pharmaceutical 3PL Market Share (%) by Company 2025

List of Tables

- Table 1: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Supply Chain 2020 & 2033

- Table 3: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Supply Chain 2020 & 2033

- Table 6: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Pharmaceutical 3PL Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the United States Pharmaceutical 3PL Market?

Key companies in the market include DB Schenker, DHL, UPS, Expeditors International of Washington Inc *List Not Exhaustive, FedEx, CEVA Logistics, Kuehne + Nagel, Agility, Kerry Logistics, C H Robinson.

3. What are the main segments of the United States Pharmaceutical 3PL Market?

The market segments include Function, Supply Chain.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies.

6. What are the notable trends driving market growth?

The United States is Leading in the Pharmaceutical Market Across the World.

7. Are there any restraints impacting market growth?

High Cost Associated with the Transportation Ordered.

8. Can you provide examples of recent developments in the market?

December 2021: FedEx Corp. began operations at its substantially bigger air cargo hub at Miami International Airport. The USD 72 million addition, two years under development and roughly the size of two football fields, doubles the hub's size to 282,000 square feet. The hub includes FedEx's largest cold storage section, covering 70,000 square feet - the equivalent of 33 tennis courts - of refrigerated and frozen storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Pharmaceutical 3PL Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Pharmaceutical 3PL Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Pharmaceutical 3PL Market?

To stay informed about further developments, trends, and reports in the United States Pharmaceutical 3PL Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence