Key Insights

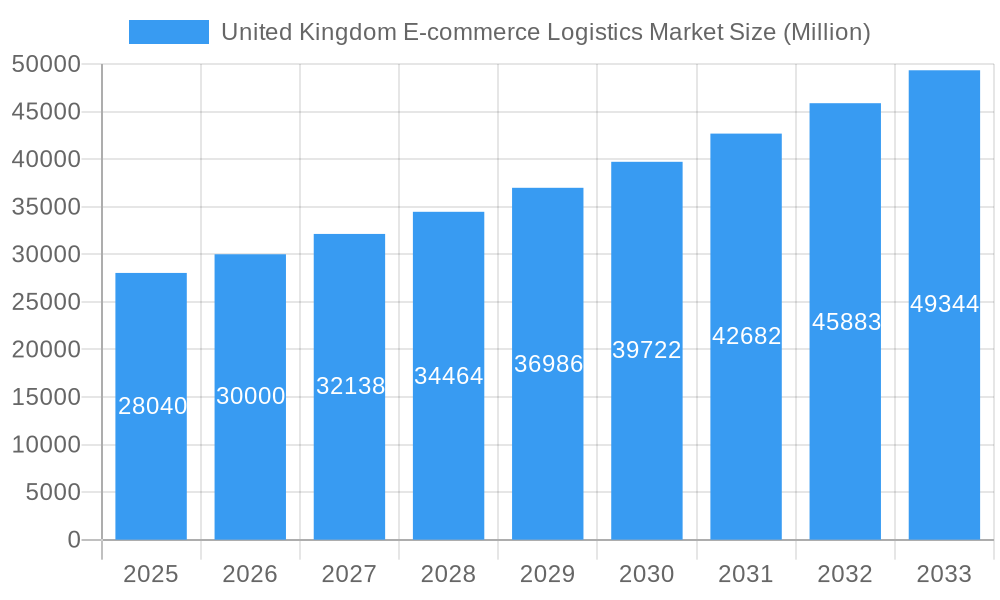

The United Kingdom e-commerce logistics market is experiencing robust growth, projected to reach a market size of £28.04 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.94%. Several key drivers fuel this expansion. The surge in online shopping, fueled by increasing internet penetration and consumer preference for convenience, is a primary factor. Furthermore, advancements in technology, such as automated warehousing systems, sophisticated delivery networks, and improved last-mile delivery solutions, are significantly enhancing efficiency and speed. The growing popularity of omnichannel retailing, where businesses integrate online and offline sales channels, further necessitates robust and adaptable logistics solutions. Segment-wise, B2C services are expected to dominate, driven by the rising number of online consumers. Within the services segment, Value-added services like labeling and packaging are gaining traction as businesses seek to enhance the customer experience. International/Cross-border e-commerce is also a significant contributor to market growth, reflecting the increasing globalization of online retail. While challenges exist, such as maintaining efficient delivery times in densely populated areas and managing increasing transportation costs, the market's overall trajectory remains positive.

United Kingdom E-commerce Logistics Market Market Size (In Billion)

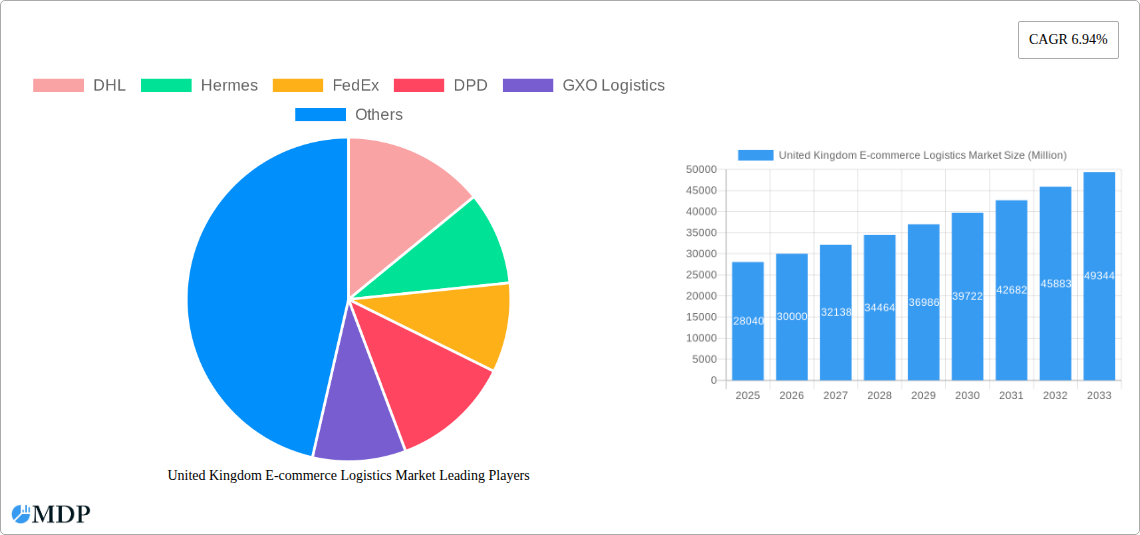

The competitive landscape is characterized by a mix of established global players like DHL, FedEx, and Hermes, and regional specialists. These companies are continually investing in infrastructure and technology to meet the evolving demands of the market. The dominance of established players does not preclude the emergence of innovative startups disrupting the sector through specialized solutions, particularly in last-mile delivery and sustainable logistics. The market is segmented by service type (transportation, warehousing, value-added services), business type (B2B, B2C), destination (domestic, international), and product type (fashion, electronics, home appliances, etc.). The UK's strategic location as a major European hub further strengthens its position within the broader European e-commerce landscape. Future growth will likely be influenced by factors such as Brexit’s long-term impact on trade, evolving consumer expectations, and the ongoing adoption of sustainable practices within the logistics industry.

United Kingdom E-commerce Logistics Market Company Market Share

United Kingdom E-commerce Logistics Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK e-commerce logistics market, offering invaluable insights for businesses, investors, and stakeholders. Covering the period 2019-2033, with a base year of 2025, this report unveils the market dynamics, key players, and future trends shaping this rapidly evolving sector. The UK e-commerce logistics market is projected to reach £XX Million by 2033, presenting significant opportunities for growth and investment.

United Kingdom E-commerce Logistics Market Dynamics & Concentration

The UK e-commerce logistics market is characterized by a dynamic interplay of factors influencing its concentration and growth. Market concentration is moderate, with several major players like DHL, FedEx, and Hermes holding significant market share, but a multitude of smaller companies and specialized providers also compete vigorously. This competitive landscape fosters innovation and drives efficiency improvements across the sector.

Market Concentration Metrics (2024 Estimates):

- Top 5 players hold approximately xx% market share.

- Top 10 players hold approximately xx% market share.

- Number of M&A deals in the last 5 years: xx

Innovation Drivers: Technological advancements, particularly in automation (robotics, AI, and machine learning), are revolutionizing warehousing and transportation. Pressure to improve delivery speeds and reduce costs fuels the adoption of these technologies.

Regulatory Framework: Government regulations concerning data privacy, environmental sustainability, and labor standards impact operational costs and strategies. Brexit has introduced new complexities in cross-border logistics, requiring businesses to adapt to new customs procedures and regulations.

Product Substitutes: While traditional logistics remain central, alternative delivery models (e.g., drone delivery, crowd-sourced logistics) present nascent competitive pressures, pushing for innovative solutions and adaptability.

End-User Trends: Consumers increasingly demand faster, more convenient, and transparent delivery options, driving companies to invest in advanced tracking systems, flexible delivery windows, and last-mile optimization strategies.

M&A Activities: Consolidation through mergers and acquisitions is a common trend, reflecting the drive for scale, technological integration, and geographical expansion.

United Kingdom E-commerce Logistics Market Industry Trends & Analysis

The UK e-commerce logistics market exhibits strong growth, driven by several key factors. The rapid expansion of online retail, fueled by increasing internet penetration and consumer preference for online shopping, is a primary catalyst. This surge in e-commerce necessitates efficient and reliable logistics solutions, leading to market expansion.

Technological advancements, including automation and data analytics, significantly enhance operational efficiency and optimize delivery networks. The integration of AI and machine learning allows for predictive analytics, improved route planning, and proactive risk management. Consumer preferences for same-day and next-day delivery are pushing the market towards faster, more flexible solutions, requiring substantial investment in infrastructure and technology.

Key Market Growth Drivers:

- Increased e-commerce penetration.

- Demand for faster delivery options.

- Technological advancements in automation and data analytics.

- Growth in cross-border e-commerce.

Market Growth Metrics:

- CAGR (2025-2033): xx%

- Market penetration of automated solutions (2024): xx%

Competitive dynamics are intensifying, with established players facing increasing competition from smaller, agile companies specializing in niche services or leveraging advanced technologies. The market is witnessing increased focus on sustainability and ethical practices, impacting logistics providers' operational choices and strategies.

Leading Markets & Segments in United Kingdom E-commerce Logistics Market

The UK e-commerce logistics market is segmented by service type, business model, destination, and product type. The largest segment by service type is Transportation, followed by Warehousing and Inventory Management and Value-Added Services. B2C accounts for a larger share than B2B, due to the massive growth in direct-to-consumer e-commerce. Domestic delivery is the most dominant segment by destination, though the international/cross-border segment demonstrates significant potential for growth. In terms of product types, Fashion and Apparel, Consumer Electronics, and Home Appliances are the leading segments.

Key Drivers by Segment:

- Transportation: Demand for faster and more efficient delivery networks, particularly last-mile solutions.

- Warehousing and Inventory Management: Growing need for efficient storage and inventory management solutions due to increasing e-commerce volumes.

- Value-added Services: Growing customer demand for specialized services such as packaging, labeling, and returns processing.

- B2C: Explosive growth of direct-to-consumer e-commerce.

- Domestic: High concentration of online shoppers within the UK market.

- International/Cross-border: Growing demand for cross-border e-commerce, with increased trade flows despite Brexit complexities.

- Fashion and Apparel: High volume and frequency of online orders in this sector.

United Kingdom E-commerce Logistics Market Product Developments

Product innovation is centered around automation and data-driven optimization. This includes the implementation of robotic process automation in warehousing, the use of AI-powered route optimization software for transportation, and the development of advanced tracking and delivery management systems. These advancements offer significant competitive advantages by enhancing efficiency, reducing costs, and improving customer satisfaction. The focus is on solutions that seamlessly integrate into existing e-commerce platforms and provide real-time visibility into the entire logistics process.

Key Drivers of United Kingdom E-commerce Logistics Market Growth

The UK e-commerce logistics market's growth is spurred by several factors. Technological advancements such as AI-powered route optimization and automated warehousing are boosting efficiency and lowering costs. The expansion of e-commerce, driven by rising internet penetration and consumer preference for online shopping, is creating substantial demand. Favorable economic conditions and supportive government policies also contribute to market expansion. Finally, the increasing demand for faster, more reliable delivery options pushes innovation and efficiency within the sector.

Challenges in the United Kingdom E-commerce Logistics Market Market

The UK e-commerce logistics market faces several challenges. Brexit-related complexities, including new customs procedures and increased border checks, have increased costs and delivery times for cross-border shipments. Fluctuations in fuel prices and driver shortages impact transportation costs. Intense competition among logistics providers creates pricing pressures. Lastly, meeting stringent environmental regulations and consumer expectations for sustainable logistics presents ongoing operational challenges.

Emerging Opportunities in United Kingdom E-commerce Logistics Market

The UK e-commerce logistics market presents numerous opportunities for growth. The increasing adoption of automation and AI-powered solutions offers potential for significant efficiency gains and cost reductions. Strategic partnerships between logistics providers and e-commerce platforms enhance service offerings and create synergies. Market expansion into new segments, such as specialized logistics for bulky or fragile goods, can capture additional market share. The growth of omnichannel retail is also creating opportunities for integrated logistics solutions.

Leading Players in the United Kingdom E-commerce Logistics Market Sector

- DHL

- Hermes

- FedEx

- DPD

- GXO Logistics

- Amazon Logistics

- Agility Logistics

- TNT Express

- DTDC

- Royal Mail

- Zendbox

- 73 Other Companies

Key Milestones in United Kingdom E-commerce Logistics Market Industry

- May 2023: Flexport acquired Shopify Logistics assets, including Deliverr, Inc., strengthening its position in the e-commerce logistics market.

- January 2024: DHL Supply Chain announced a strategic alliance with Robust.ai to deploy a robotic warehouse fleet, signifying increased automation in the sector.

Strategic Outlook for United Kingdom E-commerce Logistics Market Market

The future of the UK e-commerce logistics market is bright, driven by continued e-commerce growth, technological innovation, and the increasing demand for efficient and sustainable logistics solutions. Strategic partnerships, investment in automation, and expansion into new service offerings will be crucial for success in this competitive market. The focus on sustainable practices and the adoption of advanced technologies will shape the competitive landscape in the years to come. Companies that can adapt quickly to changing consumer demands and regulatory environments will be best positioned to capture the significant growth opportunities in the UK e-commerce logistics market.

United Kingdom E-commerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-added services (labeling, packaging, etc.)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross Border

-

4. product

- 4.1. Fashion and pparel

- 4.2. Consumer electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal care

- 4.6. Other products (Toys, Food Products, etc.)

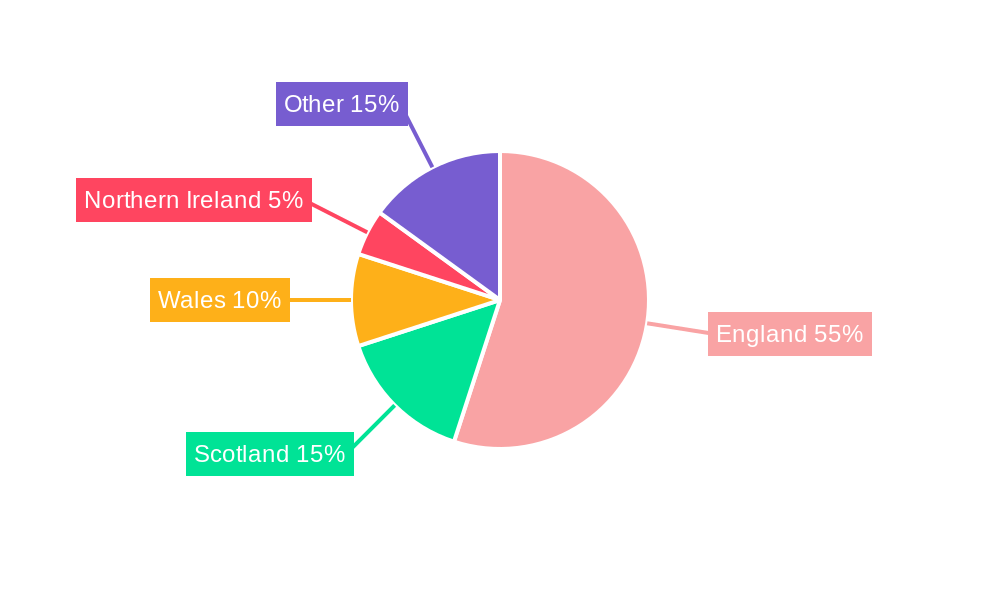

United Kingdom E-commerce Logistics Market Segmentation By Geography

- 1. United Kingdom

United Kingdom E-commerce Logistics Market Regional Market Share

Geographic Coverage of United Kingdom E-commerce Logistics Market

United Kingdom E-commerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing E-commerce Penetration; Surge in Cross-Border Trade Activities

- 3.3. Market Restrains

- 3.3.1. Infrastructure Challenges; Regulatory Complexities

- 3.4. Market Trends

- 3.4.1. Immense Growth Projection for the Domestic Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-added services (labeling, packaging, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross Border

- 5.4. Market Analysis, Insights and Forecast - by product

- 5.4.1. Fashion and pparel

- 5.4.2. Consumer electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal care

- 5.4.6. Other products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hermes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FedEx

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DPD

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GXO Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amazon Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Agility Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TNT Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DTDC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal Mail

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Zendbox**List Not Exhaustive 7 3 Other Companie

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: United Kingdom E-commerce Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom E-commerce Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by product 2020 & 2033

- Table 5: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by product 2020 & 2033

- Table 10: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom E-commerce Logistics Market?

The projected CAGR is approximately 6.94%.

2. Which companies are prominent players in the United Kingdom E-commerce Logistics Market?

Key companies in the market include DHL, Hermes, FedEx, DPD, GXO Logistics, Amazon Logistics, Agility Logistics, TNT Express, DTDC, Royal Mail, Zendbox**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the United Kingdom E-commerce Logistics Market?

The market segments include Service, Business, Destination, product.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing E-commerce Penetration; Surge in Cross-Border Trade Activities.

6. What are the notable trends driving market growth?

Immense Growth Projection for the Domestic Segment.

7. Are there any restraints impacting market growth?

Infrastructure Challenges; Regulatory Complexities.

8. Can you provide examples of recent developments in the market?

January 2024: DHL Supply chain announced a strategic alliance with robotics company Robust.ai to create and deploy a cutting-edge robotic warehouse fleet. This strategic alliance brought together the DHL Supply chain’s extensive knowledge of logistics issues, track record in implementing automated solutions, and Robust.ai’s experience in AI and advanced robotics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom E-commerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom E-commerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom E-commerce Logistics Market?

To stay informed about further developments, trends, and reports in the United Kingdom E-commerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence