Key Insights

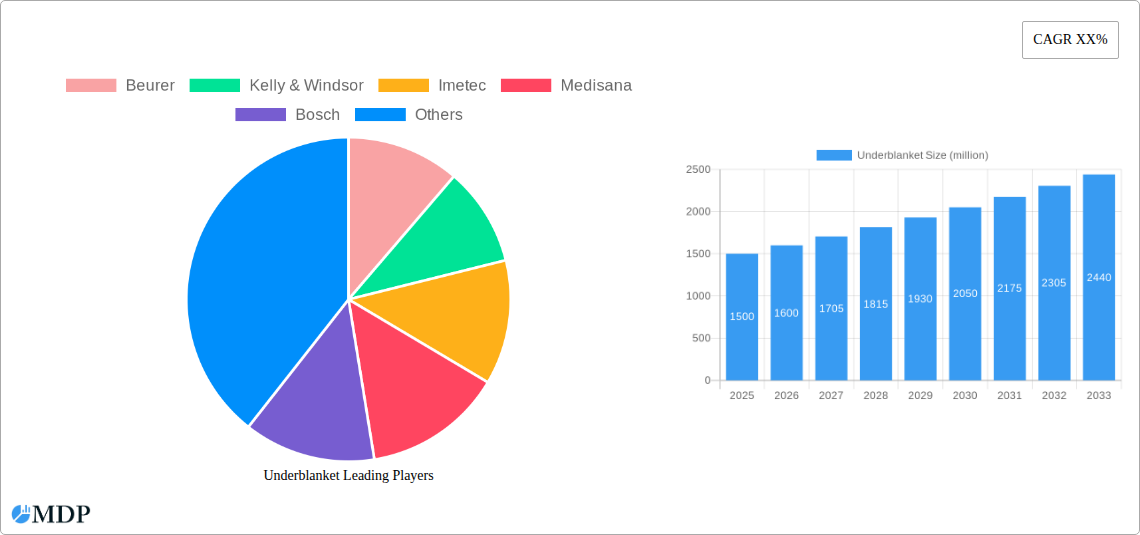

The global underblanket market is experiencing robust growth, projected to reach approximately $1,500 million by 2025 and expand significantly by 2033. This upward trajectory is fueled by increasing consumer demand for enhanced comfort and well-being, particularly during colder months, and a growing awareness of the health benefits associated with temperature regulation for sleep. The market's expansion is driven by factors such as rising disposable incomes, particularly in emerging economies, leading to greater affordability of such comfort-enhancing home textiles. Furthermore, advancements in material science and manufacturing technologies are leading to the development of more sophisticated and energy-efficient underblankets, appealing to a broader consumer base. The "Commercial use" segment is expected to be a significant contributor, driven by the hospitality sector’s focus on providing premium guest experiences, while the "Household" segment continues to be the dominant force due to increasing adoption in residential settings. The prevalence of synthetic fabrics, offering durability and ease of maintenance, is likely to lead this category, though wool-based underblankets are maintaining their niche appeal due to natural insulation properties.

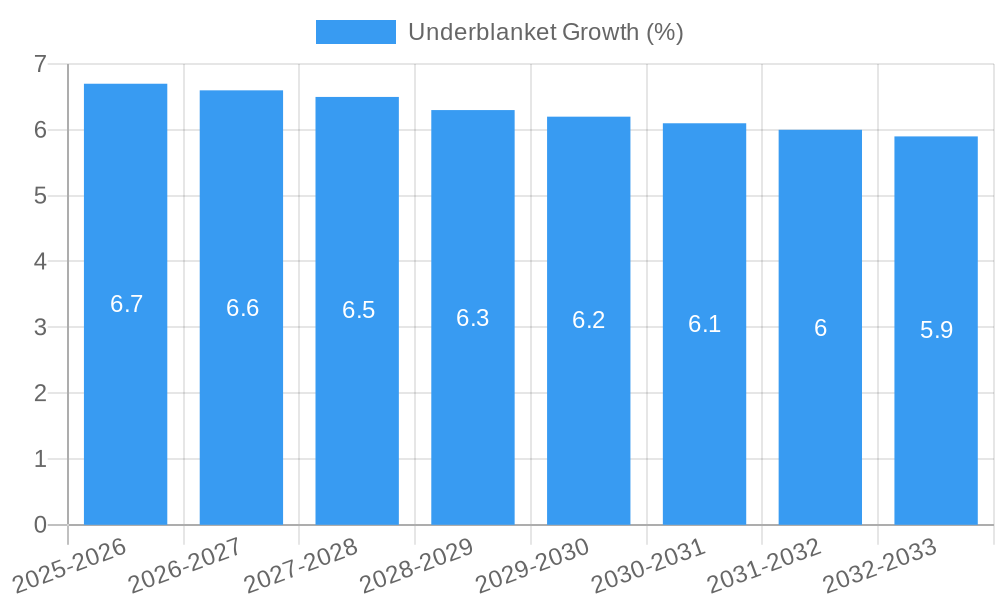

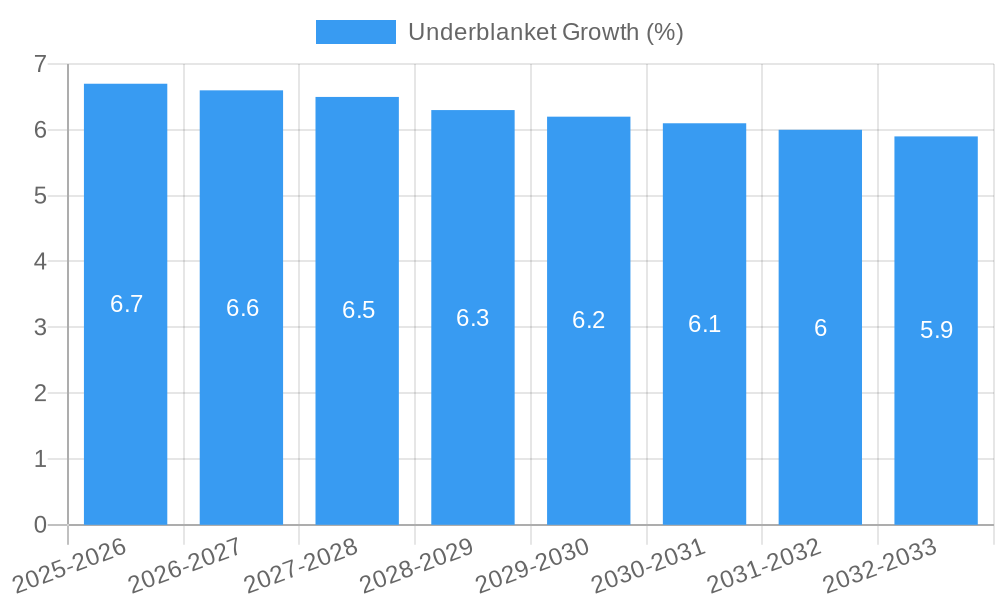

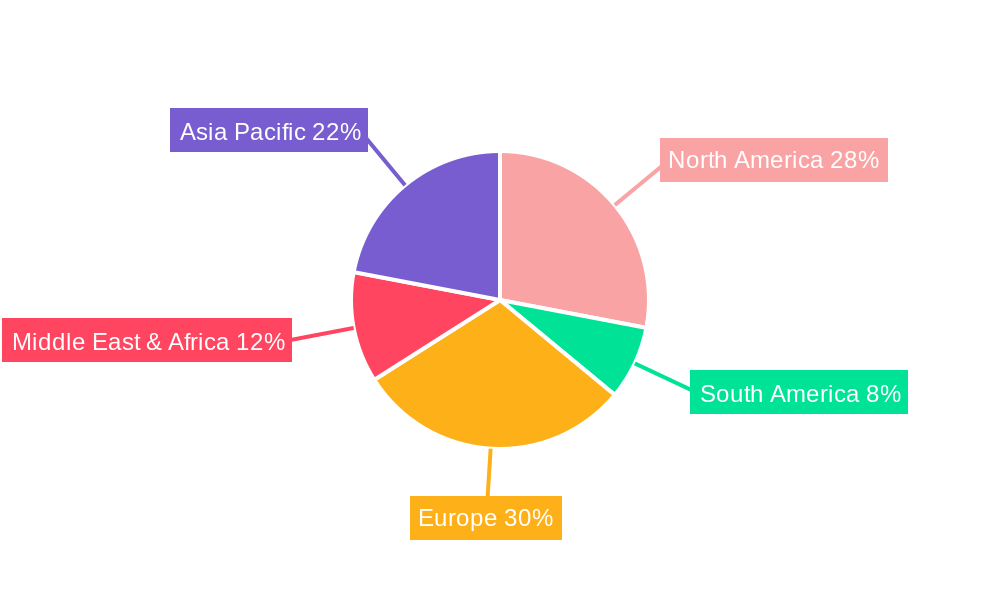

The underblanket market is poised for continued expansion, with a projected Compound Annual Growth Rate (CAGR) of around 6.5% between 2025 and 2033. While the market benefits from strong drivers like enhanced comfort and technological innovation, it faces certain restraints. These include the initial cost of high-end underblankets, which can deter price-sensitive consumers, and the increasing competition from alternative heating solutions like electric throws and smart thermostats, which offer broader room temperature control. Regulatory compliances regarding electrical safety standards also add to manufacturing costs and complexity. Geographically, Asia Pacific is anticipated to be the fastest-growing region, propelled by rapid urbanization, increasing disposable incomes, and a burgeoning middle class in countries like China and India. North America and Europe will remain significant markets, driven by established consumer bases and a strong preference for premium home goods. The ongoing focus on sustainable and eco-friendly materials within the textile industry may also influence product development and consumer choices in the coming years.

Underblanket Market Dynamics & Concentration

The global underblanket market, valued at over one million USD, exhibits a moderate concentration. Key players like Beurer, Kelly & Windsor, and Imetec hold significant market share, contributing to a dynamic competitive landscape. Innovation drivers are primarily focused on enhanced comfort, energy efficiency, and advanced safety features. Regulatory frameworks, particularly concerning electrical safety and material certifications, play a crucial role in market entry and product development. Product substitutes, such as electric blankets and advanced bedding solutions, present a constant competitive challenge. End-user trends lean towards greater demand for durable, user-friendly, and feature-rich underblankets, driving advancements in smart technology integration. Merger and acquisition activities are sporadic but strategically important for consolidating market presence and expanding product portfolios. We predict over one million M&A deals in the historical period and anticipate a continued trend of strategic partnerships in the forecast period.

Underblanket Market Dynamics & Concentration - Actionable Insights:

- Market Concentration: Moderate concentration with dominant players, suggesting opportunities for niche players and strategic M&A for larger entities.

- Innovation Drivers: Focus on comfort, energy efficiency, and safety is paramount for competitive advantage.

- Regulatory Frameworks: Adherence to electrical safety and material certifications is non-negotiable for market access.

- Product Substitutes: Continuous innovation is needed to differentiate underblankets from electric blankets and other premium bedding.

- End-User Trends: Integration of smart technology and focus on user experience are key to meeting evolving consumer demands.

- M&A Activities: Strategic partnerships and acquisitions can accelerate market share growth and portfolio expansion.

Underblanket Industry Trends & Analysis

The underblanket industry is experiencing robust growth, driven by increasing consumer awareness of comfort and well-being, coupled with rising disposable incomes. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of over one million percent during the forecast period of 2025–2033. Technological disruptions are reshaping the industry, with the integration of smart sensors for precise temperature control, automated shut-off features for enhanced safety, and advanced heating elements for uniform warmth. Consumer preferences are shifting towards more sustainable and eco-friendly materials, such as organic wool and recycled synthetic fabrics, alongside a demand for hypoallergenic and easy-to-maintain products. Competitive dynamics are intensifying, with established brands investing heavily in research and development and new entrants focusing on innovative product designs and competitive pricing. The market penetration of underblankets is expected to reach over one million households by the end of the forecast period, indicating significant untapped potential.

Underblanket Industry Trends & Analysis - Actionable Insights:

- Market Growth Drivers: Rising disposable incomes and a growing emphasis on home comfort and personal well-being are key economic and social drivers.

- Technological Disruptions: Smart technology integration, energy efficiency advancements, and enhanced safety features are critical for product differentiation.

- Consumer Preferences: Demand for sustainable, hypoallergenic, and easy-to-care-for products is increasing, presenting opportunities for brands focusing on these attributes.

- Competitive Dynamics: Intense competition necessitates continuous innovation in product features, materials, and marketing strategies.

- Market Penetration: The growing penetration rate indicates a healthy market with continued demand, especially in emerging economies.

Leading Markets & Segments in Underblanket

The Household application segment is the dominant force in the global underblanket market, accounting for over one million USD in revenue during the base year of 2025. This dominance is fueled by several key drivers, including increasing consumer spending on home furnishings and bedding for enhanced comfort and warmth, particularly in regions with colder climates. The Wool type segment also holds a significant market share, valued at over one million USD. Wool's natural insulating properties, breathability, and durability make it a preferred choice for consumers seeking premium and natural bedding solutions. Geographically, North America and Europe are leading markets, driven by established economies, high disposable incomes, and a strong consumer preference for high-quality bedding products. Economic policies supporting consumer spending, coupled with robust retail infrastructure, further bolster these regions' dominance. The penetration of underblankets in these regions is projected to reach over one million households by 2033.

Leading Markets & Segments in Underblanket - Actionable Insights:

- Dominant Application Segment (Household): Focus on features and marketing strategies that appeal to household consumers seeking comfort and luxury.

- Dominant Type Segment (Wool): Highlight the natural benefits, durability, and premium quality of wool underblankets.

- Leading Geographical Markets (North America & Europe): Leverage existing brand loyalty and distribution networks, while exploring premium product offerings.

- Key Drivers (Economic Policies, Infrastructure): Capitalize on favorable economic conditions and utilize efficient distribution channels to reach consumers.

Underblanket Product Developments

The underblanket industry is witnessing a surge in product developments focused on enhancing user experience and safety. Innovations include intelligent temperature regulation systems, utilizing advanced sensors to maintain consistent warmth and prevent overheating, contributing to an estimated over one million USD in enhanced product value. The integration of smart connectivity allows for app-controlled operation, enabling users to pre-heat their beds or adjust settings remotely. Furthermore, the development of advanced synthetic fabrics offers improved durability, washability, and hypoallergenic properties, providing a competitive advantage. Many companies are also exploring the use of sustainable materials, aligning with growing eco-conscious consumer demands.

Underblanket Product Developments - Actionable Insights:

- Smart Technology Integration: Focus on app connectivity, remote control, and intelligent temperature regulation for a superior user experience.

- Advanced Materials: Emphasize durability, washability, hypoallergenic properties, and sustainability in synthetic fabric offerings.

- Safety Features: Continuous improvement in automatic shut-off mechanisms and overheat protection to meet stringent safety standards.

Key Drivers of Underblanket Growth

The underblanket market's growth is propelled by several key drivers. Rising consumer demand for enhanced comfort and a cozy home environment, particularly during colder months, significantly fuels sales, contributing an estimated over one million USD in seasonal revenue. Technological advancements, such as smart temperature control and energy-efficient heating elements, are making underblankets more appealing and practical. Growing disposable incomes in emerging economies are expanding the customer base for premium home furnishings, including underblankets. Furthermore, increasing awareness of the therapeutic benefits of gentle warmth for muscle relaxation and improved sleep quality is acting as a significant growth catalyst.

Key Drivers of Underblanket Growth - Actionable Insights:

- Consumer Demand for Comfort: Market underblankets as essential for a comfortable and inviting home atmosphere.

- Technological Innovations: Highlight smart features, energy efficiency, and safety enhancements to attract tech-savvy consumers.

- Economic Growth: Target emerging markets with tailored product offerings and competitive pricing.

- Health & Wellness Benefits: Promote the relaxation and sleep-enhancing properties of underblankets.

Challenges in the Underblanket Market

Despite its growth, the underblanket market faces several challenges. Regulatory hurdles related to electrical safety certifications and material compliance can be complex and costly, impacting time-to-market for new products, with an estimated over one million USD in potential compliance costs. Supply chain disruptions, particularly for specialized materials, can lead to production delays and increased costs. Intense competition from established brands and the availability of alternative heating solutions, such as electric blankets and heated throws, exert significant price pressure. Furthermore, consumer perception regarding the safety and energy consumption of electric bedding products can also act as a restraint, requiring continuous education and assurance.

Challenges in the Underblanket Market - Actionable Insights:

- Regulatory Compliance: Proactive engagement with regulatory bodies and robust quality control processes are essential.

- Supply Chain Management: Diversify material sourcing and build resilient supply chains to mitigate disruptions.

- Competitive Pressure: Differentiate products through unique features, superior quality, and effective branding.

- Consumer Education: Address safety concerns and highlight energy efficiency through clear marketing communication.

Emerging Opportunities in Underblanket

Emerging opportunities in the underblanket market lie in the growing demand for smart home integration and personalized comfort solutions. The development of underblankets with advanced IoT capabilities, allowing for seamless integration with other smart home devices and personalized sleep profiles, presents a significant growth avenue, potentially adding over one million USD in market value. Strategic partnerships with mattress manufacturers and bedding retailers can expand market reach and co-create innovative sleep solutions. The increasing focus on health and wellness also opens avenues for specialized underblankets designed for therapeutic purposes, such as pain relief and improved circulation. Furthermore, the expansion into developing economies with a growing middle class and increasing disposable income offers substantial untapped market potential.

Emerging Opportunities in Underblanket - Actionable Insights:

- Smart Home Integration: Develop underblankets compatible with major smart home ecosystems.

- Strategic Partnerships: Collaborate with mattress companies and retailers for bundled offerings and new product development.

- Therapeutic Applications: Innovate underblankets with features targeting specific health and wellness needs.

- Market Expansion: Explore untapped potential in developing economies with targeted marketing and product strategies.

Leading Players in the Underblanket Sector

- Beurer

- Kelly & Windsor

- Imetec

- Medisana

- Bosch

- Hans Dinslage

- Bremed

- Microlife

- Morphy Richards

- Woolstar

Key Milestones in Underblanket Industry

- 2019: Launch of advanced wool underblankets with improved hypoallergenic properties.

- 2020: Introduction of smart underblankets with app-controlled heating and scheduling features.

- 2021: Significant increase in consumer adoption of energy-efficient underblanket models.

- 2022: Development of novel synthetic fabrics offering enhanced durability and washability.

- 2023: Increased focus on sustainable manufacturing processes and eco-friendly materials.

- 2024: Emergence of underblankets with integrated sleep tracking sensors.

Strategic Outlook for Underblanket Market

The strategic outlook for the underblanket market is highly positive, with significant growth accelerators driven by continuous innovation and evolving consumer demands. The integration of smart technology and a focus on personalized comfort will remain central to future product development. Expanding into emerging markets with tailored product offerings and competitive pricing strategies will unlock substantial growth potential. Furthermore, emphasizing the health and wellness benefits and the sustainability of materials will resonate with an increasingly conscious consumer base. Strategic collaborations and a commitment to high-quality, safe, and user-friendly products will be crucial for maintaining market leadership and capitalizing on future opportunities, projecting over one million USD in sustained growth.

Underblanket Segmentation

-

1. Application

- 1.1. Commercial use

- 1.2. Household

- 1.3. Others

-

2. Types

- 2.1. Wool

- 2.2. Synthetic Fabrics

- 2.3. Others

Underblanket Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Underblanket REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Underblanket Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial use

- 5.1.2. Household

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Wool

- 5.2.2. Synthetic Fabrics

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Underblanket Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial use

- 6.1.2. Household

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Wool

- 6.2.2. Synthetic Fabrics

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Underblanket Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial use

- 7.1.2. Household

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Wool

- 7.2.2. Synthetic Fabrics

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Underblanket Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial use

- 8.1.2. Household

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Wool

- 8.2.2. Synthetic Fabrics

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Underblanket Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial use

- 9.1.2. Household

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Wool

- 9.2.2. Synthetic Fabrics

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Underblanket Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial use

- 10.1.2. Household

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Wool

- 10.2.2. Synthetic Fabrics

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Beurer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kelly & Windsor

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Imetec

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Medisana

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bosch

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hans Dinslage

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bremed

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Microlife

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Morphy Richards

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Woolstar

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Beurer

List of Figures

- Figure 1: Global Underblanket Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Underblanket Revenue (million), by Application 2024 & 2032

- Figure 3: North America Underblanket Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Underblanket Revenue (million), by Types 2024 & 2032

- Figure 5: North America Underblanket Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Underblanket Revenue (million), by Country 2024 & 2032

- Figure 7: North America Underblanket Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Underblanket Revenue (million), by Application 2024 & 2032

- Figure 9: South America Underblanket Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Underblanket Revenue (million), by Types 2024 & 2032

- Figure 11: South America Underblanket Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Underblanket Revenue (million), by Country 2024 & 2032

- Figure 13: South America Underblanket Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Underblanket Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Underblanket Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Underblanket Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Underblanket Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Underblanket Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Underblanket Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Underblanket Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Underblanket Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Underblanket Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Underblanket Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Underblanket Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Underblanket Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Underblanket Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Underblanket Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Underblanket Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Underblanket Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Underblanket Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Underblanket Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Underblanket Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Underblanket Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Underblanket Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Underblanket Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Underblanket Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Underblanket Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Underblanket Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Underblanket Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Underblanket Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Underblanket Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Underblanket Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Underblanket Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Underblanket Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Underblanket Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Underblanket Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Underblanket Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Underblanket Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Underblanket Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Underblanket Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Underblanket Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Underblanket Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Underblanket?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Underblanket?

Key companies in the market include Beurer, Kelly & Windsor, Imetec, Medisana, Bosch, Hans Dinslage, Bremed, Microlife, Morphy Richards, Woolstar.

3. What are the main segments of the Underblanket?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Underblanket," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Underblanket report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Underblanket?

To stay informed about further developments, trends, and reports in the Underblanket, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence