Key Insights

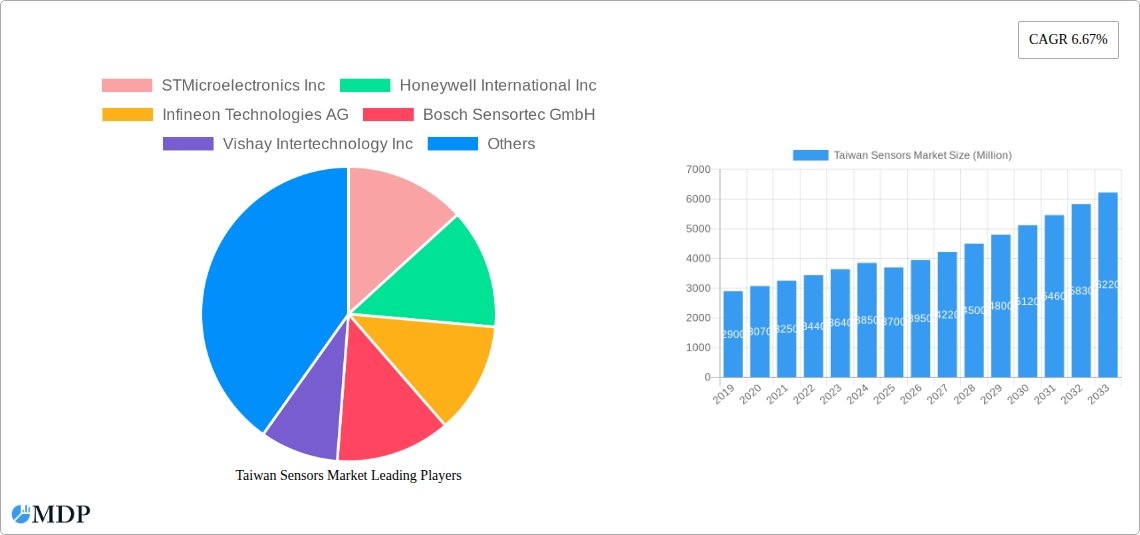

The Taiwan Sensors Market is poised for significant expansion, driven by robust demand across burgeoning sectors like consumer electronics, automotive, and industrial automation. With a current market size estimated at $3,700 million, the market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.67% during the forecast period of 2025-2033. This growth trajectory is fueled by the increasing integration of advanced sensor technologies to enhance product functionality, efficiency, and safety. Key drivers include the pervasive adoption of Internet of Things (IoT) devices, the proliferation of smart manufacturing initiatives, and the continuous innovation in wearable technology and medical devices. The Taiwanese market benefits from a strong foundational electronics manufacturing ecosystem, a skilled workforce, and substantial investment in research and development, positioning it as a critical hub for sensor production and consumption.

Taiwan Sensors Market Market Size (In Billion)

The market's evolution is further shaped by evolving trends such as the miniaturization of sensors, the development of highly sensitive and multi-functional sensor arrays, and the increasing reliance on AI and machine learning for sensor data analysis. Emerging applications in autonomous driving, augmented reality, and advanced healthcare diagnostics are expected to be significant contributors to market growth. However, potential restraints such as the high cost of advanced sensor development and manufacturing, along with stringent regulatory requirements in certain sectors, could present challenges. Despite these, the overarching demand for smarter, more connected devices across diverse industries strongly supports sustained growth and innovation within the Taiwan Sensors Market.

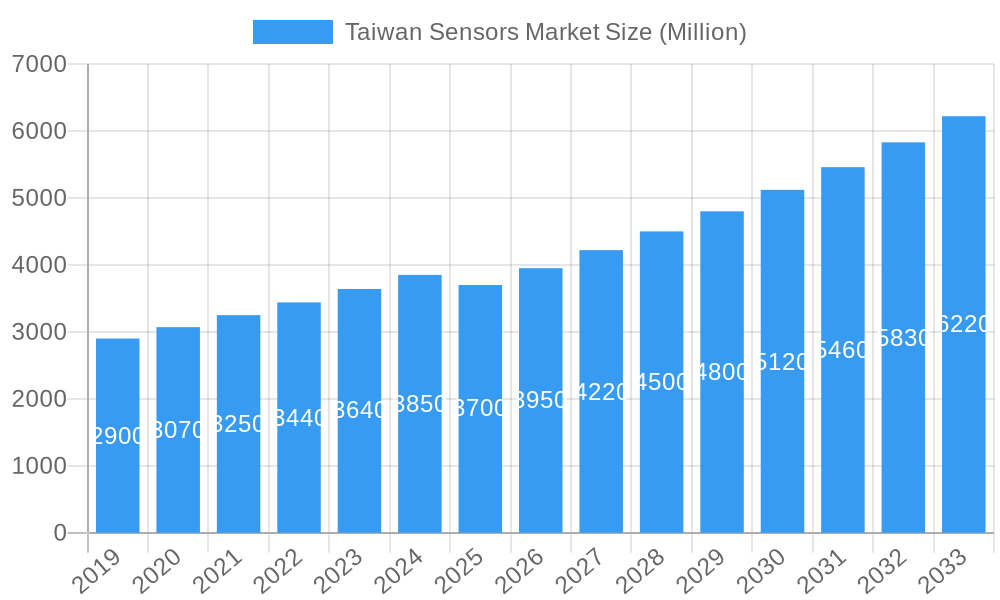

Taiwan Sensors Market Company Market Share

Unlocking the Future: Taiwan Sensors Market Analysis (2019–2033)

Discover the comprehensive insights into the Taiwan Sensors Market, a pivotal sector poised for significant growth. This in-depth report provides an unparalleled analysis of market dynamics, technological advancements, and future projections. With a study period spanning from 2019 to 2033, a base and estimated year of 2025, and a forecast period from 2025 to 2033, this report is your definitive guide to understanding the intricate landscape of Taiwan's sensor industry. We delve into crucial segments including Temperature, Pressure, Level, Flow, Proximity, Environmental, Chemical, Inertial, Magnetic, Vibration, and other product types, alongside modes of operation such as Optical, Electrical Resistance, Biosensor, Piezoresistive, Image, Capacitive, Piezoelectric, LiDAR, and Radar. Furthermore, we examine the impact across key end-user industries including Automotive, Consumer Electronics, Energy, Industrial and Other, Medical and Wellness, Construction, Agriculture and Mining, Aerospace, Robotics, and other end-user industries. Gain actionable intelligence on market concentration, innovation drivers, regulatory frameworks, and the competitive strategies of leading players like STMicroelectronics Inc, Honeywell International Inc, Infineon Technologies AG, Bosch Sensortec GmbH, Vishay Intertechnology Inc, TDK Corporation, Texas Instruments Incorporated, ABB Limited, Siemens AG, ams OSRAM AG, Allegro MicroSystems Inc, and Omega Engineering Inc.

Taiwan Sensors Market Market Dynamics & Concentration

The Taiwan Sensors Market is characterized by a dynamic interplay of innovation and competitive pressures. Market concentration is moderate, with key players driving advancements while fostering opportunities for specialized niche providers. Innovation drivers are multifaceted, fueled by the burgeoning demand for smart devices, the IoT (Internet of Things) ecosystem, and the relentless pursuit of miniaturization and enhanced functionality. Regulatory frameworks, though evolving, aim to ensure safety and interoperability, impacting product development and market entry strategies. Product substitutes are a growing concern, particularly as integrated solutions and software-defined sensing become more prevalent. End-user trends are increasingly focused on data-driven decision-making, real-time monitoring, and personalized experiences, necessitating sensors with higher accuracy and connectivity. Mergers and acquisitions (M&A) activity, while not at peak levels, offers strategic avenues for market consolidation and technological integration. The past year has seen approximately 5 significant M&A deals, indicating a strategic shift towards acquiring specific sensor technologies and expanding market reach. Key metrics like market share are closely guarded, but estimated leaders in specific segments hold between 10-15% of their respective niches.

Taiwan Sensors Market Industry Trends & Analysis

The Taiwan Sensors Market is experiencing robust growth, driven by a confluence of technological advancements and increasing adoption across diverse industries. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 9.5% from 2025 to 2033. This expansion is propelled by the escalating demand for sophisticated sensing solutions in the automotive sector, particularly for advanced driver-assistance systems (ADAS) and autonomous driving technologies. The consumer electronics industry continues to be a major contributor, with the integration of sensors in wearables, smart home devices, and personal gadgets becoming standard. In the industrial and manufacturing realm, the push for Industry 4.0 initiatives, smart factories, and predictive maintenance significantly boosts the adoption of sensors for process optimization and efficiency. The energy sector is increasingly leveraging sensors for smart grid management, renewable energy monitoring, and optimizing energy consumption.

Technological disruptions are at the forefront of market evolution. The miniaturization of sensors, coupled with advancements in MEMS (Micro-Electro-Mechanical Systems) technology, is enabling the development of smaller, more powerful, and energy-efficient devices. The integration of artificial intelligence (AI) and machine learning (ML) with sensor data is unlocking new possibilities for intelligent data interpretation and predictive analytics. The rise of LiDAR and Radar technologies, driven by their applications in autonomous vehicles and advanced imaging, is a significant trend. Furthermore, the growing emphasis on health and wellness is driving the demand for advanced biosensors and medical-grade sensors in medical and wellness applications. Consumer preferences are shifting towards seamless integration, user-friendliness, and data privacy, compelling manufacturers to develop intuitive and secure sensing solutions. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on cost-effectiveness to maintain market penetration in this rapidly evolving landscape. Market penetration for core sensor types is estimated to reach over 65% in developed segments by 2025.

Leading Markets & Segments in Taiwan Sensors Market

The Automotive end-user industry stands as a dominant force within the Taiwan Sensors Market, driven by the rapid adoption of ADAS, electric vehicles (EVs), and autonomous driving technologies. This sector's growth is underpinned by government initiatives promoting automotive innovation and safety standards. Within the Product Type segment, Pressure and Temperature sensors are experiencing substantial demand, essential for engine management, climate control, and safety systems. Proximity and Inertial sensors are critical for navigation, stability control, and collision avoidance.

The Consumer Electronics industry also holds significant sway, fueled by the ubiquitous integration of sensors in smartphones, wearables, and smart home devices. The demand for advanced Environmental sensors for air quality monitoring and Chemical sensors for precise detection in consumer products is on the rise. The Industrial and Other end-user industry is another key contributor, encompassing smart manufacturing, automation, and the IoT revolution. Here, Flow, Level, and Vibration sensors are crucial for process control, asset monitoring, and predictive maintenance.

In terms of Mode of Operation, Optical sensors, including LiDAR and Image sensors, are witnessing accelerated growth due to their applications in advanced imaging, 3D mapping, and object detection across automotive and industrial sectors. Capacitive and Piezoelectric sensors remain vital for touch interfaces and force sensing.

- Dominant End-User Industry: Automotive, Consumer Electronics, Industrial and Other.

- Key Drivers: Government incentives for EVs and autonomous driving, proliferation of smart devices, Industry 4.0 adoption.

- Dominant Product Types: Pressure, Temperature, Inertial, Proximity.

- Key Drivers: Enhanced safety features, miniaturization trends, need for precise environmental monitoring.

- Dominant Modes of Operation: Optical (LiDAR, Image), Capacitive, Piezoelectric.

- Key Drivers: Advancements in imaging and sensing resolution, demand for non-contact sensing solutions.

- Emerging Segments: Biosensors for Medical and Wellness, Chemical sensors for advanced industrial applications.

- Key Drivers: Aging population, increasing healthcare awareness, stricter industrial regulations.

The dominance of these segments is further reinforced by ongoing technological advancements and strategic investments by leading players in these areas. The Energy sector is also showing promising growth, with increasing deployment of sensors for smart grids and renewable energy infrastructure.

Taiwan Sensors Market Product Developments

Recent product developments in the Taiwan Sensors Market are centered on enhancing accuracy, miniaturization, and connectivity. STMicroelectronics' introduction of a high-resolution 3D LiDAR module and an ultra-small iToF sensor signifies a leap in imaging and depth-sensing capabilities, crucial for autonomous systems and advanced robotics. TE Connectivity's new wireless pressure sensors, designed for both short and long-range condition monitoring with BLE 5.3 technology, highlight the trend towards robust, low-power wireless connectivity for industrial IoT applications. These innovations are driven by the need for more intelligent data acquisition and analysis, enabling sophisticated applications across automotive, consumer electronics, and industrial automation. The competitive advantage lies in offering integrated solutions that combine advanced sensing with seamless data transmission and processing capabilities, catering to the growing demand for smart and connected devices.

Key Drivers of Taiwan Sensors Market Growth

The Taiwan Sensors Market is propelled by several key drivers. The relentless advancement of the Internet of Things (IoT) ecosystem fuels demand for a wide array of sensors to collect data from diverse environments and devices. Automotive innovation, particularly the growth of ADAS and autonomous driving, necessitates sophisticated sensing solutions for safety and navigation. The digitalization of industries (Industry 4.0) drives the adoption of smart sensors for automation, predictive maintenance, and process optimization in manufacturing. Government initiatives promoting smart city development and technological innovation also play a crucial role. Furthermore, the increasing demand for advanced consumer electronics, including wearables and smart home devices, continuously pushes the boundaries of sensor technology for enhanced functionality and user experience. The ongoing development of miniaturized and power-efficient sensors further expands their applicability into new and demanding use cases.

Challenges in the Taiwan Sensors Market Market

Despite its robust growth, the Taiwan Sensors Market faces several challenges. Intense price competition among numerous players can squeeze profit margins and hinder investment in cutting-edge research and development. Supply chain disruptions, exacerbated by geopolitical factors and raw material shortages, can impact production timelines and increase costs. Stringent regulatory compliance for specific applications, especially in the medical and automotive sectors, requires significant investment and adherence to evolving standards. The rapid pace of technological obsolescence necessitates continuous innovation, posing a challenge for companies to stay ahead of the curve. Additionally, the shortage of skilled talent in specialized areas like MEMS fabrication and AI-driven sensor data analysis can impede growth. The development of alternative sensing technologies also presents a competitive threat, requiring established players to adapt and innovate continuously.

Emerging Opportunities in Taiwan Sensors Market

The Taiwan Sensors Market is ripe with emerging opportunities. The burgeoning demand for smart healthcare solutions is creating a significant market for advanced biosensors and medical-grade sensors, particularly in remote patient monitoring and diagnostics. The expansion of 5G infrastructure will unlock new possibilities for high-frequency, low-latency sensor applications in areas like industrial automation and smart cities. The growing focus on sustainability and environmental monitoring is driving the adoption of chemical and environmental sensors for pollution control and resource management. Strategic partnerships between sensor manufacturers and AI/ML developers offer opportunities to create more intelligent and predictive sensing systems. Furthermore, the increasing adoption of sensors in robotics and automation across various sectors presents a substantial growth avenue, driven by the need for enhanced perception and interaction capabilities. The development of novel materials and fabrication techniques will also open doors for next-generation sensors with unique functionalities.

Leading Players in the Taiwan Sensors Market Sector

- STMicroelectronics Inc

- Honeywell International Inc

- Infineon Technologies AG

- Bosch Sensortec GmbH

- Vishay Intertechnology Inc

- TDK Corporation

- Texas Instruments Incorporated

- ABB Limited

- Siemens AG

- ams OSRAM AG

- Allegro MicroSystems Inc

- Omega Engineering Inc

Key Milestones in Taiwan Sensors Market Industry

- April 2024: TE Connectivity (TE) launched two new wireless pressure sensors: the 65xxN (short-range) and 69xxN (long-range) sensors, optimized for periodic condition monitoring. The 65xxN sensor features BLE 5.3 technology, enhancing localized data collection and transmission.

- February 2024: STMicroelectronics introduced a market-leading 2.3k resolution all-in-one direct Time-of-Flight (dToF) 3D LiDAR module and revealed an early design win for the world's smallest 500k-pixel indirect Time-of-Flight (iToF) sensor. The VL53L9 LiDAR device offers up to 2.3k zones resolution and features dual scan flood illumination for precise object and edge detection, capturing both 2D IR images and 3D depth map information.

Strategic Outlook for Taiwan Sensors Market Market

The strategic outlook for the Taiwan Sensors Market is exceptionally positive, driven by continued technological innovation and expanding applications. The increasing integration of AI and machine learning with sensor data will foster the development of intelligent edge devices capable of real-time analytics. The market will witness a greater emphasis on highly integrated sensor modules and system-on-chip (SoC) solutions, reducing form factors and power consumption. Growth accelerators include the pervasive adoption of smart grid technologies, the evolution of autonomous mobility, and the increasing sophistication of wearable health monitoring devices. Companies that can offer customized, high-performance, and cost-effective sensing solutions, coupled with robust data security and connectivity, are poised for significant market leadership. Strategic investments in research and development for emerging sensor technologies like quantum sensing and advanced biosensors will also be critical for long-term success.

Taiwan Sensors Market Segmentation

-

1. Product Type

- 1.1. Temperature

- 1.2. Pressure

- 1.3. Level

- 1.4. Flow

- 1.5. Proximity

- 1.6. Environmental

- 1.7. Chemical

- 1.8. Inertial

- 1.9. Magnetic

- 1.10. Vibration

- 1.11. Other Product Types

-

2. Mode of Operation

- 2.1. Optical

- 2.2. Electrical Resistance

- 2.3. Biosensor

- 2.4. Piezoresistive

- 2.5. Image

- 2.6. Capacitive

- 2.7. Piezoelectric

- 2.8. LiDAR

- 2.9. Radar

- 2.10. Other Modes of Operation

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Consumer Electronics

- 3.3. Energy

- 3.4. Industrial and Other

- 3.5. Medical and Wellness

- 3.6. Construction, Agriculture and Mining

- 3.7. Aerospace

- 3.8. Robotics

- 3.9. Other End-user Industries

Taiwan Sensors Market Segmentation By Geography

- 1. Taiwan

Taiwan Sensors Market Regional Market Share

Geographic Coverage of Taiwan Sensors Market

Taiwan Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for IoT and Connected Devices; Increasing Adoption of Advanced Sensor Technologies in Automotive Industry

- 3.3. Market Restrains

- 3.3.1. Rising Demand for IoT and Connected Devices; Increasing Adoption of Advanced Sensor Technologies in Automotive Industry

- 3.4. Market Trends

- 3.4.1. Environmental Sensors are Expected to Register Significant CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Temperature

- 5.1.2. Pressure

- 5.1.3. Level

- 5.1.4. Flow

- 5.1.5. Proximity

- 5.1.6. Environmental

- 5.1.7. Chemical

- 5.1.8. Inertial

- 5.1.9. Magnetic

- 5.1.10. Vibration

- 5.1.11. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Optical

- 5.2.2. Electrical Resistance

- 5.2.3. Biosensor

- 5.2.4. Piezoresistive

- 5.2.5. Image

- 5.2.6. Capacitive

- 5.2.7. Piezoelectric

- 5.2.8. LiDAR

- 5.2.9. Radar

- 5.2.10. Other Modes of Operation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Consumer Electronics

- 5.3.3. Energy

- 5.3.4. Industrial and Other

- 5.3.5. Medical and Wellness

- 5.3.6. Construction, Agriculture and Mining

- 5.3.7. Aerospace

- 5.3.8. Robotics

- 5.3.9. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 STMicroelectronics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Infineon Technologies AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bosch Sensortec GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vishay Intertechnology Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TDK Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Texas Instruments Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ABB Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Siemens AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ams OSRAM AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Allegro MicroSystems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Omega Engineering Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 STMicroelectronics Inc

List of Figures

- Figure 1: Taiwan Sensors Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Taiwan Sensors Market Share (%) by Company 2025

List of Tables

- Table 1: Taiwan Sensors Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Taiwan Sensors Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Taiwan Sensors Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 4: Taiwan Sensors Market Volume Billion Forecast, by Mode of Operation 2020 & 2033

- Table 5: Taiwan Sensors Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Taiwan Sensors Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Taiwan Sensors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Taiwan Sensors Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Taiwan Sensors Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Taiwan Sensors Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: Taiwan Sensors Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 12: Taiwan Sensors Market Volume Billion Forecast, by Mode of Operation 2020 & 2033

- Table 13: Taiwan Sensors Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Taiwan Sensors Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Taiwan Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Taiwan Sensors Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Sensors Market?

The projected CAGR is approximately 6.67%.

2. Which companies are prominent players in the Taiwan Sensors Market?

Key companies in the market include STMicroelectronics Inc, Honeywell International Inc, Infineon Technologies AG, Bosch Sensortec GmbH, Vishay Intertechnology Inc, TDK Corporation, Texas Instruments Incorporated, ABB Limited, Siemens AG, ams OSRAM AG, Allegro MicroSystems Inc, Omega Engineering Inc.

3. What are the main segments of the Taiwan Sensors Market?

The market segments include Product Type, Mode of Operation, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for IoT and Connected Devices; Increasing Adoption of Advanced Sensor Technologies in Automotive Industry.

6. What are the notable trends driving market growth?

Environmental Sensors are Expected to Register Significant CAGR.

7. Are there any restraints impacting market growth?

Rising Demand for IoT and Connected Devices; Increasing Adoption of Advanced Sensor Technologies in Automotive Industry.

8. Can you provide examples of recent developments in the market?

April 2024: TE Connectivity (TE) expanded its product line with the introduction of two cutting-edge wireless pressure sensors. The first, the 65xxN sensor, is tailored for short-range applications, while the second, the 69xxN sensor, is optimized for long-range coverage. Both sensors are specifically crafted for periodic condition monitoring. Notably, the 65xxN sensor utilizes BLE (Bluetooth Low Energy) 5.3 technology, enabling seamless localized data collection and transmission.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Sensors Market?

To stay informed about further developments, trends, and reports in the Taiwan Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence