Key Insights

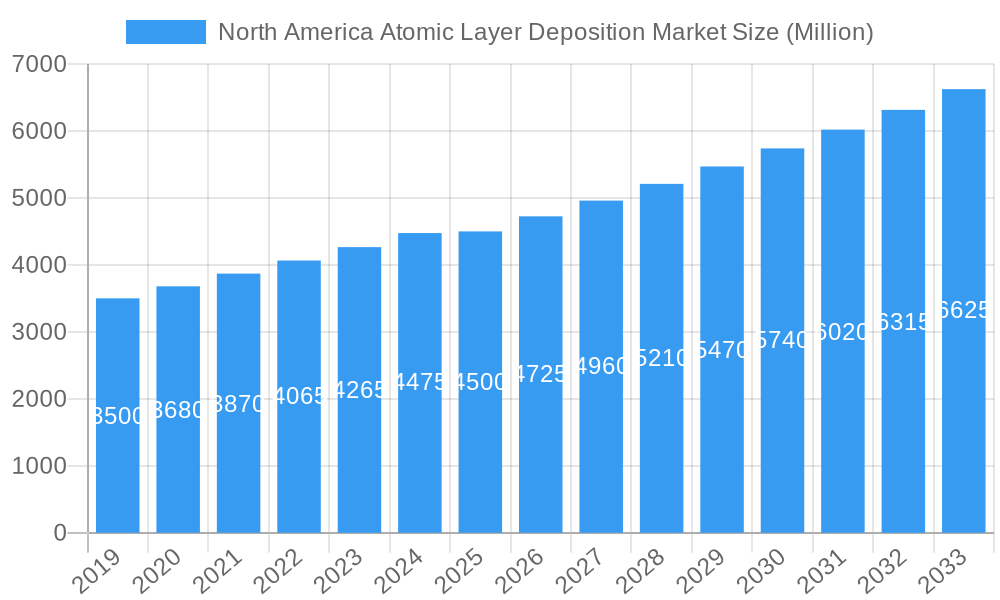

The North America Atomic Layer Deposition (ALD) market is poised for substantial growth, projected to reach a market size of approximately $4,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.00% expected to continue through 2033. This robust expansion is primarily driven by the increasing demand for advanced semiconductor manufacturing, where ALD is critical for creating ultra-thin, precise films essential for next-generation microelectronics. The healthcare and biomedical sectors are also significant contributors, leveraging ALD for applications such as drug delivery systems, medical implants, and advanced diagnostics that require biocompatible and highly controlled surface modifications. Furthermore, the automotive industry's push towards more sophisticated electronics, including advanced driver-assistance systems (ADAS) and electric vehicle (EV) components, is fueling the adoption of ALD for enhanced performance and reliability. Emerging trends like the miniaturization of electronic devices, the development of novel materials for specialized applications, and the growing focus on energy efficiency in manufacturing processes are further propelling market momentum.

North America Atomic Layer Deposition Market Market Size (In Billion)

Despite this positive outlook, certain restraints could temper the pace of growth. The high initial cost of ALD equipment and specialized precursor chemicals can be a barrier for smaller companies and research institutions. Additionally, the technical expertise required for operating and maintaining ALD systems, along with the complexity of developing new processes for emerging materials, presents a skilled labor challenge. Nevertheless, the inherent advantages of ALD – its atomic-level precision, excellent conformality, and high uniformity – continue to outweigh these limitations, particularly in high-value applications. Key players in the North American market, including Lam Research Corporation, Applied Materials Inc., and ASM International, are actively investing in research and development to overcome these challenges and expand their product portfolios, further solidifying the market's upward trajectory. North America, with the United States and Canada at its forefront, is a leading region due to its strong R&D ecosystem and significant presence of key end-use industries.

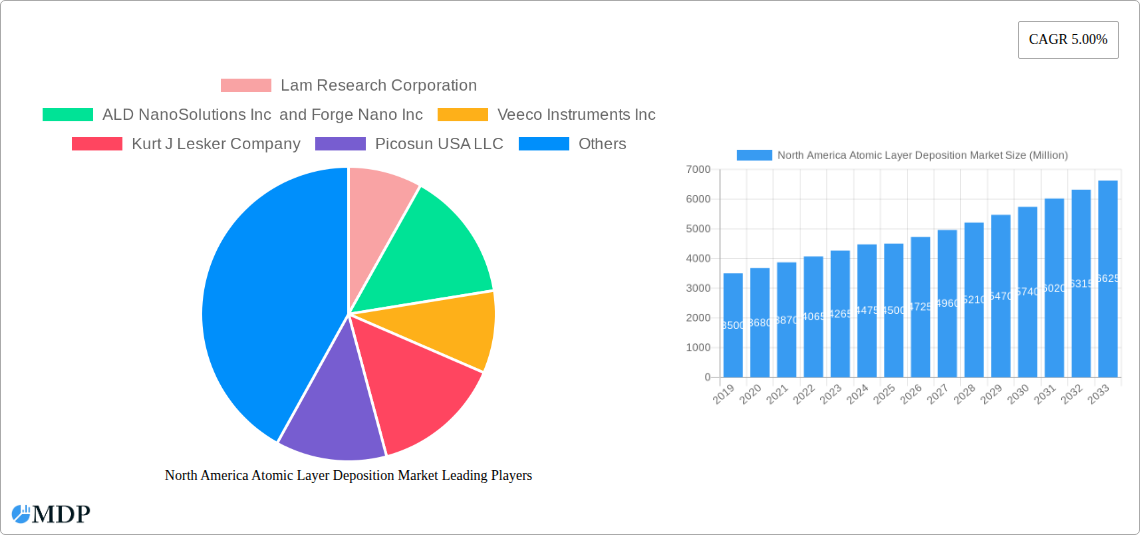

North America Atomic Layer Deposition Market Company Market Share

This in-depth report provides an unparalleled view into the North America Atomic Layer Deposition (ALD) Market, offering critical insights into its dynamics, trends, and future trajectory. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research is essential for stakeholders seeking to understand and capitalize on the burgeoning ALD sector. Discover the key drivers, challenges, and opportunities shaping this vital industry, with a particular focus on its applications in semiconductors, healthcare, automotive, and beyond. Our analysis includes granular data on market size, CAGR projections, leading players, and pivotal industry developments, ensuring you possess the actionable intelligence needed for strategic decision-making in the rapidly evolving North American ALD landscape.

North America Atomic Layer Deposition Market Market Dynamics & Concentration

The North America Atomic Layer Deposition market exhibits moderate to high concentration, driven by the significant capital investment and specialized expertise required for ALD equipment and process development. Key innovation drivers include the relentless demand for miniaturization and enhanced performance in semiconductors, the critical need for precise surface engineering in advanced healthcare applications, and the burgeoning use of ALD in protective and functional coatings for the automotive sector. Regulatory frameworks, particularly those related to environmental impact and safety in advanced manufacturing, play an increasingly influential role. Product substitutes, while present in niche applications, struggle to match the atomic-level precision and conformality offered by ALD. End-user trends are characterized by a strong push towards next-generation electronics, biocompatible medical devices, and lightweight, durable automotive components. Mergers and acquisition (M&A) activities are observed as larger players seek to consolidate market share, acquire innovative technologies, and expand their product portfolios. For instance, an estimated XX M&A deals were recorded between 2019 and 2024, with market leaders holding substantial market share estimated at XX%.

North America Atomic Layer Deposition Market Industry Trends & Analysis

The North America Atomic Layer Deposition market is poised for substantial growth, driven by an escalating demand for advanced materials and manufacturing processes. The market is projected to witness a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, reaching an estimated market size of $XX Billion by 2033. Technological disruptions are central to this expansion, with ongoing advancements in ALD precursors, reactor designs, and process control enabling wider adoption across diverse industries. The semiconductor industry remains a primary growth engine, fueled by the insatiable need for smaller, faster, and more power-efficient microchips for applications ranging from artificial intelligence to 5G infrastructure. Consumer preferences for higher-performance electronic devices and more sophisticated healthcare solutions are directly translating into increased demand for ALD-enabled components and materials. Furthermore, the automotive sector's focus on electric vehicles (EVs) and autonomous driving technologies is spurring interest in ALD for battery enhancement, sensor coatings, and lightweight structural components. Competitive dynamics are intensifying, with both established ALD equipment manufacturers and emerging material science companies vying for market dominance through continuous innovation and strategic partnerships. The market penetration of ALD is expected to deepen across new application areas as the cost-effectiveness and scalability of ALD processes continue to improve.

Leading Markets & Segments in North America Atomic Layer Deposition Market

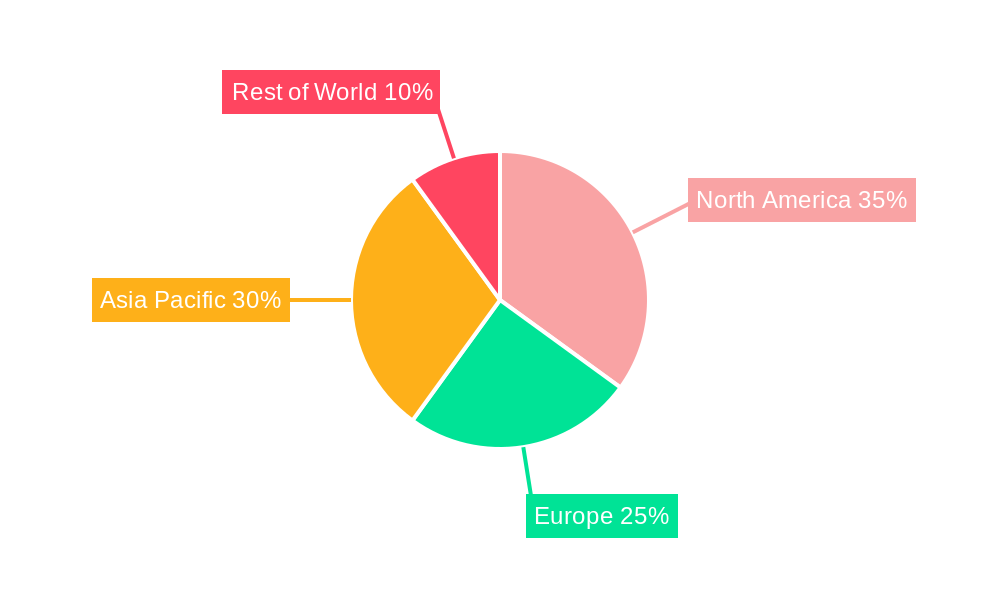

The North America Atomic Layer Deposition market is largely dominated by the United States, which commands a significant market share due to its robust semiconductor manufacturing base, advanced research and development infrastructure, and a thriving biotechnology sector. Canada also contributes to the regional market, albeit to a lesser extent, with growing applications in specialized manufacturing and materials science.

Dominant Segments:

Semiconductor Application: This segment is the undisputed leader, driven by the continuous innovation in semiconductor fabrication.

- Key Drivers:

- The exponential growth of data centers and cloud computing.

- The widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML) requiring sophisticated processors.

- The ongoing development of advanced packaging techniques for microchips.

- The demand for higher performance and energy efficiency in consumer electronics.

- Dominance Analysis: The stringent requirements for precise film deposition in advanced nodes, critical for transistors, memory devices, and interconnects, make ALD indispensable. The presence of major semiconductor manufacturing hubs and research institutions in the US underpins this segment's leading position.

- Key Drivers:

Healthcare and Biomedical Application: This segment is experiencing rapid growth, showcasing the transformative potential of ALD.

- Key Drivers:

- Development of biocompatible coatings for medical implants and devices.

- Creation of advanced drug delivery systems and biosensors.

- Enhanced functionality and longevity of diagnostic tools.

- Dominance Analysis: The US, with its leading pharmaceutical and medical device industries, is a prime market for ALD in healthcare. The ability of ALD to deposit ultrathin, conformal, and chemically inert coatings is crucial for improving the performance and safety of medical technologies.

- Key Drivers:

Automotive: While currently a smaller segment compared to semiconductors, its growth potential is substantial.

- Key Drivers:

- Demand for improved battery performance and longevity in electric vehicles (EVs).

- Development of advanced sensors for autonomous driving systems.

- Application of protective coatings to enhance component durability and reduce weight.

- Dominance Analysis: Increasing investment in EV technology and advanced automotive manufacturing in North America is creating new opportunities for ALD applications in functional coatings and material enhancement.

- Key Drivers:

Other Applications: This segment encompasses a diverse range of emerging uses.

- Key Drivers:

- Catalysis and energy storage solutions.

- Advanced optics and photonics.

- Protective coatings for aerospace and defense.

- Dominance Analysis: These applications, though nascent, represent significant future growth avenues as ALD technology matures and its unique capabilities are recognized across various industrial sectors.

- Key Drivers:

North America Atomic Layer Deposition Market Product Developments

Recent product developments in the North America ALD market are characterized by increased equipment throughput, enhanced process control, and the development of novel precursor chemistries. Innovations are focused on achieving higher deposition rates for improved manufacturing efficiency and exploring new material compositions for specialized applications. Competitive advantages are being gained through modular equipment designs that offer greater flexibility and scalability. Furthermore, advancements in in-situ monitoring and plasma-enhanced ALD (PEALD) are enabling the deposition of a wider range of materials with improved properties, catering to the stringent demands of the semiconductor, healthcare, and automotive sectors. The market fit for these developments is strong, directly addressing the need for precise, high-volume manufacturing of critical components.

Key Drivers of North America Atomic Layer Deposition Market Growth

The North America Atomic Layer Deposition market is propelled by several key growth drivers. Technologically, the relentless miniaturization and performance enhancement demands in the semiconductor industry, coupled with the growing complexity of integrated circuits, necessitate ALD's atomic-level precision. Economically, increasing investments in advanced manufacturing infrastructure, particularly in the US, are fostering market expansion. Regulatory factors, while sometimes posing challenges, also drive innovation towards more environmentally friendly ALD processes and precursor materials. Specific examples include the demand for ALD in advanced logic and memory chips, the use of ALD in creating more efficient catalysts for clean energy, and the development of ALD-coated medical devices with enhanced biocompatibility.

Challenges in the North America Atomic Layer Deposition Market Market

Despite its strong growth prospects, the North America Atomic Layer Deposition market faces several challenges. High capital expenditure for ALD equipment can be a significant barrier for smaller companies and emerging applications. Supply chain complexities, particularly for specialized precursor chemicals, can lead to lead time issues and cost fluctuations. Intense competitive pressures among established players and new entrants necessitate continuous innovation and cost optimization. Furthermore, the learning curve associated with implementing and optimizing ALD processes can pose a hurdle for some end-users. Quantifiable impacts include potential delays in product development cycles and increased operational costs for adopters.

Emerging Opportunities in North America Atomic Layer Deposition Market

Emerging opportunities in the North America Atomic Layer Deposition market are abundant, driven by technological breakthroughs and strategic market expansion. The increasing demand for advanced materials in areas like quantum computing, flexible electronics, and next-generation battery technologies presents significant growth catalysts. Strategic partnerships between ALD equipment manufacturers and material science companies are fostering the development of tailored solutions for niche applications. Furthermore, the expansion of ALD applications into areas such as advanced coatings for renewable energy technologies and protective layers for aerospace components signifies substantial long-term growth potential.

Leading Players in the North America Atomic Layer Deposition Market Sector

- Lam Research Corporation

- ALD NanoSolutions Inc

- Forge Nano Inc

- Veeco Instruments Inc

- Kurt J Lesker Company

- Picosun USA LLC

- Nano-Master Inc

- Applied Materials Inc

- ASM International

- Entegris Inc

- Tokyo Electron US Holdings Inc

Key Milestones in North America Atomic Layer Deposition Market Industry

- 2019: Increased adoption of PEALD for a wider range of dielectric and metallic films in semiconductor manufacturing.

- 2020: Growing interest in ALD for enhancing the performance and lifespan of lithium-ion batteries.

- 2021: Advancements in novel ALD precursor chemistries for improved safety and environmental profiles.

- 2022: Significant R&D investments in ALD for advanced packaging solutions in the semiconductor industry.

- 2023: Emergence of ALD applications in biocompatible coatings for advanced medical implants.

- 2024: Increased focus on scaling ALD processes for cost-effective high-volume manufacturing.

Strategic Outlook for North America Atomic Layer Deposition Market Market

The strategic outlook for the North America Atomic Layer Deposition market is exceptionally positive, characterized by a strong demand for precision manufacturing and advanced material solutions. Future market potential is driven by the continued evolution of the semiconductor industry, the growing adoption of ALD in healthcare for novel therapeutics and diagnostics, and the expanding use of ALD in the automotive sector for next-generation vehicle technologies. Strategic opportunities lie in the development of more cost-effective and scalable ALD solutions, the exploration of new precursor chemistries for novel material deposition, and the expansion of ALD applications into emerging fields like quantum computing and advanced energy storage.

North America Atomic Layer Deposition Market Segmentation

-

1. Application

- 1.1. Semiconductor

- 1.2. Healthcare and Biomedical Application

- 1.3. Automotive

- 1.4. Other Applications

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

-

2.1. North America

North America Atomic Layer Deposition Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America Atomic Layer Deposition Market Regional Market Share

Geographic Coverage of North America Atomic Layer Deposition Market

North America Atomic Layer Deposition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Flexible Sensors and Related Biomedical Applications; Growing R&D Activities Involving Tissue Engineering and Drug Delivery

- 3.3. Market Restrains

- 3.3.1. ; Limitation Regarding the Substrate Size and Higher Costs for the Coating Gases

- 3.4. Market Trends

- 3.4.1. Semiconductor and Electronics Segment are Expected to Hold the Largest Market Share in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Atomic Layer Deposition Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Semiconductor

- 5.1.2. Healthcare and Biomedical Application

- 5.1.3. Automotive

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lam Research Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ALD NanoSolutions Inc and Forge Nano Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Veeco Instruments Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kurt J Lesker Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Picosun USA LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nano-Master Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Applied Materials Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ASM International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Entegris Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tokyo Electron US Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Lam Research Corporation

List of Figures

- Figure 1: North America Atomic Layer Deposition Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Atomic Layer Deposition Market Share (%) by Company 2025

List of Tables

- Table 1: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Atomic Layer Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Atomic Layer Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Atomic Layer Deposition Market?

The projected CAGR is approximately 12.88%.

2. Which companies are prominent players in the North America Atomic Layer Deposition Market?

Key companies in the market include Lam Research Corporation, ALD NanoSolutions Inc and Forge Nano Inc, Veeco Instruments Inc, Kurt J Lesker Company, Picosun USA LLC, Nano-Master Inc, Applied Materials Inc, ASM International, Entegris Inc, Tokyo Electron US Holdings Inc.

3. What are the main segments of the North America Atomic Layer Deposition Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Flexible Sensors and Related Biomedical Applications; Growing R&D Activities Involving Tissue Engineering and Drug Delivery.

6. What are the notable trends driving market growth?

Semiconductor and Electronics Segment are Expected to Hold the Largest Market Share in the Forecast Period.

7. Are there any restraints impacting market growth?

; Limitation Regarding the Substrate Size and Higher Costs for the Coating Gases.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Atomic Layer Deposition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Atomic Layer Deposition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Atomic Layer Deposition Market?

To stay informed about further developments, trends, and reports in the North America Atomic Layer Deposition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence