Key Insights

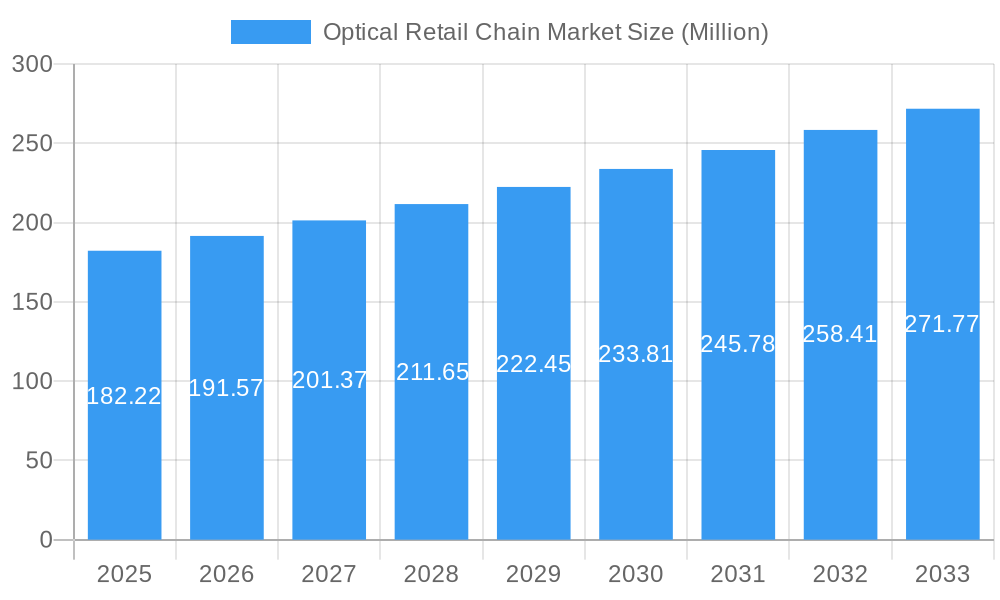

The global Optical Retail Chain Market is poised for robust expansion, projected to reach an estimated value of $182.22 million by 2025. This growth trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of 4.89% from 2019 to 2033, indicating sustained and significant market development. The primary drivers of this expansion are the increasing prevalence of vision impairments worldwide, a growing emphasis on eye health and preventative care, and the rising disposable incomes that empower consumers to invest in quality eyewear and optical solutions. Furthermore, the evolving fashion landscape and the perception of eyeglasses as fashion accessories rather than mere corrective tools are also contributing to market dynamism. The market segmentation reveals a diversified landscape, with the "Beauty and Personal Care" segment likely to hold a substantial share due to the aesthetic appeal and customization options in eyewear. "Food and Beverages" and "Entertainment" are also recognized, suggesting the integration of optical retail within broader consumer experiences or catering to specific needs within these sectors.

Optical Retail Chain Market Market Size (In Million)

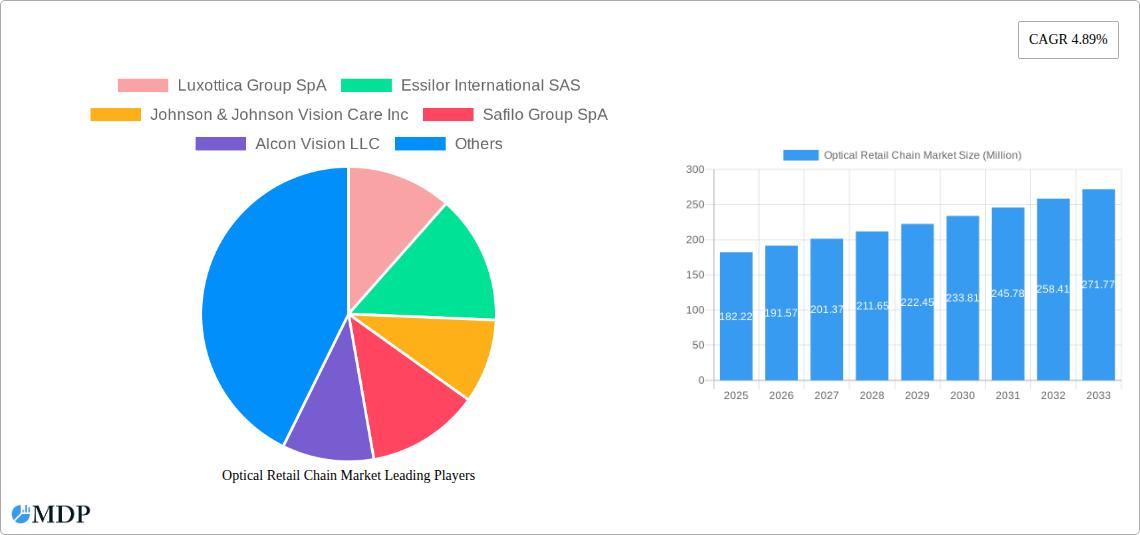

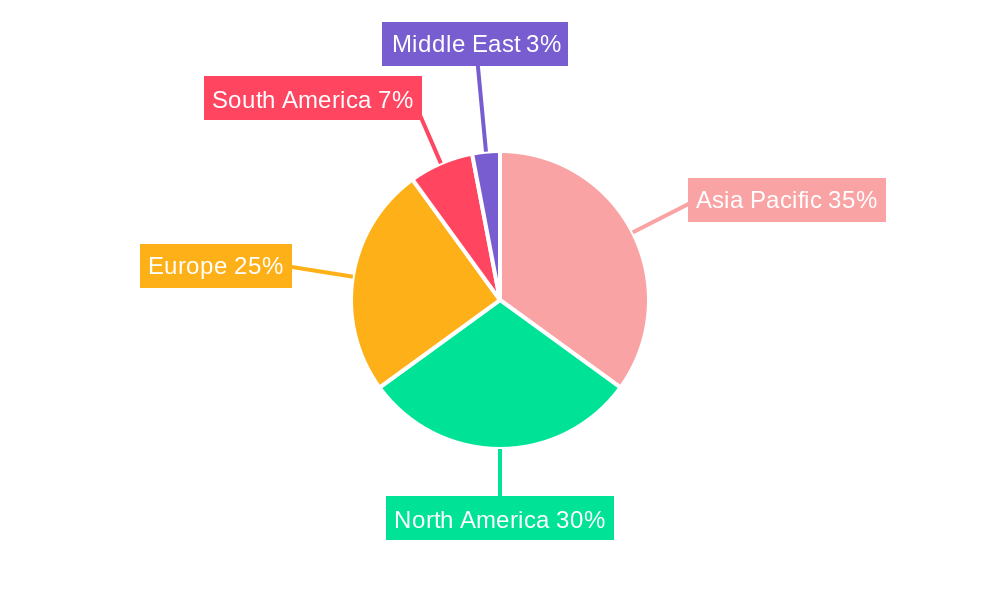

The end-user segment is broadly defined, encompassing Men, Women, and Kids, reflecting the universal need for optical solutions across all demographics. The payment modes, primarily "Online Payment" and "Cash on Delivery," highlight the ongoing digital transformation in retail, with online channels becoming increasingly critical for accessibility and convenience. Geographically, Asia Pacific, particularly India and China, is expected to be a key growth engine, driven by a large population base and increasing awareness about eye care. North America and Europe will continue to represent mature but significant markets, characterized by advanced healthcare infrastructure and a strong demand for premium optical products. The presence of major players like Luxottica Group SpA, Essilor International SAS, and Johnson & Johnson Vision Care Inc. signifies a competitive environment focused on innovation, product quality, and strategic market penetration to capture this expanding market.

Optical Retail Chain Market Company Market Share

Unveiling the Global Optical Retail Chain Market: Trends, Dynamics, and Growth Opportunities (2019–2033)

This comprehensive report provides an in-depth analysis of the global Optical Retail Chain Market, offering critical insights into market dynamics, industry trends, leading segments, and future growth trajectories. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report is an essential resource for industry stakeholders seeking to navigate the evolving landscape of optical retail. Our analysis delves into market concentration, key growth drivers, technological advancements, consumer preferences, and strategic opportunities, equipping businesses with the knowledge to thrive in this dynamic sector.

Optical Retail Chain Market Market Dynamics & Concentration

The Optical Retail Chain Market exhibits a moderate to high level of concentration, with major players like Luxottica Group SpA, Essilor International SAS, and Johnson & Johnson Vision Care Inc. dominating significant market share. Innovation remains a key driver, fueled by advancements in lens technology, frame materials, and digital retailing. Regulatory frameworks, while essential for product safety and accessibility, can also present challenges for market entry and expansion. Product substitutes, such as contact lenses and corrective surgeries, influence consumer choices, necessitating a focus on value-added services and personalized experiences. End-user trends are increasingly driven by health consciousness, fashion trends, and the demand for specialized eyewear. Mergers and acquisitions (M&A) activities are crucial for strategic expansion and market consolidation. For instance, the acquisition of Aerie Pharmaceuticals by Alcon in November 2022 signifies a strategic move to bolster its pharmaceutical pipeline. The market has witnessed a XX% increase in M&A deal counts over the historical period, indicating an active consolidation phase. Market share for the top 5 players is estimated at over 60% in 2025.

Optical Retail Chain Market Industry Trends & Analysis

The global Optical Retail Chain Market is experiencing robust growth, driven by several interconnected factors. A primary growth driver is the escalating prevalence of vision-related disorders, including myopia, hyperopia, and age-related macular degeneration, propelled by factors like increased screen time, an aging global population, and evolving lifestyles. The market penetration of corrective eyewear is steadily increasing, reaching an estimated XX% in 2025. Technological disruptions are revolutionizing the optical retail landscape. The advent of advanced lens technologies, such as digital freeform lenses and photochromic coatings, offers enhanced visual clarity and comfort, boosting consumer demand for premium products. Furthermore, the integration of Artificial Intelligence (AI) and Augmented Reality (AR) in virtual try-on applications and personalized recommendations is enhancing the online shopping experience, leading to a projected XX% growth in e-commerce sales within the sector.

Consumer preferences are shifting towards personalized and fashion-forward eyewear. Beyond their functional purpose, spectacles and sunglasses are increasingly viewed as fashion accessories, driving demand for a wider variety of designs, brands, and customization options. The emphasis on eye health and the preventative benefits of regular eye check-ups is also contributing to market expansion. The competitive dynamics within the market are characterized by intense competition among established global players, regional chains, and independent optical retailers. Companies are vying for market share through product innovation, strategic partnerships, and enhanced customer service. The global Optical Retail Chain Market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. This growth is supported by increasing disposable incomes in emerging economies and a heightened awareness of eye care. The increasing adoption of omnichannel strategies, blending online and offline retail experiences, is becoming a crucial element for sustained success.

Leading Markets & Segments in Optical Retail Chain Market

The Optical Retail Chain Market is characterized by significant regional variations and segment-specific dominance.

Dominant Region: North America currently holds a leading position in the Optical Retail Chain Market, driven by high disposable incomes, widespread awareness of eye health, and a robust retail infrastructure. The United States, in particular, is a key market, with a strong presence of both global and domestic optical retailers.

- Key Drivers for North America's Dominance:

- Economic Policies: Favorable economic conditions and supportive healthcare policies contribute to consumer spending on vision care.

- Infrastructure: A well-developed retail and e-commerce infrastructure facilitates accessibility and convenience.

- Consumer Spending Power: High per capita income allows for greater expenditure on premium eyewear and related services.

- Technological Adoption: Early and widespread adoption of advanced lens technologies and digital retail solutions.

Dominant Segment by Service: Beauty and Personal Care services represent a significant segment, as eyewear is increasingly integrated into personal style and grooming. This includes services related to frame styling, lens customization for cosmetic purposes, and aftercare. The demand for fashionable frames and sunglasses that complement personal aesthetics drives this segment's growth.

- Key Drivers for Beauty and Personal Care Dominance:

- Fashion Influence: The perception of eyewear as a fashion accessory.

- Brand Marketing: Strong branding and celebrity endorsements influencing consumer choices.

- Customization Options: Availability of personalized frame and lens options to match individual styles.

- Holistic Wellness Trends: Integration of eye health with overall personal appearance and well-being.

Dominant Segment by End User: Women constitute a substantial end-user segment within the Optical Retail Chain Market. This is attributed to a greater inclination towards fashion and style, a higher propensity to invest in premium eyewear, and the influence of social trends. Women often seek eyewear that complements their outfits and expresses their personal identity.

- Key Drivers for Women's Dominance:

- Fashion-Forward Preferences: Greater emphasis on style and trends in eyewear selection.

- Brand Loyalty: Strong attachment to specific eyewear brands and designers.

- Social Influence: The role of social media and peer influence in shaping purchasing decisions.

- Product Variety: A wider range of frame styles, colors, and materials catering to diverse tastes.

Dominant Segment by Mode of Payment: Online Payment has emerged as the dominant mode of payment, driven by the convenience, accessibility, and competitive pricing offered by e-commerce platforms. The increasing trust in online transactions and the proliferation of secure payment gateways have further accelerated this trend.

- Key Drivers for Online Payment Dominance:

- Convenience and Accessibility: 24/7 shopping availability from any location.

- Competitive Pricing: Online retailers often offer discounts and promotional deals.

- User-Friendly Interfaces: Streamlined online purchasing processes.

- Secure Payment Gateways: Increased consumer confidence in online transaction security.

Optical Retail Chain Market Product Developments

Product innovation in the Optical Retail Chain Market is rapidly evolving. Manufacturers are focusing on developing advanced lens materials, such as high-index plastics and specialized coatings that offer enhanced UV protection, scratch resistance, and blue light filtering. Smart eyewear, integrating technology for augmented reality experiences and health monitoring, represents a significant emerging trend. The development of lightweight, durable, and sustainable frame materials is also a key focus. These innovations aim to provide consumers with superior visual comfort, protection, and a more personalized user experience, thereby enhancing competitive advantage.

Key Drivers of Optical Retail Chain Market Growth

Several key drivers are propelling the growth of the Optical Retail Chain Market. Technologically, advancements in lens manufacturing, such as digital freeform technology, are enabling highly personalized prescriptions and improved visual outcomes. Economically, rising disposable incomes, particularly in emerging markets, are increasing consumer spending on premium eyewear and eye care services. Regulatory frameworks, when supportive of innovation and market access, also contribute to growth. Furthermore, increasing global awareness of the importance of regular eye examinations and the preventative measures against vision impairment is a significant catalyst. The growing adoption of e-commerce and omnichannel retail strategies is also expanding market reach.

Challenges in the Optical Retail Chain Market Market

Despite its growth, the Optical Retail Chain Market faces several challenges. Intense price competition, particularly from online retailers, can pressure profit margins for brick-and-mortar stores. Navigating complex and varying regulatory frameworks across different countries can be a barrier to market entry and expansion. Supply chain disruptions, as witnessed in recent global events, can impact product availability and lead times. Additionally, counterfeiting and the proliferation of low-quality, uncertified eyewear pose a threat to brand reputation and consumer safety. Educating consumers about the importance of genuine, prescription-accurate eyewear remains an ongoing challenge.

Emerging Opportunities in Optical Retail Chain Market

Emerging opportunities within the Optical Retail Chain Market are abundant. The growing demand for specialized eyewear, such as sports-specific lenses and protective eyewear for industrial applications, presents a significant growth avenue. The expansion of telehealth and remote eye examination services, facilitated by digital technologies, offers new models for customer engagement and service delivery. Strategic partnerships between optical retailers and technology companies, focusing on the development of smart eyewear and personalized vision solutions, are poised to unlock new market segments. Furthermore, the untapped potential in developing economies, with rising disposable incomes and increasing awareness of eye health, represents a substantial long-term growth opportunity.

Leading Players in the Optical Retail Chain Market Sector

- Luxottica Group SpA

- Essilor International SAS

- Johnson & Johnson Vision Care Inc

- Safilo Group SpA

- Alcon Vision LLC

- Oakley Inc

- The Cooper Companies Inc

- Bausch & Lomb Incorporated

- Hoya Corporation

- Carl Zeiss AG

Key Milestones in Optical Retail Chain Market Industry

- July 2023: Johnson & Johnson completed the sale of its Blink product line, including over-the-counter eye and contact lens drops, to Bausch + Lomb for USD 106.5 million. This divestment underscored Johnson & Johnson's strategic shift away from the consumer business, impacting the competitive landscape of over-the-counter eye care products.

- November 2022: Alcon acquired Aerie Pharmaceuticals Inc., significantly strengthening its ophthalmic pharmaceutical business and acquiring a promising pipeline of pharmaceutical product candidates. This strategic acquisition aimed to enhance Alcon's position in the eye drug market and diversify its product portfolio.

Strategic Outlook for Optical Retail Chain Market Market

The strategic outlook for the Optical Retail Chain Market is highly optimistic, fueled by continuous innovation and evolving consumer needs. The market is expected to witness a further integration of digital technologies, with AI-powered diagnostics and AR-enhanced virtual try-ons becoming standard offerings. Expansion into emerging markets, driven by increasing disposable incomes and growing awareness of eye health, will be a key growth accelerator. Strategic alliances and collaborations, particularly with technology providers and healthcare institutions, will be crucial for developing novel products and services. The increasing focus on personalized vision care and fashion-forward eyewear will drive demand for premium offerings, presenting significant opportunities for differentiation and market leadership.

Optical Retail Chain Market Segmentation

-

1. Service

- 1.1. Beauty and Personal Care

- 1.2. Food And Beverages

- 1.3. Entertainment

- 1.4. Others Services

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids

-

3. Mode of Payment

- 3.1. Online Payment

- 3.2. Cash on Delivery

Optical Retail Chain Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Russia

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. South Africa

- 6.2. Rest of Middle East

Optical Retail Chain Market Regional Market Share

Geographic Coverage of Optical Retail Chain Market

Optical Retail Chain Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness of Eye Health; Eyewear has Become an Integral Fashion Accessory

- 3.3. Market Restrains

- 3.3.1. Increasing Awareness of Eye Health; Eyewear has Become an Integral Fashion Accessory

- 3.4. Market Trends

- 3.4.1. Offline Optical Retail Chain is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Beauty and Personal Care

- 5.1.2. Food And Beverages

- 5.1.3. Entertainment

- 5.1.4. Others Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids

- 5.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.3.1. Online Payment

- 5.3.2. Cash on Delivery

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Asia Pacific Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Beauty and Personal Care

- 6.1.2. Food And Beverages

- 6.1.3. Entertainment

- 6.1.4. Others Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids

- 6.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 6.3.1. Online Payment

- 6.3.2. Cash on Delivery

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. North America Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Beauty and Personal Care

- 7.1.2. Food And Beverages

- 7.1.3. Entertainment

- 7.1.4. Others Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids

- 7.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 7.3.1. Online Payment

- 7.3.2. Cash on Delivery

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Beauty and Personal Care

- 8.1.2. Food And Beverages

- 8.1.3. Entertainment

- 8.1.4. Others Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids

- 8.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 8.3.1. Online Payment

- 8.3.2. Cash on Delivery

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. South America Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Beauty and Personal Care

- 9.1.2. Food And Beverages

- 9.1.3. Entertainment

- 9.1.4. Others Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Kids

- 9.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 9.3.1. Online Payment

- 9.3.2. Cash on Delivery

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Beauty and Personal Care

- 10.1.2. Food And Beverages

- 10.1.3. Entertainment

- 10.1.4. Others Services

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Kids

- 10.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 10.3.1. Online Payment

- 10.3.2. Cash on Delivery

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. United Arab Emirates Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Beauty and Personal Care

- 11.1.2. Food And Beverages

- 11.1.3. Entertainment

- 11.1.4. Others Services

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Men

- 11.2.2. Women

- 11.2.3. Kids

- 11.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 11.3.1. Online Payment

- 11.3.2. Cash on Delivery

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Luxottica Group SpA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Essilor International SAS

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Johnson & Johnson Vision Care Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Safilo Group SpA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Alcon Vision LLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Oakley Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 The Cooper Companies Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Bausch & Lomb Incorporated

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hoya Corportation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Carl Zeiss AG

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Luxottica Group SpA

List of Figures

- Figure 1: Global Optical Retail Chain Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Optical Retail Chain Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 4: Asia Pacific Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 5: Asia Pacific Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: Asia Pacific Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 7: Asia Pacific Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 8: Asia Pacific Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 9: Asia Pacific Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: Asia Pacific Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 11: Asia Pacific Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 12: Asia Pacific Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 13: Asia Pacific Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 14: Asia Pacific Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 15: Asia Pacific Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Asia Pacific Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Asia Pacific Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

- Figure 19: North America Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 20: North America Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 21: North America Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: North America Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 23: North America Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 24: North America Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 25: North America Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 26: North America Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 27: North America Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 28: North America Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 29: North America Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 30: North America Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 31: North America Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 32: North America Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 33: North America Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 36: Europe Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 37: Europe Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 38: Europe Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 39: Europe Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 40: Europe Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 41: Europe Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 42: Europe Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 43: Europe Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 44: Europe Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 45: Europe Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 46: Europe Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 47: Europe Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Europe Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 52: South America Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 53: South America Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 54: South America Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 55: South America Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 56: South America Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 57: South America Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: South America Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 59: South America Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 60: South America Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 61: South America Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 62: South America Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 63: South America Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 64: South America Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 65: South America Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 68: Middle East Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 69: Middle East Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 70: Middle East Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 71: Middle East Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 72: Middle East Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 73: Middle East Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 74: Middle East Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 75: Middle East Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 76: Middle East Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 77: Middle East Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 78: Middle East Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 79: Middle East Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

- Figure 83: United Arab Emirates Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 84: United Arab Emirates Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 85: United Arab Emirates Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 86: United Arab Emirates Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 87: United Arab Emirates Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 88: United Arab Emirates Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 89: United Arab Emirates Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 90: United Arab Emirates Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 91: United Arab Emirates Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 92: United Arab Emirates Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 93: United Arab Emirates Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 94: United Arab Emirates Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 95: United Arab Emirates Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 96: United Arab Emirates Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 97: United Arab Emirates Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: United Arab Emirates Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 3: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 6: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 7: Global Optical Retail Chain Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Optical Retail Chain Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 13: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 14: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 15: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: India Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: India Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: China Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: China Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Australia Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Australia Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 28: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 29: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 31: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 32: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 33: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 35: United States Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United States Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Canada Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Canada Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of North America Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of North America Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 42: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 43: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 44: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 45: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 46: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 47: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Germany Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Germany Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: France Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: France Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Russia Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Europe Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Europe Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 60: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 61: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 62: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 63: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 64: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 65: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 67: Brazil Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Brazil Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Argentina Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Argentina Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of South America Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of South America Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 74: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 75: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 76: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 77: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 78: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 79: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 81: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 82: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 83: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 84: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 85: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 86: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 87: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 88: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 89: South Africa Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: South Africa Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Middle East Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Middle East Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optical Retail Chain Market?

The projected CAGR is approximately 4.89%.

2. Which companies are prominent players in the Optical Retail Chain Market?

Key companies in the market include Luxottica Group SpA, Essilor International SAS, Johnson & Johnson Vision Care Inc, Safilo Group SpA, Alcon Vision LLC, Oakley Inc, The Cooper Companies Inc, Bausch & Lomb Incorporated, Hoya Corportation, Carl Zeiss AG.

3. What are the main segments of the Optical Retail Chain Market?

The market segments include Service, End User, Mode of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD 182.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness of Eye Health; Eyewear has Become an Integral Fashion Accessory.

6. What are the notable trends driving market growth?

Offline Optical Retail Chain is Driving the Market.

7. Are there any restraints impacting market growth?

Increasing Awareness of Eye Health; Eyewear has Become an Integral Fashion Accessory.

8. Can you provide examples of recent developments in the market?

July 2023: Johnson & Johnson completed the sale of its Blink product line, which includes over-the-counter eye and contact lens drops, to Bausch + Lomb for USD 106.5 million. This divestment was a strategic move by Johnson & Johnson to exit the consumer business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Optical Retail Chain Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Optical Retail Chain Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Optical Retail Chain Market?

To stay informed about further developments, trends, and reports in the Optical Retail Chain Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence