Key Insights

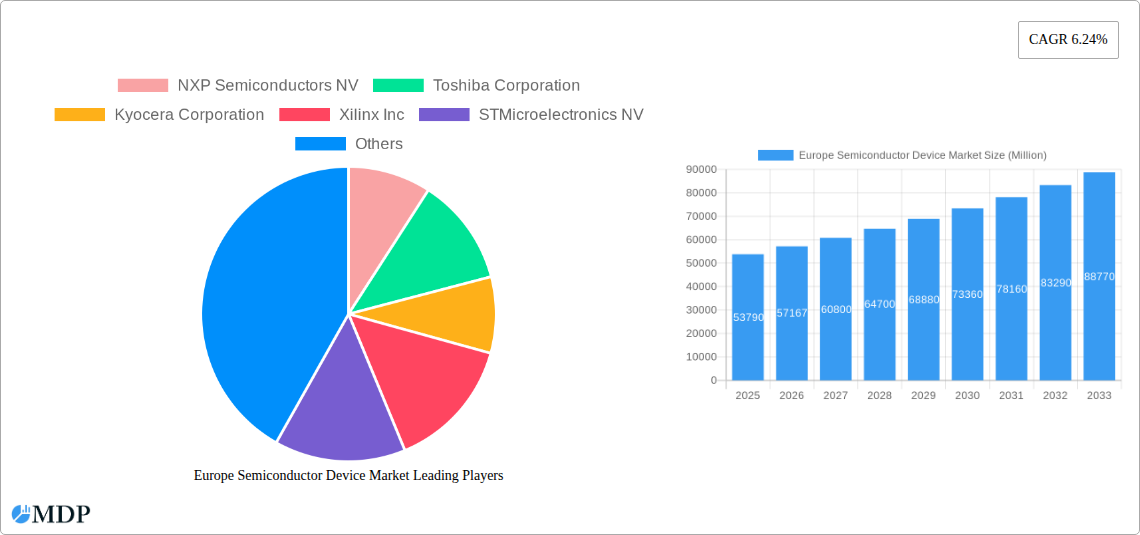

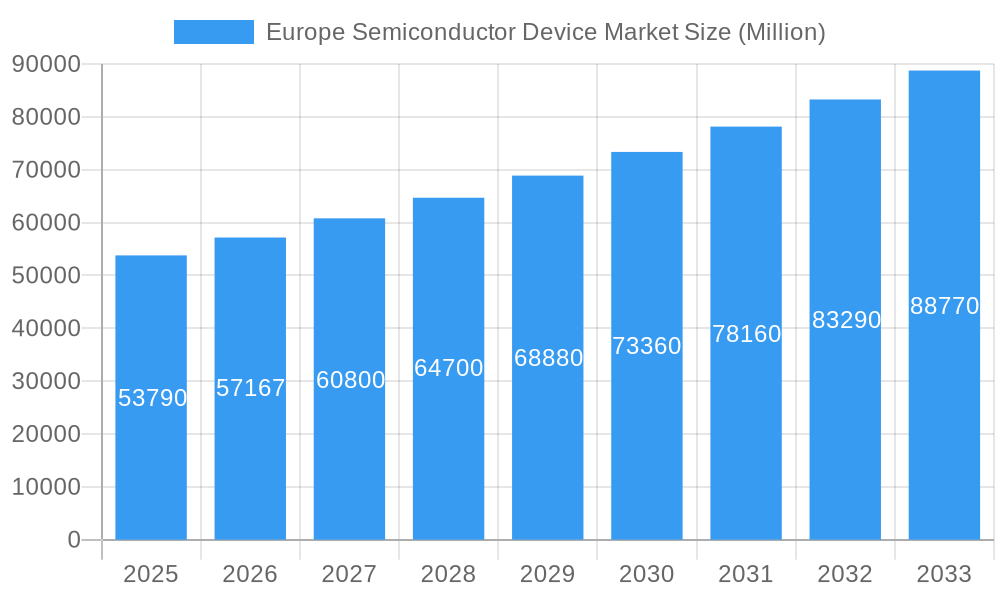

The European semiconductor device market, valued at €53.79 billion in 2025, is projected to experience robust growth, driven by the increasing demand for advanced electronics across various sectors. A compound annual growth rate (CAGR) of 6.24% is anticipated from 2025 to 2033, indicating a substantial market expansion. This growth is fueled by several key factors. The automotive industry's relentless pursuit of autonomous driving and advanced driver-assistance systems (ADAS) is a significant driver, demanding high-performance semiconductors for processing vast amounts of data. Similarly, the burgeoning Internet of Things (IoT) and the expansion of 5G and other wireless communication technologies are creating substantial demand for sensors, integrated circuits, and other semiconductor components. The continuous miniaturization and improvement of semiconductor devices, coupled with increasing digitalization across all industry verticals, further underpin this market expansion. The dominance of key players like NXP Semiconductors, STMicroelectronics, and Infineon Technologies, combined with the emergence of innovative startups in the region, creates a dynamic and competitive landscape.

Europe Semiconductor Device Market Market Size (In Billion)

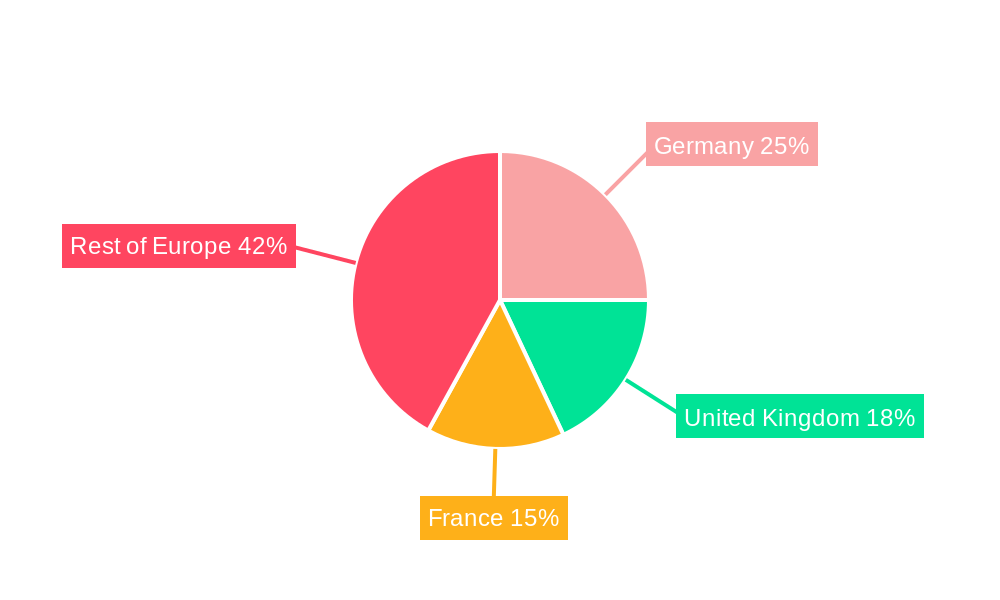

Significant regional variations within Europe are expected. Germany, the United Kingdom, and France represent the largest national markets, benefiting from established technological infrastructure and a strong presence of automotive and industrial manufacturers. However, other European nations are also witnessing increasing adoption of semiconductor-based technologies, driving growth across the region. While challenges remain, such as potential supply chain disruptions and geopolitical uncertainties, the long-term outlook for the European semiconductor device market remains positive, with substantial opportunities for growth and innovation across various segments, including discrete semiconductors, optoelectronics, and memory chips. The increasing focus on sustainable technologies and the rise of artificial intelligence (AI) are also likely to further fuel market expansion in the coming years.

Europe Semiconductor Device Market Company Market Share

Europe Semiconductor Device Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Semiconductor Device Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Europe Semiconductor Device Market Market Dynamics & Concentration

The European semiconductor device market is characterized by a moderately concentrated landscape, with a few key players holding significant market share. However, the market is dynamic, driven by continuous innovation, evolving regulatory frameworks, and the emergence of substitute technologies. The automotive and industrial sectors are major end-users, driving significant demand for high-performance and specialized semiconductors.

Market Concentration: The top five players account for approximately xx% of the market share in 2025. This concentration is expected to remain relatively stable during the forecast period, although smaller players are expected to gain some traction through specialized product offerings and strategic partnerships.

Innovation Drivers: Technological advancements such as the Internet of Things (IoT), artificial intelligence (AI), and 5G are fueling innovation in semiconductor design and manufacturing. This leads to the development of more energy-efficient, powerful, and specialized devices.

Regulatory Frameworks: The European Union's Chips Act is a major influence, aiming to boost domestic semiconductor production and reduce reliance on external suppliers. This initiative is expected to stimulate investment and innovation within the European market.

Product Substitutes: While semiconductors are crucial components in various applications, ongoing research explores alternative technologies like memristors and other emerging materials. The impact of these alternatives on the market is currently limited but deserves monitoring.

End-User Trends: The increasing demand for advanced features in automotive electronics, communication devices, and industrial automation is boosting the growth of the market. The rise of connected devices and the proliferation of data centers are also key contributing factors.

M&A Activities: The number of mergers and acquisitions in the European semiconductor industry has seen a slight increase in recent years, with xx deals recorded in 2024. This activity reflects strategic efforts by companies to expand their product portfolios and gain access to new technologies and markets.

Europe Semiconductor Device Market Industry Trends & Analysis

The Europe Semiconductor Device Market is witnessing significant growth fueled by various factors. The rising adoption of advanced driver-assistance systems (ADAS) in the automotive industry, coupled with increased demand for high-speed data processing in communication networks and data centers, are primary growth drivers. The integration of semiconductors into various consumer electronics, including smartphones and wearable devices, further stimulates market growth. Technological disruptions, such as the development of advanced semiconductor materials and packaging technologies, are pushing the boundaries of performance and efficiency.

Consumer preferences are increasingly directed towards energy-efficient, high-performance devices which has created demand for smaller, faster and more energy-efficient devices. This trend is driving innovation in semiconductor technology, with manufacturers focusing on developing more power-efficient designs and advanced packaging solutions.

The competitive landscape is characterized by intense rivalry between established players and emerging companies. Major players are investing heavily in research and development, seeking to maintain their market position and enhance their technological leadership. This leads to a continuous cycle of product innovation and improvements in semiconductor technology. The market is expected to exhibit a robust CAGR of xx% between 2025 and 2033, with market penetration reaching xx% by 2033.

Leading Markets & Segments in Europe Semiconductor Device Market

Dominant Segments and Regions:

By Device Type: Integrated Circuits (ICs) currently dominate the market, driven by the high demand for sophisticated electronics in various applications. The segment is expected to maintain its leading position throughout the forecast period. Memory devices, particularly micro memory, are also experiencing notable growth, due to increasing data storage requirements.

By End-User Vertical: The automotive sector is a major driving force for growth, fueled by advancements in ADAS and electric vehicle technology. The communication sector (wired and wireless) is also a key segment due to the increasing proliferation of 5G networks and IoT devices. The industrial sector is experiencing growth driven by automation and process optimization requirements.

By Country: Germany holds the largest market share, driven by its strong automotive industry and established semiconductor manufacturing infrastructure. The United Kingdom and France also contribute significantly to the market.

Key Drivers:

Germany: Strong automotive manufacturing base, advanced research and development infrastructure, supportive government policies including the European Chips Act.

United Kingdom: Growing presence of technology companies, significant investment in research and development.

France: Investments in research, development, and manufacturing, governmental support for the semiconductor industry.

Europe Semiconductor Device Market Product Developments

Recent product innovations focus on miniaturization, enhanced performance, and improved energy efficiency. Advances in semiconductor materials, such as silicon carbide and gallium nitride, are enabling higher power density and improved thermal management. New packaging technologies are allowing for more efficient integration and reduced form factors, improving market fit and making the devices more adaptable.

Key Drivers of Europe Semiconductor Device Market Growth

Technological advancements in AI, IoT, and 5G are pushing demand for high-performance semiconductors. Government initiatives like the European Chips Act are providing significant funding and incentives, fostering domestic production. The increasing integration of semiconductors into various applications across automotive, industrial, and consumer sectors is also creating substantial growth opportunities. The rising demand for advanced computing and data storage solutions fuels further growth in the semiconductor market.

Challenges in the Europe Semiconductor Device Market Market

The market faces challenges such as reliance on global supply chains leading to potential disruptions, increasing manufacturing complexity and costs. The stringent regulatory environment and competition from established players and new entrants also pose difficulties. These factors create a complex and dynamic environment impacting the overall growth trajectory of the market. The estimated impact of these challenges on market growth is approximately xx% reduction in the next 5 years.

Emerging Opportunities in Europe Semiconductor Device Market

The development of specialized semiconductors for emerging applications, like quantum computing and neuromorphic computing, presents significant growth potential. Strategic partnerships between European semiconductor manufacturers and technology companies will provide access to new markets and technologies. Furthermore, the expansion of the semiconductor industry into new geographical regions within Europe offers considerable opportunities for market expansion and growth.

Leading Players in the Europe Semiconductor Device Market Sector

Key Milestones in Europe Semiconductor Device Market Industry

- August 2023: TSMC, Robert Bosch GmbH, Infineon Technologies AG, and NXP Semiconductors N.V. announced investment in the European Semiconductor Manufacturing Company (ESMC) GmbH in Dresden, Germany, signaling a major push for local semiconductor manufacturing.

- April 2024: Infineon Technologies AG partnered with Amkor Technology, Inc. to establish a specialized packaging and testing facility in Porto, Portugal, strengthening Europe's backend semiconductor manufacturing capabilities.

Strategic Outlook for Europe Semiconductor Device Market Market

The European semiconductor device market is poised for robust growth, driven by technological innovation, government support, and increasing demand from various end-user sectors. Strategic partnerships, investments in research and development, and a focus on specialized semiconductor applications will be key factors driving future market potential. Companies that can successfully navigate the complexities of the market, adapt to evolving technological trends, and leverage strategic collaborations will be well-positioned for long-term success.

Europe Semiconductor Device Market Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors and Actuators

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.5. Micro

- 1.5.1. Microprocessors (MPU)

- 1.5.2. Microcontrollers (MCU)

- 1.5.3. Digital Signal Processors

-

2. End-user Vertical

- 2.1. Automotive

- 2.2. Communication (Wired and Wireless)

- 2.3. Consumer

- 2.4. Industrial

- 2.5. Computing/Data Storage

- 2.6. Other End Users

Europe Semiconductor Device Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Semiconductor Device Market Regional Market Share

Geographic Coverage of Europe Semiconductor Device Market

Europe Semiconductor Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Technologies like IoT and AI; Rising Demand for Consumer Electronics Goods

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Rising Demand for Consumer Electronics Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Semiconductor Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors and Actuators

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.5. Micro

- 5.1.5.1. Microprocessors (MPU)

- 5.1.5.2. Microcontrollers (MCU)

- 5.1.5.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Automotive

- 5.2.2. Communication (Wired and Wireless)

- 5.2.3. Consumer

- 5.2.4. Industrial

- 5.2.5. Computing/Data Storage

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NXP Semiconductors NV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kyocera Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xilinx Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qualcomm Incorporated

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung Electronics Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ON Semiconductor Corporatio

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nvidia Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 NXP Semiconductors NV

List of Figures

- Figure 1: Europe Semiconductor Device Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Semiconductor Device Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Semiconductor Device Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Europe Semiconductor Device Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Europe Semiconductor Device Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Semiconductor Device Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 5: Europe Semiconductor Device Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Europe Semiconductor Device Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Semiconductor Device Market?

The projected CAGR is approximately 6.24%.

2. Which companies are prominent players in the Europe Semiconductor Device Market?

Key companies in the market include NXP Semiconductors NV, Toshiba Corporation, Kyocera Corporation, Xilinx Inc, STMicroelectronics NV, Qualcomm Incorporated, Samsung Electronics Co Ltd, ON Semiconductor Corporatio, Nvidia Corporation, Intel Corporation.

3. What are the main segments of the Europe Semiconductor Device Market?

The market segments include Device Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Technologies like IoT and AI; Rising Demand for Consumer Electronics Goods.

6. What are the notable trends driving market growth?

Rising Demand for Consumer Electronics Goods.

7. Are there any restraints impacting market growth?

Lack of Awareness.

8. Can you provide examples of recent developments in the market?

April 2024 - Infineon Technologies AG, a prominent player in power systems and IoT, is bolstering its outsourced backend manufacturing presence in Europe. The company has unveiled a strategic, multi-year collaboration with Amkor Technology, Inc., a key player in semiconductor packaging and testing. As part of this partnership, both entities will jointly run a specialized packaging and testing facility at Amkor's Porto manufacturing hub.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Semiconductor Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Semiconductor Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Semiconductor Device Market?

To stay informed about further developments, trends, and reports in the Europe Semiconductor Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence