Key Insights

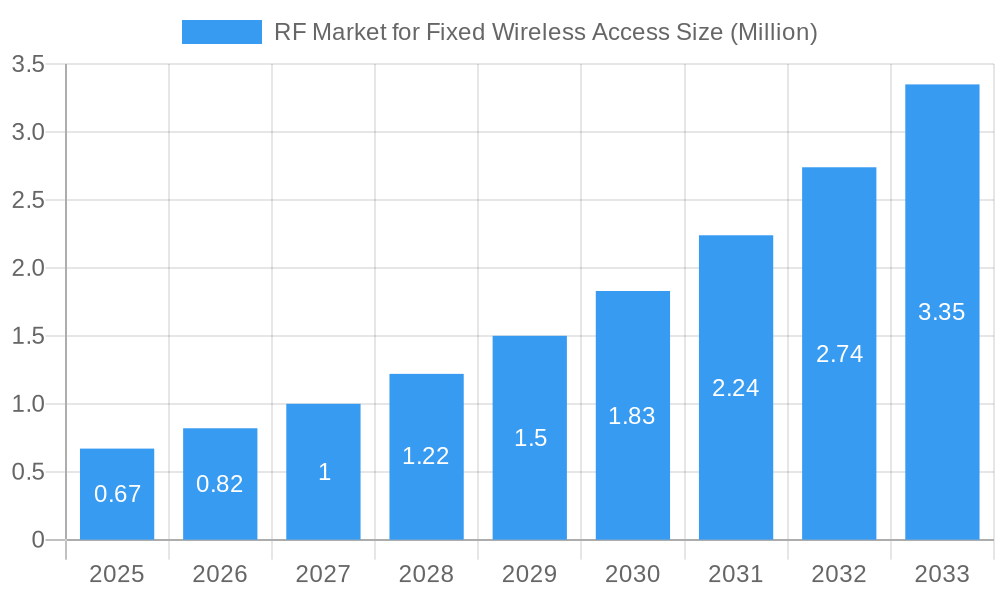

The RF market for Fixed Wireless Access (FWA) is experiencing unprecedented growth, projected to reach a substantial $0.67 million in 2025, with an astonishing Compound Annual Growth Rate (CAGR) of 29.80% through 2033. This rapid expansion is fueled by the escalating demand for high-speed, reliable internet connectivity, especially in areas underserved by traditional fiber optics. The inherent flexibility and cost-effectiveness of FWA solutions are driving their adoption across residential, enterprise, and industrial sectors, enabling a more connected future. Key market drivers include the relentless pursuit of 5G deployment, the need for enhanced network capacity to support data-intensive applications, and government initiatives promoting digital inclusivity. The FWA RF ecosystem encompasses a sophisticated array of components, including transmit modules like Power Amplifier Modules (PAM) and Massive MIMO Power Amplifiers (MMMB PA), receive modules such as Front-End Modules (FEM) and Low-Front-End Modules (LFEM), Antenna-in-Package (AiP) and Beamformers for precise signal directionality, essential filters, and discrete components like switches, Low-Noise Amplifiers (LNA), Power Management Integrated Circuits (PMIC), and tuners. Leading the charge in this dynamic market are industry giants such as Renesas Electronic Corporation, Murata Manufacturing Co., Microchip Technology Inc., Texas Instruments, and Qualcomm Technologies Inc., alongside other significant players like Skyworks Inc., Qorvo Inc., and Analog Devices Inc., all contributing to the innovation and supply chain robustness.

RF Market for Fixed Wireless Access Market Size (In Million)

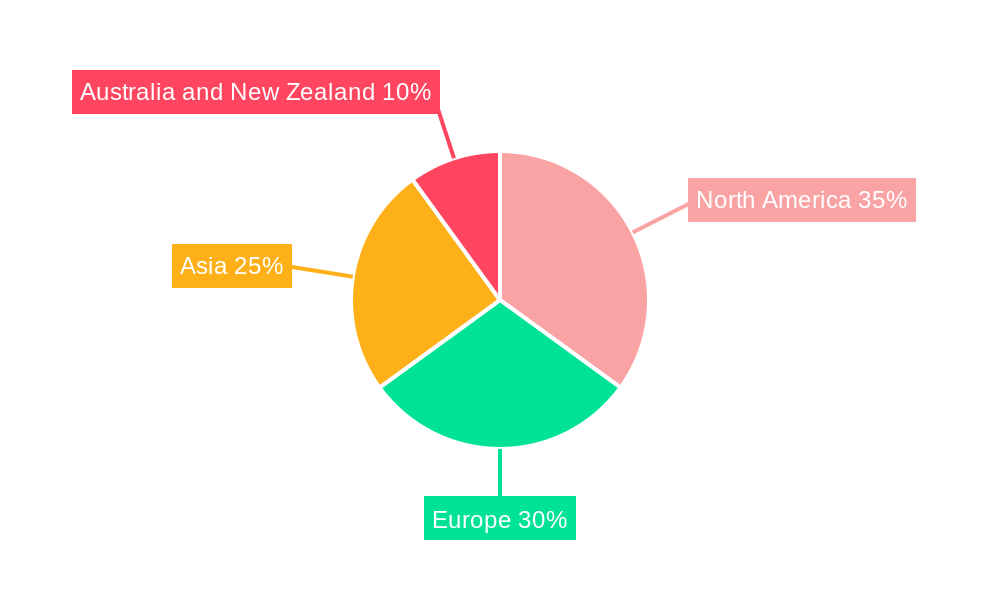

The FWA RF market is characterized by significant technological advancements and evolving consumer expectations. Trends such as the increasing integration of RF components into single packages (AiP) to reduce form factor and improve performance, the widespread adoption of beamforming technologies for optimal signal delivery, and the development of more efficient and powerful amplifier solutions are shaping the competitive landscape. While the growth trajectory is steep, certain factors could present challenges. These may include supply chain complexities for specialized RF components, the ongoing evolution of wireless standards requiring continuous R&D investment, and the potential for increased interference in densely populated FWA deployments. However, the overwhelming demand for faster and more accessible internet is expected to outweigh these restraints, ensuring robust growth across all segments. Geographically, North America and Asia are poised to be major growth engines, driven by substantial 5G investments and a burgeoning digital economy. Europe also presents significant opportunities as it accelerates its FWA deployments.

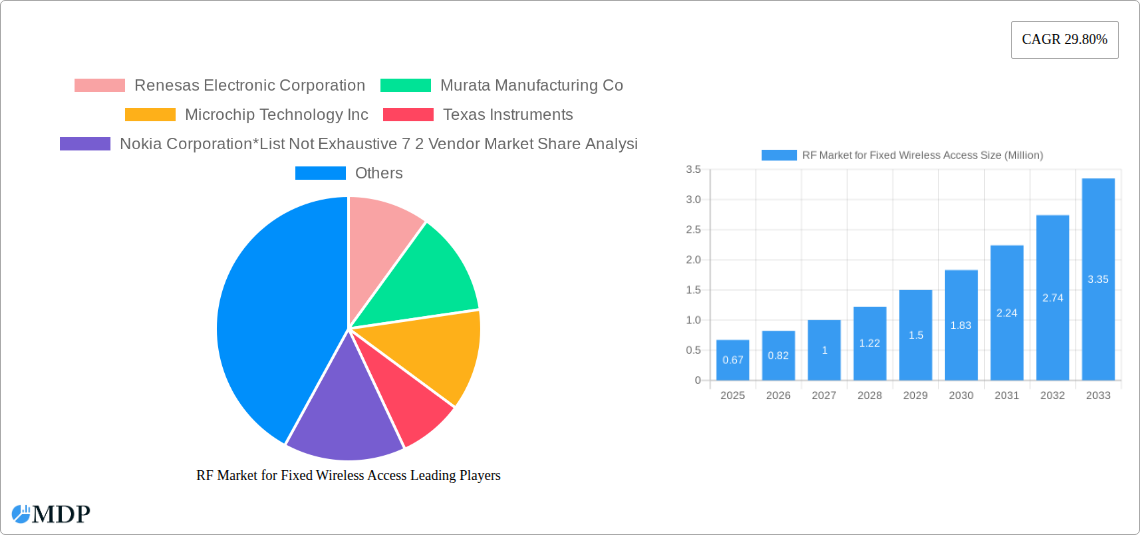

RF Market for Fixed Wireless Access Company Market Share

Here is an SEO-optimized, engaging report description for the "RF Market for Fixed Wireless Access" report, incorporating high-traffic keywords and structured as requested:

Report Title: RF Market for Fixed Wireless Access: Market Dynamics, Industry Trends, Leading Segments, and Future Outlook (2019-2033)

Report Description:

Dive deep into the rapidly evolving RF market for Fixed Wireless Access (FWA) with this comprehensive industry analysis. This report provides an in-depth examination of market dynamics, technological advancements, and strategic growth opportunities within the FWA ecosystem. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this analysis is essential for understanding the trajectory of wireless broadband. Explore key segments including Radio: Transmit Modules (PAM, MMMB PA, PAD, LPAD), Receive Modules (FEM, LFEM), Antenna-in-Package (AiP) and Beamformer, Filters, and Discrete components (Switch, LNA, PMIC, Tuner). Gain critical insights into the competitive landscape featuring giants like Qualcomm Technologies, Nokia Corporation, Ericsson, Murata Manufacturing Co, Renesas Electronic Corporation, and many more. Uncover market share analyses, innovation drivers, regulatory impacts, and the competitive advantages shaping the future of FWA connectivity. This report offers actionable intelligence for stakeholders seeking to capitalize on the burgeoning demand for high-speed wireless internet solutions.

RF Market for Fixed Wireless Access Market Dynamics & Concentration

The RF market for Fixed Wireless Access (FWA) is characterized by a moderate to high level of concentration, driven by the significant R&D investments required for cutting-edge 5G FWA and mmWave FWA technologies. Innovation is primarily fueled by the relentless pursuit of higher data speeds, lower latency, and enhanced spectral efficiency, directly impacting the development of advanced RF components. Regulatory frameworks, particularly those related to spectrum allocation for 5G NR bands, play a crucial role in shaping market accessibility and deployment strategies. While traditional wired broadband remains a substitute, the increasing cost-effectiveness and rapid deployment capabilities of FWA are diminishing its competitive threat. End-user trends are shifting towards a greater demand for reliable, high-speed internet for both residential and enterprise applications, especially in areas underserved by fiber optics. Merger and acquisition (M&A) activities, though not extensively detailed, are anticipated to increase as key players consolidate their positions and acquire specialized technologies to enhance their FWA RF portfolios. The market share for key RF component manufacturers is closely watched, with a focus on their contributions to leading FWA equipment providers. The total number of M&A deals in the RF component space relevant to FWA is estimated to be around xx million, indicating strategic consolidation.

RF Market for Fixed Wireless Access Industry Trends & Analysis

The RF market for Fixed Wireless Access (FWA) is experiencing robust growth, propelled by several key market growth drivers. The accelerating global demand for high-speed broadband connectivity, particularly in underserved urban and rural areas, is a primary catalyst. The ongoing expansion of 5G networks and the subsequent availability of dedicated 5G FWA solutions are significantly boosting market penetration. Technological disruptions are primarily centered around advancements in millimeter-wave (mmWave) frequencies, enabling higher bandwidth and faster speeds essential for next-generation FWA services. Innovations in RF front-end modules (FEMs), power amplifiers (PAs), antenna-in-package (AiP) solutions, and beamforming technologies are continuously improving FWA performance and reducing deployment costs. Consumer preferences are increasingly favoring FWA due to its comparable or superior performance to wired alternatives, coupled with quicker installation times and greater flexibility. The competitive dynamics within the RF sector are intense, with leading semiconductor and component manufacturers vying for market share by offering integrated and highly efficient solutions. The Compound Annual Growth Rate (CAGR) of the RF market for FWA is projected to be approximately 18% over the forecast period, signifying substantial expansion. Market penetration of FWA services is expected to reach xx% by 2033, driven by both consumer adoption and enterprise solutions requiring high-capacity wireless links. The shift from traditional broadband to wireless alternatives is a significant trend, influenced by the cost-effectiveness and deployment speed of FWA infrastructure. The growing adoption of smart city initiatives and the increasing need for robust connectivity in industrial IoT applications further contribute to the expansion of the FWA market. The development of more efficient and cost-effective RF components is crucial for driving down the overall cost of FWA deployments, making it a viable option for a wider range of service providers and end-users. The evolution of 5G standards, including the integration of AI capabilities for network optimization, will further enhance the performance and appeal of FWA solutions.

Leading Markets & Segments in RF Market for Fixed Wireless Access

The North American region currently dominates the RF market for Fixed Wireless Access (FWA), driven by early and aggressive adoption of 5G technologies and significant investments in broadband infrastructure across the United States and Canada. Economically robust markets, coupled with favorable regulatory environments that encourage broadband expansion and spectrum availability for FWA, further solidify its leading position.

Within this dynamic market, the Radio: Transmit Module (PAM, MMMB PA, PAD, and LPAD) segment holds substantial prominence.

- Key Drivers for Transmit Module Dominance:

- High Power Requirements: Delivering high-speed FWA services over longer distances, especially in mmWave bands, necessitates powerful and efficient transmit modules capable of handling significant output power.

- Integration and Miniaturization: The trend towards integrated solutions, such as module-level integration for 5G mMIMO and beamforming, boosts the demand for compact yet high-performance PAM and MMMB PA components.

- Performance Efficiency: Manufacturers are focused on developing transmit modules with improved power efficiency to minimize heat dissipation and reduce operational costs for FWA base stations and customer premises equipment (CPEs).

- 5G Advancement: The continuous evolution of 5G standards, including the push towards 5G-Advanced, demands more sophisticated and flexible transmit solutions.

The Receive Module (FEM and LFEM) segment also plays a crucial role, enabling the capture of incoming wireless signals with high sensitivity and low noise.

- Key Drivers for Receive Module Significance:

- Sensitivity and Noise Figure: Achieving reliable connectivity, especially in challenging RF environments, depends on the sensitivity of receive modules to capture weak signals.

- Integration with Downconversion: Front-end modules that integrate filtering, amplification, and downconversion stages simplify system design and reduce overall component count.

- Support for Wide Bandwidths: The increasing need for high data rates in FWA necessitates receive modules capable of operating across a wide range of frequencies and bandwidths.

The Antenna-in-Package (AiP) and Beamformer segment is experiencing rapid growth due to its critical role in enabling phased array antennas for FWA.

- Key Drivers for AiP and Beamformer Growth:

- Beamforming Technology: Essential for directing RF energy towards the user and mitigating interference in mmWave FWA, beamforming capabilities are integrated into these components.

- Compact Form Factors: AiP solutions integrate antennas and RF circuitry into a single package, significantly reducing the size and complexity of FWA CPEs and base stations.

- Increased Throughput: Advanced beamforming techniques improve signal quality and enable higher data throughput, a key selling point for FWA services.

The Filter segment is vital for signal selectivity, ensuring that the FWA system operates effectively by isolating desired frequencies and rejecting unwanted interference.

- Key Drivers for Filter Importance:

- Spectral Purity: Maintaining signal integrity and preventing interference with other wireless services is paramount, requiring highly selective filters.

- Compact and High-Performance Filters: The demand for smaller, more efficient filters that can operate at higher frequencies is continuous.

Finally, the Discrete (Switch, LNA, PMIC, and Tuner) segment provides essential foundational components for RF systems.

- Key Drivers for Discrete Components:

- Switching Functionality: RF switches are critical for routing signals within the FWA system, enabling flexibility and efficient operation.

- Low-Noise Amplifiers (LNAs): Crucial for boosting weak incoming signals without introducing significant noise, LNAs are fundamental to receiver performance.

- Power Management Integrated Circuits (PMICs): Efficient power management is vital for FWA devices, especially battery-operated CPEs, ensuring optimal performance and battery life.

- Tuners: Enabling flexible operation across different frequency bands, tuners are becoming increasingly important for multi-band FWA solutions.

RF Market for Fixed Wireless Access Product Developments

The RF market for Fixed Wireless Access (FWA) is witnessing a surge in product innovation, driven by the need for enhanced performance, lower costs, and smaller form factors. Key developments include the integration of advanced AI capabilities into modem-RF systems, such as Qualcomm Technologies' Snapdragon X80 5G Modem-RF System, which features a dedicated 5G AI Processor for optimized performance. Furthermore, cutting-edge RF modules like Sivers Semiconductors AB's BFM02803 are being designed for high-power 5G FR2 mmWave bands, catering to the demands of mass-produced FWA products and enabling product differentiation through superior performance. These advancements in components like RF front-end modules (FEMs), Antenna-in-Package (AiP) solutions, and beamformers are crucial for unlocking the full potential of next-generation FWA networks, facilitating faster speeds, lower latency, and broader coverage.

Key Drivers of RF Market for Fixed Wireless Access Growth

The rapid expansion of the RF market for Fixed Wireless Access (FWA) is driven by several interconnected factors. Firstly, the increasing global demand for high-speed, reliable internet connectivity, particularly in areas where fiber deployment is cost-prohibitive, is a major catalyst. Secondly, the widespread rollout of 5G networks provides the necessary infrastructure and spectrum for advanced FWA solutions, enabling higher bandwidth and lower latency. Technological advancements in RF components, such as highly integrated front-end modules (FEMs), efficient power amplifiers (PAs), and sophisticated beamforming antennas, are continuously improving FWA performance and reducing deployment costs. Favorable regulatory policies promoting broadband expansion and spectrum allocation also play a significant role in accelerating FWA adoption.

Challenges in the RF Market for Fixed Wireless Access Market

Despite its promising growth, the RF market for Fixed Wireless Access (FWA) faces several challenges. Regulatory hurdles related to spectrum licensing and deployment permits can slow down market penetration. Supply chain disruptions and the increasing complexity of RF components can lead to higher manufacturing costs and potential delays in product availability. Intense competition from both wired broadband providers and other FWA solution vendors puts pressure on pricing and margins. Furthermore, the need for specialized technical expertise for installation and maintenance can be a barrier for some service providers and end-users, impacting the overall adoption rate. The significant upfront investment required for deploying robust FWA infrastructure can also be a restraint.

Emerging Opportunities in RF Market for Fixed Wireless Access

The RF market for Fixed Wireless Access (FWA) presents numerous emerging opportunities driven by technological breakthroughs and evolving market needs. The expansion of 6G research and development promises even faster speeds and lower latency, creating a future demand for next-generation RF components. Strategic partnerships between FWA equipment manufacturers and RF component suppliers are crucial for co-developing integrated solutions that meet specific network requirements. Market expansion into developing economies, where high-speed internet access is a critical developmental need, offers significant untapped potential. The growing adoption of private 5G networks for industrial applications and smart cities also opens new avenues for FWA RF solutions, requiring robust and customized connectivity.

Leading Players in the RF Market for Fixed Wireless Access Sector

- Renesas Electronic Corporation

- Murata Manufacturing Co

- Microchip Technology Inc

- Texas Instruments

- Nokia Corporation

- STMicroelectronics Inc

- Skyworks Inc

- Amphenol Broadband Solutions

- Qorvo Inc

- Qualcomm Technologies Inc

- Airgain Inc

- Taiyo Yuden Co Ltd

- Analog Devices Inc

- Bridgewave Communications

- Ericsson

Key Milestones in RF Market for Fixed Wireless Access Industry

- February 2024: Qualcomm Technologies launched the Snapdragon X80 5G Modem-RF System, marking the seventh evolution in its 5G modem-to-antenna lineup. This system features a dedicated 5G AI Processor and a 5G-Advanced-ready architecture, enhancing FWA performance and capabilities.

- February 2024: Sivers Semiconductors AB unveiled its cutting-edge RF Module, the BFM02803, specifically designed for 5G FR2 mmWave bands (N257, N258, N261). This module is engineered for high-power Fixed Wireless Access applications, enabling product differentiation and supporting the mass production of FWA products with top-tier performance.

Strategic Outlook for RF Market for Fixed Wireless Access Market

The strategic outlook for the RF market for Fixed Wireless Access (FWA) is highly positive, driven by the relentless demand for faster and more ubiquitous broadband. Future growth will be accelerated by the continued evolution of 5G Advanced and the foundational groundwork for 6G technologies, requiring increasingly sophisticated RF components. Strategic opportunities lie in the development of highly integrated, cost-effective, and energy-efficient RF solutions that cater to both residential and enterprise FWA deployments. Collaboration between component manufacturers and network equipment providers will be key to unlocking synergistic innovations. Expansion into emerging markets and the growing adoption of private FWA networks for specialized industrial and IoT applications represent significant avenues for sustained market expansion and revenue growth.

RF Market for Fixed Wireless Access Segmentation

-

1. Radio

- 1.1. Transmit Module (PAM, MMMB PA, PAD, and LPAD)

- 1.2. Receive Module (FEM and LFEM)

- 1.3. Antenna in Package (AiP) and Beamformer

- 1.4. Filter

- 1.5. Discrete (Switch, LNA, PMIC, and Tuner)

RF Market for Fixed Wireless Access Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

RF Market for Fixed Wireless Access Regional Market Share

Geographic Coverage of RF Market for Fixed Wireless Access

RF Market for Fixed Wireless Access REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 29.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Penetration of Internet and Digital Services; Expansion of 5G Infrastructure

- 3.3. Market Restrains

- 3.3.1. Expansion of Broadband and Satellite Data Services

- 3.4. Market Trends

- 3.4.1. The Expansion of 5G Infrastructure to Support the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global RF Market for Fixed Wireless Access Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Radio

- 5.1.1. Transmit Module (PAM, MMMB PA, PAD, and LPAD)

- 5.1.2. Receive Module (FEM and LFEM)

- 5.1.3. Antenna in Package (AiP) and Beamformer

- 5.1.4. Filter

- 5.1.5. Discrete (Switch, LNA, PMIC, and Tuner)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Radio

- 6. North America RF Market for Fixed Wireless Access Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Radio

- 6.1.1. Transmit Module (PAM, MMMB PA, PAD, and LPAD)

- 6.1.2. Receive Module (FEM and LFEM)

- 6.1.3. Antenna in Package (AiP) and Beamformer

- 6.1.4. Filter

- 6.1.5. Discrete (Switch, LNA, PMIC, and Tuner)

- 6.1. Market Analysis, Insights and Forecast - by Radio

- 7. Europe RF Market for Fixed Wireless Access Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Radio

- 7.1.1. Transmit Module (PAM, MMMB PA, PAD, and LPAD)

- 7.1.2. Receive Module (FEM and LFEM)

- 7.1.3. Antenna in Package (AiP) and Beamformer

- 7.1.4. Filter

- 7.1.5. Discrete (Switch, LNA, PMIC, and Tuner)

- 7.1. Market Analysis, Insights and Forecast - by Radio

- 8. Asia RF Market for Fixed Wireless Access Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Radio

- 8.1.1. Transmit Module (PAM, MMMB PA, PAD, and LPAD)

- 8.1.2. Receive Module (FEM and LFEM)

- 8.1.3. Antenna in Package (AiP) and Beamformer

- 8.1.4. Filter

- 8.1.5. Discrete (Switch, LNA, PMIC, and Tuner)

- 8.1. Market Analysis, Insights and Forecast - by Radio

- 9. Australia and New Zealand RF Market for Fixed Wireless Access Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Radio

- 9.1.1. Transmit Module (PAM, MMMB PA, PAD, and LPAD)

- 9.1.2. Receive Module (FEM and LFEM)

- 9.1.3. Antenna in Package (AiP) and Beamformer

- 9.1.4. Filter

- 9.1.5. Discrete (Switch, LNA, PMIC, and Tuner)

- 9.1. Market Analysis, Insights and Forecast - by Radio

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Renesas Electronic Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Murata Manufacturing Co

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Microchip Technology Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Texas Instruments

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nokia Corporation*List Not Exhaustive 7 2 Vendor Market Share Analysi

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 STMicroelectronics Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Skyworks Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Amphenol Broadband Solutions

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Qorvo Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Qualcomm Technologies Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Airgain Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Taiyo Yuden Co Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Analog Devices Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Bridgewave Communications

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Ericsson

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Renesas Electronic Corporation

List of Figures

- Figure 1: Global RF Market for Fixed Wireless Access Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America RF Market for Fixed Wireless Access Revenue (Million), by Radio 2025 & 2033

- Figure 3: North America RF Market for Fixed Wireless Access Revenue Share (%), by Radio 2025 & 2033

- Figure 4: North America RF Market for Fixed Wireless Access Revenue (Million), by Country 2025 & 2033

- Figure 5: North America RF Market for Fixed Wireless Access Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe RF Market for Fixed Wireless Access Revenue (Million), by Radio 2025 & 2033

- Figure 7: Europe RF Market for Fixed Wireless Access Revenue Share (%), by Radio 2025 & 2033

- Figure 8: Europe RF Market for Fixed Wireless Access Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe RF Market for Fixed Wireless Access Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia RF Market for Fixed Wireless Access Revenue (Million), by Radio 2025 & 2033

- Figure 11: Asia RF Market for Fixed Wireless Access Revenue Share (%), by Radio 2025 & 2033

- Figure 12: Asia RF Market for Fixed Wireless Access Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia RF Market for Fixed Wireless Access Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand RF Market for Fixed Wireless Access Revenue (Million), by Radio 2025 & 2033

- Figure 15: Australia and New Zealand RF Market for Fixed Wireless Access Revenue Share (%), by Radio 2025 & 2033

- Figure 16: Australia and New Zealand RF Market for Fixed Wireless Access Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand RF Market for Fixed Wireless Access Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global RF Market for Fixed Wireless Access Revenue Million Forecast, by Radio 2020 & 2033

- Table 2: Global RF Market for Fixed Wireless Access Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global RF Market for Fixed Wireless Access Revenue Million Forecast, by Radio 2020 & 2033

- Table 4: Global RF Market for Fixed Wireless Access Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global RF Market for Fixed Wireless Access Revenue Million Forecast, by Radio 2020 & 2033

- Table 6: Global RF Market for Fixed Wireless Access Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global RF Market for Fixed Wireless Access Revenue Million Forecast, by Radio 2020 & 2033

- Table 8: Global RF Market for Fixed Wireless Access Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global RF Market for Fixed Wireless Access Revenue Million Forecast, by Radio 2020 & 2033

- Table 10: Global RF Market for Fixed Wireless Access Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the RF Market for Fixed Wireless Access?

The projected CAGR is approximately 29.80%.

2. Which companies are prominent players in the RF Market for Fixed Wireless Access?

Key companies in the market include Renesas Electronic Corporation, Murata Manufacturing Co, Microchip Technology Inc, Texas Instruments, Nokia Corporation*List Not Exhaustive 7 2 Vendor Market Share Analysi, STMicroelectronics Inc, Skyworks Inc, Amphenol Broadband Solutions, Qorvo Inc, Qualcomm Technologies Inc, Airgain Inc, Taiyo Yuden Co Ltd, Analog Devices Inc, Bridgewave Communications, Ericsson.

3. What are the main segments of the RF Market for Fixed Wireless Access?

The market segments include Radio.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Penetration of Internet and Digital Services; Expansion of 5G Infrastructure.

6. What are the notable trends driving market growth?

The Expansion of 5G Infrastructure to Support the Market's Growth.

7. Are there any restraints impacting market growth?

Expansion of Broadband and Satellite Data Services.

8. Can you provide examples of recent developments in the market?

February 2024: Qualcomm Technologies launched, the Snapdragon X80 5G Modem-RF System, marking the seventh evolution in its 5G modem-to-antenna lineup. Setting itself apart from its predecessors, the Snapdragon X80 boasts a dedicated 5G AI Processor and a 5G-Advanced-ready architecture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "RF Market for Fixed Wireless Access," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the RF Market for Fixed Wireless Access report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the RF Market for Fixed Wireless Access?

To stay informed about further developments, trends, and reports in the RF Market for Fixed Wireless Access, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence