Key Insights

The global Plasma Etching Equipment market is projected for substantial growth, valued at $8.03 billion in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 14.58% through 2033. This expansion is driven by the increasing demand for advanced semiconductor devices across consumer electronics, industrial automation, and medical technology. The miniaturization of integrated circuits requires precise etching processes, making plasma etching equipment essential. Advancements in Inductively Coupled Plasma (ICP) and Deep Reactive Ion Etching (DRIE) technologies are accelerating market adoption due to their superior etch profiles, enabling the fabrication of intricate microstructures for next-generation electronics and medical implants.

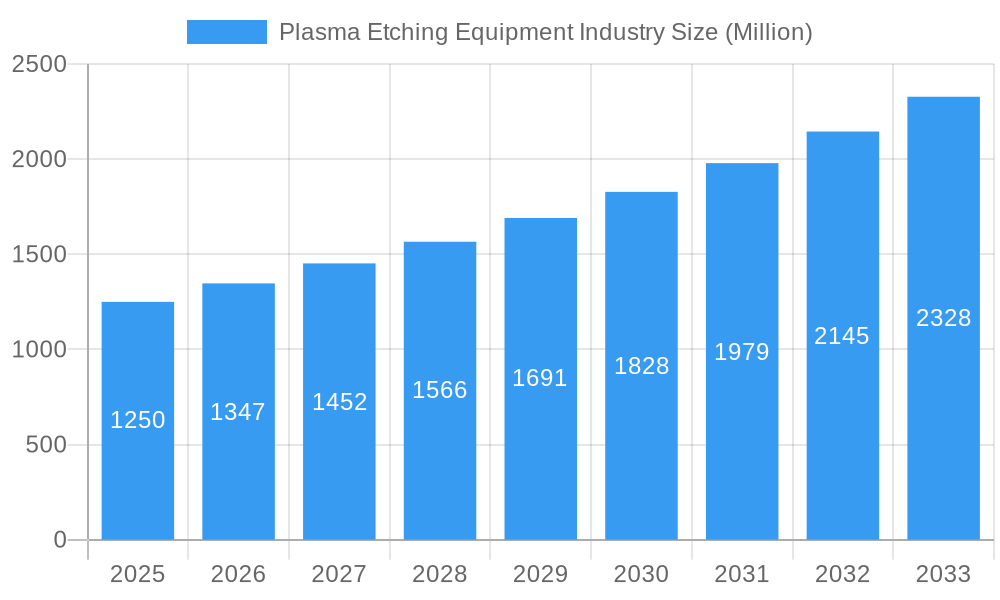

Plasma Etching Equipment Industry Market Size (In Billion)

Key restraints include the high capital investment for advanced systems and stringent environmental regulations. However, ongoing technological innovation and the need for higher yields and performance in semiconductor manufacturing are expected to mitigate these challenges. Leading companies such as Lam Research Corporation, Applied Materials Inc., and Tokyo Electron Limited are investing in R&D to deliver sophisticated and cost-effective solutions. Future market success depends on overcoming these obstacles through technological advancements and strategic expansion, particularly in regions with a strong focus on electronics manufacturing and R&D.

Plasma Etching Equipment Industry Company Market Share

This report provides an in-depth analysis of the global Plasma Etching Equipment market, forecasting significant growth from 2025 to 2033. Covering the historical period of 2019–2024 and the forecast period of 2025–2033, this study offers actionable insights for manufacturers, suppliers, investors, and end-users navigating the semiconductor manufacturing sector. The market is expected to reach billions of dollars, and this report examines market dynamics, emerging trends, key segments, and influential players shaping microchip fabrication.

Plasma Etching Equipment Industry Market Dynamics & Concentration

The global Plasma Etching Equipment market exhibits a moderately concentrated structure, with a few key players dominating a significant portion of the market share. Innovation is the primary driver, fueled by the relentless demand for smaller, faster, and more power-efficient semiconductor devices. Advancements in areas like Deep Reactive Ion Etching (DRIE) for 3D structures and improved plasma uniformity are critical. Regulatory frameworks, particularly concerning environmental impact and safety standards in manufacturing, influence equipment design and adoption. Product substitutes, while limited in terms of direct plasma etching capabilities, can arise from alternative fabrication techniques or shifts in end-user technology preferences. End-user trends, such as the burgeoning demand for AI, 5G, and IoT devices, directly propel the need for sophisticated plasma etching solutions. Merger and acquisition (M&A) activities are strategic, aimed at consolidating expertise, expanding product portfolios, and securing market share. For instance, KLA's acquisition of SPTS Technologies underscores this trend. The market has seen xx number of significant M&A deals in the historical period, contributing to the current market concentration. Market share for the top five players is estimated to be around 70 million.

Plasma Etching Equipment Industry Industry Trends & Analysis

The Plasma Etching Equipment industry is experiencing robust growth, largely driven by the exponential expansion of the semiconductor industry. The Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be around 7.5 million. This growth is underpinned by several critical factors. Firstly, the escalating demand for advanced integrated circuits (ICs) across diverse applications—from consumer electronics and automotive to industrial automation and artificial intelligence—necessitates cutting-edge etching capabilities. The continuous drive towards miniaturization and increased performance in semiconductors directly translates into a higher requirement for precise and efficient plasma etching processes. Technological disruptions are constant, with ongoing research and development focused on improving etch selectivity, reducing plasma damage, and enabling finer feature resolution. Innovations in plasma source design, process control, and wafer handling are crucial for meeting the stringent demands of next-generation chip architectures, such as those used in advanced processors and memory devices. Consumer preferences for more powerful, compact, and energy-efficient electronic devices also indirectly fuel the market, as manufacturers strive to meet these demands through advanced semiconductor manufacturing. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a race to develop equipment that can handle new materials and complex 3D structures. Market penetration of advanced etching technologies like ICP and DRIE is steadily increasing, driven by their superior performance in fabricating intricate semiconductor features. The market penetration for advanced etching techniques is expected to reach xx% by 2028.

Leading Markets & Segments in Plasma Etching Equipment Industry

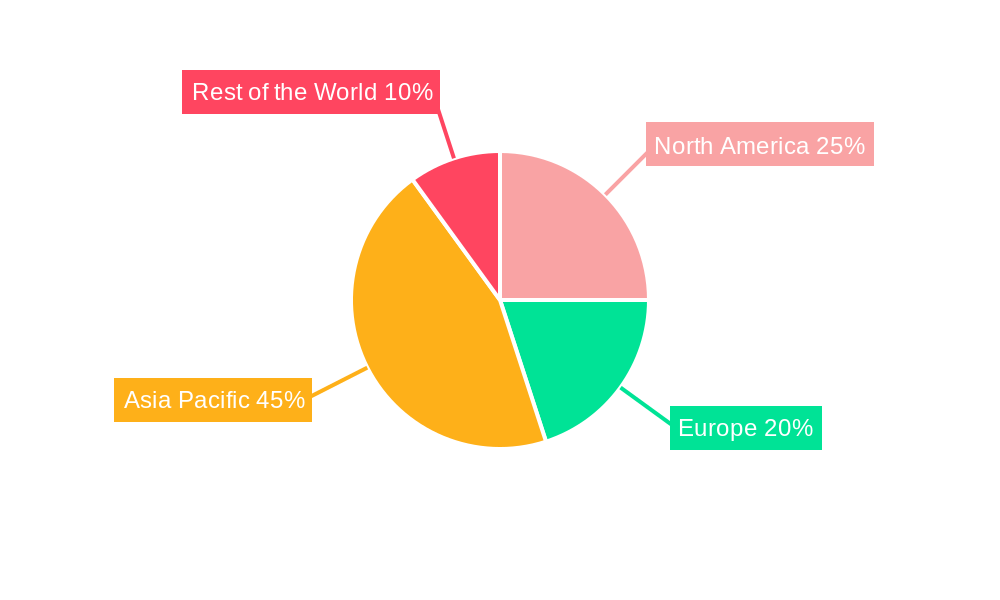

The Asia Pacific region is the dominant market for plasma etching equipment, primarily driven by the robust semiconductor manufacturing ecosystem in countries like Taiwan, South Korea, China, and Japan. Economic policies, government incentives for domestic semiconductor production, and the presence of major foundries and Integrated Device Manufacturers (IDMs) in this region are key economic policies fostering significant infrastructure development for chip manufacturing.

By Type:

- Deep Reactive Ion Etching (DRIE): This segment holds a significant market share due to its critical role in fabricating high-aspect-ratio structures essential for advanced memory, MEMS devices, and power semiconductors. The increasing complexity of chip designs, particularly for 3D NAND flash memory and advanced logic devices, makes DRIE indispensable. The growth in this segment is further propelled by its application in micro-electromechanical systems (MEMS) for sensors and actuators used in automotive and consumer electronics.

- Reactive Ion Etching (RIE): RIE remains a foundational etching technology, widely used for various patterning and etching applications in semiconductor fabrication. Its versatility and established reliability ensure its continued dominance in less demanding, high-volume manufacturing processes.

- Inductively Coupled Plasma Etching (ICP): ICP offers higher plasma densities and better control over ion energy, making it increasingly important for advanced logic and memory fabrication where precise etch profiles and damage control are paramount. The demand for high-resolution processing in advanced nodes is a key driver for ICP.

By Application:

- Consumer Electronics: This segment is the largest consumer of plasma etching equipment, driven by the insatiable global demand for smartphones, tablets, laptops, and other personal electronic devices. The constant need for smaller, faster, and more powerful chips directly translates into higher demand for advanced etching solutions.

- Industrial Applications: This rapidly growing segment includes applications in automotive electronics, industrial automation, telecommunications (5G infrastructure), and the Internet of Things (IoT). The increasing sophistication of electronic components in these sectors is a significant growth catalyst.

- Medical Applications: The medical device industry utilizes plasma etching for fabricating microfluidic devices, sensors, and implantable components. The growing demand for advanced diagnostics, minimally invasive surgical tools, and wearable health monitoring devices fuels this segment.

Plasma Etching Equipment Industry Product Developments

Recent product developments in the Plasma Etching Equipment industry highlight a strong focus on enhanced precision, throughput, and versatility. Companies are innovating to meet the demands of shrinking node sizes and novel materials. For instance, the introduction of tools like Lam Research Corporation's Syndion GP, designed for advanced power device manufacturing using DRIE, showcases the industry's commitment to enabling next-generation chip technologies. Similarly, Tokyo Electron's Impressio 2400 PICP Pro demonstrates advancements in processing large glass substrates for high-resolution applications. These developments are crucial for achieving competitive advantages by offering improved etch control, reduced defect rates, and the ability to handle complex 3D structures, directly addressing evolving semiconductor manufacturing needs. The market is projected to see continued investment in R&D for these advanced solutions.

Key Drivers of Plasma Etching Equipment Industry Growth

The Plasma Etching Equipment industry's growth is primarily propelled by the relentless advancement of semiconductor technology. The burgeoning demand for high-performance computing, artificial intelligence, 5G networks, and the Internet of Things (IoT) necessitates smaller, more complex, and more efficient integrated circuits, directly driving the need for sophisticated plasma etching solutions. Technological drivers include the ongoing miniaturization of transistors (Moore's Law), the transition to new materials like 2D materials, and the increasing adoption of 3D device architectures (e.g., FinFETs, Gate-All-Around FETs). Economic factors like substantial government investments in semiconductor manufacturing capabilities globally, particularly in Asia and North America, are also critical growth accelerators. Furthermore, the expansion of the electric vehicle (EV) market and the growing sophistication of automotive electronics are creating new avenues for demand.

Challenges in the Plasma Etching Equipment Industry Market

Despite robust growth, the Plasma Etching Equipment industry faces several challenges. The extreme complexity and high cost of developing and manufacturing these advanced systems create significant capital investment barriers. Stringent environmental regulations regarding the use and disposal of process gases and byproducts necessitate continuous investment in compliance and sustainable solutions. Supply chain disruptions, particularly for specialized components and raw materials, can impact production timelines and increase costs. Furthermore, the highly competitive landscape demands continuous innovation, requiring substantial R&D expenditure to stay ahead. The need for highly skilled personnel for operation and maintenance of these sophisticated tools also presents a challenge. The projected cost of new equipment is estimated to be upwards of $5 million per unit.

Emerging Opportunities in Plasma Etching Equipment Industry

Emerging opportunities in the Plasma Etching Equipment industry are abundant, driven by technological breakthroughs and market expansion strategies. The rapid growth of the AI sector, particularly in training complex neural networks, is creating unprecedented demand for high-performance processors and memory, requiring advanced etching capabilities. The increasing adoption of advanced packaging techniques also presents opportunities for specialized etching solutions. Furthermore, the development of novel materials for next-generation semiconductors, such as Gallium Nitride (GaN) and Silicon Carbide (SiC) for power electronics, opens up new markets for tailored etching equipment. Strategic partnerships between equipment manufacturers and semiconductor companies are crucial for co-developing solutions for future technology nodes and exploring new application areas like quantum computing.

Leading Players in the Plasma Etching Equipment Industry Sector

- Lam Research Corporation

- GigaLane Co Ltd

- SPTS Technologies (KLA company)

- Thierry Corporation

- Plasma Etch Inc

- Applied Materials Inc

- Plasma-Therm LLC

- Tokyo Electron Limited

- Oxford Instruments PLC

- Samco Inc

- Sentech Instruments GmbH

- Advanced Micro-Fabrication Equipment Inc

Key Milestones in Plasma Etching Equipment Industry Industry

- February 2022: Lam Research Corporation announced the Syndion GP, a new product designed to enable chipmakers to develop next-generation power management integrated circuits and power devices using deep silicon etch technology. According to the company, Syndion GP can provide good control of the plasma across the wafer by controlling the distribution of ions and radicals for the deep silicon etch (DRIE) process.

- December 2021: Tokyo Electron launched Impressio 2400 PICP Pro, a plasma etch system for processing 8th generation glass substrates featuring the new PICP Pro chamber for high-resolution processes.

Strategic Outlook for Plasma Etching Equipment Industry Market

The strategic outlook for the Plasma Etching Equipment industry is exceptionally positive, fueled by an intensifying global demand for advanced semiconductors. Key growth accelerators include the relentless pursuit of smaller node technologies, the proliferation of AI and 5G infrastructure, and the electrification of the automotive sector. Companies that can offer highly precise, efficient, and cost-effective etching solutions will be well-positioned for success. Strategic opportunities lie in expanding R&D investments in areas like atomic layer etching (ALE), innovative plasma source designs, and equipment capable of processing novel materials. Furthermore, forming strategic alliances with leading chip manufacturers to develop customized solutions for future technology nodes and emerging applications will be crucial for sustained market leadership. The market is expected to see significant technological advancements and strategic collaborations in the coming years.

Plasma Etching Equipment Industry Segmentation

-

1. Type

- 1.1. Reactive Ion Etching (RIE)

- 1.2. Inductively Coupled Plasma Etching (ICP)

- 1.3. Deep Reactive Ion Etching (DRIE)

- 1.4. Other Types

-

2. Application

- 2.1. Industrial Applications

- 2.2. Medical Applications

- 2.3. Consumer Electronics

- 2.4. Other Applications

Plasma Etching Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Plasma Etching Equipment Industry Regional Market Share

Geographic Coverage of Plasma Etching Equipment Industry

Plasma Etching Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Semiconductor Industry; Rising Demand for Compact and Energy Efficient Electronic Devices

- 3.3. Market Restrains

- 3.3.1. Growing Complexities Related to Miniaturized Structures of Circuits

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Segment to Drive the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Reactive Ion Etching (RIE)

- 5.1.2. Inductively Coupled Plasma Etching (ICP)

- 5.1.3. Deep Reactive Ion Etching (DRIE)

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial Applications

- 5.2.2. Medical Applications

- 5.2.3. Consumer Electronics

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Reactive Ion Etching (RIE)

- 6.1.2. Inductively Coupled Plasma Etching (ICP)

- 6.1.3. Deep Reactive Ion Etching (DRIE)

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Industrial Applications

- 6.2.2. Medical Applications

- 6.2.3. Consumer Electronics

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Reactive Ion Etching (RIE)

- 7.1.2. Inductively Coupled Plasma Etching (ICP)

- 7.1.3. Deep Reactive Ion Etching (DRIE)

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Industrial Applications

- 7.2.2. Medical Applications

- 7.2.3. Consumer Electronics

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Reactive Ion Etching (RIE)

- 8.1.2. Inductively Coupled Plasma Etching (ICP)

- 8.1.3. Deep Reactive Ion Etching (DRIE)

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Industrial Applications

- 8.2.2. Medical Applications

- 8.2.3. Consumer Electronics

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Reactive Ion Etching (RIE)

- 9.1.2. Inductively Coupled Plasma Etching (ICP)

- 9.1.3. Deep Reactive Ion Etching (DRIE)

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Industrial Applications

- 9.2.2. Medical Applications

- 9.2.3. Consumer Electronics

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Lam Research Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 GigaLane Co Ltd*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SPTS Technologies (KLA company)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Thierry Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Plasma Etch Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Applied Materials Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Plasma-Therm LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tokyo Electron Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Oxford Instruments PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Samco Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sentech Instruments GmbH

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Advanced Micro-Fabrication Equipment Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Lam Research Corporation

List of Figures

- Figure 1: Global Plasma Etching Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Plasma Etching Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Plasma Etching Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Plasma Etching Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Plasma Etching Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Plasma Etching Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Plasma Etching Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Plasma Etching Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Plasma Etching Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Plasma Etching Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Plasma Etching Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Plasma Etching Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Plasma Etching Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Plasma Etching Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Plasma Etching Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Plasma Etching Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Plasma Etching Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Plasma Etching Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Plasma Etching Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Plasma Etching Equipment Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Rest of the World Plasma Etching Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Plasma Etching Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Rest of the World Plasma Etching Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Plasma Etching Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Plasma Etching Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Plasma Etching Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plasma Etching Equipment Industry?

The projected CAGR is approximately 14.58%.

2. Which companies are prominent players in the Plasma Etching Equipment Industry?

Key companies in the market include Lam Research Corporation, GigaLane Co Ltd*List Not Exhaustive, SPTS Technologies (KLA company), Thierry Corporation, Plasma Etch Inc, Applied Materials Inc, Plasma-Therm LLC, Tokyo Electron Limited, Oxford Instruments PLC, Samco Inc, Sentech Instruments GmbH, Advanced Micro-Fabrication Equipment Inc.

3. What are the main segments of the Plasma Etching Equipment Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.03 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Semiconductor Industry; Rising Demand for Compact and Energy Efficient Electronic Devices.

6. What are the notable trends driving market growth?

Consumer Electronics Segment to Drive the Demand.

7. Are there any restraints impacting market growth?

Growing Complexities Related to Miniaturized Structures of Circuits.

8. Can you provide examples of recent developments in the market?

February 2022 - Lam Research Corporation, a plasma etch and deposition tool manufacturer, announced the Syndion GP, a new product designed to enable chipmakers to develop next-generation power management integrated circuits and power devices using deep silicon etch technology. According to the company, Syndion GP can provide good control of the plasma across the wafer by controlling the distribution of ions and radicals for the deep silicon etch (DRIE) process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plasma Etching Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plasma Etching Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plasma Etching Equipment Industry?

To stay informed about further developments, trends, and reports in the Plasma Etching Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence