Key Insights

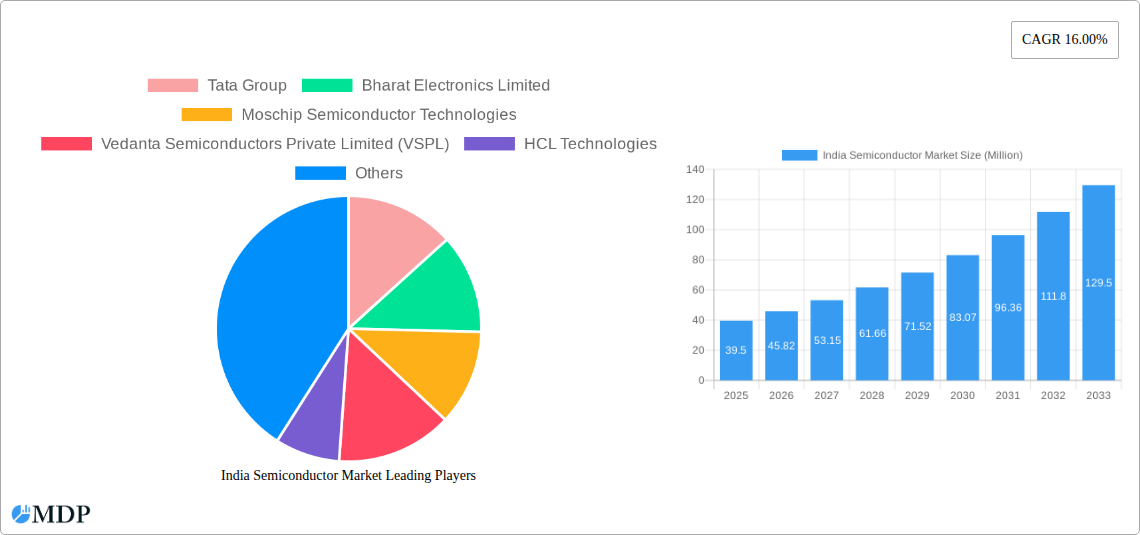

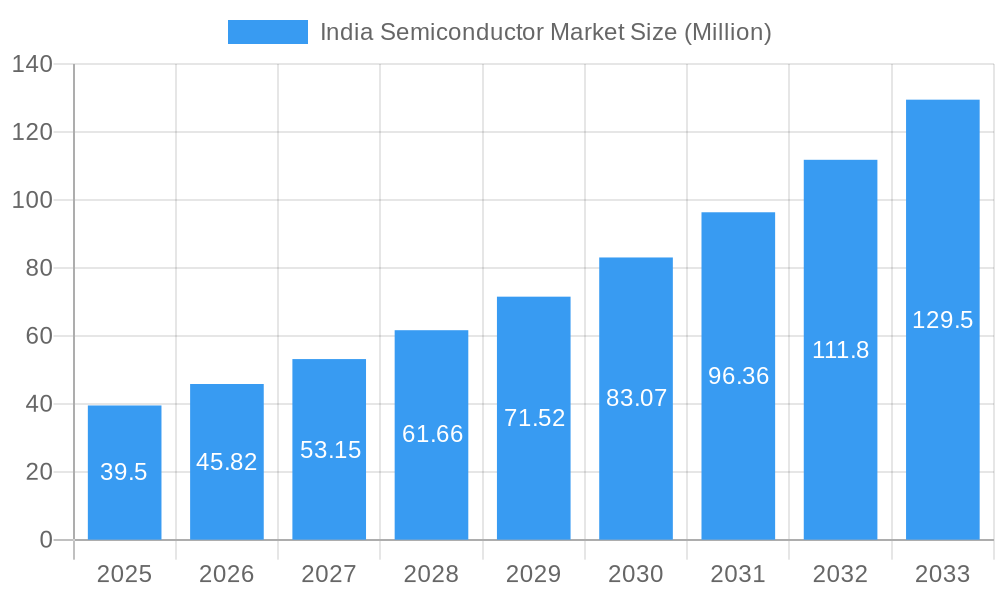

The India semiconductor market is poised for remarkable expansion, projected to reach an estimated market size of $39.5 million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 16.00% from 2019 to 2033. This impressive growth trajectory is fueled by a confluence of strategic government initiatives like the Production Linked Incentive (PLI) scheme for semiconductors and advanced chemistry cell batteries, alongside increasing domestic demand across various end-user industries. The "Make in India" initiative is further bolstering local manufacturing capabilities, attracting significant foreign investment and fostering a conducive ecosystem for semiconductor design, manufacturing, and assembly. Key drivers include the burgeoning electronics manufacturing sector, the rapid adoption of 5G technology, the expanding automotive industry's demand for sophisticated electronic components, and the ever-growing consumer electronics market. The sensors and actuators segment, along with integrated circuits (specifically microprocessors and memory chips), are expected to witness substantial demand, supporting the nation's digital transformation agenda.

India Semiconductor Market Market Size (In Million)

This dynamic growth is further shaped by prevailing trends such as the increasing focus on semiconductor research and development, the rise of fabless semiconductor companies, and the strategic partnerships being forged between Indian entities and global semiconductor giants. While the market presents immense opportunities, potential restraints such as the high capital expenditure required for establishing semiconductor fabrication plants (fabs), the global shortage of skilled talent, and the reliance on imported raw materials and specialized equipment need to be strategically addressed. The market is segmented across various semiconductor device types, including discrete semiconductors, optoelectronics, sensors and actuators, and a broad range of integrated circuits such as analog, micro, logic, and memory. End-user industries like computers, communication (wireline and wireless), automotive, and consumer electronics are major contributors to this market's expansion, with "Other" industries also playing a significant role. The competitive landscape is characterized by the presence of both domestic players like Tata Group and Bharat Electronics Limited, and international heavyweights such as Intel Corporation, Samsung Electronics, and Qualcomm Incorporated, all vying for a larger share in this burgeoning market.

India Semiconductor Market Company Market Share

Dive deep into the burgeoning Indian semiconductor landscape with this indispensable report. Uncover critical market dynamics, identify key growth drivers, and navigate the competitive terrain of one of the world's most promising semiconductor markets. This in-depth analysis, spanning the historical period of 2019–2024 and forecasting through 2033 with 2025 as the base and estimated year, provides actionable insights for investors, manufacturers, policymakers, and industry stakeholders.

India Semiconductor Market Market Dynamics & Concentration

The Indian semiconductor market is characterized by a moderate level of concentration, with a growing number of domestic and international players vying for market share. Innovation is a primary driver, fueled by government initiatives and increasing R&D investments aimed at fostering a robust domestic ecosystem. The regulatory framework, including the India Semiconductor Mission, is instrumental in providing incentives and establishing policies to attract foreign investment and promote local manufacturing. Product substitutes are emerging, particularly in areas like advanced packaging and system-on-chip (SoC) integration, challenging traditional semiconductor component dominance. End-user trends are shifting towards high-performance computing, AI-driven applications, and the rapidly expanding automotive and consumer electronics sectors, all demanding sophisticated semiconductor solutions. Merger and acquisition activities are on the rise as companies seek to consolidate their presence, acquire new technologies, and expand their manufacturing capabilities. Key M&A deals continue to shape the market's competitive structure, driving consolidation and fostering innovation. The market share distribution is influenced by the dominance of specific segments like Integrated Circuits, with key players holding significant portions of the market.

- Innovation Drivers: Government incentives, R&D investments, academic-industry collaborations, demand for advanced electronics.

- Regulatory Frameworks: India Semiconductor Mission, PLI schemes, FAME India scheme.

- Product Substitutes: Advanced packaging solutions, SoC integration, open-source hardware initiatives.

- End-User Trends: AI & Machine Learning, 5G deployment, IoT expansion, electric vehicles, smart devices.

- M&A Activities: Consolidation for technology acquisition, market expansion, and manufacturing capacity building.

India Semiconductor Market Industry Trends & Analysis

The Indian semiconductor industry is poised for exponential growth, driven by a confluence of strategic government policies, burgeoning domestic demand, and a burgeoning talent pool. The Semicon India Programme and its associated Production Linked Incentive (PLI) schemes are acting as significant catalysts, encouraging both foreign direct investment and domestic manufacturing capabilities. This has led to an anticipated Compound Annual Growth Rate (CAGR) of approximately 20% over the forecast period (2025–2033), with the market projected to reach several hundred billion USD by the end of the study period. Technological disruptions are rapidly transforming the industry, with a strong focus on next-generation semiconductor technologies such as AI-accelerated chips, advanced memory solutions, and low-power processors for the Internet of Things (IoT). Consumer preferences are increasingly leaning towards smart devices, wearable technology, and connected automotive solutions, all of which are heavily reliant on sophisticated semiconductor components. The competitive dynamics are intensifying, with global semiconductor giants establishing a significant presence in India, alongside the emergence of ambitious domestic players like the Tata Group and Vedanta Semiconductors Private Limited (VSPL). This vibrant ecosystem is fostering innovation and driving down costs, making India a crucial hub for semiconductor design, manufacturing, and assembly. Market penetration is expected to see a significant surge as local production ramps up and the adoption of advanced electronic devices becomes more widespread across various sectors.

Leading Markets & Segments in India Semiconductor Market

The Integrated Circuits (ICs) segment is the undisputed leader within the Indian semiconductor market, accounting for a substantial portion of the total market value. Within ICs, Microprocessors and Analog ICs are witnessing particularly robust growth due to the increasing demand from the computing, communication, and automotive industries. The Communication (Includes Wireline and Wireless) end-user industry is another dominant force, driven by the rapid expansion of 5G networks, increased smartphone penetration, and the growing adoption of IoT devices. The Automotive sector is rapidly emerging as a critical growth engine, fueled by the global shift towards electric vehicles (EVs) and the increasing integration of advanced driver-assistance systems (ADAS) and infotainment systems in modern vehicles.

Dominant Semiconductor Device Type:

- Integrated Circuits (ICs):

- Microprocessors & Logic ICs: Essential for computing, AI, and embedded systems.

- Analog ICs: Crucial for signal processing in communication, automotive, and industrial applications.

- Memory ICs: Driving demand for data storage in computers and mobile devices.

- Sensors and Actuators: Growing demand from automotive, industrial automation, and consumer electronics.

- Integrated Circuits (ICs):

Dominant End-user Industry:

- Communication (Includes Wireline and Wireless): Propelled by 5G deployment, expanding mobile networks, and IoT proliferation.

- Key Drivers: Government initiatives for digital India, increasing internet penetration, growing demand for connected devices.

- Automotive: Accelerated by the EV revolution and the adoption of advanced electronics.

- Key Drivers: Government incentives for EVs, increasing safety and convenience features, rise of connected car technology.

- Computer: Sustained by demand for personal computing, servers, and high-performance computing.

- Key Drivers: Digital transformation across industries, growth of cloud computing, demand for gaming and high-end PCs.

- Communication (Includes Wireline and Wireless): Propelled by 5G deployment, expanding mobile networks, and IoT proliferation.

India Semiconductor Market Product Developments

Product developments in the Indian semiconductor market are increasingly focused on energy-efficient AI chips, advanced memory solutions, and specialized analog and mixed-signal ICs. The emphasis is on catering to the burgeoning needs of the communication, automotive, and consumer electronics sectors. Innovations in low-power processors are critical for the proliferation of IoT devices, while advancements in high-performance computing architectures are supporting the growth of data centers and AI research. The competitive advantage lies in developing application-specific integrated circuits (ASICs) that offer tailored solutions for burgeoning Indian industries, ensuring optimal performance and cost-effectiveness.

Key Drivers of India Semiconductor Market Growth

The Indian semiconductor market's growth is propelled by a potent combination of factors. Government support and incentives through programs like the India Semiconductor Mission provide a fertile ground for investment and manufacturing. The vast and growing domestic market for electronics, driven by a young population and increasing disposable incomes, creates substantial demand for semiconductor components. Furthermore, India's strong talent pool in engineering and R&D fosters innovation and supports the development of cutting-edge semiconductor technologies. Strategic collaborations with global technology leaders are also accelerating the adoption of advanced manufacturing processes and design capabilities.

Challenges in the India Semiconductor Market Market

Despite the immense growth potential, the Indian semiconductor market faces several hurdles. High capital expenditure requirements for setting up and operating semiconductor fabrication plants are a significant barrier. Dependence on imported raw materials and specialized equipment poses a supply chain risk. Intense global competition from established semiconductor hubs with mature ecosystems requires continuous innovation and cost optimization. Furthermore, developing a highly skilled workforce at scale to meet the demands of advanced semiconductor manufacturing is an ongoing challenge. Regulatory complexities, though improving, can still present challenges for new entrants.

Emerging Opportunities in India Semiconductor Market

Several catalysts are driving long-term growth in the Indian semiconductor market. The increasing global demand for diversified supply chains presents a significant opportunity for India to emerge as a reliable manufacturing hub. The rapid advancements in AI, 5G, and IoT technologies are creating new market niches and demand for specialized semiconductor solutions. Strategic partnerships and joint ventures between Indian companies and global semiconductor giants are crucial for technology transfer and capacity building. Furthermore, the growing focus on electric vehicles and sustainable technologies opens up significant avenues for semiconductor innovation in power management and battery control systems.

Leading Players in the India Semiconductor Market Sector

- Tata Group

- Bharat Electronics Limited

- Moschip Semiconductor Technologies

- Vedanta Semiconductors Private Limited (VSPL)

- HCL Technologies

- ASM Technologies Ltd

- Applied Materials India Pvt Ltd

- Hon Hai Technology Group (Foxconn)

- Broadcom Inc

- NXP Semiconductors

- ROHM Semiconductor

- Infineon Technologies

- Renesas Electronics

- STMicroelectronics

- Powerchip Semiconductor Manufacturing Corp (PSMC)

- AMD Group

- Intel Corporation

- Samsung Electronics Co Ltd

- Qualcomm Incorporated

- Micron Technology Inc

- Texas Instruments Incorporated

- Mediatek Inc

Key Milestones in India Semiconductor Market Industry

- July 2024: AMD announced a partnership with the Society for Innovation and Entrepreneurship (SINE) at IIT Bombay. Through this collaboration, AMD will provide grants to startups incubated at IIT Bombay focused on developing energy-efficient Spiking Neural Network (SNN) chips. These startups will be working on innovative ways to decrease the energy consumption of traditional neural networks. As part of this partnership, Numelo Technologies was awarded the first grant to develop SNN chips using ultralow power quantum tunneling on silicon-on-insulator (SOI) technology.

- July 2024: Horiba, a Japanese analytical and measurement solutions company with a valuation of USD 2.5 billion, announced that it was considering establishing a unit in India. This facility aims to serve the needs of India's developing fabrication (fab) plants, OSAT (outsourced semiconductor assembly and test) companies, and ATMP (modified assembly, testing, marking, and packaging) players, as well as the expanding global market.

Strategic Outlook for India Semiconductor Market Market

The strategic outlook for the Indian semiconductor market is exceptionally bright, fueled by a proactive government vision and a rapidly expanding industrial base. Future growth will be accelerated by continued investments in advanced manufacturing capabilities, particularly in wafer fabrication and OSAT facilities, attracting substantial foreign direct investment. The focus on developing specialized semiconductor solutions for emerging technologies like AI, 5G, and electric vehicles will further solidify India's position in the global semiconductor value chain. Strategic alliances and a commitment to nurturing indigenous R&D will be crucial for fostering innovation and reducing dependency on foreign technology. The market's trajectory suggests a sustained period of high growth, positioning India as a critical player in the global semiconductor ecosystem.

India Semiconductor Market Segmentation

-

1. Semiconductor Device Type

- 1.1. Discrete Semiconductor

- 1.2. Optoelectronics

- 1.3. Sensors and Actuators

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Micro

- 1.4.3. Logic

- 1.4.4. Memory

-

2. End-user Industry

- 2.1. Computer

- 2.2. Communication (Includes Wireline and Wireless)

- 2.3. Automotive

- 2.4. Consumer

- 2.5. Other En

India Semiconductor Market Segmentation By Geography

- 1. India

India Semiconductor Market Regional Market Share

Geographic Coverage of India Semiconductor Market

India Semiconductor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Automotive Industry and EV Demand; Smartphone and Consumer Electronics Demand Growth; Growing Telecom Infrastructure Augmented by 5G and Fixed Internet Connections

- 3.3. Market Restrains

- 3.3.1. Growing Automotive Industry and EV Demand; Smartphone and Consumer Electronics Demand Growth; Growing Telecom Infrastructure Augmented by 5G and Fixed Internet Connections

- 3.4. Market Trends

- 3.4.1. The Sensors and Actuators Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Semiconductor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Semiconductor Device Type

- 5.1.1. Discrete Semiconductor

- 5.1.2. Optoelectronics

- 5.1.3. Sensors and Actuators

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Micro

- 5.1.4.3. Logic

- 5.1.4.4. Memory

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Computer

- 5.2.2. Communication (Includes Wireline and Wireless)

- 5.2.3. Automotive

- 5.2.4. Consumer

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Semiconductor Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tata Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bharat Electronics Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Moschip Semiconductor Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vedanta Semiconductors Private Limited (VSPL)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HCL Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ASM Technologies Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Applied Materials India Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hon Hai Technology Group (Foxconn)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Broadcom Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NXP Semiconductors

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ROHM Semiconductor

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Infineon Technologies

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Renesas Electronics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 STMicroelectronics

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Powerchip Semiconductor Manufacturing Corp (PSMC)

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 AMD Group

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Intel Corporation

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Samsung Electronics Co Ltd

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Qualcomm Incorporated

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Micron Technology Inc

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Texas Instruments Incorporated

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Mediatek Inc

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.1 Tata Group

List of Figures

- Figure 1: India Semiconductor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Semiconductor Market Share (%) by Company 2025

List of Tables

- Table 1: India Semiconductor Market Revenue Million Forecast, by Semiconductor Device Type 2020 & 2033

- Table 2: India Semiconductor Market Volume Billion Forecast, by Semiconductor Device Type 2020 & 2033

- Table 3: India Semiconductor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: India Semiconductor Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: India Semiconductor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Semiconductor Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: India Semiconductor Market Revenue Million Forecast, by Semiconductor Device Type 2020 & 2033

- Table 8: India Semiconductor Market Volume Billion Forecast, by Semiconductor Device Type 2020 & 2033

- Table 9: India Semiconductor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: India Semiconductor Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: India Semiconductor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Semiconductor Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Semiconductor Market?

The projected CAGR is approximately 16.00%.

2. Which companies are prominent players in the India Semiconductor Market?

Key companies in the market include Tata Group, Bharat Electronics Limited, Moschip Semiconductor Technologies, Vedanta Semiconductors Private Limited (VSPL), HCL Technologies, ASM Technologies Ltd, Applied Materials India Pvt Ltd, Hon Hai Technology Group (Foxconn), Broadcom Inc, NXP Semiconductors, ROHM Semiconductor, Infineon Technologies, Renesas Electronics, STMicroelectronics, Powerchip Semiconductor Manufacturing Corp (PSMC), AMD Group, Intel Corporation, Samsung Electronics Co Ltd, Qualcomm Incorporated, Micron Technology Inc, Texas Instruments Incorporated, Mediatek Inc.

3. What are the main segments of the India Semiconductor Market?

The market segments include Semiconductor Device Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Automotive Industry and EV Demand; Smartphone and Consumer Electronics Demand Growth; Growing Telecom Infrastructure Augmented by 5G and Fixed Internet Connections.

6. What are the notable trends driving market growth?

The Sensors and Actuators Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Growing Automotive Industry and EV Demand; Smartphone and Consumer Electronics Demand Growth; Growing Telecom Infrastructure Augmented by 5G and Fixed Internet Connections.

8. Can you provide examples of recent developments in the market?

July 2024: AMD announced a partnership with the Society for Innovation and Entrepreneurship (SINE) at IIT Bombay. Through this collaboration, AMD will provide grants to startups incubated at IIT Bombay focused on developing energy-efficient Spiking Neural Network (SNN) chips. These startups will be working on innovative ways to decrease the energy consumption of traditional neural networks. As part of this partnership, Numelo Technologies was awarded the first grant to develop SNN chips using ultralow power quantum tunneling on silicon-on-insulator (SOI) technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Semiconductor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Semiconductor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Semiconductor Market?

To stay informed about further developments, trends, and reports in the India Semiconductor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence