Key Insights

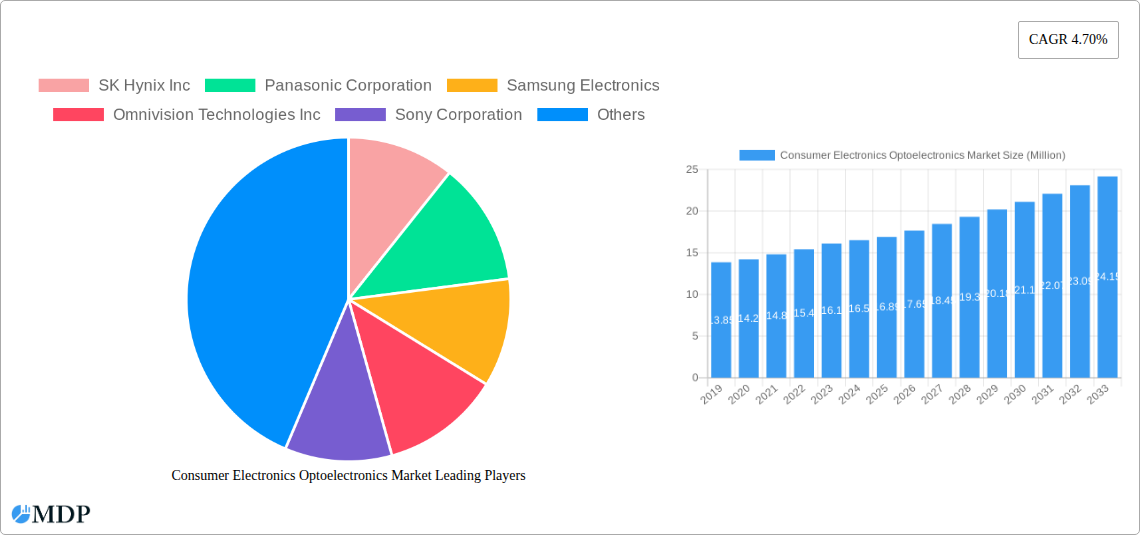

The global consumer electronics optoelectronics market is poised for robust growth, estimated at USD 16.89 billion, with a projected Compound Annual Growth Rate (CAGR) of 4.70% from 2025 through 2033. This expansion is driven by the increasing integration of advanced optoelectronic components across a wide array of consumer devices, including smartphones, televisions, wearables, and home appliances. Key demand drivers include the relentless pursuit of enhanced visual experiences through higher resolution displays powered by LED and Laser Diode technologies, and the miniaturization of sophisticated functionalities enabled by Image Sensors and Optocouplers. The burgeoning popularity of smart home ecosystems and the Internet of Things (IoT) further bolsters this market, as optoelectronic devices are critical for sensing, communication, and human-machine interfaces within these connected environments. Furthermore, the growing adoption of energy-efficient lighting solutions, particularly those leveraging advanced LED technologies, is a significant contributor to market momentum.

Consumer Electronics Optoelectronics Market Market Size (In Million)

The market's trajectory is also shaped by several emerging trends, including the proliferation of flexible and transparent displays, the advancement of micro-LED technology for premium display applications, and the increasing use of image sensors in augmented reality (AR) and virtual reality (VR) devices. Innovations in optocoupler technology are enabling greater power efficiency and signal integrity in complex electronic circuits within consumer products. While the market enjoys substantial growth, certain restraints, such as the high cost associated with cutting-edge optoelectronic component manufacturing and the ongoing supply chain volatilities for critical raw materials, warrant careful consideration. However, the continuous innovation by leading companies such as Samsung Electronics, Sony Corporation, and Omnivision Technologies Inc., coupled with the expanding application landscape, ensures a dynamic and evolving market. The dominance of regions like Asia Pacific, particularly China and South Korea, is expected to continue, owing to their strong manufacturing capabilities and high consumer demand for the latest electronic gadgets.

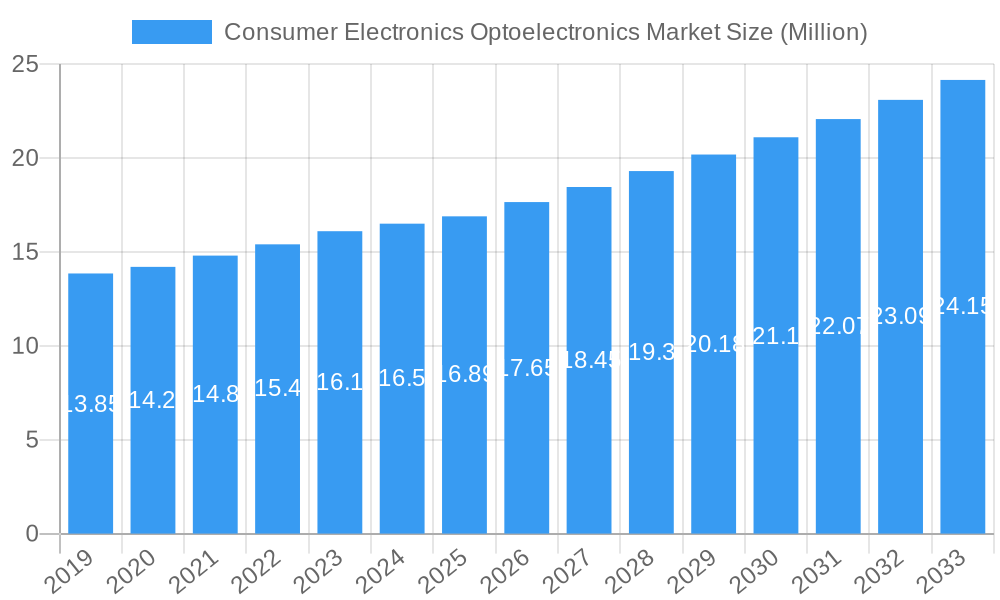

Consumer Electronics Optoelectronics Market Company Market Share

Consumer Electronics Optoelectronics Market: Comprehensive Analysis & Future Outlook (2019–2033)

Report Description:

This in-depth market research report provides a comprehensive analysis of the Consumer Electronics Optoelectronics Market, offering critical insights into market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, and emerging opportunities. Spanning the historical period of 2019–2024 and a forecast period of 2025–2033, with 2025 as the base and estimated year, this report leverages high-traffic keywords like "consumer electronics," "optoelectronics market," "LED market," "image sensors," "laser diodes," and "semiconductor technology" to maximize search visibility. It is an indispensable resource for industry stakeholders including manufacturers, suppliers, investors, and market researchers seeking to understand the evolving landscape of optoelectronic components powering consumer devices. Gain actionable intelligence on market concentration, technological advancements, regulatory impacts, and competitive strategies shaping the future of this dynamic sector.

Consumer Electronics Optoelectronics Market Market Dynamics & Concentration

The Consumer Electronics Optoelectronics Market is characterized by a moderate to high concentration, with a few dominant players holding significant market share in specific product segments. Innovation drivers are paramount, fueled by relentless demand for enhanced performance, miniaturization, and energy efficiency in consumer devices. Key advancements in LED technology for displays and lighting, the rapid evolution of image sensors for smartphones and cameras, and the growing adoption of laser diodes in applications like LiDAR and AR/VR are reshaping the competitive landscape. Regulatory frameworks, particularly concerning energy efficiency standards and the restriction of hazardous substances, play a crucial role in product development and market entry. Product substitutes, while present in some niche applications, are generally outpaced by the rapid technological evolution of optoelectronic components. End-user trends, driven by consumer desire for immersive experiences, high-resolution imaging, and smart functionalities, are significantly influencing product roadmaps. Mergers and acquisitions (M&A) activities are observed as companies seek to consolidate market positions, acquire new technologies, and expand their product portfolios. For instance, in the historical period, there have been approximately 15-20 significant M&A deals, reflecting strategic consolidation. Key players like Samsung Electronics and Sony Corporation often lead in market share for image sensors, while companies like Signify Holding dominate the LED lighting segment.

Consumer Electronics Optoelectronics Market Industry Trends & Analysis

The Consumer Electronics Optoelectronics Market is experiencing robust growth, propelled by several interlocking trends and technological disruptions. The ever-increasing demand for high-performance consumer electronics, ranging from advanced smartphones and wearables to sophisticated home entertainment systems and smart home devices, acts as a primary growth engine. The ubiquitous integration of sophisticated imaging capabilities in devices like smartphones and digital cameras, for example, has led to a surge in the image sensor market, driving innovation in resolution, low-light performance, and advanced imaging features such as AI-powered scene recognition. The global Compound Annual Growth Rate (CAGR) for the overall optoelectronics market is projected to be around 10-12% during the forecast period.

Technological disruptions are a constant feature, with ongoing advancements in semiconductor fabrication processes enabling smaller, more power-efficient, and higher-performing optoelectronic components. The evolution of micro-LED technology for displays promises superior brightness, contrast, and energy efficiency, positioning it as a potential successor to OLED in premium consumer electronics. Similarly, the development of more compact and powerful laser diodes is expanding their applications beyond traditional uses, into areas like augmented reality (AR) and virtual reality (VR) headsets, as well as advanced optical communication modules within consumer devices.

Consumer preferences are increasingly shifting towards personalized and immersive experiences. This translates into a demand for richer visual content, enhanced interactivity, and seamless connectivity, all of which rely heavily on advanced optoelectronic solutions. The growing adoption of smartphones with multiple camera modules, each serving a distinct purpose (e.g., wide-angle, telephoto, macro), underscores this trend. The market penetration of high-definition displays and 4K/8K content is also a significant driver for advanced display technologies.

Competitive dynamics within the market are intense, characterized by fierce R&D investments, strategic partnerships, and a continuous race to introduce next-generation products. Companies are heavily investing in proprietary technologies and intellectual property to maintain their competitive edge. The increasing commoditization of certain optoelectronic components, such as standard LEDs, also intensifies price competition, pushing players to differentiate through higher value-added products and integrated solutions. The market penetration of advanced optoelectronic features in mid-range and even budget consumer electronics is also expanding, democratizing access to these technologies.

Leading Markets & Segments in Consumer Electronics Optoelectronics Market

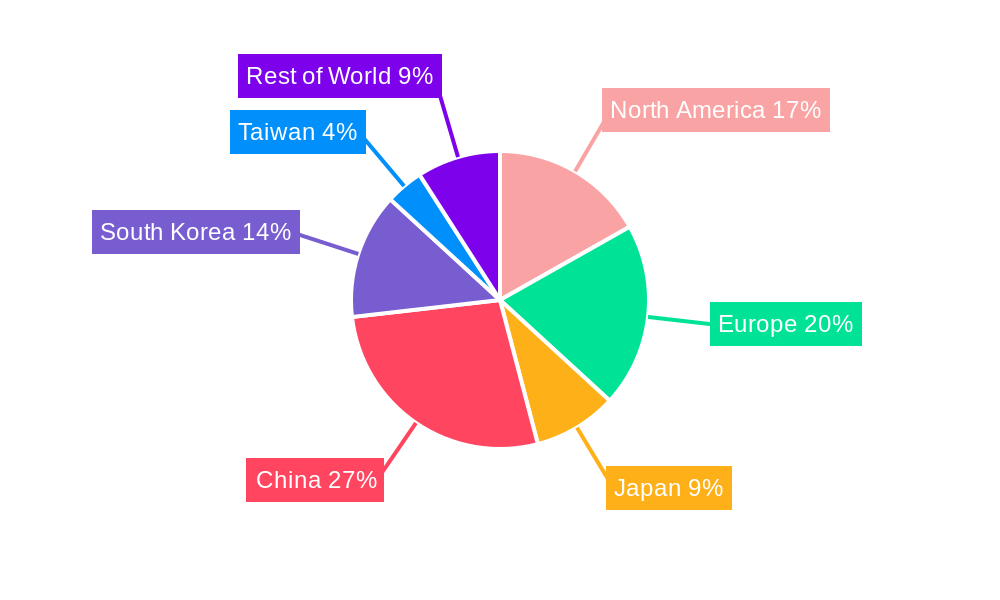

The Consumer Electronics Optoelectronics Market is dominated by several key regions and product segments, each driven by distinct economic policies and infrastructure development.

Dominant Segments by Device Type:

Image Sensors: This segment holds a significant share of the market, driven by the insatiable demand for high-quality imaging capabilities in smartphones, digital cameras, and increasingly, in automotive and industrial applications that overlap with consumer electronics. The rapid evolution of smartphone photography, with multi-camera systems and advanced computational photography, fuels continuous innovation and market growth. Economic policies that encourage R&D in semiconductor manufacturing and the availability of skilled labor in regions like East Asia contribute to the dominance of this segment. For example, government incentives for advanced manufacturing in countries like South Korea and Taiwan bolster the production of cutting-edge image sensors.

LED (Light Emitting Diodes): LEDs are foundational components in a vast array of consumer electronics, from backlighting for displays (TVs, monitors, smartphones) to general lighting solutions and indicator lights. The transition to energy-efficient lighting, coupled with the adoption of advanced display technologies like QLED and Mini-LED, ensures the continued dominance of this segment. Infrastructure development related to smart grids and smart home ecosystems further amplifies the demand for LED solutions. The economic focus on sustainability and energy conservation globally directly supports the growth of the LED market.

Laser Diodes: While perhaps a smaller segment in terms of volume compared to LEDs and image sensors, laser diodes are experiencing rapid growth due to their critical role in emerging consumer technologies. Applications such as LiDAR for autonomous driving features in premium vehicles, 3D sensing in smartphones, laser projectors for home entertainment, and components for AR/VR devices are driving significant market expansion. Investments in advanced materials and photonics research are key economic drivers, particularly in regions with strong R&D ecosystems.

Leading Geographical Markets:

Asia-Pacific: This region is the undisputed leader in both the production and consumption of consumer electronics optoelectronics. Countries like China, South Korea, Japan, and Taiwan are home to major manufacturers of semiconductors, displays, and finished consumer goods. Strong manufacturing capabilities, a vast domestic consumer base, favorable government policies supporting the tech industry, and robust supply chains contribute to Asia-Pacific's dominance. Extensive infrastructure, including advanced logistics and connectivity, further facilitates market growth. The region accounts for approximately 60-65% of the global market share.

North America: While a significant consumer market, North America also boasts substantial R&D capabilities and a growing ecosystem for advanced optoelectronics, particularly in areas like image sensors for specialized applications and laser diode technology for emerging fields. Economic policies that foster innovation and investment in high-tech industries, alongside a strong demand for premium consumer electronics, drive market growth in this region.

Consumer Electronics Optoelectronics Market Product Developments

Recent product developments highlight the relentless pursuit of enhanced functionality and performance in the Consumer Electronics Optoelectronics Market. OMNIVISION's unveiling of the OV50K40 smartphone image sensor, powered by TheiaCel technology, exemplifies this trend. This sensor's ability to achieve human-eye-like dynamic range in a single exposure is a significant leap forward, promising to redefine photography in flagship smartphones by delivering unparalleled image quality, especially in challenging lighting conditions. Concurrently, the strategic shift by Onsemi to commence internal production of CMOS image sensors signifies a move towards greater control over manufacturing processes and potentially faster innovation cycles. These advancements underscore the market's focus on image capture excellence, pushing the boundaries of what's possible in mobile photography and videography.

Key Drivers of Consumer Electronics Optoelectronics Market Growth

The Consumer Electronics Optoelectronics Market is propelled by a confluence of powerful drivers. Technological Advancements in semiconductor miniaturization, material science, and optical engineering are continuously enabling smaller, more powerful, and energy-efficient optoelectronic components. The growing consumer demand for enhanced visual experiences, including higher resolution displays, superior camera capabilities in smartphones, and immersive AR/VR technologies, is a primary catalyst. Falling production costs due to economies of scale and improved manufacturing processes make these advanced components more accessible to a broader consumer base. Furthermore, government initiatives promoting innovation and digital transformation in various economies provide a supportive environment for R&D and market expansion. For example, subsidies for semiconductor manufacturing and investments in 5G infrastructure indirectly boost the demand for optoelectronic components.

Challenges in the Consumer Electronics Optoelectronics Market Market

Despite its robust growth, the Consumer Electronics Optoelectronics Market faces several significant challenges. Intense competition and price erosion in commoditized segments can squeeze profit margins for manufacturers. Rapid technological obsolescence necessitates continuous and substantial R&D investment, posing a financial burden, especially for smaller players. Supply chain disruptions, as witnessed in recent years due to geopolitical events and raw material shortages, can lead to production delays and increased costs. Stringent regulatory compliance, particularly concerning environmental standards and product safety, adds complexity and cost to product development. For example, the constant evolution of energy efficiency standards for displays and lighting requires ongoing product redesign. The market also contends with the ever-increasing cost of R&D for next-generation technologies, such as micro-LED and advanced photonics, which require massive capital outlay.

Emerging Opportunities in Consumer Electronics Optoelectronics Market

The Consumer Electronics Optoelectronics Market is ripe with emerging opportunities driven by disruptive technologies and evolving consumer behaviors. The proliferation of the Internet of Things (IoT) is creating demand for a wide array of optoelectronic sensors and communication modules for smart home devices, wearables, and connected appliances. The expansion of AR/VR technologies presents a significant opportunity for high-performance displays, spatial sensors, and advanced laser diode applications. The increasing integration of AI and machine learning into consumer devices further drives the need for sophisticated image sensors and processing capabilities. Strategic partnerships between optoelectronics manufacturers and consumer electronics giants, focused on co-development and integration, are key to unlocking new market segments. Furthermore, the growing emphasis on sustainable and energy-efficient solutions opens avenues for innovative optoelectronic components that contribute to a greener future.

Leading Players in the Consumer Electronics Optoelectronics Market Sector

- SK Hynix Inc

- Panasonic Corporation

- Samsung Electronics

- Omnivision Technologies Inc

- Sony Corporation

- Ams Osram AG

- Signify Holding

- Vishay Intertechnology Inc

- Texas Instruments Inc

- LITE-ON Technology Corporation

- Rohm Company Limited

- Mitsubishi Electric Corporation

- Broadcom Inc

- Sharp Corporation

Key Milestones in Consumer Electronics Optoelectronics Market Industry

- March 2024: OMNIVISION unveiled the OV50K40, a cutting-edge smartphone image sensor utilizing TheiaCel technology. This innovation delivers human-eye-comparable dynamic range in a single exposure, setting a new benchmark for flagship rear-facing main cameras.

- November 2023: Onsemi announced a strategic decision to commence internal production of CMOS image sensors (CIS) in 2024, marking a significant shift from its previous reliance on external manufacturing partners.

Strategic Outlook for Consumer Electronics Optoelectronics Market Market

The strategic outlook for the Consumer Electronics Optoelectronics Market is exceptionally bright, fueled by continued innovation and expanding applications. The market will witness accelerated adoption of advanced technologies like Micro-LEDs for premium displays and further integration of sophisticated AI-powered image sensors in a wider range of consumer devices. Growth accelerators include the pervasive expansion of 5G infrastructure, which necessitates higher-performing optoelectronic components for seamless connectivity and data transfer. Strategic opportunities lie in leveraging miniaturization trends for wearables and IoT devices, as well as developing cost-effective solutions for emerging markets. Furthermore, the growing emphasis on augmented and virtual reality applications will drive demand for specialized laser diodes and high-resolution displays, paving the way for significant future market expansion.

Consumer Electronics Optoelectronics Market Segmentation

-

1. Device Type

- 1.1. LED

- 1.2. Laser Diode

- 1.3. Image Sensors

- 1.4. Optocouplers

- 1.5. Photovoltaic cells

- 1.6. Other Device Types

Consumer Electronics Optoelectronics Market Segmentation By Geography

- 1. United States

- 2. Europe

- 3. Japan

- 4. China

- 5. South Korea

- 6. Taiwan

Consumer Electronics Optoelectronics Market Regional Market Share

Geographic Coverage of Consumer Electronics Optoelectronics Market

Consumer Electronics Optoelectronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Demand for 5G Smartphones

- 3.2.2 and Laptops; Technology Advancements

- 3.2.3 and AI Developments will Drive the Growth

- 3.3. Market Restrains

- 3.3.1 Growing Demand for 5G Smartphones

- 3.3.2 and Laptops; Technology Advancements

- 3.3.3 and AI Developments will Drive the Growth

- 3.4. Market Trends

- 3.4.1. Image Sensors are Expected to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. LED

- 5.1.2. Laser Diode

- 5.1.3. Image Sensors

- 5.1.4. Optocouplers

- 5.1.5. Photovoltaic cells

- 5.1.6. Other Device Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Europe

- 5.2.3. Japan

- 5.2.4. China

- 5.2.5. South Korea

- 5.2.6. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. United States Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. LED

- 6.1.2. Laser Diode

- 6.1.3. Image Sensors

- 6.1.4. Optocouplers

- 6.1.5. Photovoltaic cells

- 6.1.6. Other Device Types

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. LED

- 7.1.2. Laser Diode

- 7.1.3. Image Sensors

- 7.1.4. Optocouplers

- 7.1.5. Photovoltaic cells

- 7.1.6. Other Device Types

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Japan Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. LED

- 8.1.2. Laser Diode

- 8.1.3. Image Sensors

- 8.1.4. Optocouplers

- 8.1.5. Photovoltaic cells

- 8.1.6. Other Device Types

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. China Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. LED

- 9.1.2. Laser Diode

- 9.1.3. Image Sensors

- 9.1.4. Optocouplers

- 9.1.5. Photovoltaic cells

- 9.1.6. Other Device Types

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. South Korea Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. LED

- 10.1.2. Laser Diode

- 10.1.3. Image Sensors

- 10.1.4. Optocouplers

- 10.1.5. Photovoltaic cells

- 10.1.6. Other Device Types

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Taiwan Consumer Electronics Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 11.1.1. LED

- 11.1.2. Laser Diode

- 11.1.3. Image Sensors

- 11.1.4. Optocouplers

- 11.1.5. Photovoltaic cells

- 11.1.6. Other Device Types

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 SK Hynix Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Panasonic Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Samsung Electronics

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Omnivision Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Sony Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Ams Osram AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Signify Holding

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Vishay Intertechnology Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Texas Instruments Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 LITE-ON Technology Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Rohm Company Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Mitsubishi Electric Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Broadcom Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Sharp Corporatio

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 SK Hynix Inc

List of Figures

- Figure 1: Global Consumer Electronics Optoelectronics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Consumer Electronics Optoelectronics Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 4: United States Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 5: United States Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: United States Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 7: United States Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 8: United States Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 9: United States Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United States Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 12: Europe Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 13: Europe Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 14: Europe Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 15: Europe Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Japan Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 20: Japan Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 21: Japan Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 22: Japan Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 23: Japan Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Japan Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Japan Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: China Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 28: China Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 29: China Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 30: China Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 31: China Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 32: China Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 33: China Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: China Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South Korea Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 36: South Korea Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 37: South Korea Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 38: South Korea Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 39: South Korea Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South Korea Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 41: South Korea Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South Korea Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Taiwan Consumer Electronics Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 44: Taiwan Consumer Electronics Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 45: Taiwan Consumer Electronics Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 46: Taiwan Consumer Electronics Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 47: Taiwan Consumer Electronics Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Taiwan Consumer Electronics Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Taiwan Consumer Electronics Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Taiwan Consumer Electronics Optoelectronics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 3: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 6: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 7: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 10: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 11: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 14: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 15: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 18: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 19: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 22: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 23: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 26: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 27: Global Consumer Electronics Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Consumer Electronics Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Electronics Optoelectronics Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Consumer Electronics Optoelectronics Market?

Key companies in the market include SK Hynix Inc, Panasonic Corporation, Samsung Electronics, Omnivision Technologies Inc, Sony Corporation, Ams Osram AG, Signify Holding, Vishay Intertechnology Inc, Texas Instruments Inc, LITE-ON Technology Corporation, Rohm Company Limited, Mitsubishi Electric Corporation, Broadcom Inc, Sharp Corporatio.

3. What are the main segments of the Consumer Electronics Optoelectronics Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for 5G Smartphones. and Laptops; Technology Advancements. and AI Developments will Drive the Growth.

6. What are the notable trends driving market growth?

Image Sensors are Expected to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Growing Demand for 5G Smartphones. and Laptops; Technology Advancements. and AI Developments will Drive the Growth.

8. Can you provide examples of recent developments in the market?

March 2024: OMNIVISION, a prominent global semiconductor solutions developer, unveiled its latest innovation, the OV50K40. This cutting-edge smartphone image sensor, powered by TheiaCel technology, achieves a high dynamic range (HDR) comparable to the human eye in a single exposure. The OV50K40 is poised to redefine industry standards, particularly for flagship rear-facing main cameras.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Consumer Electronics Optoelectronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Consumer Electronics Optoelectronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Consumer Electronics Optoelectronics Market?

To stay informed about further developments, trends, and reports in the Consumer Electronics Optoelectronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence