Key Insights

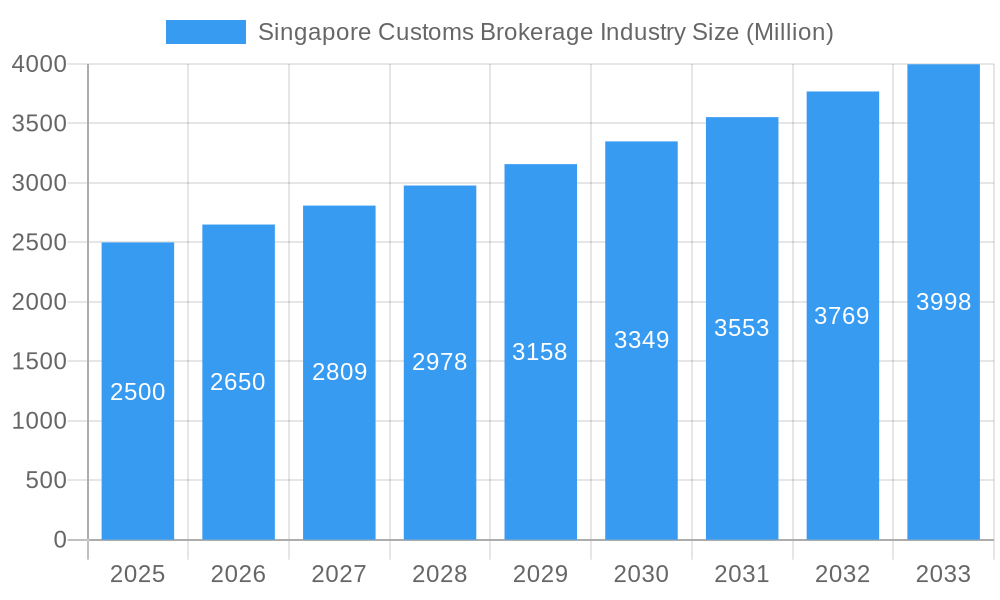

The Singapore customs brokerage industry, exhibiting a robust Compound Annual Growth Rate (CAGR) exceeding 6%, presents a lucrative market opportunity. Driven by Singapore's strategic location as a global trade hub and its commitment to facilitating seamless cross-border commerce, the industry is experiencing significant expansion. The increasing volume of international trade, coupled with the rising complexity of customs regulations and the need for specialized expertise, fuels demand for efficient and reliable customs brokerage services. Growth is particularly strong in segments involving air and sea freight, reflecting Singapore's prominence as a major air and seaport. The industry is also witnessing a surge in cross-border land transport due to increased regional trade within Southeast Asia. Major players like DHL, FedEx, UPS, and Kuehne + Nagel dominate the market, leveraging their extensive global networks and technological capabilities. However, smaller, specialized firms are also thriving by catering to niche market segments and offering customized solutions. While regulatory changes and economic fluctuations pose potential challenges, the overall outlook for the Singapore customs brokerage industry remains positive, projected to maintain its strong growth trajectory throughout the forecast period (2025-2033). The industry is likely to see further consolidation as larger players seek to expand their market share through acquisitions and strategic partnerships. Technological advancements, such as automation and digitalization of customs processes, are expected to further enhance efficiency and transparency, driving growth and improving customer service.

Singapore Customs Brokerage Industry Market Size (In Billion)

The competitive landscape is marked by both established multinational corporations and agile local companies. While the larger players benefit from extensive global reach and brand recognition, the smaller firms often excel in providing personalized and flexible services tailored to specific client needs. This duality fosters innovation and competition, ultimately benefiting businesses seeking customs brokerage services in Singapore. The continuous evolution of international trade regulations necessitates continuous adaptation and investment in technology and expertise by firms within this industry, fostering a dynamic and competitive environment. Future growth will hinge on the ability of firms to adeptly navigate regulatory changes, adopt cutting-edge technologies, and effectively meet the evolving needs of their clients. A focus on digital solutions and supply chain optimization will be paramount for achieving sustained success in this sector.

Singapore Customs Brokerage Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Singapore Customs Brokerage Industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this report projects robust growth fueled by technological advancements and evolving trade dynamics. The report meticulously examines market dynamics, leading players, emerging opportunities, and challenges faced by businesses operating within this vital sector. Expect detailed analysis, actionable data points, and strategic recommendations for navigating the complexities of the Singapore Customs Brokerage landscape.

Singapore Customs Brokerage Industry Market Dynamics & Concentration

The Singapore Customs Brokerage Industry is characterized by a dynamic interplay of market concentration, rapid innovation, and evolving regulatory oversight. The market has seen robust M&A activity, with approximately xx deals recorded between 2019 and 2024. Looking ahead, this trend is projected to intensify, with an anticipated increase to around xx M&A deals by 2033. Dominant players such as DHL, FedEx, and Kuehne + Nagel currently command a significant market share, estimated at a combined xx% in 2025. However, the landscape is being reshaped by the emergence of smaller, agile, and specialized firms that are effectively challenging the established order by focusing on niche segments and offering tailored solutions.

- Market Concentration: The market exhibits high concentration, with the top 5 players estimated to control approximately xx% of the market share in 2025. This dominance is being steadily challenged by specialized entrants.

- Innovation Drivers: Key innovation drivers include the adoption of advanced technological solutions such as AI-powered customs clearance platforms for enhanced efficiency and accuracy, and blockchain-based systems for secure and transparent supply chain management.

- Regulatory Framework: The industry operates under a stringent regulatory framework that mandates high levels of compliance. These requirements significantly influence operational costs and necessitate continuous investment in specialized expertise and updated systems.

- Product Substitutes: While direct substitutes for customs brokerage services are limited, there is increasing pressure from technology-driven self-service platforms that cater to simpler customs procedures, pushing traditional brokers to add greater value.

- End-User Trends: Clients are increasingly demanding faster, more efficient customs clearance processes and enhanced transparency and visibility throughout their supply chains. This is driving the adoption of advanced technological solutions.

- M&A Activity: A projected increase in M&A activity is anticipated, fueled by ongoing industry consolidation, the pursuit of economies of scale, and strategic expansion into new geographic and service segments.

Singapore Customs Brokerage Industry Industry Trends & Analysis

The Singapore Customs Brokerage industry is projected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a market value of $xx Million by 2033. This growth is driven by several key factors. The increasing globalization of trade, particularly within the Asia-Pacific region, fuels the demand for efficient customs brokerage services. Furthermore, technological advancements are streamlining operations, improving accuracy, and reducing processing times. E-commerce growth significantly contributes to the industry's expansion, creating a higher volume of smaller shipments requiring customs processing. The rise of specialized logistics solutions, such as those catering to specific industries or product types, also contributes to market fragmentation and growth. Intense competition among established players and new entrants keeps prices competitive and fosters innovation. Market penetration by digital customs brokerage platforms is also projected to increase significantly, reaching xx% by 2033.

Leading Markets & Segments in Singapore Customs Brokerage Industry

The sea freight segment remains the cornerstone of the Singapore Customs Brokerage market, accounting for an estimated xx% of the total market value in 2025. This sustained dominance is directly attributable to Singapore's unparalleled strategic position as a major global shipping and transshipment hub.

Key Drivers for Sea Freight Dominance:

- Strategic Global Location: Singapore's prime location at the nexus of major East-West shipping routes facilitates massive volumes of seaborne trade, making it an indispensable gateway for regional and international commerce.

- World-Class Infrastructure: The nation boasts highly developed port facilities, advanced technological integration within its terminals, and a sophisticated, efficient logistics network that robustly supports the high throughput of containerized and bulk cargo.

- Pro-Business Government Policies: Consistent government investment in port expansion, coupled with a suite of pro-business policies and a focus on trade facilitation, creates an environment conducive to sustained growth in seaborne trade and related brokerage services.

The air freight segment, while currently smaller, exhibits significant growth potential, largely propelled by the explosive growth of the e-commerce sector and the increasing consumer and business demand for expedited delivery times. Cross-border land transport represents a smaller yet steadily growing segment, driven by expanding regional trade agreements, improved infrastructure connectivity between neighboring countries, and a desire for diversified supply chain options. A detailed analysis indicates that while sea freight will continue to hold the largest market share, the growth rate of air freight is projected to outpace other segments considerably within the forecast period, signaling a potential strategic shift in market dynamics and service emphasis.

Singapore Customs Brokerage Industry Product Developments

Recent product and service innovations within the Singapore Customs Brokerage industry are predominantly centered on the strategic integration of cutting-edge technologies. Artificial intelligence (AI) and machine learning (ML) are revolutionizing customs declarations and documentation processes by enhancing automation, improving accuracy, and reducing human error. Concurrently, blockchain technology is making significant strides in bolstering transparency and traceability across complex supply chains, thereby mitigating risks associated with fraud, counterfeiting, and compliance breaches. These advanced solutions collectively offer enhanced speed, greater operational efficiency, and superior data security, directly addressing the escalating client demands for streamlined customs processes, real-time visibility, and a more resilient supply chain. The industry's enthusiastic adoption of these innovations underscores its agility and responsiveness to the evolving needs of its diverse clientele and the ever-changing global regulatory landscape.

Key Drivers of Singapore Customs Brokerage Industry Growth

Several factors contribute to the robust growth projected for the Singapore Customs Brokerage industry. Technological advancements are automating processes, improving efficiency, and reducing errors. The burgeoning e-commerce sector fuels demand for customs clearance services. Singapore's strategic location and pro-business environment attract international trade, further stimulating the industry. Supportive government policies and investments in infrastructure enhance the efficiency of logistics networks.

Challenges in the Singapore Customs Brokerage Industry Market

The industry faces regulatory complexity and compliance requirements. Supply chain disruptions, particularly those arising from geopolitical events, cause significant uncertainty and operational challenges. Intense competition from both established players and new entrants puts downward pressure on pricing and profit margins. These factors create a demanding environment requiring continuous adaptation and innovation to maintain competitiveness.

Emerging Opportunities in Singapore Customs Brokerage Industry

Strategic partnerships between customs brokers and technology providers can lead to innovative solutions that address industry challenges and create new revenue streams. Expansion into new niche segments, such as specialized industries or high-value goods, presents significant growth opportunities. The adoption of emerging technologies, such as AI and blockchain, allows for differentiation and competitive advantage.

Leading Players in the Singapore Customs Brokerage Industry Sector

- DHL

- JAS

- C.H. Robinson

- Yusen Logistics

- UPS

- FedEx

- M&P International Freight

- Kuehne + Nagel

- Janio

- SeaLand Maersk

- Rhenus Logistics

- Geodis

- List Not Exhaustive

Key Milestones in Singapore Customs Brokerage Industry Industry

- 2020: Implementation of new customs regulations impacting clearance procedures.

- 2021: Launch of several AI-powered customs declaration platforms by major players.

- 2022: Significant increase in e-commerce-related shipments requiring customs brokerage services.

- 2023: Several mergers and acquisitions within the industry.

- 2024: Adoption of blockchain technology for improved supply chain transparency.

- 2025: Industry-wide adoption of new risk management and compliance tools.

Strategic Outlook for Singapore Customs Brokerage Industry Market

The Singapore Customs Brokerage industry is strategically positioned for sustained and robust growth over the coming decade. This positive outlook is underpinned by several key factors: the relentless pace of technological innovation, continuously expanding global and regional trade volumes, and a supportive and forward-thinking government policy framework designed to foster trade and investment. To thrive in this increasingly competitive and complex market, companies must prioritize strategic partnerships and make significant investments in cutting-edge technologies, including AI, blockchain, and advanced data analytics. Ultimately, organizations that demonstrate the greatest agility in adapting to evolving regulatory requirements, embracing digital transformation, and proactively responding to shifting customer preferences will be best positioned to capitalize on the substantial market opportunities projected for the foreseeable future.

Singapore Customs Brokerage Industry Segmentation

-

1. Mode of Transport

- 1.1. Sea

- 1.2. Air

- 1.3. Cross-border Land Transport

Singapore Customs Brokerage Industry Segmentation By Geography

- 1. Singapore

Singapore Customs Brokerage Industry Regional Market Share

Geographic Coverage of Singapore Customs Brokerage Industry

Singapore Customs Brokerage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing need for simple and effective supply chain systems; Increase in demand for household appliances

- 3.3. Market Restrains

- 3.3.1. 4.; Drivers Availability

- 3.4. Market Trends

- 3.4.1. Singapore Surge in Imports and Exports Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Customs Brokerage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Sea

- 5.1.2. Air

- 5.1.3. Cross-border Land Transport

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JAS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 C H Robinson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yusen Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 M&P International Freight

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne + Nagel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Janio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SeaLand Maersk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rhenus Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Geodis**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Singapore Customs Brokerage Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Singapore Customs Brokerage Industry Share (%) by Company 2025

List of Tables

- Table 1: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 2: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 4: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Customs Brokerage Industry?

The projected CAGR is approximately 7.44%.

2. Which companies are prominent players in the Singapore Customs Brokerage Industry?

Key companies in the market include DHL, JAS, C H Robinson, Yusen Logistics, UPS, FedEx, M&P International Freight, Kuehne + Nagel, Janio, SeaLand Maersk, Rhenus Logistics, Geodis**List Not Exhaustive.

3. What are the main segments of the Singapore Customs Brokerage Industry?

The market segments include Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing need for simple and effective supply chain systems; Increase in demand for household appliances.

6. What are the notable trends driving market growth?

Singapore Surge in Imports and Exports Driving the Market.

7. Are there any restraints impacting market growth?

4.; Drivers Availability.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Customs Brokerage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Customs Brokerage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Customs Brokerage Industry?

To stay informed about further developments, trends, and reports in the Singapore Customs Brokerage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence