Key Insights

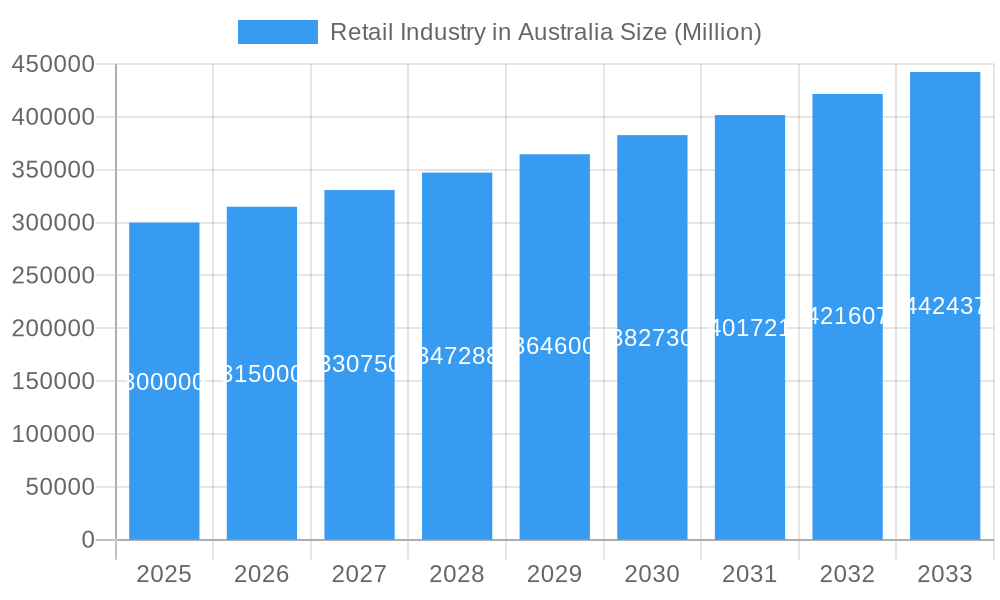

The Australian retail sector is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 3.1% from a base year of 2025. The market is estimated to reach 551.11 billion by the end of the forecast period. Key growth drivers include rising disposable incomes, a rapidly expanding e-commerce landscape, and a growing consumer preference for experiential retail. The widespread adoption of omnichannel strategies, integrating online and offline customer journeys, further fuels market momentum. However, market growth faces headwinds from economic uncertainty impacting consumer confidence, intense competition from established and emerging players, and escalating operational costs, including wages and supply chain challenges. The industry is segmented across food & grocery, general merchandise, electronics, and online marketplaces, featuring prominent players such as Coles Group, Woolworths Group Ltd, Aldi Group, Kmart Australia Ltd, Myer Group Pty Ltd, David Jones Properties Pty Ltd, JB Hi-Fi Ltd, and Kogan.com Ltd, necessitating continuous innovation and adaptation.

Retail Industry in Australia Market Size (In Billion)

Strategic partnerships, mergers, and acquisitions are expected to become increasingly vital. Retailers will prioritize supply chain optimization, enhanced customer experiences through personalization and loyalty programs, and sustainable sourcing to attract environmentally conscious consumers. Data analytics will be crucial for understanding consumer behavior and refining marketing and inventory management. The future of Australian retail hinges on embracing technology, responding to evolving consumer demands, and navigating a competitive market. The presence of diverse established and emerging competitors indicates a dynamic landscape offering both opportunities and challenges.

Retail Industry in Australia Company Market Share

Australian Retail Market Analysis: Size, Growth, and Forecast (2019-2033)

This comprehensive report offers in-depth analysis of Australia's retail market from 2019 to 2033, with a base year of 2025. Discover key trends, challenges, and opportunities within this expansive market. The study includes insights from leading companies such as ALDI Group, Metcash Ltd, Woolworths Group Ltd, Wesfarmers Ltd, JB Hi-Fi Ltd, Coles Group, Kmart Australia Ltd, Myer Group Pty Ltd, David Jones Properties Pty Ltd, and Kogan.com Ltd. Gain a competitive advantage by downloading this report.

Retail Industry in Australia Market Dynamics & Concentration

Australia's retail sector is characterized by a concentrated market structure, dominated by a few major players controlling a significant market share. Woolworths Group Ltd and Coles Group collectively hold a substantial portion, exceeding xx%. This high concentration influences pricing strategies, innovation, and overall market competitiveness. The industry is subject to robust regulatory frameworks, including consumer protection laws and competition regulations, aiming to maintain a fair market environment. Increased online shopping represents a major shift, driving innovation in e-commerce logistics and omnichannel strategies. The market witnesses continuous mergers and acquisitions (M&A) activity, with an average of xx M&A deals annually during the historical period (2019-2024). This consolidation trend is further fueled by the need for scale and expansion into new segments. Substitutes like online marketplaces and direct-to-consumer brands pose a challenge to traditional retailers, prompting adaptation and diversification strategies. Consumer preferences are shifting towards sustainable and ethically sourced products, demanding higher transparency and responsible business practices from retailers.

- Market Share: Woolworths & Coles combined: xx%

- M&A Deal Count (2019-2024): xx

- Key Regulatory Frameworks: Australian Consumer Law, Competition and Consumer Act

Retail Industry in Australia Industry Trends & Analysis

The Australian retail industry experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth trajectory is expected to continue, albeit at a moderated pace, with a forecasted CAGR of xx% during the forecast period (2025-2033). Several factors contribute to this trend. Firstly, a growing population and rising disposable incomes fuel consumer spending. Secondly, technological disruptions, particularly the rapid growth of e-commerce and the increasing adoption of mobile shopping, significantly reshape the retail landscape. Consumer preferences are evolving towards convenience, personalized experiences, and value for money. The competitive landscape is intensely dynamic, with both established players and emerging online retailers vying for market share. The market penetration of online retail continues to increase, reaching xx% in 2024 and projected to reach xx% by 2033. These trends necessitate innovative strategies for retailers to adapt to the changing demands of consumers and maintain a competitive edge.

Leading Markets & Segments in Retail Industry in Australia

The Australian retail market is geographically diverse, with significant variations in consumer behavior and market dynamics across different regions. While a single dominant region isn't easily identified, major metropolitan areas like Sydney and Melbourne are consistently high-performing, driven by high population density, robust infrastructure, and strong consumer spending. The food retail segment accounts for the largest market share, followed by apparel and general merchandise.

- Key Drivers of Metropolitan Area Dominance:

- High Population Density

- Robust Infrastructure (Transportation & Logistics)

- Higher Disposable Incomes

- Strong Consumer Spending

- Well-established supply chains

The dominance of these regions is attributed to robust infrastructure, higher disposable income levels, and a significant concentration of population. However, growth in regional areas is also notable, driven by government initiatives to improve infrastructure and attract investment. The segment-wise dominance of food and grocery highlights the importance of affordability and convenience in the Australian consumer market.

Retail Industry in Australia Product Developments

Recent product innovations in Australian retail focus on enhanced customer experiences, sustainability, and technology integration. This includes the rise of personalized recommendations, seamless omnichannel shopping experiences, and the incorporation of AR/VR technologies for product visualization. Retailers are increasingly emphasizing sustainable sourcing and eco-friendly packaging to appeal to environmentally conscious consumers. The integration of technology like AI-powered inventory management and personalized marketing drives greater efficiency and enhances customer engagement. These innovations aim to improve customer satisfaction, enhance operational efficiency, and maintain a competitive edge in the evolving retail landscape.

Key Drivers of Retail Industry in Australia Growth

Several factors contribute to the continued growth of the Australian retail industry. Firstly, the country's stable economy and rising disposable incomes directly impact consumer spending. Technological advancements, particularly in e-commerce and omnichannel strategies, expand market reach and enhance customer engagement. Government initiatives, such as infrastructure development and supportive policies, create a favorable environment for retail expansion. Furthermore, the increasing adoption of digital payment methods further streamlines transactions and drives higher sales conversions.

Challenges in the Retail Industry in Australia Market

The Australian retail sector faces several challenges. Increasing competition from both domestic and international players puts pressure on margins and necessitates cost-optimization strategies. Supply chain disruptions, exacerbated by global events, lead to stock shortages and increased costs. Evolving consumer preferences towards sustainability and ethical sourcing demand greater transparency and adaptation from retailers. Furthermore, stringent regulatory environments can impose significant compliance costs. These challenges significantly impact profitability and require innovative solutions for effective mitigation.

Emerging Opportunities in Retail Industry in Australia

Long-term growth in Australia's retail sector hinges on strategic partnerships, technological innovation, and market expansion. The integration of AI and big data analytics can offer personalized experiences and streamline operations. Strategic collaborations with tech companies can enhance e-commerce capabilities and customer engagement. Expanding into untapped markets or exploring niche segments offers significant growth potential. Embracing sustainable business practices and building strong brand reputations further attract environmentally conscious consumers.

Leading Players in the Retail Industry in Australia Sector

- ALDI Group

- Metcash Ltd

- Woolworths Group Ltd

- Wesfarmers Ltd

- JB Hi-Fi Ltd

- Coles Group

- Kmart Australia Ltd

- Myer Group Pty Ltd

- David Jones Properties Pty Ltd

- Kogan.com Ltd

Key Milestones in Retail Industry in Australia Industry

- November 2020: Wesfarmers expands Kmart's presence with new stores in Victoria and Western Australia, converting existing Target locations. This demonstrates aggressive expansion strategies within the group.

Strategic Outlook for Retail Industry in Australia Market

The Australian retail industry presents substantial growth potential driven by technological advancements, evolving consumer preferences, and a robust economy. Embracing omnichannel strategies, personalized marketing, and sustainable business practices will become crucial for success. Strategic partnerships and investments in technology will be key differentiators. The industry's future trajectory will depend on adapting to the dynamic market landscape and focusing on customer-centric innovation to navigate the competition and capture emerging opportunities.

Retail Industry in Australia Segmentation

-

1. Product

- 1.1. Food and Beverages

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Electronic and Household Appliances

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Supermar

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Retail Industry in Australia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Retail Industry in Australia Regional Market Share

Geographic Coverage of Retail Industry in Australia

Retail Industry in Australia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand for Food and Beverages Continues to be Strong Despite the COVID-19 Challenges

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverages

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Electronic and Household Appliances

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermar

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Food and Beverages

- 6.1.2. Personal and Household Care

- 6.1.3. Apparel, Footwear, and Accessories

- 6.1.4. Furniture, Toys, and Hobby

- 6.1.5. Electronic and Household Appliances

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermar

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Food and Beverages

- 7.1.2. Personal and Household Care

- 7.1.3. Apparel, Footwear, and Accessories

- 7.1.4. Furniture, Toys, and Hobby

- 7.1.5. Electronic and Household Appliances

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermar

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Food and Beverages

- 8.1.2. Personal and Household Care

- 8.1.3. Apparel, Footwear, and Accessories

- 8.1.4. Furniture, Toys, and Hobby

- 8.1.5. Electronic and Household Appliances

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermar

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Food and Beverages

- 9.1.2. Personal and Household Care

- 9.1.3. Apparel, Footwear, and Accessories

- 9.1.4. Furniture, Toys, and Hobby

- 9.1.5. Electronic and Household Appliances

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermar

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Retail Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Food and Beverages

- 10.1.2. Personal and Household Care

- 10.1.3. Apparel, Footwear, and Accessories

- 10.1.4. Furniture, Toys, and Hobby

- 10.1.5. Electronic and Household Appliances

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermar

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ALDI Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Metcash Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Woolworths Group Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wesfarmers Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JB Hi-Fi Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Coles Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kmart Australia Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Myer Group Pty Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 David Jones Properties Pty Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kogan com Ltd**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ALDI Group

List of Figures

- Figure 1: Global Retail Industry in Australia Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 9: South America Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 15: Europe Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East & Africa Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Retail Industry in Australia Revenue (billion), by Product 2025 & 2033

- Figure 27: Asia Pacific Retail Industry in Australia Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Retail Industry in Australia Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Retail Industry in Australia Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Retail Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Retail Industry in Australia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Retail Industry in Australia Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Retail Industry in Australia Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Retail Industry in Australia Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Retail Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Retail Industry in Australia Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Industry in Australia?

The projected CAGR is approximately 3.1%.

2. Which companies are prominent players in the Retail Industry in Australia?

Key companies in the market include ALDI Group, Metcash Ltd, Woolworths Group Ltd, Wesfarmers Ltd, JB Hi-Fi Ltd, Coles Group, Kmart Australia Ltd, Myer Group Pty Ltd, David Jones Properties Pty Ltd, Kogan com Ltd**List Not Exhaustive.

3. What are the main segments of the Retail Industry in Australia?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 551.11 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand for Food and Beverages Continues to be Strong Despite the COVID-19 Challenges.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2020, Wesfarmers retail businesses continued to expand their business. Kmart opened new stores in Camberwell and Casey in Victoria and Cockburn in Western Australia, all converted from Target stores, alongside its newest K Hub store in Bairnsdale in regional Victoria.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Industry in Australia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Industry in Australia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Industry in Australia?

To stay informed about further developments, trends, and reports in the Retail Industry in Australia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence