Key Insights

The North American Shipping Agency Market is poised for significant expansion, projected to reach $7.29 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of approximately 15.32% from 2025 to 2033. This robust growth is propelled by escalating global trade volumes, particularly between North America and Asia, which necessitates highly efficient and dependable shipping solutions, thereby increasing the demand for specialized agencies. The burgeoning e-commerce sector further fuels this expansion, as it relies heavily on prompt and secure goods delivery. Technological advancements, including sophisticated logistics software and digital platforms, are revolutionizing operational efficiency within the shipping industry, contributing to market growth. The market is segmented by agency type (port, cargo, charter, and others) and by application (shipowner and lessee), reflecting the diverse operational requirements of the shipping industry. Key market participants include established entities such as Evergreen Shipping Agency and GAC North America, alongside numerous regional and specialized agencies, indicating a moderately competitive landscape. While potential regulatory shifts and economic volatility present challenges, the long-term outlook remains optimistic, underpinned by sustained global trade growth and continuous technological innovation.

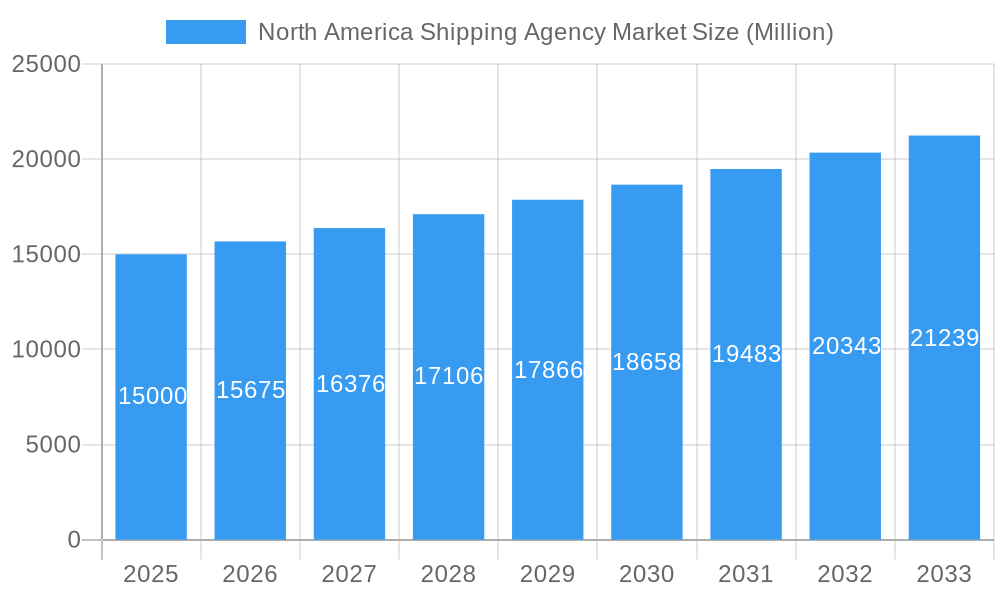

North America Shipping Agency Market Market Size (In Billion)

Within this dynamic market, port agencies are expected to maintain a substantial share due to their indispensable role in managing port operations. The increasing throughput of containerized cargo directly drives the demand for efficient port agency services. The cargo agency segment also benefits from the expansion of global trade, as specialized handling is crucial for diverse cargo types. Charter agencies are anticipated to experience significant growth, driven by the rising global demand for chartered vessels. North America, encompassing the United States, Canada, and Mexico, represents a key market owing to its strategic geographical positioning and substantial involvement in international commerce. However, future growth hinges on addressing potential obstacles such as infrastructure constraints and labor availability. Sustained investment in port infrastructure modernization and workforce development will be critical for sustaining this positive growth trajectory.

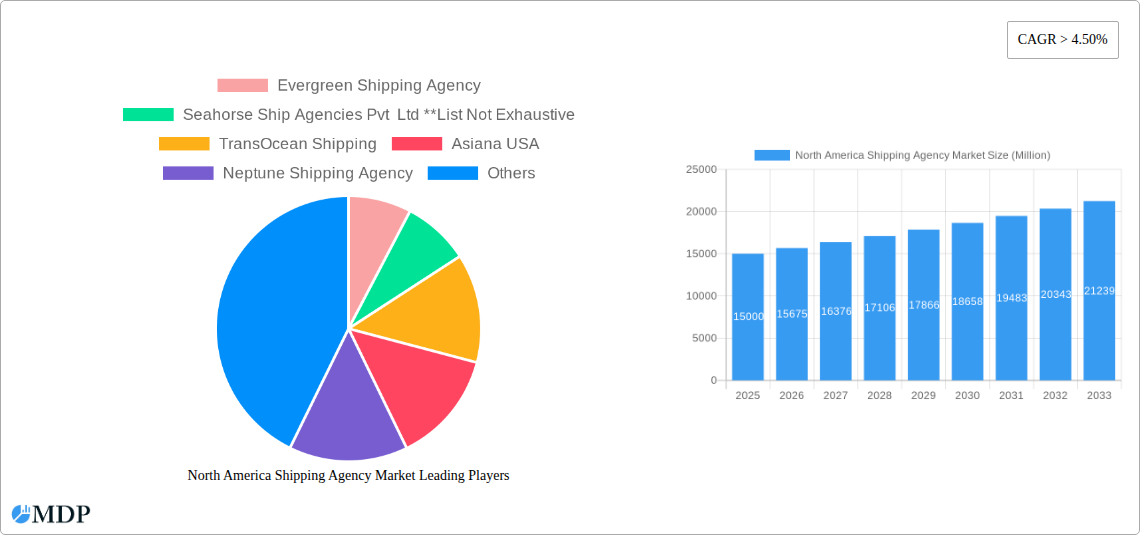

North America Shipping Agency Market Company Market Share

North America Shipping Agency Market Report: 2019-2033

Unlocking Growth Opportunities in the Dynamic North American Shipping Sector

This comprehensive report provides an in-depth analysis of the North America Shipping Agency market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and emerging opportunities. With a detailed segmentation analysis (By Type: Port Agency, Cargo Agency, Charter Agency, Others; By Application: Shipowner, Lessee), this study illuminates the key trends shaping the future of the North American shipping landscape. The report also profiles leading players such as Evergreen Shipping Agency, Seahorse Ship Agencies Pvt Ltd, TransOcean Shipping, Asiana USA, Neptune Shipping Agency, North American Shipping Agencies (NASA), Lighthouse Shipping Agency Inc, GAC North America, United Shipping, and Moran Shipping Agency, offering crucial competitive intelligence. The market is expected to reach xx Million by 2033.

North America Shipping Agency Market Market Dynamics & Concentration

The North America Shipping Agency market exhibits a moderately consolidated structure, with a few major players holding significant market share. Market concentration is influenced by factors such as economies of scale, established networks, and regulatory compliance. The market is characterized by intense competition, driving innovation and efficiency improvements. The industry is subject to stringent regulatory frameworks concerning safety, environmental protection, and trade regulations. Product substitutes, such as alternative logistics solutions, exert a moderate influence on market dynamics. End-user trends, particularly towards efficient and reliable shipping solutions, shape demand. Mergers and acquisitions (M&A) activities are relatively frequent, as companies seek to expand their geographical reach and service offerings. Between 2019 and 2024, approximately xx M&A deals were recorded, resulting in a xx% increase in market concentration. Key players are actively pursuing strategies to enhance their market share and improve operational efficiency.

North America Shipping Agency Market Industry Trends & Analysis

The North America Shipping Agency market demonstrates robust growth, driven by increasing global trade volumes, expanding e-commerce activities, and the rising demand for efficient logistics solutions. Technological disruptions, such as automation and digitalization, are significantly impacting the industry, leading to improved operational efficiency and reduced costs. Consumer preferences are shifting towards faster, more reliable, and transparent shipping services. The market displays a competitive landscape, with established players and new entrants vying for market share. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was estimated at xx%, and is projected to reach xx% during the forecast period (2025-2033). Market penetration of advanced technologies, such as blockchain and AI, is gradually increasing, impacting operational efficiency and cost optimization.

Leading Markets & Segments in North America Shipping Agency Market

The dominant segments within the North America Shipping Agency market are Port Agencies and Cargo Agencies. These segments contribute significantly to the overall market revenue due to their high demand among shippers and vessel owners.

- Key Drivers for Port Agencies: High vessel traffic in major North American ports, stringent port regulations, and the need for specialized port services drive substantial growth.

- Key Drivers for Cargo Agencies: Growing import-export activities, increasing demand for efficient cargo handling, and the need for expertise in customs clearance and documentation management boost the growth of this segment.

- Geographic Dominance: The East Coast of North America, specifically areas with major ports like New York, New Jersey, and Los Angeles, currently holds the largest market share due to high trading volumes and established infrastructure. However, significant growth is anticipated in the West Coast region in the coming years.

- Shipowner vs. Lessee: Shipowners account for a larger market share compared to lessees, as they directly engage shipping agencies for various operational needs.

North America Shipping Agency Market Product Developments

Recent product innovations focus on digitalization and automation, encompassing online platforms for booking and tracking, integrated data management systems, and advanced analytics tools for optimized service delivery. These innovations streamline processes, enhance transparency, and improve efficiency, leading to enhanced customer experience and operational cost reductions. The key competitive advantage lies in offering comprehensive, integrated solutions with a strong technological edge.

Key Drivers of North America Shipping Agency Market Growth

Several key factors are driving the growth of the North America Shipping Agency market. These include:

- Increased Global Trade: The steady rise in international trade fuels demand for efficient shipping and logistics solutions.

- E-commerce Expansion: The explosive growth of e-commerce significantly increases the volume of packages needing shipping and handling, boosting demand for agency services.

- Technological Advancements: Automation, AI, and digital platforms enhance efficiency and transparency in shipping operations.

- Government Regulations: Stringent regulations for port operations and safety drive demand for specialized agency services.

Challenges in the North America Shipping Agency Market Market

The North America Shipping Agency market faces several challenges:

- Fluctuating Fuel Prices: Fuel price volatility directly impacts operational costs and profitability.

- Port Congestion: Congestion in major ports leads to delays, increased costs, and reduced efficiency.

- Geopolitical Uncertainty: Global political instability and trade tensions create uncertainty and impact shipping volumes.

- Intense Competition: The market's competitive nature necessitates continuous innovation and cost optimization to maintain profitability.

Emerging Opportunities in North America Shipping Agency Market

Significant opportunities exist for growth in the North America Shipping Agency market through strategic partnerships with technology providers, expansion into underserved markets, and the development of specialized niche services catering to specific industry needs. Technological breakthroughs, such as blockchain technology and AI-powered route optimization, can substantially enhance efficiency and transparency, creating new avenues for growth and differentiation.

Leading Players in the North America Shipping Agency Market Sector

- Evergreen Shipping Agency

- Seahorse Ship Agencies Pvt Ltd

- TransOcean Shipping

- Asiana USA

- Neptune Shipping Agency

- North American Shipping Agencies (NASA)

- Lighthouse Shipping Agency Inc

- GAC North America

- United Shipping

- Moran Shipping Agency

Key Milestones in North America Shipping Agency Market Industry

- 2020: Implementation of new digital platforms for cargo tracking and management by several leading agencies.

- 2021: Increased focus on sustainability and environmental compliance within the industry.

- 2022: Several mergers and acquisitions aimed at expanding market reach and service offerings.

- 2023: Significant investment in automation and AI-powered solutions to improve operational efficiency.

- 2024: Introduction of advanced data analytics tools to enhance forecasting and risk management.

Strategic Outlook for North America Shipping Agency Market Market

The future of the North America Shipping Agency market appears promising, with continued growth fueled by ongoing globalization and technological advancements. Strategic partnerships, investments in technology, and a focus on sustainable practices will be crucial for success. Agencies that can adapt to evolving customer demands, embrace digital transformation, and effectively manage risks will secure a strong competitive position in this dynamic market.

North America Shipping Agency Market Segmentation

-

1. Type

- 1.1. Port Agency

- 1.2. Cargo Agency

- 1.3. Charter Agency

- 1.4. Others

-

2. Application

- 2.1. Shipowner

- 2.2. Lessee

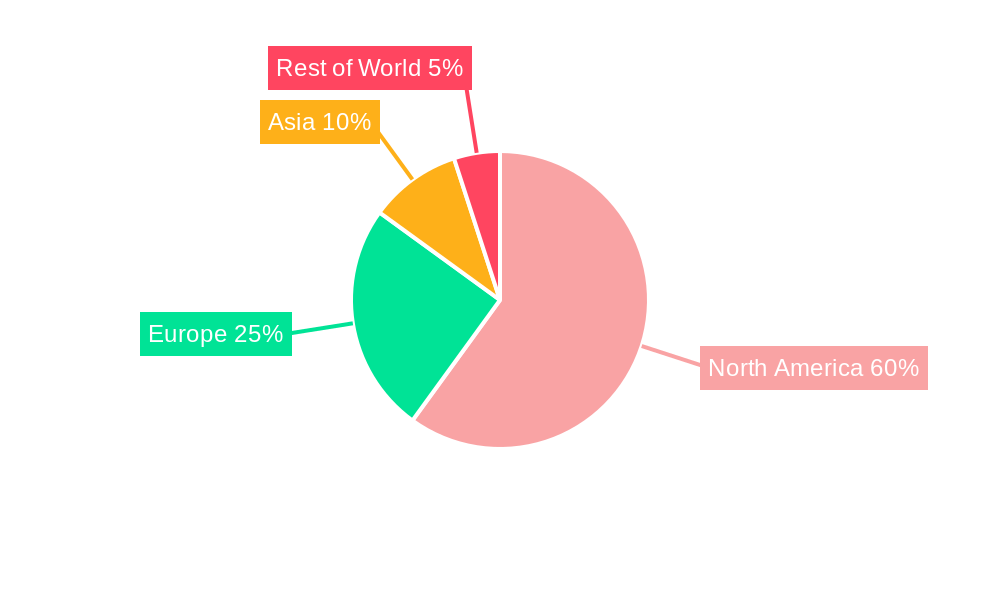

North America Shipping Agency Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Shipping Agency Market Regional Market Share

Geographic Coverage of North America Shipping Agency Market

North America Shipping Agency Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Increase Marintime Trade Boosting the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Shipping Agency Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Port Agency

- 5.1.2. Cargo Agency

- 5.1.3. Charter Agency

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Shipowner

- 5.2.2. Lessee

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Evergreen Shipping Agency

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Seahorse Ship Agencies Pvt Ltd **List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TransOcean Shipping

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Asiana USA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Neptune Shipping Agency

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 North American Shipping Agencies (NASA)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lighthouse Shipping Agency Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GAC North America

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 United Shipping

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Moran Shipping Agency

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Evergreen Shipping Agency

List of Figures

- Figure 1: North America Shipping Agency Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Shipping Agency Market Share (%) by Company 2025

List of Tables

- Table 1: North America Shipping Agency Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Shipping Agency Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Shipping Agency Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Shipping Agency Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America Shipping Agency Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: North America Shipping Agency Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Shipping Agency Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Shipping Agency Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Shipping Agency Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Shipping Agency Market?

The projected CAGR is approximately 15.32%.

2. Which companies are prominent players in the North America Shipping Agency Market?

Key companies in the market include Evergreen Shipping Agency, Seahorse Ship Agencies Pvt Ltd **List Not Exhaustive, TransOcean Shipping, Asiana USA, Neptune Shipping Agency, North American Shipping Agencies (NASA), Lighthouse Shipping Agency Inc, GAC North America, United Shipping, Moran Shipping Agency.

3. What are the main segments of the North America Shipping Agency Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.29 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Increase Marintime Trade Boosting the market.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Shipping Agency Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Shipping Agency Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Shipping Agency Market?

To stay informed about further developments, trends, and reports in the North America Shipping Agency Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence