Key Insights

The North American same-day delivery market is poised for substantial expansion, propelled by the sustained surge in e-commerce, escalating consumer demand for expedited shipping, and widespread business adoption of rapid fulfillment solutions. This dynamic sector is projected to achieve a CAGR of 21.5%, reaching a market size of 14.41 billion by the base year 2025. Key growth drivers include the continued rise of online shopping and evolving consumer expectations for immediate product availability and unparalleled convenience. The market is segmented by transport mode (air, road, others), shipment weight (light, medium, heavy), destination (domestic, international), and end-user industry (e-commerce, BFSI, healthcare, manufacturing, wholesale & retail, others). Leading global logistics providers are significantly investing in enhancing their same-day delivery networks, fostering intense competition and driving innovation in supply chain technology. Urban centers with high population density and robust transportation infrastructure are expected to be key hubs for this growth. While localized regulatory and infrastructure challenges may present minor headwinds, technological advancements in delivery optimization and autonomous systems are set to significantly fuel market expansion.

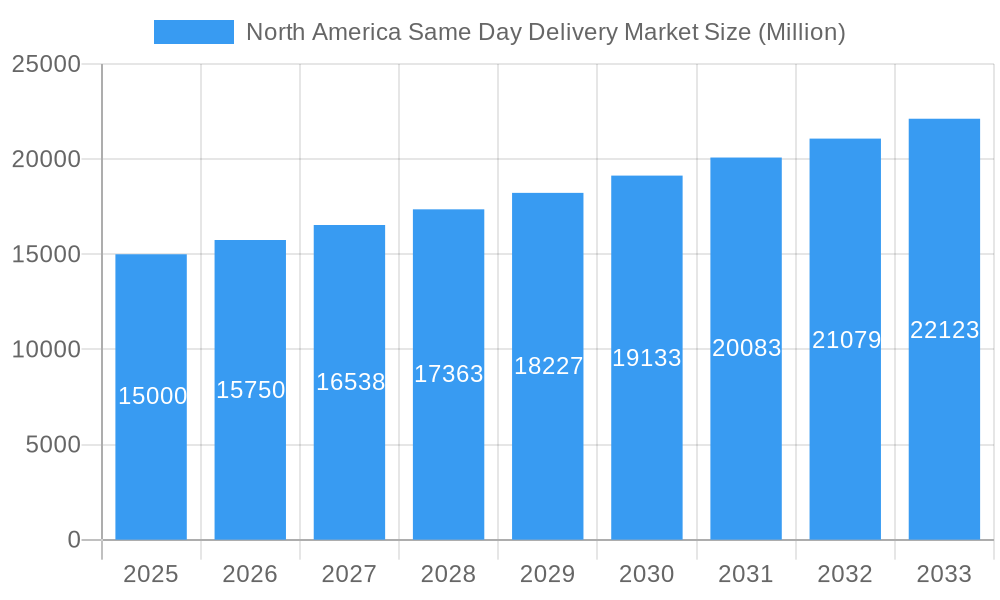

North America Same Day Delivery Market Market Size (In Billion)

Market segmentation provides critical insights into the North American same-day delivery landscape. E-commerce remains the primary demand generator, with significant contributions also emerging from the healthcare, BFSI, and manufacturing sectors for time-critical shipments. Geographically, the United States leads market activity, followed by Canada and Mexico. The selection of transport modes is strategically determined by factors such as distance, shipment volume, and delivery urgency, with air transport favored for long-haul, time-sensitive deliveries and road transport for shorter routes. Ongoing advancements in logistics technology and operational efficiencies are anticipated to optimize performance and reduce costs across all segments, further stimulating market growth. Increased competition is expected from both established industry leaders and emerging specialized players targeting niche markets or specific regions.

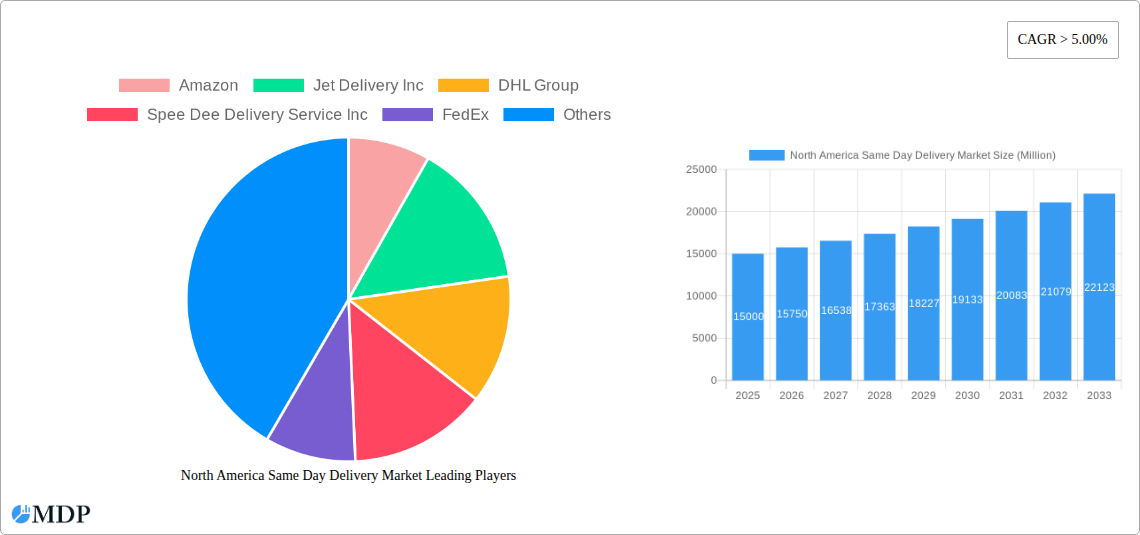

North America Same Day Delivery Market Company Market Share

North America Same Day Delivery Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America Same Day Delivery Market, covering the period from 2019 to 2033. It offers in-depth insights into market dynamics, industry trends, leading players, and future growth opportunities. The report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on this rapidly evolving market. With a focus on actionable intelligence, this report provides the data needed to make informed strategic decisions. The market is estimated to reach xx Million by 2025, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

North America Same Day Delivery Market Market Dynamics & Concentration

The North America Same Day Delivery market is characterized by high growth potential driven by increasing e-commerce adoption, rising consumer demand for faster delivery options, and technological advancements in logistics and transportation. Market concentration is relatively high, with major players like Amazon, FedEx, and UPS holding significant market share. However, the market also witnesses considerable activity from smaller, specialized players focusing on niche segments.

- Market Concentration: The top 5 players command approximately xx% of the market share in 2025. This concentration is expected to remain relatively stable throughout the forecast period, though smaller players continue to emerge.

- Innovation Drivers: Technological advancements, such as AI-powered route optimization, autonomous delivery vehicles, and advanced tracking systems, are key drivers of innovation within the industry.

- Regulatory Frameworks: Government regulations concerning transportation, data privacy, and labor laws influence market dynamics and operational costs. Compliance requirements vary across different regions and impact business strategies.

- Product Substitutes: While same-day delivery offers unparalleled speed, alternatives exist, including next-day delivery and standard shipping. The choice depends on consumer needs and cost sensitivity. The competitive landscape requires continuous improvement in efficiency and cost-effectiveness.

- End-User Trends: The increasing preference for online shopping and instant gratification is a major catalyst for same-day delivery growth, particularly among younger demographics. Changing consumer expectations will continually reshape the market.

- M&A Activities: The number of mergers and acquisitions in the sector averaged xx deals annually during the historical period (2019-2024), indicating substantial consolidation and strategic expansion by larger players.

North America Same Day Delivery Market Industry Trends & Analysis

The North American Same-Day Delivery market exhibits significant growth potential. Driving factors include the exponential growth of e-commerce, the rising preference for faster and more convenient delivery options among consumers, and technological advancements enabling improved efficiency and cost-effectiveness. The market is experiencing disruption from technological innovations, changing consumer preferences, and the intense competitive landscape. The increasing adoption of omnichannel strategies by retailers significantly fuels demand for same-day delivery services. This trend is expected to persist throughout the forecast period. Key performance indicators such as market penetration and customer satisfaction are closely monitored to gauge the effectiveness of delivery strategies. Market growth is further propelled by the continuous improvement in infrastructure and logistics networks, which enables smoother and faster deliveries.

Leading Markets & Segments in North America Same Day Delivery Market

The United States dominates the North American Same Day Delivery market, driven by its larger e-commerce sector and higher consumer spending. However, Canada and Mexico are also experiencing substantial growth, fueled by increasing internet penetration and urbanization. Within the market, several segments exhibit significant growth potential:

- Dominant Region: United States

- Dominant Mode of Transport: Road

- Dominant Shipment Weight: Light Weight Shipments

- Dominant Destination: Domestic

- Dominant End-User Industry: E-Commerce

Key Drivers by Segment:

- United States: Strong e-commerce infrastructure, high consumer disposable income, and dense urban population.

- Road Transport: Cost-effectiveness and accessibility across widespread geographical areas.

- Light Weight Shipments: High volume of e-commerce packages and relatively low delivery costs.

- Domestic Deliveries: Majority of e-commerce orders are fulfilled within national borders.

- E-commerce: The sector represents the largest driver of growth, given its rapid expansion and reliance on quick delivery options.

North America Same Day Delivery Market Product Developments

The industry is witnessing continuous product innovation, encompassing improvements in delivery route optimization software, advancements in last-mile delivery technologies (e.g., drones, autonomous vehicles), and the implementation of advanced tracking and delivery management systems. These developments significantly enhance efficiency, reduce delivery times, and improve overall customer experience. Competition forces providers to continuously refine their offerings to meet evolving consumer demands and maintain a competitive edge. The focus is on optimizing delivery routes, improving package handling, and providing real-time tracking updates.

Key Drivers of North America Same Day Delivery Market Growth

The growth of the North American same-day delivery market is fueled by several key factors:

- E-commerce Boom: The rapid expansion of online retail necessitates fast and convenient delivery options.

- Technological Advancements: Improved logistics software, autonomous vehicles, and drone technology enhance efficiency.

- Urbanization: Higher population density in urban areas facilitates faster delivery networks.

- Consumer Expectations: Customers increasingly expect rapid delivery as a standard feature.

Challenges in the North America Same Day Delivery Market Market

The market faces challenges, including:

- High Operating Costs: Same-day delivery requires significant investments in infrastructure and logistics.

- Traffic Congestion: Urban traffic significantly impacts delivery times and efficiency, leading to increased costs.

- Regulatory Hurdles: Varying regulations across regions create compliance complexities.

- Competition: Intense competition among established players and new entrants increases pressure on pricing.

Emerging Opportunities in North America Same Day Delivery Market

Significant opportunities exist for growth, including:

- Strategic Partnerships: Collaboration between logistics companies and retailers can optimize delivery networks.

- Technological Breakthroughs: The adoption of AI and automation further enhances efficiency and reduces costs.

- Market Expansion: Growth in smaller cities and rural areas represents untapped potential.

Leading Players in the North America Same Day Delivery Market Sector

- Amazon

- Jet Delivery Inc

- DHL Group

- Spee Dee Delivery Service Inc

- FedEx

- Fastfrate Group

- United Parcel Service of America Inc (UPS)

- USP

- International Distributions Services (including GLS)

- OnTrac

- Aramex

- DTDC Express Limited

Key Milestones in North America Same Day Delivery Market Industry

- December 2023: Amazon delivers 1 billion packages from same-day sites in the US, showcasing the scale of its operations and the growing demand for rapid delivery.

- December 2023: Amazon launches a second same-day delivery facility in Massachusetts, expanding its reach and capacity in the region.

- July 2023: XLT Pack and Ship Services opens a new service center in Jamestown, Virginia, expanding access to same-day delivery services in underserved areas.

Strategic Outlook for North America Same Day Delivery Market Market

The North America Same Day Delivery market is poised for sustained growth, driven by e-commerce expansion, technological innovations, and evolving consumer expectations. Strategic opportunities lie in optimizing logistics, embracing technological advancements, and expanding into underserved markets. Companies that can effectively manage costs, enhance efficiency, and provide a superior customer experience are expected to thrive in this dynamic market.

North America Same Day Delivery Market Segmentation

-

1. Mode Of Transport

- 1.1. Air

- 1.2. Road

- 1.3. Others

-

2. Shipment Weight

- 2.1. Heavy Weight Shipments

- 2.2. Light Weight Shipments

- 2.3. Medium Weight Shipments

-

3. Destination

- 3.1. Domestic

- 3.2. International

-

4. End User Industry

- 4.1. E-Commerce

- 4.2. Financial Services (BFSI)

- 4.3. Healthcare

- 4.4. Manufacturing

- 4.5. Primary Industry

- 4.6. Wholesale and Retail Trade (Offline)

- 4.7. Others

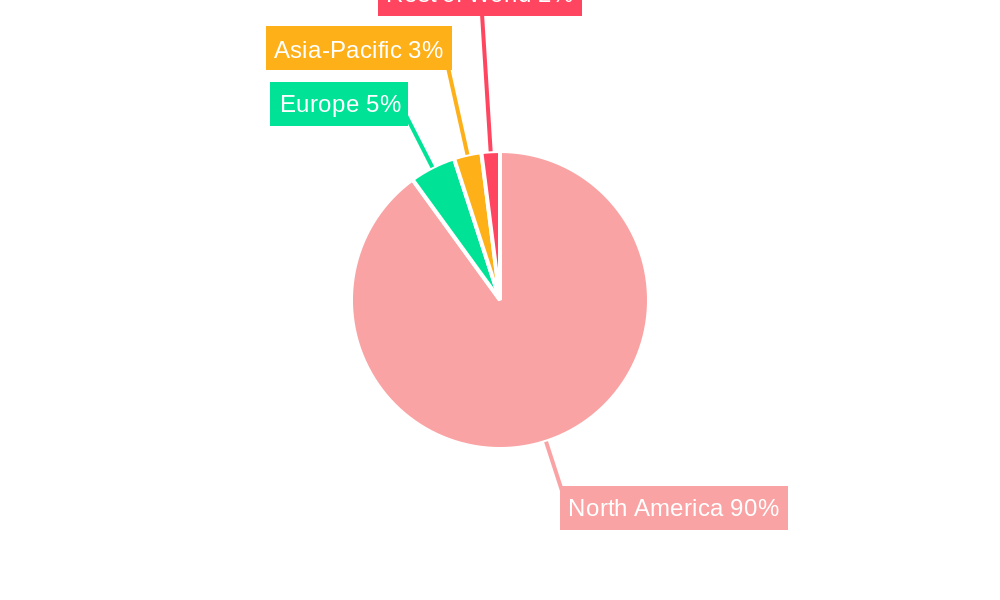

North America Same Day Delivery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Same Day Delivery Market Regional Market Share

Geographic Coverage of North America Same Day Delivery Market

North America Same Day Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Same Day Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.1.1. Air

- 5.1.2. Road

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.2.1. Heavy Weight Shipments

- 5.2.2. Light Weight Shipments

- 5.2.3. Medium Weight Shipments

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by End User Industry

- 5.4.1. E-Commerce

- 5.4.2. Financial Services (BFSI)

- 5.4.3. Healthcare

- 5.4.4. Manufacturing

- 5.4.5. Primary Industry

- 5.4.6. Wholesale and Retail Trade (Offline)

- 5.4.7. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jet Delivery Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Spee Dee Delivery Service Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fastfrate Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 United Parcel Service of America Inc (UPS)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 USP

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 International Distributions Services (including GLS)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 OnTrac

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Aramex

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DTDC Express Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: North America Same Day Delivery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Same Day Delivery Market Share (%) by Company 2025

List of Tables

- Table 1: North America Same Day Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 2: North America Same Day Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 3: North America Same Day Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: North America Same Day Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: North America Same Day Delivery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Same Day Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 7: North America Same Day Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 8: North America Same Day Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: North America Same Day Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: North America Same Day Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Same Day Delivery Market?

The projected CAGR is approximately 21.5%.

2. Which companies are prominent players in the North America Same Day Delivery Market?

Key companies in the market include Amazon, Jet Delivery Inc, DHL Group, Spee Dee Delivery Service Inc, FedEx, Fastfrate Group, United Parcel Service of America Inc (UPS), USP, International Distributions Services (including GLS), OnTrac, Aramex, DTDC Express Limited.

3. What are the main segments of the North America Same Day Delivery Market?

The market segments include Mode Of Transport, Shipment Weight, Destination, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.41 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

December 2023: Amazon has delivered 1 billion packages from Same-Day sites in the United States. The same-day delivery facilities are designed for quick deliveries, fulfillment, and sorting all from one site making delivering customer packages even faster.December 2023: Amazon has launched 2nd same-day delivery facility in Massachusetts for certain towns and cities in Central Massachusetts. It is a 200,000-square-foot, custom-built site launched in Westborough. It was a part of its plan to expand its same-day delivery services in Massachusetts.July 2023: XLT Pack and Ship Services opened a service center in James Town, Virginia, where there were no packing and shipping centers available. It offers packing and shipping services through Spee-Dee Delivery Service Inc. and other companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Same Day Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Same Day Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Same Day Delivery Market?

To stay informed about further developments, trends, and reports in the North America Same Day Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence