Key Insights

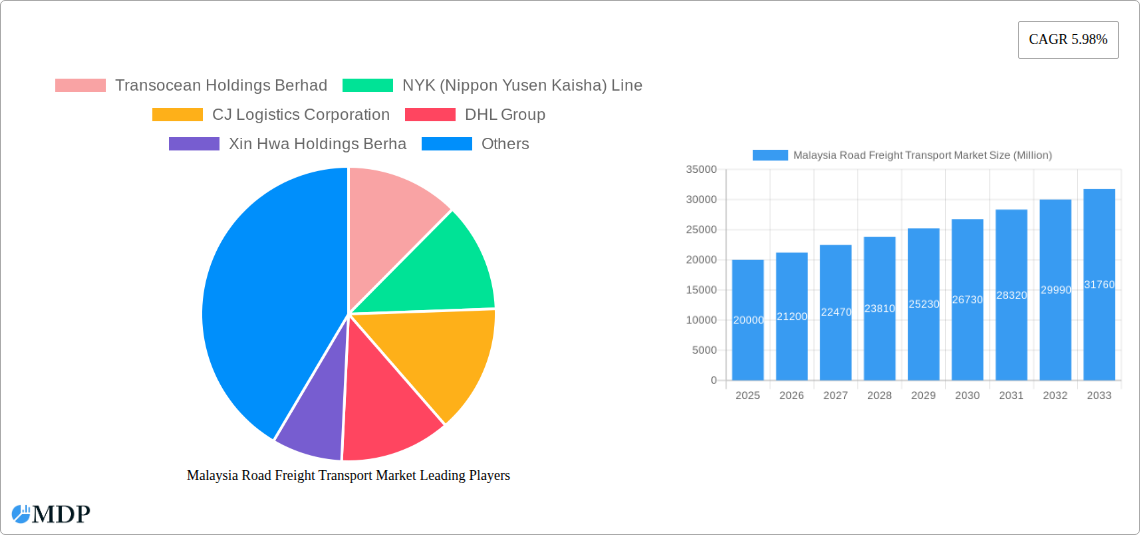

Malaysia's Road Freight Transport Market is projected for substantial growth, estimated at 29.7 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033. This expansion is primarily driven by the escalating e-commerce sector, demanding efficient last-mile delivery, and ongoing infrastructure enhancements like improved highways and logistics hubs. Increased industrial output across manufacturing, construction, and agriculture further propels demand. The market is segmented by truckload (FTL and LTL), containerization, distance, goods type (fluid and solid), temperature control, end-user industry, and destination (domestic and international). Full Truckload (FTL) and temperature-controlled services are key segments influencing market dynamics.

Malaysia Road Freight Transport Market Market Size (In Billion)

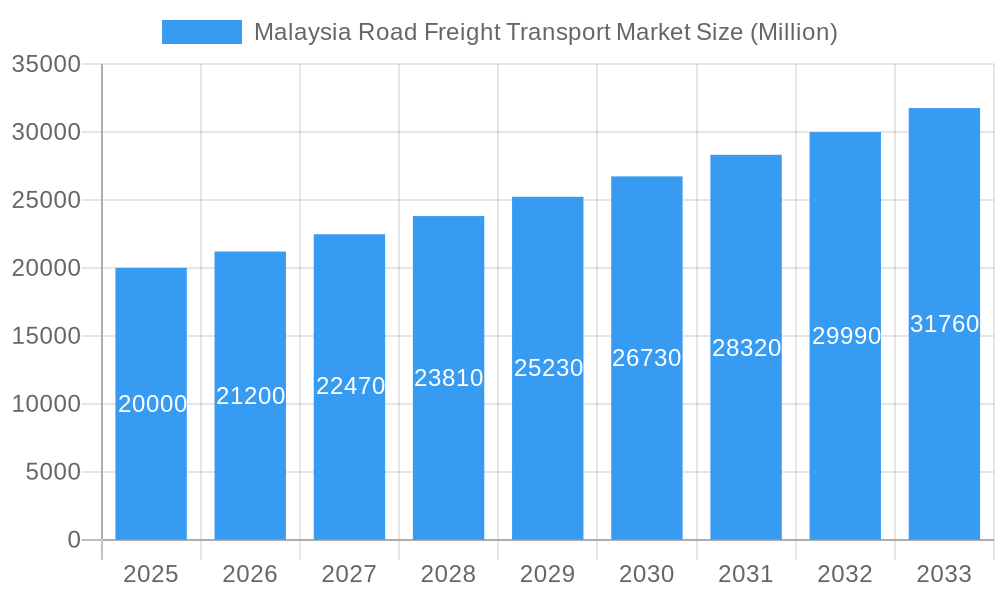

Challenges such as escalating fuel costs, driver shortages, and stringent environmental regulations require strategic adaptation. Intense competition from established players like Transocean Holdings Berhad, NYK Line, and CJ Logistics Corporation, alongside emerging local providers, underscores the market's dynamism. To thrive, companies must optimize operations, adopt advanced technologies for route planning and tracking, and commit to sustainable practices. The market's future success depends on effectively navigating these challenges while capitalizing on technological innovation and economic growth.

Malaysia Road Freight Transport Market Company Market Share

Malaysia Road Freight Transport Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Malaysia Road Freight Transport Market, offering crucial insights for stakeholders across the logistics and transportation sectors. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future potential. The report analyzes key segments, including Full-Truck-Load (FTL), Less-than-Truck-Load (LTL), containerized and non-containerized freight, long and short haul transport, various goods configurations (fluid and solid), temperature-controlled and non-temperature-controlled transportation, and diverse end-user industries. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Malaysia Road Freight Transport Market Dynamics & Concentration

The Malaysian road freight transport market exhibits a moderately concentrated landscape, with several major players commanding significant market share. Key factors influencing market dynamics include stringent regulatory frameworks focused on safety and sustainability, ongoing innovation in logistics technology (e.g., route optimization software, telematics), and the emergence of alternative transportation solutions. The market witnesses consistent M&A activity, with a noticeable uptick in recent years, reflecting consolidation and expansion strategies by leading players. For instance, the acquisition of CAC Logistics Services Pte Ltd by FM Global Logistics in September 2023 showcases this trend.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Innovation Drivers: Technological advancements in fleet management, route optimization, and delivery tracking systems.

- Regulatory Frameworks: Stringent regulations on vehicle emissions, driver safety, and cargo security.

- Product Substitutes: Limited direct substitutes, but competition from rail and sea freight for long-haul transport.

- End-User Trends: Growing e-commerce and manufacturing sectors are driving demand for efficient and reliable road freight services.

- M&A Activities: A total of xx M&A deals were recorded between 2019 and 2024, with an average deal value of xx Million.

Malaysia Road Freight Transport Market Industry Trends & Analysis

The Malaysian road freight transport market is experiencing robust growth fueled by a burgeoning e-commerce sector, expanding manufacturing activities, and robust infrastructure development. Technological disruptions, such as the adoption of digital platforms for freight management and autonomous vehicle technology, are transforming the industry landscape. Consumer preferences are shifting towards faster, more reliable, and transparent delivery services, putting pressure on companies to innovate and enhance their service offerings. The competitive landscape is characterized by intense rivalry among established players and the emergence of new entrants, leading to price pressures and a focus on operational efficiency. Market penetration of technology solutions, such as telematics and route optimization software, is gradually increasing, improving efficiency and reducing costs.

Leading Markets & Segments in Malaysia Road Freight Transport Market

The Malaysian road freight transport market demonstrates strong growth across various segments. The domestic segment dominates the market, driven by the robust intra-country trade and the expanding e-commerce sector. The FTL segment holds a larger market share compared to LTL, reflecting the preference for dedicated transport for large shipments. The manufacturing and wholesale and retail trade sectors are significant end-user industries.

- Key Drivers of FTL Dominance: Increased efficiency for large shipments, cost-effectiveness for bulk transport.

- Key Drivers of Domestic Segment Dominance: Strong domestic trade and e-commerce growth.

- Key Drivers of Manufacturing Sector Dominance: High volume of goods movement in the manufacturing value chain.

- Key Drivers of Containerized Freight: Standardization, ease of handling and efficient logistics.

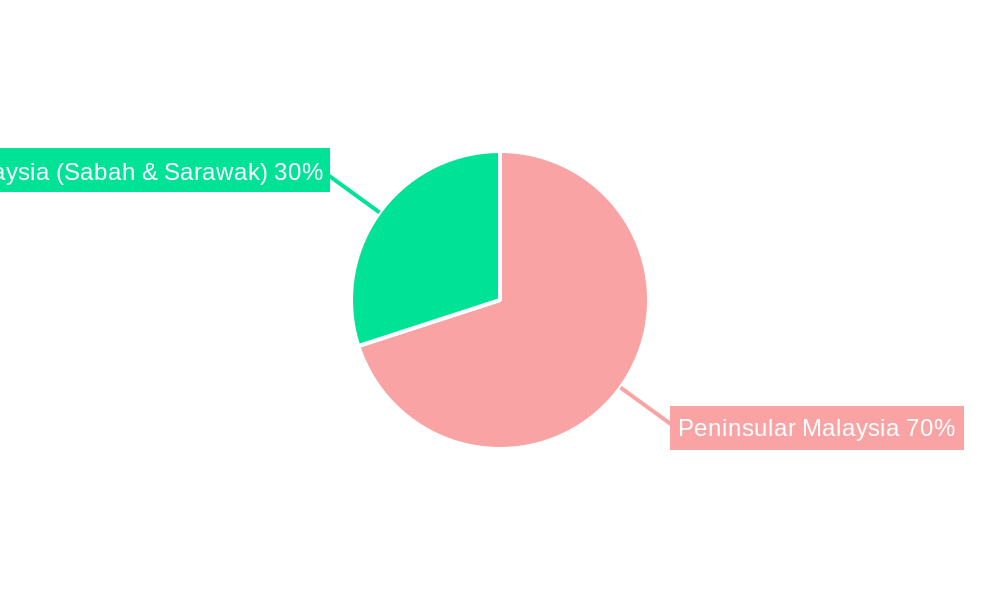

- Geographic Dominance: The Klang Valley region, due to its concentration of industries and ports, holds the largest market share.

Malaysia Road Freight Transport Market Product Developments

Recent product developments focus on enhancing efficiency and sustainability. Companies are investing in advanced telematics systems for real-time tracking and fleet management, and integrating digital platforms for better communication and coordination with shippers and carriers. The adoption of electric vehicles and alternative fuels is gaining traction, aligning with government initiatives towards cleaner transportation. These advancements improve operational efficiency, reduce costs, and enhance environmental sustainability, thus increasing market competitiveness.

Key Drivers of Malaysia Road Freight Transport Market Growth

Several factors are propelling the growth of Malaysia's road freight transport market. Economic growth, particularly in manufacturing and e-commerce, fuels demand for efficient logistics. Government initiatives promoting infrastructure development and logistics modernization are creating a favorable environment for industry expansion. Furthermore, advancements in technology, such as route optimization software and telematics, are improving operational efficiency and reducing costs. Finally, the growing focus on sustainability is driving the adoption of cleaner transportation solutions.

Challenges in the Malaysia Road Freight Transport Market

The Malaysian road freight transport market faces several challenges. These include infrastructure limitations, such as congested roads and limited parking facilities, resulting in increased transit times and higher costs. Driver shortages and high labor costs pose significant operational challenges. Moreover, increasing fuel prices and fluctuating exchange rates impact profitability. Competition intensifies as new players enter the market, further pressuring margins. These factors collectively impose xx Million in annual losses on the industry.

Emerging Opportunities in Malaysia Road Freight Transport Market

The Malaysian road freight transport market presents promising opportunities. The increasing adoption of technology, particularly in areas like autonomous vehicles and artificial intelligence for route planning and logistics optimization, offers substantial potential for cost savings and efficiency gains. Strategic partnerships between freight companies and technology providers can foster innovation and accelerate market growth. Expanding into regional markets and catering to the growing cross-border e-commerce sector are lucrative strategies for long-term market expansion.

Leading Players in the Malaysia Road Freight Transport Market Sector

- Transocean Holdings Berhad

- NYK (Nippon Yusen Kaisha) Line

- CJ Logistics Corporation

- DHL Group

- Xin Hwa Holdings Berha

- FM Global Logistics

- GAC Malaysia

- FedEx

- Tiong Nam Logistics

- Taipanco Sdn Bhd

Key Milestones in Malaysia Road Freight Transport Market Industry

- September 2023: FM Global Logistics Holdings Bhd acquired CAC Logistics Services Pte Ltd, expanding its regional footprint.

- September 2023: CJ Logistics launched 'the unban,' a transformative transport platform connecting shippers and carriers.

- November 2023: DHL Express added 44 electric vans and seven electric scooters, reinforcing its commitment to clean mobility.

- October 2022: DHL Express became the first in Malaysia to deploy electric vehicles for logistics.

Strategic Outlook for Malaysia Road Freight Transport Market Market

The Malaysian road freight transport market is poised for sustained growth, driven by a combination of factors including economic expansion, technological advancements, and supportive government policies. Companies that strategically invest in technology, embrace sustainable practices, and develop strong partnerships will be well-positioned to capture significant market share. The focus on enhancing efficiency, improving service quality, and adapting to evolving customer needs will be crucial for long-term success. The market is expected to continue to consolidate, with larger players acquiring smaller ones to gain scale and efficiency.

Malaysia Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Malaysia Road Freight Transport Market Segmentation By Geography

- 1. Malaysia

Malaysia Road Freight Transport Market Regional Market Share

Geographic Coverage of Malaysia Road Freight Transport Market

Malaysia Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Road Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Transocean Holdings Berhad

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NYK (Nippon Yusen Kaisha) Line

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CJ Logistics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xin Hwa Holdings Berha

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FM Global Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GAC Malaysia

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tiong Nam Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Taipanco Sdn Bhd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Transocean Holdings Berhad

List of Figures

- Figure 1: Malaysia Road Freight Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Malaysia Road Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Road Freight Transport Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Malaysia Road Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Malaysia Road Freight Transport Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 4: Malaysia Road Freight Transport Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 5: Malaysia Road Freight Transport Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 6: Malaysia Road Freight Transport Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 7: Malaysia Road Freight Transport Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 8: Malaysia Road Freight Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 9: Malaysia Road Freight Transport Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: Malaysia Road Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 11: Malaysia Road Freight Transport Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 12: Malaysia Road Freight Transport Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 13: Malaysia Road Freight Transport Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 14: Malaysia Road Freight Transport Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 15: Malaysia Road Freight Transport Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 16: Malaysia Road Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Road Freight Transport Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Malaysia Road Freight Transport Market?

Key companies in the market include Transocean Holdings Berhad, NYK (Nippon Yusen Kaisha) Line, CJ Logistics Corporation, DHL Group, Xin Hwa Holdings Berha, FM Global Logistics, GAC Malaysia, FedEx, Tiong Nam Logistics, Taipanco Sdn Bhd.

3. What are the main segments of the Malaysia Road Freight Transport Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

November 2023: DHL Express reaffirmed its commitment to clean mobility by adding 44 electric vans and seven electric scooters in Malaysia. This latest investment builds on the company’s milestone of being the first in the country to deploy electric vehicles for logistics use in October 2022.September 2023: FM Global Logistics Holdings Bhd has acquired Singapore-based CAC Logistics Services Pte Ltd for RM18.86 million (USD 5.5 million) cash, as it looks to expand its footing regionally. CAC is principally engaged in general warehousing, road transportation and other related services.September 2023: CJ Logistics has launched a transport platform called ‘the unban,’ connecting shippers and carriers, addressing entrenched transport issues and bringing a transformative wind to the freight transport market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Malaysia Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence