Key Insights

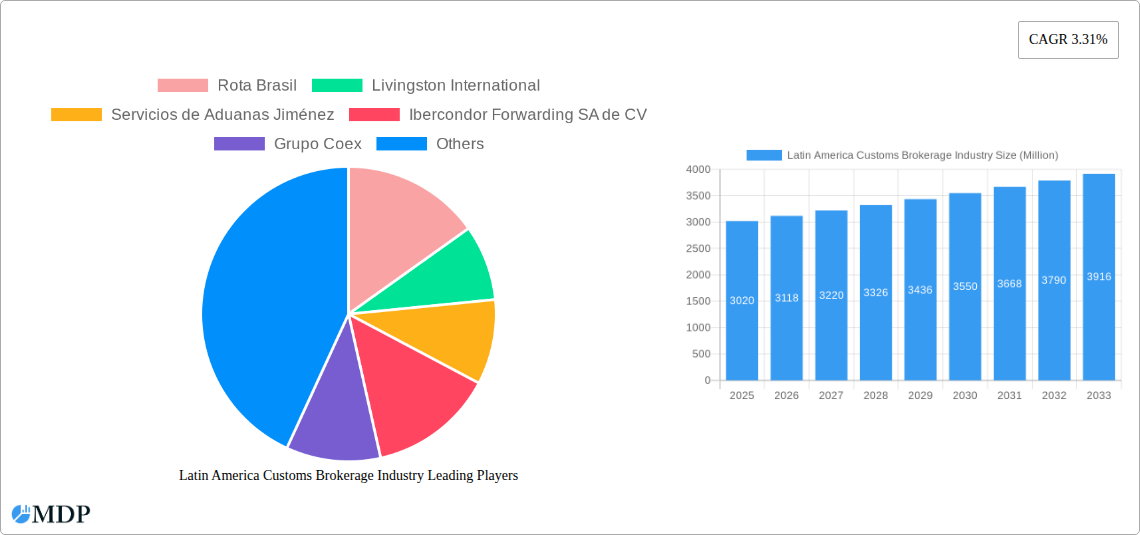

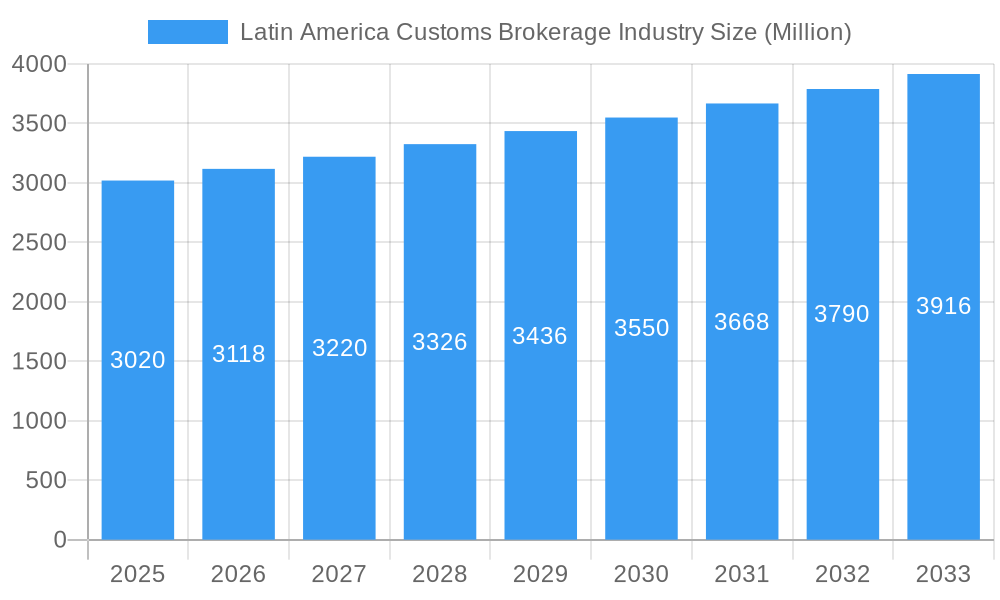

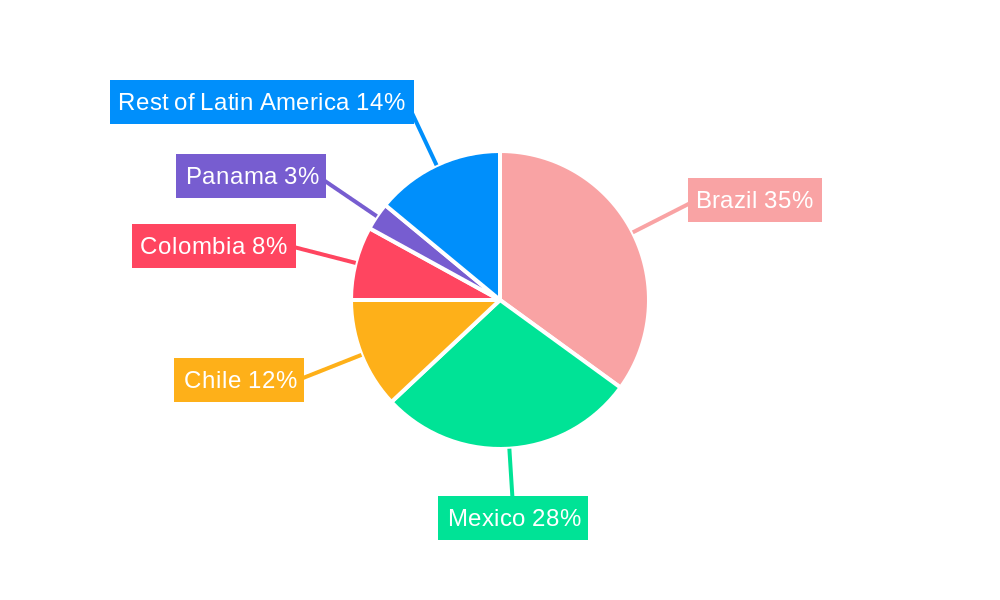

The Latin American Customs Brokerage industry, valued at $3.02 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.31% from 2025 to 2033. This growth is fueled by several key factors. The expansion of e-commerce across the region is significantly boosting cross-border trade, creating a higher demand for customs brokerage services. Furthermore, increasing international trade, particularly within the automotive, chemicals, and FMCG sectors, necessitates efficient and reliable customs clearance processes. The industry is segmented by mode of transport (ocean, air, land) and end-user sectors, with significant contributions from automotive, FMCG, retail, and the reefer segment (perishable goods). Brazil, Mexico, and Chile represent the largest markets within Latin America, driving a considerable portion of the overall industry revenue. However, growth is also expected in other countries like Colombia and Panama, reflecting the expanding economies and increasing trade activities in these regions. While regulatory complexities and potential trade wars pose challenges, the overall outlook for the Latin American customs brokerage market remains positive, driven by consistent economic growth and increasing globalization.

Latin America Customs Brokerage Industry Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational players like Expeditors International and Deutsche Post DHL Group, alongside several regional and smaller-scale companies catering to specific market niches and geographic areas. These smaller companies often offer specialized services or focus on particular end-user segments, creating a dynamic and competitive market. The success of these companies relies heavily on their ability to navigate the intricate regulatory environment, maintain strong client relationships, and offer efficient, cost-effective solutions. Technological advancements, such as digital customs clearance platforms, are expected to further shape the industry landscape, promoting greater transparency, efficiency, and cost optimization for both brokers and their clients. Companies that proactively adopt and integrate these technologies will likely gain a competitive edge in the coming years.

Latin America Customs Brokerage Industry Company Market Share

Latin America Customs Brokerage Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America customs brokerage industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report examines market dynamics, leading players, and future growth opportunities across key countries and segments. The report leverages data from the historical period (2019-2024) and incorporates the latest market trends to offer actionable strategic insights. Key players such as Rota Brasil, Livingston International, Servicios de Aduanas Jiménez, Ibercondor Forwarding SA de CV, Grupo Coex, and Expeditors International are analyzed, along with many other significant players.

Latin America Customs Brokerage Industry Market Dynamics & Concentration

The Latin American customs brokerage market is characterized by a moderate level of concentration, with a few large multinational players alongside numerous smaller, regional firms. Market share data suggests that the top 5 players account for approximately XX% of the total market revenue in 2025 (estimated). This concentration is expected to shift slightly by 2033, with larger players potentially consolidating their market presence through mergers and acquisitions (M&A). Over the study period (2019-2024), an estimated XX M&A deals occurred, driven primarily by a desire to expand geographic reach and service offerings.

- Innovation Drivers: Technological advancements in customs compliance software, data analytics, and automation are driving efficiency improvements and market expansion.

- Regulatory Frameworks: Varying regulatory landscapes across Latin American countries present both challenges and opportunities for customs brokers. Harmonization efforts within regional trade blocs could influence the market concentration.

- Product Substitutes: The emergence of digital platforms and streamlined customs processes presents some level of indirect substitution, though the specialized expertise of customs brokers remains crucial.

- End-User Trends: The growth of e-commerce and the increasing complexity of global supply chains are fueling demand for customs brokerage services.

- M&A Activities: The estimated XX M&A deals observed during 2019-2024 indicate a trend toward consolidation, particularly among larger players seeking economies of scale and broader market access.

Latin America Customs Brokerage Industry Industry Trends & Analysis

The Latin America customs brokerage industry is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This growth is driven by several key factors, including increasing international trade, rising e-commerce penetration, expanding manufacturing activities, and government initiatives to streamline customs procedures. Technological disruptions, such as blockchain technology and AI-powered customs solutions, are transforming the industry by improving efficiency and transparency. Market penetration is expected to increase from XX% in 2025 to XX% by 2033, driven by growth in key segments like FMCG, automotive and technology. The competitive dynamics are influenced by the interplay between large multinational players and smaller, localized businesses, creating both opportunities and challenges for all market participants. The industry is characterized by price competition alongside differentiation strategies focused on specialized service offerings and technological innovation.

Leading Markets & Segments in Latin America Customs Brokerage Industry

Mexico and Brazil represent the largest markets for customs brokerage services in Latin America, accounting for XX% and XX% of the total market value in 2025 (estimated), respectively. This dominance is attributable to their larger economies, higher volumes of international trade, and well-established logistics infrastructure. Other key markets include Colombia, Chile, and Panama.

Key Drivers for Leading Markets:

- Mexico: Strong manufacturing sector, proximity to the US, robust automotive and technology industries.

- Brazil: Large and diversified economy, significant agricultural exports (driving demand for Reefer services), and ongoing efforts to improve its logistics infrastructure.

- Colombia: Growth in the retail and FMCG sectors.

- Chile: Strong mining and agricultural exports.

- Panama: Strategic geographic location as a transit hub, supporting large volumes of ocean freight.

Dominant Segments:

- Mode of Transport: Ocean freight remains the most significant segment, followed by Air and Cross-border Land Transport. The growing e-commerce sector is driving demand for Air freight.

- End User: The FMCG, Automotive, and Retail sectors are the largest end-users of customs brokerage services in Latin America, while significant growth is projected in the Technology sector.

Latin America Customs Brokerage Industry Product Developments

Recent product innovations in the Latin American customs brokerage industry focus on enhanced digital platforms offering real-time tracking, improved data analytics for better risk management, and automated customs compliance solutions. These developments improve efficiency, reduce processing times, and enhance transparency for clients. The competitive advantage rests in offering seamless integration across diverse supply chains, coupled with specialized expertise in navigating the complex regulatory environments of different Latin American countries. The focus is on user-friendly interfaces, integration with existing enterprise resource planning (ERP) systems, and proactive risk mitigation services.

Key Drivers of Latin America Customs Brokerage Industry Growth

The growth of the Latin America customs brokerage industry is underpinned by several key factors:

- Technological advancements: Automation, digitalization, and data analytics are enhancing efficiency and reducing costs.

- Economic growth: Expanding economies in several Latin American countries are driving increased international trade.

- Regulatory reforms: Initiatives to streamline customs procedures and improve cross-border trade facilitation contribute to market expansion. Examples include regional trade agreements and digital customs platforms.

Challenges in the Latin America Customs Brokerage Industry Market

Significant challenges confront the Latin American customs brokerage industry:

- Regulatory complexity: Varied and sometimes inconsistent regulations across different countries present operational hurdles and compliance risks. The cost of navigating these complexities impacts overall profitability and service delivery.

- Supply chain disruptions: Global supply chain vulnerabilities, geopolitical instability, and unexpected events can significantly impact business operations.

- Competition: Intense competition from both large multinational players and smaller, agile local firms necessitates strategic differentiation and continuous innovation.

Emerging Opportunities in Latin America Customs Brokerage Industry

Several key opportunities are driving long-term growth:

- Technological innovation: The adoption of blockchain technology for secure and transparent customs processes, as well as the further development of AI-powered solutions are creating efficiency gains and opening new business models.

- Strategic partnerships: Collaboration between customs brokers, logistics providers, and technology companies can provide comprehensive supply chain solutions to clients.

- Market expansion: Untapped potential exists in less-developed regions of Latin America, presenting opportunities for expansion into new markets and service offerings.

Leading Players in the Latin America Customs Brokerage Industry Sector

- Rota Brasil

- Livingston International

- Servicios de Aduanas Jiménez

- Ibercondor Forwarding SA de CV

- Grupo Coex

- Expeditors International

- Elemar

- Deutsche Post DHL Group

- Aduana Cordero

- Grupo Ei

- Farrow

- DSV Panalpina AS

Key Milestones in Latin America Customs Brokerage Industry Industry

- 2020: Several key players implemented new digital platforms to improve efficiency and transparency.

- 2021: Increased focus on sustainable supply chain practices amongst major companies.

- 2022: Several mergers and acquisitions reshaped the market landscape.

- 2023: Introduction of new AI-powered customs compliance tools by leading players.

- 2024: Increased adoption of blockchain technology for secure data transfer amongst selected players.

Strategic Outlook for Latin America Customs Brokerage Industry Market

The Latin America customs brokerage industry is poised for continued growth, driven by technological advancements, economic expansion, and evolving regulatory landscapes. The future success of market players hinges on their ability to embrace digitalization, foster strategic partnerships, and adapt to the evolving needs of clients. Focusing on specialization, providing value-added services, and developing innovative solutions will be crucial for achieving sustainable growth and maintaining a competitive edge in this dynamic market.

Latin America Customs Brokerage Industry Segmentation

-

1. Mode of Transport

- 1.1. Ocean

- 1.2. Air

- 1.3. Cross-border Land Transport

-

2. End User

- 2.1. Automotive

- 2.2. Chemicals

- 2.3. FMCG (Fa

- 2.4. Retail (

- 2.5. Fashion and Lifestyle (Apparel and Footwear)

- 2.6. Reefer (

- 2.7. Technology (Consumer Electronics, Home Appliances)

- 2.8. Other End Users

Latin America Customs Brokerage Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Customs Brokerage Industry Regional Market Share

Geographic Coverage of Latin America Customs Brokerage Industry

Latin America Customs Brokerage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Increase in Ocean Freight

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Customs Brokerage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Ocean

- 5.1.2. Air

- 5.1.3. Cross-border Land Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Chemicals

- 5.2.3. FMCG (Fa

- 5.2.4. Retail (

- 5.2.5. Fashion and Lifestyle (Apparel and Footwear)

- 5.2.6. Reefer (

- 5.2.7. Technology (Consumer Electronics, Home Appliances)

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rota Brasil

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Livingston International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Servicios de Aduanas Jiménez

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ibercondor Forwarding SA de CV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grupo Coex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Expeditors International**List Not Exhaustive 6 3 Other Companies (Key Information/Overview - List of Key Small to Medium-scale Players in Each Country

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elemar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Deutsche Post DHL Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Aduana Cordero

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grupo Ei

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Farrow

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DSV Panalpina AS

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Rota Brasil

List of Figures

- Figure 1: Latin America Customs Brokerage Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Customs Brokerage Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Customs Brokerage Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 2: Latin America Customs Brokerage Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Latin America Customs Brokerage Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Customs Brokerage Industry Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 5: Latin America Customs Brokerage Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Latin America Customs Brokerage Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Customs Brokerage Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Customs Brokerage Industry?

The projected CAGR is approximately 3.31%.

2. Which companies are prominent players in the Latin America Customs Brokerage Industry?

Key companies in the market include Rota Brasil, Livingston International, Servicios de Aduanas Jiménez, Ibercondor Forwarding SA de CV, Grupo Coex, Expeditors International**List Not Exhaustive 6 3 Other Companies (Key Information/Overview - List of Key Small to Medium-scale Players in Each Country, Elemar, Deutsche Post DHL Group, Aduana Cordero, Grupo Ei, Farrow, DSV Panalpina AS.

3. What are the main segments of the Latin America Customs Brokerage Industry?

The market segments include Mode of Transport, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.02 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Increase in Ocean Freight.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Customs Brokerage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Customs Brokerage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Customs Brokerage Industry?

To stay informed about further developments, trends, and reports in the Latin America Customs Brokerage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence