Key Insights

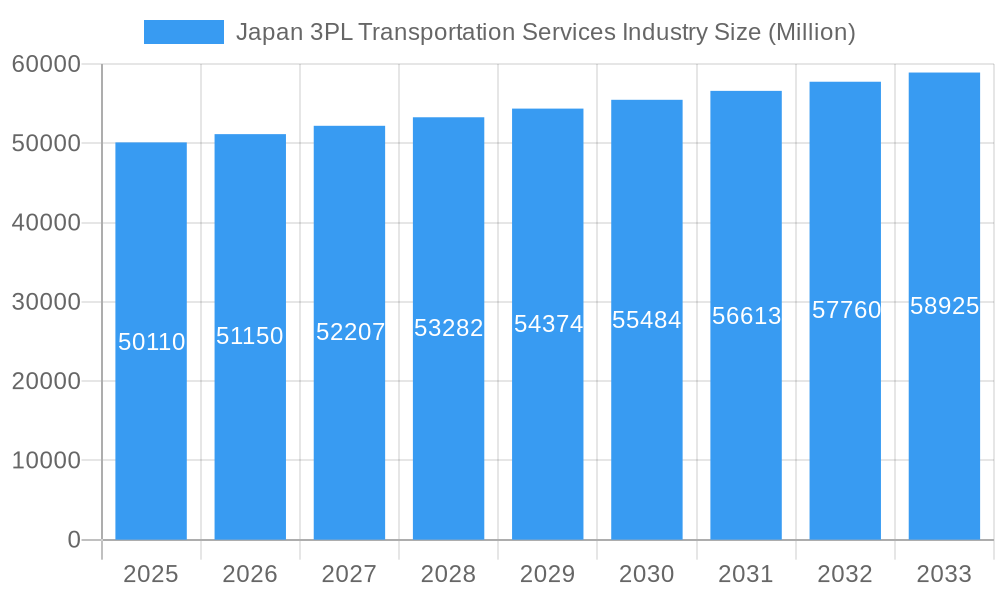

The Japan 3PL (Third-Party Logistics) transportation services market, valued at ¥50.11 billion in 2025, exhibits a steady growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 2.16% from 2025 to 2033. This growth is fueled by several key factors. The burgeoning e-commerce sector in Japan is significantly driving demand for efficient and reliable warehousing and distribution solutions, pushing 3PL providers to enhance their technological capabilities and optimize their supply chains. Simultaneously, the manufacturing and automotive industries, crucial pillars of the Japanese economy, continue to leverage 3PL services for streamlined logistics and inventory management, particularly for just-in-time manufacturing processes. Increased globalization and the growing complexity of international trade also contribute to the demand for robust international transportation management services. While regulatory hurdles and competition from domestic carriers pose some challenges, the overall market outlook remains positive, driven by the ongoing digital transformation within the logistics sector and increasing focus on supply chain resilience.

Japan 3PL Transportation Services Industry Market Size (In Billion)

The market segmentation reveals a diverse landscape. Domestic transportation management commands a significant share, reflecting the robust domestic trade within Japan. However, the international transportation management segment is expected to witness comparatively faster growth due to increasing cross-border trade. Value-added warehousing and distribution services are gaining traction, driven by the need for specialized inventory management solutions, including temperature-controlled storage for pharmaceuticals. Key end-user segments include manufacturing & automotive, oil & gas and chemicals, distributive trade (including e-commerce), pharma & healthcare, and construction. Leading players like Fukuyama, Sagawa Express, Nippon Express, and DHL are actively investing in technology and expanding their service offerings to consolidate their market position. Regional variations are expected, with Kanto and Kansai regions likely maintaining a larger market share due to higher economic activity and population density. The forecast period of 2025-2033 anticipates a steady market expansion, underpinned by the factors outlined above, suggesting ample opportunities for both established players and new entrants.

Japan 3PL Transportation Services Industry Company Market Share

Japan 3PL Transportation Services Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the Japan 3PL transportation services market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report delivers actionable intelligence on market size, segmentation, competitive dynamics, and future growth potential. The market value is predicted to reach XX Million by 2033.

Japan 3PL Transportation Services Industry Market Dynamics & Concentration

The Japanese 3PL transportation services market is a dynamic landscape characterized by a robust concentration of established players, alongside burgeoning opportunities for agile innovators. The competitive environment is shaped by deep-rooted strengths of incumbents, including expansive logistics networks, advanced technological infrastructure, and enduring client partnerships. Nevertheless, the influx of novel technologies and the emergence of specialized providers are actively reshaping market dynamics and creating pathways for disruption. Companies are increasingly prioritizing integrated solutions that go beyond basic transportation, encompassing warehousing, inventory management, and value-added services.

- Market Concentration: While the top 5 players, notably Fukuyama, Sagawa Express, and Nippon Express, command a significant portion of market share (estimated at 60%), a fragmented segment of numerous smaller and regional companies contribute to market diversity. This concentration is evolving as new business models and niche service providers gain traction.

- Innovation Drivers: The relentless pursuit of operational excellence is driving innovation. Key catalysts include the widespread adoption of automation (e.g., Autonomous Guided Vehicles (AGVs), robotic warehousing systems), the pervasive digitalization of logistics workflows through cloud-based platforms and IoT integration, and a growing demand for sophisticated value-added services such as kitting, assembly, and postponement.

- Regulatory Framework: The Japanese government's commitment to enhancing logistics infrastructure and optimizing regulatory frameworks provides a supportive ecosystem for industry growth. However, the evolving landscape of data privacy regulations and increasingly stringent environmental standards necessitate strategic adaptation and investment from 3PL providers.

- Product Substitutes: While direct substitutes for comprehensive 3PL services are limited, alternative transportation modes, such as an intensified reliance on high-speed rail for intercity freight, and the strategic decision by some businesses to insource their logistics operations, represent competitive pressures that 3PLs must proactively address through enhanced service offerings and cost-effectiveness.

- End-User Trends: The exponential growth of e-commerce continues to be a paramount driver, fueling demand for rapid, reliable, and hyper-personalized delivery solutions. Concurrently, a heightened emphasis on sustainability across all industries is compelling 3PLs to integrate eco-friendly practices into their supply chain strategies, including carbon footprint reduction and circular economy principles.

- M&A Activity: The Japanese 3PL market has experienced a notable uptick in Mergers and Acquisitions (M&A) activity. These strategic consolidations are primarily fueled by companies seeking to broaden their service portfolios, achieve greater economies of scale, and expand their operational footprints. An estimated 15-20 M&A deals were concluded between 2019 and 2024, indicative of an industry ripe for strategic integration.

Japan 3PL Transportation Services Industry Industry Trends & Analysis

The Japan 3PL transportation services market is projected for robust expansion, with an estimated Compound Annual Growth Rate (CAGR) of approximately 6-8% from 2025 to 2033. This sustained growth trajectory is fundamentally propelled by the insatiable appetite for e-commerce, the accelerating integration of cutting-edge technologies like Artificial Intelligence (AI) and advanced automation, and a discernible trend towards the strategic outsourcing of complex logistics functions by businesses of all sizes. Consumer expectations are rapidly evolving, demanding delivery services that are not only faster and more dependable but also demonstrably environmentally responsible. This paradigm shift places significant pressure on 3PL providers to continuously innovate and adapt their operational models. Competition remains intensely fierce, with established market leaders strategically investing in technological advancements, forging critical partnerships, and diversifying into burgeoning market segments to fortify their competitive positions. The penetration of advanced logistics technologies is on a steady, albeit measured, ascent, largely due to the initial capital expenditure required and the complexities associated with seamless integration into existing infrastructure.

Leading Markets & Segments in Japan 3PL Transportation Services Industry

While the national market is robust, certain segments and regions demonstrate stronger growth. The Distributive Trade segment (wholesale, retail, e-commerce) is experiencing significant growth due to increasing e-commerce activity.

- By Service: Domestic Transportation Management holds the largest market share, followed by Value-added Warehousing and Distribution. International Transportation Management is also growing, driven by increased globalization.

- By End-User:

- Manufacturing & Automotive: This segment remains a significant driver of demand, requiring complex, integrated logistics solutions.

- Distributive Trade (Wholesale and Retail including e-commerce): Rapid e-commerce growth is fueling demand for efficient last-mile delivery and warehousing solutions.

- Pharma & Healthcare: This segment presents a growth opportunity with increasing demand for temperature-controlled transportation and storage.

Key Drivers:

- Robust domestic economy: Japan's relatively stable economy supports consistent demand for 3PL services.

- Government infrastructure initiatives: Investments in transportation infrastructure enhance logistics efficiency.

- Advanced technological adoption: The adoption of automation and digitalization enhances efficiency and reduces costs.

- E-commerce expansion: Rapid growth of online retail drives demand for efficient last-mile delivery.

Japan 3PL Transportation Services Industry Product Developments

Recent advancements in the Japan 3PL transportation services industry are heavily focused on elevating operational efficiency, enhancing end-to-end supply chain visibility, and championing sustainability. The integration of automation, encompassing sophisticated AGVs, intelligent robotic picking systems, and high-speed automated sorting solutions, is revolutionizing warehouse productivity and significantly accelerating delivery timelines. The deployment of real-time tracking technologies, coupled with advanced data analytics platforms, provides stakeholders with unparalleled visibility and granular control over their entire supply chain operations. In line with global environmental imperatives, sustainable practices are gaining significant traction, manifesting in the growing adoption of electric vehicle fleets for last-mile deliveries and the implementation of AI-driven route optimization algorithms to minimize carbon emissions. Furthermore, the market is witnessing a notable proliferation of specialized logistics solutions, including highly controlled temperature-sensitive transportation for pharmaceuticals and perishables, and robust reverse logistics services catering to the growing volume of returns.

Key Drivers of Japan 3PL Transportation Services Industry Growth

Several pivotal factors are propelling the sustained growth of the Japan 3PL transportation services industry. The transformative impact of technological advancements, particularly in AI and automation, is a primary driver, leading to substantial improvements in operational efficiency and significant cost reductions. The burgeoning e-commerce sector continues to be a monumental force, generating escalating demand for swift, secure, and reliable delivery networks. Complementing these internal market forces, proactive government initiatives aimed at bolstering logistics infrastructure and streamlining regulatory processes are creating a more conducive environment for industry expansion and innovation.

Challenges in the Japan 3PL Transportation Services Industry Market

The Japan 3PL transportation services industry grapples with a multifaceted set of challenges. A critical concern is the demographic shift leading to a shrinking workforce, which directly impacts labor availability and drives up labor costs. Volatile and escalating fuel prices present a persistent operational cost pressure. The competitive landscape is intensifying, with both domestic and international players vying for market share, often leading to price wars. Stringent environmental regulations, while necessary, mandate significant investments in sustainable technologies and practices, adding to operational overheads. Furthermore, the inherent vulnerability of global supply chains, exacerbated by geopolitical events and unforeseen disruptions, poses significant risks that require robust contingency planning and resilient operational frameworks.

Emerging Opportunities in Japan 3PL Transportation Services Industry

The sector’s future looks promising. Expanding e-commerce and increasing demand for specialized logistics services create significant opportunities. Strategic partnerships with technology providers can enhance capabilities and offer innovative solutions. Expansion into underserved regions and the integration of sustainable practices open up new avenues for growth.

Leading Players in the Japan 3PL Transportation Services Industry Sector

- Fukuyama

- Sagawa Express

- Nippon Express

- Yusen Logistics

- Kokusai Express

- Mitsui-Soko

- Alps Logistics

- Sankyu

- Kintetsu World Express

- DHL

- Yamato Holdings

- Hitachi Transport System

- Nichirei Logistics

Key Milestones in Japan 3PL Transportation Services Industry Industry

- April 2022: KKR's intended tender offer for Hitachi Transport System's shares signals investor confidence in the 3PL sector.

- January 2023: Geekplus's adoption of the Boomi platform highlights the growing importance of automation and intelligent connectivity in the Japanese 3PL market.

Strategic Outlook for Japan 3PL Transportation Services Industry Market

The Japan 3PL market offers strong long-term growth potential driven by technological advancements, e-commerce growth, and government initiatives. Companies focusing on automation, sustainable practices, and strategic partnerships are well-positioned to capitalize on emerging opportunities and solidify their market position. The increasing demand for customized and value-added services presents a significant growth avenue for innovative players.

Japan 3PL Transportation Services Industry Segmentation

-

1. Service

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Manufacturing & Automotive

- 2.2. Oil & Gas and Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End-Users

Japan 3PL Transportation Services Industry Segmentation By Geography

- 1. Japan

Japan 3PL Transportation Services Industry Regional Market Share

Geographic Coverage of Japan 3PL Transportation Services Industry

Japan 3PL Transportation Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for cold chain logistics4.; Expansion of international trade in the region

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of proper infrastructure and facilities4.; High cost associated to cold chain logistics

- 3.4. Market Trends

- 3.4.1. Growth in automotive and manufacturing sector driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan 3PL Transportation Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fukuyama

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sagawa Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nippon Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yusen Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kokusai Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsui-Soko

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alps Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sankyu

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kintetsu World Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DHL**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yamato Holdings

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hitachi Transport System

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Nichirei Logistics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Fukuyama

List of Figures

- Figure 1: Japan 3PL Transportation Services Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan 3PL Transportation Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan 3PL Transportation Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Japan 3PL Transportation Services Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Japan 3PL Transportation Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan 3PL Transportation Services Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Japan 3PL Transportation Services Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Japan 3PL Transportation Services Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan 3PL Transportation Services Industry?

The projected CAGR is approximately 2.16%.

2. Which companies are prominent players in the Japan 3PL Transportation Services Industry?

Key companies in the market include Fukuyama, Sagawa Express, Nippon Express, Yusen Logistics, Kokusai Express, Mitsui-Soko, Alps Logistics, Sankyu, Kintetsu World Express, DHL**List Not Exhaustive, Yamato Holdings, Hitachi Transport System, Nichirei Logistics.

3. What are the main segments of the Japan 3PL Transportation Services Industry?

The market segments include Service, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 50.11 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for cold chain logistics4.; Expansion of international trade in the region.

6. What are the notable trends driving market growth?

Growth in automotive and manufacturing sector driving the market.

7. Are there any restraints impacting market growth?

4.; Lack of proper infrastructure and facilities4.; High cost associated to cold chain logistics.

8. Can you provide examples of recent developments in the market?

January 2023: BoomiTM, a pioneer in intelligent connectivity and automation, revealed that Geekplus Co., Ltd. (Geekplus), which has dominated the Japanese market for automated guided vehicles (AGV) for four years running, has chosen the Boomi AtomSphereTM Platform to automate its upcoming smart logistics platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan 3PL Transportation Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan 3PL Transportation Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan 3PL Transportation Services Industry?

To stay informed about further developments, trends, and reports in the Japan 3PL Transportation Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence