Key Insights

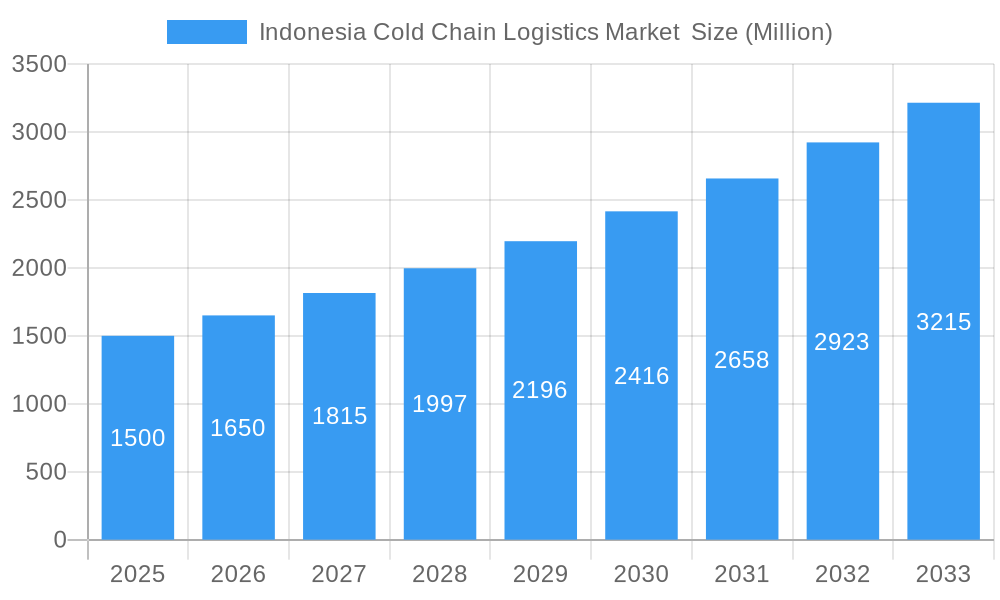

The Indonesian cold chain logistics market is experiencing robust growth, driven by a burgeoning population, rising disposable incomes, and increasing demand for perishable goods. The market's Compound Annual Growth Rate (CAGR) of 10% from 2019 to 2024 indicates significant expansion, projected to continue into the forecast period (2025-2033). Key drivers include the expanding processed food and pharmaceutical sectors, along with increasing consumer preference for fresh produce and refrigerated dairy products. The market is segmented by application (horticulture, dairy, meat, poultry, processed food, pharmaceuticals, and others), service (storage, transportation, and value-added services like blast freezing and inventory management), and temperature (chilled, frozen, and ambient). Growth within the chilled and frozen segments is particularly noteworthy, reflecting the rising demand for temperature-sensitive products. While challenges exist, such as inadequate infrastructure in certain regions and the need for enhanced technology adoption, the overall market outlook remains positive. The presence of established players like Pluit Cold Storage PT and MGM Bosco Logistics Bekasi, coupled with emerging companies, indicates a competitive yet dynamic market landscape ready for further expansion. The government's focus on improving infrastructure and supporting the logistics sector also contributes positively to the market's long-term trajectory.

Indonesia Cold Chain Logistics Market Market Size (In Billion)

The substantial market size (although the precise figure is unavailable, estimates based on the CAGR and industry benchmarks suggest a sizeable and rapidly expanding market) presents significant opportunities for investment and growth. The focus on value-added services suggests an increasing sophistication in the cold chain, indicating a shift toward more efficient and technologically advanced solutions. This includes the adoption of advanced tracking and monitoring systems, enhancing supply chain transparency and reducing spoilage. Furthermore, the diversification of applications across sectors such as pharmaceuticals and life sciences points towards a resilient and diverse market, less vulnerable to fluctuations in individual sectors. Continued growth hinges on sustained investment in infrastructure, technological advancements, and a skilled workforce capable of managing the complexities of the cold chain.

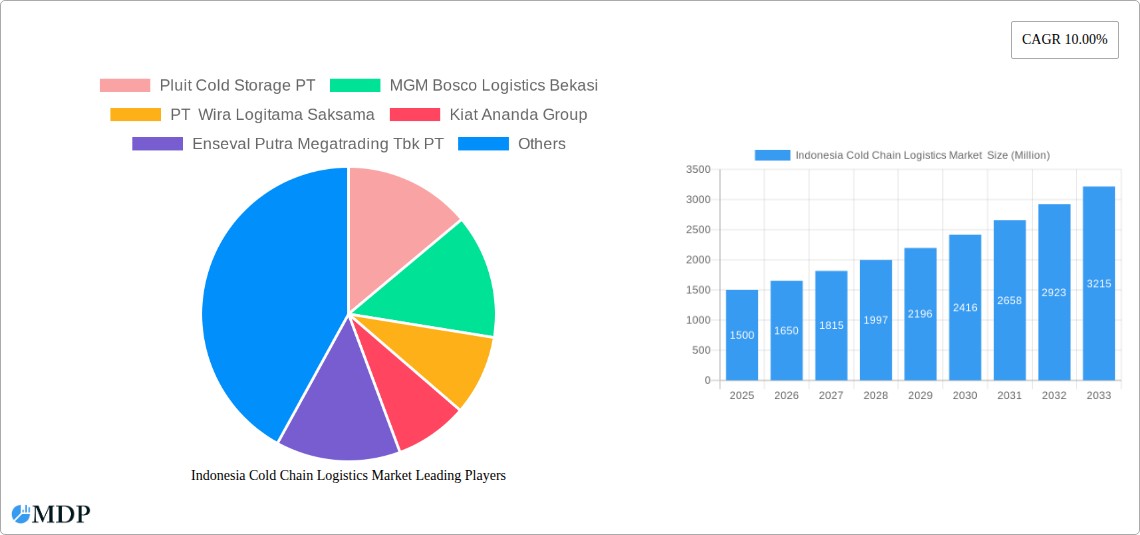

Indonesia Cold Chain Logistics Market Company Market Share

Indonesia Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Indonesia Cold Chain Logistics Market, covering market dynamics, industry trends, leading segments, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for stakeholders across the cold chain logistics ecosystem. The Indonesian cold chain market is experiencing significant growth, driven by rising disposable incomes, a burgeoning middle class, and increasing demand for perishable goods. This report uncovers the key factors shaping this dynamic landscape.

Indonesia Cold Chain Logistics Market Market Dynamics & Concentration

The Indonesian cold chain logistics market is characterized by a moderately fragmented landscape, with a mix of large multinational players and smaller domestic companies competing for market share. Market concentration is influenced by factors such as infrastructure development, regulatory changes, and technological advancements. While data on precise market share for individual companies is limited, we estimate that the top 5 players account for approximately xx% of the market in 2025. Significant M&A activity is driving consolidation, with a notable increase in deal counts observed in recent years. For example, the investment in Coldspace highlights the interest from both domestic and international investors.

Innovation Drivers: Technological advancements in areas like temperature-controlled containers, IoT-enabled tracking devices, and advanced warehouse management systems are enhancing efficiency and reducing costs.

Regulatory Frameworks: Government initiatives focused on improving infrastructure and food safety standards are creating a more favorable operating environment. However, inconsistencies and complexities within the regulatory framework remain a challenge for some operators.

Product Substitutes: While traditional methods of transportation and storage still hold significant market share, the emergence of innovative solutions such as specialized packaging and improved transport vehicles is posing a competitive threat.

End-User Trends: Rising consumer awareness regarding food safety and quality is driving demand for reliable cold chain solutions. This is particularly noticeable in the growth of e-commerce for perishable goods.

M&A Activities: The recent investments in Coldspace (USD 3.8 Million) and Fresh Factory (USD 4.5 Million) demonstrate a surge in investment in the sector, illustrating the market's attractiveness for investors and pointing towards further consolidation. The number of M&A deals is expected to increase by xx% in the forecast period, reaching an estimated xx deals by 2033.

Indonesia Cold Chain Logistics Market Industry Trends & Analysis

The Indonesian cold chain logistics market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Rising Disposable Incomes: Increased purchasing power among Indonesian consumers leads to higher demand for perishable goods, including fresh produce, dairy, and meat.

- E-commerce Boom: The rapid expansion of online grocery shopping is driving the need for efficient and reliable cold chain solutions.

- Government Initiatives: Infrastructure development projects, coupled with supportive policies focused on food security and supply chain modernization, are contributing to market expansion.

- Technological Advancements: Adoption of sophisticated technologies like GPS tracking, temperature monitoring, and data analytics is improving operational efficiency and reducing losses.

- Growing Awareness of Food Safety: Consumers are becoming more aware of food safety and quality, making reliable cold chain services vital.

- Market Penetration: While the penetration of cold chain infrastructure remains relatively low compared to developed nations, there is substantial scope for growth and expansion, particularly in rural areas.

The competitive landscape is dynamic, with both domestic and international players vying for market share. This has led to increased price competition and a focus on differentiation through service quality and technological innovation. The entry of new players further fuels competition and innovation within the sector.

Leading Markets & Segments in Indonesia Cold Chain Logistics Market

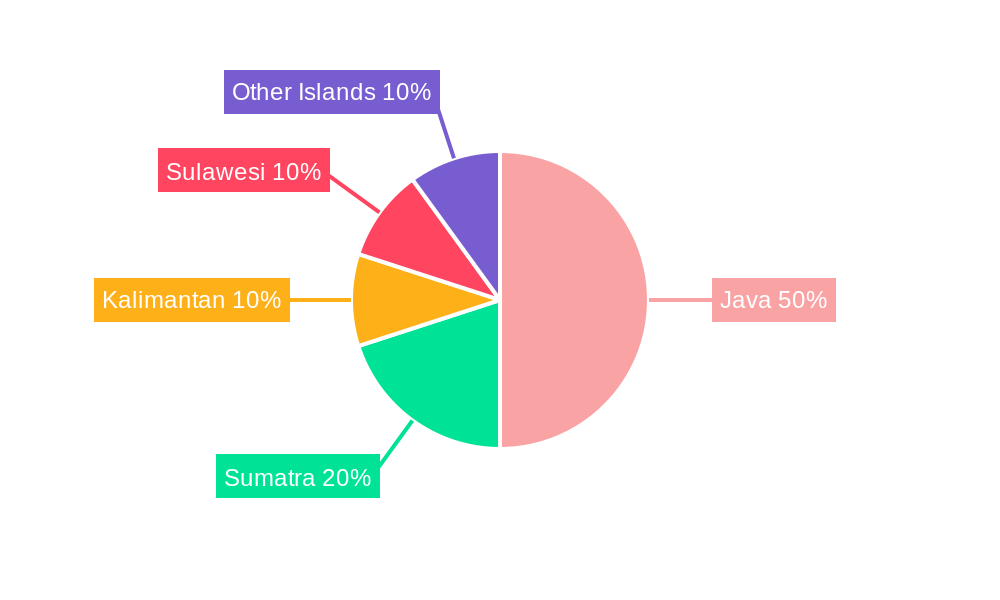

Indonesia's cold chain logistics market is geographically diverse with significant variations in demand and infrastructure across different regions. Java remains the dominant region due to its high population density, established infrastructure, and strong economic activity. However, growth potential is considerable in other regions such as Sumatra and Sulawesi.

By Application:

- Horticulture (Fresh Fruits & Vegetables): This segment dominates the market due to Indonesia's significant agricultural output and increasing consumer preference for fresh produce.

- Dairy Products: Rapid urbanization and changes in dietary habits are fuelling growth in this segment.

- Fish, Meat, and Poultry: Strong domestic consumption and export opportunities drive demand for efficient cold chain solutions.

- Processed Food Products: The expansion of the processed food industry is creating significant opportunities.

- Pharma and Life Sciences: This segment is experiencing increasing demand for temperature-sensitive pharmaceutical products.

By Service:

- Storage: Warehousing and cold storage facilities are crucial infrastructure elements within the sector.

- Transportation: Road, rail, and sea transportation contribute to overall logistical capabilities.

- Value-added Services: Services like blast freezing, labeling, and inventory management add value for clients and are witnessing increasing demand.

By Temperature:

- Chilled: This category holds the largest share, reflecting high demand for chilled produce and dairy products.

- Frozen: The frozen segment is experiencing steady growth due to its preservation capabilities.

- Ambient: This category caters to products that do not require strict temperature control, often playing a supporting role in the overall supply chain.

Key Drivers:

- Government infrastructure investment in transportation networks and cold storage facilities.

- Economic growth leading to rising disposable incomes and increased consumer demand.

- Supportive policies aimed at improving food safety and agricultural productivity.

Indonesia Cold Chain Logistics Market Product Developments

Recent product innovations focus on enhancing efficiency, improving temperature control, and reducing waste. Technological advancements, such as smart containers with real-time monitoring capabilities and automated warehouse systems, are improving traceability and reducing spoilage. New packaging materials, designed to maintain product quality and extend shelf life, are also gaining traction. These developments address the market's needs for improved reliability, greater efficiency, and enhanced food safety.

Key Drivers of Indonesia Cold Chain Logistics Market Growth

Several key factors are propelling the growth of the Indonesian cold chain logistics market:

- Technological advancements: IoT-enabled devices, automated systems, and sophisticated software enhance efficiency and visibility throughout the supply chain.

- Government support: Infrastructure development initiatives and favorable policies promoting food security are critical.

- Economic expansion: Rising disposable incomes and a growing middle class boost demand for perishable goods.

Challenges in the Indonesia Cold Chain Logistics Market Market

The Indonesian cold chain logistics market faces several key challenges:

- Inadequate infrastructure: Limited cold storage facilities, particularly in rural areas, hinders efficient operations. This leads to estimated xx Million USD in annual losses due to spoilage.

- High energy costs: The substantial energy consumption of cold chain facilities increases operational expenses.

- Regulatory complexities: Varying regulations across different regions create operational complexities and compliance challenges.

Emerging Opportunities in Indonesia Cold Chain Logistics Market

The Indonesian cold chain logistics market offers significant long-term growth opportunities:

- Expanding e-commerce: The rapidly expanding online grocery sector necessitates efficient cold chain solutions.

- Technological innovation: Adoption of new technologies can greatly improve efficiency and sustainability.

- Strategic partnerships: Collaboration between logistics providers and agricultural businesses enhances supply chain integration and efficiency.

Leading Players in the Indonesia Cold Chain Logistics Market Sector

- Pluit Cold Storage PT

- MGM Bosco Logistics Bekasi

- PT Wira Logitama Saksama

- Kiat Ananda Group

- Enseval Putra Megatrading Tbk PT

- PT YCH Indonesia

- PT Agility International

- GAC Samudera Logistics

- PT International Mega Sejahtera

- Dua Putera Perkasa Pratama

- PT Halal Logistic Multi Terminal Indonesia

Key Milestones in Indonesia Cold Chain Logistics Market Industry

- June 2022: Fresh Factory secures USD 4.5 Million in funding for expansion across Java, Sumatra, and Sulawesi. This highlights the growing investor interest in the sector and its expansion potential.

- May 2023: Coldspace completes a USD 3.8 Million seed round, indicating significant early-stage investment in integrated cold chain solutions. This underscores a focus on end-to-end solutions and technological innovation within the market.

Strategic Outlook for Indonesia Cold Chain Logistics Market Market

The Indonesian cold chain logistics market presents a compelling investment opportunity. Continued growth is expected, driven by increasing consumer demand, technological advancements, and supportive government policies. Strategic partnerships, investments in infrastructure, and the adoption of innovative technologies will be crucial for players seeking to capitalize on the significant market potential. The market is poised for significant expansion, particularly in underserved regions, with opportunities for both established players and new entrants to gain market share.

Indonesia Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Pr

- 3.3. Fish, Meat, and Poultry

- 3.4. Processed Food Products

- 3.5. Pharma and Life Sciences

- 3.6. Other Ap

Indonesia Cold Chain Logistics Market Segmentation By Geography

- 1. Indonesia

Indonesia Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Indonesia Cold Chain Logistics Market

Indonesia Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Oil and Natural Gas; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Increasing Regulatory Burden and Compliance Costs; Volatility of Fuel Prices

- 3.4. Market Trends

- 3.4.1. Growing Demand from E-Commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat, and Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma and Life Sciences

- 5.3.6. Other Ap

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pluit Cold Storage PT

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MGM Bosco Logistics Bekasi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Wira Logitama Saksama

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kiat Ananda Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Enseval Putra Megatrading Tbk PT

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT YCH Indonesia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Agility International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GAC Samudera Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT International Mega Sejahtera

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dua Putera Perkasa Pratama**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT Halal Logistic Multi Terminal Indonesia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Pluit Cold Storage PT

List of Figures

- Figure 1: Indonesia Cold Chain Logistics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Cold Chain Logistics Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 2: Indonesia Cold Chain Logistics Market Revenue undefined Forecast, by Temperature 2020 & 2033

- Table 3: Indonesia Cold Chain Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Indonesia Cold Chain Logistics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Indonesia Cold Chain Logistics Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 6: Indonesia Cold Chain Logistics Market Revenue undefined Forecast, by Temperature 2020 & 2033

- Table 7: Indonesia Cold Chain Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Indonesia Cold Chain Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Cold Chain Logistics Market ?

The projected CAGR is approximately 6.91%.

2. Which companies are prominent players in the Indonesia Cold Chain Logistics Market ?

Key companies in the market include Pluit Cold Storage PT, MGM Bosco Logistics Bekasi, PT Wira Logitama Saksama, Kiat Ananda Group, Enseval Putra Megatrading Tbk PT, PT YCH Indonesia, PT Agility International, GAC Samudera Logistics, PT International Mega Sejahtera, Dua Putera Perkasa Pratama**List Not Exhaustive, PT Halal Logistic Multi Terminal Indonesia.

3. What are the main segments of the Indonesia Cold Chain Logistics Market ?

The market segments include Service, Temperature, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Oil and Natural Gas; Technological Advancements.

6. What are the notable trends driving market growth?

Growing Demand from E-Commerce Sector.

7. Are there any restraints impacting market growth?

Increasing Regulatory Burden and Compliance Costs; Volatility of Fuel Prices.

8. Can you provide examples of recent developments in the market?

May 2023: ASSA, one of the largest logistics companies in Indonesia, Triputra Group, a significant agricultural conglomerate in Indonesia, and MKA & ITS all participated in the USD 3.8 million (RM17 million) seed round that was completed by Coldspace, an Indonesian provider of integrated cold chain solutions. Coldspace, a supplier of complete end-to-end cold chain solutions for B2B and B2C clients in Indonesia, was established in December 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Cold Chain Logistics Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Cold Chain Logistics Market ?

To stay informed about further developments, trends, and reports in the Indonesia Cold Chain Logistics Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence