Key Insights

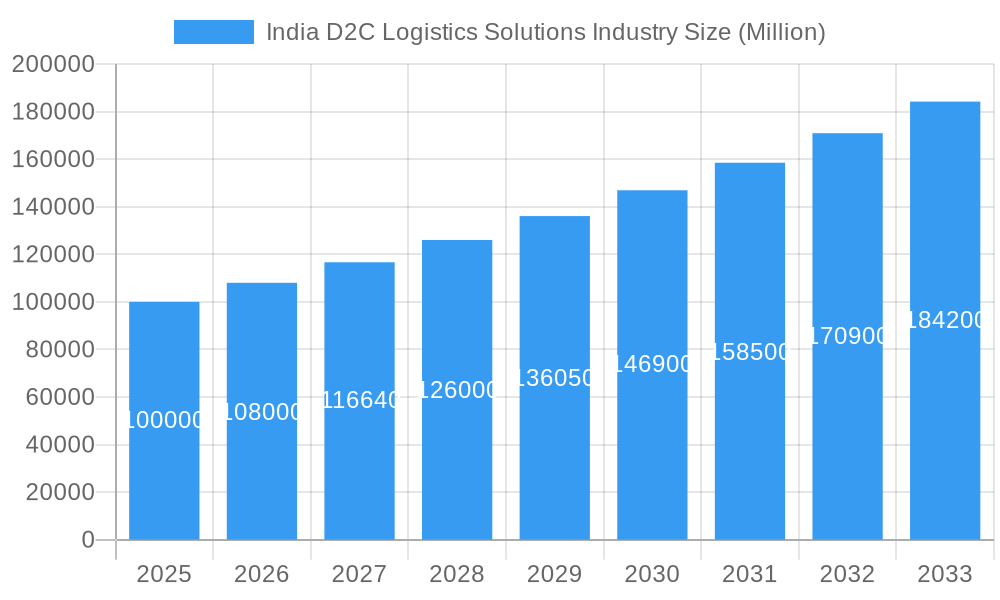

The India D2C logistics solutions market is poised for significant expansion, driven by the burgeoning e-commerce sector and the increasing adoption of direct-to-consumer (D2C) brand strategies. With a current market size of 14 billion, and projected to grow at a CAGR of 25% from the base year 2025, the market is forecast to reach substantial figures by 2033. This growth trajectory is underpinned by the digital transformation of D2C brands, advancements in logistics infrastructure, and a growing consumer base with enhanced purchasing power. Key market trends include the proliferation of hyperlocal delivery services, the integration of AI and machine learning for operational optimization, and a rising demand for sustainable logistics solutions. While challenges such as regional infrastructure gaps and last-mile delivery complexities persist, the overall market outlook remains highly favorable. Segmentation by end-user, including fashion, consumer electronics, beauty and personal care, and home decor, highlights the diverse needs of D2C businesses and presents opportunities for specialized logistics providers. Leading players are strategically positioned to leverage this growth, although intense competition is anticipated.

India D2C Logistics Solutions Industry Market Size (In Billion)

The projected CAGR of 25% indicates a robust and sustained expansion throughout the forecast period. This necessitates continuous innovation in logistics to meet escalating demand. Companies are actively investing in technology and infrastructure to improve operational efficiency, delivery speed, and customer experience. A strong focus on customer satisfaction, coupled with technological advancements, will be critical in shaping the future of the India D2C logistics solutions landscape. The market is expected to undergo further consolidation via mergers, acquisitions, and strategic alliances to expand market share and service offerings. Building resilient and scalable logistics networks will be paramount for success in this dynamic and rapidly evolving market.

India D2C Logistics Solutions Industry Company Market Share

India D2C Logistics Solutions Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic India D2C logistics solutions industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, growth drivers, challenges, and opportunities. High-growth segments like fashion, consumer electronics, and beauty & personal care are thoroughly dissected, along with key players such as Delhivery, Ecom Express, Unicommerce, and more. Download now to gain a competitive edge.

India D2C Logistics Solutions Industry Market Dynamics & Concentration

The Indian D2C logistics solutions market is experiencing robust growth, fueled by the burgeoning e-commerce sector and increasing consumer demand. Market concentration is moderate, with several key players holding significant market share, but numerous smaller players also contributing significantly. Delhivery and Ecom Express are amongst the leading players, commanding a combined xx% market share in 2025 (estimated). However, the landscape is dynamic, with considerable M&A activity shaping the competitive landscape. Innovation in areas like AI-powered route optimization and automation is driving efficiency and cost reduction. Favorable government policies promoting digitalization are further bolstering growth. The regulatory framework, while evolving, remains relatively supportive of market expansion. Product substitutes, such as in-house logistics solutions, exist but lack the scale and efficiency of dedicated third-party logistics providers. End-user trends increasingly favor faster delivery times and enhanced transparency in the delivery process.

- Market Concentration: Moderate, with top players holding xx% market share (estimated).

- M&A Activity: A significant number of M&A deals were recorded during the historical period (2019-2024), with xx deals observed in 2024 (predicted).

- Innovation Drivers: AI-powered solutions, automation, improved route optimization.

- Regulatory Framework: Generally supportive of market growth.

- End-User Trends: Preference for faster delivery, increased transparency.

India D2C Logistics Solutions Industry Industry Trends & Analysis

The Indian D2C logistics solutions market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by the rapid expansion of the e-commerce sector, rising disposable incomes, and increasing smartphone penetration. Technological advancements, such as the adoption of IoT and big data analytics, are significantly improving supply chain efficiency and enhancing customer experience. Consumer preferences are shifting towards faster and more reliable delivery options, including same-day and next-day delivery services. The competitive landscape is characterized by intense rivalry among established players and the emergence of new entrants. Market penetration is rapidly increasing, with xx% of D2C businesses utilizing third-party logistics solutions in 2025 (estimated).

Leading Markets & Segments in India D2C Logistics Solutions Industry

The fashion segment currently dominates the Indian D2C logistics solutions market, driven by the high demand for online apparel and accessories. This segment is expected to maintain its leading position throughout the forecast period. Strong economic growth, a large and young population, and a growing preference for online shopping are key drivers. However, significant growth is also observed in the consumer electronics and beauty and personal care segments.

- Fashion: High growth due to rising online apparel sales and favorable demographics.

- Consumer Electronics: Strong growth fueled by increased smartphone and electronics adoption.

- Beauty and Personal Care: Expanding rapidly due to increasing consumer spending and online beauty retail growth.

- Home Decor: Moderate growth, influenced by changing lifestyles and increased online shopping in this category.

- Other End Users: A diverse segment with varied growth rates.

Key Drivers:

- Economic policies: Government initiatives supporting e-commerce and digitalization are boosting the market.

- Infrastructure development: Improvements in logistics infrastructure, such as improved road networks and warehousing facilities, facilitate growth.

India D2C Logistics Solutions Industry Product Developments

Product development in the India D2C logistics solutions sector is being dramatically reshaped by cutting-edge technological advancements. Key innovations include sophisticated real-time tracking systems offering granular visibility across the entire supply chain, AI-powered route optimization algorithms that dynamically adjust delivery paths to minimize transit times and fuel consumption, and advanced automated warehousing solutions employing robotics and intelligent sorting systems to enhance throughput and accuracy. These developments are not merely incremental; they are fundamentally transforming operations, leading to substantial gains in efficiency, significant cost reductions, and a marked improvement in overall customer satisfaction. The market is witnessing a pronounced trend towards the seamless integration of these disparate technologies, creating unified platforms that offer end-to-end visibility and granular control over every stage of the delivery lifecycle. This holistic approach empowers businesses with optimized delivery networks, enhanced predictability of delivery times, and a superior, more personalized customer experience.

Key Drivers of India D2C Logistics Solutions Industry Growth

The growth of the India D2C logistics solutions industry is propelled by several key factors. Technological advancements, such as AI and IoT, streamline operations and improve efficiency. The burgeoning e-commerce sector creates significant demand for reliable logistics services. Favorable government policies promoting digitalization and infrastructure development further enhance market growth. For example, the Digital India initiative has significantly impacted the adoption of technology within the logistics sector.

Challenges in the India D2C Logistics Solutions Industry Market

The burgeoning India D2C logistics solutions industry, while experiencing rapid growth, navigates a complex landscape fraught with challenges. Navigating the intricate and often evolving regulatory frameworks across different states presents a significant hurdle. Furthermore, persistent infrastructure limitations, particularly in Tier 2 and Tier 3 cities, can impede efficient operations and extend delivery timelines. The inherent vulnerability of supply chains to disruptions, especially during peak e-commerce seasons like festivals, poses a constant threat to service reliability. The intensely competitive market environment, with a mix of large, established players and nimble startups, exerts considerable pressure on pricing strategies and profit margins. Collectively, these factors contribute to elevated operational costs and a higher risk of delivery delays, with the impact on profitability for larger players being estimated at approximately xx Million INR annually, a figure predicted to fluctuate based on market dynamics and operational efficiencies.

Emerging Opportunities in India D2C Logistics Solutions Industry

Significant opportunities arise from technological breakthroughs in areas such as drone delivery and autonomous vehicles, promising greater efficiency and reach. Strategic partnerships between logistics providers and D2C brands enhance market penetration and create unique value propositions. Expansion into underserved markets presents significant growth potential, as does the increasing adoption of omnichannel strategies by D2C businesses.

Leading Players in the India D2C Logistics Solutions Industry Sector

- Delhivery

- Ecom Express

- Unicommerce

- Gati Ltd

- DHL E-commerce

- Shipyaari

- Shiprocket

- Shipway

- Shadowfax

- Pickrr

Key Milestones in India D2C Logistics Solutions Industry Industry

- May 2023: Delhivery invests Rs 25 crore in Vinculum to strengthen D2C offerings. This signifies a strategic move towards enhancing its technological capabilities and expanding its D2C market share.

- July 2023: Myntra's D2C program accelerates growth for 200 Indian fashion and lifestyle brands, indicating a major push towards direct engagement with consumers and highlighting the importance of robust logistics for D2C success.

- August 2023: CEVA Logistics acquires a 96% stake in Stellar Value Chain Solutions, demonstrating significant consolidation within the Indian logistics landscape and potentially altering the competitive dynamics.

Strategic Outlook for India D2C Logistics Solutions Industry Market

The future trajectory of the India D2C logistics solutions market appears exceptionally promising, fueled by a confluence of powerful growth drivers. Continued advancements in technology, the ever-increasing adoption of e-commerce by both consumers and businesses, and supportive government initiatives aimed at bolstering digital infrastructure and trade are set to propel the industry forward. Strategic collaborations and partnerships will be instrumental in expanding reach and enhancing service offerings, while a focused approach on penetrating emerging markets will unlock new avenues for growth. Ultimately, companies that proactively embrace technological innovation, demonstrate agility in adapting to evolving consumer expectations for speed and convenience, and forge strong operational capabilities are exceptionally well-positioned to achieve significant market leadership and sustained success in this dynamic sector.

India D2C Logistics Solutions Industry Segmentation

-

1. End user

- 1.1. Fashion

- 1.2. Consumer electronic

- 1.3. Beauty and Personal Care

- 1.4. Home decor

- 1.5. Other end users

India D2C Logistics Solutions Industry Segmentation By Geography

- 1. India

India D2C Logistics Solutions Industry Regional Market Share

Geographic Coverage of India D2C Logistics Solutions Industry

India D2C Logistics Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of digital infrastructure and rise in the number of millennials; Higher internet penetration

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Competition from established brands

- 3.4. Market Trends

- 3.4.1. Festive Season and Mega Sales Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India D2C Logistics Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End user

- 5.1.1. Fashion

- 5.1.2. Consumer electronic

- 5.1.3. Beauty and Personal Care

- 5.1.4. Home decor

- 5.1.5. Other end users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by End user

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delhivery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ecom Express**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unicommerce

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gati Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL E-commerce

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shipyaari

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shiprocket

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shipway

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shadowfax

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pickrr

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Delhivery

List of Figures

- Figure 1: India D2C Logistics Solutions Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India D2C Logistics Solutions Industry Share (%) by Company 2025

List of Tables

- Table 1: India D2C Logistics Solutions Industry Revenue billion Forecast, by End user 2020 & 2033

- Table 2: India D2C Logistics Solutions Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India D2C Logistics Solutions Industry Revenue billion Forecast, by End user 2020 & 2033

- Table 4: India D2C Logistics Solutions Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India D2C Logistics Solutions Industry?

The projected CAGR is approximately 25%.

2. Which companies are prominent players in the India D2C Logistics Solutions Industry?

Key companies in the market include Delhivery, Ecom Express**List Not Exhaustive, Unicommerce, Gati Ltd, DHL E-commerce, Shipyaari, Shiprocket, Shipway, Shadowfax, Pickrr.

3. What are the main segments of the India D2C Logistics Solutions Industry?

The market segments include End user.

4. Can you provide details about the market size?

The market size is estimated to be USD 14 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of digital infrastructure and rise in the number of millennials; Higher internet penetration.

6. What are the notable trends driving market growth?

Festive Season and Mega Sales Driving the Market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Competition from established brands.

8. Can you provide examples of recent developments in the market?

May 2023: Delhivery India's largest fully integrated logistics services provider, will invest around Rs 25 crore in Vinculum, a global software leader enabling omnichannel retailing for D2C enterprises, brands, brand distributors, and quick commerce companies, to strengthen its D2C offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India D2C Logistics Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India D2C Logistics Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India D2C Logistics Solutions Industry?

To stay informed about further developments, trends, and reports in the India D2C Logistics Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence