Key Insights

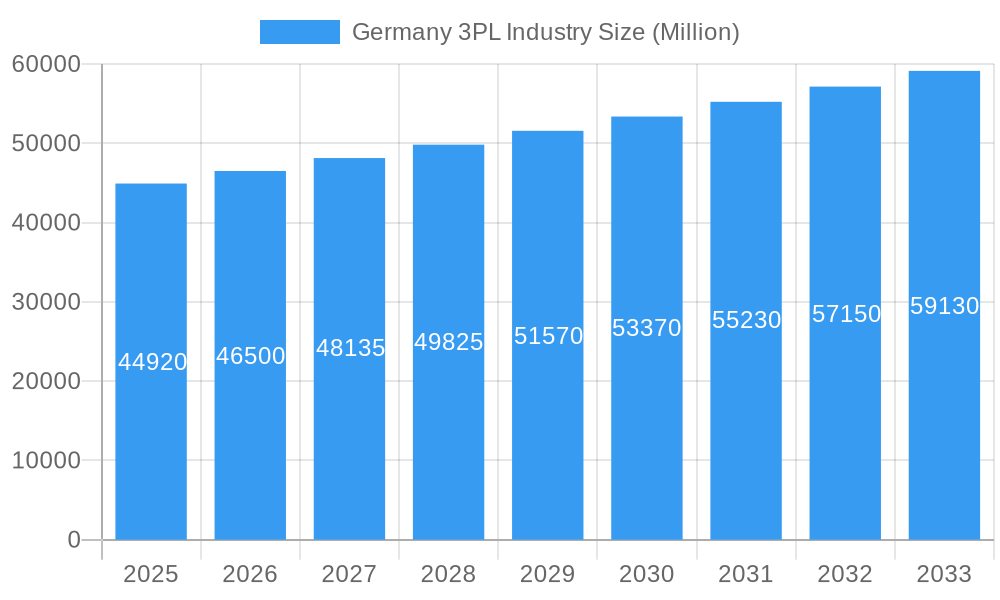

The German 3PL (Third-Party Logistics) market, valued at €44.92 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 3.43% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector in Germany necessitates efficient and scalable logistics solutions, significantly boosting demand for 3PL services, particularly value-added warehousing and distribution. Furthermore, the automotive and manufacturing sectors, significant contributors to the German economy, rely heavily on streamlined supply chains, fostering continuous growth within the 3PL market. Increased automation and technological advancements in warehouse management systems and transportation optimization further contribute to this growth. While regulatory changes and potential labor shortages could present challenges, the overall market outlook remains positive, driven by the strong economic fundamentals of Germany and the increasing adoption of advanced logistics technologies.

Germany 3PL Industry Market Size (In Billion)

The regional distribution of the German 3PL market reflects the country's economic landscape. States like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse, major industrial and commercial hubs, dominate the market share. The leading players, including DB Schenker, Kuehne + Nagel, DHL, and Dachser, compete fiercely, offering a wide range of services encompassing domestic and international transportation management, warehousing, and value-added services tailored to specific industry needs (automotive, consumer goods, healthcare, etc.). The increasing complexity of global supply chains and the growing preference for outsourcing logistics functions among businesses of all sizes are expected to drive further consolidation and innovation within the German 3PL sector over the forecast period. The market will likely witness intensified competition, with companies investing in digitalization and sustainable logistics solutions to maintain a competitive edge.

Germany 3PL Industry Company Market Share

Germany 3PL Industry Market Report: 2019-2033

This comprehensive report provides a deep dive into the dynamic German 3PL industry, offering invaluable insights for stakeholders seeking to navigate this competitive landscape. Covering the period 2019-2033, with a base year of 2025, this analysis illuminates key trends, challenges, and opportunities shaping the future of 3PL services in Germany. The report leverages extensive data analysis to forecast market growth, identify leading players, and pinpoint strategic imperatives for success. Expect detailed breakdowns of market segments, including transportation management (domestic and international) and value-added warehousing and distribution, across various end-user industries.

Germany 3PL Industry Market Dynamics & Concentration

The German 3PL market is characterized by a moderate level of concentration, with several large players holding significant market share. However, a fragmented landscape also exists, particularly among smaller, specialized providers. The market's dynamism is driven by several key factors:

- Innovation: Technological advancements, such as AI-powered logistics optimization and automation in warehousing, are significantly impacting efficiency and cost-effectiveness. The adoption of sustainable practices, including electric vehicle fleets and green logistics solutions, is also a major innovation driver.

- Regulatory Framework: Stringent environmental regulations and evolving data privacy laws influence operational strategies and investments. Compliance requirements create both challenges and opportunities for 3PL providers.

- Product Substitutes: The rise of e-commerce and direct-to-consumer models presents both competition and collaboration opportunities. Traditional 3PL providers are adapting their services to meet the demands of omnichannel distribution strategies.

- End-User Trends: The growing demand for customized logistics solutions, particularly in sectors such as e-commerce and healthcare, fuels market growth. The shift towards greater supply chain transparency and resilience is another key trend.

- M&A Activity: The industry witnesses ongoing mergers and acquisitions, with larger players seeking to expand their service portfolios and geographic reach. The number of M&A deals in the period 2019-2024 is estimated at xx, resulting in a xx% increase in market concentration. Key players like DB Schenker and Deutsche Post DHL are actively involved in shaping this consolidation. The market share of the top 5 players in 2024 was approximately xx%.

Germany 3PL Industry Industry Trends & Analysis

The German 3PL market is a dynamic and rapidly expanding sector, demonstrating significant resilience and adaptability. Historically, from 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of XX%. Projections indicate a continued upward trajectory, with an estimated CAGR of XX% for the forecast period spanning 2025 to 2033. This robust growth is underpinned by a confluence of influential factors. The penetration of 3PL services has markedly increased across critical end-user segments, with e-commerce standing out as a primary driver. Technological innovation is a cornerstone of this evolution; advancements such as the integration of blockchain technology are revolutionizing supply chain transparency and security. Furthermore, shifting consumer expectations, particularly the demand for expedited delivery times and a strong emphasis on sustainable logistics, are compelling 3PL providers to refine their service portfolios. The competitive landscape is characterized by intense rivalry, prompting market participants to differentiate through sophisticated value-added services, the deployment of cutting-edge technologies, and a strategic focus on specialized industry verticals. The market size in 2025 is anticipated to reach XX Million, propelled by a substantial XX% surge in e-commerce logistics and an equivalent XX% rise in the demand for bespoke value-added services, including customized packaging solutions and efficient returns management.

Leading Markets & Segments in Germany 3PL Industry

While the entire German market is significant, certain regions and segments are outperforming others. The strongest growth is witnessed in major metropolitan areas due to high population density and robust industrial activity.

By Services:

- International Transportation Management: This segment experiences significant growth due to Germany's role as a major trading hub within Europe and globally. Key drivers include increasing cross-border e-commerce and the globalization of supply chains.

- Value-added Warehousing and Distribution: This segment shows strong growth driven by the rising demand for customized warehousing solutions, including specialized storage for temperature-sensitive goods and value-added services like kitting and labeling.

By End User:

- Consumer and Retail (including E-commerce): This is the largest and fastest-growing segment, fuelled by the explosive growth of online shopping and the need for efficient last-mile delivery solutions.

- Automotive: This sector remains a major driver due to Germany's prominence in automotive manufacturing. However, growth is influenced by factors like global supply chain disruptions and the shift towards electric vehicles.

- Life Sciences and Healthcare: This segment is experiencing steady growth, driven by the need for secure and temperature-controlled transportation and storage of pharmaceuticals and medical devices.

Key drivers for these segments include:

- Strong economic growth in Germany.

- Well-developed infrastructure including roads, rail, and airports.

- Supportive government policies promoting logistics and supply chain efficiency.

Germany 3PL Industry Product Developments

The industry witnesses ongoing product innovation, with a focus on technology integration. Software solutions for real-time tracking, predictive analytics, and route optimization enhance efficiency and transparency. Automated warehousing systems, including robotics and AI, are improving speed and accuracy in order fulfillment. The integration of sustainable practices, such as electric vehicles and optimized routing for reduced fuel consumption, is becoming increasingly crucial for market competitiveness. These developments are aimed at offering clients improved cost-effectiveness, enhanced visibility, and greater responsiveness to market demands.

Key Drivers of Germany 3PL Industry Growth

The sustained expansion of the German 3PL market is attributed to several pivotal forces:

- Technological Advancements & Digital Transformation: The integration of advanced technologies like Artificial Intelligence (AI), Internet of Things (IoT), automation, and sophisticated data analytics is fundamentally reshaping operational efficiency. These innovations are instrumental in optimizing warehousing, transportation, and inventory management, leading to significant cost reductions and improved service delivery.

- E-commerce Dominance & Omnichannel Fulfillment: The relentless growth of online retail continues to be a paramount driver. The increasing volume of e-commerce transactions necessitates sophisticated logistics solutions for warehousing, last-mile delivery, and efficient reverse logistics to manage returns, thereby boosting demand for 3PL services.

- Sustainability & Green Logistics Initiatives: A growing imperative for environmentally conscious operations is driving demand for sustainable logistics solutions. This includes the adoption of electric vehicles, optimized routing to reduce emissions, and the implementation of eco-friendly packaging. Government incentives and corporate sustainability goals are further accelerating this trend.

- Globalization & Complex Supply Chains: The interconnected nature of global trade and increasingly intricate supply chains require specialized expertise in managing international logistics, customs clearance, and cross-border movements, areas where 3PL providers excel.

- Government Support & Infrastructure Development: Favorable government policies, strategic investments in logistics infrastructure, and initiatives aimed at enhancing the digitalization of the transport sector provide a conducive environment for the growth of the 3PL industry.

Challenges in the Germany 3PL Industry Market

Despite its growth, the German 3PL market navigates several significant challenges:

- Skilled Workforce Shortages (Especially Drivers): The industry continues to grapple with a critical shortage of qualified professionals, most notably drivers. This deficit directly impacts operational capacity and can lead to increased lead times and service disruptions. This shortage is projected to escalate transportation costs by an estimated XX% by 2028.

- Volatile Fuel Prices & Energy Costs: Fluctuations in global energy markets and rising fuel prices exert considerable pressure on operational expenses, impacting profitability and necessitating robust cost management strategies.

- Intensified Competition & Margin Pressure: The market is characterized by a highly competitive environment with numerous established and emerging players. This leads to pricing pressures and necessitates constant innovation and efficiency improvements to maintain healthy profit margins.

- Regulatory Landscape & Compliance: Navigating complex national and international regulations, including those related to transportation, environmental standards, and labor laws, requires significant resources and expertise.

- Digitalization Adoption & Cybersecurity: While technology is a driver, the pace of adoption and the associated costs can be challenging. Ensuring robust cybersecurity measures to protect sensitive supply chain data is also a critical concern.

Emerging Opportunities in Germany 3PL Industry

The German 3PL market presents several promising opportunities:

- Sustainable Logistics: Growing demand for environmentally friendly solutions presents opportunities for providers offering green logistics services.

- Technological Integration: Companies can leverage advanced technologies such as AI and blockchain to enhance efficiency and transparency.

- Strategic Partnerships: Collaborations between 3PL providers and technology firms can lead to innovative service offerings.

Leading Players in the Germany 3PL Industry Sector

- DB Schenker

- Hellmann Worldwide Logistics

- APL Logistics

- Honold Logistik Gruppe

- Dachser SE

- Ziegler Logistics Deutschland GmbH & Co. KG

- Kuehne + Nagel International AG

- FIEGE Group Foundation & Co. KG

- Havi Logistics

- Helm AG

- WemoveBW GmbH

- Rigterink Logistics B.V.

- Deutsche Post DHL Group

Key Milestones in Germany 3PL Industry Industry

- December 2022: DACHSER announced ambitious plans to integrate 50 Mercedes-Benz eActros LongHaul trucks into its European fleet, underscoring a significant commitment to advancing sustainable and emissions-free long-haul transportation.

- May 2022: Deutsche Post DHL achieved a major milestone by expanding its fleet to include its 20,000th e-vehicle. This expansion represents a substantial investment in green logistics, with the company allocating EUR 300 Million in 2022 alone towards this initiative. Furthermore, plans were revealed for the construction of 100 carbon-neutral delivery depots by the end of the year, alongside a commitment to procuring 400 (bio) gas-powered trucks over the subsequent two years. The launch of "GoGreen Plus" products empowers customers with tangible climate-friendly shipping options, further cementing the group's sustainability leadership.

Strategic Outlook for Germany 3PL Industry Market

The German 3PL market is poised for continued growth, driven by technological innovation, e-commerce expansion, and a growing focus on sustainability. Strategic partnerships and investments in advanced technologies will be crucial for success. Providers who adapt to changing consumer preferences and regulatory landscapes, while embracing sustainable practices, are best positioned to capitalize on the market's long-term potential. The market is expected to reach xx Million by 2033.

Germany 3PL Industry Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End User

- 2.1. Automobile

- 2.2. Construction

- 2.3. Consumer and Retail (including E-commerce)

- 2.4. Life Sciences and Healthcare

- 2.5. Manufacturing

- 2.6. Other End Users

Germany 3PL Industry Segmentation By Geography

- 1. Germany

Germany 3PL Industry Regional Market Share

Geographic Coverage of Germany 3PL Industry

Germany 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Complicated Product Returns

- 3.4. Market Trends

- 3.4.1. Growth in the Automotive Sector to Drive the German 3PL Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automobile

- 5.2.2. Construction

- 5.2.3. Consumer and Retail (including E-commerce)

- 5.2.4. Life Sciences and Healthcare

- 5.2.5. Manufacturing

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hellmann Worldwide Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 APL Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honold

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dachser

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ziegler Logistics Deutschland**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FIEGE Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Havi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Helm

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 WemoveBW GmbH

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rigterink Logistics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Deutsche Post DHL

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Germany 3PL Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany 3PL Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Germany 3PL Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Germany 3PL Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Germany 3PL Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 5: Germany 3PL Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Germany 3PL Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany 3PL Industry?

The projected CAGR is approximately 3.43%.

2. Which companies are prominent players in the Germany 3PL Industry?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistics, APL Logistics, Honold, Dachser, Ziegler Logistics Deutschland**List Not Exhaustive, Kuehne + Nagel, FIEGE Logistics, Havi, Helm, WemoveBW GmbH, Rigterink Logistics, Deutsche Post DHL.

3. What are the main segments of the Germany 3PL Industry?

The market segments include Services, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.92 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing E-commerce Sector.

6. What are the notable trends driving market growth?

Growth in the Automotive Sector to Drive the German 3PL Market.

7. Are there any restraints impacting market growth?

4.; Complicated Product Returns.

8. Can you provide examples of recent developments in the market?

Dec 2022: The logistics service provider DACHSER is planning to add 50 units of Mercedes-Benz eActros LongHaul, presented at IAA Transportation 2022, to its European fleet. The global company from Kempten signed a Letter of Intent with Mercedes-Benz Trucks to this end.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany 3PL Industry?

To stay informed about further developments, trends, and reports in the Germany 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence