Key Insights

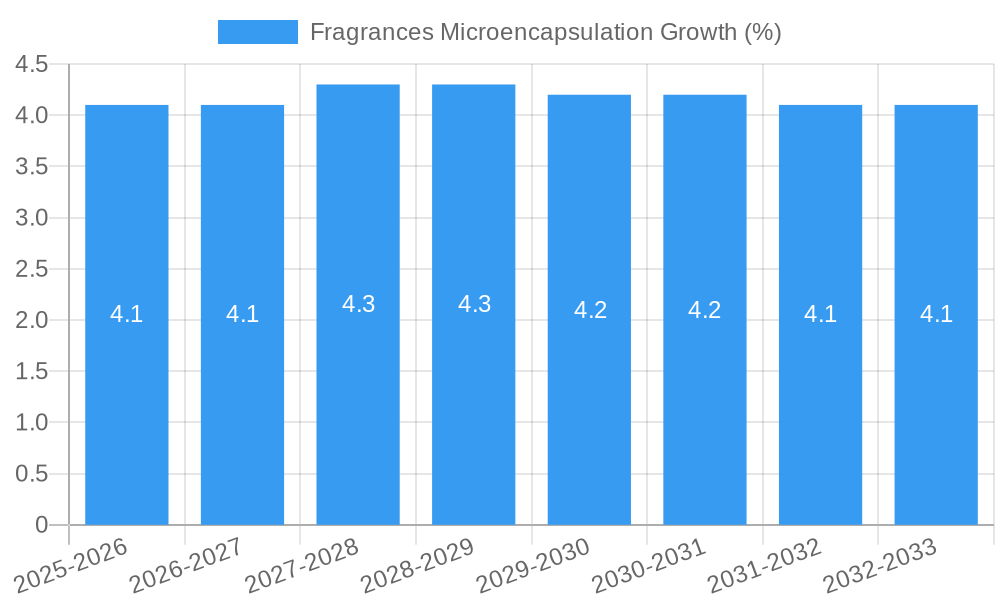

The global market for Fragrances Microencapsulation is poised for significant expansion, driven by its crucial role in enhancing product performance and consumer experience across diverse industries. Valued at an estimated USD 239 million in 2025, the market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 4.2% throughout the forecast period of 2025-2033. This sustained growth is underpinned by the increasing demand for encapsulated fragrances in high-value applications such as cosmetics and personal care products, where prolonged scent release and improved stability are paramount. The cleaning agents sector also presents substantial opportunities, as manufacturers seek to differentiate their offerings with advanced fragrance delivery systems that provide a more noticeable and longer-lasting olfactory impact. As consumer preferences lean towards sophisticated and enduring scent profiles, microencapsulation technologies are becoming indispensable for formulators aiming to deliver premium sensory experiences.

The market's trajectory is further influenced by a confluence of technological advancements and evolving consumer trends. Innovative physico-mechanical and chemical encapsulation methods are enabling greater control over fragrance release rates and improved shell integrity, leading to more effective and efficient products. For instance, advances in spray drying and coacervation techniques are facilitating the production of smaller, more uniform microcapsules with enhanced encapsulation efficiency. While the widespread adoption of these technologies fuels growth, potential restraints such as the cost of specialized equipment and raw materials, alongside stringent regulatory compliance for certain applications, may present challenges. However, the inherent benefits of microencapsulation in preserving fragrance integrity, preventing premature degradation, and enabling controlled release are strong counterbalances, ensuring continued market dynamism and innovation. Key players like Givaudan, International Flavors & Fragrances, Firmenich, and Symrise are at the forefront of this innovation, investing heavily in research and development to expand the application landscape and meet the evolving demands of the global consumer.

Fragrances Microencapsulation Market: Comprehensive Report Description

This in-depth report provides a detailed analysis of the fragrances microencapsulation market, a rapidly evolving sector crucial for enhancing the performance and longevity of aromatic compounds across diverse applications. With a study period spanning from 2019 to 2033, including a base and estimated year of 2025 and a forecast period from 2025 to 2033, this comprehensive market research delves into the intricate dynamics shaping this industry. We explore key segments including Cosmetic, Cleaning Agents, and Others, alongside various microencapsulation types such as Physico-Mechanical Methods, Chemical Methods, and Physico-Chemical Methods. Industry stakeholders, including manufacturers, ingredient suppliers, R&D professionals, and investors, will find actionable insights and strategic guidance within this report.

Fragrances Microencapsulation Market Dynamics & Concentration

The fragrances microencapsulation market is characterized by moderate to high concentration, with a significant market share held by key players who dominate through innovation and strategic acquisitions. The study analyzes the competitive landscape, identifying dominant companies and their estimated market share. Innovation drivers are a critical focus, including advancements in controlled release technologies and the development of novel encapsulation materials that offer enhanced fragrance stability and performance. Regulatory frameworks play a pivotal role, with stringent guidelines governing the use of encapsulation ingredients in consumer products, particularly in cosmetics and personal care. Product substitutes, such as direct fragrance incorporation and alternative scent delivery systems, are also examined for their impact on market penetration. End-user trends are continuously shifting, with a growing demand for long-lasting and personalized fragrance experiences, driving the need for sophisticated microencapsulation solutions. Mergers and acquisitions (M&A) activities are a significant indicator of market consolidation and expansion strategies, with several substantial deal counts anticipated throughout the forecast period. For instance, the historical period saw approximately 5 significant M&A deals, with projections for the forecast period indicating a potential increase to 10-15 deals annually, reflecting a growing appetite for market expansion and technological integration.

Fragrances Microencapsulation Industry Trends & Analysis

The fragrances microencapsulation industry is poised for substantial growth, driven by a confluence of factors that underscore its increasing importance in product development. The projected Compound Annual Growth Rate (CAGR) for the market is robust, estimated at a healthy 7.5%, indicating strong expansion from approximately 1,500 million in the base year 2025. Market penetration is expected to deepen as the benefits of microencapsulation—including improved scent longevity, reduced fragrance degradation, and controlled release—become more widely recognized and adopted across a broader range of consumer and industrial products. Technological disruptions are at the forefront of this growth. Innovations in microfluidics, spray drying, and coacervation are leading to more efficient, cost-effective, and environmentally friendly encapsulation processes. These advancements allow for the creation of microcapsules with tailored properties, such as specific particle sizes, shell thicknesses, and release profiles, catering to precise application requirements. Consumer preferences are also playing a pivotal role. There is a clear upward trend in demand for products offering extended fragrance experiences, from laundry detergents that keep clothes smelling fresh for weeks to fine fragrances that evolve throughout the day. This consumer desire for enduring olfactory pleasure directly fuels the adoption of microencapsulated fragrances. Furthermore, the growing emphasis on "clean beauty" and sustainable formulations is prompting manufacturers to seek encapsulation solutions that utilize natural and biodegradable materials, aligning with eco-conscious consumer values. The competitive dynamics within the industry are intense, marked by continuous R&D efforts to differentiate product offerings and secure intellectual property. Companies are investing heavily in developing proprietary technologies and specialized encapsulation techniques to gain a competitive edge. The increasing sophistication of these technologies allows for finer control over fragrance release, enabling a more nuanced and customizable sensory experience for the end-user. The market penetration of microencapsulated fragrances in the cleaning agents segment, for example, is projected to reach 60% by 2033, up from approximately 35% in 2019, highlighting the significant shift towards performance-enhanced consumer goods.

Leading Markets & Segments in Fragrances Microencapsulation

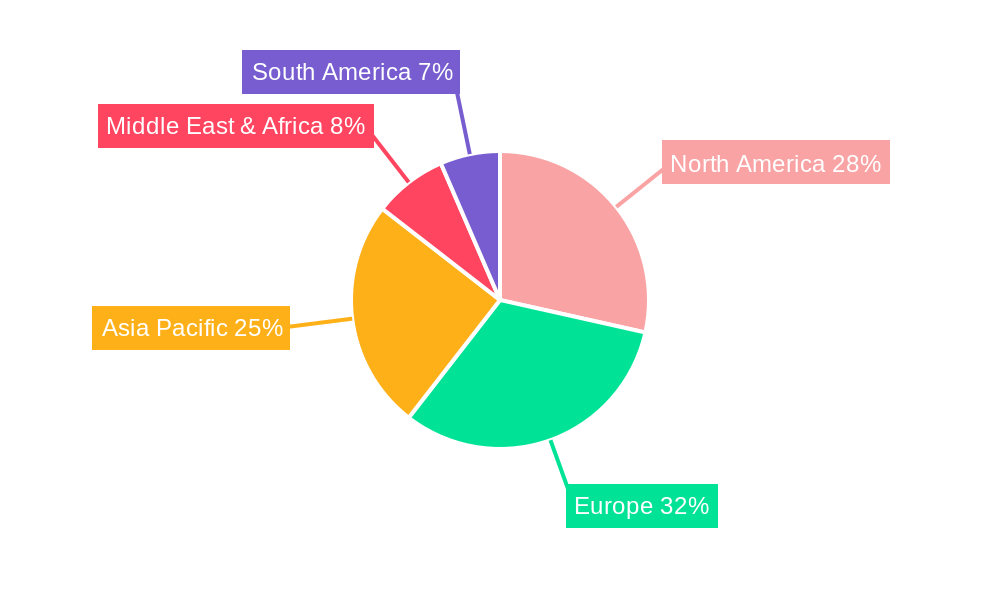

The fragrances microencapsulation market exhibits significant regional and segment-specific dominance. North America currently leads the market, driven by a strong consumer demand for premium personal care and home care products, coupled with a well-established infrastructure for research and development. Within North America, the United States represents the largest country-specific market, accounting for an estimated 30% of global market share in 2025. The Cosmetic application segment is the most dominant, representing approximately 55% of the total market value, projected to reach over 800 million by 2025. This dominance is fueled by the relentless innovation in skincare, haircare, and color cosmetics, where controlled fragrance release enhances the user experience and brand differentiation. The Cleaning Agents segment follows, holding a substantial 35% market share, driven by the consumer expectation of lasting freshness in laundry detergents, fabric softeners, and air fresheners. The Others segment, encompassing industrial applications, animal feed, and niche consumer goods, accounts for the remaining 10% but presents significant growth potential.

In terms of encapsulation types, Physico-Chemical Methods are currently the most prevalent, contributing an estimated 45% to the market. This is due to their versatility in encapsulating a wide range of fragrance molecules with good control over release characteristics. Physico-Mechanical Methods, including spray drying and extrusion, represent 35% of the market, favored for their scalability and cost-effectiveness for certain applications. Chemical Methods, such as in-situ polymerization and coacervation, account for 20% but are gaining traction for their ability to create highly stable and specialized microcapsules with precise release profiles.

Key drivers for the dominance of the Cosmetic segment include:

- Consumer demand for sensory experiences: Consumers increasingly seek multi-sensory product experiences, with fragrance playing a crucial role in emotional connection and perceived product quality.

- Brand differentiation: Microencapsulation allows cosmetic brands to offer unique and long-lasting scent profiles, setting them apart in a highly competitive market.

- Technological advancements: Continuous improvements in encapsulation techniques enable the development of smaller, more stable microcapsules that seamlessly integrate into cosmetic formulations without impacting texture or appearance.

The dominance of North America is further supported by:

- High disposable income: Consumers in this region have the purchasing power to invest in premium fragranced products.

- Robust R&D ecosystem: Significant investment in research and development by leading fragrance houses and ingredient manufacturers fosters innovation.

- Favorable regulatory environment: While regulations exist, the market generally supports innovation in ingredient technology.

Fragrances Microencapsulation Product Developments

Product developments in fragrances microencapsulation are rapidly evolving, focusing on enhanced performance and expanded application possibilities. Innovations include the creation of ultra-fine microcapsules for seamless integration into water-based formulations and the development of novel biodegradable shell materials derived from natural sources, aligning with sustainability trends. These advancements offer superior fragrance retention, controlled and triggered release mechanisms (e.g., heat or shear activation), and improved stability against degradation. Competitive advantages are being gained through proprietary encapsulation technologies that provide unique texture profiles and extended scent longevity, meeting the increasing consumer demand for immersive and enduring olfactory experiences across cosmetics, personal care, and home care products. The market is witnessing a surge in patented technologies that allow for precise fragrance delivery, enhancing product efficacy and consumer satisfaction.

Key Drivers of Fragrances Microencapsulation Growth

The fragrances microencapsulation market is experiencing significant growth due to several interconnected drivers. Technologically, advancements in encapsulation techniques, such as nanoencapsulation and advanced spray drying, enable more efficient and precise delivery of fragrance molecules, leading to prolonged scent diffusion and reduced fragrance loss. Economically, the increasing consumer demand for long-lasting and unique fragrance experiences in personal care, home care, and even food products is a major catalyst. This translates into higher market penetration for products enhanced by microencapsulation. Regulatory factors, while sometimes posing challenges, also drive innovation, pushing manufacturers to develop safer and more sustainable encapsulation materials. For instance, the growing preference for eco-friendly ingredients in cosmetics encourages the development of bio-based microcapsules, opening new market avenues. The global market size for fragrances microencapsulation is projected to grow from approximately 1,200 million in the historical year 2019 to an estimated 2,500 million by 2025, underscoring the robust growth trajectory.

Challenges in the Fragrances Microencapsulation Market

Despite its growth potential, the fragrances microencapsulation market faces several challenges. Regulatory hurdles, particularly concerning the use of specific encapsulation materials in food and cosmetic applications, can slow down product development and market entry. Supply chain issues, including the availability and cost volatility of key raw materials required for encapsulation, can impact production efficiency and profitability. Competitive pressures from alternative scent delivery technologies and the ongoing need for significant R&D investment to maintain a technological edge also present considerable obstacles. The cost of advanced microencapsulation technologies can be a barrier for smaller manufacturers, limiting widespread adoption in certain price-sensitive segments. For example, the market penetration of advanced encapsulation in the "Others" segment is currently limited to 15% due to these cost considerations.

Emerging Opportunities in Fragrances Microencapsulation

Emerging opportunities in the fragrances microencapsulation market are abundant, driven by technological breakthroughs and evolving consumer demands. The development of smart encapsulation technologies that respond to specific environmental triggers (e.g., humidity, light, or touch) offers new possibilities for dynamic fragrance release, enhancing product interactivity. Strategic partnerships between fragrance houses, ingredient suppliers, and end-product manufacturers are fostering co-creation and accelerating the adoption of innovative microencapsulation solutions. Market expansion into emerging economies, where the demand for fragranced consumer goods is rapidly growing, presents a significant avenue for growth. Furthermore, the increasing focus on sustainable and natural ingredients is creating a demand for bio-based and biodegradable microencapsulation systems, offering a distinct competitive advantage and aligning with global environmental consciousness.

Leading Players in the Fragrances Microencapsulation Sector

- Givaudan S.A.

- International Flavors & Fragrances, Inc.

- Calyxia S.A.

- Follmann GmbH & Co. KG

- Firmenich Incorporated

- Symrise AG

- Ingredion Incorporated

- MikroCaps d.o.o

- Koehler Innovative Solutions

- Ashland Global Holdings Inc.

- Robertet Group

- Vantage Specialty Chemicals

Key Milestones in Fragrances Microencapsulation Industry

- 2019: Launch of novel biodegradable polymer-based microcapsules for laundry care, extending scent release up to 12 weeks.

- 2020: Significant increase in patent filings related to controlled fragrance release for cosmetic applications, indicating intensified R&D.

- 2021: Acquisition of a specialized microencapsulation technology firm by a major fragrance ingredient supplier, aiming to bolster its product portfolio.

- 2022: Development of aroma-release technology for edible applications, opening new possibilities in the food and beverage sector.

- 2023: Introduction of UV-activated microcapsules for fragrances, designed for enhanced stability and controlled release in outdoor applications.

- 2024: Major ingredient manufacturer announces investment of over 100 million in a new microencapsulation production facility to meet growing demand.

- 2025 (Estimated): Anticipated launch of AI-driven formulation tools for optimizing microencapsulation parameters for specific fragrance profiles.

- 2026-2030: Expected emergence of advanced multi-functional microcapsules that combine fragrance release with other benefits like UV protection or antimicrobial properties.

- 2031-2033: Projections for widespread adoption of fully compostable microencapsulation technologies across major consumer product categories.

Strategic Outlook for Fragrances Microencapsulation Market

The strategic outlook for the fragrances microencapsulation market is highly positive, with growth accelerators firmly in place. Continued innovation in encapsulation materials and techniques, particularly those focusing on sustainability and enhanced performance, will be crucial for market leadership. Companies that can effectively leverage advanced technologies to offer tailored fragrance release profiles and unique sensory experiences will capture significant market share. The increasing consumer consciousness regarding environmental impact will drive demand for bio-based and biodegradable microencapsulation solutions, creating a distinct competitive advantage for early adopters. Strategic collaborations and partnerships will be instrumental in accelerating product development and market penetration. The market is projected to experience sustained growth, driven by the insatiable consumer desire for enduring and evolving fragrances across a widening array of product categories, with the global market size expected to surpass 5,000 million by 2033.

Fragrances Microencapsulation Segmentation

-

1. Application

- 1.1. Cosmetic

- 1.2. Cleaning Agents

- 1.3. Others

-

2. Types

- 2.1. Physico-Mechanical Methods

- 2.2. Chemical Methods

- 2.3. Physico-Chemical Methods

Fragrances Microencapsulation Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fragrances Microencapsulation REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fragrances Microencapsulation Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cosmetic

- 5.1.2. Cleaning Agents

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Physico-Mechanical Methods

- 5.2.2. Chemical Methods

- 5.2.3. Physico-Chemical Methods

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fragrances Microencapsulation Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cosmetic

- 6.1.2. Cleaning Agents

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Physico-Mechanical Methods

- 6.2.2. Chemical Methods

- 6.2.3. Physico-Chemical Methods

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fragrances Microencapsulation Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cosmetic

- 7.1.2. Cleaning Agents

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Physico-Mechanical Methods

- 7.2.2. Chemical Methods

- 7.2.3. Physico-Chemical Methods

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fragrances Microencapsulation Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cosmetic

- 8.1.2. Cleaning Agents

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Physico-Mechanical Methods

- 8.2.2. Chemical Methods

- 8.2.3. Physico-Chemical Methods

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fragrances Microencapsulation Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cosmetic

- 9.1.2. Cleaning Agents

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Physico-Mechanical Methods

- 9.2.2. Chemical Methods

- 9.2.3. Physico-Chemical Methods

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fragrances Microencapsulation Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cosmetic

- 10.1.2. Cleaning Agents

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Physico-Mechanical Methods

- 10.2.2. Chemical Methods

- 10.2.3. Physico-Chemical Methods

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Givaudan S.A.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 International Flavors & Fragrances

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Calyxia S.A.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Follmann GmbH & Co. KG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Firmenich Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Symrise AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ingredion Incorporated

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MikroCaps d.o.o

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Koehler Innovative Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ashland Global Holdings Inc.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Robertet Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Vantage Specialty Chemicals

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Givaudan S.A.

List of Figures

- Figure 1: Global Fragrances Microencapsulation Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fragrances Microencapsulation Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fragrances Microencapsulation Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fragrances Microencapsulation Revenue (million), by Types 2024 & 2032

- Figure 5: North America Fragrances Microencapsulation Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Fragrances Microencapsulation Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fragrances Microencapsulation Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fragrances Microencapsulation Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fragrances Microencapsulation Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fragrances Microencapsulation Revenue (million), by Types 2024 & 2032

- Figure 11: South America Fragrances Microencapsulation Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Fragrances Microencapsulation Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fragrances Microencapsulation Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fragrances Microencapsulation Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fragrances Microencapsulation Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fragrances Microencapsulation Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Fragrances Microencapsulation Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Fragrances Microencapsulation Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fragrances Microencapsulation Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fragrances Microencapsulation Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fragrances Microencapsulation Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fragrances Microencapsulation Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Fragrances Microencapsulation Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Fragrances Microencapsulation Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fragrances Microencapsulation Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fragrances Microencapsulation Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fragrances Microencapsulation Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fragrances Microencapsulation Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Fragrances Microencapsulation Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Fragrances Microencapsulation Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fragrances Microencapsulation Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fragrances Microencapsulation Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fragrances Microencapsulation Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fragrances Microencapsulation Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Fragrances Microencapsulation Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fragrances Microencapsulation Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fragrances Microencapsulation Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Fragrances Microencapsulation Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fragrances Microencapsulation Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fragrances Microencapsulation Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Fragrances Microencapsulation Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fragrances Microencapsulation Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fragrances Microencapsulation Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Fragrances Microencapsulation Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fragrances Microencapsulation Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fragrances Microencapsulation Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Fragrances Microencapsulation Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fragrances Microencapsulation Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fragrances Microencapsulation Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Fragrances Microencapsulation Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fragrances Microencapsulation Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fragrances Microencapsulation?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Fragrances Microencapsulation?

Key companies in the market include Givaudan S.A., International Flavors & Fragrances, Inc., Calyxia S.A., Follmann GmbH & Co. KG, Firmenich Incorporated, Symrise AG, Ingredion Incorporated, MikroCaps d.o.o, Koehler Innovative Solutions, Ashland Global Holdings Inc., Robertet Group, Vantage Specialty Chemicals.

3. What are the main segments of the Fragrances Microencapsulation?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 239 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fragrances Microencapsulation," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fragrances Microencapsulation report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fragrances Microencapsulation?

To stay informed about further developments, trends, and reports in the Fragrances Microencapsulation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence