Key Insights

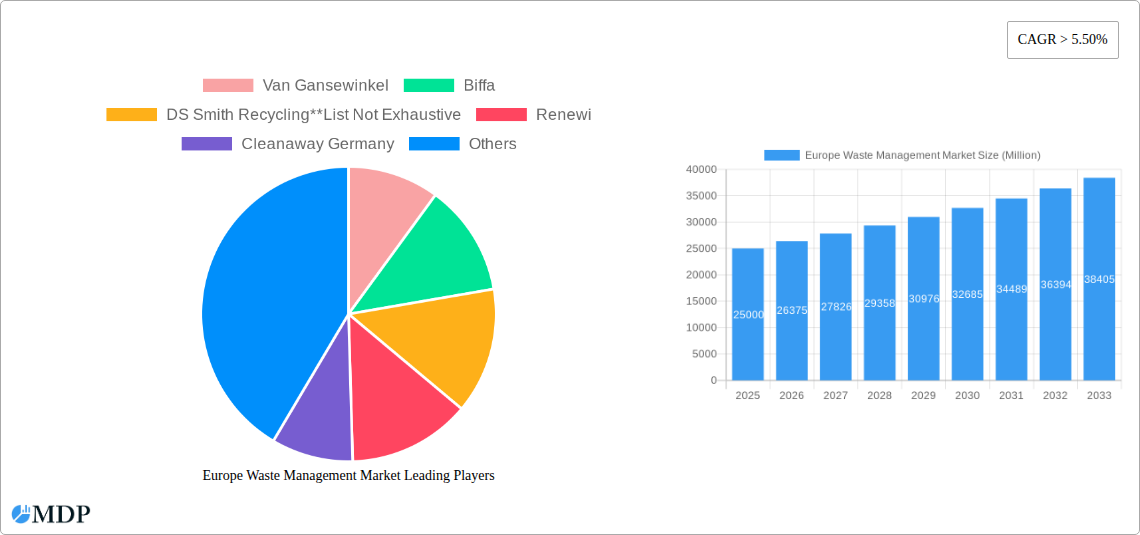

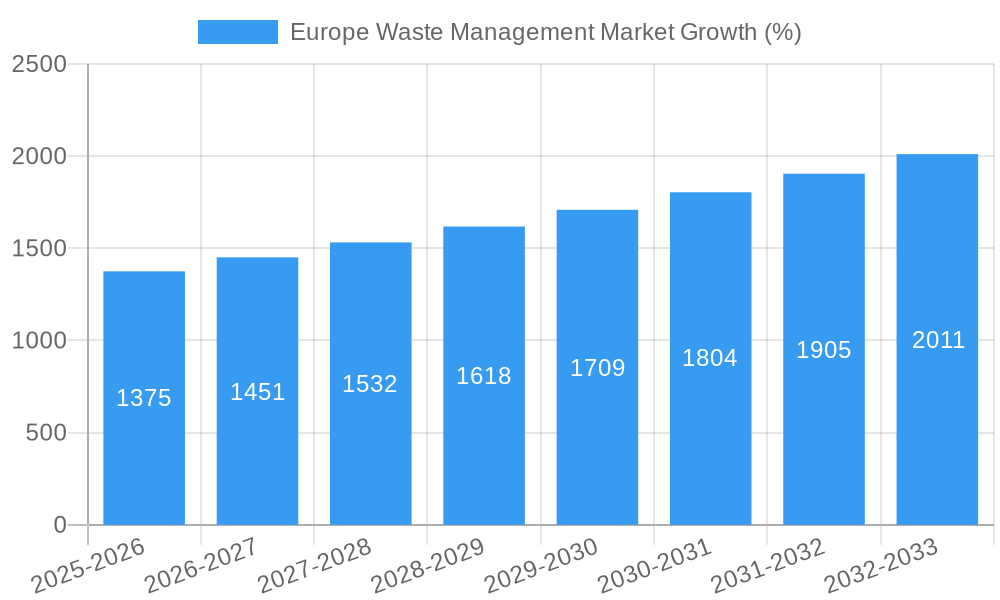

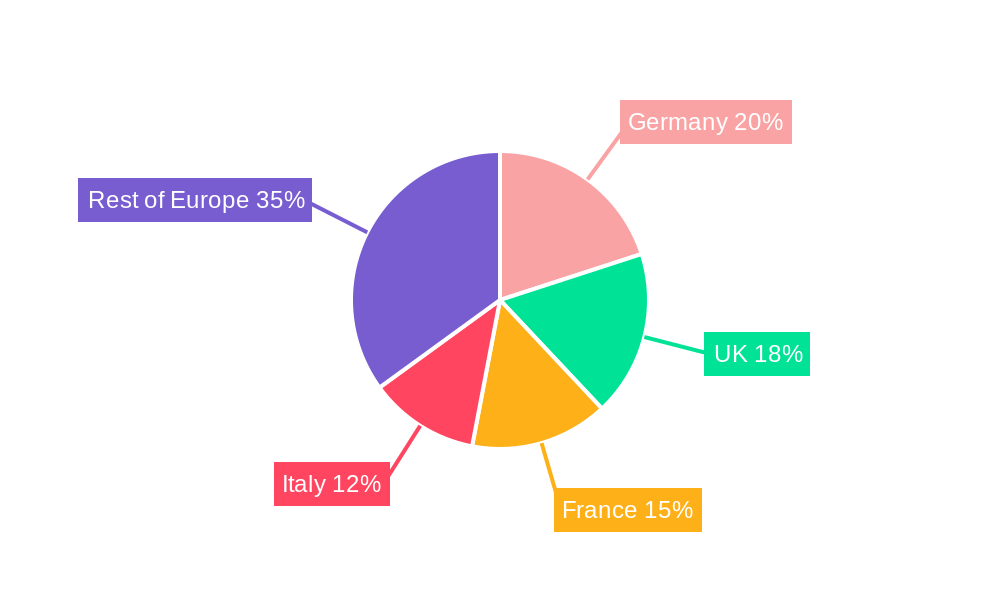

The European waste management market, currently experiencing robust growth with a CAGR exceeding 5.5%, is projected to reach significant value by 2033. Driven by stringent environmental regulations, increasing urbanization leading to higher waste generation, and a growing focus on sustainability and circular economy initiatives across the region, the market demonstrates considerable potential. Key segments like industrial waste management and recycling are experiencing particularly strong growth, fueled by increasing industrial activity and the rising demand for recycled materials. The market is further segmented by ownership type (public, private, and public-private partnerships), country (with Germany, UK, France, and Italy as major players), and waste type (industrial, municipal solid, hazardous, e-waste, plastic, and biomedical). The adoption of advanced waste management technologies, including incineration with energy recovery and sophisticated recycling processes, is contributing to market expansion. However, challenges such as high infrastructure costs, inconsistent waste collection systems across different regions, and the need for further development of sustainable waste disposal solutions, particularly for hazardous waste, represent potential restraints.

Despite these challenges, the overall outlook remains positive, with substantial opportunities for both established players and new entrants. The increasing emphasis on resource efficiency and waste reduction across various European Union member states, coupled with government initiatives promoting sustainable waste management practices, will continue to stimulate market growth. Furthermore, the increasing awareness among consumers regarding environmental protection and the adoption of responsible waste disposal habits are important factors pushing market expansion. Companies are increasingly adopting innovative technologies and strategies to improve efficiency and meet evolving regulatory demands, which is expected to further shape the competitive landscape. The market’s future trajectory depends heavily on continued policy support and investment in infrastructure and innovation. Given the current trends, continued growth at a CAGR above 5.5% is realistic through the forecast period, though specific growth rates will vary depending on segment and country.

Europe Waste Management Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Waste Management Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future opportunities within this crucial sector. The report leverages extensive data analysis and incorporates key industry developments to paint a clear picture of the current landscape and future trajectory of the European waste management market. This report is crucial for understanding the complexities and growth potential of this ever-evolving market, worth an estimated xx Million in 2025.

Europe Waste Management Market Dynamics & Concentration

The European waste management market is characterized by a moderately concentrated landscape with several large multinational players and numerous regional operators. Market share is distributed among these companies, with the top players holding a significant portion. Innovation in waste-to-energy technologies, advanced recycling techniques, and digitalization are key drivers of growth. Stringent environmental regulations across various European countries are shaping industry practices, pushing companies towards sustainable solutions. Product substitution is evident with the increasing adoption of biodegradable materials and a shift towards circular economy models. End-user trends reflect a growing awareness of environmental responsibility and a demand for efficient waste management solutions. The market has seen significant M&A activity in recent years, illustrated by several key deals.

- Market Concentration: Moderately concentrated, with the top five players holding approximately xx% market share in 2025.

- M&A Activity: An average of xx M&A deals annually between 2019 and 2024.

- Innovation Drivers: Waste-to-energy, advanced recycling, digital waste management platforms.

- Regulatory Framework: Stringent EU directives and national regulations driving sustainable practices.

- Product Substitutes: Biodegradable materials, compostable packaging, and circular economy models.

- End-User Trends: Increasing environmental awareness and demand for eco-friendly solutions.

Europe Waste Management Market Industry Trends & Analysis

The European waste management market is experiencing robust growth, driven by several key factors. A rising population and increasing urbanization contribute to a larger volume of waste generated. Simultaneously, stricter environmental regulations mandate more efficient and sustainable waste disposal methods. Technological advancements in waste processing and recycling enhance efficiency and resource recovery. Consumer preferences are shifting towards environmentally responsible products and services, influencing both waste generation and management choices. Competitive dynamics are marked by intense rivalry among established players and emerging companies focused on innovative solutions. This intense competition fuels innovation and improves overall market efficiency. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033). Market penetration of advanced recycling technologies is projected to increase from xx% in 2025 to xx% by 2033.

Leading Markets & Segments in Europe Waste Management Market

The United Kingdom, Germany, and France represent the largest national markets within Europe, driven by high waste generation, established infrastructure, and supportive regulatory frameworks. The private sector holds the largest share of the market by ownership type, owing to significant private investment in waste management infrastructure and services. Within waste types, Municipal Solid Waste (MSW) and Industrial Waste constitute the most substantial segments. Recycling is the most prevalent disposal method, owing to rising environmental awareness and regulatory pressures. Key drivers for growth include:

- United Kingdom: Strong government support for recycling initiatives and robust infrastructure.

- Germany: Advanced recycling technologies and a well-developed waste management sector.

- France: Stringent environmental regulations and a focus on sustainable waste management.

- Private Sector Dominance: Significant private investments and expertise in waste management operations.

- MSW & Industrial Waste: High volume generation and increasing demand for efficient management.

- Recycling: Growing preference for sustainable disposal and resource recovery.

Europe Waste Management Market Product Developments

Recent product developments focus on improving efficiency, sustainability, and resource recovery. This includes the use of AI and IoT for optimized waste collection routes, improved sorting technologies to enhance recycling rates, and the development of innovative waste-to-energy solutions such as anaerobic digestion and advanced incineration. These innovations aim to reduce landfill reliance, increase resource recovery, and minimize environmental impact, aligning with the broader trend towards a circular economy.

Key Drivers of Europe Waste Management Market Growth

The market's growth is fueled by a confluence of factors: Stringent environmental regulations mandating higher recycling rates, increasing awareness of environmental issues, rising urbanization leading to higher waste generation, technological advancements in waste processing and recycling techniques, and government incentives promoting sustainable practices. Furthermore, growing demand for renewable energy and resource recovery is boosting the adoption of innovative waste-to-energy technologies.

Challenges in the Europe Waste Management Market

Significant challenges remain, including inconsistent regulatory frameworks across different European countries leading to operational complexities and added costs, the high capital expenditure required for new infrastructure and technology, competition for funding and resources amongst various waste management players, and fluctuating commodity prices impacting the profitability of recycling operations. These issues need to be addressed to realize the full potential of the market.

Emerging Opportunities in Europe Waste Management Market

Significant growth opportunities exist in expanding waste-to-energy capacities, developing advanced recycling technologies for hard-to-recycle materials, implementing digital solutions for waste management optimization, and fostering strategic partnerships between public and private sectors to leverage expertise and resources. Market expansion into Eastern Europe holds substantial potential given the region's growing waste generation and developing infrastructure.

Leading Players in the Europe Waste Management Sector

- Van Gansewinkel

- Biffa

- DS Smith Recycling

- Renewi

- Cleanaway Germany

- PreZero International

- Augean

- CheaperWaste

- FCC

- Urbaser

- ALBA Recycling

- Biffa PLC

- Suez

- Veolia

- Remondis

- IAG - Ihlenberger

- AVR

- Viridor

Key Milestones in Europe Waste Management Industry

- December 2022: Saica Group acquires 76% of Fox Recykling, expanding its presence in the Eastern European market. This deal signals increased investment in the region and enhanced competition.

- August 2022: Beauparc invests in a biomass power plant, showcasing commitment to sustainable practices and carbon neutrality. This reflects industry trend towards eco-friendly operations.

Strategic Outlook for Europe Waste Management Market

The European waste management market presents a compelling investment opportunity. Continued growth is expected, driven by technological innovations, increasing regulatory pressure, and rising environmental awareness. Companies that can successfully adapt to changing market dynamics, embrace sustainable practices, and invest in advanced technologies are well-positioned for significant long-term success. Focus on circular economy models and efficient resource recovery will be key strategic imperatives.

Europe Waste Management Market Segmentation

-

1. Waste Type

- 1.1. Industrial Waste

- 1.2. Municipal Solid Waste

- 1.3. Hazardous Waste

- 1.4. E-waste

- 1.5. Plastic Waste

- 1.6. Bio-medical Waste

-

2. Disposal Methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

-

3. Type of Ownership

- 3.1. Public

- 3.2. Private

- 3.3. Public-private Partnership

Europe Waste Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing global trade activities; Infrastructure Development is on rise

- 3.3. Market Restrains

- 3.3.1. Manufacturers' lack of control over logistics services and also increasing logistical costs

- 3.4. Market Trends

- 3.4.1. Increasing Electronic and Electrical Waste Production in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Waste Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 5.1.1. Industrial Waste

- 5.1.2. Municipal Solid Waste

- 5.1.3. Hazardous Waste

- 5.1.4. E-waste

- 5.1.5. Plastic Waste

- 5.1.6. Bio-medical Waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal Methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Type of Ownership

- 5.3.1. Public

- 5.3.2. Private

- 5.3.3. Public-private Partnership

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 6. Germany Europe Waste Management Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Waste Management Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Waste Management Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Waste Management Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Waste Management Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Waste Management Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Waste Management Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Van Gansewinkel

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Biffa

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 DS Smith Recycling**List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Renewi

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cleanaway Germany

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PreZero International

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Augean

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 CheaperWaste

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 FCC

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Urbaser

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 ALBA Recycling

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Biffa PLC

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Suez

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Veolia

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Remondis

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 IAG - Ihlenberger

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 AVR

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Viridor

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.1 Van Gansewinkel

List of Figures

- Figure 1: Europe Waste Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Waste Management Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Waste Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Waste Management Market Revenue Million Forecast, by Waste Type 2019 & 2032

- Table 3: Europe Waste Management Market Revenue Million Forecast, by Disposal Methods 2019 & 2032

- Table 4: Europe Waste Management Market Revenue Million Forecast, by Type of Ownership 2019 & 2032

- Table 5: Europe Waste Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Waste Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Waste Management Market Revenue Million Forecast, by Waste Type 2019 & 2032

- Table 15: Europe Waste Management Market Revenue Million Forecast, by Disposal Methods 2019 & 2032

- Table 16: Europe Waste Management Market Revenue Million Forecast, by Type of Ownership 2019 & 2032

- Table 17: Europe Waste Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Waste Management Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Europe Waste Management Market?

Key companies in the market include Van Gansewinkel, Biffa, DS Smith Recycling**List Not Exhaustive, Renewi, Cleanaway Germany, PreZero International, Augean, CheaperWaste, FCC, Urbaser, ALBA Recycling, Biffa PLC, Suez, Veolia, Remondis, IAG - Ihlenberger, AVR, Viridor.

3. What are the main segments of the Europe Waste Management Market?

The market segments include Waste Type, Disposal Methods, Type of Ownership.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing global trade activities; Infrastructure Development is on rise.

6. What are the notable trends driving market growth?

Increasing Electronic and Electrical Waste Production in Europe.

7. Are there any restraints impacting market growth?

Manufacturers' lack of control over logistics services and also increasing logistical costs.

8. Can you provide examples of recent developments in the market?

December 2022: In an effort to increase the scope of its waste management services in the Eastern European market through its Saica Natur business division, Saica Group has reached an agreement to buy 76% of Fox Recykling's shares. Fox Recykling, based in Gdynia, northern Poland, is estimated to have handled about 45,000 tonnes of garbage and generated about EUR 9 Million(USD 10.09 Million) in revenue in 2021. The company's value offering in the eastern European market and the development objectives outlined in its Saica 2025 strategy plan are anticipated to benefit from its partly acquisition by Saica.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Waste Management Market?

To stay informed about further developments, trends, and reports in the Europe Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence