Key Insights

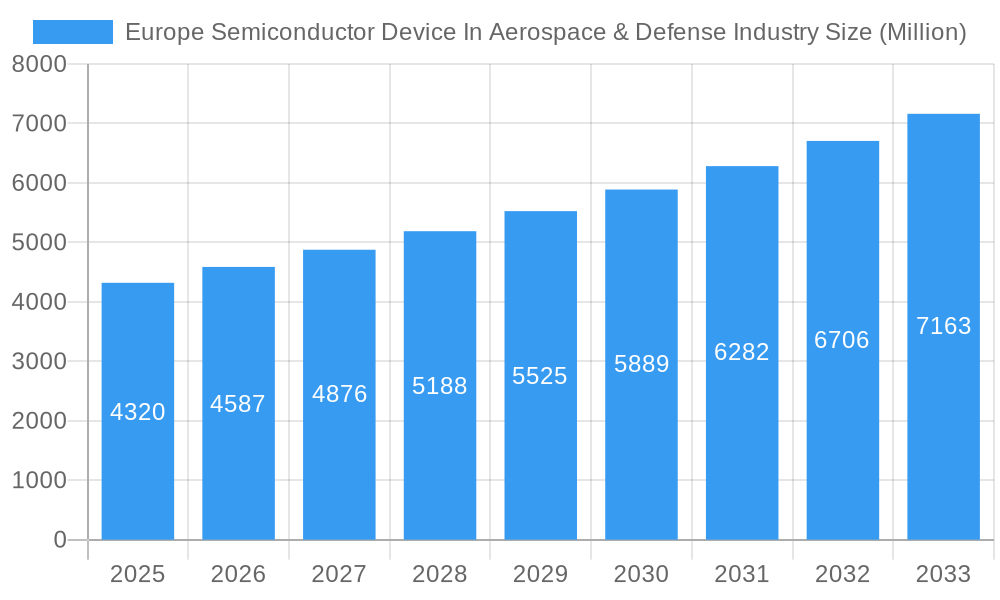

The European semiconductor device market within the aerospace and defense industry is experiencing robust growth, projected to reach €4.32 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.95% from 2025 to 2033. This expansion is fueled by several key factors. Increasing demand for advanced functionalities in military and civilian aircraft, coupled with the ongoing development of autonomous systems and unmanned aerial vehicles (UAVs), is driving significant investment in high-performance, reliable semiconductor components. Furthermore, the push towards increased digitalization within aerospace and defense operations, encompassing areas like improved sensor integration, enhanced communication systems, and sophisticated onboard computing, further accelerates market growth. Germany, France, and the United Kingdom are the leading contributors to this market, owing to their established aerospace and defense industries, robust R&D infrastructure, and substantial government spending in defense modernization programs. The market segmentation reveals a strong reliance on integrated circuits, followed by discrete semiconductors and sensors, highlighting the sophistication of the technology employed. While supply chain constraints and geopolitical factors could pose challenges, the long-term outlook for the European aerospace and defense semiconductor market remains positive, supported by continuous technological advancements and the strategic importance of the sector.

Europe Semiconductor Device In Aerospace & Defense Industry Market Size (In Billion)

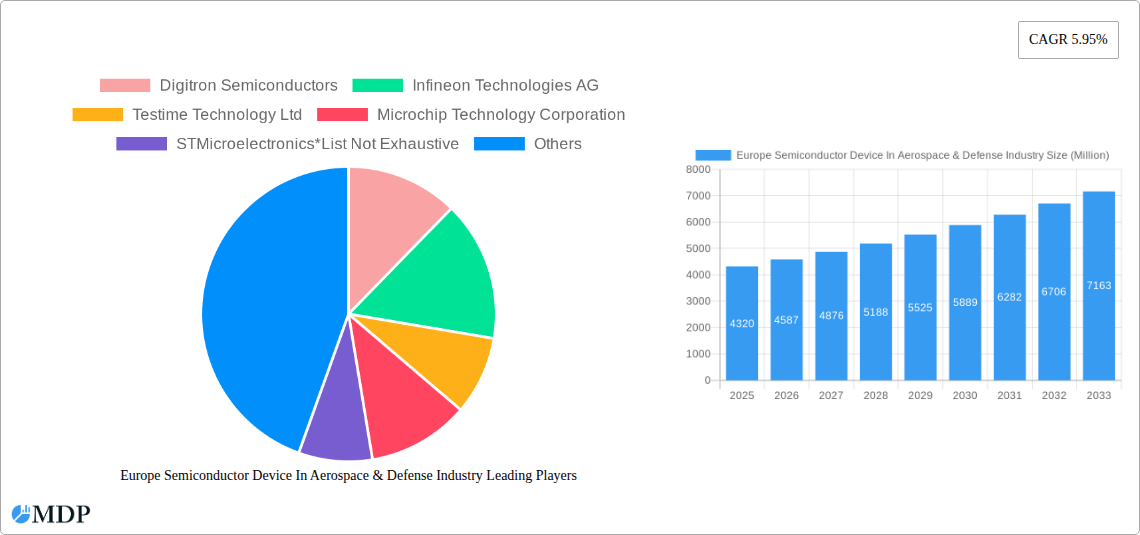

The market's growth is segmented by device type (discrete semiconductors, optoelectronics, sensors, integrated circuits, with further subdivisions into microprocessors, microcontrollers, and digital signal processors) and geographically across key European nations (United Kingdom, Germany, France, and the Rest of Europe). The leading companies are a mix of established global players like Infineon Technologies, STMicroelectronics, Texas Instruments, and Microchip Technology, alongside specialized semiconductor manufacturers catering specifically to the aerospace and defense sector. The historical data from 2019-2024 indicates a steady growth trajectory, providing a solid foundation for the projected CAGR. Future market performance will depend on factors including government defense budgets, technological innovation in semiconductor design, and the pace of adoption of new technologies within the aerospace and defense sector. Competition is expected to remain high, with companies vying for market share through product differentiation, strategic partnerships, and technological advancements.

Europe Semiconductor Device In Aerospace & Defense Industry Company Market Share

Europe Semiconductor Device in Aerospace & Defense Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the European semiconductor device market within the aerospace and defense industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, trends, leading players, and future opportunities. Expect detailed segmentation by country (United Kingdom, Germany, France, Rest of Europe), device type (Discrete Semiconductors, Optoelectronics, Sensors, Integrated Circuits, Microprocessors, Microcontrollers, Digital Signal Processors), and a comprehensive overview of key market players including Digitron Semiconductors, Infineon Technologies AG, Testime Technology Ltd, Microchip Technology Corporation, STMicroelectronics, SEMICOA, Skyworks Solutions Inc, NXP Semiconductors, Texas Instruments Incorporated, and Teledyne Technologies. The report uses Million for all values and predicts values where data is unavailable.

Europe Semiconductor Device In Aerospace & Defense Industry Market Dynamics & Concentration

The European aerospace and defense semiconductor market exhibits a moderately concentrated landscape, with several multinational corporations holding significant market share. Market concentration is influenced by factors such as stringent regulatory frameworks, high barriers to entry (requiring substantial R&D investments and certifications), and the prevalence of long-term contracts within the defense sector. Innovation is driven by the demand for advanced functionalities, such as improved reliability, miniaturization, and enhanced performance in harsh environments. Furthermore, the increasing adoption of electric and autonomous flight systems is fueling demand for sophisticated semiconductor devices. Mergers and acquisitions (M&A) are a notable feature of the market, as larger companies seek to expand their product portfolios and enhance their technological capabilities. The number of M&A deals in the sector has averaged xx per year over the historical period (2019-2024), with a projected increase to xx deals annually during the forecast period (2025-2033). The market share held by the top 5 players is estimated at xx% in 2025.

- Market Concentration: Moderately concentrated, dominated by a few major players.

- Innovation Drivers: Demand for enhanced reliability, miniaturization, and improved performance.

- Regulatory Frameworks: Stringent regulations impact market entry and operations.

- Product Substitutes: Limited direct substitutes; performance and reliability are key differentiators.

- End-User Trends: Growing demand for electric and autonomous systems.

- M&A Activity: Significant M&A activity to consolidate market share and enhance technological capabilities.

Europe Semiconductor Device In Aerospace & Defense Industry Industry Trends & Analysis

The European aerospace and defense semiconductor market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: increasing investments in defense modernization, the rising adoption of advanced technologies such as AI and machine learning in aerospace systems, and the global shift towards more sustainable and electric aircraft. Technological disruptions, particularly in areas such as silicon carbide (SiC) and gallium nitride (GaN) power electronics, are transforming the industry landscape, leading to more efficient and powerful semiconductor devices. The market penetration of SiC and GaN devices is expected to reach xx% by 2033, driven by their superior power handling capabilities and higher efficiency compared to traditional silicon-based solutions. Consumer preferences are increasingly focused on safety, reliability, and sustainability which further shapes the industry demands. Competitive dynamics are marked by a mix of collaboration and competition, with companies forging strategic partnerships while simultaneously vying for market share.

Leading Markets & Segments in Europe Semiconductor Device In Aerospace & Defense Industry

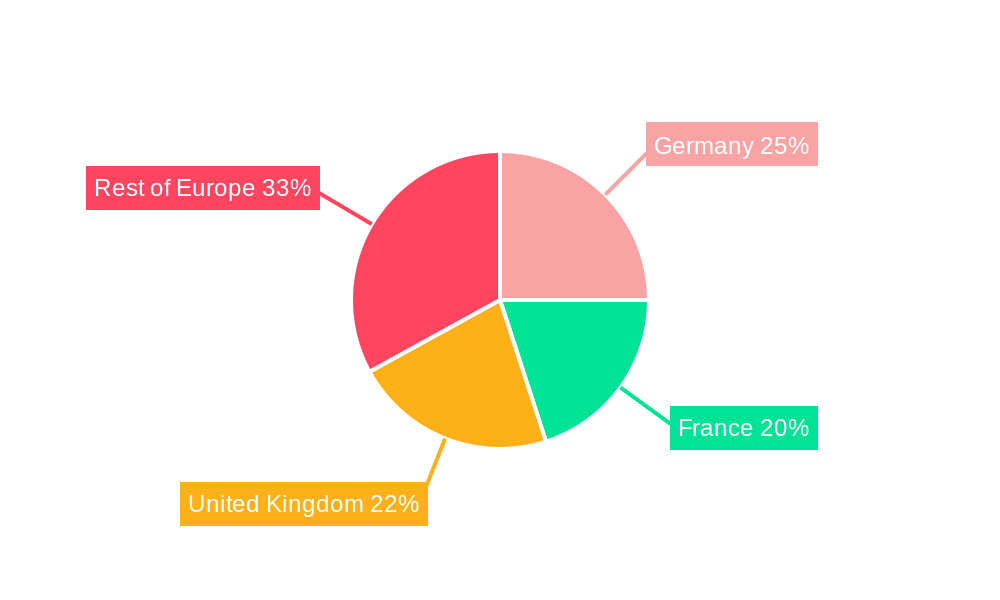

The United Kingdom currently holds the leading position in the European aerospace and defense semiconductor market.

- Key Drivers for United Kingdom Dominance:

- Strong government support for aerospace technology and defense.

- Well-established aerospace and defense industry ecosystem.

- Significant investments in research and development.

- Presence of key industry players.

Germany and France follow closely, each contributing significantly to the overall market. The Integrated Circuits segment accounts for the largest market share due to the demand for advanced processing power in modern aerospace and defense systems. Within the Integrated Circuits category, microprocessors and microcontrollers are experiencing significant growth, fueled by the increasing integration of digital technologies in aircraft and defense systems. The discrete semiconductor market is also experiencing healthy growth, driven by the demand for power management and signal processing capabilities.

- Dominant Country: United Kingdom

- Dominant Segment: Integrated Circuits

- Fastest Growing Segment: Microprocessors and Microcontrollers.

Europe Semiconductor Device In Aerospace & Defense Industry Product Developments

Recent product developments focus on enhancing power efficiency, miniaturization, and radiation hardness for aerospace and defense applications. New silicon carbide (SiC) and gallium nitride (GaN) based devices are being widely adopted for their superior performance characteristics. These advancements enable more efficient power systems, lighter weight designs, and improved overall system performance, leading to a significant competitive advantage in the market. The integration of artificial intelligence and machine learning capabilities into semiconductor devices is another notable trend, enabling advanced functionalities in both commercial and military applications.

Key Drivers of Europe Semiconductor Device In Aerospace & Defense Industry Growth

Several factors are driving the growth of the European aerospace and defense semiconductor market. Technological advancements, particularly in power electronics (SiC and GaN) and advanced packaging technologies, are enhancing device performance and efficiency. Increased investments in defense modernization across Europe, coupled with supportive government policies promoting technological innovation, are further stimulating market expansion. The growing adoption of electric and autonomous aircraft, along with the increasing demand for sophisticated sensor systems, is also contributing to significant growth within the sector.

Challenges in the Europe Semiconductor Device In Aerospace & Defense Industry Market

The market faces challenges, including stringent regulatory compliance requirements that increase costs and time-to-market. Supply chain disruptions caused by geopolitical factors and concentration of manufacturing in specific regions pose significant risks. Intense competition from established players and emerging companies, characterized by pricing pressures, necessitates continuous innovation.

Emerging Opportunities in Europe Semiconductor Device In Aerospace & Defense Industry

The long-term growth of the European aerospace and defense semiconductor market is driven by opportunities stemming from significant investments in research and development of next-generation semiconductor materials and technologies, strategic partnerships between semiconductor companies and aerospace manufacturers leading to integrated solutions, and the expansion of the market into adjacent sectors such as space and renewable energy. The integration of AI and machine learning in aerospace and defense systems presents further opportunities.

Leading Players in the Europe Semiconductor Device In Aerospace & Defense Industry Sector

Key Milestones in Europe Semiconductor Device In Aerospace & Defense Industry Industry

- February 2023: The UK government awarded GBP 113.6 Million (USD 136 Million) to Vertical Aerospace and Rolls-Royce for electric and hydrogen aircraft development. This significantly boosted the market for relevant semiconductor devices.

- March 2023: NI's acquisition of SET GmbH accelerated the adoption of SiC and GaN power electronics in aerospace and defense, reducing time-to-market for advanced solutions.

Strategic Outlook for Europe Semiconductor Device In Aerospace & Defense Industry Market

The European aerospace and defense semiconductor market presents significant long-term growth potential. Continuous technological advancements, coupled with supportive government policies and increasing investments in defense modernization, will drive market expansion. Strategic partnerships and collaborations between semiconductor companies and aerospace manufacturers will play a crucial role in shaping the future of the industry. The market's future success hinges on companies' ability to innovate, adapt to evolving technological landscapes, and navigate regulatory complexities.

Europe Semiconductor Device In Aerospace & Defense Industry Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.4.4. Micro

- 1.4.4.1. Microprocessor

- 1.4.4.2. Microcontroller

- 1.4.4.3. Digital Signal Processors

Europe Semiconductor Device In Aerospace & Defense Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Semiconductor Device In Aerospace & Defense Industry Regional Market Share

Geographic Coverage of Europe Semiconductor Device In Aerospace & Defense Industry

Europe Semiconductor Device In Aerospace & Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing government spending on space technology and modernizing the Defense industry; Increasing global issues like climate and biodiversity crises

- 3.3. Market Restrains

- 3.3.1. Limited Supply of Semiconductors

- 3.4. Market Trends

- 3.4.1. Sensors Segment to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Semiconductor Device In Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.4.4. Micro

- 5.1.4.4.1. Microprocessor

- 5.1.4.4.2. Microcontroller

- 5.1.4.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Digitron Semiconductors

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Testime Technology Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Microchip Technology Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SEMICOA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skyworks Solutions Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NXP Semiconductors

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Texas Instruments Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Teledyne Technologies

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Digitron Semiconductors

List of Figures

- Figure 1: Europe Semiconductor Device In Aerospace & Defense Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Semiconductor Device In Aerospace & Defense Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Semiconductor Device In Aerospace & Defense Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Europe Semiconductor Device In Aerospace & Defense Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe Semiconductor Device In Aerospace & Defense Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 4: Europe Semiconductor Device In Aerospace & Defense Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Semiconductor Device In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Semiconductor Device In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe Semiconductor Device In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Semiconductor Device In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Semiconductor Device In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Semiconductor Device In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Semiconductor Device In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Semiconductor Device In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Semiconductor Device In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Semiconductor Device In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Semiconductor Device In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Semiconductor Device In Aerospace & Defense Industry?

The projected CAGR is approximately 5.95%.

2. Which companies are prominent players in the Europe Semiconductor Device In Aerospace & Defense Industry?

Key companies in the market include Digitron Semiconductors, Infineon Technologies AG, Testime Technology Ltd, Microchip Technology Corporation, STMicroelectronics*List Not Exhaustive, SEMICOA, Skyworks Solutions Inc, NXP Semiconductors, Texas Instruments Incorporated, Teledyne Technologies.

3. What are the main segments of the Europe Semiconductor Device In Aerospace & Defense Industry?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing government spending on space technology and modernizing the Defense industry; Increasing global issues like climate and biodiversity crises.

6. What are the notable trends driving market growth?

Sensors Segment to Grow Significantly.

7. Are there any restraints impacting market growth?

Limited Supply of Semiconductors.

8. Can you provide examples of recent developments in the market?

March 2023: NI (National Instruments) revealed the acquisition of SET GmbH, renowned experts in aerospace and defense test systems development, and recent pioneers in electrical reliability testing for semiconductors. This strategic move aims to expedite the introduction of critical, uniquely advanced solutions and promote the integration of power electronic materials like silicon carbide (SiC) and gallium nitride (GaN) across the semiconductor-to-transportation supply chain, ultimately reducing time to market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Semiconductor Device In Aerospace & Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Semiconductor Device In Aerospace & Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Semiconductor Device In Aerospace & Defense Industry?

To stay informed about further developments, trends, and reports in the Europe Semiconductor Device In Aerospace & Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence