Key Insights

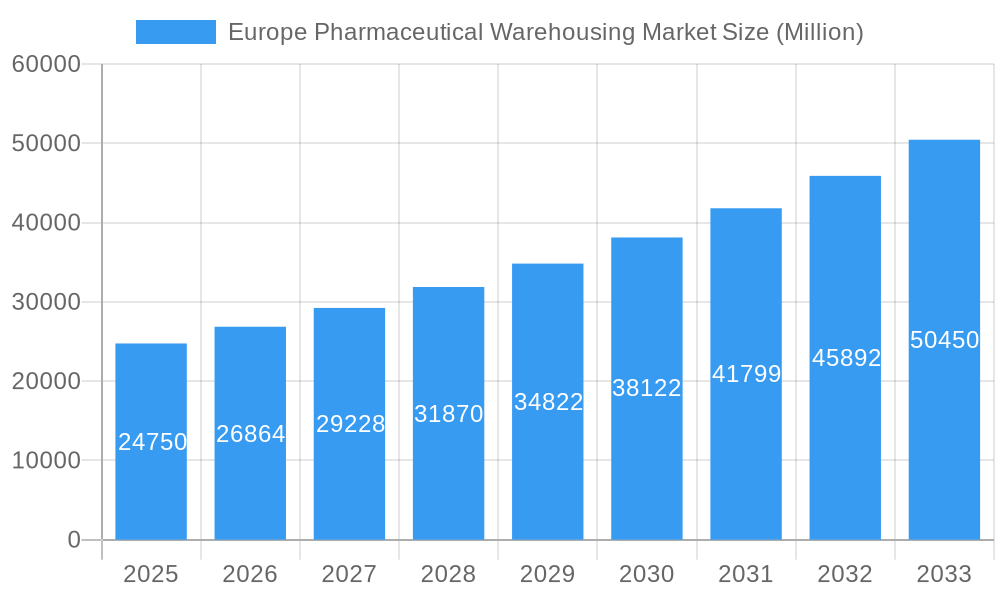

The European pharmaceutical warehousing market, valued at €24.75 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 8.26% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of chronic diseases necessitates efficient pharmaceutical supply chains, fueling demand for specialized warehousing solutions. Stringent regulatory compliance requirements within the pharmaceutical industry are also driving investment in advanced warehousing technologies, such as cold chain facilities and integrated inventory management systems. Furthermore, the rising adoption of e-commerce in pharmaceutical distribution and the growth of personalized medicine are contributing to this market's expansion. The market is segmented by warehouse type (cold chain and non-cold chain) and application (pharmaceutical factories, pharmacies, hospitals, and others). Major players like DB Schenker, UPS, and FedEx dominate the landscape, alongside specialized pharmaceutical logistics providers. Growth will be particularly strong in countries like Germany, France, and the UK, which are major pharmaceutical hubs within Europe, but other regions will also see expansion as infrastructure and regulatory landscapes improve.

Europe Pharmaceutical Warehousing Market Market Size (In Billion)

The competitive landscape is characterized by both large multinational logistics companies and smaller, specialized providers catering to the unique requirements of pharmaceutical storage and distribution. The ongoing trend toward consolidation within the logistics industry will likely continue to reshape the market. Challenges remain, however, including the high infrastructure costs associated with maintaining cold chain facilities, the need for advanced technology integration, and potential supply chain disruptions. Successfully navigating these challenges will require continuous innovation in warehousing technology, robust risk management strategies, and a focus on regulatory compliance. The market's substantial growth trajectory, coupled with the increasing complexity of pharmaceutical logistics, indicates ample opportunities for companies investing in this sector in the coming years.

Europe Pharmaceutical Warehousing Market Company Market Share

Europe Pharmaceutical Warehousing Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Pharmaceutical Warehousing Market, offering invaluable insights for stakeholders across the pharmaceutical supply chain. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market dynamics, trends, leading players, and future opportunities. Maximize your understanding of this rapidly evolving market and make informed strategic decisions.

Keywords: Europe Pharmaceutical Warehousing Market, Cold Chain Warehouse, Pharmaceutical Logistics, Pharmaceutical Storage, Supply Chain Management, Healthcare Logistics, Market Analysis, Market Growth, DB Schenker, UPS, FedEx, Kuehne Nagel, GEODIS, Market Trends, Market Forecast, M&A Activity, Regulatory Landscape, Industry Developments

Europe Pharmaceutical Warehousing Market Market Dynamics & Concentration

The European pharmaceutical warehousing market is characterized by a moderately concentrated landscape, with several major players holding significant market share. This concentration is a result of factors such as substantial economies of scale, ongoing technological advancements, and the imperative of rigorous regulatory compliance. The market exhibits dynamic competition, fueled by continuous innovation in critical areas like cold chain technologies, advanced automation systems, and sophisticated data analytics for operational optimization. Stringent regulatory frameworks governing the storage and transportation of pharmaceuticals play a pivotal role in shaping market dynamics, demanding specialized infrastructure and adherence to high standards. Due to the highly specialized nature of pharmaceutical products, direct product substitution within warehousing services is limited, underscoring the critical need for dedicated facilities and deep industry expertise.

End-user trends increasingly favor outsourced warehousing solutions, driven by the pursuit of cost optimization and enhanced operational efficiency. The landscape is marked by frequent Mergers and Acquisitions (M&A) activity, where larger entities consolidate their market positions and expand their geographic reach, thereby influencing market concentration. Recent years have witnessed approximately XX M&A deals, contributing to an estimated XX% increase in overall market concentration. Prominent players such as DB Schenker, UPS, and Kuehne + Nagel currently command significant market shares, estimated at approximately XX%, XX%, and XX% respectively (based on 2025 estimates). This elevated level of concentration is largely attributable to their substantial and ongoing investments in state-of-the-art infrastructure and cutting-edge technology.

Estimated Market Share (2025):

- DB Schenker: XX%

- UPS: XX%

- Kuehne + Nagel: XX%

- Others: XX%

M&A Activity (2019-2024): Approximately XX deals, contributing to an estimated XX% increase in market concentration.

Key Drivers of Market Dynamics:

- Accelerated technological advancements, including widespread adoption of automation and the Internet of Things (IoT) for enhanced visibility and control.

- Unwavering demand for stringent regulatory compliance, necessitating continuous investment and adaptation.

- Growing preference and adoption of outsourced warehousing solutions by pharmaceutical companies.

- Ongoing consolidation through strategic M&A activity, reshaping the competitive landscape.

- Increasing importance of sustainable and environmentally friendly warehousing practices.

- The evolving needs for specialized temperature-controlled (cold chain) logistics.

Europe Pharmaceutical Warehousing Market Industry Trends & Analysis

The European pharmaceutical warehousing market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected during the forecast period (2025-2033). This growth is fueled by several factors. The increasing prevalence of chronic diseases and the consequent rise in pharmaceutical consumption are primary drivers. Technological disruptions, such as the adoption of automation and advanced analytics, are enhancing operational efficiency and reducing costs. Consumer preferences are shifting towards specialized services, including temperature-controlled storage and value-added services, like packaging and labeling. Competitive dynamics are marked by intense rivalry amongst established players and emerging entrants, spurring innovation and service diversification. Market penetration of advanced cold chain technologies remains high, exceeding xx% in key markets.

Leading Markets & Segments in Europe Pharmaceutical Warehousing Market

Germany, France, and the UK are the leading markets in Europe for pharmaceutical warehousing, accounting for approximately xx% of the total market value in 2025. This dominance stems from their robust pharmaceutical industries, well-developed infrastructure, and high healthcare expenditure. The cold chain warehouse segment dominates the market, driven by the increasing demand for temperature-sensitive pharmaceuticals.

Key Drivers for Leading Markets:

- Strong pharmaceutical industries

- Advanced infrastructure and logistics networks

- High healthcare expenditure

- Favorable regulatory environments

Dominant Segments (2025):

- By Type: Cold Chain Warehousing (xx% market share) significantly exceeds Non-Cold Chain Warehousing (xx% market share).

- By Application: Pharmaceutical Factories hold the largest share (xx%), followed by Hospitals (xx%) and Pharmacies (xx%). The "Others" category accounts for xx%.

The detailed analysis within the full report provides a region-by-region breakdown of market trends, market size estimations and forecasts for all regions.

Europe Pharmaceutical Warehousing Market Product Developments

Recent product innovations focus on enhancing cold chain efficiency, improving inventory management, and enhancing traceability. This includes the integration of IoT sensors, advanced automation systems, and data analytics platforms. These advancements provide enhanced security, reduce waste, and improve overall operational efficiency, offering key competitive advantages to market players. The market is witnessing the adoption of automated guided vehicles (AGVs) and robotic systems for optimizing warehouse operations.

Key Drivers of Europe Pharmaceutical Warehousing Market Growth

The European pharmaceutical warehousing market is propelled by several key factors. Technological advancements, including automation and the Internet of Things (IoT), are enhancing efficiency and reducing costs. Favorable economic conditions in several European countries are boosting pharmaceutical production and consumption. Stringent regulatory frameworks, while posing challenges, also drive the demand for specialized and compliant warehousing solutions. The growth in e-commerce channels for pharmaceutical products is leading to a rise in the need for efficient distribution networks and associated warehousing.

Challenges in the Europe Pharmaceutical Warehousing Market Market

The European pharmaceutical warehousing market grapples with several significant challenges. Foremost among these is the perpetual requirement for stringent regulatory compliance, which demands substantial and ongoing investments in specialized infrastructure, advanced technologies, and highly trained personnel. Supply chain disruptions, exacerbated by geopolitical instability, natural disasters, or unforeseen global events, pose a considerable risk to operational continuity and can lead to significant financial losses. The intensely competitive environment, characterized by the presence of established players and the emergence of new entrants, exerts downward pressure on pricing and profit margins. Navigating this complex and dynamic market landscape requires astute strategic planning and operational agility. The estimated financial impact of these challenges amounts to approximately XX Million in lost revenue annually due to inefficiencies, compliance failures, or supply chain interruptions.

Emerging Opportunities in Europe Pharmaceutical Warehousing Market

The European pharmaceutical warehousing market is ripe with emerging opportunities poised to drive future growth and innovation. Technological breakthroughs in areas such as blockchain technology, offering enhanced traceability and transparency across the supply chain, and AI-powered predictive analytics for optimized inventory management and demand forecasting, present transformative potential. Strategic partnerships between pharmaceutical manufacturers and specialized warehousing providers are increasingly focused on developing integrated, end-to-end solutions that cater to the unique needs of the pharmaceutical industry. Furthermore, the expansion into emerging markets within Europe, particularly in Eastern Europe, presents significant untapped growth potential as these regions develop their healthcare infrastructure. These evolving trends and opportunities are expected to fundamentally reshape the market dynamics over the next decade, creating new avenues for value creation and market leadership.

Leading Players in the Europe Pharmaceutical Warehousing Market Sector

Key Milestones in Europe Pharmaceutical Warehousing Market Industry

- June 2023: ViaPharma solidified its commitment to the Central European market by signing a 20-year lease agreement with CTP for two strategically located Czech CTParks. This expansion adds nearly 27,000 square meters of specialized pharmaceutical warehousing space, signaling substantial investment and growth in the region.

- August 2022: UPS significantly bolstered its capabilities in the critical cold chain warehousing segment through the strategic acquisition of BomiGroup. This acquisition expands UPS's temperature-controlled facility network across 14 countries, underscoring a prominent consolidation trend among major global logistics players seeking to enhance their specialized service offerings.

Strategic Outlook for Europe Pharmaceutical Warehousing Market Market

The European pharmaceutical warehousing market is strategically positioned for sustained and robust growth in the coming years. This trajectory will be primarily propelled by continuous technological innovation, a burgeoning demand for highly specialized logistics services, and the formation of strategic alliances and partnerships. A paramount focus on enhancing supply chain resilience, optimizing operational efficiencies through advanced technologies, and leveraging data-driven insights will be indispensable for achieving success and maintaining a competitive edge. The market's potential for expansion, driven by the adoption of novel technologies and the formation of strategic collaborations, indicates considerable long-term growth prospects. Early and strategic adoption of these transformative technological advancements will be absolutely crucial for market players aiming to secure and strengthen their competitive standing in this dynamic sector.

Europe Pharmaceutical Warehousing Market Segmentation

-

1. Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Others

Europe Pharmaceutical Warehousing Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Russia

- 1.5. Spain

- 1.6. Rest of Europe

Europe Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of Europe Pharmaceutical Warehousing Market

Europe Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The rise in demand for outsourcing pharmaceutical warehousing services; The demand for efficiency

- 3.2.2 visibility

- 3.2.3 and product safety from pharmaceutical companies

- 3.3. Market Restrains

- 3.3.1. Lack of efficient logistics support in emerging economies

- 3.4. Market Trends

- 3.4.1. Rise in the demand Pharmaceutical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hellmann Worldwide Logistics SE and Co KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alloga

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rhenus SE and Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bio Pharma Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne Nagel Management AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 XPO Logistics Inc **List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GEODIS SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KRC Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Europe Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pharmaceutical Warehousing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Germany Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: UK Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Russia Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pharmaceutical Warehousing Market?

The projected CAGR is approximately > 8.26%.

2. Which companies are prominent players in the Europe Pharmaceutical Warehousing Market?

Key companies in the market include DB Schenker, United Parcel Service Inc, Hellmann Worldwide Logistics SE and Co KG, Alloga, FedEx Corp, Rhenus SE and Co KG, Bio Pharma Logistics, Kuehne Nagel Management AG, XPO Logistics Inc **List Not Exhaustive, GEODIS SA, KRC Logistics.

3. What are the main segments of the Europe Pharmaceutical Warehousing Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.75 Million as of 2022.

5. What are some drivers contributing to market growth?

The rise in demand for outsourcing pharmaceutical warehousing services; The demand for efficiency. visibility. and product safety from pharmaceutical companies.

6. What are the notable trends driving market growth?

Rise in the demand Pharmaceutical.

7. Are there any restraints impacting market growth?

Lack of efficient logistics support in emerging economies.

8. Can you provide examples of recent developments in the market?

June 2023: ViaPharma signed a 20-year lease agreement with the developer CTP for two Czech CTParks. CTP will prepare and hand over the premises, with a total area of almost 27,000 sq m and several specific modifications for the pharmaceutical industry, at the end of 2023. CTPark Ostrava Poruba and CTPark Brno Líšeň will be the next locations of cooperation. ViaPharma already leased three warehouses in Romania, including the largest ever pharmaceutical warehouse in the country with an area of 35,000 sq m in CTPark Mogosoaia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the Europe Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence