Key Insights

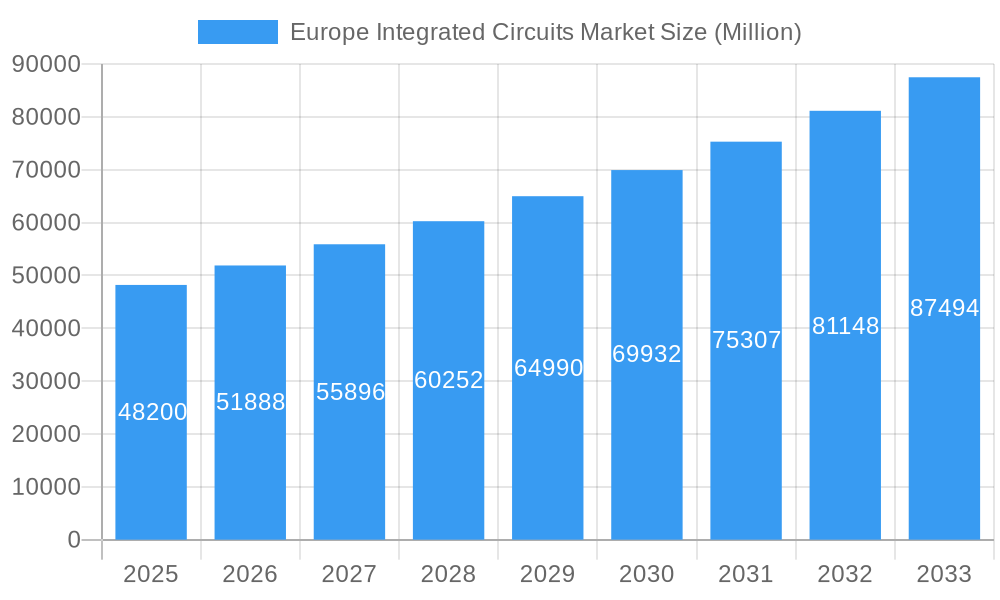

The European Integrated Circuits (IC) market, valued at €48.2 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.83% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for sophisticated electronics across various sectors, including automotive, industrial automation, and consumer electronics, fuels the need for advanced ICs. The ongoing trend towards miniaturization and improved energy efficiency in electronic devices further stimulates market growth. Furthermore, significant investments in research and development within the European Union, focused on enhancing semiconductor technology and production capabilities, are contributing to this positive trajectory. Government initiatives aimed at reducing reliance on external suppliers and fostering domestic semiconductor production also play a crucial role.

Europe Integrated Circuits Market Market Size (In Billion)

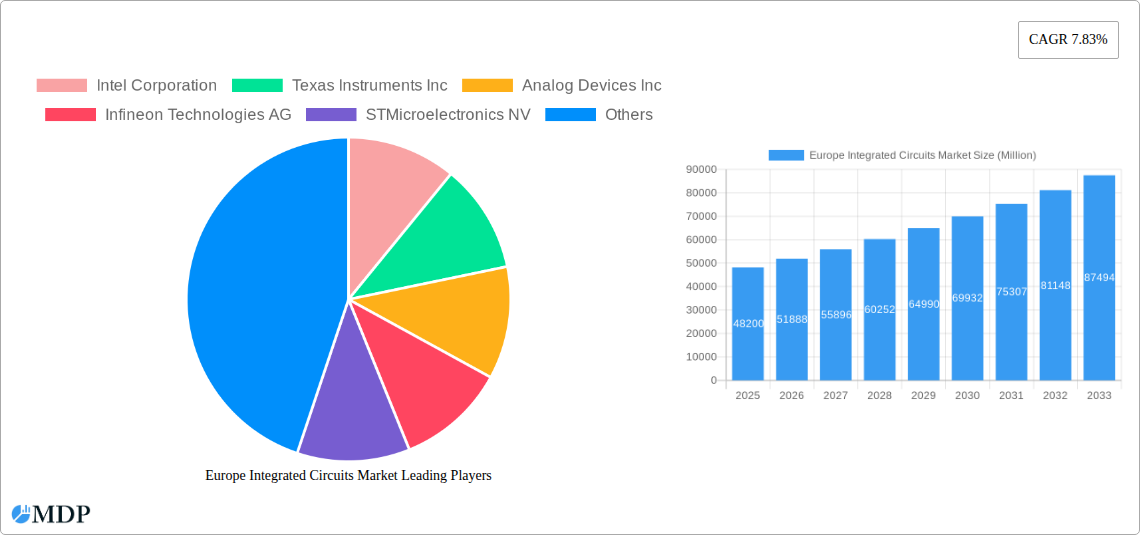

However, the market faces certain challenges. Supply chain disruptions, geopolitical uncertainties, and the fluctuating price of raw materials pose potential risks. Competition from established players and emerging companies from Asia also exerts pressure on market dynamics. Nevertheless, the strong underlying demand and continuous technological advancements are expected to mitigate these challenges, ensuring sustained growth throughout the forecast period. The market segmentation, while not explicitly provided, likely includes various IC types like microprocessors, memory chips, analog ICs, and power management ICs, each contributing to the overall market size and growth. Leading players like Intel, Texas Instruments, and STMicroelectronics are well-positioned to capitalize on these opportunities, leveraging their established expertise and technological advancements.

Europe Integrated Circuits Market Company Market Share

Europe Integrated Circuits Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Integrated Circuits market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report delivers a holistic view of market trends, growth drivers, and challenges. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Europe Integrated Circuits Market Market Dynamics & Concentration

The European Integrated Circuits market is characterized by a moderately concentrated landscape, with key players vying for market share. While a few dominant players hold significant portions, the market also sees active participation from numerous smaller specialized firms. Market concentration is influenced by factors such as M&A activity, technological innovation, and regulatory changes. The market share of the top 5 players is estimated at xx% in 2025. Innovation is a key driver, with companies continuously investing in R&D to develop advanced ICs for various applications. The regulatory framework, particularly concerning data privacy and security, significantly impacts market dynamics. Product substitutes, such as alternative technologies in specific applications, pose a moderate level of competition. End-user trends, driven by increasing demand for electronics in various sectors, propel market growth. M&A activity has played a crucial role in shaping the market landscape; xx major M&A deals were recorded between 2019 and 2024.

- Market Share: Top 5 players hold approximately xx% of the market in 2025.

- M&A Activity: xx major deals between 2019-2024.

- Innovation Drivers: Focus on miniaturization, increased processing power, and energy efficiency.

- Regulatory Frameworks: Compliance with data protection regulations (GDPR) and cybersecurity standards.

Europe Integrated Circuits Market Industry Trends & Analysis

The Europe Integrated Circuits market is experiencing substantial growth, driven by several key factors. The increasing adoption of electronics in diverse sectors like automotive, consumer electronics, and industrial automation fuels demand for sophisticated ICs. Technological advancements, particularly in areas like 5G, AI, and IoT, are creating new opportunities and pushing market expansion. Consumer preferences for smaller, faster, and more energy-efficient devices are impacting IC design and production. Competitive dynamics are intense, with companies focusing on product differentiation, technological innovation, and strategic partnerships to maintain a competitive edge. Market penetration of advanced ICs, such as those using advanced node processes, is expected to reach xx% by 2033.

Leading Markets & Segments in Europe Integrated Circuits Market

Germany and the United Kingdom are the dominant markets within Europe, driven by strong technological infrastructure, substantial R&D investment, and robust automotive and industrial sectors. Other key regions include France, Italy, and the Nordic countries. The automotive segment is a major contributor to market growth, followed by consumer electronics and industrial applications.

- Germany: Strong automotive industry, significant R&D investments, supportive government policies.

- United Kingdom: Thriving technology sector, substantial investment in semiconductor research, significant presence of key players.

- Automotive Segment: High demand for advanced driver-assistance systems (ADAS) and electric vehicles.

- Consumer Electronics Segment: Growing demand for smartphones, wearables, and smart home devices.

Europe Integrated Circuits Market Product Developments

Recent innovations in integrated circuits focus on improved performance, miniaturization, and lower power consumption. The development of advanced process nodes, like xx nm and beyond, is enhancing capabilities. New applications are emerging in fields like AI, IoT, and automotive, requiring specialized IC designs. Companies are emphasizing energy efficiency and improved reliability to gain a competitive edge. This continuous innovation fuels the market's rapid growth.

Key Drivers of Europe Integrated Circuits Market Growth

The Europe Integrated Circuits market is propelled by several key factors. Technological advancements, such as the development of more powerful and energy-efficient ICs, are driving adoption across various sectors. Economic growth in major European economies stimulates demand for electronics, creating a substantial market for ICs. Supportive government policies and initiatives aimed at boosting the semiconductor industry further contribute to growth.

Challenges in the Europe Integrated Circuits Market Market

The market faces several challenges, including the global semiconductor shortage affecting supply chains and causing price volatility. Geopolitical uncertainties and trade tensions also impact the market. Stringent regulatory compliance requirements for ICs used in critical applications pose a hurdle for some players. Intense competition among established and emerging players creates pressure on profit margins.

Emerging Opportunities in Europe Integrated Circuits Market

The long-term growth prospects are positive, fueled by the expanding IoT market, the growing adoption of AI and machine learning technologies, and the continued electrification of vehicles. Strategic partnerships between IC manufacturers and end-users are likely to drive innovation. Market expansion into new applications, such as healthcare and renewable energy, presents additional growth opportunities.

Leading Players in the Europe Integrated Circuits Market Sector

Key Milestones in Europe Integrated Circuits Market Industry

- June 2024: Asahi Kasei Microdevices launched the CQ36 series of digital output coreless current sensor ICs for the robotics market. This launch showcases advancements in miniaturization and improved performance for specialized applications.

- May 2024: Apogee Semiconductor Inc. launched the AF54RHC GEO family of radiation-hardened ICs for space missions. This highlights the growing demand for specialized ICs in demanding environments.

Strategic Outlook for Europe Integrated Circuits Market Market

The Europe Integrated Circuits market is poised for sustained growth, driven by technological innovation, increasing demand across various sectors, and supportive government initiatives. Companies focusing on product differentiation, strategic partnerships, and investment in R&D are well-positioned to capitalize on emerging opportunities. The market is expected to witness significant expansion in the coming years, fueled by the trends outlined in this report.

Europe Integrated Circuits Market Segmentation

-

1. Type

- 1.1. Analog IC

- 1.2. Logic IC

- 1.3. Memory

-

1.4. Micro

- 1.4.1. Microprocessors (MPU)

- 1.4.2. Microcontrollers (MCU)

- 1.4.3. Digital Signal Processors

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. IT & Telecommunications

- 2.4. Manufacturing & Automation

- 2.5. Other En

Europe Integrated Circuits Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

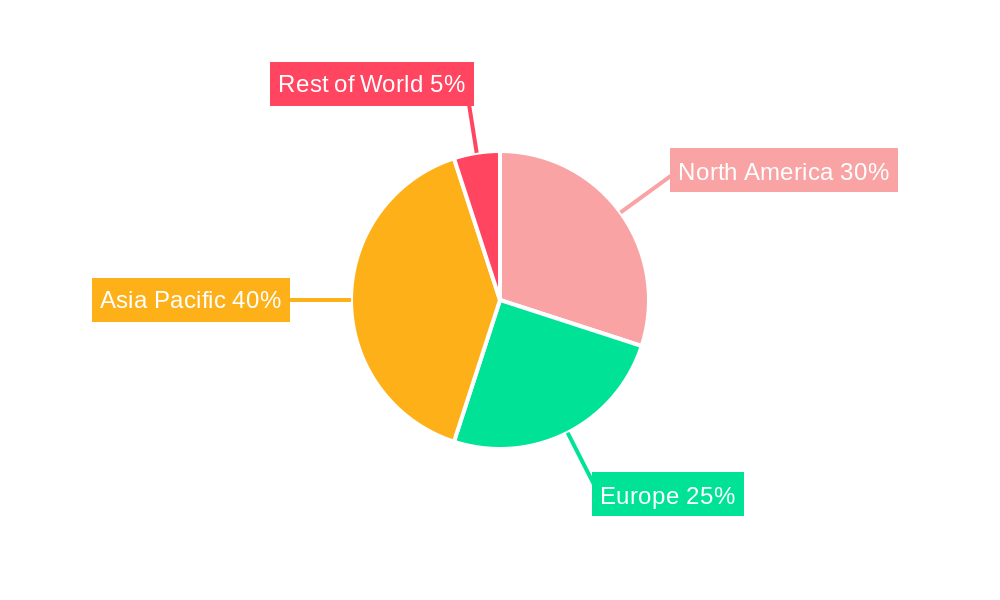

Europe Integrated Circuits Market Regional Market Share

Geographic Coverage of Europe Integrated Circuits Market

Europe Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Penetration of Smartphones

- 3.2.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1 Increasing Penetration of Smartphones

- 3.3.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.4. Market Trends

- 3.4.1. Memory Segment is Expected to Have a Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog IC

- 5.1.2. Logic IC

- 5.1.3. Memory

- 5.1.4. Micro

- 5.1.4.1. Microprocessors (MPU)

- 5.1.4.2. Microcontrollers (MCU)

- 5.1.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. IT & Telecommunications

- 5.2.4. Manufacturing & Automation

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intel Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Analog Devices Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infineon Technologies AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NXP Semiconductors NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 On Semiconductor Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microchip Technology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Renesas Electronics Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MediaTek Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Intel Corporation

List of Figures

- Figure 1: Europe Integrated Circuits Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Integrated Circuits Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Europe Integrated Circuits Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Integrated Circuits Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Europe Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Europe Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Integrated Circuits Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Integrated Circuits Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Integrated Circuits Market?

The projected CAGR is approximately 7.83%.

2. Which companies are prominent players in the Europe Integrated Circuits Market?

Key companies in the market include Intel Corporation, Texas Instruments Inc, Analog Devices Inc, Infineon Technologies AG, STMicroelectronics NV, NXP Semiconductors NV, On Semiconductor Corporation, Microchip Technology Inc, Renesas Electronics Corporation, MediaTek Inc.

3. What are the main segments of the Europe Integrated Circuits Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

Memory Segment is Expected to Have a Significant Growth Rate.

7. Are there any restraints impacting market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

8. Can you provide examples of recent developments in the market?

June 2024: Asahi Kasei Microdevices launched a new line of integrated circuits (ICs) offering advanced capabilities in a more compact package than previous solutions. The CQ36 series of digital output coreless current sensor ICs caters to the growing robotics market. The series features a built-in Delta-Sigma (ΔΣ) modulator, enabling the IC to replace traditional shunt resistors and isolated analog-to-digital converters (ADCs) in a single package.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the Europe Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence