Key Insights

The Colombian Third-Party Logistics (3PL) market is projected for significant expansion, driven by the rapid growth of e-commerce, increasingly intricate supply chains, and a heightened demand for efficient logistics across diverse industries. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 8.1%, reaching an estimated market size of $1.27 billion by 2025. Key growth catalysts include the burgeoning FMCG sector, particularly in beauty, personal care, and beverages, alongside the thriving e-commerce retail environment necessitating optimized delivery networks. Sectors like automotive, fashion, and technology also contribute substantially, requiring specialized handling and warehousing, including value-added warehousing and distribution services. While granular segment data is pending, the presence of leading players such as Coordinadora Mercantil SA and DHL signifies a dynamic and competitive marketplace.

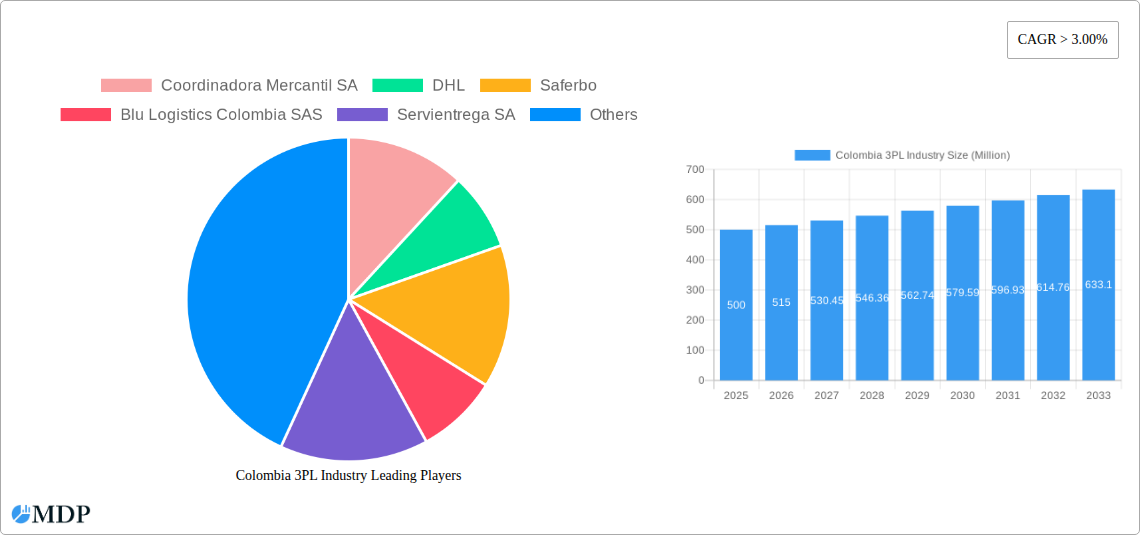

Colombia 3PL Industry Market Size (In Billion)

Future growth from 2025-2033 is expected to be bolstered by government infrastructure investments, expanded e-commerce reach, and the widespread adoption of technology within the 3PL sector. To maintain a competitive edge, companies must prioritize tailored solutions, advanced technological integration, and scalable operations. The robust presence of both global and local 3PL providers highlights the market's maturity and investment appeal. Strong growth is anticipated in value-added warehousing and international transportation management, aligning with global 3PL industry trends.

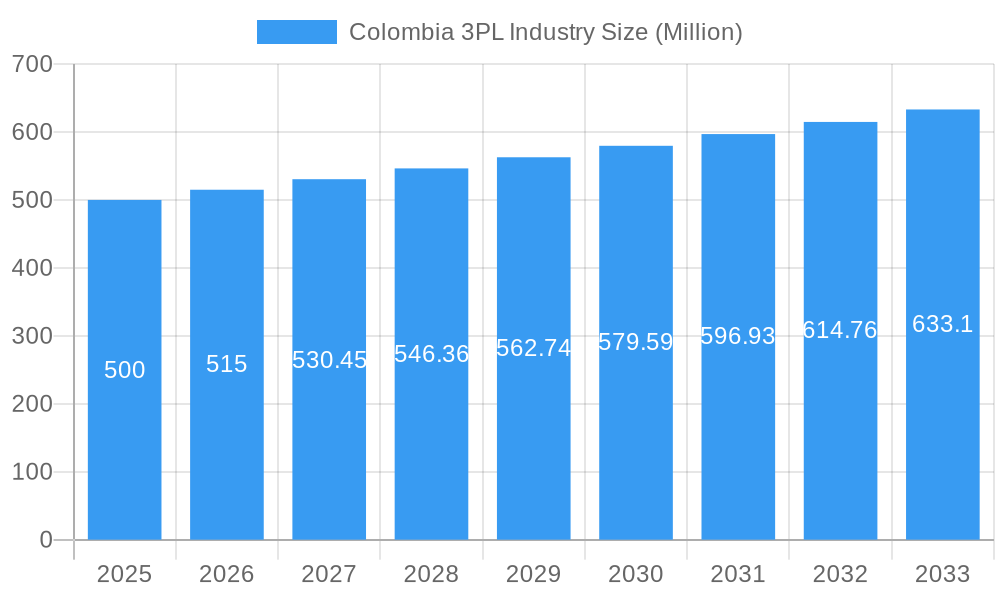

Colombia 3PL Industry Company Market Share

Colombia 3PL Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Colombia 3PL (Third-Party Logistics) industry, offering invaluable insights for stakeholders across the supply chain. We delve into market dynamics, leading players, emerging trends, and future growth projections, covering the period from 2019 to 2033, with a focus on 2025. The report features detailed segmentation by service type and end-user industry, revealing key opportunities and challenges within this dynamic market. Expect actionable intelligence on market share, M&A activity, and technological disruptions affecting the $XX Million industry.

Colombia 3PL Industry Market Dynamics & Concentration

The Colombian 3PL market, valued at $XX Million in 2025, exhibits a moderately concentrated landscape, with several large players dominating alongside numerous smaller, specialized providers. Market share data indicates that Coordinadora Mercantil SA, DHL, and Servientrega SA hold significant portions, while regional players like Saferbo and Blu Logistics Colombia SAS compete vigorously in specific segments. The industry is driven by innovation in areas such as warehousing automation, digitalization of logistics processes, and sustainable supply chain practices. A supportive regulatory framework and the growth of e-commerce are further catalysts. However, challenges exist regarding infrastructure limitations and fluctuating fuel prices.

- Market Concentration: High, with the top 5 players controlling an estimated XX% of the market.

- Innovation Drivers: Automation, digitalization, and sustainable logistics.

- Regulatory Framework: Supportive, but with areas needing improvement in infrastructure investment.

- Product Substitutes: Limited, given the specialized nature of 3PL services.

- End-User Trends: Growth in e-commerce, FMCG, and automotive is driving demand.

- M&A Activity: A moderate number of deals (XX) were observed during the historical period, reflecting industry consolidation.

Colombia 3PL Industry Industry Trends & Analysis

The Colombian 3PL market demonstrates robust growth, with a Compound Annual Growth Rate (CAGR) of XX% projected from 2025 to 2033. This growth is primarily fueled by the expansion of e-commerce, increasing demand for efficient supply chain solutions, and foreign investment in various sectors. Technological advancements, such as the implementation of AI-powered logistics solutions and blockchain technology for enhanced transparency, are reshaping the competitive landscape. Consumer preferences are shifting towards faster delivery times and greater transparency, pressuring 3PL providers to enhance their services. Intense competition fosters innovation and drives efficiency improvements. Market penetration of advanced technologies remains moderate, indicating significant opportunities for future growth.

Leading Markets & Segments in Colombia 3PL Industry

The Bogota metropolitan area constitutes the dominant market for 3PL services in Colombia, driven by its high population density, robust economic activity, and established infrastructure. Among the service segments, Value-added Warehousing and Distribution is the largest, reflecting the increasing need for efficient inventory management and specialized handling. Within end-user industries, FMCG, Automotive, and Retail are the leading segments, demonstrating significant demand for 3PL solutions.

- Key Drivers for Bogota Dominance: Concentrated population, strong economic activity, developed infrastructure.

- Value-added Warehousing & Distribution: Driven by e-commerce growth and the need for inventory optimization.

- FMCG Dominance: High consumption levels and complex distribution networks.

- Automotive Growth: Increased production and import/export activity.

- Retail Expansion: The rise of e-commerce and modern retail formats.

Colombia 3PL Industry Product Developments

Recent product developments focus on incorporating advanced technologies to enhance efficiency, transparency, and sustainability. This includes the adoption of warehouse management systems (WMS), transportation management systems (TMS), and route optimization software. Emphasis is placed on providing value-added services like customized packaging, labeling, and inventory management to cater to specific client needs. The integration of Internet of Things (IoT) devices and real-time tracking capabilities is gaining traction, enabling improved visibility and control across the supply chain. The market shows strong interest in sustainable and eco-friendly logistics solutions.

Key Drivers of Colombia 3PL Industry Growth

The Colombian 3PL market benefits from strong economic growth, increased foreign investment, and the expansion of e-commerce. Government initiatives promoting infrastructure development and logistics efficiency play a key role. Technological advancements, such as automation and digitalization, improve operational efficiency and reduce costs, further enhancing growth. The rising demand for specialized services, like temperature-controlled transportation for the Reefer segment and customized warehousing solutions for FMCG, contributes to market expansion.

Challenges in the Colombia 3PL Industry Market

The industry faces challenges related to infrastructure limitations, especially in less developed regions. High fuel prices and fluctuating exchange rates impact operational costs. Intense competition from both domestic and international players necessitates continuous innovation and efficiency improvements. Regulatory complexities and bureaucratic hurdles can pose obstacles for smooth operations. These challenges can negatively impact profitability and limit market growth. The lack of skilled labor in certain areas creates another barrier. These factors combine to restrict the market growth by an estimated XX%.

Emerging Opportunities in Colombia 3PL Industry

The growing demand for sustainable and ethical supply chain practices presents lucrative opportunities. The increasing adoption of technology, such as AI and blockchain, offers avenues for innovation and service differentiation. Strategic partnerships with e-commerce platforms and expansion into niche markets like specialized healthcare logistics can lead to significant growth. Government support for infrastructure development and logistics modernization provides a favorable environment for market expansion.

Leading Players in the Colombia 3PL Industry Sector

- Coordinadora Mercantil SA

- DHL https://www.dhl.com/

- Saferbo

- Blu Logistics Colombia SAS

- Servientrega SA

- EGA - KAT

- Kuehne + Nagel https://www.kuehne-nagel.com/

- Icoltrans

- TCC SAS

- Almaviva

Key Milestones in Colombia 3PL Industry Industry

December 2022: CEVA Logistics opened a new carbon-neutral, 15,000-square-meter warehouse in Bogota, significantly expanding its capacity and solidifying its position in the market. This move reflects the growing importance of sustainability and demonstrates commitment to serving key sectors like technology, industrial, and automotive.

December 2022: Leschaco acquired Coltrans S.A.S., strengthening its presence in Colombia and expanding its global network to 24 countries. This acquisition demonstrates the ongoing consolidation within the industry and highlights the strategic importance of the Colombian market.

Strategic Outlook for Colombia 3PL Industry Market

The Colombian 3PL market is poised for substantial growth, driven by economic expansion, technological advancements, and increasing demand for efficient and sustainable logistics solutions. Companies that successfully embrace innovation, enhance their technological capabilities, and develop strong partnerships will be well-positioned to capitalize on the emerging opportunities. Focus on sustainability and offering specialized services will further enhance competitive advantage in this dynamic market. The predicted market size in 2033 is $XX Million.

Colombia 3PL Industry Segmentation

-

1. Service

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End User

- 2.1. Automotive

- 2.2. FMCG (Fa

- 2.3. Retail (

- 2.4. Fashion and Lifestyle (Apparel and Footwear)

- 2.5. Technolo

- 2.6. Reefer (

- 2.7. Other End Users

Colombia 3PL Industry Segmentation By Geography

- 1. Colombia

Colombia 3PL Industry Regional Market Share

Geographic Coverage of Colombia 3PL Industry

Colombia 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Events in E-commerce Sector; Increasing Demand for Qualified Event Logistics Services

- 3.3. Market Restrains

- 3.3.1. High Labour Cost; High Pricing

- 3.4. Market Trends

- 3.4.1. Colombia Third-party Logistics (3PL) Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. FMCG (Fa

- 5.2.3. Retail (

- 5.2.4. Fashion and Lifestyle (Apparel and Footwear)

- 5.2.5. Technolo

- 5.2.6. Reefer (

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Coordinadora Mercantil SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saferbo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Blu Logistics Colombia SAS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Servientrega SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EGA - KAT**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Icoltrans

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TCC SAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Almaviva

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Coordinadora Mercantil SA

List of Figures

- Figure 1: Colombia 3PL Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Colombia 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: Colombia 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Colombia 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Colombia 3PL Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Colombia 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Colombia 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Colombia 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia 3PL Industry?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Colombia 3PL Industry?

Key companies in the market include Coordinadora Mercantil SA, DHL, Saferbo, Blu Logistics Colombia SAS, Servientrega SA, EGA - KAT**List Not Exhaustive, Kuehne + Nagel, Icoltrans, TCC SAS, Almaviva.

3. What are the main segments of the Colombia 3PL Industry?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Events in E-commerce Sector; Increasing Demand for Qualified Event Logistics Services.

6. What are the notable trends driving market growth?

Colombia Third-party Logistics (3PL) Market Trends.

7. Are there any restraints impacting market growth?

High Labour Cost; High Pricing.

8. Can you provide examples of recent developments in the market?

December 2022: CEVA Logistics opened a new multi-client, 15,000-square-meter warehouse in Bogota, Colombia, allowing the company to better serve the strategic growth needs of its customers in South and Latin America. The new facility is the first carbon-neutral CEVA warehouse in the country and consolidates the operations of three other former sites in Colombia, while also adding space for new customers. The Bogota facility will serve existing technology, industrial and automotive clients, who have shifted from other CEVA operations in Colombia. The new warehouse also serves several new customers, including a new automaker, whose spare parts operation will occupy roughly one-third of the total space. In addition to its sustainability measures, the Bogota warehouse will employ advanced security measures, as well as leading-edge software, workflow, and picking and sorting technologies. The facility also positions CEVA for future growth in a thriving region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia 3PL Industry?

To stay informed about further developments, trends, and reports in the Colombia 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence