Key Insights

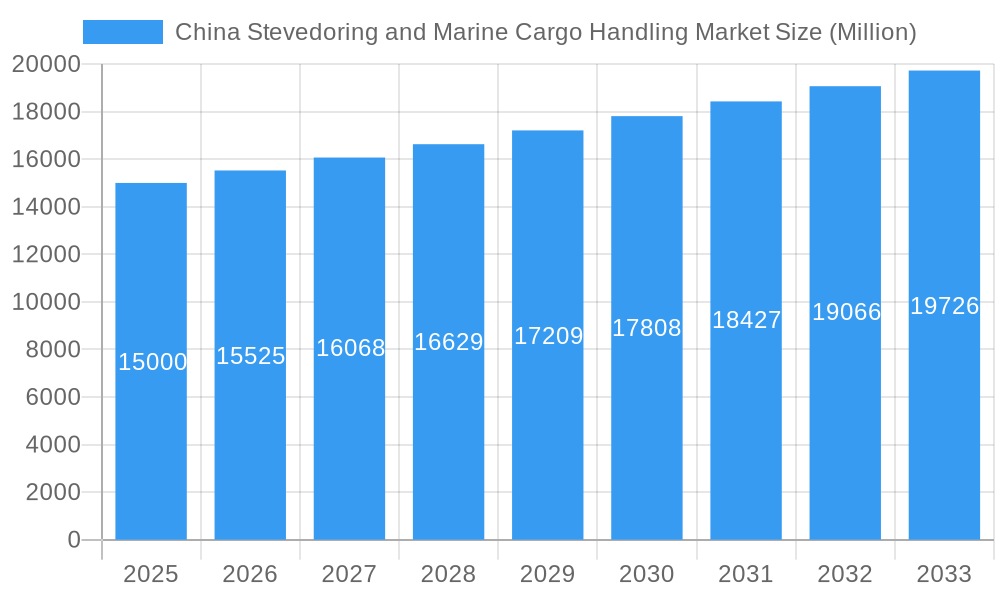

The China stevedoring and marine cargo handling market is experiencing robust growth, driven by the country's expanding import-export activities and substantial investments in port infrastructure modernization. The market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR and market trends), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2025 to 2033. This growth is fueled by several key factors. Firstly, China's strategic Belt and Road Initiative continues to stimulate international trade, significantly increasing cargo volumes handled at its numerous ports. Secondly, the ongoing expansion and upgrading of port facilities, including the adoption of automated and technologically advanced handling systems, enhances efficiency and capacity, further supporting market growth. Finally, the rise of e-commerce and related cross-border logistics are adding to the demand for efficient stevedoring and cargo handling services.

China Stevedoring and Marine Cargo Handling Market Market Size (In Billion)

However, the market faces certain challenges. Fluctuations in global trade due to geopolitical uncertainties and economic slowdowns can impact cargo volumes. Furthermore, increasing labor costs and stringent environmental regulations necessitate investments in advanced technologies and sustainable practices, potentially impacting profitability for some market players. Segmentation reveals a significant contribution from bulk cargo and containerized cargo handling, highlighting the importance of these segments for market growth. Key players like ASEAN Seas Line Co Limited, Guangzhou Shipyard International, and China Shipbuilding Trading Co Ltd are actively shaping the market landscape through investments, technological advancements, and strategic partnerships. The market's future trajectory hinges on effective infrastructure development, consistent trade growth, and the industry's ability to adapt to evolving technological and environmental standards. Given China's role as a global manufacturing and trading hub, this sector is poised for continued expansion in the coming years.

China Stevedoring and Marine Cargo Handling Market Company Market Share

China Stevedoring and Marine Cargo Handling Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China Stevedoring and Marine Cargo Handling Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report unveils the market's dynamics, trends, challenges, and future opportunities. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

China Stevedoring and Marine Cargo Handling Market Market Dynamics & Concentration

The China stevedoring and marine cargo handling market is characterized by a complex interplay of factors influencing its growth and concentration. Market concentration is moderately high, with several major players commanding significant market share, although a large number of smaller companies also operate. The market share of the top 5 players is estimated at xx%. Innovation in automation, digitalization, and sustainable technologies is a key driver, pushing efficiency and reducing operational costs. Stringent regulatory frameworks concerning safety, environmental protection, and labor practices shape market operations. The emergence of substitute technologies, like automated guided vehicles (AGVs) and robotic systems, presents both challenges and opportunities. End-user trends, primarily driven by e-commerce growth and increasing global trade, significantly impact demand. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024. These activities often involve consolidation among smaller players or strategic acquisitions by larger firms to expand their market reach and service capabilities.

China Stevedoring and Marine Cargo Handling Market Industry Trends & Analysis

The China stevedoring and marine cargo handling market is witnessing robust growth, fueled by several key trends. Rising e-commerce activities and increasing globalization contribute significantly to the surge in cargo volumes, driving demand for efficient stevedoring and handling services. Technological disruptions, including the adoption of automation, AI-powered systems, and big data analytics, are transforming operational efficiency and enhancing productivity. Consumer preferences for faster delivery times and improved supply chain transparency exert pressure on the industry to adopt innovative solutions. The competitive landscape is dynamic, characterized by both intense competition among established players and the emergence of new entrants offering specialized services. The market exhibits a strong focus on sustainability and environmental concerns, encouraging companies to invest in eco-friendly technologies and practices. The government’s continuous investments in port infrastructure development play a crucial role in market expansion and facilitating smooth cargo handling operations.

Leading Markets & Segments in China Stevedoring and Marine Cargo Handling Market

The dynamic landscape of the China stevedoring and marine cargo handling market is primarily shaped by its coastal economic powerhouses. The Yangtze River Delta, renowned for its dense industrial clusters and vibrant trade activity, the Pearl River Delta, a global manufacturing hub with extensive port facilities, and the Bohai Rim, strategically positioned for trade with Northeast Asia, collectively represent the dominant markets. These regions are characterized by their advanced port infrastructure, proximity to pivotal manufacturing and consumption centers, and consistently high cargo throughput volumes.

- Key Drivers for Dominant Regions:

- Continuous and substantial investments in world-class port infrastructure and modernization initiatives.

- A crucial strategic geographic location that facilitates seamless international trade routes and connectivity.

- The presence of robust and expanding manufacturing sectors, coupled with a strong export-oriented economy.

- Supportive government policies, including favorable regulations, economic incentives, and strategic development plans, all fostering growth and efficiency.

Within the segments, Containerized Cargo currently commands the largest market share. This dominance is a direct consequence of the global maritime industry's enduring shift towards containerized shipping, which offers standardization, efficiency, and security for a wide array of goods. Simultaneously, the Bulk Cargo segment maintains a significant and vital share, underpinned by China's immense import and export activities of essential raw materials such as coal, iron ore, grains, and petroleum. In terms of operational type, the Stevedoring segment stands as the largest, unequivocally highlighting the fundamental and indispensable role of efficient, safe, and timely cargo loading and unloading operations in the overall supply chain.

- Dominance Analysis: The pronounced concentration of major, high-capacity ports in China's coastal areas, coupled with the ever-increasing global and domestic demand for containerized goods and bulk commodities, collectively drives the dominance of these specific segments and geographical regions. Furthermore, ongoing and ambitious government initiatives meticulously designed to enhance port infrastructure, streamline logistics networks, and promote intermodal connectivity continue to solidify and amplify this prevailing trend, ensuring sustained market leadership.

China Stevedoring and Marine Cargo Handling Market Product Developments

The evolution of the China stevedoring and marine cargo handling market is characterized by a strong impetus towards automation, enhanced operational efficiency, and a growing commitment to sustainability. Recent product innovations are at the forefront of this transformation. We are witnessing the widespread implementation of Automated Guided Vehicles (AGVs) and advanced robotic cranes that significantly increase speed and precision. Furthermore, sophisticated software solutions are being deployed to optimize cargo handling workflows, from planning and execution to tracking. These technological advancements collectively contribute to improved throughput speeds, substantial reductions in labor costs, and critically, enhanced safety measures for personnel and cargo. The integration of big data analytics and Internet of Things (IoT) devices is further revolutionizing operational visibility, enabling real-time monitoring, predictive maintenance, and more informed, data-driven decision-making. These cutting-edge innovations are not merely addressing the demands of a rapidly expanding market but are also pivotal in meeting increasing environmental regulations and corporate sustainability goals.

Key Drivers of China Stevedoring and Marine Cargo Handling Market Growth

The robust and sustained growth of the China stevedoring and marine cargo handling market is propelled by a confluence of powerful factors. At the forefront are technological advancements, particularly in automation, digitalization, and smart port technologies, which are instrumental in achieving higher levels of efficiency, productivity, and operational accuracy. The exponential growth of e-commerce, both domestically and internationally, has led to a significant surge in cross-border trade and parcel volumes, thereby escalating the demand for seamless and rapid cargo handling services. Complementing these trends are proactive government initiatives that prioritize the development and upgrading of port infrastructure, the optimization of logistics networks, and the creation of efficient intermodal transportation systems, fostering a highly conducive environment for market expansion. Finally, China's continuously expanding and resilient economy, coupled with its pivotal role as a global manufacturing and trading powerhouse, ensures a consistent and increasing volume of cargo throughput, directly fueling the market's ongoing growth trajectory.

Challenges in the China Stevedoring and Marine Cargo Handling Market Market

The market faces challenges such as stringent regulatory compliance, especially regarding environmental protection and worker safety, impacting operational costs. Supply chain disruptions, including port congestion and logistical bottlenecks, can negatively affect operational efficiency and lead to delays. Intense competition among numerous players, both domestic and international, creates price pressure and necessitates continuous innovation to maintain market share. These factors create a complex and dynamic operating environment.

Emerging Opportunities in China Stevedoring and Marine Cargo Handling Market

The China stevedoring and marine cargo handling market is rich with emerging opportunities for forward-thinking stakeholders. Significant potential lies in embracing technological breakthroughs, especially in the fields of Artificial Intelligence (AI), advanced robotics, and blockchain technology. These innovations promise to further revolutionize operational efficiency, enhance security protocols, and provide greater transparency across the supply chain. The formation of strategic partnerships between stevedoring companies and a wider spectrum of logistics providers, including freight forwarders, warehousing operators, and last-mile delivery services, can lead to more integrated service offerings and expanded market reach. The increasing global and governmental emphasis on sustainability presents substantial opportunities for companies that invest in and promote eco-friendly solutions, such as electric-powered equipment, optimized energy consumption, and waste reduction initiatives. Furthermore, the strategic expansion into less-developed but rapidly industrializing regions of China offers considerable untapped potential for market penetration and significant growth.

Leading Players in the China Stevedoring and Marine Cargo Handling Market Sector

- ASEAN Seas Line Co Limited

- Guangzhou Shipyard International (GSI)

- China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- China Shipbuilding Trading Co Ltd (CSTC)

- CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- Qingdao Port International Limited

- Taizhou Sanfu Ship Engineering Co Ltd

- China Merchants Jinling Shipyard (Weihai) Co Ltd

- Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- China Ocean Shipping Company

Key Milestones in China Stevedoring and Marine Cargo Handling Market Industry

- July 2022: Commissioning of China's first indigenously developed offshore oil and gas extraction facility ("Xmas Tree" system) in Hainan Province, boosting energy sector logistics.

- May 2022: Successful maiden voyage of the world's first LNG dual-fuel ultra-large crude oil tanker, demonstrating China's commitment to sustainable maritime transport and influencing fuel choices for future vessels.

Strategic Outlook for China Stevedoring and Marine Cargo Handling Market Market

The China stevedoring and marine cargo handling market is poised for significant long-term growth, driven by continuous expansion in global trade and technological advancements. Strategic opportunities lie in leveraging automation, big data analytics, and sustainable technologies to enhance operational efficiency, reduce costs, and improve service offerings. Focusing on strategic partnerships and market expansion into less-developed regions can unlock further growth potential. Companies adapting to evolving regulations and consumer preferences will be best positioned to succeed in this dynamic market.

China Stevedoring and Marine Cargo Handling Market Segmentation

-

1. Type

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Bulk Cargo

- 2.2. Containerized Cargo

- 2.3. Other Cargo

China Stevedoring and Marine Cargo Handling Market Segmentation By Geography

- 1. China

China Stevedoring and Marine Cargo Handling Market Regional Market Share

Geographic Coverage of China Stevedoring and Marine Cargo Handling Market

China Stevedoring and Marine Cargo Handling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. China’s increasing investments in the ocean freight shipping industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Bulk Cargo

- 5.2.2. Containerized Cargo

- 5.2.3. Other Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ASEAN Seas Line Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guangzhou Shipyard International (GSI)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Shipbuilding Trading Co Ltd (CSTC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qingdao Port International Limited**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Taizhou Sanfu Ship Engineering Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Merchants Jinling Shipyard (Weihai) Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Ocean Shipping Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ASEAN Seas Line Co Limited

List of Figures

- Figure 1: China Stevedoring and Marine Cargo Handling Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Stevedoring and Marine Cargo Handling Market Share (%) by Company 2025

List of Tables

- Table 1: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 3: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 6: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Stevedoring and Marine Cargo Handling Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the China Stevedoring and Marine Cargo Handling Market?

Key companies in the market include ASEAN Seas Line Co Limited, Guangzhou Shipyard International (GSI), China (Shenzhen) International Logistics and Supply Chain Fair (CILF), China Shipbuilding Trading Co Ltd (CSTC), CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS), Qingdao Port International Limited**List Not Exhaustive, Taizhou Sanfu Ship Engineering Co Ltd, China Merchants Jinling Shipyard (Weihai) Co Ltd, Shenzhen Yihaitong Global Supply Chain Management Co Ltd, China Ocean Shipping Company.

3. What are the main segments of the China Stevedoring and Marine Cargo Handling Market?

The market segments include Type, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

China’s increasing investments in the ocean freight shipping industry.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

July 2022: China's first indigenously developed offshore oil and gas extraction facility, subsea 'Xmas Tree' system, was put into operation in the Yingge Sea, south China's Hainan Province. The system is able to produce about 200 million cubic meters of natural gas per year, according to China National Offshore Oil Corporation (CNOOC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Stevedoring and Marine Cargo Handling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Stevedoring and Marine Cargo Handling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Stevedoring and Marine Cargo Handling Market?

To stay informed about further developments, trends, and reports in the China Stevedoring and Marine Cargo Handling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence