Key Insights

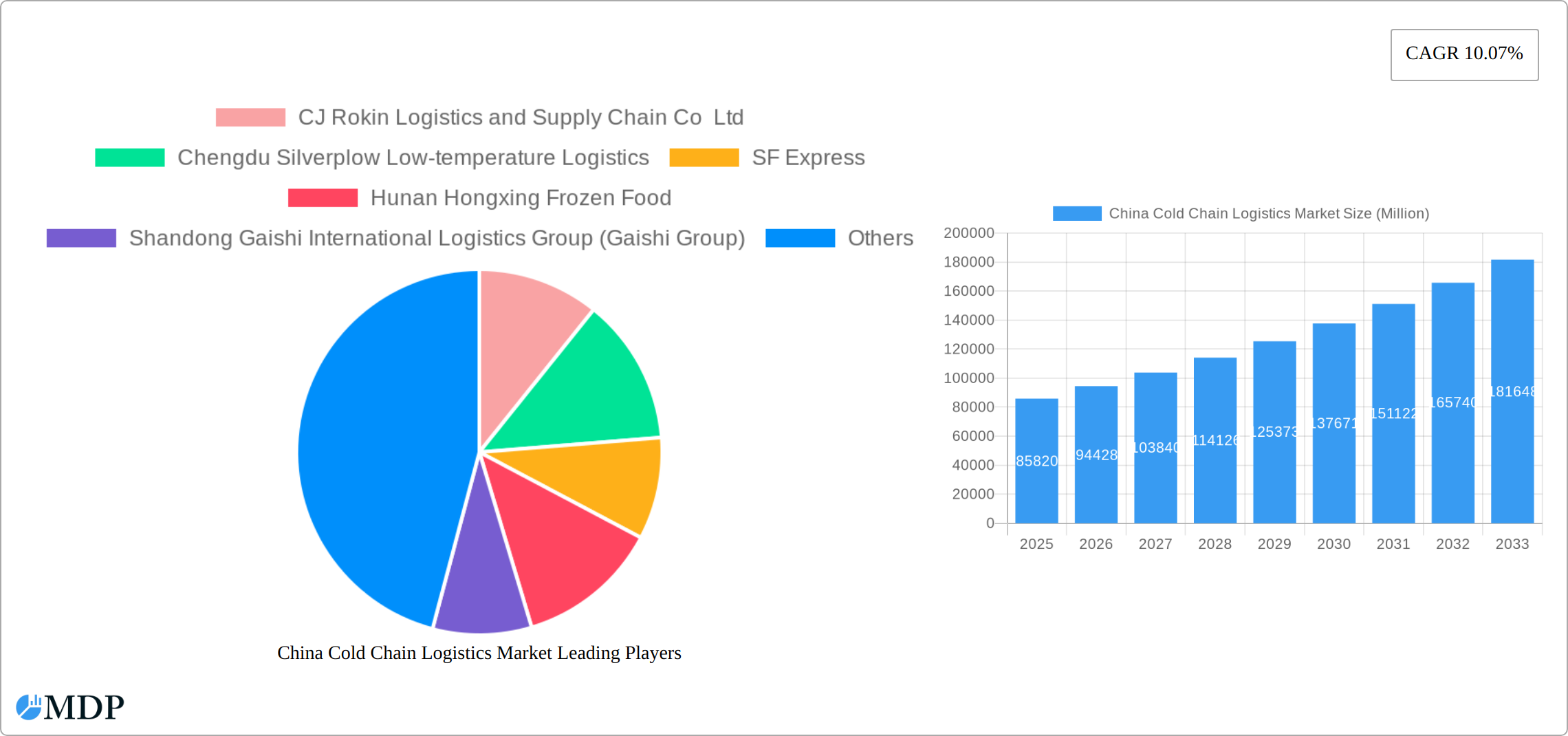

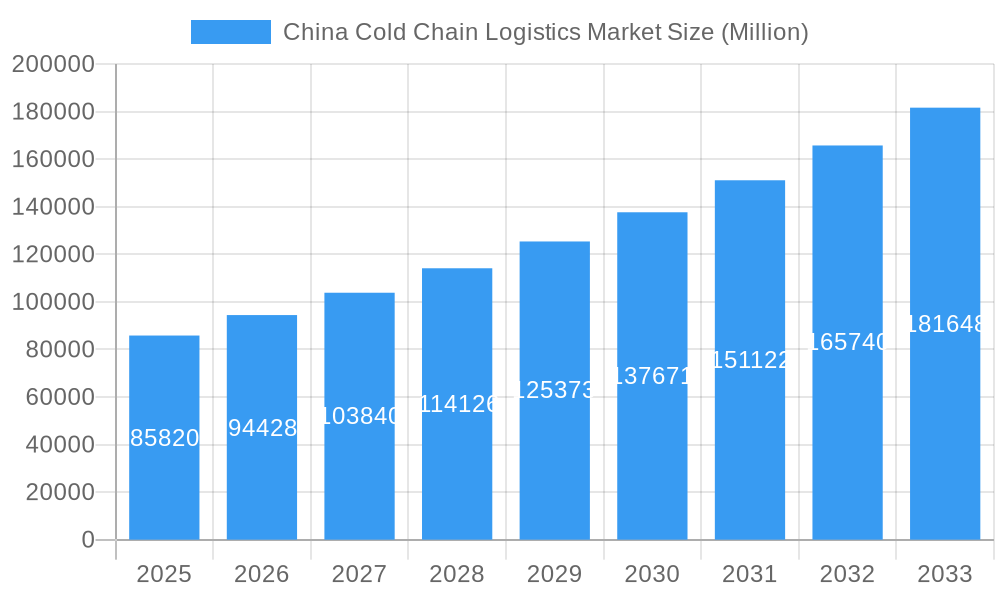

The China cold chain logistics market, valued at $85.82 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.07% from 2025 to 2033. This significant expansion is driven by several key factors. The burgeoning e-commerce sector and rising consumer demand for fresh and processed foods, particularly in urban areas, are fueling the need for efficient and reliable cold chain solutions. Furthermore, increasing government initiatives promoting food safety and quality standards are incentivizing investment in advanced cold chain infrastructure and technology. Growth is also spurred by the diversification of cold chain services, encompassing storage, transportation, and value-added services like blast freezing and inventory management, catering to the specific needs of various sectors including horticulture, dairy, meat, seafood, pharmaceuticals, and life sciences. However, challenges remain. These include the uneven distribution of cold chain infrastructure across the country, particularly in rural areas, along with the need for continuous investment in upgrading existing facilities and technologies to meet the rising demands and maintain optimal product quality and safety. The competitive landscape comprises both domestic and international players, with companies like CJ Rokin Logistics, SF Express, and Nichirei Logistics Group vying for market share through strategic expansions and technological advancements.

China Cold Chain Logistics Market Market Size (In Billion)

The market segmentation reveals significant opportunities across different service types and application areas. The demand for chilled and frozen storage and transportation is particularly high, driven by the perishable nature of many goods. Within applications, horticulture (fresh fruits and vegetables) and dairy products dominate, highlighting the crucial role of the cold chain in maintaining the quality and safety of these essential food items. The pharmaceutical and life sciences sectors are also significant contributors, demanding high levels of temperature control and traceability throughout the logistics process. Future growth will be significantly impacted by advancements in technology, including the adoption of IoT sensors, AI-powered route optimization, and blockchain technology for enhanced traceability and efficiency. Addressing the infrastructural gaps and investing in skilled workforce development will be key to unlocking the full potential of the China cold chain logistics market.

China Cold Chain Logistics Market Company Market Share

China Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning China cold chain logistics market, offering invaluable insights for stakeholders across the industry. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, identifies key players, and forecasts future growth potential. Maximize your understanding of this rapidly evolving sector and gain a competitive edge.

China Cold Chain Logistics Market Market Dynamics & Concentration

The China cold chain logistics market is undergoing a period of robust expansion, propelled by a confluence of factors. Rising disposable incomes and evolving consumer tastes for fresher, more processed food options are significant demand drivers. Furthermore, the burgeoning e-commerce sector is creating substantial opportunities for specialized logistics services. Despite this growth, the market is characterized by a competitive landscape featuring both established giants and numerous smaller enterprises. Market concentration is currently moderate, with dominant players often specializing in specific niches, while a broader array of smaller companies vie for market share in other segments. Technological innovation is a critical differentiator, with significant investments being channeled into automated warehousing solutions, advanced temperature-controlled transportation fleets, and sophisticated real-time tracking systems to enhance efficiency and product integrity.

The regulatory environment is dynamic, with ongoing policy updates aimed at bolstering food safety standards and optimizing logistics operations. The market faces competition from product substitutes, such as shelf-stable processed foods, which can divert demand from fresh produce. Conversely, the exponential growth of online grocery shopping is a powerful catalyst for cold chain logistics, amplifying the need for reliable, temperature-controlled delivery networks. End-user preferences are increasingly shifting towards convenient, high-quality, and sustainably sourced products, compelling cold chain providers to adapt their service offerings. Mergers and acquisitions (M&A) have been a prominent feature in recent years, signaling a trend towards industry consolidation and the pursuit of economies of scale. M&A activities were valued at approximately [Insert Specific M&A Value Here] Million in 2024, marking a notable [Insert Specific Percentage Increase Here]% increase year-on-year. In 2024, the market share remained somewhat fragmented, with the top 5 players collectively holding an estimated [Insert Specific Market Share Percentage Here]% of the overall market.

China Cold Chain Logistics Market Industry Trends & Analysis

The China cold chain logistics market is characterized by robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the rising demand for fresh produce and processed foods, the rapid expansion of e-commerce, and government initiatives promoting cold chain infrastructure development. Technological disruptions, such as the adoption of blockchain technology for traceability and the implementation of IoT sensors for real-time temperature monitoring, are transforming the industry.

Consumer preferences for convenience, safety, and quality are driving demand for value-added services, including blast freezing, labeling, and inventory management. Competitive dynamics are intense, with both domestic and international players vying for market share. Market penetration of advanced cold chain technologies remains relatively low, but it is expected to increase significantly in the coming years, particularly in urban areas. The increasing focus on sustainability and environmental responsibility is also influencing industry practices, with companies adopting eco-friendly solutions to minimize their carbon footprint.

Leading Markets & Segments in China Cold Chain Logistics Market

-

Dominant Region: Eastern China, especially its highly developed coastal provinces, continues to lead in cold chain logistics. This dominance is attributed to its dense population, advanced infrastructure, and significant economic activity.

-

Dominant Segment (By Services): Transportation remains the largest segment, primarily driven by the escalating demand for efficient and dependable delivery of temperature-sensitive goods. However, the value-added services segment is experiencing rapid growth, fueled by the increasing need for tailored logistics solutions and improved supply chain visibility.

-

Dominant Segment (By Temperature Type): The frozen segment holds a commanding position, largely due to the substantial demand for frozen food products and the extended shelf-life they offer.

-

Dominant Segment (By Application): Horticulture, encompassing fresh fruits and vegetables, is currently the largest application segment. Nevertheless, processed food products and pharmaceuticals are demonstrating significant growth trajectories and are poised to capture a larger market share.

Key Drivers:

- Economic Policies: Government initiatives, including incentives and substantial investments in infrastructure development, are pivotal for market expansion and sustainability.

- Infrastructure Development: The continuous expansion and modernization of cold storage facilities, transportation networks, and the adoption of cutting-edge technologies are crucial for enhancing operational efficiency and capacity.

- Urbanization: The ongoing trend of urbanization is a significant contributor to the demand for more sophisticated and efficient food distribution systems.

The leadership of these segments is primarily a consequence of robust consumer demand, focused government attention, and well-established infrastructural foundations. The potential for future growth in other segments is substantial, driven by evolving consumer preferences and rapid technological advancements.

China Cold Chain Logistics Market Product Developments

Recent product innovations focus on enhancing temperature control, improving traceability, and reducing waste. Technological advancements, such as the use of IoT sensors and AI-powered predictive analytics, are playing a crucial role in optimizing cold chain operations and improving efficiency. New applications are emerging in specialized sectors, like pharmaceuticals and life sciences, requiring sophisticated temperature control and stringent quality standards. The competitive advantage lies in offering innovative solutions that meet the evolving needs of customers while ensuring safety, reliability, and sustainability.

Key Drivers of China Cold Chain Logistics Market Growth

Several factors fuel the growth of the China cold chain logistics market. Technological advancements such as IoT-enabled tracking and automated warehousing improve efficiency and reduce costs. Economic expansion and rising disposable incomes lead to increased demand for fresh and processed foods. Government regulations mandating food safety standards and promoting cold chain infrastructure development are also significant drivers.

Challenges in the China Cold Chain Logistics Market Market

The China cold chain logistics market confronts a complex set of challenges. Navigating intricate regulatory frameworks pertaining to food safety and transportation is a persistent hurdle. Maintaining precise and consistent temperature control across the vast geographical expanse of China is another significant operational challenge. Supply chain disruptions, including existing infrastructure gaps in certain remote regions, present considerable obstacles to seamless operations. The highly competitive nature of the market necessitates continuous innovation and a relentless focus on operational efficiencies to ensure profitability. Furthermore, a notable shortage of skilled labor poses a substantial impediment to the industry's overall growth and development. These cumulative factors are estimated to contribute to a [Insert Specific Percentage Increase Here]% increase in overall operational costs.

Emerging Opportunities in China Cold Chain Logistics Market

The market presents promising opportunities. Technological breakthroughs, such as advanced refrigeration technologies and automation, are creating new possibilities. Strategic partnerships between logistics providers and food producers enable efficient integration of the supply chain. Expanding into underserved rural markets offers significant potential for growth. The integration of blockchain technology for enhanced product traceability is opening up new revenue streams.

Leading Players in the China Cold Chain Logistics Market Sector

- CJ Rokin Logistics and Supply Chain Co Ltd

- Chengdu Silverplow Low-temperature Logistics

- SF Express

- Hunan Hongxing Frozen Food

- Shandong Gaishi International Logistics Group (Gaishi Group)

- China Merchants Americold (CMAC)

- Henan Fresh Easy Supply Chain Co Ltd (Xianyi Holding China)

- Shanghai Speed Fresh Logistics Co Ltd

- Beijing Er Shang Group

- Nichirei Logistics Group Inc

- HNA Cold Chain

- Sinotrans Ltd

- Zhenjiang Hengwei Supply Chain Management Co Ltd

- Shanghai Jin Jiang International Industrial Investment Co Ltd

Key Milestones in China Cold Chain Logistics Market Industry

- 2020: The Chinese government announced significant strategic investments aimed at bolstering cold chain infrastructure nationwide.

- 2021: Several leading industry players introduced and launched innovative cold chain technologies, enhancing operational capabilities.

- 2022: The market witnessed an observable increase in merger and acquisition activities among key participants, indicating industry consolidation.

- 2023: Stricter and more comprehensive food safety regulations were implemented across various key regions, impacting logistics practices.

- 2024: The e-commerce sector experienced substantial growth, directly driving increased demand and expansion in cold chain delivery services.

Strategic Outlook for China Cold Chain Logistics Market Market

The future of the China cold chain logistics market is promising, with substantial growth potential driven by technological advancements, rising consumer demand, and supportive government policies. Strategic opportunities include focusing on value-added services, expanding into underserved markets, and leveraging technology to enhance efficiency and sustainability. Further consolidation through mergers and acquisitions is anticipated, creating larger, more efficient players better equipped to navigate industry complexities and capitalize on emerging trends.

China Cold Chain Logistics Market Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

China Cold Chain Logistics Market Segmentation By Geography

- 1. China

China Cold Chain Logistics Market Regional Market Share

Geographic Coverage of China Cold Chain Logistics Market

China Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing International Trade Driving the Market4.; Increasing online users driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Regulatory Compliance Affecting the Market4.; High Competition in the Market

- 3.4. Market Trends

- 3.4.1. Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CJ Rokin Logistics and Supply Chain Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chengdu Silverplow Low-temperature Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SF Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hunan Hongxing Frozen Food

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shandong Gaishi International Logistics Group (Gaishi Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Merchants Americold (CMAC)**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Henan Fresh Easy Supply Chain Co Ltd (Xianyi Holding China)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai Speed Fresh Logistics Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beijing Er Shang Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nichirei Logistics Group Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HNA Cold Chain

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sinotrans Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Zhenjiang Hengwei Supply Chain Management Co Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Shanghai Jin Jiang International Industrial Investment Co Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 CJ Rokin Logistics and Supply Chain Co Ltd

List of Figures

- Figure 1: China Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: China Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: China Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: China Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: China Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: China Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: China Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: China Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Cold Chain Logistics Market?

The projected CAGR is approximately 10.07%.

2. Which companies are prominent players in the China Cold Chain Logistics Market?

Key companies in the market include CJ Rokin Logistics and Supply Chain Co Ltd, Chengdu Silverplow Low-temperature Logistics, SF Express, Hunan Hongxing Frozen Food, Shandong Gaishi International Logistics Group (Gaishi Group), China Merchants Americold (CMAC)**List Not Exhaustive, Henan Fresh Easy Supply Chain Co Ltd (Xianyi Holding China), Shanghai Speed Fresh Logistics Co Ltd, Beijing Er Shang Group, Nichirei Logistics Group Inc, HNA Cold Chain, Sinotrans Ltd, Zhenjiang Hengwei Supply Chain Management Co Ltd, Shanghai Jin Jiang International Industrial Investment Co Ltd.

3. What are the main segments of the China Cold Chain Logistics Market?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.82 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing International Trade Driving the Market4.; Increasing online users driving the market.

6. What are the notable trends driving market growth?

Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities.

7. Are there any restraints impacting market growth?

4.; Regulatory Compliance Affecting the Market4.; High Competition in the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the China Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence