Key Insights

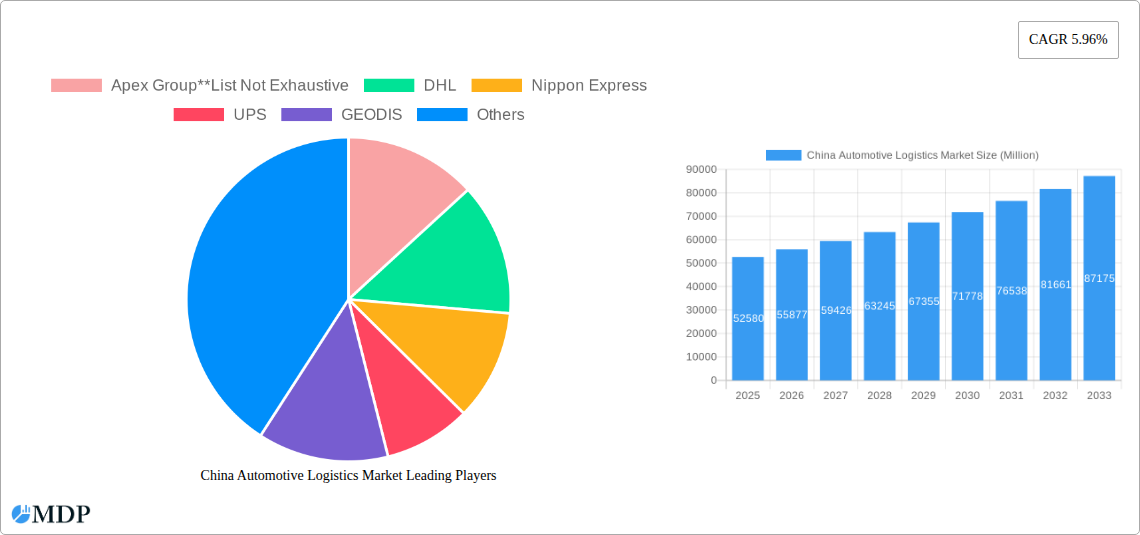

The China automotive logistics market, valued at $52.58 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.96% from 2025 to 2033. This expansion is driven by several key factors. Firstly, China's burgeoning automotive manufacturing sector, a global leader, fuels significant demand for efficient and reliable logistics solutions. The increasing production and sales of electric vehicles (EVs) further contribute to market growth, necessitating specialized logistics infrastructure and handling to accommodate the unique requirements of EV transportation and battery management. Secondly, advancements in technology, such as the adoption of advanced tracking systems, automation in warehousing, and optimized route planning, are improving efficiency and reducing costs within the automotive logistics sector. Finally, the ongoing expansion of China's national infrastructure, including improved road networks and high-speed rail lines, facilitates smoother and faster transportation of vehicles and components across vast distances.

China Automotive Logistics Market Market Size (In Billion)

However, the market also faces certain challenges. Rising fuel prices and labor costs represent significant headwinds, potentially impacting profitability for logistics providers. Stringent environmental regulations are also influencing operational practices, necessitating investments in sustainable and eco-friendly logistics solutions. Increased competition among logistics providers, both domestic and international, further adds pressure on pricing and margins. Despite these constraints, the long-term outlook for the China automotive logistics market remains positive, fueled by the continuous expansion of the automotive industry, technological advancements, and government initiatives promoting infrastructure development and sustainable logistics practices. The market segmentation by type (finished vehicles and auto components) and service (transportation, warehousing, distribution, and inventory management) offers diverse avenues for growth and specialization within the industry. The significant presence of major players like DHL, UPS, and several Chinese logistics giants underscores the market's maturity and competitive landscape.

China Automotive Logistics Market Company Market Share

China Automotive Logistics Market Report: 2019-2033

Dive deep into the dynamic landscape of China's automotive logistics market with our comprehensive report, providing actionable insights for strategic decision-making. This in-depth analysis covers market size, segmentation, key players, growth drivers, challenges, and emerging opportunities across the 2019-2033 period. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033. Expect detailed breakdowns by type (Finished Vehicle, Auto Component) and service (Transportation, Warehousing, Distribution & Inventory Management, Other Services). Discover crucial information on market concentration, technological advancements, and the impact of regulatory changes shaping this rapidly evolving sector. The report's value exceeds $xx Million.

China Automotive Logistics Market Market Dynamics & Concentration

The China automotive logistics market is characterized by a complex interplay of factors influencing its growth and concentration. Market concentration is moderately high, with a few dominant players holding significant market share. However, the presence of numerous smaller, specialized firms fosters competition. Innovation is a key driver, spurred by technological advancements in areas such as automation, data analytics, and sustainable transportation solutions. Stringent regulatory frameworks, aimed at improving efficiency and environmental sustainability, present both opportunities and challenges. The market witnesses a considerable number of M&A activities, reflecting the industry's consolidation and expansion strategies. Substitute products, such as rail transport, pose some competitive pressure, although road transport remains dominant. End-user trends, reflecting increasing demand for electric vehicles and improved supply chain agility, further reshape market dynamics.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024.

- Innovation Drivers: Automation, AI, and sustainable logistics solutions.

- Regulatory Framework: Emphasis on emission reduction and supply chain transparency.

China Automotive Logistics Market Industry Trends & Analysis

The China automotive logistics market exhibits robust growth, driven primarily by the expansion of the domestic automotive industry, particularly in the electric vehicle (EV) sector. Technological disruptions, such as the adoption of autonomous vehicles and blockchain technology for enhanced traceability, are revolutionizing logistics operations. Consumer preferences are shifting towards faster and more reliable delivery services, prompting logistics providers to invest in advanced technologies and infrastructure. The competitive landscape is intense, with both domestic and international players vying for market share through strategic partnerships, capacity expansion, and service differentiation. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at xx%. Market penetration of advanced logistics technologies is expected to reach xx% by 2033.

Leading Markets & Segments in China Automotive Logistics Market

The coastal regions of China, particularly areas around Shanghai, Guangzhou, and Tianjin, dominate the automotive logistics market due to their well-established port infrastructure and proximity to major automotive manufacturing hubs. Finished vehicle transportation remains the largest segment by type, driven by the high volume of vehicle production and distribution. Within services, transportation dominates, accounting for the largest share, followed by warehousing and distribution.

- Key Drivers for Dominant Regions:

- Extensive highway and rail networks.

- Strategic port locations facilitating international trade.

- Clustering of automotive manufacturers and suppliers.

- Key Drivers for Dominant Segments:

- High production volumes of finished vehicles.

- Growing demand for efficient warehousing and distribution solutions to manage increasing inventory.

China Automotive Logistics Market Product Developments

Recent product innovations focus on enhancing efficiency, sustainability, and traceability. This includes the adoption of advanced technologies like telematics, IoT sensors, and AI-powered route optimization systems. These innovations offer competitive advantages by improving delivery times, reducing costs, and enhancing supply chain visibility. The focus on sustainable solutions, such as methanol-ready car carriers and the adoption of electric vehicles in transportation fleets, is gaining traction, reflecting the industry's commitment to environmental responsibility.

Key Drivers of China Automotive Logistics Market Growth

The growth of the China automotive logistics market is propelled by several factors. The continued expansion of China's automotive manufacturing sector, particularly the rise of new energy vehicles (NEVs), fuels increased demand for logistics services. Government policies promoting infrastructure development and technological advancements further stimulate market expansion. Moreover, increasing consumer demand for faster and more reliable delivery of vehicles and auto components is driving innovation and investment within the industry. Specifically, the government’s initiatives to improve transportation infrastructure are key drivers.

Challenges in the China Automotive Logistics Market Market

The China automotive logistics market faces several challenges. Stricter environmental regulations necessitate investment in cleaner transportation solutions, potentially increasing operating costs. Supply chain disruptions, particularly those experienced in recent years, highlight the need for improved resilience and diversification. Furthermore, intense competition among logistics providers necessitates continuous innovation and cost optimization to maintain market share. These challenges together impact the market's growth by approximately xx% annually.

Emerging Opportunities in China Automotive Logistics Market

Long-term growth opportunities exist in leveraging technological advancements, such as AI-powered route optimization and autonomous trucking, to enhance efficiency and reduce costs. Strategic partnerships between logistics providers and automotive manufacturers can lead to the creation of integrated supply chains. Expanding into less-developed regions of China presents a significant opportunity to tap into growing demand for automotive logistics services. Moreover, the increasing focus on sustainable logistics presents opportunities for providers specializing in green transportation solutions.

Leading Players in the China Automotive Logistics Market Sector

- Apex Group

- DHL

- Nippon Express

- UPS

- GEODIS

- Yusen Logistics Co Ltd

- China Ocean Shipping (Group) Company

- SAIC Anji Logistics

- BLG Logistics

- Sinotrans Co Ltd

- HYCX Group

Key Milestones in China Automotive Logistics Market Industry

- May 2023: SAIC Anji orders four methanol-ready car carriers, signifying a shift towards sustainable shipping practices.

- July 2023: COSCO Shipping launches a full-chain logistics service for new energy vehicles, catering to the growing EV export market.

Strategic Outlook for China Automotive Logistics Market Market

The future of the China automotive logistics market appears bright, fueled by continuous growth in the automotive sector and ongoing technological advancements. Strategic opportunities lie in focusing on sustainable solutions, enhancing supply chain resilience, and leveraging data analytics for improved efficiency. Players who adapt to changing market dynamics, embrace innovation, and focus on customer needs are poised for significant growth in the years to come.

China Automotive Logistics Market Segmentation

-

1. Type

- 1.1. Finished Vehicle

- 1.2. Auto Component

-

2. Service

- 2.1. Transportation

- 2.2. Warehous

- 2.3. Other Services

China Automotive Logistics Market Segmentation By Geography

- 1. China

China Automotive Logistics Market Regional Market Share

Geographic Coverage of China Automotive Logistics Market

China Automotive Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing New Energy Vehicles Sales

- 3.3. Market Restrains

- 3.3.1. Trade War between China and the United States

- 3.4. Market Trends

- 3.4.1. Chinese Investment in NEVs (New Energy Vehicles) Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Finished Vehicle

- 5.1.2. Auto Component

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Transportation

- 5.2.2. Warehous

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Apex Group**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nippon Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UPS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GEODIS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yusen Logistics Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Ocean Shipping (Group) Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAIC Anji Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BLG Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sinotrans Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HYCX Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Apex Group**List Not Exhaustive

List of Figures

- Figure 1: China Automotive Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Automotive Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: China Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 3: China Automotive Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: China Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: China Automotive Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Logistics Market?

The projected CAGR is approximately 5.96%.

2. Which companies are prominent players in the China Automotive Logistics Market?

Key companies in the market include Apex Group**List Not Exhaustive, DHL, Nippon Express, UPS, GEODIS, Yusen Logistics Co Ltd, China Ocean Shipping (Group) Company, SAIC Anji Logistics, BLG Logistics, Sinotrans Co Ltd, HYCX Group.

3. What are the main segments of the China Automotive Logistics Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing New Energy Vehicles Sales.

6. What are the notable trends driving market growth?

Chinese Investment in NEVs (New Energy Vehicles) Driving the Market Growth.

7. Are there any restraints impacting market growth?

Trade War between China and the United States.

8. Can you provide examples of recent developments in the market?

May 2023: SAIC Anji (a wholly-owned subsidiary of China’s SAIC Motor specializing in the automotive logistics business) placed an order for four methanol-ready car carriers to reduce greenhouse gas (GHG) emissions. As informed, the 9,000 CEU vessels will be built by China Merchants Jinling Shipyard (CMJL Nanjing). They will measure 228 meters in length with a molded depth of 15.4 meters and a width of 37.8 meters. The car carriers will also be scrubber-fitted to reduce greenhouse gas (GHG) emissions additionally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Logistics Market?

To stay informed about further developments, trends, and reports in the China Automotive Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence