Key Insights

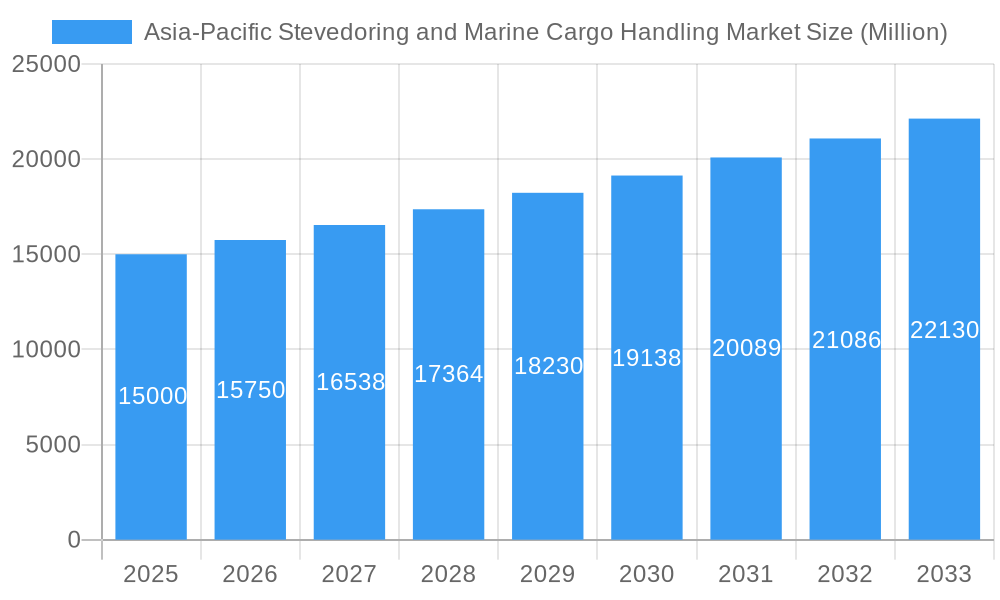

The Asia-Pacific stevedoring and marine cargo handling market is experiencing robust growth, driven by the region's expanding e-commerce sector, increasing global trade volumes, and the development of major port infrastructure. The market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on global trends and a CAGR of >5%), is projected to maintain a compound annual growth rate (CAGR) exceeding 5% through 2033. Key growth drivers include the continuous expansion of major ports in China, India, and other Southeast Asian nations, coupled with rising demand for efficient cargo handling solutions to meet the needs of a rapidly evolving global supply chain. The increasing adoption of automation and technological advancements, such as AI-powered systems and improved logistics management software, are further enhancing operational efficiency and contributing to market expansion. Segmentation reveals significant contributions from both containerized and bulk cargo handling, with containerized cargo potentially holding a larger market share due to the ongoing growth in global container shipping. Major players like PSA International, China Merchants Port Holdings, and APM Terminals are strategically investing in infrastructure upgrades and technological enhancements to maintain their competitive edge within this dynamic market.

Asia-Pacific Stevedoring and Marine Cargo Handling Market Market Size (In Billion)

The market's growth is however subject to certain restraints. Geopolitical uncertainties, fluctuating fuel prices, and potential disruptions to global supply chains due to unforeseen events can impact market performance. Furthermore, the intense competition amongst established players necessitates continuous innovation and strategic partnerships to ensure sustained growth. Despite these challenges, the long-term outlook remains positive, with significant opportunities for companies offering advanced technology, sustainable solutions, and specialized services in emerging markets within the Asia-Pacific region. The growth is further fueled by the increasing focus on improving port efficiency and reducing logistics costs, which drives demand for sophisticated stevedoring and cargo handling services. The market's diverse segments, including stevedoring, cargo handling and transportation, and other specialized services, provide multiple avenues for growth and investment.

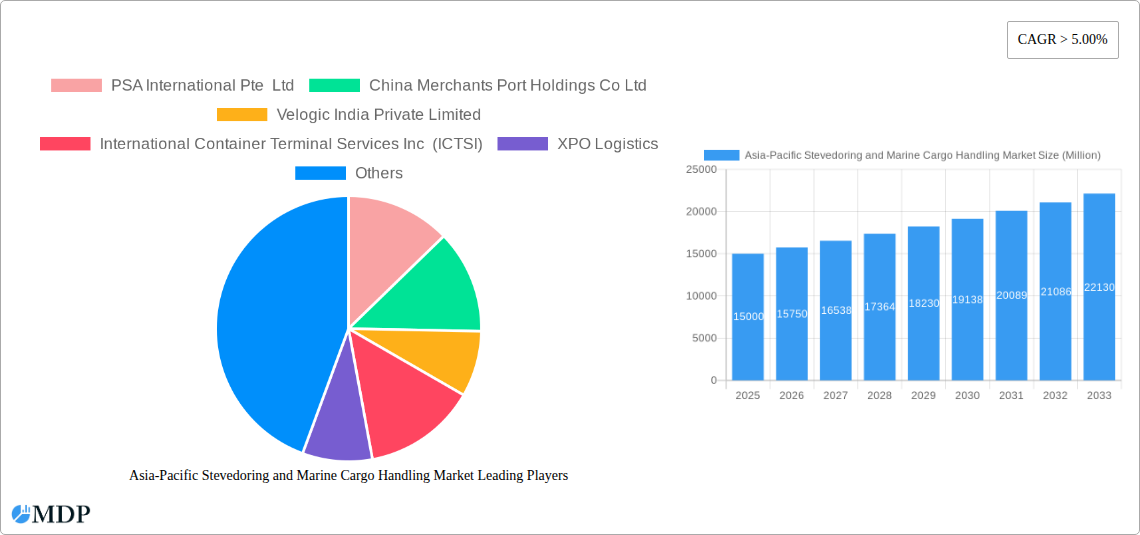

Asia-Pacific Stevedoring and Marine Cargo Handling Market Company Market Share

Asia-Pacific Stevedoring and Marine Cargo Handling Market Report: 2019-2033

Unlocking Growth Potential in a Dynamic Market: A Comprehensive Analysis of the Asia-Pacific Stevedoring and Marine Cargo Handling Sector

This comprehensive report provides an in-depth analysis of the Asia-Pacific stevedoring and marine cargo handling market, offering invaluable insights for stakeholders across the supply chain. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, emerging trends, and future growth prospects. The market is segmented by type (Stevedoring, Cargo Handling and Transportation, Others) and cargo type (Bulk Cargo, Containerized Cargo, Other Cargo). Key players such as PSA International Pte Ltd, China Merchants Port Holdings Co Ltd, and APM Terminals are analyzed, along with numerous other significant contributors. This report is your essential resource for navigating the complexities and opportunities of this crucial sector.

Asia-Pacific Stevedoring and Marine Cargo Handling Market Market Dynamics & Concentration

The Asia-Pacific stevedoring and marine cargo handling market is characterized by a complex interplay of factors influencing its growth and concentration. Market concentration is moderate, with a few major players holding significant market share but numerous smaller players contributing to the overall activity. PSA International Pte Ltd, China Merchants Port Holdings Co Ltd, and APM Terminals are among the leading players, but the market exhibits significant regional variations in terms of dominance.

Innovation Drivers: Technological advancements, such as automation, AI-powered optimization systems, and improved container handling equipment, are driving efficiency and capacity improvements. The adoption of these technologies is uneven across the region, with more developed economies leading the way.

Regulatory Frameworks: Varying regulatory environments across different Asia-Pacific countries impact operational costs and efficiency. Harmonization of regulations and simplification of customs procedures are key factors influencing market growth.

Product Substitutes: Limited direct substitutes exist for core stevedoring and cargo handling services. However, efficiency gains from technology indirectly serve as substitutes by reducing the need for excessive capacity.

End-User Trends: E-commerce growth significantly impacts the demand for efficient containerized cargo handling and last-mile delivery solutions. The increasing volume of cross-border e-commerce transactions fuels the need for seamless and integrated logistics across the Asia-Pacific region.

M&A Activities: The market has witnessed several significant mergers and acquisitions in recent years, with a notable increase in deal counts from xx in 2019 to xx in 2024. This signifies consolidation within the sector. For example, Maersk's acquisitions of LF Logistics and the intended acquisition of Pilot Freight Services illustrate the strategic moves of major players to expand their market presence and enhance service offerings.

Asia-Pacific Stevedoring and Marine Cargo Handling Market Industry Trends & Analysis

The Asia-Pacific stevedoring and marine cargo handling market is experiencing robust growth, driven by several key factors. The expanding global trade, particularly within the Asia-Pacific region itself, fuels the demand for efficient cargo handling. This is further amplified by the rise of e-commerce and the increasing complexity of supply chains. Technological advancements play a vital role, leading to improvements in efficiency, automation, and real-time tracking capabilities. The CAGR for the period 2025-2033 is estimated at xx%, showcasing considerable market expansion. Market penetration of automated systems is gradually increasing, with a projected xx% penetration rate by 2033.

Consumer preferences are shifting towards faster and more reliable delivery, putting pressure on the industry to adopt more agile and technology-driven solutions. Competitive dynamics are intense, with companies constantly striving to improve their efficiency, service offerings, and technological capabilities to maintain a competitive edge. This leads to continuous innovation and a push for greater operational efficiency across the industry.

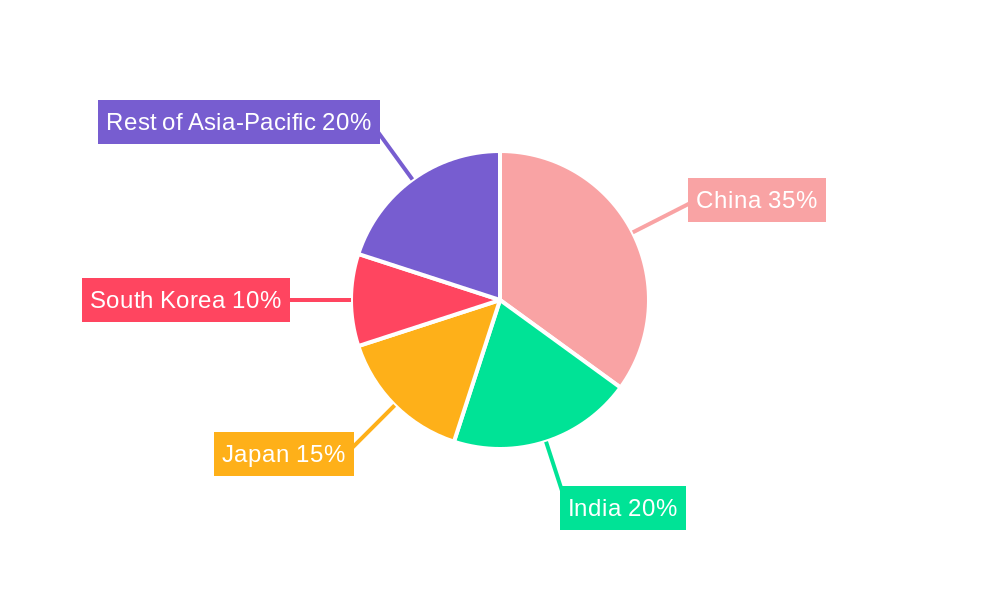

Leading Markets & Segments in Asia-Pacific Stevedoring and Marine Cargo Handling Market

Dominant Region/Country: China and other major economies like India, Singapore, Japan and South Korea are currently dominating the market due to their substantial port infrastructure and significant trade volumes.

Dominant Segment (By Type): Containerized cargo handling constitutes the largest segment, benefiting from the continuous rise in global containerized trade. Stevedoring services remain a crucial component, representing a significant share of the market.

Dominant Segment (By Cargo Type): Containerized cargo dominates the market due to the strong growth in global containerized trade. Bulk cargo remains a significant segment, driven by the continuous demand for raw materials and commodities in the region.

Key Drivers:

- Economic Growth: Strong economic growth in several Asia-Pacific countries fuels trade and consequently, demand for stevedoring and marine cargo handling services.

- Infrastructure Development: Ongoing investments in port infrastructure and transportation networks enhance the capacity and efficiency of cargo handling operations.

- Government Policies: Supportive government policies aimed at boosting trade and improving logistics infrastructure play a significant role in market growth.

- Technological Advancements: Increased adoption of automation and digitalization in ports improves efficiency and reduces costs.

Asia-Pacific Stevedoring and Marine Cargo Handling Market Product Developments

The Asia-Pacific stevedoring and marine cargo handling market is witnessing significant product innovations, driven by the need for increased efficiency and automation. New technologies like automated guided vehicles (AGVs), automated stacking cranes, and advanced software for cargo management are being implemented to optimize operations. The integration of IoT sensors and data analytics allows for real-time tracking and improved decision-making. This trend towards automation aims to enhance speed, reduce human error, and improve overall throughput. The market fit of these new technologies is excellent, addressing the industry's need for greater efficiency and capacity in the face of growing demand.

Key Drivers of Asia-Pacific Stevedoring and Marine Cargo Handling Market Growth

The growth of the Asia-Pacific stevedoring and marine cargo handling market is propelled by several key factors. Firstly, the increasing volume of global trade, particularly within the Asia-Pacific region, fuels the need for efficient cargo handling services. Secondly, technological advancements such as automation and AI-driven optimization systems are improving efficiency and throughput. Finally, supportive government policies and investments in port infrastructure further enhance the capacity and competitiveness of the market. The rise of e-commerce significantly boosts demand for efficient last-mile delivery solutions, further driving market growth.

Challenges in the Asia-Pacific Stevedoring and Marine Cargo Handling Market Market

The Asia-Pacific stevedoring and marine cargo handling market faces several challenges. Inconsistent regulatory frameworks across different countries can lead to operational complexities and increased costs. Supply chain disruptions, including port congestion and labor shortages, can significantly impact operations and lead to delays. Furthermore, intense competition among numerous players necessitates continuous investment in technology and efficiency improvements to maintain a competitive edge. These challenges collectively impact the overall cost-effectiveness and timely delivery of services.

Emerging Opportunities in Asia-Pacific Stevedoring and Marine Cargo Handling Market

The Asia-Pacific stevedoring and marine cargo handling market presents numerous growth opportunities. Continued technological advancements in automation, AI, and data analytics will drive efficiency gains and reduce operational costs. Strategic partnerships between logistics providers, technology firms, and port operators can create innovative solutions and expand market reach. The expansion of e-commerce and the increasing demand for last-mile delivery solutions offer significant opportunities for specialized services and niche market players. Finally, government investments in port modernization and improved infrastructure create a favorable environment for market expansion.

Leading Players in the Asia-Pacific Stevedoring and Marine Cargo Handling Market Sector

- PSA International Pte Ltd

- China Merchants Port Holdings Co Ltd

- Velogic India Private Limited

- International Container Terminal Services Inc (ICTSI)

- XPO Logistics

- EUROKAI GmbH & Co KGaA

- Pacific Cargo Services

- APM Terminals

- Hutchison Port Holdings Trust

- Orissa Stevedores Limited

- A P Moller-Maersk

Key Milestones in Asia-Pacific Stevedoring and Marine Cargo Handling Market Industry

- September 2022: MAERSK completed its acquisition of LF Logistics, expanding its warehousing capabilities and strengthening its presence in Asia-Pacific e-commerce.

- February 2022: A.P. Moller - Maersk announced its intended acquisition of Pilot Freight Services, enhancing its North American last-mile delivery capabilities.

Strategic Outlook for Asia-Pacific Stevedoring and Marine Cargo Handling Market Market

The Asia-Pacific stevedoring and marine cargo handling market exhibits strong long-term growth potential. Continuous technological innovation, coupled with expanding global trade and supportive government policies, will drive market expansion. Strategic partnerships and investments in infrastructure modernization will further enhance the sector's capacity and efficiency. Companies that proactively embrace technological advancements and adapt to evolving consumer demands are well-positioned to capture significant market share and benefit from the substantial growth opportunities within this dynamic sector. The market is poised for considerable expansion, offering attractive prospects for both established players and emerging companies.

Asia-Pacific Stevedoring and Marine Cargo Handling Market Segmentation

-

1. Type

- 1.1. Stevedoring

- 1.2. Cargo Handling and Transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Bulk Cargo

- 2.2. Containerized Cargo

- 2.3. Other Cargo

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Singapore

- 3.6. Rest of Asia-Pacific

Asia-Pacific Stevedoring and Marine Cargo Handling Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Singapore

- 6. Rest of Asia Pacific

Asia-Pacific Stevedoring and Marine Cargo Handling Market Regional Market Share

Geographic Coverage of Asia-Pacific Stevedoring and Marine Cargo Handling Market

Asia-Pacific Stevedoring and Marine Cargo Handling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Rising Container Handling Services are driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stevedoring

- 5.1.2. Cargo Handling and Transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Bulk Cargo

- 5.2.2. Containerized Cargo

- 5.2.3. Other Cargo

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Singapore

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Singapore

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Stevedoring

- 6.1.2. Cargo Handling and Transportation

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Cargo Type

- 6.2.1. Bulk Cargo

- 6.2.2. Containerized Cargo

- 6.2.3. Other Cargo

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Singapore

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Stevedoring

- 7.1.2. Cargo Handling and Transportation

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Cargo Type

- 7.2.1. Bulk Cargo

- 7.2.2. Containerized Cargo

- 7.2.3. Other Cargo

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Singapore

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Stevedoring

- 8.1.2. Cargo Handling and Transportation

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Cargo Type

- 8.2.1. Bulk Cargo

- 8.2.2. Containerized Cargo

- 8.2.3. Other Cargo

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Singapore

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Stevedoring

- 9.1.2. Cargo Handling and Transportation

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Cargo Type

- 9.2.1. Bulk Cargo

- 9.2.2. Containerized Cargo

- 9.2.3. Other Cargo

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Singapore

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Singapore Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Stevedoring

- 10.1.2. Cargo Handling and Transportation

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Cargo Type

- 10.2.1. Bulk Cargo

- 10.2.2. Containerized Cargo

- 10.2.3. Other Cargo

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Singapore

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia-Pacific Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Stevedoring

- 11.1.2. Cargo Handling and Transportation

- 11.1.3. Others

- 11.2. Market Analysis, Insights and Forecast - by Cargo Type

- 11.2.1. Bulk Cargo

- 11.2.2. Containerized Cargo

- 11.2.3. Other Cargo

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. Australia

- 11.3.5. Singapore

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 PSA International Pte Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 China Merchants Port Holdings Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Velogic India Private Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 International Container Terminal Services Inc (ICTSI)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 XPO Logistics

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 EUROKAI GmbH & Co KGaA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Pacific Cargo Services**List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 APM Terminals

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hutchison Port Holdings Trust

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Orissa Stevedores Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 A P Moller-Maersk

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 PSA International Pte Ltd

List of Figures

- Figure 1: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Stevedoring and Marine Cargo Handling Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 3: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 7: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 11: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 15: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 19: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 23: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 27: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Stevedoring and Marine Cargo Handling Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Asia-Pacific Stevedoring and Marine Cargo Handling Market?

Key companies in the market include PSA International Pte Ltd, China Merchants Port Holdings Co Ltd, Velogic India Private Limited, International Container Terminal Services Inc (ICTSI), XPO Logistics, EUROKAI GmbH & Co KGaA, Pacific Cargo Services**List Not Exhaustive, APM Terminals, Hutchison Port Holdings Trust, Orissa Stevedores Limited, A P Moller-Maersk.

3. What are the main segments of the Asia-Pacific Stevedoring and Marine Cargo Handling Market?

The market segments include Type, Cargo Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Rising Container Handling Services are driving the market.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

September 2022: MAERSK has completed its acquisition of LF Logistics, a contract logistics company with capabilities across e-commerce and inland transport in the Asia Pacific region. Having acquired the Hong Kong-based company, Maersk will add 223 warehouses to its existing portfolio, bringing the total number of warehouse facilities to 549 globally, spread across a total of 9.5 million square kilometres. With the addition of LF Logistics, Maersk gains unique and best in class capabilities to servicing the important and fast-growing consumer markets in Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Stevedoring and Marine Cargo Handling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Stevedoring and Marine Cargo Handling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Stevedoring and Marine Cargo Handling Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Stevedoring and Marine Cargo Handling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence