Key Insights

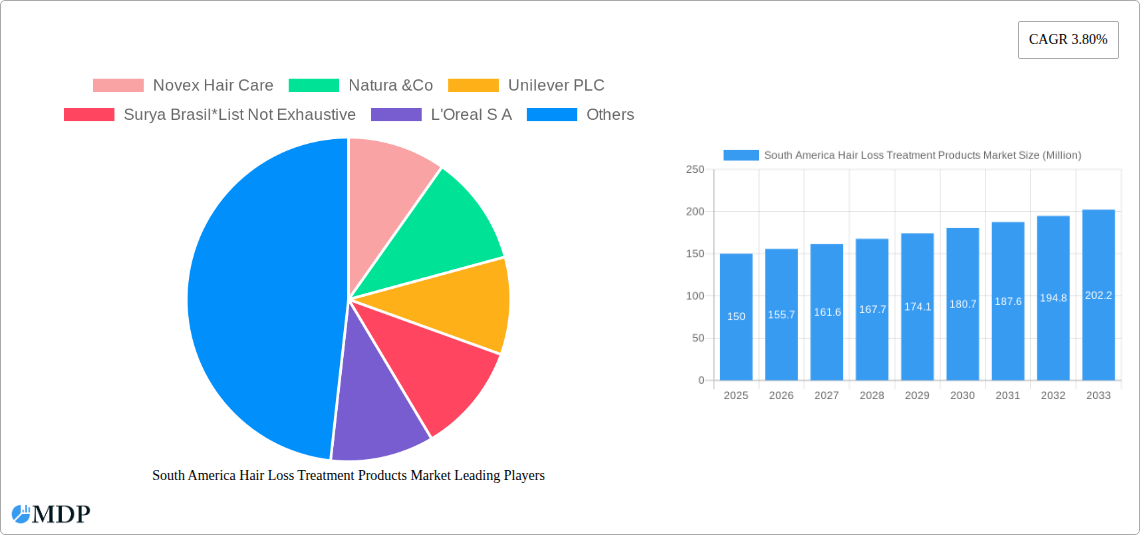

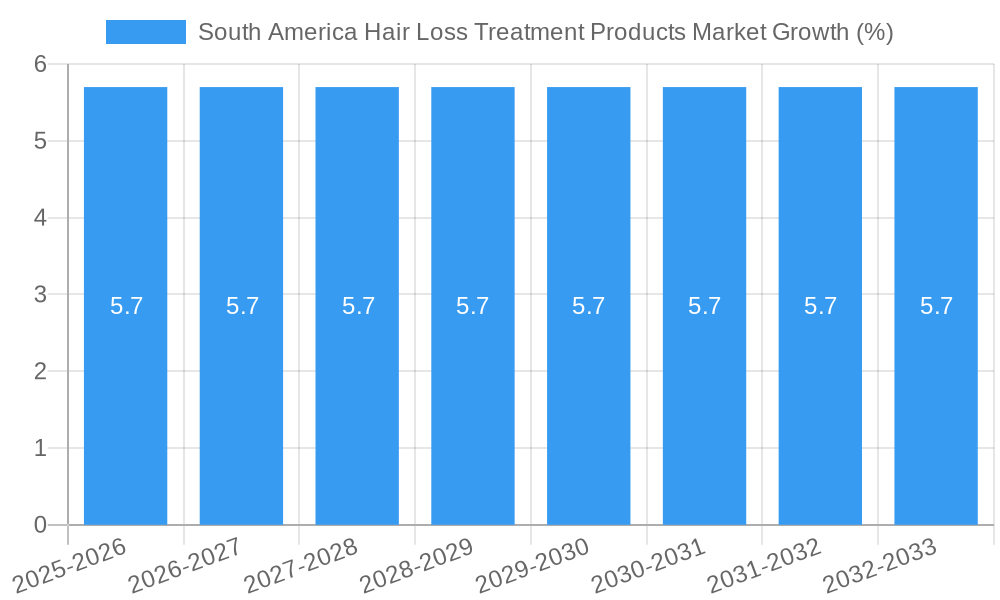

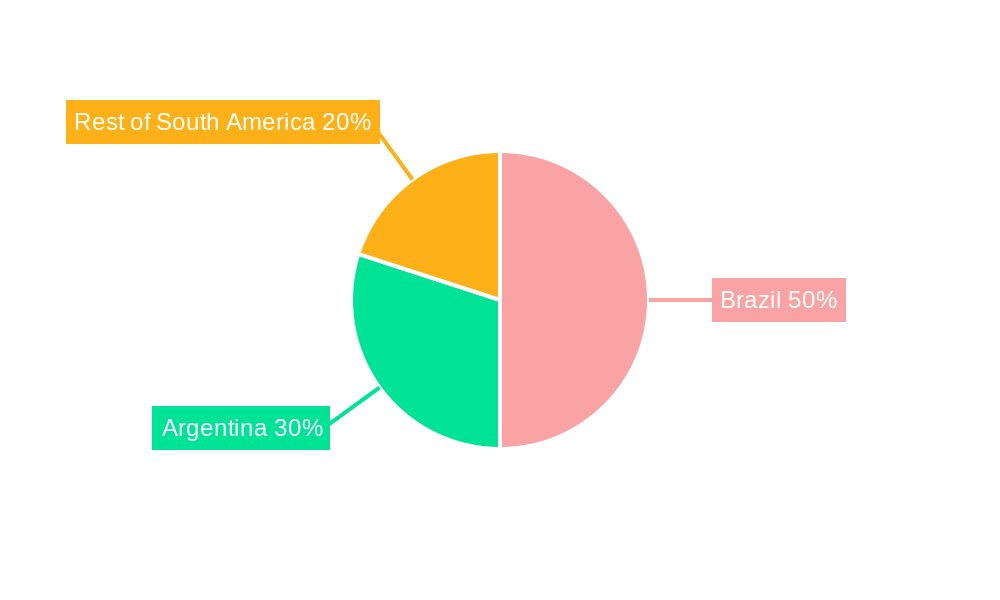

The South American hair loss treatment products market, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.80% from 2025 to 2033. This growth is fueled by several key factors. Rising awareness of hair loss solutions, increasing disposable incomes particularly in urban areas, and a growing preference for natural and organic hair care products are driving market expansion. The market segmentation reveals strong demand across various product types, with shampoos, conditioners, and serums/oils holding significant market share. Distribution channels are diversifying, with online stores experiencing rapid growth alongside traditional outlets like supermarkets, pharmacies, and specialist retailers. Brazil and Argentina represent the largest markets within South America, driven by factors such as higher population density and greater consumer awareness. However, challenges remain, including the relatively high cost of advanced treatments and a lack of widespread access in remote areas. Competitive landscape analysis highlights the presence of major international players like Unilever, L'Oreal, and Procter & Gamble, alongside regional brands like Novex Hair Care and Natura & Co., signifying a dynamic market with both established and emerging players vying for market share. The market is expected to see increasing innovation in product formulations, incorporating advanced technologies and natural ingredients to cater to the evolving consumer preferences.

The forecast period from 2025 to 2033 is expected to witness a continuous rise in the adoption of hair loss treatment products across various segments. The increasing availability of effective and affordable treatment options will further contribute to market expansion. Marketing campaigns focused on consumer education regarding hair loss and its treatment are also expected to propel market growth. While the market faces challenges related to affordability and access, the overall positive growth trajectory is largely driven by the confluence of rising consumer awareness, product innovation, and expanding distribution channels. The competitive landscape is expected to remain intense, with existing players investing in research and development and expanding their product portfolios to maintain and gain market share. Further analysis focusing on specific product categories and regional variations will provide a more granular understanding of market dynamics within South America.

South America Hair Loss Treatment Products Market: 2019-2033 Report

Unlocking Growth Opportunities in a Thriving Market: This comprehensive report provides an in-depth analysis of the South America Hair Loss Treatment Products Market, offering invaluable insights for stakeholders seeking to capitalize on its dynamic landscape. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period. Key segments analyzed include product type (shampoo, conditioner, serum & oil, others) and distribution channels (supermarkets/hypermarkets, convenience stores, pharmacies, specialist retailers, online stores, others). Leading players like Novex Hair Care, Natura &Co, Unilever PLC, Surya Brasil, L'Oreal S.A, The Procter & Gamble Company, and Johnson & Johnson are profiled, providing a complete picture of the competitive arena.

South America Hair Loss Treatment Products Market Dynamics & Concentration

The South America hair loss treatment products market is characterized by moderate concentration, with a few major players holding significant market share. The market share of the top five companies in 2024 is estimated at xx%, indicating opportunities for both established players and emerging brands. Innovation is a key driver, with companies continually developing new formulations and technologies to address diverse hair types and concerns. Regulatory frameworks vary across South American countries, impacting product approvals and marketing claims. The market sees competition from traditional remedies and home-based treatments, highlighting the need for effective product differentiation. Mergers and acquisitions (M&A) activity has been relatively low in recent years, with approximately xx deals recorded between 2019 and 2024, suggesting potential for future consolidation. End-user trends lean toward natural and organic products, driving demand for ethically sourced and sustainable solutions.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Innovation Drivers: Development of natural, organic, and technologically advanced products.

- Regulatory Framework: Varying regulations across South American countries.

- Product Substitutes: Traditional remedies and home-based treatments.

- M&A Activity: Approximately xx deals between 2019 and 2024.

South America Hair Loss Treatment Products Market Industry Trends & Analysis

The South America hair loss treatment products market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing awareness of hair loss issues, rising disposable incomes in several key markets, and the growing popularity of preventative hair care routines. Technological advancements, such as the introduction of innovative active ingredients and advanced delivery systems, further enhance market expansion. Consumer preferences are shifting toward natural and organic products, alongside a growing demand for specialized solutions catering to specific hair types and conditions. The competitive landscape is dynamic, with both established multinational corporations and smaller niche players vying for market share. Market penetration of premium hair loss treatment products remains relatively low, presenting significant untapped potential for expansion.

Leading Markets & Segments in South America Hair Loss Treatment Products Market

Brazil represents the largest market within South America for hair loss treatment products, driven by high consumer spending and a large population. Other key markets include Argentina, Colombia, and Mexico. Within product types, shampoos and conditioners constitute the largest segments due to their widespread accessibility and affordability. The serum and oil segment is experiencing the fastest growth, reflecting the increasing demand for specialized and high-efficacy treatments. Online sales channels are also growing rapidly, outpacing traditional retail formats.

- Brazil: Largest market due to high consumer spending and population size.

- Argentina, Colombia, and Mexico: Significant contributing markets.

- Shampoo and Conditioner: Largest product segments.

- Serum and Oil: Fastest-growing segment.

- Online Stores: Fastest-growing distribution channel.

Brazil's dominance is attributable to several factors: a large and growing middle class with increasing disposable income, robust retail infrastructure, and a strong awareness of hair care among consumers. The country’s high population density also creates economies of scale beneficial for producers.

South America Hair Loss Treatment Products Market Product Developments

Recent product innovations focus on incorporating natural and organic ingredients, such as plant extracts and essential oils, addressing consumer demand for healthier and more sustainable solutions. Technological advancements in delivery systems, including micellar technology and liposomes, enhance product efficacy and absorption. Companies are increasingly focusing on personalized solutions, developing targeted products to address specific hair types and concerns. This trend towards personalization and natural ingredients contributes significantly to the market's competitive advantage.

Key Drivers of South America Hair Loss Treatment Products Market Growth

Several factors contribute to the market's growth trajectory. Rising disposable incomes, particularly in urban areas, fuel higher spending on personal care products. Increasing awareness of hair loss problems, driven by media coverage and influencer marketing, encourages proactive hair care practices. Technological advancements in formulations and delivery systems lead to more effective and appealing products. Finally, the expanding e-commerce sector provides greater product accessibility and reaches a wider consumer base.

Challenges in the South America Hair Loss Treatment Products Market

The market faces certain challenges. Regulatory hurdles and varying standards across South American countries complicate product launches and marketing. Supply chain disruptions and fluctuations in raw material costs can impact product pricing and availability. Intense competition among established and emerging players requires ongoing innovation and effective marketing strategies to maintain market share. Counterfeit products also pose a threat, potentially affecting consumer trust and brand reputation. These factors can collectively impact market growth by an estimated xx% annually.

Emerging Opportunities in South America Hair Loss Treatment Products Market

Significant long-term growth opportunities exist in the market. Expanding into new markets within South America offers considerable potential. Strategic partnerships with local distributors and retailers can enhance market penetration. Technological breakthroughs in hair loss treatment offer the chance to develop innovative and high-value products. Focusing on personalization and customization strategies enables targeting specific niche customer segments effectively. The growing adoption of telehealth and remote consultations presents opportunities for direct-to-consumer sales and personalized recommendations.

Leading Players in the South America Hair Loss Treatment Products Market Sector

- Novex Hair Care

- Natura &Co

- Unilever PLC

- Surya Brasil

- L'Oreal S.A

- The Procter & Gamble Company

- Johnson & Johnson

Key Milestones in South America Hair Loss Treatment Products Market Industry

- 2020: Launch of a new line of organic hair loss treatment products by Natura &Co.

- 2021: Unilever PLC acquires a smaller, specialized hair care company in Brazil.

- 2022: Increased regulatory scrutiny leads to stricter guidelines for marketing claims on hair loss products.

- 2023: A major e-commerce platform in Brazil launches a dedicated section for hair loss treatment products.

- 2024: Introduction of several new products incorporating advanced technologies such as stem cell therapy.

Strategic Outlook for South America Hair Loss Treatment Products Market

The South America hair loss treatment products market is poised for sustained growth, driven by rising consumer awareness, evolving preferences, and technological innovations. Future market potential is substantial, especially in untapped segments and regions. Strategic opportunities include focusing on premium, personalized, and natural product offerings, alongside targeted marketing and distribution strategies to capitalize on the increasing e-commerce penetration. Expanding partnerships with research institutions and dermatologists can strengthen product credibility and drive market leadership.

South America Hair Loss Treatment Products Market Segmentation

-

1. Product Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Serum and Oil

- 1.4. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Pharmacies and Drug Stores

- 2.4. Specialist Retailers

- 2.5. Online Stores

- 2.6. Others

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of South America

-

3.1. South America

South America Hair Loss Treatment Products Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America Hair Loss Treatment Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness

- 3.3. Market Restrains

- 3.3.1. High Risk and Safety Concerns; Fluctuating Weather Patterns

- 3.4. Market Trends

- 3.4.1. Increase in Hair-Fall Related Problems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Hair Loss Treatment Products Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Serum and Oil

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacies and Drug Stores

- 5.2.4. Specialist Retailers

- 5.2.5. Online Stores

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Hair Loss Treatment Products Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Hair Loss Treatment Products Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Hair Loss Treatment Products Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Novex Hair Care

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Natura &Co

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Unilever PLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Surya Brasil*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 L'Oreal S A

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 The Procter & Gamble Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Johnson & Johnson

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Novex Hair Care

List of Figures

- Figure 1: South America Hair Loss Treatment Products Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Hair Loss Treatment Products Market Share (%) by Company 2024

List of Tables

- Table 1: South America Hair Loss Treatment Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Hair Loss Treatment Products Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: South America Hair Loss Treatment Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: South America Hair Loss Treatment Products Market Volume K Units Forecast, by Product Type 2019 & 2032

- Table 5: South America Hair Loss Treatment Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: South America Hair Loss Treatment Products Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 7: South America Hair Loss Treatment Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: South America Hair Loss Treatment Products Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 9: South America Hair Loss Treatment Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: South America Hair Loss Treatment Products Market Volume K Units Forecast, by Region 2019 & 2032

- Table 11: South America Hair Loss Treatment Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South America Hair Loss Treatment Products Market Volume K Units Forecast, by Country 2019 & 2032

- Table 13: Brazil South America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Brazil South America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Argentina South America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina South America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America South America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America South America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: South America Hair Loss Treatment Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: South America Hair Loss Treatment Products Market Volume K Units Forecast, by Product Type 2019 & 2032

- Table 21: South America Hair Loss Treatment Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: South America Hair Loss Treatment Products Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 23: South America Hair Loss Treatment Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: South America Hair Loss Treatment Products Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 25: South America Hair Loss Treatment Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South America Hair Loss Treatment Products Market Volume K Units Forecast, by Country 2019 & 2032

- Table 27: Brazil South America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Brazil South America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 29: Argentina South America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina South America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America South America Hair Loss Treatment Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America South America Hair Loss Treatment Products Market Volume (K Units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Hair Loss Treatment Products Market?

The projected CAGR is approximately 3.80%.

2. Which companies are prominent players in the South America Hair Loss Treatment Products Market?

Key companies in the market include Novex Hair Care, Natura &Co, Unilever PLC, Surya Brasil*List Not Exhaustive, L'Oreal S A, The Procter & Gamble Company, Johnson & Johnson.

3. What are the main segments of the South America Hair Loss Treatment Products Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness.

6. What are the notable trends driving market growth?

Increase in Hair-Fall Related Problems.

7. Are there any restraints impacting market growth?

High Risk and Safety Concerns; Fluctuating Weather Patterns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Hair Loss Treatment Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Hair Loss Treatment Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Hair Loss Treatment Products Market?

To stay informed about further developments, trends, and reports in the South America Hair Loss Treatment Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence