Key Insights

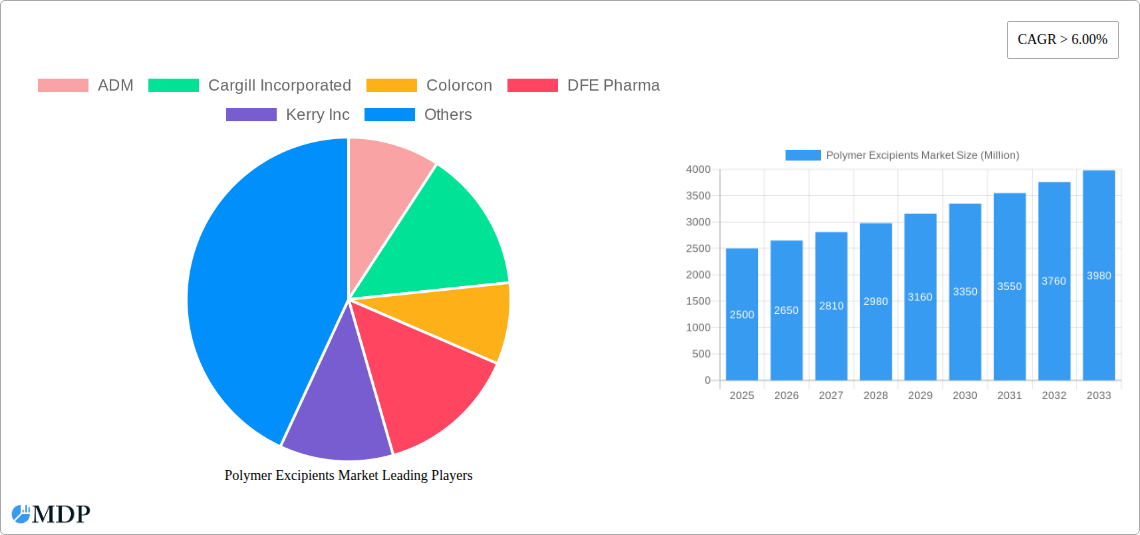

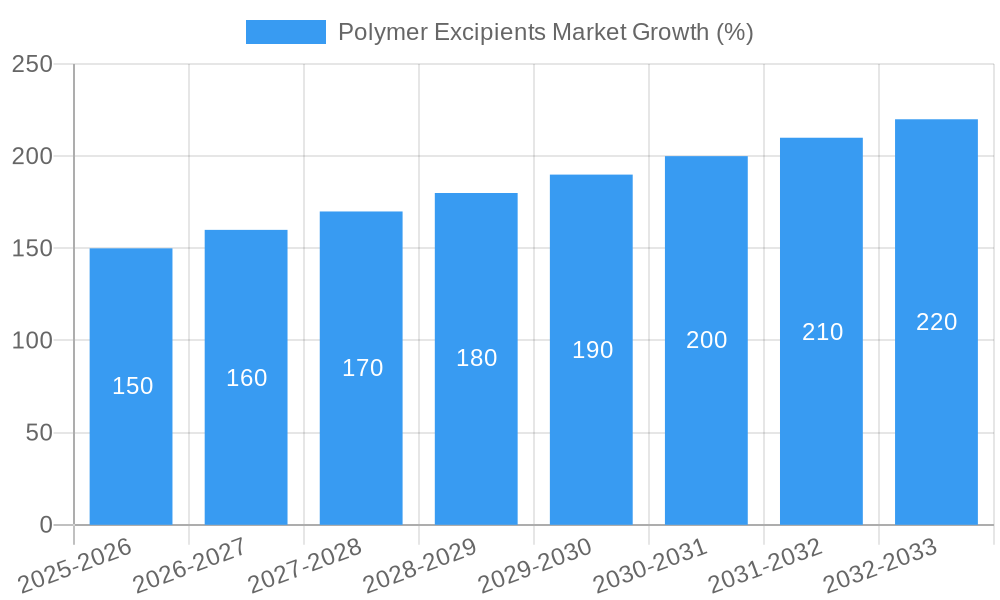

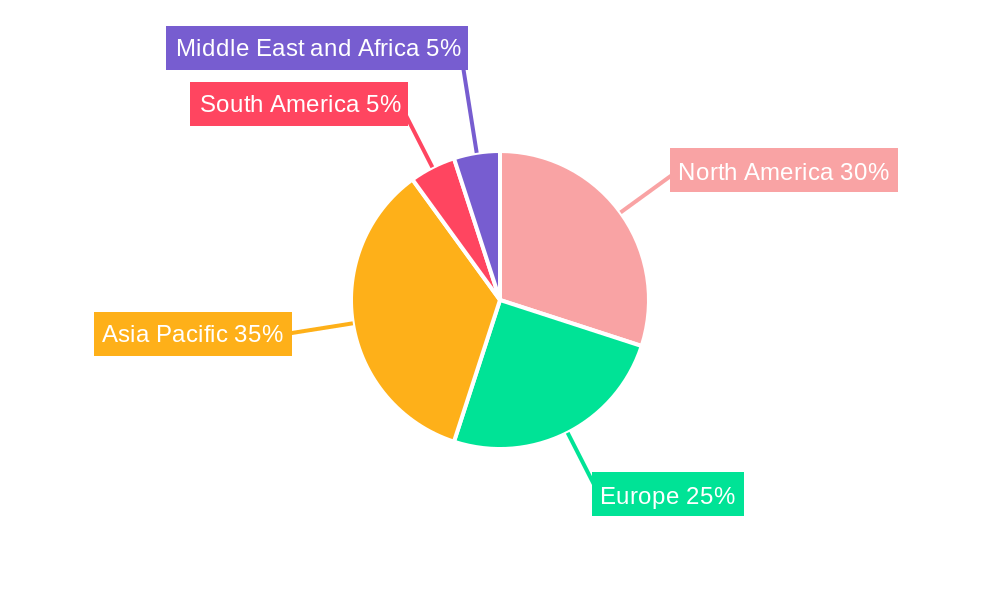

The global polymer excipients market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6.00% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for pharmaceutical and nutraceutical products globally drives the need for high-quality, safe, and effective excipients. Advancements in drug delivery systems, particularly in targeted drug delivery and controlled-release formulations, are creating new applications for polymer excipients. Furthermore, the growing preference for convenient dosage forms like tablets and capsules, which heavily rely on polymer excipients for binding, stability, and other functionalities, contributes significantly to market growth. Stringent regulatory requirements for excipient quality and safety are also shaping market trends, incentivizing manufacturers to invest in research and development and adopt advanced manufacturing techniques. The market is segmented by product type (Polyvinylpyrrolidone, Polyethylene Glycol, Starch, Micro Crystalline Cellulose (MCC), Ethyl and Methyl Cellulose, Hydroxypropyl Methylcellulose (HPMC), and Others) and application (Binders, Viscosity Modifiers, Coatings, Flavors, Preservatives, Colorants, Sweeteners, and Others). The Asia-Pacific region, particularly China and India, is expected to dominate the market due to rapid growth in the pharmaceutical and healthcare sectors in these countries.

Competition in the polymer excipients market is intense, with numerous major players, including ADM, Cargill Incorporated, Colorcon, DFE Pharma, and others, vying for market share. These companies are focusing on innovation, strategic partnerships, and acquisitions to strengthen their market positions. The industry is also witnessing a trend towards the development of bio-based and sustainable polymer excipients to address growing environmental concerns. Despite the promising growth outlook, potential challenges include fluctuations in raw material prices, stringent regulatory approvals, and the need for continuous innovation to meet evolving industry needs. Successful players will need to adapt to these challenges by investing in R&D, optimizing supply chains, and establishing strong relationships with pharmaceutical and nutraceutical companies. The forecast period of 2025-2033 suggests a sustained period of growth, driven by these underlying trends and market dynamics.

Polymer Excipients Market Report: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Polymer Excipients Market, offering actionable insights for stakeholders across the pharmaceutical and food industries. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by product type (Polyvinylpyrrolidone, Polyethylene Glycol, Starch, Micro Crystalline Cellulose (MCC), Ethyl and Methyl Cellulose, Hydroxypropyl Methylcellulose (HPMC), Others) and application (Binders, Viscosity Modifiers, Coatings, Flavors, Preservatives, Colorants, Sweeteners, Others). The report values the market at xx Million in 2025 and projects a CAGR of xx% during the forecast period. Key players analyzed include ADM, Cargill Incorporated, Colorcon, DFE Pharma, Kerry Inc, Evonik Industries AG, Croda International Plc, Ashland, BASF SE, Roquette Frères, DuPont, Dow, Eastman Chemical Company, ABITEC, The Lubrizol Corporation, JRS PHARMA, and FINAR LIMITED.

Polymer Excipients Market Market Dynamics & Concentration

The Polymer Excipients market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Market concentration is influenced by factors including economies of scale in production, strong R&D capabilities, and established distribution networks. Innovation drives market growth, with companies continuously developing new polymer excipients with enhanced functionalities and improved performance characteristics. Stringent regulatory frameworks governing the use of excipients in pharmaceuticals and food products significantly impact market dynamics. The availability of substitutes, such as natural-based excipients, poses a challenge to market growth, though synthetic polymers often maintain advantages in consistency and scalability. End-user trends, particularly the increasing demand for specialized formulations in pharmaceuticals and functional foods, drive market expansion. Mergers and acquisitions (M&A) activity has been moderate, with a few notable deals in recent years contributing to market consolidation. For instance, xx M&A deals were recorded between 2020 and 2024, resulting in a xx% increase in market share for the top 5 players.

Polymer Excipients Market Industry Trends & Analysis

The Polymer Excipients market is experiencing robust growth fueled by several key factors. Increasing demand for pharmaceutical and nutraceutical products globally, coupled with a growing preference for convenient and customized formulations, are major growth drivers. Technological advancements in polymer synthesis and characterization methods are leading to the development of novel excipients with improved properties such as enhanced solubility, controlled release, and targeted drug delivery. Consumer preferences are shifting towards natural and organic ingredients; however, synthetic polymers continue to dominate due to their consistency and performance advantages. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of new entrants offering specialized products or innovative technologies. The market exhibits a significant regional disparity, with North America and Europe accounting for a large share, driven by advanced healthcare infrastructure and stringent regulatory frameworks. The market is expected to grow at a CAGR of xx% from 2025 to 2033, achieving a market penetration rate of xx% by 2033 in the key regions.

Leading Markets & Segments in Polymer Excipients Market

The North American region currently dominates the Polymer Excipients market, driven by factors including a strong pharmaceutical industry, high disposable incomes, and a favorable regulatory environment. Within product types, Hydroxypropyl Methylcellulose (HPMC) and Polyethylene Glycol (PEG) hold the largest market shares due to their versatility and wide range of applications. In terms of applications, binders and viscosity modifiers constitute the largest segments, reflecting their crucial role in various pharmaceutical and food formulations.

Key Drivers in North America:

- Robust pharmaceutical and food industries.

- High R&D investment.

- Favorable regulatory environment.

- High disposable incomes.

Key Drivers in Europe:

- Stringent regulatory frameworks promoting product quality.

- Strong focus on research and development in the pharmaceutical industry.

- High consumer awareness regarding health and wellness.

Dominance Analysis: North America's dominance stems from the large pharmaceutical and biotechnology sectors, coupled with significant investments in R&D. The high adoption of advanced technologies and stringent regulatory standards further contribute to the region's leading position. Europe follows closely, driven by similar factors, while the Asia-Pacific region is expected to witness substantial growth in the coming years due to increasing healthcare spending and a growing middle class.

Polymer Excipients Market Product Developments

Recent innovations in polymer excipients focus on improving functionalities like controlled release, targeted drug delivery, enhanced solubility, and biodegradability. Companies are developing novel polymers with tailored properties to address specific formulation challenges and meet evolving regulatory requirements. For example, the development of biocompatible and biodegradable polymers caters to the growing demand for environmentally friendly products. These advancements enhance the efficiency and effectiveness of pharmaceutical and food products, leading to a competitive advantage in the market.

Key Drivers of Polymer Excipients Market Growth

Several factors are driving the growth of the Polymer Excipients market. Technological advancements, particularly in polymer synthesis and characterization, are enabling the creation of excipients with superior properties. Economic growth, especially in emerging economies, is increasing healthcare spending and boosting demand for pharmaceuticals and functional foods. Furthermore, favorable regulatory frameworks in many countries are promoting the development and adoption of safe and effective excipients. For example, the growing demand for personalized medicine necessitates the development of excipients that can enable targeted drug delivery and enhanced bioavailability.

Challenges in the Polymer Excipients Market Market

The Polymer Excipients market faces several challenges. Stringent regulatory approvals and compliance requirements increase development costs and timelines. Supply chain disruptions, particularly those related to raw materials, can impact production and pricing. Intense competition among established players and the emergence of new entrants also pose challenges. The impact of these factors on profitability is estimated to be xx% reduction in profit margin for the top 10 players in 2024.

Emerging Opportunities in Polymer Excipients Market

The Polymer Excipients market presents significant long-term growth opportunities. Technological breakthroughs, such as the development of novel biocompatible polymers and advanced drug delivery systems, are creating new avenues for innovation. Strategic partnerships between polymer manufacturers and pharmaceutical/food companies are driving the development of customized excipients. Expanding into emerging markets with significant unmet needs offers substantial growth potential.

Leading Players in the Polymer Excipients Market Sector

- ADM

- Cargill Incorporated

- Colorcon

- DFE Pharma

- Kerry Inc

- Evonik Industries AG

- Croda International Plc

- Ashland

- BASF SE

- Roquette Frères

- DuPont

- Dow

- Eastman Chemical Company

- ABITEC

- The Lubrizol Corporation

- JRS PHARMA

- FINAR LIMITED

Key Milestones in Polymer Excipients Market Industry

- 2021-Q3: Launch of a novel biodegradable polymer by Croda International Plc.

- 2022-Q1: Acquisition of a smaller excipient manufacturer by BASF SE.

- 2023-Q2: Approval of a new polymer excipient by the FDA for use in oral solid dosage forms.

- 2024-Q4: Strategic partnership between ADM and a major pharmaceutical company for the development of customized excipients.

Strategic Outlook for Polymer Excipients Market Market

The Polymer Excipients market is poised for significant growth in the coming years. Continued technological advancements, coupled with increasing demand from the pharmaceutical and food industries, will drive market expansion. Strategic partnerships, mergers and acquisitions, and expansion into new markets will play a crucial role in shaping the future of the industry. Companies that invest in R&D, focus on product innovation, and adopt efficient manufacturing processes will be well-positioned to capitalize on the growth opportunities.

Polymer Excipients Market Segmentation

-

1. Product Type

- 1.1. Polyvinylpyrrolidone

- 1.2. Polyethylene Glycol

- 1.3. Starch

- 1.4. Micro Crystalline Cellulose (MCC)

- 1.5. Ethyl and Methyl Cellulose

- 1.6. Hydroxypropyl Methylcellulose (HPMC)

- 1.7. Others

-

2. Application

- 2.1. Binders

- 2.2. Viscosity Modifiers

- 2.3. Coatings

- 2.4. Flavors

- 2.5. Preservatives

- 2.6. Colorants

- 2.7. Sweeteners

- 2.8. Others

Polymer Excipients Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Polymer Excipients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Pharmaceutical Industry; Rising Demand for Polymer Excipients from Coatings Application

- 3.3. Market Restrains

- 3.3.1. ; Stringent Rules by Regulatory Bodies; Concerns to Meet the Required Quality of Product

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Polyvinylpyrrolidone (Povidone)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polymer Excipients Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Polyvinylpyrrolidone

- 5.1.2. Polyethylene Glycol

- 5.1.3. Starch

- 5.1.4. Micro Crystalline Cellulose (MCC)

- 5.1.5. Ethyl and Methyl Cellulose

- 5.1.6. Hydroxypropyl Methylcellulose (HPMC)

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Binders

- 5.2.2. Viscosity Modifiers

- 5.2.3. Coatings

- 5.2.4. Flavors

- 5.2.5. Preservatives

- 5.2.6. Colorants

- 5.2.7. Sweeteners

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Polymer Excipients Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Polyvinylpyrrolidone

- 6.1.2. Polyethylene Glycol

- 6.1.3. Starch

- 6.1.4. Micro Crystalline Cellulose (MCC)

- 6.1.5. Ethyl and Methyl Cellulose

- 6.1.6. Hydroxypropyl Methylcellulose (HPMC)

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Binders

- 6.2.2. Viscosity Modifiers

- 6.2.3. Coatings

- 6.2.4. Flavors

- 6.2.5. Preservatives

- 6.2.6. Colorants

- 6.2.7. Sweeteners

- 6.2.8. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Polymer Excipients Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Polyvinylpyrrolidone

- 7.1.2. Polyethylene Glycol

- 7.1.3. Starch

- 7.1.4. Micro Crystalline Cellulose (MCC)

- 7.1.5. Ethyl and Methyl Cellulose

- 7.1.6. Hydroxypropyl Methylcellulose (HPMC)

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Binders

- 7.2.2. Viscosity Modifiers

- 7.2.3. Coatings

- 7.2.4. Flavors

- 7.2.5. Preservatives

- 7.2.6. Colorants

- 7.2.7. Sweeteners

- 7.2.8. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Polymer Excipients Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Polyvinylpyrrolidone

- 8.1.2. Polyethylene Glycol

- 8.1.3. Starch

- 8.1.4. Micro Crystalline Cellulose (MCC)

- 8.1.5. Ethyl and Methyl Cellulose

- 8.1.6. Hydroxypropyl Methylcellulose (HPMC)

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Binders

- 8.2.2. Viscosity Modifiers

- 8.2.3. Coatings

- 8.2.4. Flavors

- 8.2.5. Preservatives

- 8.2.6. Colorants

- 8.2.7. Sweeteners

- 8.2.8. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Polymer Excipients Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Polyvinylpyrrolidone

- 9.1.2. Polyethylene Glycol

- 9.1.3. Starch

- 9.1.4. Micro Crystalline Cellulose (MCC)

- 9.1.5. Ethyl and Methyl Cellulose

- 9.1.6. Hydroxypropyl Methylcellulose (HPMC)

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Binders

- 9.2.2. Viscosity Modifiers

- 9.2.3. Coatings

- 9.2.4. Flavors

- 9.2.5. Preservatives

- 9.2.6. Colorants

- 9.2.7. Sweeteners

- 9.2.8. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Polymer Excipients Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Polyvinylpyrrolidone

- 10.1.2. Polyethylene Glycol

- 10.1.3. Starch

- 10.1.4. Micro Crystalline Cellulose (MCC)

- 10.1.5. Ethyl and Methyl Cellulose

- 10.1.6. Hydroxypropyl Methylcellulose (HPMC)

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Binders

- 10.2.2. Viscosity Modifiers

- 10.2.3. Coatings

- 10.2.4. Flavors

- 10.2.5. Preservatives

- 10.2.6. Colorants

- 10.2.7. Sweeteners

- 10.2.8. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Asia Pacific Polymer Excipients Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 India

- 11.1.3 Japan

- 11.1.4 South Korea

- 11.1.5 Rest of Asia Pacific

- 12. North America Polymer Excipients Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Polymer Excipients Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 Italy

- 13.1.4 France

- 13.1.5 Rest of Europe

- 14. South America Polymer Excipients Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Polymer Excipients Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 South Africa

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 ADM

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Cargill Incorporated

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Colorcon

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 DFE Pharma

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kerry Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Evonik Industries AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Croda International Plc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Ashland

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 BASF SE

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Roquette Frères

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 DuPont

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Dow

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Eastman Chemical Company

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 ABITEC

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 The Lubrizol Corporation*List Not Exhaustive

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 JRS PHARMA

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 FINAR LIMITED

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.1 ADM

List of Figures

- Figure 1: Global Polymer Excipients Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Polymer Excipients Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific Polymer Excipients Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Polymer Excipients Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Polymer Excipients Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Polymer Excipients Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Polymer Excipients Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Polymer Excipients Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Polymer Excipients Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Polymer Excipients Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Polymer Excipients Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Asia Pacific Polymer Excipients Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: Asia Pacific Polymer Excipients Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: Asia Pacific Polymer Excipients Market Revenue (Million), by Application 2024 & 2032

- Figure 15: Asia Pacific Polymer Excipients Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: Asia Pacific Polymer Excipients Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Asia Pacific Polymer Excipients Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Polymer Excipients Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: North America Polymer Excipients Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: North America Polymer Excipients Market Revenue (Million), by Application 2024 & 2032

- Figure 21: North America Polymer Excipients Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: North America Polymer Excipients Market Revenue (Million), by Country 2024 & 2032

- Figure 23: North America Polymer Excipients Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Polymer Excipients Market Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Europe Polymer Excipients Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Europe Polymer Excipients Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Europe Polymer Excipients Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Europe Polymer Excipients Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Polymer Excipients Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Polymer Excipients Market Revenue (Million), by Product Type 2024 & 2032

- Figure 31: South America Polymer Excipients Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: South America Polymer Excipients Market Revenue (Million), by Application 2024 & 2032

- Figure 33: South America Polymer Excipients Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: South America Polymer Excipients Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Polymer Excipients Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Polymer Excipients Market Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Middle East and Africa Polymer Excipients Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Middle East and Africa Polymer Excipients Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Polymer Excipients Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Polymer Excipients Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Polymer Excipients Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Polymer Excipients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Polymer Excipients Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Polymer Excipients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Polymer Excipients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Polymer Excipients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Asia Pacific Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Polymer Excipients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Polymer Excipients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Germany Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Polymer Excipients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Polymer Excipients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Saudi Arabia Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Polymer Excipients Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Global Polymer Excipients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Polymer Excipients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: China Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: India Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: South Korea Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Asia Pacific Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Polymer Excipients Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Global Polymer Excipients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Global Polymer Excipients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United States Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Canada Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Polymer Excipients Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 44: Global Polymer Excipients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 45: Global Polymer Excipients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Germany Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Italy Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: France Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Europe Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Polymer Excipients Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 52: Global Polymer Excipients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 53: Global Polymer Excipients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Brazil Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Argentina Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of South America Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Polymer Excipients Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 58: Global Polymer Excipients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 59: Global Polymer Excipients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Saudi Arabia Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Africa Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East and Africa Polymer Excipients Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polymer Excipients Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Polymer Excipients Market?

Key companies in the market include ADM, Cargill Incorporated, Colorcon, DFE Pharma, Kerry Inc, Evonik Industries AG, Croda International Plc, Ashland, BASF SE, Roquette Frères, DuPont, Dow, Eastman Chemical Company, ABITEC, The Lubrizol Corporation*List Not Exhaustive, JRS PHARMA, FINAR LIMITED.

3. What are the main segments of the Polymer Excipients Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Pharmaceutical Industry; Rising Demand for Polymer Excipients from Coatings Application.

6. What are the notable trends driving market growth?

Increasing Demand for Polyvinylpyrrolidone (Povidone).

7. Are there any restraints impacting market growth?

; Stringent Rules by Regulatory Bodies; Concerns to Meet the Required Quality of Product.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polymer Excipients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polymer Excipients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polymer Excipients Market?

To stay informed about further developments, trends, and reports in the Polymer Excipients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence