Key Insights

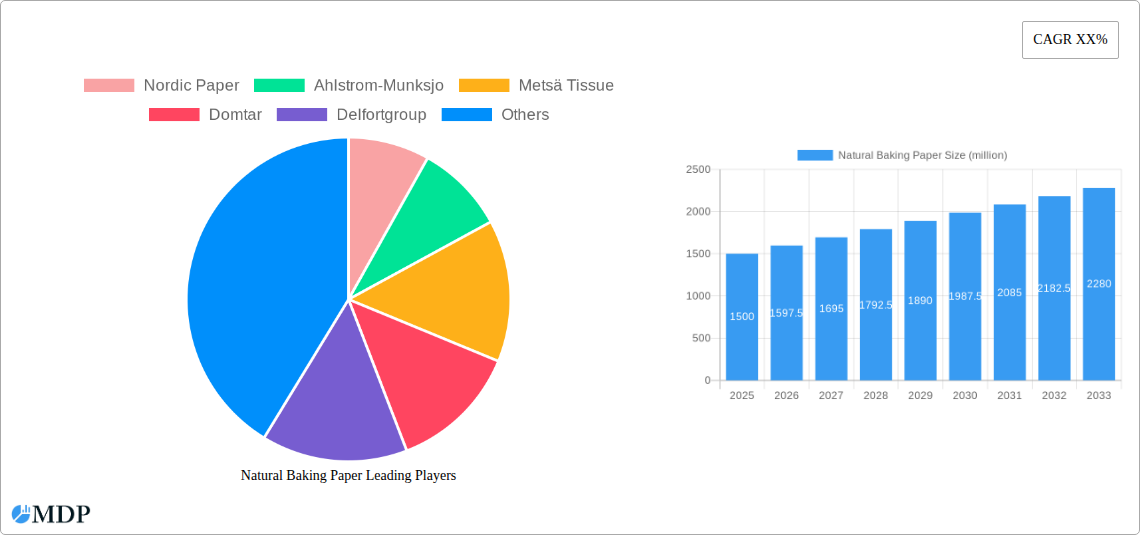

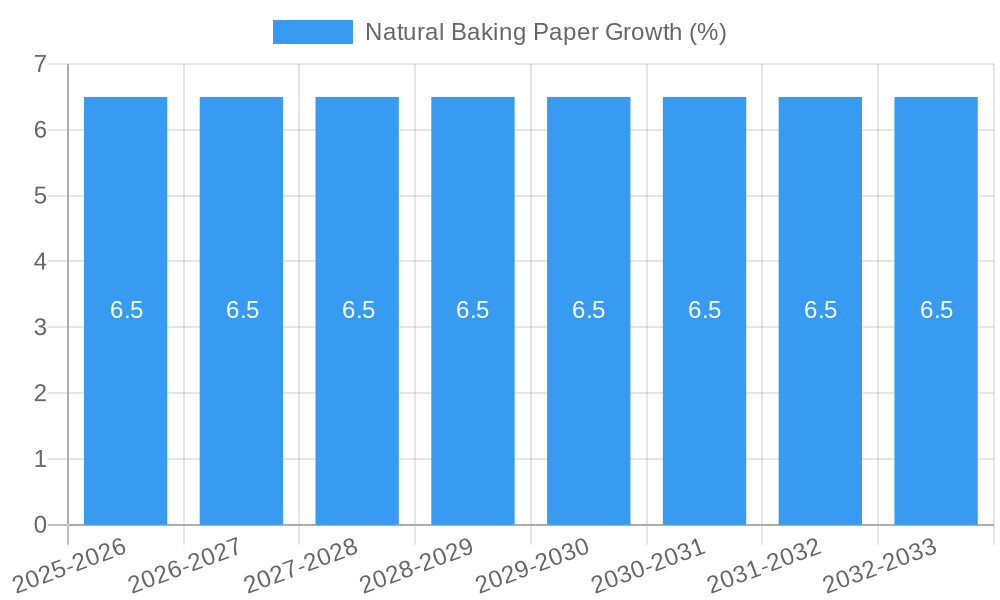

The global natural baking paper market is poised for substantial growth, estimated at a market size of USD 1.5 billion in 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This robust expansion is primarily fueled by a growing consumer preference for healthier and more sustainable food preparation methods, driving demand for parchment and wax paper alternatives in both home and commercial settings. The increasing adoption of plant-based diets and a heightened awareness of the environmental impact of traditional food wraps are significant catalysts. Furthermore, advancements in paper manufacturing technology, leading to improved product quality, heat resistance, and non-stick properties, are enhancing user experience and broadening application possibilities. The convenience and ease of use associated with baking paper, coupled with its role in reducing oil usage and facilitating cleaner cooking, further bolster its market appeal.

Key drivers for this market include the rising disposable incomes in emerging economies, leading to increased household spending on kitchenware and food preparation tools. The burgeoning food service industry, encompassing restaurants, cafes, and bakeries, represents another significant growth avenue, as they increasingly utilize baking paper for hygiene, efficiency, and consistent product presentation. While the market benefits from these positive trends, it faces certain restraints. Fluctuations in raw material prices, particularly for pulp and energy, can impact manufacturing costs and, consequently, product pricing. Moreover, the availability of reusable baking mats and silicone alternatives, though currently a smaller segment, could pose a competitive challenge. However, the inherent disposability and biodegradability of natural baking paper, especially when derived from sustainable sources, often outweigh these concerns for environmentally conscious consumers and businesses. The market segmentation reveals a strong emphasis on "Home Use" applications, reflecting the DIY baking culture and home cooking trends, while the "Commercial" segment also shows steady growth due to the operational efficiencies it offers to food businesses.

This in-depth report provides an unparalleled analysis of the Natural Baking Paper market, covering the historical period from 2019 to 2024, the base year 2025, and a robust forecast extending to 2033. Delve into market dynamics, industry trends, leading segments, key players, and strategic opportunities within this rapidly evolving sector. Discover actionable insights for stakeholders seeking to capitalize on the growing demand for sustainable and high-performance baking solutions. With an estimated market size of $6,500 million in 2025, projected to reach $10,200 million by 2033, the market is poised for significant expansion. The Compound Annual Growth Rate (CAGR) for the forecast period is a healthy 5.8%.

Natural Baking Paper Market Dynamics & Concentration

The Natural Baking Paper market exhibits a moderate level of concentration, with a few key players holding substantial market share. Major companies like Nordic Paper and Ahlstrom-Munksjo are at the forefront, driving innovation and influencing market trends. The market is characterized by a dynamic interplay of innovation drivers, including the increasing demand for sustainable and eco-friendly packaging solutions, advancements in paper coating technologies, and the growing popularity of home baking. Regulatory frameworks, particularly those related to food contact safety and environmental sustainability, play a crucial role in shaping market entry and product development. Product substitutes, such as reusable silicone mats and aluminum foil, pose a competitive challenge, but the convenience and disposability of natural baking paper continue to drive its adoption. End-user trends are heavily influenced by health consciousness and a preference for natural, unbleached products. Merger and Acquisition (M&A) activities are moderately present, with an estimated 75 significant M&A deals recorded during the historical period, indicating consolidation and strategic expansion efforts. Companies are actively seeking to enhance their product portfolios and geographical reach through these strategic moves. The estimated market share of the top 5 players in 2025 is approximately 62%.

Natural Baking Paper Industry Trends & Analysis

The Natural Baking Paper industry is experiencing robust growth, fueled by a confluence of factors that are reshaping consumer behavior and industrial applications. A primary driver is the escalating consumer demand for sustainable and eco-friendly products. As awareness of environmental issues grows, consumers are actively seeking alternatives to traditional plastic-based or chemically treated food packaging. Natural baking paper, often derived from renewable resources and boasting biodegradable properties, perfectly aligns with this trend. The increasing adoption of e-commerce platforms for grocery and home goods has also boosted the demand for such products, as they are often preferred for their ease of use and perceived health benefits during online food preparation. Technological disruptions are also playing a significant role. Innovations in paper manufacturing processes, including improved pulp treatments and advanced coating techniques, are leading to enhanced performance characteristics. These advancements result in baking papers with superior non-stick properties, increased heat resistance, and improved grease barrier capabilities, thereby elevating the user experience in both home and commercial settings. The global market penetration for natural baking paper is estimated to be around 28% in 2025, with significant room for expansion. The industry is witnessing a notable shift towards specialized products tailored to specific culinary needs, such as high-temperature baking or delicate pastry preparation. Competitive dynamics are intensifying, with both established players and emerging brands vying for market share. Companies are investing heavily in research and development to differentiate their offerings and capture new customer segments. The average price for natural baking paper has seen a slight increase of 3.5% year-over-year due to rising raw material costs and enhanced product features. The projected market penetration by 2033 is expected to reach 45%.

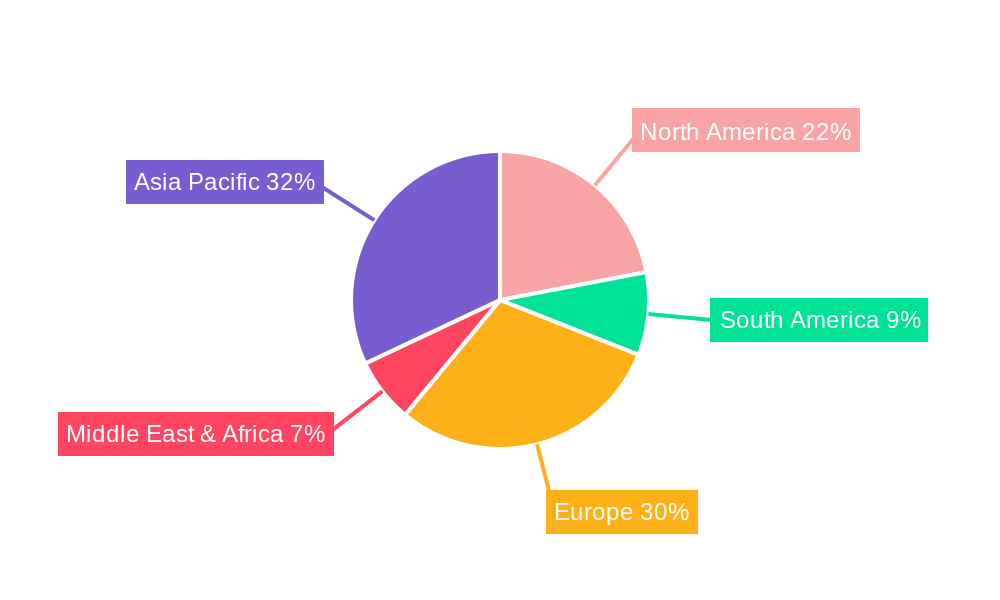

Leading Markets & Segments in Natural Baking Paper

The Home Use application segment currently dominates the Natural Baking Paper market, driven by the burgeoning trend of home baking and a growing awareness of healthier cooking practices. Consumers are increasingly opting for natural baking paper for its convenience, non-stick properties, and the assurance of food safety without chemical residues. The ease of cleanup and the ability to bake a wider variety of delicate pastries and breads without sticking contribute significantly to its popularity in households. Within the Types segment, Natural Parchment holds the largest market share. Its inherent greaseproof and moisture-resistant qualities make it ideal for a wide range of baking applications, from lining cake tins to wrapping food for steaming. The demand for unbleached and naturally processed parchment paper is particularly strong.

North America stands out as the leading regional market for Natural Baking Paper. This dominance is attributed to:

- High Disposable Income: A substantial portion of the population possesses the financial capacity to invest in premium kitchenware and baking supplies.

- Strong Culinary Culture: The region boasts a vibrant culinary scene with a significant emphasis on home cooking, baking, and gourmet food preparation.

- Consumer Awareness of Health and Sustainability: North American consumers are highly attuned to health trends and environmental concerns, actively seeking out natural and sustainable products.

- Robust Retail Infrastructure: An extensive network of supermarkets, specialty stores, and online retailers ensures widespread accessibility of natural baking paper.

Europe follows closely, with key markets like Germany, the UK, and France showing strong growth. Factors contributing to Europe's significant market presence include:

- Established Baking Traditions: Centuries of rich baking heritage have ingrained baking as a popular pastime and culinary art form.

- Stringent Food Safety Regulations: The European Union's rigorous food safety standards encourage the use of compliant and natural food contact materials.

- Growing Eco-Consciousness: A strong environmental movement and increasing consumer preference for sustainable products further propel the demand for natural baking paper.

The Commercial application segment is also witnessing rapid expansion, driven by the food service industry's increasing adoption of sustainable and food-safe packaging solutions. Restaurants, cafes, and bakeries are recognizing the benefits of using natural baking paper for improved food presentation, efficient cooking, and a commitment to eco-friendly operations. The Natural Wax Paper segment, while smaller, is experiencing steady growth due to its specific applications in wrapping sandwiches and other food items, offering a natural alternative to plastic wraps. The forecast indicates a steady growth trajectory for all segments, with the Commercial segment projected to experience a higher CAGR of 6.5% due to increasing adoption by food service businesses.

Natural Baking Paper Product Developments

Product innovation in the Natural Baking Paper market is focused on enhancing functionality and sustainability. Companies are developing baking papers with improved non-stick coatings derived from natural sources, offering superior food release and reducing the need for added fats. Developments include biodegradable and compostable options that address growing environmental concerns. Advanced treatments are also leading to papers with enhanced heat resistance and greaseproof properties, suitable for a wider range of cooking temperatures and food types. Competitive advantages are being built around certifications for food safety, sustainability, and eco-friendliness, appealing to a discerning consumer base. The integration of smart packaging features, such as temperature indicators, is also an emerging area of development.

Key Drivers of Natural Baking Paper Growth

The Natural Baking Paper market's growth is propelled by several key factors. Firstly, the increasing global emphasis on health and wellness is driving consumers towards natural and chemical-free food preparation products. Secondly, environmental consciousness and the demand for sustainable packaging are paramount, with consumers actively seeking biodegradable and compostable alternatives. Technological advancements in paper manufacturing are leading to improved product performance, such as enhanced non-stick and heat-resistant qualities. The booming home baking trend, further amplified by social media and increased leisure time, directly fuels demand for convenient and effective baking essentials. Finally, evolving regulatory frameworks supporting eco-friendly products create a favorable environment for market expansion.

Challenges in the Natural Baking Paper Market

Despite its promising growth, the Natural Baking Paper market faces several challenges. Fluctuations in raw material prices, particularly for wood pulp, can impact production costs and profit margins. Intense competition from established players and emerging brands necessitates continuous innovation and competitive pricing strategies. Supply chain disruptions, as witnessed during global events, can affect the availability and timely delivery of products. While market penetration is increasing, some consumers may still perceive natural baking paper as a premium product, leading to price sensitivity and slower adoption in certain price-conscious segments. The development and adherence to evolving international food safety and environmental certifications require ongoing investment and compliance.

Emerging Opportunities in Natural Baking Paper

Catalysts for long-term growth in the Natural Baking Paper market lie in several emerging areas. Technological breakthroughs in bio-based coatings and sustainable paper treatments offer opportunities for superior product performance and enhanced eco-credentials. Strategic partnerships between paper manufacturers and food brands can lead to the co-development of innovative packaging solutions, expanding market reach and consumer engagement. Market expansion into emerging economies with a growing middle class and increasing awareness of health and sustainability presents significant untapped potential. The development of specialized baking papers for niche applications, such as allergen-free baking or specific dietary needs, can create new revenue streams and cater to specialized consumer demands.

Leading Players in the Natural Baking Paper Sector

- Nordic Paper

- Ahlstrom-Munksjo

- Metsä Tissue

- Domtar

- Delfortgroup

- Eurocartex SpA

- Dispapali

- Amber Paper

- KRPA PAPER

- Rotofresh Rotochef

- TrueChoicePack

Key Milestones in Natural Baking Paper Industry

- 2019: Increased consumer adoption of plant-based diets and sustainable living, boosting demand for natural food products.

- 2020: Surge in home baking activities due to global lockdowns, significantly driving sales of baking paper.

- 2021: Growing awareness and regulatory push for compostable and biodegradable packaging solutions globally.

- 2022: Introduction of innovative, high-heat resistant natural baking papers by key manufacturers.

- 2023: Expansion of e-commerce channels for kitchen and baking supplies, increasing accessibility to natural baking paper.

- 2024: Strategic collaborations between paper producers and sustainable packaging solution providers to develop advanced eco-friendly options.

Strategic Outlook for Natural Baking Paper Market

The strategic outlook for the Natural Baking Paper market remains highly positive, driven by sustained consumer preference for sustainable and healthy living. Growth accelerators include the continued expansion of the home baking sector, increasing adoption by the commercial food service industry, and ongoing innovation in eco-friendly product development. Companies are advised to focus on strengthening their supply chains, investing in R&D for advanced biodegradable materials, and forging strategic alliances to capture market share. Expanding into emerging economies and developing specialized product lines will be crucial for long-term success. The market is set for continued growth, with an estimated market valuation of $10,200 million by 2033, offering substantial opportunities for stakeholders who align their strategies with evolving consumer demands and technological advancements.

Natural Baking Paper Segmentation

-

1. Application

- 1.1. Home Use

- 1.2. Commercial

-

2. Types

- 2.1. Natural Parchment

- 2.2. Natural Wax Paper

- 2.3. Others

Natural Baking Paper Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Natural Baking Paper REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Natural Baking Paper Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home Use

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Natural Parchment

- 5.2.2. Natural Wax Paper

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Natural Baking Paper Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Home Use

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Natural Parchment

- 6.2.2. Natural Wax Paper

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Natural Baking Paper Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Home Use

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Natural Parchment

- 7.2.2. Natural Wax Paper

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Natural Baking Paper Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Home Use

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Natural Parchment

- 8.2.2. Natural Wax Paper

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Natural Baking Paper Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Home Use

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Natural Parchment

- 9.2.2. Natural Wax Paper

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Natural Baking Paper Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Home Use

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Natural Parchment

- 10.2.2. Natural Wax Paper

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nordic Paper

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ahlstrom-Munksjo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Metsä Tissue

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Domtar

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Delfortgroup

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eurocartex SpA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dispapali

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amber Paper

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KRPA PAPER

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rotofresh Rotochef

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TrueChoicePack

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Nordic Paper

List of Figures

- Figure 1: Global Natural Baking Paper Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Natural Baking Paper Revenue (million), by Application 2024 & 2032

- Figure 3: North America Natural Baking Paper Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Natural Baking Paper Revenue (million), by Types 2024 & 2032

- Figure 5: North America Natural Baking Paper Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Natural Baking Paper Revenue (million), by Country 2024 & 2032

- Figure 7: North America Natural Baking Paper Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Natural Baking Paper Revenue (million), by Application 2024 & 2032

- Figure 9: South America Natural Baking Paper Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Natural Baking Paper Revenue (million), by Types 2024 & 2032

- Figure 11: South America Natural Baking Paper Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Natural Baking Paper Revenue (million), by Country 2024 & 2032

- Figure 13: South America Natural Baking Paper Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Natural Baking Paper Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Natural Baking Paper Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Natural Baking Paper Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Natural Baking Paper Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Natural Baking Paper Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Natural Baking Paper Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Natural Baking Paper Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Natural Baking Paper Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Natural Baking Paper Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Natural Baking Paper Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Natural Baking Paper Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Natural Baking Paper Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Natural Baking Paper Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Natural Baking Paper Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Natural Baking Paper Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Natural Baking Paper Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Natural Baking Paper Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Natural Baking Paper Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Natural Baking Paper Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Natural Baking Paper Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Natural Baking Paper Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Natural Baking Paper Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Natural Baking Paper Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Natural Baking Paper Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Natural Baking Paper Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Natural Baking Paper Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Natural Baking Paper Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Natural Baking Paper Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Natural Baking Paper Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Natural Baking Paper Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Natural Baking Paper Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Natural Baking Paper Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Natural Baking Paper Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Natural Baking Paper Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Natural Baking Paper Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Natural Baking Paper Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Natural Baking Paper Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Natural Baking Paper Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Natural Baking Paper?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Natural Baking Paper?

Key companies in the market include Nordic Paper, Ahlstrom-Munksjo, Metsä Tissue, Domtar, Delfortgroup, Eurocartex SpA, Dispapali, Amber Paper, KRPA PAPER, Rotofresh Rotochef, TrueChoicePack.

3. What are the main segments of the Natural Baking Paper?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Natural Baking Paper," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Natural Baking Paper report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Natural Baking Paper?

To stay informed about further developments, trends, and reports in the Natural Baking Paper, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence