Key Insights

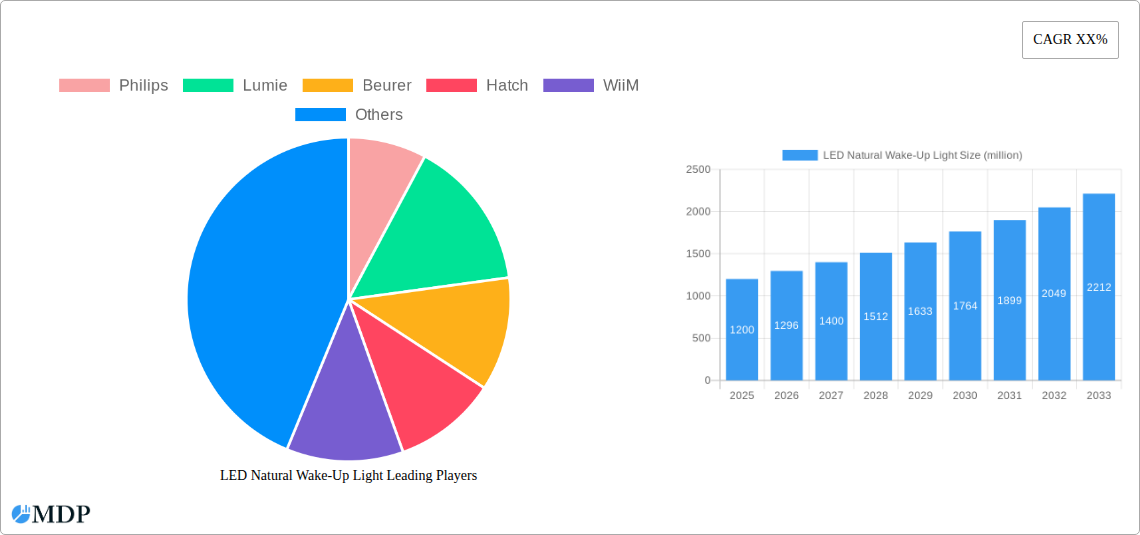

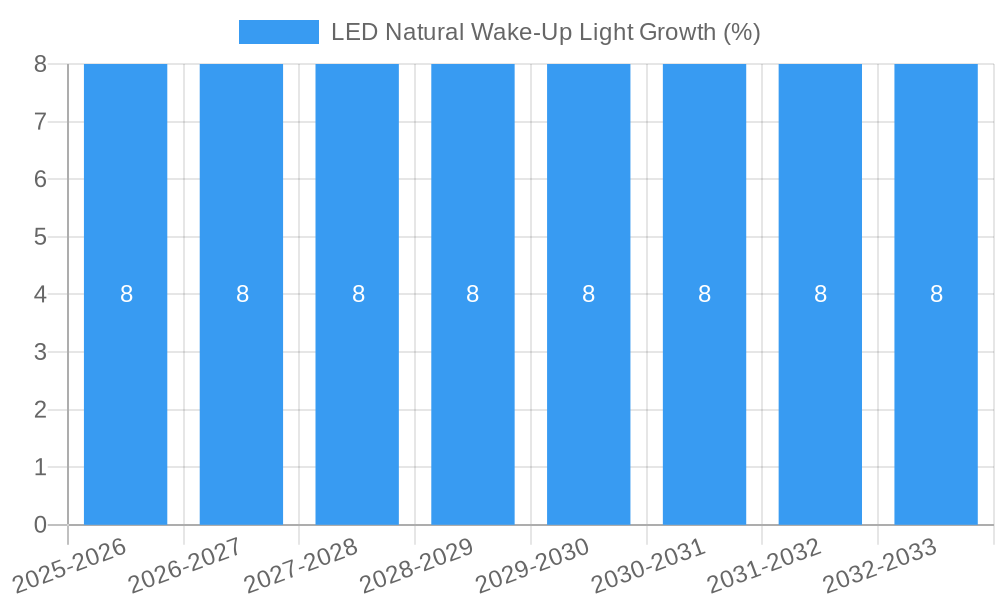

The global LED Natural Wake-Up Light market is experiencing robust growth, projected to reach approximately $1.2 billion by 2025 and expand at a Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This significant expansion is primarily driven by increasing consumer awareness regarding the benefits of natural light simulation for improved sleep cycles and overall well-being, coupled with the growing adoption of smart home technology. The market is witnessing a substantial surge in demand for devices that offer a gentle and gradual awakening experience, moving away from jarring traditional alarms. Key applications like online sales are poised for dominant growth, reflecting the ease of access and wide product selection available to consumers. The rise of touch screen functionality further enhances user experience and accessibility, appealing to a tech-savvy demographic. Major players like Philips, Lumie, and Xiaomi are actively innovating, introducing feature-rich products that cater to diverse consumer needs.

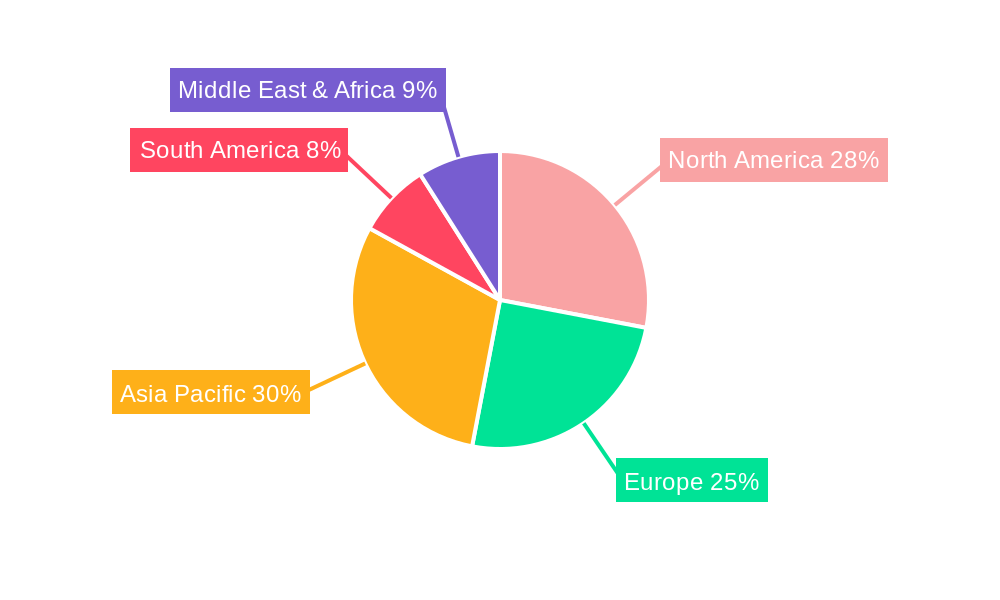

The market's growth trajectory is further supported by lifestyle trends emphasizing self-care and sleep hygiene. As individuals increasingly prioritize mental and physical health, the demand for products that support restorative sleep is escalating. The integration of advanced features such as personalized light settings, sunrise and sunset simulations, and even soundscapes is contributing to market expansion. While the market benefits from strong drivers, potential restraints include the initial cost of some advanced models and the availability of basic wake-up features in multi-functional smart devices. However, the overwhelming positive consumer response to the wellness benefits of LED natural wake-up lights, alongside continuous product innovation and expanding distribution channels, indicates a highly promising future for this segment. The Asia Pacific region, particularly China and India, is expected to emerge as a key growth hub, driven by a burgeoning middle class and increasing disposable incomes.

Report Description: LED Natural Wake-Up Light Market Insights - Global Trends, Competitive Landscape, and Future Projections (2019-2033)

Unlock unparalleled insights into the burgeoning LED Natural Wake-Up Light market with this comprehensive report. Spanning 2019–2033, this analysis provides deep dives into market dynamics, industry trends, leading segments, and strategic outlook, empowering stakeholders to navigate this high-growth sector. Leveraging millions of data points, we deliver actionable intelligence for manufacturers, distributors, investors, and industry professionals. Discover the impact of innovation, understand evolving consumer preferences for natural light solutions, and identify lucrative opportunities within the online and offline sales channels, touch screen and non-touch screen segments. This report is your definitive guide to the global LED Natural Wake-Up Light market.

LED Natural Wake-Up Light Market Dynamics & Concentration

The LED Natural Wake-Up Light market is characterized by a moderate to high level of concentration, with key players like Philips, Lumie, and Hatch holding significant market share, estimated to be in the millions of dollars. Innovation serves as a primary driver, fueled by increasing consumer demand for wellness-oriented smart home devices and improved sleep hygiene solutions. Regulatory frameworks, while generally supportive of consumer electronics, are increasingly focusing on energy efficiency and safety standards, influencing product design and manufacturing. Product substitutes, such as traditional alarm clocks and smartphone apps, exist but are increasingly outcompeted by the unique benefits of gradual light simulation. End-user trends highlight a growing preference for devices that promote natural waking cycles, reduce sleep inertia, and enhance overall well-being, contributing to a projected market value in the millions. Mergers and acquisitions (M&A) activities, though not yet at peak levels, are expected to increase as larger companies seek to integrate innovative technologies and expand their smart home portfolios. We anticipate a growing number of M&A deals, potentially exceeding hundreds, as market leaders consolidate their positions and smaller innovators are acquired.

LED Natural Wake-Up Light Industry Trends & Analysis

The LED Natural Wake-Up Light industry is experiencing robust growth, driven by a confluence of technological advancements and evolving consumer consciousness around health and wellness. The estimated Compound Annual Growth Rate (CAGR) for this market is projected to be significant, reaching into the double digits millions. This expansion is underpinned by an increasing market penetration of smart home devices and a growing understanding of the detrimental effects of abrupt waking. Consumers are actively seeking solutions that mimic natural sunrise and sunset cycles, thereby promoting more regulated sleep patterns and reducing morning grogginess. Technological disruptions, such as the integration of AI for personalized sleep routines and advanced light therapy algorithms, are setting new benchmarks for product efficacy. Furthermore, the proliferation of e-commerce platforms has opened up unprecedented avenues for online sales, democratizing access to these wellness-enhancing devices and contributing to a global market valuation in the billions. The competitive landscape is intensifying, with established brands investing heavily in research and development to differentiate their offerings and capture a larger share of this dynamic market. Emerging players are also carving out niches by focusing on specific features like ambient sound integration, app connectivity, and minimalist design aesthetics, further stimulating innovation and competition. The market's trajectory indicates a sustained upward trend, with the overall market size expected to reach many millions in the coming years, reflecting the increasing adoption and perceived value of these devices.

Leading Markets & Segments in LED Natural Wake-Up Light

The dominance within the LED Natural Wake-Up Light market is multifaceted, with certain regions and segments exhibiting particularly strong performance.

Dominant Region: North America currently leads the market, driven by high disposable incomes, a strong consumer appetite for smart home technology, and widespread awareness of sleep hygiene benefits. Economic policies that support technological adoption and robust retail infrastructure contribute to its leading position. The United States, in particular, represents a significant portion of this regional dominance, with a market value estimated in the millions of dollars.

Dominant Application Segment: Online Sales are increasingly becoming the primary channel for LED Natural Wake-Up Lights. This is largely due to the convenience, wider selection, and competitive pricing offered by e-commerce platforms. The ease of comparison and access to detailed product reviews further empowers consumers, driving significant sales volumes in the millions. While Offline Sales still hold a considerable share, the growth trajectory of online channels is far more pronounced.

Dominant Type Segment: The Touch Screen segment is emerging as the preferred type, offering users an intuitive and modern interface for controlling light intensity, alarm settings, and other features. This segment's growth is propelled by the desire for sleeker product designs and enhanced user experience. While Non-Touch Screen variants remain relevant, particularly for budget-conscious consumers or those preferring simpler interfaces, the innovation and consumer appeal of touch screen technology are driving its dominance, with a projected market share in the millions.

The interplay of these factors—regional economic strength, the convenience of online retail, and the technological appeal of touch screens—solidifies the current leadership within the LED Natural Wake-Up Light market. Future growth will likely see continued expansion across these dominant areas, with potential shifts as emerging markets mature and technological preferences evolve.

LED Natural Wake-Up Light Product Developments

Recent product developments in the LED Natural Wake-Up Light sector emphasize enhanced user experience and personalized wellness. Innovations include advanced color temperature simulation mimicking natural daylight cycles, integrated ambient sounds for a holistic wake-up experience, and seamless connectivity with smart home ecosystems. Companies are focusing on developing sleeker, more aesthetically pleasing designs that integrate well into bedroom décor. Competitive advantages are being carved out through features like app-controlled customization, AI-powered sleep tracking integration, and gradual light intensity adjustments designed to promote deep sleep and reduce morning grogginess. The market fit is evident as consumers increasingly prioritize solutions that contribute to improved sleep quality and overall well-being.

Key Drivers of LED Natural Wake-Up Light Growth

The growth of the LED Natural Wake-Up Light market is propelled by several key factors. Technologically, the miniaturization of LED components and advancements in light simulation algorithms enable more sophisticated and energy-efficient devices. Economically, increasing disposable incomes and a growing consumer willingness to invest in health and wellness products create a favorable demand environment, with market growth projected in the millions. Regulatory support for energy-efficient lighting solutions also indirectly benefits the market. Furthermore, a heightened societal awareness of the importance of sleep hygiene and the detrimental effects of artificial wake-ups is a significant socio-cultural driver, pushing consumers towards naturalistic solutions.

Challenges in the LED Natural Wake-Up Light Market

Despite its growth potential, the LED Natural Wake-Up Light market faces several challenges. Regulatory hurdles concerning electromagnetic compatibility and safety certifications can be time-consuming and costly for manufacturers, impacting the speed of product launches. Supply chain disruptions, exacerbated by global events, can lead to increased production costs and lead times, affecting product availability and profitability, with potential impacts in the millions. Intense competitive pressures from both established brands and new entrants necessitate continuous innovation and aggressive pricing strategies, potentially eroding profit margins. Consumer education regarding the long-term benefits of light therapy and the unique advantages of wake-up lights over conventional alarms also remains an ongoing challenge.

Emerging Opportunities in LED Natural Wake-Up Light

Emerging opportunities in the LED Natural Wake-Up Light market are significant, driven by technological breakthroughs and strategic market expansion. The integration of AI and machine learning for highly personalized sleep and wake-up routines presents a major growth catalyst, offering users tailored experiences beyond basic sunrise simulation. Strategic partnerships between wake-up light manufacturers and sleep tracking app developers or wearable technology companies can create synergistic ecosystems, enhancing value propositions. Market expansion into developing economies, where awareness of sleep health is growing, offers substantial untapped potential. Furthermore, the development of specialized wake-up lights for specific demographics, such as children or shift workers, can open up niche but lucrative market segments.

Leading Players in the LED Natural Wake-Up Light Sector

- Philips

- Lumie

- Beurer

- Hatch

- WiiM

- Groov-e

- Homelabs

- Casper

- Suright

- Xiaomi

- iHome

- Loftie

Key Milestones in LED Natural Wake-Up Light Industry

- 2019: Increased adoption of smart home integration features in wake-up lights.

- 2020: Growth in online sales channels accelerated by global events.

- 2021: Introduction of advanced color temperature control for more natural sunrise simulation.

- 2022: Emergence of AI-powered personalized sleep and wake-up algorithms.

- 2023: Enhanced focus on sustainable materials and energy efficiency in product design.

- 2024: Increased product diversification, including models with integrated soundscapes and meditation features.

Strategic Outlook for LED Natural Wake-Up Light Market

The strategic outlook for the LED Natural Wake-Up Light market is exceptionally positive, driven by sustained consumer interest in health and wellness. Future growth accelerators include further integration with broader smart home ecosystems, enabling seamless control and personalized routines. Innovation in therapeutic light applications beyond simple waking, such as mood enhancement and seasonal affective disorder management, will unlock new market segments. Strategic partnerships with healthcare providers and wellness influencers can bolster credibility and drive adoption. Continued investment in user-friendly interfaces and advanced customization options will be crucial for retaining market share. The market is poised for continued expansion, with a strong emphasis on technological sophistication and holistic well-being solutions.

LED Natural Wake-Up Light Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Touch Screen

- 2.2. Non-Touch Screen

LED Natural Wake-Up Light Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

LED Natural Wake-Up Light REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LED Natural Wake-Up Light Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Touch Screen

- 5.2.2. Non-Touch Screen

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America LED Natural Wake-Up Light Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Touch Screen

- 6.2.2. Non-Touch Screen

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America LED Natural Wake-Up Light Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Touch Screen

- 7.2.2. Non-Touch Screen

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe LED Natural Wake-Up Light Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Touch Screen

- 8.2.2. Non-Touch Screen

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa LED Natural Wake-Up Light Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Touch Screen

- 9.2.2. Non-Touch Screen

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific LED Natural Wake-Up Light Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Touch Screen

- 10.2.2. Non-Touch Screen

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Philips

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lumie

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Beurer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hatch

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 WiiM

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Groov-e

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Homelabs

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Casper

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Suright

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Xiaomi

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 iHome

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Loftie

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Philips

List of Figures

- Figure 1: Global LED Natural Wake-Up Light Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America LED Natural Wake-Up Light Revenue (million), by Application 2024 & 2032

- Figure 3: North America LED Natural Wake-Up Light Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America LED Natural Wake-Up Light Revenue (million), by Types 2024 & 2032

- Figure 5: North America LED Natural Wake-Up Light Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America LED Natural Wake-Up Light Revenue (million), by Country 2024 & 2032

- Figure 7: North America LED Natural Wake-Up Light Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America LED Natural Wake-Up Light Revenue (million), by Application 2024 & 2032

- Figure 9: South America LED Natural Wake-Up Light Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America LED Natural Wake-Up Light Revenue (million), by Types 2024 & 2032

- Figure 11: South America LED Natural Wake-Up Light Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America LED Natural Wake-Up Light Revenue (million), by Country 2024 & 2032

- Figure 13: South America LED Natural Wake-Up Light Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe LED Natural Wake-Up Light Revenue (million), by Application 2024 & 2032

- Figure 15: Europe LED Natural Wake-Up Light Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe LED Natural Wake-Up Light Revenue (million), by Types 2024 & 2032

- Figure 17: Europe LED Natural Wake-Up Light Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe LED Natural Wake-Up Light Revenue (million), by Country 2024 & 2032

- Figure 19: Europe LED Natural Wake-Up Light Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa LED Natural Wake-Up Light Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa LED Natural Wake-Up Light Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa LED Natural Wake-Up Light Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa LED Natural Wake-Up Light Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa LED Natural Wake-Up Light Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa LED Natural Wake-Up Light Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific LED Natural Wake-Up Light Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific LED Natural Wake-Up Light Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific LED Natural Wake-Up Light Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific LED Natural Wake-Up Light Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific LED Natural Wake-Up Light Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific LED Natural Wake-Up Light Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global LED Natural Wake-Up Light Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global LED Natural Wake-Up Light Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global LED Natural Wake-Up Light Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global LED Natural Wake-Up Light Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global LED Natural Wake-Up Light Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global LED Natural Wake-Up Light Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global LED Natural Wake-Up Light Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global LED Natural Wake-Up Light Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global LED Natural Wake-Up Light Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global LED Natural Wake-Up Light Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global LED Natural Wake-Up Light Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global LED Natural Wake-Up Light Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global LED Natural Wake-Up Light Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global LED Natural Wake-Up Light Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global LED Natural Wake-Up Light Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global LED Natural Wake-Up Light Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global LED Natural Wake-Up Light Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global LED Natural Wake-Up Light Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global LED Natural Wake-Up Light Revenue million Forecast, by Country 2019 & 2032

- Table 41: China LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific LED Natural Wake-Up Light Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LED Natural Wake-Up Light?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the LED Natural Wake-Up Light?

Key companies in the market include Philips, Lumie, Beurer, Hatch, WiiM, Groov-e, Homelabs, Casper, Suright, Xiaomi, iHome, Loftie.

3. What are the main segments of the LED Natural Wake-Up Light?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LED Natural Wake-Up Light," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LED Natural Wake-Up Light report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LED Natural Wake-Up Light?

To stay informed about further developments, trends, and reports in the LED Natural Wake-Up Light, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence